- Home

- »

- Organic Chemicals

- »

-

Menthoxypropanediol Market Size, Industry Report, 2033GVR Report cover

![Menthoxypropanediol Market Size, Share & Trends Report]()

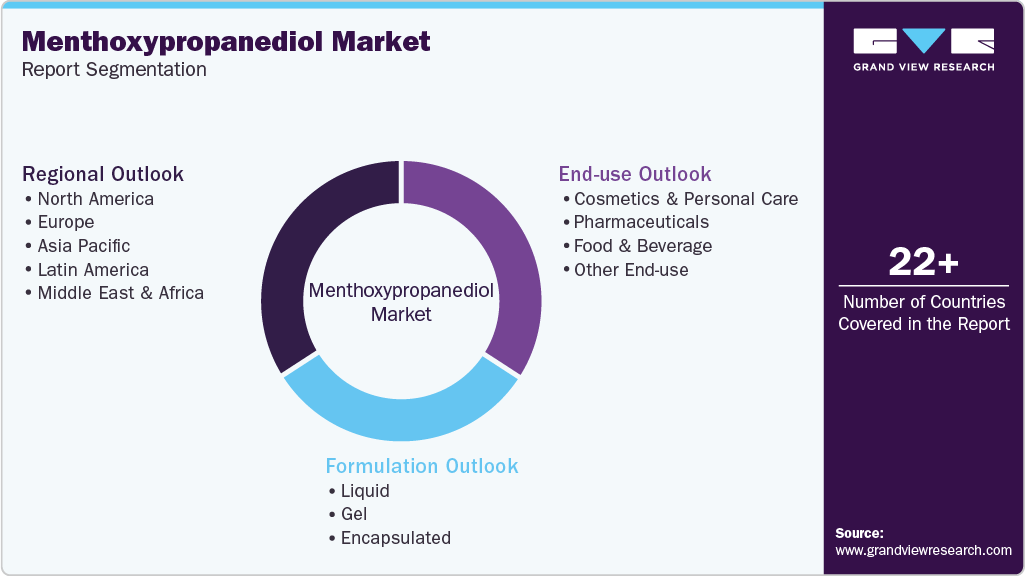

Menthoxypropanediol Market (2025 - 2033) Size, Share & Trends Analysis Report By Formulation (Liquid, Gel, Encapsulated), By End Use (Cosmetics & Personal Care, Pharmaceuticals, Food & Beverage), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-821-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Menthoxypropanediol Market Summary

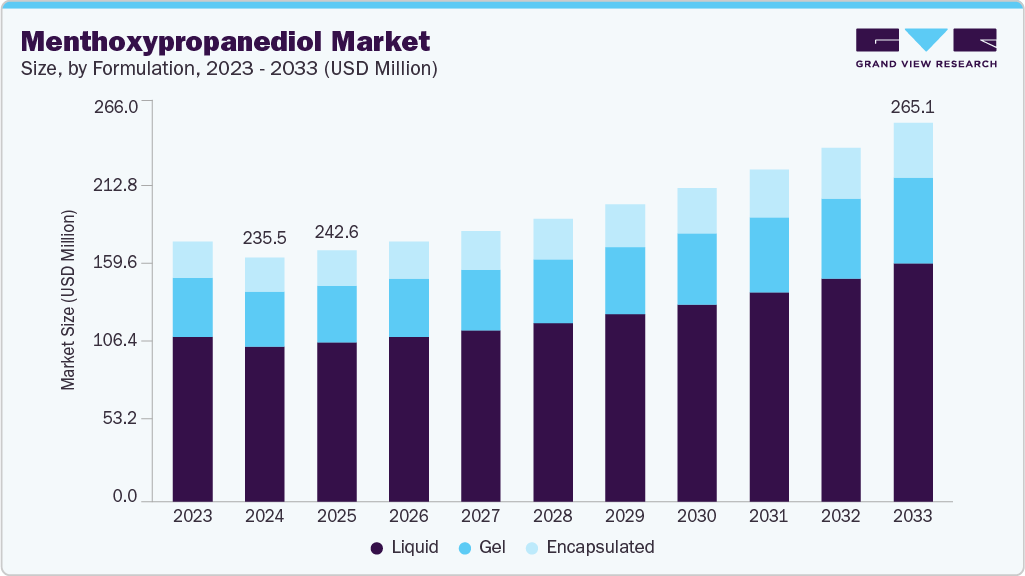

The global menthoxypropanediol market size was estimated at USD 235.5 million in 2024 and is projected to reach USD 365.1 million by 2033, growing at a CAGR of 5.2% from 2025 to 2033. The market is witnessing steady growth, primarily driven by the rising demand for high-performance cooling agents across cosmetics and personal care applications.

Key Market Trends & Insights

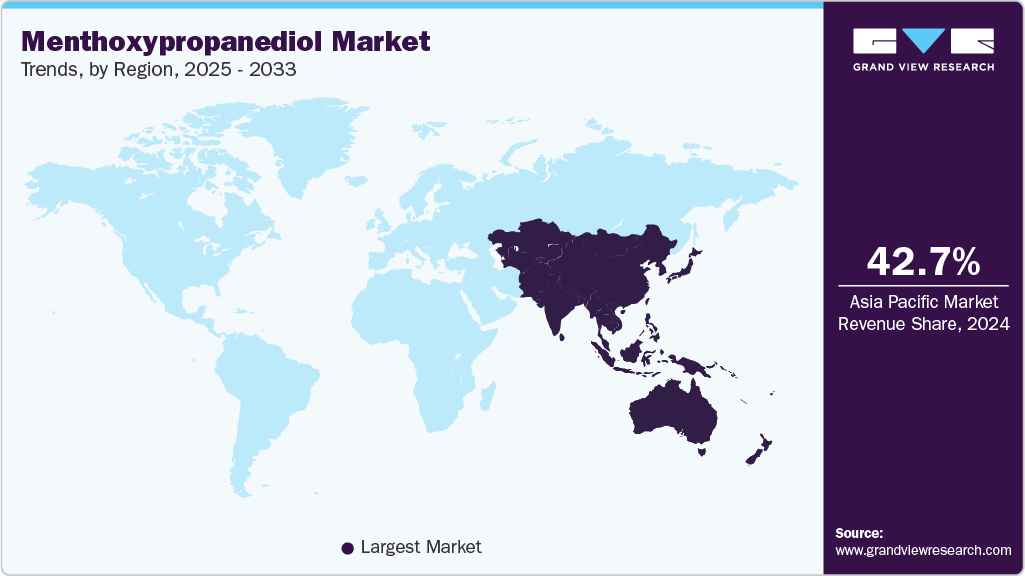

- Asia Pacific dominated the global menthoxypropanediol industry with the largest revenue share of 42.7% in 2024.

- The market in China is expected to grow at the fastest CAGR of 5.6% from 2025 to 2033.

- By formulation, the encapsulated segment is expected to grow at the fastest CAGR of 5.6% from 2025 to 2033 in terms of revenue.

- By formulation, the liquid segment held the largest revenue share of 63.4% in 2024 in terms of value.

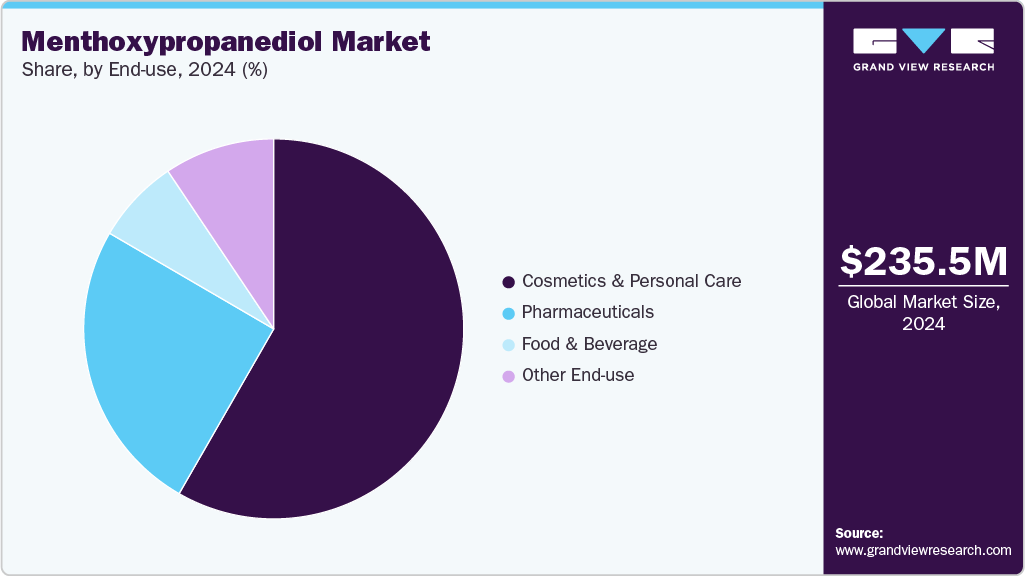

- By end use, the cosmetics & personal care segment held the largest revenue share of 58.3% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 235.5 Million

- 2033 Projected Market Size: USD 365.1 Million

- CAGR (2025-2033): 5.2%

- Asia Pacific: Largest market in 2024

Brands are increasingly formulating advanced skincare, haircare, and personal hygiene products that deliver long-lasting sensory effects. Liquid formulations dominate due to their superior solubility, ease of incorporation, and stability across a wide range of product types, making them the preferred choice for large-scale manufacturers throughout the forecast period. Strong consumption in the cosmetics and personal care sector, driven by surging grooming trends, premium product launches, and expanding use in deodorants, lotions, and after-sun products, continues to fuel market growth.The biggest opportunity in the market stems from the rapid shift toward sensory-driven formulations in skincare, haircare, and personal hygiene products, where brands are actively seeking safer, longer-lasting, and more stable cooling ingredients to replace traditional menthol. This demand is growing because consumers increasingly prefer products that deliver a premium “freshness experience” without the irritation or volatility associated with conventional cooling agents. As global brands expand into hot-climate regions, particularly in the Asia Pacific, Latin America, and the Middle East, the demand for high-performance cooling compounds is increasing rapidly, creating new opportunities for menthoxypropanediol adoption. At the same time, innovation in encapsulation technologies, water-based formulations, and hybrid active ingredients enables manufacturers to utilize menthoxypropanediol in a wider range of product categories, from leave-on cosmetics to targeted pharmaceutical topicals.

Despite growth prospects, the market faces challenges that could limit its growth momentum. One of the key challenges is the high cost of production and the dependency on specialized synthesis routes, which makes it more expensive than traditional cooling agents and can restrict adoption in price-sensitive markets. Regulatory scrutiny around cosmetic and pharmaceutical ingredients also poses restraints, as manufacturers must meet strict safety, purity, and compliance standards across different regions, increasing development time and cost. In addition, the market faces intense competition from alternative cooling agents, including synthetic menthol derivatives and natural cooling compounds, which can limit the speed of market penetration in new applications. Supply-chain fluctuations, particularly in raw materials used for menthol-derived compounds, further create uncertainties for consistent pricing and availability.

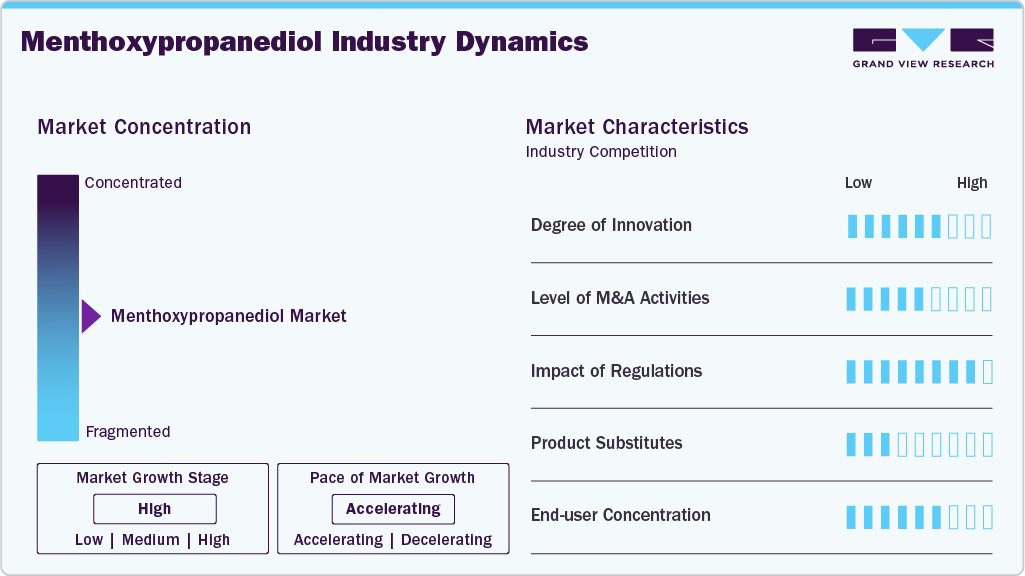

Market Concentration & Characteristics

The market is moderately consolidated, with leading players such as Takasago International Corporation, Penta Fine Ingredients, Vantage Specialty Chemicals, Ecotech and Sinofi Ingredients holding a significant share, while regional specialists Penta Fine Ingredients, The Good Scents Company, Foreverest Resources Ltd, Shanghai Vigen Fine Chemical, and Chemical Bull cater to localized demand. The top companies collectively account for around half of global revenues, leveraging strong R&D, established distribution networks, and long-term supply partnerships with major cosmetics, personal care, and pharmaceutical manufacturers. Formulation portfolios now span liquid, gel, and encapsulated formats, reflecting a strategic shift toward more versatile, stable, and performance-driven formulators in the Menthoxypropanediol industry.

Competition in the market revolves around formulation performance, regulatory compliance, and cost efficiency. Vendors are increasingly developing high-purity, irritation-free cooling solutions, as well as optimized liquid and encapsulated formats, and application-ready blends, to stand out in a highly competitive environment. However, smaller manufacturers face challenges related to fluctuating raw material costs, limited formulation expertise, and the high expenses associated with meeting global safety and quality standards. To strengthen their market position, leading players are investing in advanced cooling chemistry, expanding their regional presence through strategic partnerships, and adopting digitalized supply and customer management systems to improve operational efficiency and enhance long-term client relationships.

Formulation Insights

The liquid formulation segment dominated the market with the largest revenue share of 63.4% in 2024, primarily due to its superior compatibility with a wide range of cosmetic, personal care, and pharmaceutical systems. Liquid menthoxypropanediol offers ease of incorporation into emulsions, serums, creams, oral care solutions, and sprays, enabling manufacturers to achieve consistent cooling performance, precise dosing, and stable sensory delivery. Its high solubility, processing flexibility, and cost-effectiveness make it the preferred choice for high-volume applications such as skincare, haircare, oral hygiene products, and topical pharmaceutical formulations, thereby reinforcing its dominance in both mass-market and premium product portfolios.

The gel and encapsulated segments, while holding comparatively smaller shares, continue to gain strategic relevance. Gel formulations are increasingly adopted in performance-driven products such as sports recovery gels, after-sun treatments, and dermatological applications due to their rapid absorption, non-greasy texture, and enhanced cooling sensation. Meanwhile, encapsulated menthoxypropanediol is emerging as a high-growth niche, driven by demand for controlled-release cooling, extended sensory longevity, and improved stability in advanced cosmetic and pharmaceutical formulations. This shift toward value-added delivery systems reflects growing innovation, premiumization trends, and the need for differentiated sensory performance across high-end product categories.

End Use Insights

The cosmetics & personal care segment held the largest revenue share of 58.3% in 2024, driven by the widespread use of menthoxypropanediol as a cooling, soothing, and sensorial-enhancing ingredient in skincare, haircare, oral care, and sun care products. Its ability to deliver a long-lasting cooling effect without the irritation commonly associated with menthol has positioned it as a preferred alternative in premium and mass-market formulations alike. Rising consumer demand for multifunctional products that offer comfort, freshness, and skin-calming benefits, coupled with the expansion of premium beauty categories and dermo-cosmetics, significantly reinforced the segment’s dominance across global markets.

The pharmaceutical segment represented a critical secondary application area, supported by the incorporation of menthoxypropanediol in topical analgesics, transdermal formulations, and OTC cooling solutions for muscle relaxation and soothing therapies. The food & beverage segment, though smaller in comparison, is gradually gaining traction as manufacturers utilize menthoxypropanediol in flavor systems and functional beverages to impart controlled freshness and cooling sensations. Meanwhile, other end use, including aromatherapy, wellness products, and niche industrial applications, continue to contribute to incremental demand, primarily driven by product innovation and increasing diversification of sensory-based formulations across adjacent sectors.

Regional Insights

Asia Pacific menthoxypropanediol industry dominated the global market with a 42.7% revenue share in 2024, due to its combination of large-scale manufacturing capabilities and strong, fast-growing demand across the beauty, personal care, and pharmaceutical sectors. The region’s extensive production ecosystem spanning ingredient suppliers, contract manufacturers, and high-volume FMCG brands supports faster product development and more cost-efficient formulation adoption. In addition, the presence of major cosmetics and skincare hubs in countries such as China, Japan, South Korea, and India drives continuous innovation and high consumption of formulation additives such as Menthoxypropanediol. These structural and economic advantages make the Asia Pacific the leading regional market.

China menthoxypropanediol industry accounted for 63.2% of the Asia Pacific market in 2024, due to its large-scale chemical manufacturing infrastructure, advanced production capabilities, and role as a global hub for cosmetics and personal care supply chains. The country’s dense network of raw material suppliers, formulation specialists, and contract manufacturers reduces production costs and accelerates commercialization for domestic and international brands. China’s expanding beauty and skincare market, driven by high consumer adoption of functional and premium products, increases demand for specialized cooling ingredients. Continuous R&D investment, regulatory modernization, and export-oriented manufacturing enable Chinese producers to supply high-quality menthoxypropanediol to global markets. These combined strengths position China as the regional leader.

Europe Menthoxypropanediol Market Trends

Europe menthoxypropanediol industry captured a 25.3% share of the global market for menthoxypropanediol in 2024, due to its strong foundation of premium cosmetic brands, high regulatory standards, and steady demand for safe, high-quality formulation ingredients. The region’s focus on dermatologically tested, low-irritation, and scientifically validated actives further supports the adoption of Menthoxypropanediol in skincare, pharmaceutical topicals, and specialized personal care products. Europe benefits from a mature manufacturing base and advanced research and development (R&D) capabilities. These enable companies to develop innovative cooling formulations that meet strict performance and safety requirements. The consumer preference for functional, wellness-oriented, and sensorial products, especially in Western European markets, drives continued use of high-purity cooling agents. These factors collectively position Europe as the second most dominant region in the global market.

Germany’s menthoxypropanediol industry is expanding primarily because the country has one of the strongest functional personal care and OTC healthcare segments in Europe, driven by high consumer spending on products that address everyday comfort, skin sensitivity, and well-being. Demand is rising as German consumers increasingly seek mild cooling ingredients in sports recovery products, muscle-relief topicals, and refreshing skincare products used in active lifestyles. The country’s large presence of sports medicine brands, pharmaceutical distributors, and wellness-focused product manufacturers is also driving wider adoption of modern cooling agents. In addition, Germany’s commitment to sustainable and high-performance ingredient sourcing is encouraging companies to shift toward more stable, efficient compounds, such as menthoxypropanediol, in place of traditional menthol derivatives.

North America Menthoxypropanediol Market Trends

North America menthoxypropanediol industry held a 20.7% market share in 2024, due to strong demand for innovative, high-performance ingredients in the personal care and healthcare sectors. The market benefits from a developed cosmetics and dermatology sector. Brands there consistently adopt new cooling and soothing agents to differentiate premium skincare, deodorants, and wellness products. Rising consumer interest in clean, gentle, and irritation-free sensory ingredients is driving manufacturers to shift from traditional menthol to alternatives, such as Menthoxypropanediol. The region also has a highly active sports, fitness, and therapeutic product industry. This drives demand for effective cooling agents in muscle-relief gels, topical pain management products, and recovery formulations.

U.S. Menthoxypropanediol Market Trends

The U.S. menthoxypropanediol industry accounted for 83.8% of the North American region in 2024, this is due to evolving consumer preferences and ongoing innovations. Growth in the U.S. market for menthoxypropanediol in personal care and healthcare products is being driven by increasing sales and consumer demand. This notable expansion stems from the country’s strong appetite for advanced ingredients that enhance comfort, skin feel, and product performance across personal care and over-the-counter healthcare categories. American consumers show a high preference for premium, functional, and science-backed products, which encourages brands to incorporate modern cooling agents that offer better stability and lower irritation than menthol. The U.S. also has a large and rapidly evolving sports and wellness industry, creating consistent demand for cooling compounds in muscle-relief gels, pain-management creams, and recovery-focused formulations.

Middle East & Africa Menthoxypropanediol Market Trends

The Middle East & Africa menthoxypropanediol industry is witnessing steady growth, primarily due to the region’s hot climate, which creates strong demand for products that offer lasting cooling and comfort. Consumers are increasingly seeking deodorants, skincare, and body care products that can help manage heat, sweat, and irritation, driving the demand for effective and mild cooling ingredients. The growing presence of international beauty brands, rising personal grooming trends, and higher spending on premium personal care are further supporting market growth. In addition, the region’s developing healthcare and wellness sectors are promoting the use of gentle cooling agents in topical creams and soothing gels.

Latin America Menthoxypropanediol Market Trends

The menthoxypropanediol industry in Latin America is growing. Rising temperatures, humid climates, and increasing urban lifestyles drive demand for products that provide effective cooling and daily comfort. Consumers in Brazil, Mexico, and Colombia are buying more deodorants, body sprays, and skincare products to help manage heat, sweat, and irritation. This creates strong demand for modern cooling ingredients. The beauty and personal care industry is expanding across the region. Growth is supported by a young population, higher spending on grooming, and strong influences from global and local brands.

Key Menthoxypropyanediol Company Insights

Key players, such as Takasago International Corporation, Vantage Specialty Chemicals , Sinofi Ingredients, Shanghai Vigen Fine Chemical , Penta Fine Ingredients , and The Good Scents Company are dominating the market.

Takasago International Corporation

-

Takasago International Corporation is a leading global manufacturer of fragrances and flavors, with a strong portfolio of aroma ingredients used in personal care and cosmetic applications. Among its specialty molecules, the company produces COOLACT 10, Takasago’s high-performance grade of Menthoxypropanediol, engineered to deliver a long-lasting, refreshing cooling sensation in skincare, haircare, and hygiene formulations. Backed by the company’s deep expertise in sensory chemistry and stringent quality systems, COOLACT 10 offers consistent purity, excellent stability, and enhanced sensory performance compared to traditional cooling agents. Takasago’s continued investment in R&D, sustainability, and advanced manufacturing enables it to support global brands seeking reliable, premium-grade cooling ingredients for innovative personal care products.

Key Menthoxypropyanediol Companies:

The following are the leading companies in the menthoxypropyanediol market. These companies collectively hold the largest market share and dictate industry trends.

- Takasago International Corporation

- Vantage Specialty Chemicals

- Sinofi Ingredients

- Shanghai Vigen Fine Chemical

- Penta Fine Ingredients

- The Good Scents Company

- Ecotech

- Chemical Bull

- Foreverest Resources Ltd

- LGC Standards

Menthoxypropanediol Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 242.6 million

Revenue forecast in 2033

USD 365.1 million

Growth rate

CAGR of 5.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Formulation, end use, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Takasago International Corporation; Vantage Specialty Chemicals; Sinofi Ingredients; Shanghai Vigen Fine Chemical; Penta Fine Ingredients; The Good Scents Company; Ecotech; Chemical Bull; Foreverest Resources Ltd; LGC Standards

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Menthoxypropanediol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global menthoxypropanediol market report based on formulation, end use, and region.

-

Formulation Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Liquid

-

Gel

-

Encapsulated

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Cosmetics & Personal Care

-

Pharmaceuticals

-

Food & Beverage

-

Other End Use

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global menthoxypropanediol market size was estimated at USD 235.5 million in 2024 and is expected to reach USD 242.6 million in 2025.

b. The global menthoxypropanediol market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2033 to reach USD 365.1 million by 2033.

b. The cosmetics & personal care segment dominated the menthoxypropanediol market with the largest revenue share of 58.3% in 2024 due to its extensive use in skincare, oral care, and premium beauty formulations where long-lasting, non-irritating cooling performance is a key product differentiator. Strong consumer preference for sensorial-enhanced cosmetics and the rapid expansion of high-value dermo-cosmetic and sun care categories further reinforced its market leadership.

b. Some of the key players operating in the menthoxypropanediol market include Takasago International Corporation, Vantage Specialty Chemicals, Sinofi Ingredients, Shanghai Vigen Fine Chemical, Penta Fine Ingredients, The Good Scents Company, Ecotech, Chemical Bull, Foreverest Resources Ltd, and LGC Standards

b. The menthoxypropanediol market is primarily driven by growing demand for advanced cooling agents in premium cosmetics, personal care, and pharmaceutical formulations that deliver long-lasting sensory performance with minimal irritation. The increasing consumer preference for multifunctional products, coupled with innovation in encapsulation and controlled-release technologies, is accelerating adoption across beauty, wellness, and functional food applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.