- Home

- »

- Electronic Devices

- »

-

Latin America Coordinate Measuring Machine Market, 2030GVR Report cover

![Latin America Coordinate Measuring Machine Market Size, Share & Trends Report]()

Latin America Coordinate Measuring Machine Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Fixed CMM, Portable CMM), By Industry Vertical (Automotive, Aerospace, Electronics, Heavy Machinery Manufacturing ), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-705-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2030

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

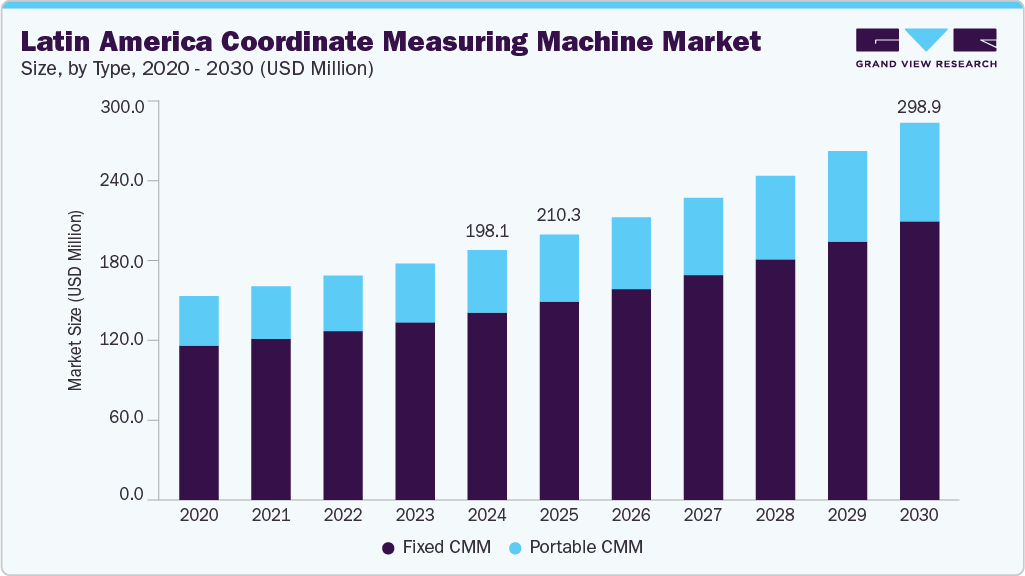

The Latin America coordinate measuring machine market size was estimated at USD 198.1 million in 2024 and is projected to reach USD 298.9 million by 2030, growing at a CAGR of 7.3% from 2025 to 2030. The market growth is driven by the growing industrial automation and digital transformation initiatives across Latin America. In addition, the diversification of CMM offerings, including portable systems, laser scanners, and fully automated bridge machines, has expanded applicability across various industries, thereby broadening the market base and accelerating adoption across Latin America.

The rising integration of cloud computing and Industry 4.0 technologies is transforming manufacturing and quality control processes across the region. Adoption of smart sensors, IoT connectivity, and digital metrology software, combined with cloud platforms, enables real-time data storage, analytics, and remote access to measurement results. Countries such as Brazil and Mexico are at the forefront of these developments, propelled by government policies and heightened investments in automation. These factors will drive the Latin America coordinate measuring machine industry growth.

In addition, the rising integration of Industry 4.0 technologies and automation trends within manufacturing processes is significantly accelerating the Latin America coordinate measuring machine industry expansion. Latin American industries increasingly leverage digital metrology solutions that incorporate smart sensors, real-time data acquisition, and connectivity features, allowing seamless integration with manufacturing execution systems (MES). This digital transformation supports predictive maintenance and process optimization, enabling manufacturers to reduce downtime and improve throughput. Key countries such as Brazil and Argentina are leading these adoption trends, supported by government initiatives encouraging modernization and innovation in industrial production.

Furthermore, the growing shift towards more flexible and non-contact measurement technologies, such as optical digitizers and scanners, is rapidly gaining traction alongside traditional tactile CMMs in Latin America. These non-contact systems provide faster, damage-free measurements and are particularly suited for complex or delicate components, complementing established CMM applications. In, there is increasing demand for portable, shop-floor-ready CMMs that enable on-site inspections, boosting efficiency. These trends, along with growing automation, are driving the market towards smarter, more automated, and cost-effective quality control solutions.

Moreover, the growing adoption of multi-sensor and non-contact measurement technologies, such as laser scanning, optical probes, and white light sensors, reshapes the Latin America coordinate measuring machine industry. These innovations enable faster, more detailed 3D data acquisition for complex geometries and delicate surfaces, which is critical in industries such as electronics, aerospace, and advanced manufacturing. This trend is expected to boost demand for technologically advanced CMMs, thereby fueling Latin America coordinate measuring machine industry growth across high-precision manufacturing sectors in the coming years.

Type Insights

The fixed CMM segment accounted for the largest market share of over 74% in 2024, driven by the increasing adoption of automated inspection systems in automotive and aerospace manufacturing, where precision and repeatability are critical. Fixed CMMs offer superior accuracy and stability, ideal for high-volume production lines. The integration of advanced software and multi-sensor capabilities is enhancing their performance, while rising investments in industrial metrology infrastructure are further supporting market expansion.

The portable CMM segment is expected to witness the fastest CAGR of 8.0% from 2025 to 2030. The increasing demand for on-site precision measurement in automotive, aerospace, and heavy machinery sectors significantly drives the adoption of portable CMMs. The segment is poised to expand steadily, including the need for mobility in quality inspection processes, cost-effective metrology solutions for SMEs, and the rising focus on improving productivity in manufacturing.

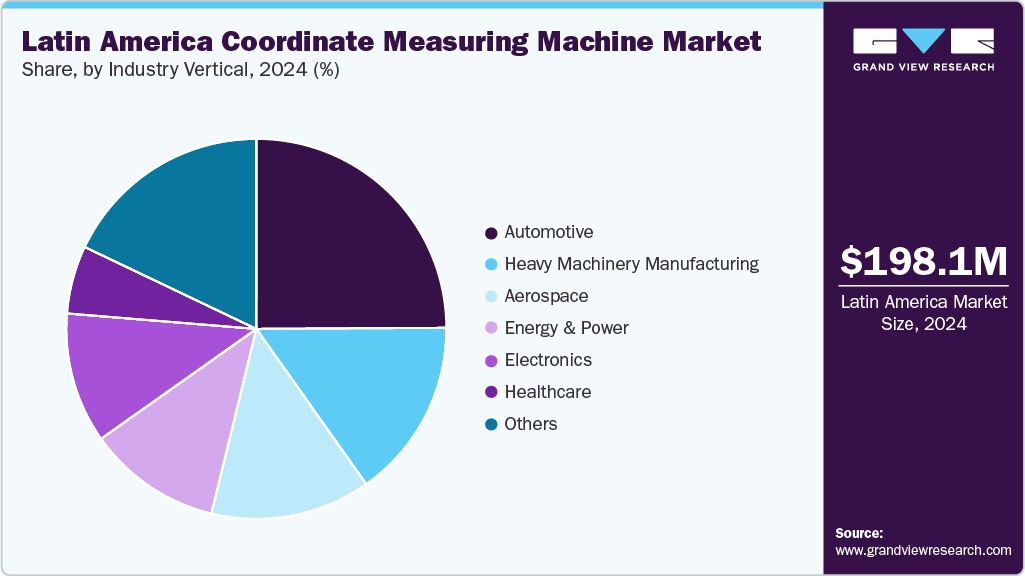

Industry Vertical Insights

The automotive segment accounted for the largest market share in 2024, driven by the rising demand for precision engineering, quality assurance, and stringent dimensional inspection requirements in automotive manufacturing. Automakers in Latin America are increasingly transitioning to electric vehicles (EVs) and advanced driver-assistance systems (ADAS), driving a growing demand for high-precision measurement tools that support complex component integration and ensure compliance with stringent global quality standards. Adopting automated CMM systems enables faster inspection cycles and reduced operational downtime, enhancing overall productivity in automotive assembly lines.

The energy & power segment is expected to register the fastest CAGR from 2025 to 2030. Rising quality assurance requirements in the energy and power industry are accelerating the adoption of coordinate measuring machines (CMMs) across Latin America. This segment is experiencing robust growth as energy infrastructure projects increasingly rely on precision metrology for turbine blade calibration, pipeline inspection, and validation of renewable energy components. The regional shift toward clean energy sources, such as solar and wind, demands high-accuracy measurement systems to ensure product integrity and regulatory compliance.

Country Insights

The Brazil coordinate measuring machine market accounted for the largest market share of over 36% in 2024, driven by Brazil’s increasing investments in precision engineering and quality assurance within its rapidly expanding aerospace and defense sectors. The Brazilian oil & gas industry’s focus on enhancing safety and component reliability in offshore platforms pushes the adoption of portable and shopfloor CMMs. The country’s tax incentives for R&D and importation of advanced manufacturing technologies further encourage the integration of coordinate measuring systems.

Mexico Coordinate Measuring Machine Market Trends

The Mexico coordinate measuring machine market is expected to grow at a CAGR of over 7% in 2024. This growth is primarily driven by the expansion of automotive and aerospace manufacturing hubs and increasing demand for precision and quality control in the electronics and metalworking sectors. The adoption of Industry 4.0-enabled CMM solutions featuring multi-sensor systems, AI-enhanced path planning, and seamless ERP integration is enhancing productivity and dimensional accuracy across industrial applications.

Key Latin America Coordinate Measuring Machine Company Insights

Some of the key players operating in the market include Carl Zeiss AG, and Hexagon AB, among others.

-

Carl Zeiss AG is a technology company specializing in optics and optoelectronics. The company offers advanced multidimensional metrology solutions, including coordinate measuring machines, optical and multisensory systems, and metrology software. The company serves critical sectors such as semiconductor manufacturing, automotive, aerospace, mechanical engineering, biomedical research, and medical technology. The company emphasizes precision engineering and innovation, utilizing proprietary sensor technologies and pioneering computer numerical control (CNC) in CMMs.

-

Hexagon AB is a globally recognized technology company, specializing in precision measurement, sensors, software, and autonomous solutions that drive productivity, quality, safety, and sustainability across key industries such as manufacturing, aerospace, automotive, construction, and mining. Its broad portfolio includes solutions for quality inspection and process optimization. The company combines advanced metrology, reality capture, and positioning systems to support digital transformation and Industry 4.0 initiatives.

Mahr GmbH and Renishaw plc are some of the emerging participants in the Latin America coordinate measuring machine market.

-

Mahr GmbH is a globally recognized technology company and specializes in high-precision measurement technology, including coordinate measuring machines, metering pumps, and ball-bearing guides. The company serves diverse and demanding industries such as automotive, aerospace, medical technology, optics, and mechanical engineering. The company is supported by a broad international network of locations and dealerships across five continents, including Latin America.

-

Renishaw plc is a global engineering technology group, specializing in the design and manufacture of high-precision technology for metrology and healthcare. The company’s portfolio includes precision measurement and process control systems, machine calibration and optimization products, additive manufacturing machines, and medical devices. The company serves diverse industries including transport, agriculture, electronics, aerospace, energy, and healthcare.

Key Latin America Coordinate Measuring Machine Companies:

- Carl Zeiss AG

- Creaform (AMETEK, Inc.)

- FARO Technologies, Inc. (AMETEK, Inc.)

- Hexagon AB

- Keyence Corporation

- Mahr GmbH

- Mitutoyo Corporation

- Nikon Metrology (Nikon Corporation)

- Renishaw plc

- Vision Engineering Ltd.

Recent Developments

-

In July 2025, AMETEK, Inc., announced the successful completion of its strategic acquisition of FARO Technologies, Inc., a global metrology solutions provider. FARO now operates as part of AMETEK’s Ultra Precision Technologies Division, expanding AMETEK’s capabilities in advanced industrial measurement and inspection technologies.

-

In June 2025, Hexagon AB introduced the Autonomous Metrology Suite, software built on its cloud-based Nexus platform to transform quality control workflows. The suite removes all coding from CMM workflows, accelerating programming times from day to hour.

-

In March 2025, Creaform (AMETEK, Inc.) expanded its Creaform Metrology Suite with the release of a new Sheet Metal Inspection software module. This addition enhances Suite’s capabilities by providing specialized tools for efficient and accurate inspection of sheet metal parts.

Latin America Coordinate Measuring Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 210.3 million

Revenue forecast in 2030

USD 298.9 million

Growth rate

CAGR of 7.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2030

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, industry vertical, country

Country scope

Brazil; Mexico; Argentina; Colombia; Central America

Key companies profiled

Carl Zeiss AG; Creaform (AMETEK, Inc.); FARO Technologies, Inc. (AMETEK, Inc.); Hexagon AB; Keyence Corporation; Mahr GmbH; Mitutoyo Corporation; Nikon Metrology (Nikon Corporation); Renishaw plc; Vision Engineering Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Latin America Coordinate Measuring Machine Market Segmentation

This report forecasts revenue growth at the regional and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Latin America coordinate measuring machine market report based on type, industry vertical, and country:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed CMM

-

Bridge

-

Cantilever

-

Gantry

-

-

Portable CMM

-

Articulated Arm

-

Handheld

-

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Heavy Machinery Manufacturing

-

Aerospace

-

Electronics

-

Energy & Power

-

Healthcare

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

Central America

-

Frequently Asked Questions About This Report

b. The Latin America coordinate measuring machine market size was estimated at USD 198.1 million in 2024 and is expected to reach USD 210.3 million in 2025.

b. The Latin America coordinate measuring machine market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2030 to reach USD 298.9 million by 2030.

b. The fixed CMM segment accounted for the largest market share of over 74% in 2024, driven by the increasing adoption of automated inspection systems in automotive and aerospace manufacturing, where precision and repeatability are critical.

b. Some key players operating in the Latin America coordinate measuring machine (CMM) market include Carl Zeiss AG, Creaform (AMETEK, Inc.), FARO Technologies, Inc. (AMETEK, Inc.), Hexagon AB, Keyence Corporation, and Mahr GmbH, among others.

b. Key factors that are driving the Latin America coordinate measuring machine (CMM) market growth include the growing industrial automation and digital transformation initiatives across the region, rising integration of cloud computing and Industry 4.0 technologies, and the growing shift towards more flexible and non-contact measurement technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.