- Home

- »

- Water & Sludge Treatment

- »

-

Liquid Waste Management Market Size & Share Report, 2033GVR Report cover

![Liquid Waste Management Market Size, Share & Trends Report]()

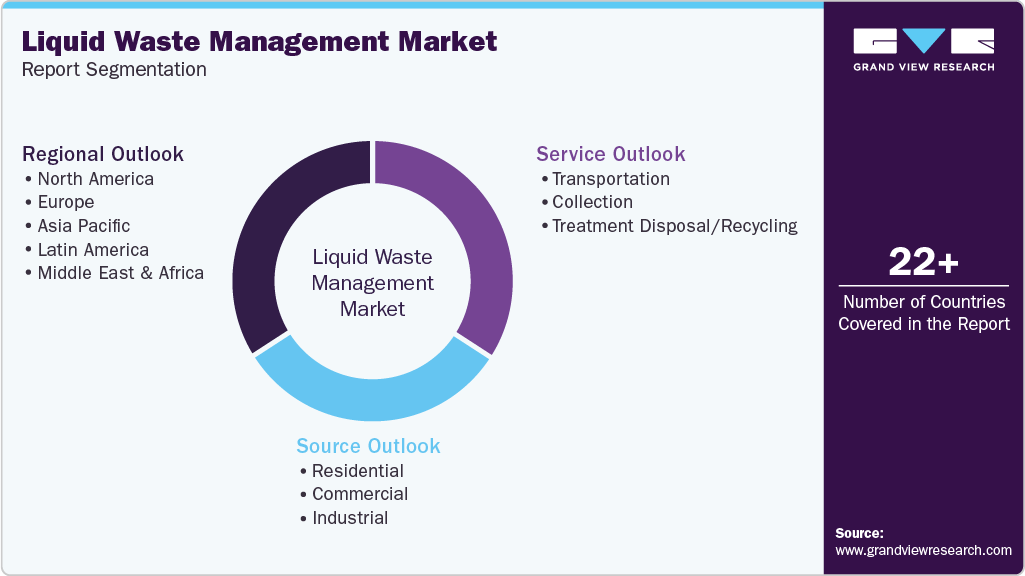

Liquid Waste Management Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Residential, Commercial, Industrial), By Source (Transportation, Collection, Treatment Disposal/ Recycling), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-498-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Liquid Waste Management Market Summary

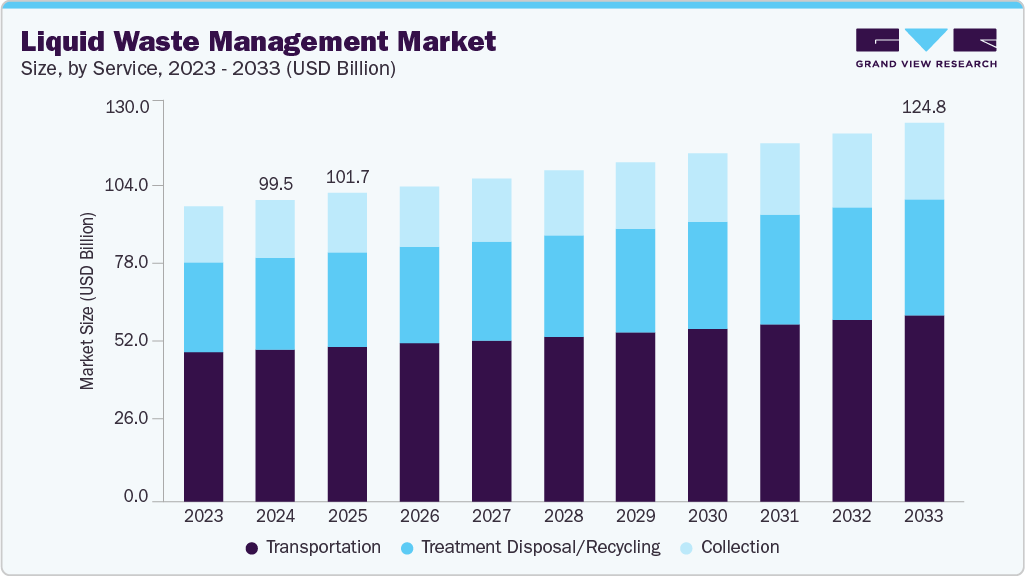

The global liquid waste management market size was estimated at USD 99.49 billion in 2024 and is projected to reach USD 124.83 billion by 2033, growing at a CAGR of 2.6% from 2025 to 2033. Rising demand for wastewater treatment plants, driven by urbanization and industrial growth, is boosting the need for effective liquid waste management.

Key Market Trends & Insights

- North America dominated the liquid waste management market with the largest revenue share of 42.1% in 2024.

- By source, the commercial segment is expected to grow at the fastest CAGR of 2.9% from 2025 to 2033.

- By service, the collection segment is expected to grow at the fastest CAGR of 3.1% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 99.49 Billion

- 2033 Projected Market Size: USD 124.83 Billion

- CAGR (2025-2033): 2.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

Growing concerns over environmental toxicity, public health, and regulatory compliance are pushing industries and municipalities to adopt advanced treatment solutions. The growing population, expansion of new housing projects, and a rising number of users connecting to centralized wastewater treatment systems are expected to drive demand for secondary wastewater treatment equipment significantly.

As urban infrastructure develops and environmental regulations tighten, the need for efficient treatment solutions will increase, further propelling market growth over the coming years across residential and municipal sectors.

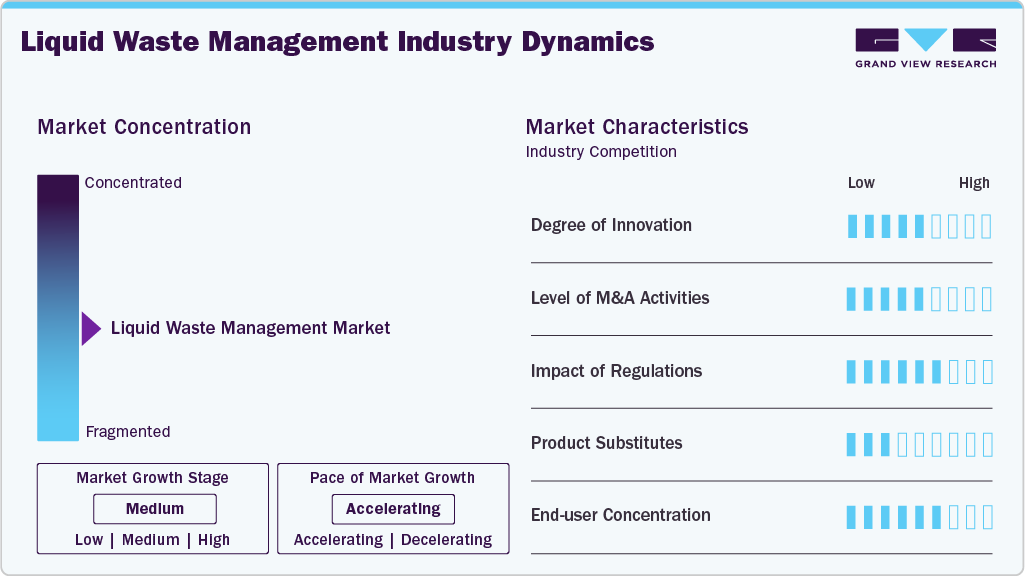

Market Concentration & Characteristics

The liquid waste management industry is moderately fragmented, with a mix of global corporations, regional service providers, and specialized local firms competing. Large players offer end-to-end waste treatment solutions, while smaller companies focus on niche services or specific regions. Despite a few dominant firms, no single company holds overwhelming market control. Varying local regulations, infrastructure needs, and customer preferences allow multiple providers to coexist, creating competitive diversity.

The liquid waste management industry is witnessing significant innovation, driven by advancements in biological treatment, membrane technologies, and real-time monitoring systems. Companies are developing eco-friendly, energy-efficient solutions to meet rising environmental concerns. Smart automation, AI-based analytics, and zero-liquid discharge technologies are also gaining traction, enhancing efficiency, compliance, and sustainability across industrial, municipal, and residential waste treatment processes.

Mergers and acquisitions in the liquid waste management industry are driven by the need to expand service portfolios, enter new regions, and enhance technological capabilities. Larger firms acquire niche or regional players to strengthen market presence and access specialized expertise. These consolidations improve operational scale, streamline logistics, and help companies better address rising environmental and regulatory demands across diverse sectors.

Stringent environmental regulations are a major force shaping the liquid waste management industry. Governments and environmental bodies are enforcing strict discharge standards, pollution control norms, and water reuse mandates. Compliance with these regulations compels industries and municipalities to invest in advanced treatment systems. Regulations also encourage the adoption of sustainable practices, driving demand for more efficient and compliant waste management solutions.

Drivers, Opportunities & Restraints

Rapid urbanization and industrialization are key drivers for the liquid waste management industry. Growing populations, expanding cities, and increased industrial activity generate higher volumes of wastewater. This surge, combined with rising awareness of environmental and public health risks, is pushing governments and industries to invest in efficient, large-scale liquid waste treatment and disposal systems to meet growing demand.

The shift toward sustainable practices and circular economy principles presents a major opportunity in the market. Technologies that enable water recycling, resource recovery, and energy generation from waste are in high demand. Governments and industries seeking eco-friendly solutions create strong growth prospects for innovative companies offering advanced treatment, reuse, and zero-liquid discharge systems globally.

A key challenge in the liquid waste management industry is the high capital and operational costs of advanced treatment technologies. Small municipalities and industries often lack resources to upgrade infrastructure or meet strict regulations. In addition, fragmented waste collection systems, varying local policies, and limited public awareness hinder consistent implementation of effective liquid waste management solutions across regions.

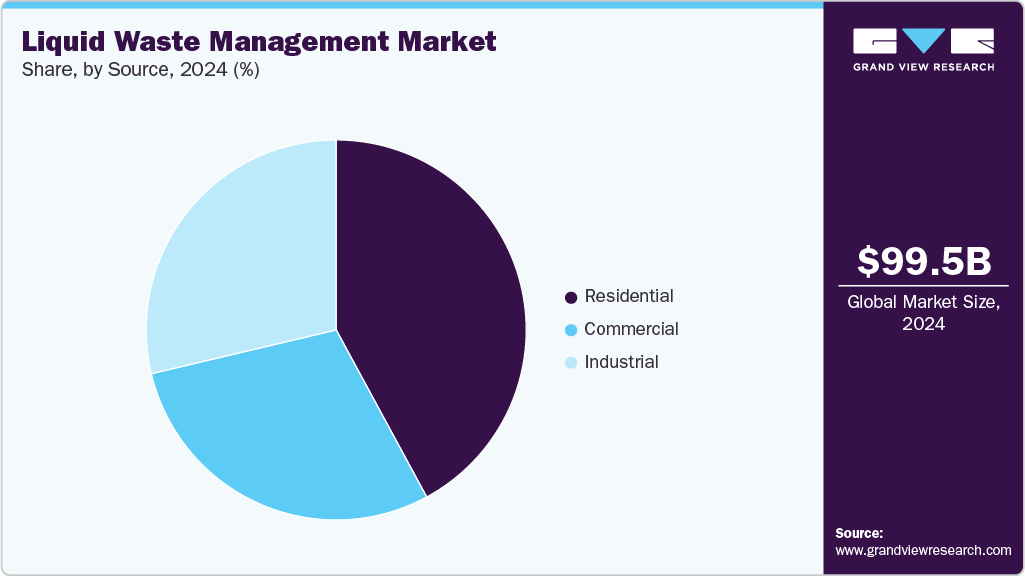

Source Insights

The residential segment led the market with the largest revenue share of 42.1% in 2024, due to rapid population growth, water usage across various household applications has surged, increasing per capita wastewater generation. Rising awareness, especially in countries like the U.S., regarding proper waste disposal for safeguarding human and animal health, has led to the adoption of advanced disposal and recycling methods, particularly for waste containing harmful substances like salts and heavy metals.

The commercial segment is projected to grow at the fastest CAGR during the forecast period, due to advancements in healthcare infrastructure and rising demand in the hospitality industry. The increased use of water in commercial buildings such as hotels and hospitals is leading to higher wastewater output. This growing water demand and subsequent waste generation are expected to fuel the need for effective liquid waste management solutions in the coming years.

Service Insights

The transportation segment led the market with the largest revenue share of 50.4% in 2024, due to rising volumes of industrial and municipal liquid waste requiring safe transfer to treatment or disposal sites. With increased regulatory oversight and the need for spill-free, compliant transport systems, demand is rising for specialized tankers and logistics services across urban and industrial regions.

The collection segment is projected to grow at the fastest CAGR during the forecast period, as expanding urban populations and stricter environmental laws drive demand for efficient liquid waste collection systems. Municipalities and industries are outsourcing services to professional waste management firms to ensure timely and compliant collection. Technological advancements like smart tracking are also enhancing operational efficiency and service reliability in this segment.

Regional Insights

North America dominated the liquid waste management market with the largest revenue share of 42.1% in 2024, due to strict environmental regulations, high industrial activity, and increasing urbanization. Rising public awareness, government funding, and advancements in treatment technologies are promoting the adoption of efficient waste management systems. Infrastructure upgrades and initiatives aimed at water reuse and pollution control further support market expansion across residential, commercial, and industrial sectors.

U.S. Liquid Waste Management Market Trends

The liquid waste management in the U.S. accounted for the largest market revenue share in 2024,driven by stringent EPA regulations, increasing wastewater volumes, and strong infrastructure investments. High awareness of environmental health, widespread industrial operations, and technological advancements are encouraging the adoption of sustainable treatment solutions. Additionally, growing emphasis on recycling and zero-liquid discharge practices is boosting demand for advanced waste management systems nationwide.

The Mexico liquid waste management is growing, supported by a rising urban population, industrial development, and the government's focus on environmental sustainability. Aging infrastructure and increasing water pollution concerns are driving investments in modern wastewater treatment facilities. In addition, international collaborations and funding programs are helping improve regulatory enforcement and technological adoption, boosting the country’s capacity to manage and treat liquid waste effectively.

Asia Pacific Liquid Waste Management Market Trends

The liquid waste management market in the Asia Pacific is expected to grow at the fastest CAGR of 3.7% during the forecast period, fueled by rapid urbanization, industrialization, and population growth. Countries in the region are investing heavily in wastewater treatment infrastructure to address rising pollution levels. Government initiatives, stricter environmental regulations, and public health concerns are driving the adoption of modern treatment technologies, especially across emerging economies with expanding manufacturing and urban sectors.

The China liquid waste management market is expected to grow at a significant CAGR during the forecast period, due to aggressive environmental reforms, expanding industrial activities, and urban population growth. The government is enforcing stricter wastewater discharge regulations and investing in smart treatment infrastructure. With rising water scarcity and pollution concerns, there is increased demand for efficient treatment, recycling, and zero-liquid discharge technologies across residential, industrial, and commercial segments nationwide.

The liquid waste management market in India is driven by its growing population, urban expansion, and rising industrial output. Initiatives like the Swachh Bharat Mission and government-led infrastructure development are boosting investment in wastewater treatment. However, challenges like aging systems and informal waste practices are pushing demand for modern, scalable, and affordable treatment solutions in both urban and rural areas.

Europe Liquid Waste Management Market Trends

The liquid waste management market in Europe is witnessing strong growth due to strict EU environmental regulations, strong sustainability goals, and advanced infrastructure. The region emphasizes circular economy practices, driving investments in wastewater recycling and resource recovery. Increasing industrial activity, urban wastewater generation, and public awareness further support demand for innovative, energy-efficient treatment technologies across both public and private sectors.

The Germany liquid waste management market isgrowingrapidly due to stringent environmental laws, industrial efficiency, and commitment to sustainable development. The country’s strong manufacturing sector produces significant liquid waste, necessitating advanced treatment systems. Public and private investment in water recycling, energy recovery, and smart wastewater infrastructure continues to boost market expansion, aligning with Germany’s ambitious environmental and resource conservation targets.

The liquid waste management market in the UK is growingdue to increasing environmental awareness, regulatory enforcement, and infrastructure upgrades. Rising demand from urban centers, healthcare, and industrial sectors is driving investment in modern treatment solutions. Post-Brexit policy shifts and climate resilience goals are also encouraging the development of localized, efficient waste management systems, particularly in wastewater recycling and pollution control.

Middle East & Africa Liquid Waste Management Market Trends

The liquid waste management market in the Middle East & Africa is fueled by rapid urbanization, industrial development, and increasing water scarcity. Governments are investing in modern wastewater treatment infrastructure to address pollution and environmental challenges. Rising awareness, tourism expansion, and regulatory pressure, especially in Gulf countries, are encouraging the adoption of advanced, sustainable waste treatment technologies across municipalities and industries.

The Saudi Arabia liquid waste management market is set to grow at a significant CAGR during the forecast period, fueled by Vision 2030, which prioritizes environmental sustainability and infrastructure modernization. The country’s expanding urban population, industrial base, and water reuse initiatives are driving demand for advanced wastewater treatment solutions. Major investments in smart cities, petrochemical zones, and tourism hubs further support growth, while stringent regulatory frameworks encourage compliance and the adoption of efficient liquid waste management systems.

Latin America Liquid Waste Management Market Trends

The liquid waste management market in Latin America is gradually expanding due to increasing urbanization, industrial expansion, and rising environmental awareness. Governments are implementing stricter wastewater treatment regulations and investing in infrastructure upgrades. However, uneven development and limited access in rural areas present challenges. Public-private partnerships and international funding are helping boost the adoption of modern liquid waste treatment systems across key urban and industrial regions.

The Brazil liquid waste management market is emerging as Latin America’s fastest-growing market,driven by rising urban population, industrial activity, and government efforts to improve sanitation infrastructure. Environmental concerns and stricter wastewater regulations are encouraging investment in advanced treatment systems. Major cities are leading adoption, while public initiatives aim to improve access in underserved areas. Increasing focus on sustainability and water reuse further supports long-term market growth.

Key Liquid Waste Management Company Insights

Some of the key players operating in the liquid waste management industry include Veolia, SUEZ S.A., Evoqua Water Technologies Corporation, and Biffa plc.

-

Veolia is a global environmental solutions company based in France, specializing in water, waste, and energy management. In the liquid waste management sector, Veolia offers advanced treatment technologies, recycling solutions, and sludge management services. The company operates in more than 40 countries, including key regions in the Middle East, providing industrial and municipal clients with sustainable systems to reduce pollution, recover resources, and comply with increasingly strict environmental regulations.

-

SUEZ S.A., headquartered in France, is a prominent player in the global water and waste management industry. The company delivers integrated solutions for wastewater treatment, industrial effluent management, and water reuse. Its services span design, engineering, and operation of liquid waste facilities. SUEZ has a significant presence in the Middle East, offering tailored technologies to address water scarcity, regulatory compliance, and environmental sustainability across urban and industrial sectors.

Key Liquid Waste Management Companies:

- Veolia

- SUEZ S.A.

- Evoqua Water Technologies Corporation

- Biffa plc

- Waste Management Inc.

- Clean Harbors Inc.

- Clean Water Environmental

- Liquid Environmental Solutions (LES)

- DC Water

- Covanta Holding Corp.

- Stericycle, Inc.

- U.S. Ecology, Inc.

- Republic Services, Inc.

- Hazardous Waste Experts

- Xylem, Inc.

Recent Developments

-

In April 2025,Veolia Water Technologies opened a new Mobile Water Service Center in Cajamar, São Paulo, Brazil. This facility enhances Veolia’s ability to provide rapid, on-site water treatment solutions, improving service efficiency and supporting industries with flexible, mobile water management and treatment capabilities in the growing Latin American market.

-

In April 2025,Waste Management (WM) announced the opening of upgraded recycling facilities near Baltimore and Central Texas. These modernized, high-tech centers aim to enhance waste processing efficiency, promote sustainability, and support cleaner energy production across key U.S. regions.

Liquid Waste Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 101.67 billion

Revenue forecast in 2033

USD 124.83 billion

Growth rate

CAGR of 2.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, service, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; Russia; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Veolia; SUEZ S.A.; Evoqua Water Technologies Corporation; Biffa plc; Waste Management Inc.; Clean Harbors Inc.; Clean Water Environmental; Liquid Environmental Solutions (LES); DC Water; Covanta Holding Corp.; Stericycle, Inc.; U.S. Ecology, Inc.; Republic Services, Inc.; Hazardous Waste Experts; Xylem, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liquid Waste Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global liquid waste management market report based on source, service, and region.

-

Source Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Commercial

-

Toxic & Hazardous

-

Organic & Non-Hazardous

-

-

Industrial

-

Toxic & Hazardous

-

Organic & Non-Hazardous

-

-

-

Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Transportation

-

Collection

-

Treatment Disposal/ Recycling

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global liquid waste management market size was estimated at USD 99.49 billion in 2024 and is expected to be USD 101.67 billion in 2025.

b. The global liquid waste management market, in terms of revenue, is expected to grow at a compound annual growth rate of 2.6% from 2025 to 2033 to reach USD 124.83 billion by 2033.

b. The transportation segment dominated the liquid waste management market in 2024, holding the largest revenue share at 50.4% due to rising volumes of industrial and municipal liquid waste requiring safe transfer to treatment or disposal sites.

b. Some of the key players operating in the global liquid waste management market include Veolia, Evoqua Water Technologies Corporation, Biffa plc, Waste Management Inc., Clean Harbors Inc., Clean Water Environmental, Liquid Environmental Solutions (LES), DC Water, Covanta Holding Corp., Stericycle, Inc., U.S. Ecology, Inc., Republic Services, Inc., Hazardous Waste Experts, Xylem, Inc.

b. Key factors driving the global liquid waste management market include rapid urbanization, industrial growth, increasing environmental regulations, rising awareness about water pollution, and the need for sustainable wastewater treatment solutions across residential, commercial, and industrial sectors worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.