- Home

- »

- IT Services & Applications

- »

-

Managed Data Center Services Market, Industry Report 2033GVR Report cover

![Managed Data Center Services Market Size, Share, & Trend Report]()

Managed Data Center Services Market (2025 - 2033) Size, Share, & Trend Analysis, By Type (Infrastructure Management, Security Management), By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-671-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Managed Data Center Services Market Summary

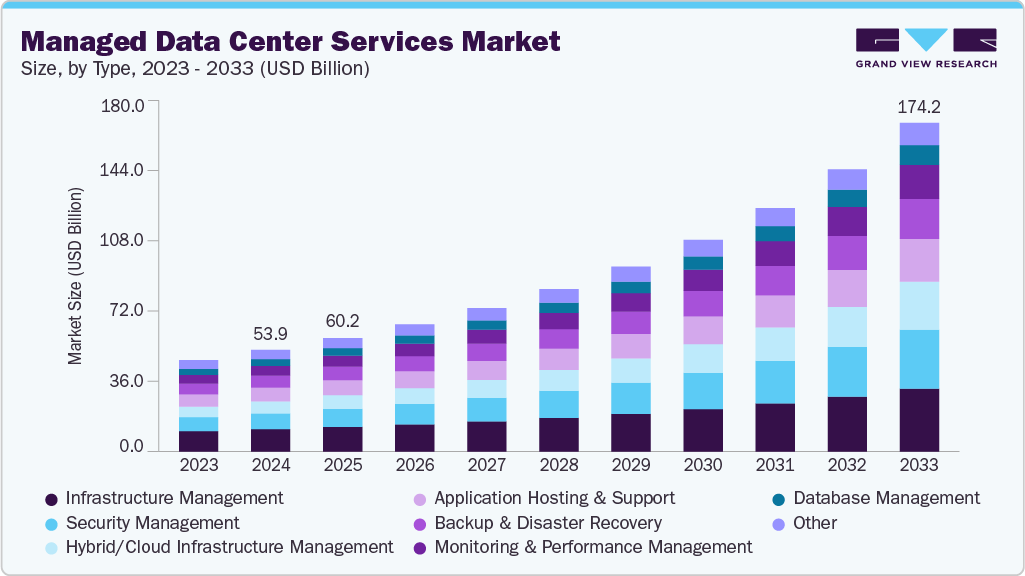

The global managed data center services market size was estimated at USD 53.88 billion in 2024 and is projected to reach USD 174.25 billion by 2033, growing at a CAGR of 14.2% from 2025 to 2033. Organizations across industries are increasingly shifting from owning and operating their own data centers to outsourcing their infrastructure needs to managed service providers.

Key Market Trends & Insights

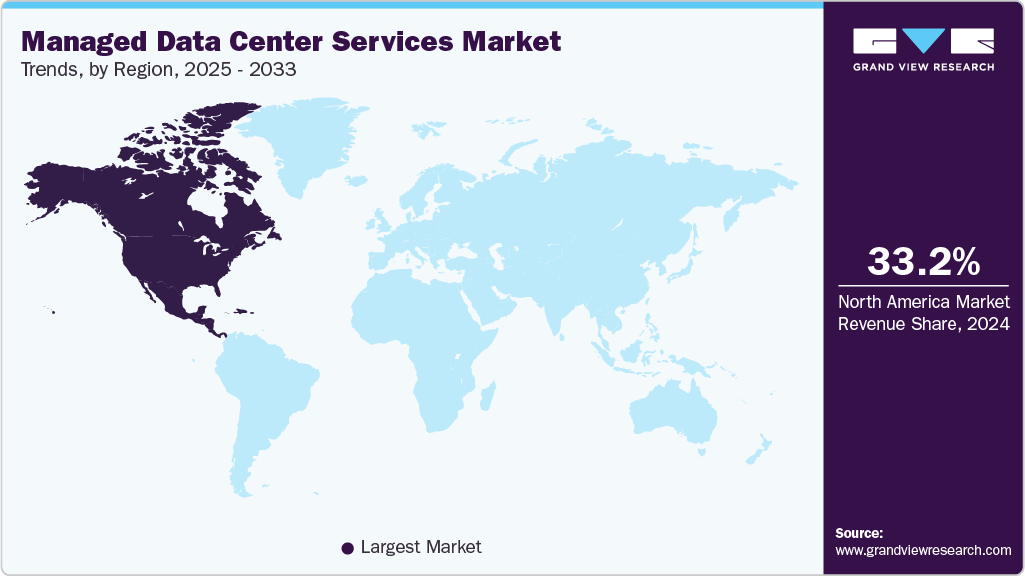

- North America managed data center services dominated the global market with the largest revenue share of 33.2% in 2024.

- The managed data center services industry in U.S. is expected to grow significantly over the forecast period.

- By type, infrastructure management led the market and held the largest revenue share of 22.0% in 2024.

- By deployment, the cloud segment held the dominant position in the market and accounted for the largest revenue share in 2024.

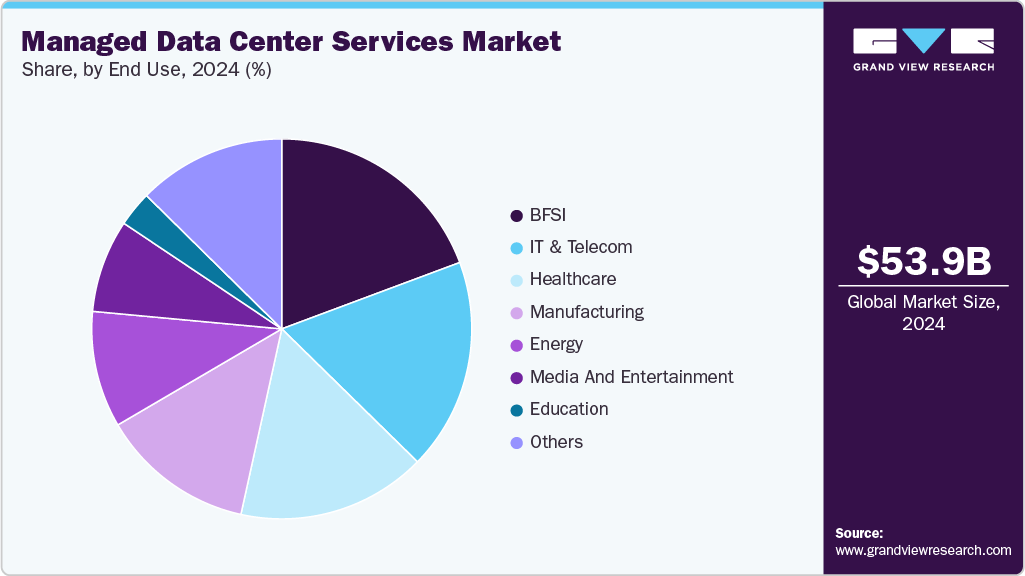

- By end use, the BFSI segment is expected to grow at the fastest CAGR from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 53.88 Billion

- 2033 Projected Market Size: USD 174.25 Billion

- CAGR (2025-2033): 14.2%

- North America: Largest market in 2024

This transformation is driven by the high capital and operational costs associated with building, maintaining, and upgrading in-house data centers. Managed data center services offer businesses scalable solutions where they pay only for the resources they use, optimizing IT expenditure. This is especially beneficial for SMEs and enterprises undergoing digital transformation, as they can quickly scale infrastructure to meet fluctuating demands without the burden of managing physical assets. The growing adoption of cloud and hybrid IT models is also a significant driver for the managed data center services industry. As businesses adopt multi-cloud and hybrid strategies to combine the benefits of public cloud, private cloud, and on-premises systems, the complexity of managing such environments increases. Managed service providers help bridge these gaps by offering seamless integration, security, and monitoring services across heterogeneous environments. This enables businesses to focus on core operations while maintaining robust, compliant, and optimized IT ecosystems.

With the surge in cyberattacks, data breaches, and stricter global data regulations such as GDPR, HIPAA, and India’s DPDP Act, organizations are under pressure to ensure high levels of data protection and regulatory compliance. Managed data center providers are investing heavily in advanced security protocols, continuous monitoring, and compliance management tools to address these challenges. By outsourcing to providers with strong cybersecurity frameworks and compliance expertise, businesses can mitigate risks, avoid penalties, and ensure business continuity, making this a critical growth driver for the market. As of January 2025, data from the International Association of Privacy Professionals (IAPP), a U.S.-based global organization focused on privacy, indicates that 144 countries have implemented national data privacy laws. These laws now extend protections to around 6.64 billion individuals, representing 82% of the global population. This marks a notable rise from the 79% coverage reported in the prior update.

Type Insights

The infrastructure management segment dominated the market and accounted for the revenue share of 22.0% in 2024, driven by the rising demand for scalable, secure, and cost-efficient IT infrastructure across enterprises of all sizes. As businesses increasingly adopt hybrid and multi-cloud environments, the need for expert management of physical and virtual infrastructure has surged. Growth is further fueled by the rapid digitization of operations, increased data volumes, and the pressure to maintain high uptime and performance. Moreover, growing cybersecurity concerns, regulatory compliance requirements, and the shift toward automation and AI-driven infrastructure monitoring are compelling organizations to outsource infrastructure management to specialized providers, enhancing operational efficiency and reducing risk.

The hybrid/cloud infrastructure management segment is anticipated to grow at the highest CAGR during the forecast period due to the widespread adoption of hybrid IT environments that blend on-premises systems with public and private cloud platforms. Organizations are increasingly seeking flexible and scalable infrastructure solutions to support digital transformation, improve business agility, and optimize costs. The complexity of managing diverse cloud resources, ensuring seamless integration, and maintaining consistent performance across platforms is encouraging enterprises to rely on managed service providers. In addition, growing concerns around data security, compliance, and disaster recovery in multi-cloud setups are amplifying demand for expert management services.

Deployment Insights

The cloud segment dominated the market and accounted for the largest revenue share in 2024, driven by the growing adoption of hybrid and multi-cloud strategies along with rising demand for data sovereignty, automated backups, and disaster recovery, has supported the appeal of cloud deployment. Businesses in industries such as IT & telecom, education, and healthcare are especially driving demand due to the need for robust, always-on digital infrastructure.

The on-premise segment is expected to grow at a significant CAGR during the forecast period due to organizations with strict data control, compliance, and latency requirements, particularly in sectors such as government, BFSI, and healthcare, opting to retain infrastructure within their premises. Managed service providers are addressing this demand by delivering on-premise managed solutions that combine localized control with the benefits of professional monitoring, security, and maintenance.

Enterprise Size Insights

The large enterprises segment dominated the market and accounted for the largest revenue share in 2024 fueled by the increased demand for customized service-level agreements (SLAs), advanced analytics, and support for industry-specific workloads. These organizations often require highly tailored infrastructure solutions that align with their unique operational, performance, and governance standards. The need to support global expansion, manage cross-border data flow, and enable real-time collaboration across geographies is pushing large enterprises toward managed data center providers with global footprints and multilingual support capabilities.

The small enterprises segment is expected to grow at a significant CAGR during the forecast period due to the rising availability of modular and bundled service offerings tailored specifically for smaller business needs. Managed service providers are designing simplified, pre-configured infrastructure solutions that minimize deployment time and technical complexity, making adoption easier for non-technical business owners. The increasing threat of cyberattacks targeting small businesses is also stimulating dependence on managed security, monitoring, and data recovery services integrated into managed infrastructure.

End Use Insights

The IT & telecom segment dominated the market and accounted for the largest revenue share in 2024, driven by the increasing adoption of Network Function Virtualization (NFV) and Software-Defined Networking (SDN), which require agile, programmable infrastructure environments best managed by specialized service providers. As telecom operators transition from legacy hardware to virtualized, cloud-native networks, they are turning to managed data centers to support dynamic workloads and reduce time-to-market for new services.

The healthcare segment is expected to grow at a significant CAGR over the forecast period owing to the increasing reliance on electronic health records (EHRs), telemedicine platforms, and AI-driven diagnostics, all of which require secure, high-performance infrastructure to operate effectively. Healthcare providers are partnering with managed service providers to ensure interoperability of systems across hospitals, clinics, and labs, enabling real-time access to patient data and seamless coordination of care.

Regional Insights

North America Managed Data Center Services Market Trends

North America dominated the global market with the largest revenue share of 33.2% in 2024 driven by the early adoption of next-gen technologies such as AI, big data, and IoT, which demand robust and responsive infrastructure. Enterprises are increasingly relying on managed services to handle complex workloads, automate operations, and ensure minimal latency in data processing. The region’s mature cloud ecosystem and high internet penetration further accelerate the shift toward third-party data center management to support agile digital operations.

The managed data center services market in the U.S. is expected to grow significantly at a CAGR of 13.3% from 2025 to 2033, due to strict industry-specific regulatory standards such as HIPAA, FedRAMP, and SOX are pushing businesses toward managed service providers with compliance expertise. In addition, the growth of hyperscalers and demand for edge computing in industries such as healthcare, finance, and manufacturing are driving demand for hybrid colocation and managed hosting solutions. The tech-savvy environment encourages the integration of AI-based monitoring and predictive maintenance tools, enhancing service quality and operational uptime.

Europe Managed Data Center Services Market Trends

The managed data center services market in Europe is anticipated to register considerable growth from 2025 to 2033 due to the continent's focus on sustainability and green data center initiatives. Managed data center providers are leveraging energy-efficient technologies and renewable energy sources to attract clients with ESG mandates. Furthermore, the fragmented nature of the European data sovereignty landscape encourages businesses to use regionally compliant managed services to meet local data residency requirements without setting up country-specific infrastructure.

The UK managed data center services market is expected to grow rapidly in the coming years, owing to to rising digital transformation in public sector services, including health, education, and transportation. Post-Brexit, there is also a heightened emphasis on data localization and UK-specific compliance frameworks, prompting businesses to rely on managed service partners familiar with local governance. Furthermore, increased demand for secure and agile disaster recovery services is pushing adoption of managed colocation and backup solutions.

The Germany managed data center services market held a substantial market share in 2024 due to country’ strong industrial base and emphasis on Industry 4.0 are leading to significant data generation from connected devices and manufacturing systems. Strict data protection laws under GDPR and the BSI IT-Grundschutz framework, is encouraging businesses to outsource infrastructure management to specialized providers. The need for mission-critical uptime and certified Tier III/IV facilities is a key factor driving growth in managed services.

Asia Pacific Managed Data Center Services Market Trends

Asia Pacific managed data center services held a significant share in the global market in 2024 due to rapid enterprise digitization and the proliferation of 5G and smart city projects. Many countries in the region are leapfrogging legacy systems and opting directly for managed cloud-first or hybrid IT infrastructures. The presence of a large SMB base with limited internal IT capabilities is further encouraging outsourcing to managed data center providers that offer integrated, low-cost solutions bundled with connectivity and security.

The Japan managed data center services market is expected to grow rapidly in the coming years due to the aging IT workforce and shrinking internal IT departments in many organizations. The need to maintain legacy systems while also embracing cloud migration strategies has led to higher reliance on managed providers. In sectors such as finance, automotive, and public services, there's an increased focus on high-security, disaster-resilient, and highly available infrastructure-which managed services are uniquely positioned to deliver.

The China managed data center services market held a substantial market share in 2024, due to the government-driven digitization initiatives and rapid expansion of internet-based businesses such as e-commerce, gaming, and fintech. With regulatory scrutiny tightening under the Cybersecurity Law and the Personal Information Protection Law (PIPL), enterprises are turning to certified managed data center providers for secure, policy-compliant infrastructure management.

Key Managed Data Center Services Company Insights

Key players operating in the managed data center services industry are IBM Corporation, Amazon Web Services (AWS), Microsoft, Hewlett Packard Development LP, and Dell Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, IBM Corporation introduced IBM Storage Ceph as a Service, expanding its portfolio of flexible, on-premises infrastructure solutions offered in an as-a-service model. This new addition complements IBM Power delivered as a service, enhancing the company’s ability to provide scalable, cloud-like capabilities within enterprise data centers. Designed to simplify storage management and improve operational efficiency, the service supports organizations looking to modernize their IT infrastructure while maintaining control through managed data center services.

-

In April 2025, Fujitsu announced a strategic collaboration with Nidec Corporation and Supermicro Inc. aimed at enhancing energy efficiency in data centers. The partnership aims to integrate Fujitsu’s liquid-cooling monitoring and control software with Supermicro Inc.’s high-performance GPU servers and Nidec Corporation’s advanced liquid-cooling systems. Together, the companies plan to develop a service that enables data centers to improve their power usage effectiveness (PUE), contributing to more sustainable and energy-efficient operations

-

In August 2024, Hewlett-Packard Enterprise Development LP announced the launch of a new managed data center hosting service in the United Arab Emirates, developed in collaboration with Khazna Data Centers, a provider of hyperscale data center solutions. The service offers access to a state-of-the-art facility equipped with end-to-end high-performance computing (HPC) infrastructure tailored for AI workloads, including advanced compute, accelerated processing, networking, software, and direct liquid-cooling (DLC) technology.

Key Managed Data Center Services Companies:

The following are the leading companies in the managed data center services market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Amazon Web Services (AWS)

- Capgemini Service SAS

- Cisco Systems Inc.

- Cognizant Technology Solutions Corp.

- Dell Inc.

- DXC Technology Company

- Fujitsu Ltd.

- HCL Technologies Ltd.

- Hewlett Packard Development LP

- Huawei Technologies Co. Ltd.

- IBM Corporation

- Microsoft Corporation

- NTT DATA Corp.

- Tata Consultancy Services Ltd. (TCS)

Managed Data Center Services Market Report Scope

Report Attribute

Details

Market size in 2025

USD 60.18 billion

Revenue forecast in 2033

USD 174.25 billion

Growth rate

CAGR of 14.2% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, enterprise size, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Accenture; Amazon Web Services (AWS); Capgemini Service SAS; Cisco Systems Inc.; Cognizant Technology Solutions Corp.; Dell Inc.; DXC Technology Company; Fujitsu; HCL Technologies Ltd.; Hewlett Packard Development LP; Huawei Technologies Co. Ltd.; IBM Corporation; Microsoft Corporation; NTT DATA Corp.; Tata Consultancy Services Ltd. (TCS)

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Managed Data Center Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the managed data center services market report based on type, deployment, enterprise size, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Infrastructure Management

-

Security Management

-

Backup & Disaster Recovery

-

Monitoring & Performance Management

-

Application Hosting & Support

-

Database Management

-

Hybrid/Cloud Infrastructure Management

-

Other

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Small Enterprises

-

Medium Enterprises

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

Manufacturing

-

IT & Telecom

-

Healthcare

-

Energy

-

Education

-

Media and Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global managed data center services market size was estimated at USD 53.88 billion in 2024 and is expected to reach USD 53.88 billion in 2025.

b. The global managed data center services market is expected to grow at a compound annual growth rate of 14.2% from 2025 to 2033 to reach USD 174.25 billion by 2033.

b. Organizations across industries are increasingly shifting from owning and operating their own data centers to outsourcing their infrastructure needs to managed service providers. This transformation is driven by the high capital and operational costs associated with building, maintaining, and upgrading in-house data centers

b. Some key players operating in the managed data center services market include Accenture, Amazon Web Services (AWS), Capgemini Service SAS, Cisco Systems Inc., Cognizant, Technology Solutions Corp., Dell Inc., DXC Technology Company, Fujitsu, HCL Technologies Ltd., Hewlett Packard Development LP, Huawei Technologies Co. Ltd., IBM Corporation, Microsoft Corporation, NTT DATA Corp., Tata Consultancy Services Ltd. (TCS)

b. Organizations across industries are increasingly shifting from owning and operating their own data centers to outsourcing their infrastructure needs to managed service providers. This transformation is driven by the high capital and operational costs associated with building, maintaining, and upgrading in-house data centers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.