- Home

- »

- Pharmaceuticals

- »

-

Middle East Bone And Joint Health Supplements Market Report, 2033GVR Report cover

![Middle East Bone And Joint Health Supplements Market Size, Share & Trends Report]()

Middle East Bone And Joint Health Supplements Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Vitamins, Mineral, Collagen, Omega-3, Glucosamine), By Formulation, By Application, By Consumer Group, By Sales Channel, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-812-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Bone And Joint Health Supplements Market Summary

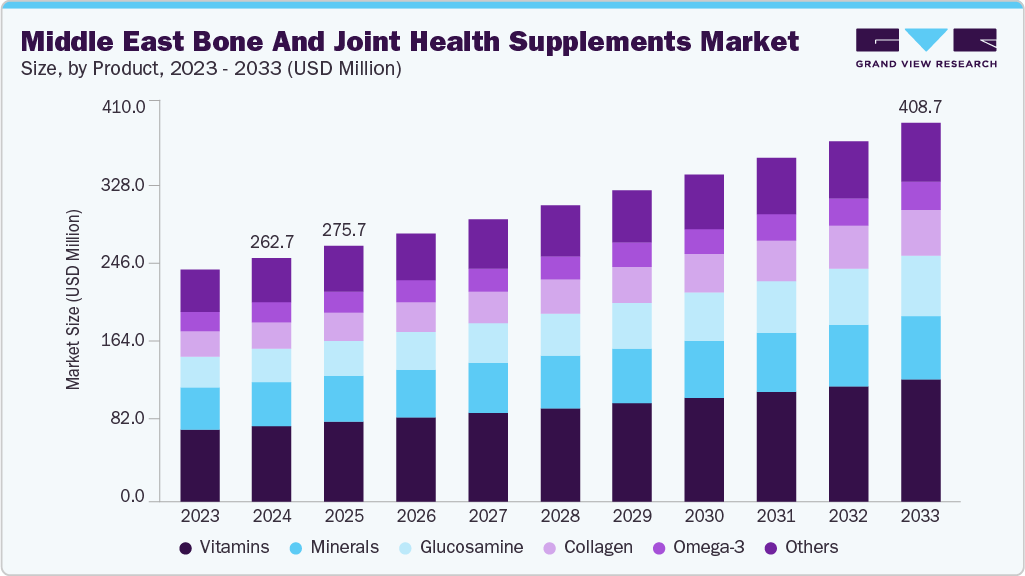

The Middle East bone and joint health supplements market size was estimated at USD 262.7 million in 2024 and is projected to reach USD 408.7 million by 2033, growing at a CAGR of 5.04% from 2025 to 2033. Market growth is driven by the rising prevalence of osteoporosis and joint disorders, increasing consumer awareness of preventive bone health, the expanding geriatric population, and higher adoption of vitamins, minerals, and joint-support supplements.

Wider product availability through pharmacies, retail chains, and e-commerce platforms, along with innovations in formulations and delivery formats, further support sustained market expansion.

Aging Population Fuels Demand for Joint Health Supplements

The Middle East bone and joint health supplements industry is witnessing a significant demographic shift, with a steadily increasing geriatric population due to improvements in healthcare, rising life expectancy, and declining birth rates. This aging population is more susceptible to musculoskeletal disorders, including osteoporosis, osteoarthritis, and general joint degeneration, which directly impacts mobility and quality of life. As a result, there is a growing need for targeted preventive and therapeutic solutions, creating strong demand for bone and joint health supplements. Older adults are increasingly adopting supplements such as calcium, vitamin D, glucosamine, chondroitin, and collagen to maintain bone density, support joint function, and alleviate age-related discomfort. The rising prevalence of chronic conditions among the elderly further accentuates the role of nutraceutical interventions as part of daily wellness routines.

Healthcare professionals and caregivers play a pivotal role in influencing supplement adoption among the geriatric segments. Physicians, nutritionists, and pharmacists frequently recommend clinically validated formulations to prevent or manage age-related bone and joint issues. Simultaneously, increased awareness campaigns and educational initiatives by public health authorities and private brands have highlighted the importance of early intervention and sustained supplementation. These efforts have made older consumers more health-conscious, encouraging regular intake of joint-support products to maintain independence and reduce reliance on medical interventions. As geriatric populations continue to grow, their proactive approach to managing musculoskeletal health is expected to be a key driver for sustained growth in the Middle East bone and joint health supplements industry.

Companies are responding to this opportunity by developing age-specific formulations and convenient delivery formats tailored to the geriatric population. Tablets, capsules, effervescent powders, and soft gels designed for ease of consumption, combined with targeted blends of vitamins, minerals, and joint-support compounds, are increasingly gaining traction. Market players are also focusing on distribution expansion through pharmacies, hospitals, and e-commerce platforms to ensure accessibility. Premium and clinically backed products are particularly appealing to older adults seeking quality and efficacy. Overall, the increasing geriatric population in the Middle East is not only expanding the consumer base for bone and joint supplements but also driving innovation, product diversification, and strategic market expansion across the region.

Rising Consumer Awareness of Nutrient Deficiencies Driving Supplement Adoption

Rising awareness of micronutrient deficiencies is a major driver of the bone and joint health supplements market in the Middle East. Increasing prevalence of vitamin D, calcium, and magnesium deficiencies-exacerbated by limited sun exposure, dietary gaps, and sedentary lifestyles-is prompting consumers to proactively seek preventive nutrition solutions. Healthcare professionals are increasingly recommending supplements to address these gaps, while public health campaigns and educational initiatives have further highlighted the importance of maintaining bone density and joint function. This heightened awareness has translated into stronger consumer demand for clinically supported products, particularly among adults and the aging population, who are more susceptible to deficiencies and related health issues.

The growing focus on preventive healthcare and wellness has led companies to innovate and expand their product offerings, introducing fortified supplements, combination formulations, and convenient delivery formats such as tablets, capsules, and gummies. Retailers and e-commerce platforms are leveraging this trend by providing wider availability, targeted promotions, and educational content to guide consumer choices. As a result, micronutrient-focused supplements are experiencing higher adoption rates across key Middle East markets such as the UAE, Saudi Arabia, and Kuwait. Continued emphasis on health literacy, coupled with rising disposable incomes and changing lifestyle preferences, is expected to sustain the momentum of supplement consumption, further reinforcing the market’s growth trajectory.

Market Concentration & Characteristics

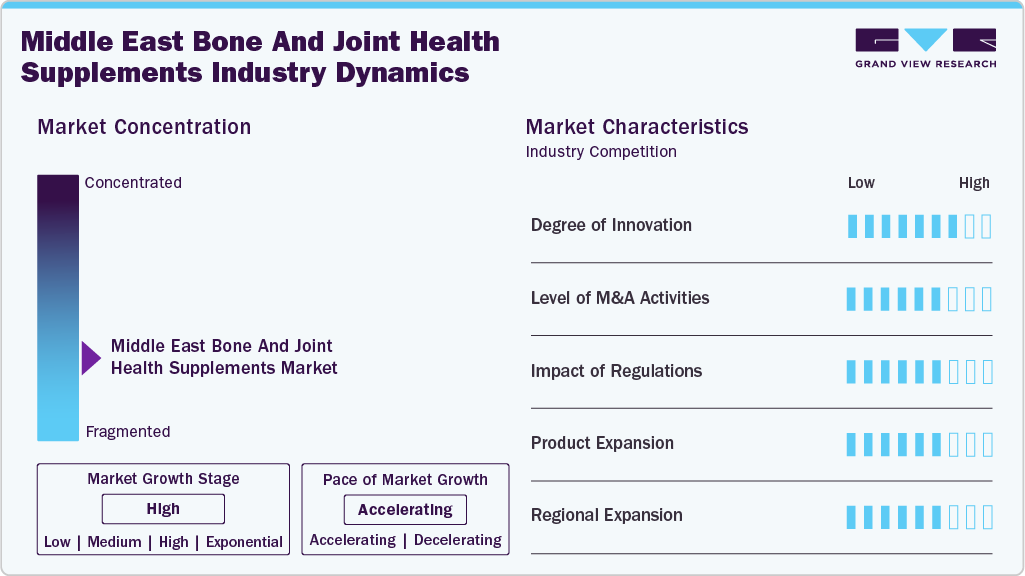

The Middle East bone and joint supplements industry exhibits a moderate to high level of innovation, fueled by increasing consumer demand for advanced, targeted formulations and insights from emerging research on bone and joint health. Companies are introducing novel ingredients, combination products, and diverse delivery formats to cater to specific age groups, lifestyles, and wellness needs. Competitive pressures encourage continuous product differentiation, while rising awareness of preventive health and functional nutrition drives brands to invest in innovative solutions that enhance efficacy, convenience, and consumer appeal across the region.

The Middle East bone and joint supplements industry has experienced moderate M&A activity, driven by companies seeking portfolio diversification, entry into new markets, and strengthened R&D capabilities. Such strategic moves enable brands to expand their product offerings, enhance innovation, and increase regional market presence while staying competitive in a growing and evolving industry.

Regulations significantly impact the Middle East bone and joint health supplements industry by governing product safety, labeling, ingredient approval, and marketing claims. Authorities in countries such as Saudi Arabia, the UAE, and Kuwait enforce stringent standards to ensure quality, efficacy, and consumer protection. Compliance with these regulatory requirements influences product formulation, import approvals, and market entry strategies. Companies must navigate registration procedures, clinical evidence requirements, and adherence to local guidelines, which shape competitive dynamics and drive investments in compliant, high-quality supplement offerings across the region.

The expansion of products in the Middle East bone and joint health supplements industry is being fueled by growing consumer demand for variety and convenience. Companies are moving beyond traditional offerings like calcium and vitamin D to introduce innovative formulations containing collagen peptides, glucosamine, chondroitin, hyaluronic acid, and herbal extracts. By broadening both ingredient options and delivery formats, brands can appeal to a wider range of consumers while strengthening their competitive positioning in the region.

Region expansion in the Middle East bone and joint supplements industryis driven by rising demand in high-consumption markets such as the UAE, Saudi Arabia, and Kuwait. Companies are increasing their presence through pharmacy chains, e-commerce platforms, and direct distribution to tap into growing health awareness, preventive wellness trends, and an aging population. Strategic market entry, localized product offerings, and targeted marketing campaigns are enabling brands to capture new consumer segments and expand their regional footprint effectively.

Product Insights

The vitamins segment led the market with the largest revenue share of 31.12% in 2024. This can be attributed to the growing prevalence of vitamin D deficiency, increasing awareness of preventive bone and joint health, and rising consumer inclination toward essential micronutrients. Physicians and nutritionists frequently recommend vitamin-based supplements, such as calcium and vitamin D formulations, to support bone density and joint function. Widespread availability across pharmacies, retail chains, and e-commerce platforms, along with trusted brand recognition, has further strengthened consumer adoption. The combination of health awareness, clinical support, and accessibility continues to underpin the segment’s leading market position.

The glucosamine segment is expected to register at the fastest CAGR from 2025 to 2033, driven by rising prevalence of osteoarthritis, joint discomfort, and age-related mobility issues across the Middle East. Consumers are increasingly adopting glucosamine-based supplements to support cartilage health, improve joint flexibility, and reduce stiffness, particularly among the geriatric and active adult populations. Growing awareness through healthcare professionals, targeted marketing campaigns, and educational initiatives has enhanced consumer trust in glucosamine formulations. In addition, wider availability through pharmacies, retail outlets, and e-commerce platforms, coupled with innovative combination products including glucosamine with chondroitin or collagen, is further accelerating adoption and segment growth.

Formulation Insights

The tablet segment led the market with the largest revenue share of 35.38% in 2024, reflecting strong consumer preference for this formulation. Tablets are favored due to their convenience, ease of storage, longer shelf life, and cost-effectiveness compared to other forms. They allow precise dosing of essential nutrients such as calcium, vitamin D, and glucosamine, making them ideal for preventive bone and joint health. In addition, widespread availability through pharmacies, specialty stores, and online platforms has reinforced consumer trust and adoption. The combination of accessibility, affordability, and established efficacy ensures tablets remain the leading choice in the Middle East bone and joint health supplements industry.

The capsule segment is expected to grow at the fastest CAGR throughout the forecast period, driven by increasing consumer preference for easy-to-swallow and fast-absorbing formulations. Capsules are favored for delivering precise doses of active ingredients such as glucosamine, collagen, and herbal extracts, appealing to health-conscious adults and the geriatric population alike. The availability of a wide variety of capsule-based supplements through both e-commerce and pharmacy channels, coupled with innovative formulations targeting joint mobility, bone strength, and overall wellness, is further accelerating adoption. Rising awareness of preventive health measures and convenience-oriented consumption trends are expected to sustain robust growth for this segment.

Application Insights

The bone density support segment led the market with the largest revenue share of 19.05% in 2024, driven by the rising focus on preventive bone health, increasing cases of vitamin D deficiency, and growing adoption of calcium-based supplements. Strong physician recommendations and wider product availability further reinforced the segment’s leading position.

The performance enhancement (sports & endurance) segment is expected to grow at the fastest CAGR throughout the forecast period. Consumers are demonstrating a growing desire to improve strength, mobility, and overall physical performance, driven by rising fitness participation, greater awareness of joint support in athletic routines, and increased use of supplements to prevent exercise-related strain and enhance endurance.

Consumer Group Insights

The adult segment led the market with the largest revenue share of 59.00% in 2024, owing to higher supplement adoption for preventive bone health, increasing lifestyle-related deficiencies, and growing demand for daily calcium and vitamin D formulations. Strong engagement with pharmacies and rising health-conscious behaviors further supported the segment’s dominance.

The geriatric segment is expected to grow at the fastest CAGR from 2025 to 2033, driven by rising age-related bone and joint issues, increasing awareness of preventive supplementation, and greater physician recommendations for calcium, vitamin D, and joint-support products. Higher healthcare spending and a growing focus on maintaining mobility and quality of life further accelerate this segment’s growth.

Sales Channel Insights

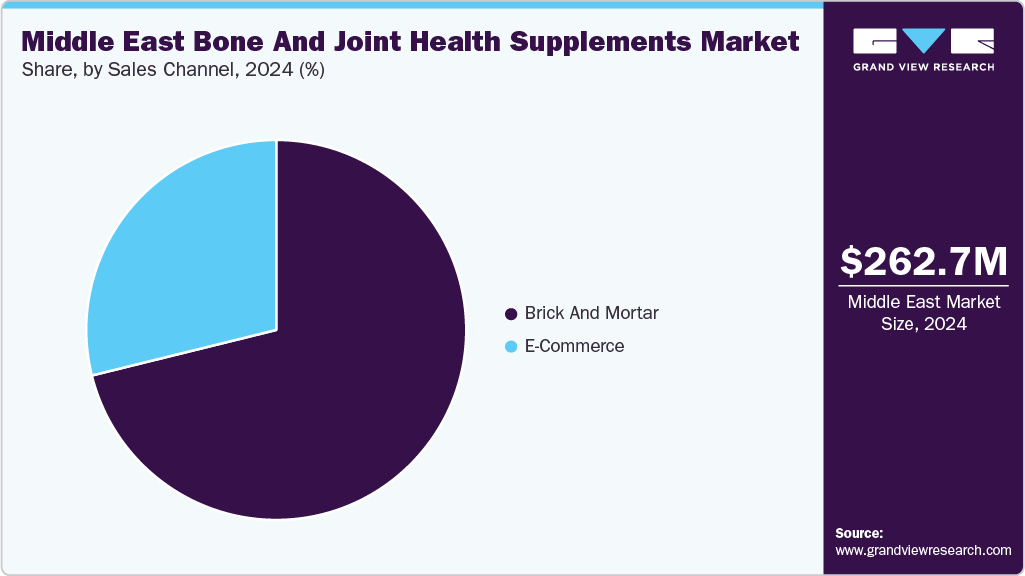

The brick-and-mortar segment led the market with the largest revenue share of 71.14% in 2024. The dominance is supported by strong consumer preference for pharmacist guidance, immediate product access, and higher trust in in-store purchases for health and wellness products. Its wide presence across pharmacies and specialty nutrition stores further reinforced its lead in the market.

The e-commerce segment is expected to witness at the fastest CAGR during the forecast period. The segment is driven by growing digital adoption, wider product availability, and increased consumer preference for convenient, home-delivered supplement purchases. Competitive pricing, frequent promotions, and easy access to brands further accelerate its rapid growth trajectory.

Country Insights

Saudi Arabia Bone And Joint Health Supplements Market Trends

Saudi Arabia dominated the Middle East bone and joint health supplements market with the largest revenue share of 36.62% in 2024, driven by rising vitamin D deficiency, growing awareness of preventive bone care, and increased demand from aging and working populations. The expansion of pharmacy chains, strong e-commerce adoption, and a preference for clinically backed formulations are further shaping purchasing patterns and accelerating market growth.

Kuwait Bone And Joint Health Supplements Market Trends

The bone and joint health supplements market in Kuwait is characterized by a high prevalence of vitamin D deficiency, a growing consumer focus on preventive wellness, and strong demand for calcium and joint-support formulations. Growth is further supported by premium international brands, expanding pharmacy retail, and increasing adoption of online channels for health supplement purchases.

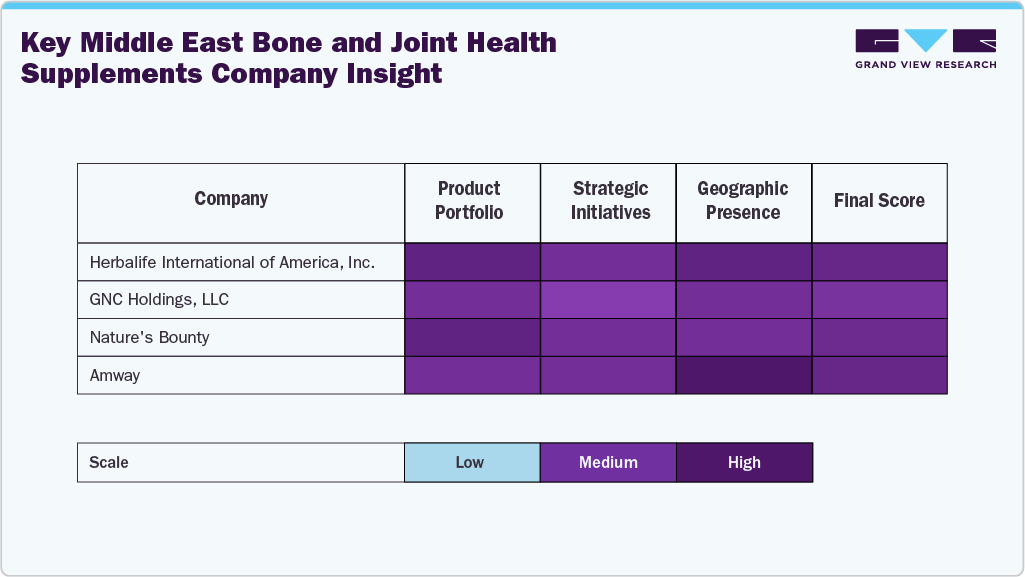

Key Middle East Bone and Joint Health Supplements Company Insights

The Middle East bone and joint health supplements industry is characterized by the presence of leading nutraceutical brands alongside established regional distributors. Key players such as GNC Holdings, Nature’s Bounty, Solgar, NOW Foods, Glanbia, Herbalife, Amway (Nutrilite), Vitabiotics, Jamieson Laboratories, and Blackmores maintain strong visibility through extensive pharmacy networks and growing e-commerce penetration. These companies benefit from high brand recognition, diversified product portfolios, and sustained investments in consumer education related to bone density, joint mobility, and preventive health. Their ability to offer clinically supported formulations, including calcium, vitamin D, collagen, and glucosamine blends, continues to strengthen their competitive position.

Market share distribution remains relatively fragmented, with no single player holding dominant control due to varying consumer preferences across UAE, Saudi Arabia, Qatar, and Kuwait. Premium international brands retain a competitive edge in urban markets, while mid-priced offerings gain momentum among value-conscious segments. Expansion strategies focus on strengthening partnerships with regional pharmacy chains, enhancing digital storefronts, and introducing targeted formulations addressing vitamin D deficiency and age-related bone concerns prevalent in the region. As consumer awareness deepens and purchasing power rises, competition among key companies is expected to intensify, driving product innovation and wider market penetration.

Key Middle East Bone and Joint Health Supplements Companies:

- GNC Holdings LLC

- Nature’s Bounty

- Solgar Inc.

- NOW Foods

- Glanbia plc

- Herbalife International

- Amway (Nutrilite)

- Vitabiotics

- Jamieson Laboratories

- Blackmores

Recent Developments

-

In September 2023, Voltaren introduced its Joint Comfort & Movement Daily Supplement and Joint Health & Bone Strength Dietary Supplement in the Middle East to strengthen its presence in the region’s growing bone and joint health supplements market.

Middle East Bone And Joint Health Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 275.7 million

Revenue forecast in 2033

USD 408.7 million

Growth rate

CAGR of 5.04% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, formulation, application, consumer group, sales channel, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

GNC Holdings LLC; Nature’s Bounty; Solgar Inc.; NOW Foods; Glanbia plc; Herbalife International; Amway (Nutrilite); Vitabiotics; Jamieson Laboratories; Blackmores

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Bone And Joint Health Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the Middle East bone and joint health supplements market report based on the product, application, formulation, consumer group, sales channel, and country:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Vitamins

-

Minerals

-

Collagen

-

Omega-3

-

Glucosamine

-

Others

-

-

Formulation Outlook (Revenue, USD Million, 2021 - 2033)

-

Capsules

-

Tablets

-

Powders

-

Softgels

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Bone Density Support

-

Bone Strength Support

-

Mobility & Physical Function

-

Muscle Health & Recovery

-

Performance Enhancement (Sports & Endurance)

-

Pain Relief & Inflammation Management

-

-

Consumer Group Outlook (Revenue, USD Million, 2021 - 2033)

-

Infants

-

Children

-

Adults

-

Pregnant Women

-

Geriatric Population

-

-

Sales Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Bricks and Mortar

-

Direct Selling

-

Chemists/Pharmacies

-

Health Food Shops

-

Hypermarkets

-

Supermarkets

-

-

E-commerce

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The Middle East bone and joint health supplements market size was estimated at USD 262.7 million in 2024 and is expected to reach USD 275.7 million in 2025.

b. The Middle East bone and joint health supplements market is projected to grow at a compound annual growth rate (CAGR) of 5.04% from 2025 to 2033, reaching USD 408.7 million by 2033.

b. Saudi Arabia held the largest share, 36.48%, of the overall revenue in 2024. This dominance is attributed to strong consumer spending on health and wellness, high awareness of joint-related conditions, and the widespread availability of premium supplement brands across pharmacies and retail channels.

b. Some key players operating in the Middle East bone and joint health supplements market include GNC Holdings LLC; Nature’s Bounty; Solgar Inc.; NOW Foods; Glanbia plc; Herbalife International; Amway (Nutrilite); Vitabiotics; Jamieson Laboratories; and Blackmores among others.

b. The Middle East bone and joint health supplements market is witnessing growth driven by rising awareness of musculoskeletal health, increasing prevalence of joint disorders, and a growing shift toward preventive nutrition. Expanding retail access and higher adoption of premium, science-backed formulations are further supporting market expansion across key countries in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.