- Home

- »

- Specialty Polymers

- »

-

Lactic Acid Market Size And Share, Industry Report, 2033GVR Report cover

![Lactic Acid Market Size, Share & Trends Report]()

Lactic Acid Market (2025 - 2033) Size, Share & Trends Analysis Report By Raw Material (Corn, Sugarcane, Cassava, Yeast Extract), By Application (Industrial, Food & Beverages, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: 978-1-68038-126-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lactic Acid Market Summary

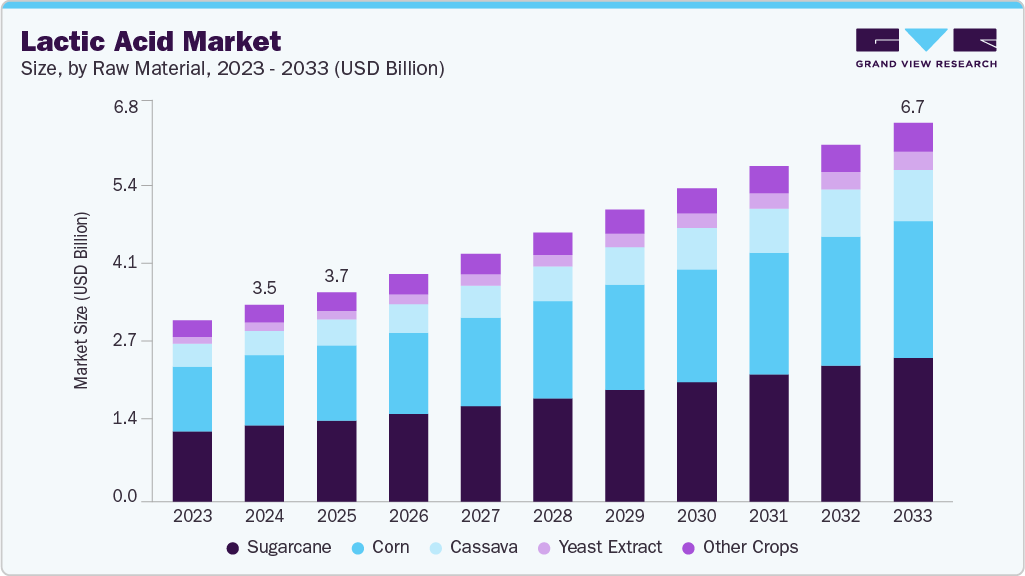

The global lactic acid market size was estimated at USD 3,454.6 million in 2024 and is expected to reach USD 6,653.7 million by 2033, and is projected to grow at a CAGR of 7.7% from 2025 to 2033. The demand for this form is expected to rise over the forecast period, primarily driven by its increasing use across industries such as pharmaceuticals and food & beverages, especially in emerging markets such as India, China, and Indonesia.

Key Market Trends & Insights

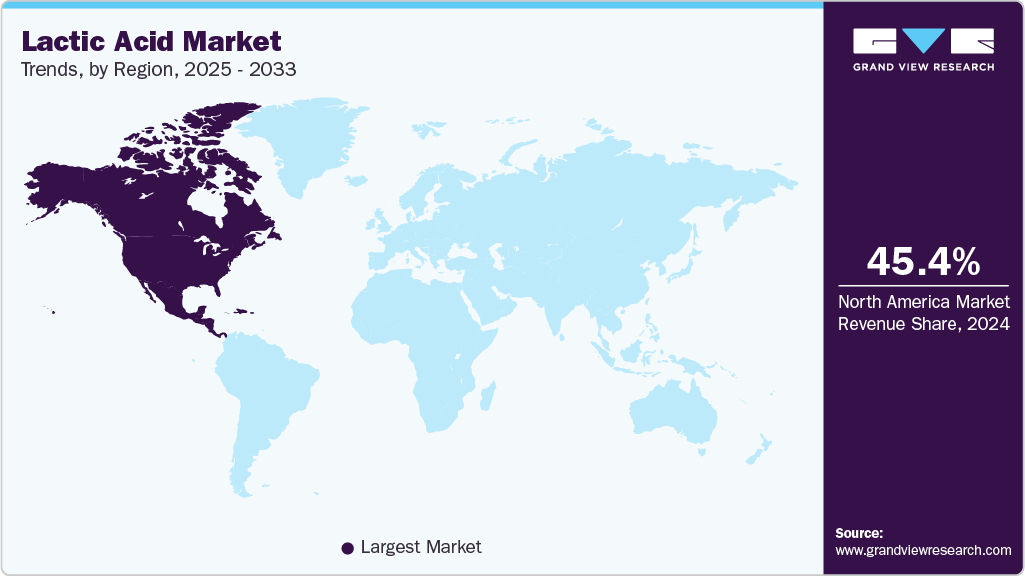

- North America dominated the lactic acid market with the largest revenue share of 45.4% in 2024.

- The global lactic acid market is projected to grow at a CAGR of 7.7% from 2025 to 2033.

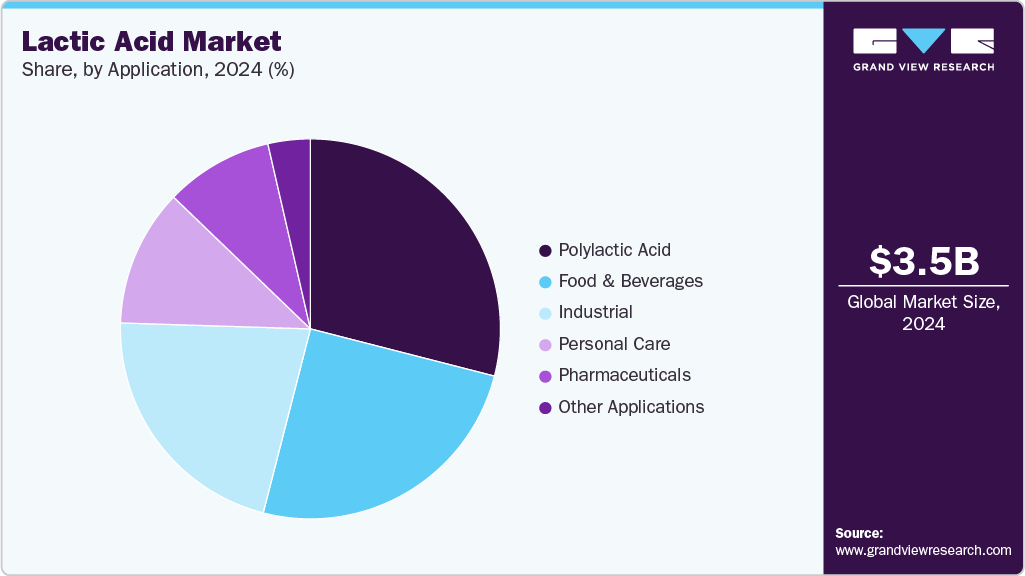

- By application, polylactic acid dominated the lactic acid market with a revenue share of 29.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3,454.6 Million

- 2033 Projected Market Size: USD 6,653.7 Million

- CAGR (2025-2033): 7.7%

Lactic acid serves as a key raw material in producing polylactic acid (PLA), which is widely utilized in the manufacture of biodegradable plastics for industries such as packaging and chemicals. Its role as a natural solvent makes it suitable for metal and mechanical cleaning processes.

This product is majorly used in formation of PLA, which is a biodegradable polymer, compostable thermoplastic made from renewable sources such as fermentation processes. This chemical is Generally Recognized as Safe (GRAS) and has great market potential in food industry being recognized as harmless By U.S. Food & Drug Administration. It can be alternatively produced by chemical synthesis or fermentation. It is considered as one of the well-known organic acids that have wide range of industrial applications. The four main applications of this form are in food, chemical, pharmaceutical, and cosmetics industries. This form is a lactic bacterium which refer to a large group of beneficial bacteria having probiotic properties. In addition, it plays a crucial role in the preparation of wine making, pickling, sausages, curing fish, meat, vegetables baking, and preparation of fermented dairy forms.

The product is not only a significant ingredient in fermented foods, including canned vegetables, yogurt, and butter, but is also used as a preservative in pickled vegetables and olives. This naturally occurring organic acid is used in a variety of applications, including food & beverages, pharmaceutical, cosmetics, chemicals, and industrial.

This is a large-scale organic acid produced, most used feedstock are carbohydrates obtained from different sources such as sugarcane, corn starch, and others. As compared to mineral variations, organic ones does not completely dissociate in water.

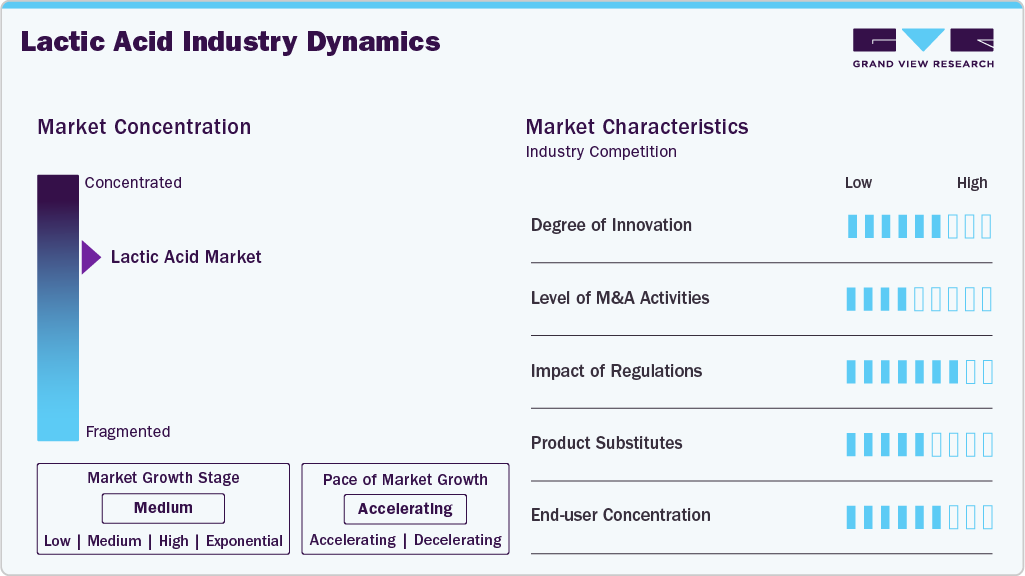

Market Concentration & Characteristics

The lactic acid market exhibits a moderately consolidated structure, with a few key players holding a significant share. The global lactic acid industry is experiencing significant growth due to its wide array of applications in various industries such as food and beverage, pharmaceuticals, personal care, and biodegradable polymers.

The global lactic acid industry is experiencing significant growth due to its wide array of applications in various industries such as food and beverage, pharmaceuticals, personal care, and biodegradable polymers. One of the key factors influencing the market is government regulations promoting the use of eco-friendly and sustainable products. For instance, the European Union's regulations promoting the use of biodegradable plastics have led to an increased demand for lactic acid-based polymers, driving the market growth. Similarly, in the food and beverage industry, the FDA's approval of lactic acid as a food additive has further propelled the market expansion.

The demand for lactic acid is being driven by various factors across different industries. A major driver responsible for significant growth in lactic acid market size is its extensive application in the production of fermented foods. Lactic bacterium is widely used as a starter culture for the production of fermented foods due to its ease of fermentation and several other functional characteristics, leading to increased demand for encapsulated lactic acid in the production of dry or semi-dry sausage.

The demand is also being driven by the increasing consumer preference for natural and organic products, especially in the personal care and cosmetics industry. The rising awareness about the harmful effects of synthetic chemicals has led to a surge in the demand for lactic acid as a key ingredient in skincare and hair care products. In addition, the availability of product substitutes such as citric acid and malic acid is influencing the market dynamics.

Lactic acid serves as a key raw material for the production of polylactic acid (PLA), a biodegradable and renewable polymer. The push for circular economies have propelled the polylactic acid market, thereby influencing the lactic acid market positively. In addition, research and development efforts are focused on expanding the applications of such as its potential use in the production of bio-based chemicals and materials, presenting new opportunities for market players.

Raw Material Insights

The sugarcane raw material dominated the lactic acid market and accounted for the largest revenue share of 38.7% in 2024. This high share is attributable to abundant biomass materials availability. Raw sugar extracted from sugar beet or sugarcane is one of major feedstock used in manufacture of lactic acid. Sugarcane contributes notably to development of bioplastics and also contributes in food and biochemical industries. Moreover, raw sugar extracted from sugarcane or sugar beet is a major feedstock used to manufacture lactic acid and its derivatives. Where Thailand & Brazil exhibit excellent conditions for growing sugarcane. Europe has presence of excellent farmland for supplying sugar beet. For instance, Wageningen University and Research Centre (WUR) and Institute for Bioplastics and Biocomposites (IFBB) analyzed and compared the data for crop yields that are ideal as feedstock for efficient manufacturing of biomaterials including bioethanol, PLA, and bio-PE, support the manufacturing of bioplastics and biochemicals made from sustainable feedstock.

Yeast extract is is expected to grow fastest with a CAGR of 10.0% from 2025 to 2033 during the forecast period, one of most commonly used ingredients for formation of lactic acid. However, high formation cost associated with this process gave rise to an alternative, namely Corn Steep Liquor (CSL), derived from corn as a by-product of the corn steeping process. Demand for corn based lactic acid in food & beverages industry as a pH regulator, microbial activity enhancer and others is expected to market growth over the coming years.

Corn has emerged as a prominent raw material segment and has accounted a significant share in 2023. This share is attributable owing to its low cost, sustainability, and abundance in nature. Rising environmental concerns, sustainable processing practices, and limited supply of petroleum feedstock is anticipated to augment demand for corn-based lactic acid forms over forecast period.

Other numerous inexpensive raw materials used in formation of lactic acid are starchy & cellulosic materials such as cassava, sweet sorghum, potato, wheat, rye-barley, rice, xylan, galactan, lignin, and other filamentous fungi such as Lactic Caid Bacteria (LAB), and Rhizopus. PLA is witnessed to constitute a significant application share in the market.

Application insights

The polylactic acid application dominated the market and accounted for the largest revenue share of 29.0% in 2024. This high share is attributable to its durability, mechanical strength, and transparency as compared to other bio-degradable plastics. Rising demand for bio-degradable plastic materials, constant growth of automotive industry, and increasing demand from end-use industries are major driving factors for this application segment. In transportation and automotive sector, numerous vehicle interior components such as interior-trim, under the hood components, and engine components are produced using light weight material. The lightweight components reduce weight of the vehicle and enhance performance, this has led to rise in demand for sustainable bioplastic material to increase fuel-economy and toughness which in turn will propel market demand for PLA.

Food & beverages emerged as second largest application segment in the year 2024. This form has ability to enhance flavor and increase the shelf life of food & beverages forms by controlling the development of pathogenic microorganisms. Owing to these properties demand for this form is anticipated to surge with its growing penetration in seafood, poultry, and meat industries.

Lactic acid serves as a vital feedstock in formation of PLA, which is further used to manufacture biodegradable plastic. These biodegradable plastics are used in numerous industries such as packaging and chemical. This form is a natural solvent used as a metal cleaning agent as well as in mechanical cleaning applications.

The pharmaceutical industry based lactic acid application is expected to grow fastest with a CAGR of 8.0% from 2025 to 2033 during the forecast period, as it is a key component in the growth of this form market over past few years on account of its increasing application in drug manufacturing and as an electrolyte in intravenous solutions used for supplementing the required bodily fluids. Properties of lactic acid such as metal sequestration, pH regulator, effectiveness in being a natural body constituent, and chiral intermediate in pharmaceutical forms are expected to be the key factors for its growth in the pharmaceutical industry. Personal care application segment is expected to be a key driver for this form, which can be attributed to increasing form use in skincare forms. Lactic acid-based skin moisturizers improve dry skin, remove acne scars, improve discoloration, and prevent damage to skin tissues.

Regional Insights

U.S. held over 91.1% revenue share of the North America lactic acid market. North America dominated the market with a revenue share of 45.4% in 2024.This high share is attributable to growing personal care, pharmaceutical, and food & beverages industries. The expanding pharmaceutical industry in the U.S. as a result of increasing expenditures on medicines is anticipated to have a positive impact on market in this region. North America market is expected to grow on account of presence of various personal care and cosmetic companies such as Maybelline New York, Procter & Gamble, Colgate-Palmolive Company, Avon, Unilever, and Johnson & Johnson Private Limited. Moreover, the robust manufacturing base of global cosmetic manufacturers such as Procter & Gamble, Unilever and Johnson & Johnson Private Limited in the U.S. is expected to promote the demand for personal care forms. Rising demand for PLA, owing to the U.S. government efforts toward reducing carbon footprint, high demand from packaging applications, and growth of pharmaceutical and personal care industries is expected to propel growth of market over the forecast period.

U.S. Lactic Acid Market Trends

The lactic acid market in U.S. held a substantial share of the North America market in 2024, driven by factors such as an aging population, the prevalence of chronic and lifestyle-related diseases, and advancements in technology that are fueling growth in the pharmaceutical sector. The country’s numerous manufacturing facilities, along with the increasing incidence of conditions such as diabetes and gastrointestinal disorders, are expected to boost pharmaceutical demand throughout the forecast period.

In addition, growing use of biodegradable polymers, valued for their environmentally friendly properties compared to petroleum-based alternatives, is likely to create new opportunities for the polylactic acid sector, further supporting the lactic acid market’s expansion. The personal care industry is also projected to grow substantially, fueled by rising demand for products such as sunscreen lotions, anti-aging creams, and facial skincare. Moreover, strong demand for men’s fragrances, including brands such as Axe and Old Spice, combined with ongoing innovation and product differentiation within the sector, is anticipated to drive increased lactic acid consumption over the coming years.

Europe Lactic Acid Market Trends

The lactic acid market in Europe held 20.4% of the global revenue share in 2024. This demand is driven the incorporation of biodegradable plastic packaging materials by various manufacturers including Plastipak and DSM is expected to drive the demand for PLA, in turn, benefitting the lactic acid market. Robust manufacturing base of cosmetics industry in Europe coupled with growing demand for the same in Germany, Italy, France, and the UK is expected to augment the demand for lactic acid in Europe over the forecast period. Key lactic acid manufacturers operating in the region include Futerro, BASF SE, Galactic, Corbion, thyssenkrupp AG, Cellulac, and Jungbunzlauer Suisse AG. In addition, cosmetics industry in Europe is driven by innovation of new color pallets and skin-specific treatments. In European countries, growing concerns about skin cancer and exposure to harmful rays have boosted the use of sun care products. Increasing number of cosmetics distribution chains and broadening consumer demand for natural cosmetics are some additional factors supplementing the growth of cosmetics industry in the region.

Asia Pacific Lactic Acid Market Trends

The Asia Pacific lactic acid market secured 26.0% of the market share in 2024 owing to the manufacturing base of personal care industries in China, Japan, and India along with government initiatives to support infrastructure development is expected to increase market share over the forecast period. In addition, growing FMCG companies in India, China, and Singapore are expected to augment market share in the near future. In addition, rapid industrialization, along with increasing FDI will promote market growth. Moreover, positive outlook toward food & beverage industry of India and China in light of rising domestic consumption and technological advancements is expected to fuel industry expansion.

Middle East & Africa Lactic Acid Market Trends

The Middle East & African lactic acid market is experiencing strong growth, driven by increasing demand high demand for lactic acid in cosmetic industry in countries including the U.A.E., Kuwait, and Saudi Arabia on account of its various properties such as skin-rejuvenation, pH regulation, and anti-acne effects are proposed to stimulate its industry penetration. Young and dynamic population along with high purchasing power is expected to contribute to the market growth over the forecast period. In addition, food & beverage sector in the Middle East region has been ripe with several growth opportunities for international investors. Reliance on food trade, international tastes, changing consumer preferences and lifestyles, strategic geographic position, and Gulf food programs have substantially contributed to the development of food & beverages industry in the region, which is further estimated to trigger the demand for lactic acid in the near future.

Latin America Lactic Acid Market Trends

The Latin American lactic acid market is witnessing steady growth, largely driven by the expanding personal care industry in Central and South America. Countries such as Brazil and Argentina are fueling this growth due to their burgeoning cosmetics sectors. Increased spending on beauty and personal care products in Brazil is prompting FMCG companies to boost their production capacities. Brazil stands out as a key market in the region for cosmetics and personal care, with rising per capita income and the introduction of new products further propelling market expansion. Growing consumer expenditure on personal care items across the region is expected to create significant opportunities for the lactic acid market moving forward.

Key Lactic Acid Company Insights

Some of the key players operating in the lactic acid market include Akzo Nobel NV, BASF SE, Arkema Group, Berger Paints India Limited and Clariant and among others.

- Akzo Nobel N.V., headquartered in Amsterdam, Netherlands, is a global leader in the Lactic Acid market. It is recognized for its strong heritage in coatings technology, sustainability leadership, and innovation-driven growth. The company offers a comprehensive portfolio of high-performance Lactic Acid designed to meet rigorous food safety standards and evolving environmental regulations. These coatings deliver critical functionalities such as corrosion resistance, flexibility, adhesion, chemical inertness, and aesthetics, making them highly suitable for food and beverage cans, aerosol containers, closures, and industrial packaging. Akzo Nobel develops next-generation waterborne, BPA-NI (Bisphenol A non-intent), and solvent-free coatings aligned with global sustainability trends. Its coatings are tailored to comply with stringent international standards, including FDA, EU Framework Regulation, and Swiss Ordinance requirements, ensuring safety and regulatory compliance across global markets.

Chugoku Marine Paints Ltd, HEMPEL A/S, Jotun, Kansai Paint Co. Ltd. are an emerging market participant in the Lactic Acid Market.

- Jotun, headquartered in Norway, is an emerging and agile player in the global Lactic Acid market. It is renowned for its advanced coating technologies and commitment to sustainability, performance, and aesthetics. With a strong legacy in decorative paints and marine, protective, and powder coatings, Jotun steadily expanded its footprint in metal lactic acid tailored for food, beverage, and general industrial packaging applications. The company emphasizes innovative, BPA-NI (Bisphenol A non-intent) solutions, corrosion resistance, and superior adhesion to meet the evolving regulatory and consumer demands for safe, durable, and eco-friendly coatings. Leveraging its robust R&D capabilities, global production facilities, and localized technical support teams, Jotun delivers high-performance solutions with consistent quality across Europe, Asia Pacific, the Middle East, and emerging markets. Its integrated supply chain, sustainability focus, and deep industry expertise position Jotun as a trusted partner for brand owners, converters, and packaging manufacturers in the dynamic global Lactic Acid landscape.

Key Lactic Acid Companies:

The following are the leading companies in the lactic acid market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Galactic

- Musashino Chemical (China) Co., Ltd.

- Futerro

- Corbion

- Dow

- TEIJIN LIMITED

- NatureWorks LLC

- Henan Jindan Lactic Acid Technology Co. Ltd.

- thyssenkrupp AG

- Cellulac

- Jungbunzlauer Suisse AG

- Vaishnavi Bio Tech

- Danimer Scientific

Recent Developments

-

In December 2023, Sulzer’s launch of the SULAC technology addresses growing market demand for lactic acid by enabling its efficient conversion into lactide, a critical intermediate for producing polylactic acid (PLA). This advancement enhances the availability of high-quality biopolymers and supports wider adoption of sustainable plastics, reinforcing Sulzer’s leadership in the PLA value chain and circular manufacturing.

-

In May 2023, The partnership between Sulzer and Jindan New Biomaterials highlights growing market demand for lactic acid, driven by its use in producing polylactic acid (PLA), a biobased plastic. With a planned annual PLA output of 75,000 tonnes for packaging, molded goods, and fiber applications, the agreement reflects strong momentum toward sustainable, circular manufacturing practices and the expanding bioplastics market in China.

Lactic Acid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,682.4 million

Revenue forecast in 2033

USD 6,653.7 million

Growth rate

CAGR of 7.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; UK; Italy; Spain; Netherlands; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF; Galactic; Musashino Chemical (China) Co., Ltd.; Futerro; Corbion; Dow; TEIJIN LIMITED; NatureWorks LLC; Henan Jindan Lactic Acid Technology Co. Ltd.; thyssenkrupp AG; Cellulac; Jungbunzlauer Suisse AG; Vaishnavi Bio Tech; Danimer Scientific

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lactic Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global lactic acid market report based on raw material, application and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Industrial

-

Food & Beverages

-

Beverages

-

Bakery & Confectionary Products

-

Dairy Products

-

Meat Products

-

Other Food Products

-

-

Pharmaceuticals

-

Personal Care

-

Polylactic Acid

-

Other Applications

-

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Corn

-

Sugarcane

-

Cassava

-

Yeast Extract

-

Other Crops

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lactic acid market size was estimated at USD 3,454.6 million in 2024 and is expected to reach USD 3,682.4 million in 2025.

b. The global lactic acid market is expected to grow at a compound annual growth rate of 7.7% from 2025 to 2033 to reach USD 6,653.7 million by 2033.

b. The corn-based lactic acid segment led the market and accounted for the largest revenue share of 35.8% in 2024, owing to its low cost, sustainability, and abundance in nature.

b. Some of the key players operating in the lactic acid market include BASF, Galactic, Musashino Chemical (China) Co., Ltd., Futerro, Corbion, Dow, TEIJIN LIMITED, NatureWorks LLC, Henan Jindan Lactic Acid Technology Co. Ltd., thyssenkrupp AG, Cellulac, Jungbunzlauer Suisse AG, Vaishnavi Bio Tech, Danimer Scientific.

b. The growth is attributed to lactic acid’increasing usage of this form in various end use industries including pharmaceuticals, food & beverages.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.