- Home

- »

- Advanced Interior Materials

- »

-

Metal Binder Jetting Market Size, Industry Report, 2033GVR Report cover

![Metal Binder Jetting Market Size, Share & Trends Report]()

Metal Binder Jetting Market (2025 - 2033) Size, Share & Trends Analysis Report By End-use (Automotive & Transportation, Industrial Machinery, Consumer Products & Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-820-4

- Number of Report Pages: 95

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Metal Binder Jetting Market Summary

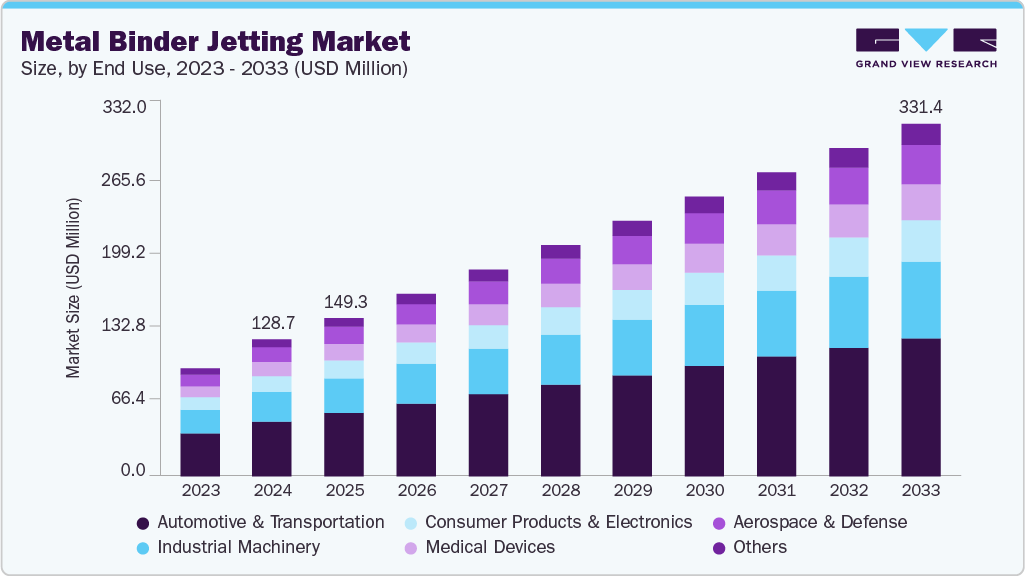

The global metal binder jetting market size was estimated at USD 128.7 million in 2024 and is projected to reach USD 331.4 million by 2033, growing at a CAGR of 10.5% from 2025 to 2033. Market growth is primarily driven by the expanding adoption of metal binder jetting for high-volume, cost-efficient production of complex metal components, enabled by its high throughput, design flexibility, and reduced material waste.

Key Market Trends & Insights

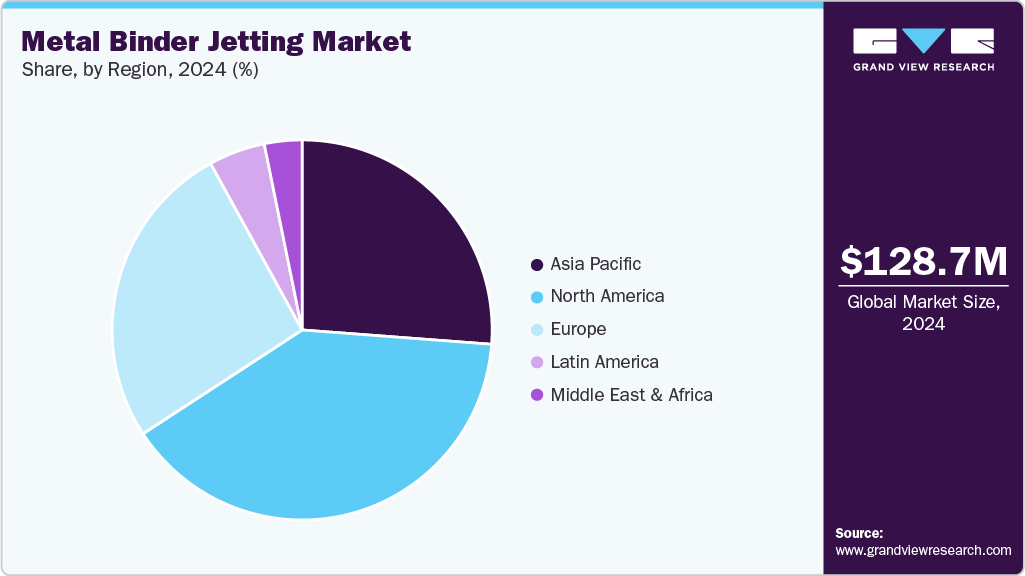

- Europe dominated the global metal binder jetting market with the largest revenue share of 39.6% in 2024 and is anticipated to grow at the fastest CAGR during the fastest CAGR during the forecast period.

- The metal binder jetting market in the Asia Pacific is expected to grow at a significant CAGR of 10.6% from 2025 to 2033.

- By end use, the automotive & transportation segment led the market with the largest revenue share of 39.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 128.7 Million

- 2033 Projected Market Size: USD 331.4 Million

- CAGR (2025-2033): 10.5%

- Europe: Largest market in 2024

Increasing utilization across automotive, industrial machinery, and consumer electronics sectors, supported by advancements in powder quality, binder chemistry, and sintering efficiency, is further accelerating demand. Ongoing improvements in process reliability and part performance are solidifying metal binder jetting’s position as a scalable alternative to traditional manufacturing routes.

The aerospace and defense segment is emerging as a strategic adopter of metal binder jetting, leveraging the technology to produce lightweight, complex components that enhance performance and reduce assembly requirements. MBJ enables the rapid fabrication of non-critical structural parts, brackets, ducts, and tooling with consistent accuracy and reduced lead times-an advantage in programs that require rapid iteration and supply chain agility. As qualification frameworks mature and high-temperature alloys become more compatible with binder-jet processes, aerospace and defense manufacturers are increasingly integrating MBJ into hybrid production workflows to lower costs and improve design flexibility.

Drivers, Opportunities & Restraints

A key driver for the metal binder jetting industry is the accelerating shift toward cost-efficient, high-volume additive manufacturing for complex metal components. Industries such as automotive, industrial machinery, and consumer electronics are increasingly turning to MBJ to reduce part consolidation, shorten production cycles, and cut material waste. Advancements in binder formulations, powder uniformity, and sintering consistency are translating into higher part reliability and lower per-unit costs. The technology’s ability to outperform laser-based metal AM in throughput is further strengthening its appeal for serial production.

A major opportunity lies in the expansion of metal binder jetting into new end-use domains driven by improved material compatibility and scalable production systems. As aluminum, copper, and high-temperature alloys become more viable for MBJ, manufacturers can target light weighting, thermal management, and electrification components across emerging sectors. The integration of automated powder handling, closed-loop quality monitoring, and continuous sintering furnaces also opens the door for end-to-end production cells. These advancements position MBJ as a strong contender for replacing traditional casting and machining in medium-volume manufacturing.

A key restraint for the metal binder jetting industry is the persistent dependency on precise sintering processes, which can introduce dimensional variability and restrict adoption for critical, high-tolerance components. Achieving repeatable density and mechanical performance across varying geometries remains challenging, particularly for large or intricate parts. Limited global standardization for qualification and certification also slows down deployment in regulated industries such as aerospace and medical. In addition, the need for specialized post-processing equipment increases upfront investment and operational complexity for new adopters.

End Use Insights & Trends

The automotive and transportation segment led the market with the largest revenue share of 39.9% in 2024. The automotive and transportation segment is one of the most aggressive adopters of metal binder jetting, leveraging the technology to produce lightweight brackets, housings, thermal-management parts, and structural components at competitive costs. MBJ’s high throughput and design freedom enable manufacturers to consolidate multiple parts, reduce tooling requirements, and speed up development cycles-critical advantages in EV platforms and next-generation mobility systems. As major OEMs validate binder-jetted components for serial production, the technology is increasingly integrated into mainstream manufacturing lines, supporting both prototyping and large-scale part deployment.

In the industrial machinery segment, metal binder jetting is gaining traction as manufacturers seek efficient production methods for complex, durable components such as pump parts, tooling inserts, fixtures, and wear-resistant elements. The ability to create customized geometries with internal channels, lattice structures, and optimized shapes offers significant performance benefits over conventionally machined parts. MBJ also supports shorter lead times and lower per-unit costs for mid-volume batches, making it attractive for equipment builders facing rising customization demands and supply chain constraints. As sintering reliability improves, adoption in heavy equipment, robotics, and precision engineering continues to expand.

Regional Insights

The metal binder jetting market in North America is experiencing rapid growth. North America demonstrates a robust adoption of metal binder jetting, driven by strong demand from the automotive, defense, and industrial machinery sectors, which seek high-throughput additive manufacturing solutions. Significant investment in AM research, coupled with a mature ecosystem of service bureaus and technology providers, supports widespread commercialization. Market growth is further strengthened by the region’s focus on reshoring and advanced production automation.

U.S. Metal Binder Jetting Market Trends

The metal binder jetting market in the U.S. leads North American adoption, propelled by early technology commercialization, strong involvement from aerospace and defense contractors, and extensive government-backed AM research programs. U.S. manufacturers are increasingly deploying MBJ systems for both prototyping and serial production as supply-chain resilience becomes a strategic priority. The presence of major AM innovators and powder producers continues to fuel domestic market expansion.

Europe Metal Binder Jetting Market Trends

Europe dominated the global metal binder jetting market with the largest revenue share of 39.6% in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. Europe remains a leading region for metal binder jetting, supported by a strong industrial base, advanced R&D capabilities, and early adoption across automotive and aerospace manufacturing hubs. Regional initiatives promoting digitalization and sustainable production are accelerating MBJ integration into mainstream workflows. With established powder suppliers and machine manufacturers, Europe continues to play a central role in technology innovation and standardization.

Asia Pacific Metal Binder Jetting Market Trends

The metal binder jetting market in the Asia Pacific is expected to grow at a significant CAGR of 10.6% from 2025 to 2033, supported by rapid industrialization and increasing interest in cost-efficient additive manufacturing solutions. The expansion of automotive, electronics, and machinery production is driving strong demand for high-volume, precision metal parts. Government-backed manufacturing programs and investment in AM infrastructure are accelerating regional capability development.

The China metal binder jetting market is witnessing rapid adoption, as local manufacturers scale up production of automotive, consumer-electronics, and industrial components using additive methods. Strong government support for advanced manufacturing and a rapidly expanding domestic AM ecosystem are fueling the deployment of MBJ systems. China’s growing powder production capacity and competitive machine manufacturing further position the country as a key player in regional and global market growth.

Key Metal Binder Jetting Company Insights

Some of the key players operating in the market include ATI, Höganäs AB, OC Oerlikon Management AG, and Others.

-

ATI is a leading North American producer of high-performance metals and specialty alloys, with a strong presence in advanced powder metallurgy for additive manufacturing. The company supplies gas-atomized metal powders engineered for consistency, spherical morphology, and tight particle-size distribution-qualities essential for reliable binder-jetting performance.

-

OC Oerlikon Management AG is a global leader in advanced materials and surface engineering, offering a comprehensive range of metal powders tailored for high-performance additive manufacturing, including metal binder jetting. The company’s Oerlikon AM division produces high-purity, gas-atomized powders with optimized flowability and uniform particle morphology, ensuring stable layer deposition and consistent sintering behavior in MBJ processes.

Key Metal Binder Jetting Companies:

The following are the leading companies in the metal binder jetting market. These companies collectively hold the largest market share and dictate industry trends.

- ATI

- CNPC Powders

- Colibrium Additive (GE Aerospace)

- GKN Powder Metallurgy

- Höganäs AB

- INDO-MIM

- Materialise NV

- OC Oerlikon Management AG

- Outokumpu

- POLEMA

- CRS Holdings, LLC.

Recent Developments

-

In June 2015, Allegheny Technologies Incorporated (ATI) announced a self-funded USD 70 million expansion of its nickel-based superalloy powder production near Monroe, North Carolina, aiming to support growing demand in aerospace jet engines and the additive manufacturing industry. The move strengthens ATI’s ability to supply high-performance powders for advanced 3D-printed parts in aerospace, medical, energy and oil & gas markets.

-

On May 20, 2025, Outokumpu Corporation announced the commercial launch of a new spherical stainless-steel metal powder grade designed for additive manufacturing in the aerospace and aviation sectors. This powder is engineered as an alternative to nickel-based alloys, enabling complex component production for demanding applications while supporting shorter development cycles.

Metal Binder Jetting Market Report Scope

Report Attribute

Details

Market Definition

The market size represents the apparent demand of metal powder in metal binder jetting technology for different end-use industries.

Market size value in 2025

USD 149.3 million

Revenue forecast in 2033

USD 331.4 million

Growth rate

CAGR of 10.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK.; Italy; China; India; Japan; South Korea; Brazil; South Africa

Key companies profiled

ATI; Höganäs AB; OC Oerlikon Management AG; CNPC Powders; Colibrium Additive (GE Aerospace); GKN Powder Metallurgy; INDO-MIM; Materialise NV; Outokumpu; POLEMA; CRS Holdings, LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal Binder Jetting Market Report Segmentation

This report forecasts global, country, and regional revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global metal binder jetting market report based on the end use and region:

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive & Transportation

-

Industrial Machinery

-

Consumer Products & Electronics

-

Medical Devices

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global metal binder jetting market size was estimated at USD 128.7 million in 2024 and is expected to reach USD 149.3 million in 2025.

b. The global metal binder jetting market is expected to grow at a compound annual growth rate of 10.5% from 2025 to 2033, reaching USD 331.4 million by 2033.

b. In 2024, automotive & transportation segment held the largest share, over 39.0% of metal binder jetting revenue.

b. Some of the key vendors in the global metal binder jetting market are ATI; Höganäs AB; OC Oerlikon Management AG; CNPC Powders; GKN Powder Metallurgy; INDO-MIM; Materialise NV; Outokumpu; POLEMA.

b. The global metal binder jetting market is driven by shift towards scalable additive manufacturing to position, binder jetting as a preferred alternative to traditional casting and machining for mid-volume applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.