- Home

- »

- Petrochemicals

- »

-

Middle East Chemical Distribution Market Size Report, 2033GVR Report cover

![Middle East Chemical Distribution Market Size, Share & Trends Report]()

Middle East Chemical Distribution Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Specialty Chemicals, Commodity Chemicals), By End Use, By Country, And Segment Forecasts, Key Companies And Competitive Analysis

- Report ID: GVR-4-68040-716-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Chemical Distribution Market Summary

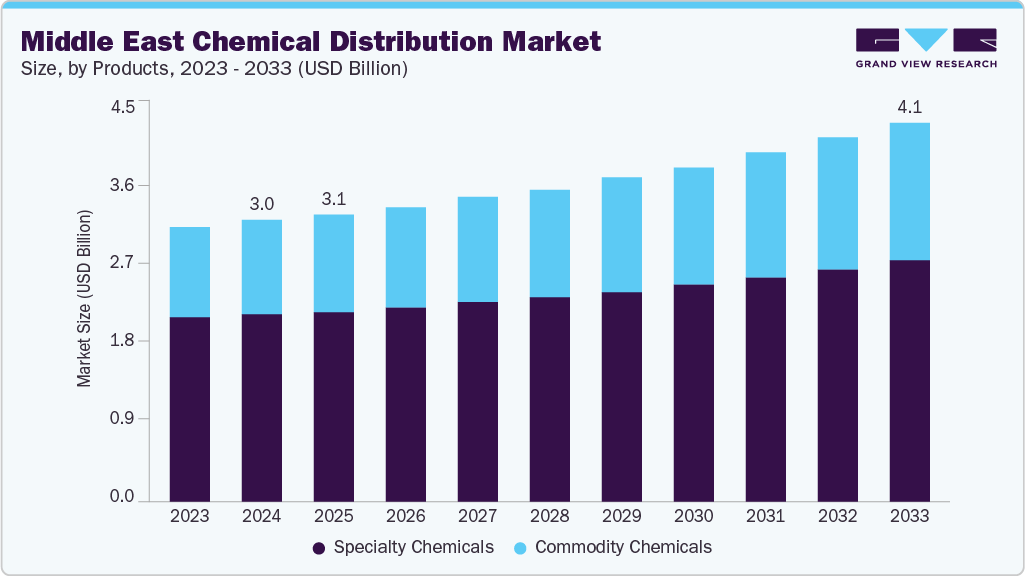

The Middle East chemical distribution market size was estimated at USD 3,039.90 million in 2024 and is projected to reach USD 4,113.35 million by 2033, growing at a CAGR of 3.6% from 2025 to 2033. The market is driven by the region’s expanding industrial base, diversification from oil dependency, and growing downstream manufacturing in sectors such as construction, packaging, water treatment, and automotive.

Key Market Trends & Insights

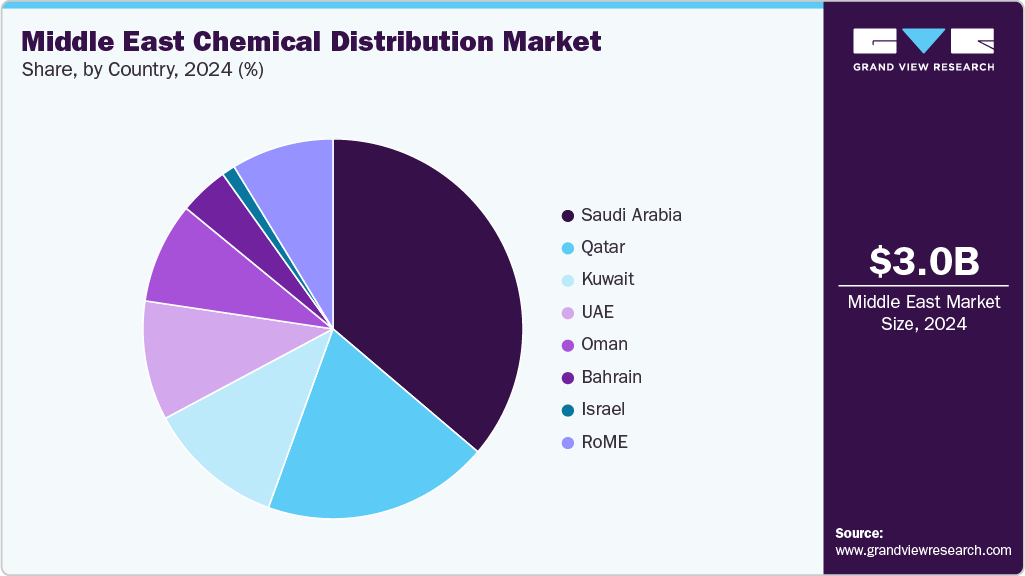

- Saudi Arabia dominated the Middle East chemical distribution market with the largest revenue share of 36.2% in 2024.

- The market in Saudi Arabia is expected to grow at a significant CAGR of 4.1% from 2025 to 2033.

- By product, the specialty chemical distribution segment is expected to grow at the fastest CAGR of 4.4% from 2025 to 2033.

- By end use, the downstream chemicals segment held the largest revenue share of 51.04% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3,039.90 Million

- 2033 Projected Market Size: USD 4,113.35 Million

- CAGR (2025-2033): 3.6%

Strategic government initiatives, including Saudi Arabia’s Vision 2030 and the UAE’s industrial expansion programs, are boosting demand for specialty and commodity chemicals. In addition, increasing trade flows through key hubs like Jebel Ali and Sohar ports, coupled with rising demand from fast-growing economies in the GCC and Levant, support market growth. The Middle East chemicals distribution industry is expanding on the back of rapid industrialization, diversification policies, and growing demand from key downstream sectors such as construction, oil & gas, water treatment, automotive, and packaging. Governments across the region, particularly in Saudi Arabia, the UAE, and Oman, are investing heavily in manufacturing clusters and industrial free zones, creating demand for both commodity and specialty chemicals. Infrastructure projects, urban development, and energy investments are also stimulating the need for coatings, lubricants, polymers, and process chemicals, positioning distributors as critical supply chain partners. The region’s strategic location between Asia, Europe, and Africa further enhances its role as a re-export and transit hub, especially through established logistics gateways such as Jebel Ali Port in the UAE and Sohar Port in Oman.

A key driver is the increasing shift toward value-added services in the distribution model. Distributors are no longer just intermediaries but are providing localized blending, repackaging, warehousing, and technical advisory services to meet customer-specific requirements. This trend is reinforced by stricter environmental regulations and quality standards, which require technical expertise and compliance capabilities from suppliers. In addition, the rising demand for specialty chemicals in industries like water desalination, renewable energy, and high-performance materials is pushing distributors to diversify portfolios and forge strategic partnerships with global chemical producers. Together, these factors are fostering a more integrated and service-oriented chemicals distribution landscape in the Middle East.

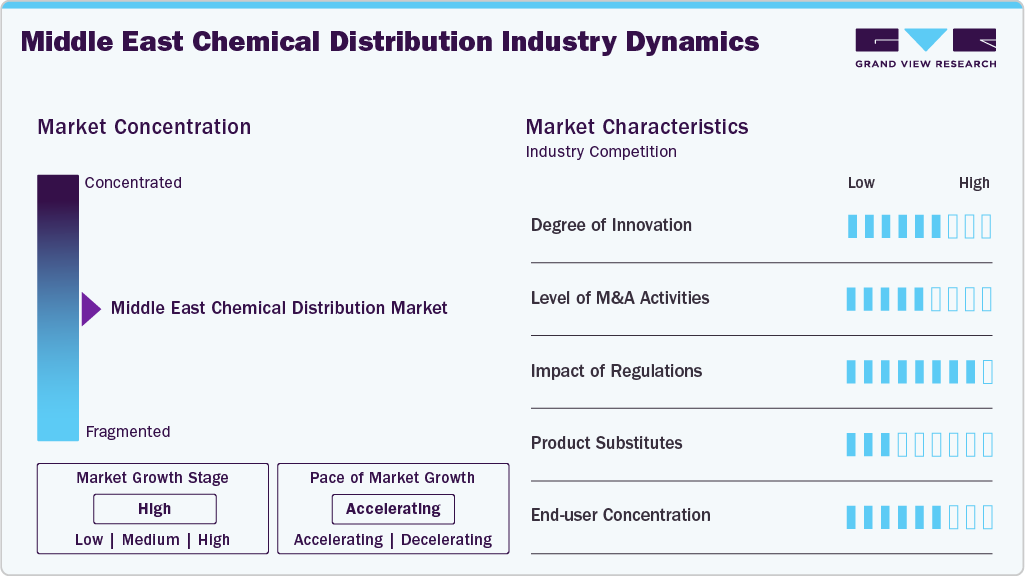

Market Concentration & Characteristics

The Middle East chemical distribution industry is moderately concentrated, with a mix of large international players, regional conglomerates, and specialized local distributors competing for market share. Global companies such as Brenntag, Univar Solutions, and IMCD maintain a strong presence through regional offices, partnerships, and distribution hubs, leveraging their broad product portfolios and global supplier relationships. Regional heavyweights, including Reda Chemicals, Gulf Chemicals, and Petrochem Middle East, dominate in key segments by offering extensive warehousing capacity, strong relationships with end-users, and tailored service capabilities. These larger players often secure long-term supply agreements with multinational chemical producers, enabling them to maintain pricing power and consistent market access.

However, the market also has a long tail of small- to mid-sized local distributors that focus on niche products, specialty chemicals, or specific geographic markets within the region. While these smaller companies lack the scale of multinational competitors, they often provide more agile customer service, competitive pricing, and deep knowledge of local regulations and procurement processes. This structure creates a competitive yet collaborative environment, with large players leading in scale and international reach, and smaller firms thriving in specialized, relationship-driven segments. Over time, ongoing industry consolidation and the growing importance of compliance, technical expertise, and logistics infrastructure are expected to tilt market share toward larger, well-capitalized distributors.

Products Insights

The commodity chemical distribution segment led the market with the largest revenue share of 88.6% in 2024. The market is driven by high demand from industries such as construction, oil & gas, plastics, textiles, and water treatment. These chemicals, such as acids, alkalis, solvents, and bulk polymers, are distributed in large volumes and are typically price-sensitive, with demand closely tied to macroeconomic and industrial activity. The region’s strong petrochemical production base, particularly in Saudi Arabia, the UAE, and Qatar, supports local sourcing and competitive pricing for many commodity products. Distributors play a key role in ensuring steady supply, bulk handling, and compliance with safety regulations, often leveraging large storage facilities and integrated logistics networks.

The specialty chemical distribution segment is expected to grow at the fastest CAGR of 4.4% during the forecast period. The market is driven by demand from high-value industries such as water desalination, renewable energy, advanced coatings, food & beverages, and pharmaceuticals. These products are typically performance-driven, requiring technical expertise, customized formulations, and stringent quality compliance, which positions distributors with strong application support capabilities at an advantage. Market growth is supported by regional diversification initiatives and the shift toward value-added manufacturing, particularly in the UAE, Saudi Arabia, and Israel.

End Use Insights

The downstream chemicals commodity chemicals segment led the market with the largest revenue share of 51.0% in 2024. Downstream commodity chemicals are widely used across end-use sectors such as construction, packaging, oil & gas, textiles, and water treatment. Construction drives demand for coatings, adhesives, and cement additives, while the packaging sector consumes bulk polymers and resins. The oil & gas industry remains a key buyer of process chemicals, drilling fluids, and corrosion inhibitors, supported by ongoing exploration and refining activities. Steady growth in these sectors ensures a consistent market for high-volume, price-sensitive commodity chemicals.

The electrical & electronics commodity segment is expected to grow at the fastest CAGR of 2.4% from 2025-2033. The electrical and electronics sector consumes commodity chemicals such as solvents, acids, resins, and plasticizers used in circuit board manufacturing, wiring insulation, and electronic component assembly. Growth in this segment is supported by rising demand for consumer electronics, renewable energy systems, and industrial automation across the region. The sector also benefits from increasing investment in electronics manufacturing and assembly hubs, particularly in the UAE, Saudi Arabia, and Israel, driving steady demand for reliable chemical supply and technical compliance support.

Country Insights

The Middle East chemical distribution marketbenefits from the region’s strategic position as a global trade hub, connecting Asia, Europe, and Africa through well-developed ports and free zones. Strong petrochemical production capacity in countries like Saudi Arabia, the UAE, and Qatar supports competitive sourcing, while diversification initiatives drive demand for specialty and value-added chemicals. Ongoing infrastructure projects, industrial expansion, and growth in sectors such as water treatment, construction, and manufacturing continue to underpin the market’s long-term growth potential.

The chemical distribution market in Saudi Arabiaaccounted for the largest market revenue share of 36.2% in Middle East in 2024. The market is driven by its strong petrochemical manufacturing base, extensive industrial zones, and large-scale infrastructure projects. Demand spans commodity and specialty chemicals for construction, oil & gas, water treatment, and manufacturing industries. Vision 2030 initiatives are accelerating diversification, boosting downstream manufacturing, and increasing demand for higher-value chemical products. Strategic logistics infrastructure, including industrial ports like Jubail and Yanbu, strengthens its role as a regional distribution hub.

Key Middle East Chemical Distribution Company Insights

Key players such as Ter Group, Univar Solutions Inc., Brenntag AG, Helm AG, and ICC Industries, Inc., are dominating the market.

-

Ter Group is a chemical production company based in Germany. It offers products to several end-use industries, including agriculture, chemicals, construction, electronic & electric, energy & resources, pharmaceuticals, and automotive & transportation. It operates through five business segments, namely performance products, chemicals, agricultural solutions, functional products & solutions, and oil & gas. The chemicals segment specializes in the manufacturing of products such as petrochemicals, catalysts, intermediates, and monomers. It also provides surface disinfectants for end uses, including home care and industrial & institutional, comprising sub-end uses such as laundry, dishwashing, food & beverage processing, and industrial cleaning, among others. The company operates through its various subsidiaries and joint ventures in over 80 countries, with more than 353 production sites spread across the globe. It also has 13 operating divisions and around 84 sub-business units worldwide. The company operates in various locations, including Germany, the U.S., Belgium, Brazil, Canada, Chile, the Netherlands, Norway, Poland, Portugal, Korea, Japan, India, Malaysia, the UAE, South Africa, and China.

Key Middle East Chemical Distribution Companies:

- Univar Solutions Inc.

- Helm AG

- Brenntag AG

- Ter Group

- Barentz

- Azelis

- Safic Alan

- ICC Industries, Inc.

- Ashland

- Omya AG

- IMCC

- Caldic B.V.

- Solvadis Deutschland GmbH

- REDA Chemicals

- Stockmeier Group

Recent Developments

-

In October 2024, Bahri Chemicals revealed that it expects cargo volumes to reach 9.1 million tonnes in 2024, representing a 56.9% increase compared to 2022. The company attributes this growth to fleet expansion and rising regional demand. However, escalating maritime security risks, particularly attacks in the Red Sea and Bab al-Mandab Strait, are straining global shipping lanes, prompting rerouting around the Cape of Good Hope, raising supply chain concerns.

Middle East Chemical Distribution Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,109.95 million

Revenue forecast in 2033

USD 4,113.35 million

Growth rate

CAGR of 3.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products, end use, country

Regional scope

Middle East

Country scope

Oman; Kuwait; Saudi Arabia; UAE; Qatar; Bahrain; RoME

Key companies profiled

Univar Solutions Inc.; Helm AG; Brenntag AG; Ter Group; Barentz; Azelis; Safic Alan; ICC Industries, Inc.; Ashland; Omya AG; IMCC; Caldic B.V.; Solvadis Deutschland GmbH; REDA Chemicals; Stockmeier Group.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Chemical Distribution Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East chemical distribution market report based on product, end use, and country.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Specialty Chemicals

-

CASE

-

Agrochemicals

-

Electronic

-

Construction

-

Specialty Polymers & Resins

-

Flavor & Fragrances

-

Others

-

-

Commodity Chemicals

-

Plastic & Polymers

-

Synthetic Rubber

-

Explosives

-

Petrochemicals

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Specialty Chemicals

-

Automotive & Transportation

-

Construction

-

Agriculture

-

Industrial Manufacturing

-

Consumer Goods

-

Textiles

-

Pharmaceuticals

-

Others

-

-

Commodity Chemicals

-

Downstream Chemicals

-

Textiles

-

Automotive & Transportation

-

Electrical & Electronics

-

Industrial Manufacturing

-

Others

-

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Oman

-

Kuwait

-

Saudi Arabia

-

UAE

-

Qatar

-

Bahrain

-

Israel

-

RoME

-

-

Frequently Asked Questions About This Report

b. The Middle East chemical distribution market size was estimated at USD 3,039.90 million in 2024 and is expected to reach USD 3,109.95 million in 2025.

b. The Middle East chemical distribution market is expected to grow at a compound annual growth rate of 3.6% from 2025 to 2033 to reach USD 4,113.35 million by 2033.

b. Saudi Arabia dominated the Middle East chemical distribution market with a share of 36.2% in 2024. This is attributable to strong petrochemical manufacturing base, extensive industrial zones, and large-scale infrastructure projects.

b. Some key players operating in the Middle East chemical distribution market include Univar Solutions Inc., Helm AG, Brenntag AG, Ter Group, Barentz, Azelis, Safic Alan, ICC Industries, Inc., Ashland, Omya AG, IMCC, Caldic B.V., Solvadis Deutschland GmbH, REDA Chemicals, and Stockmeier Group.

b. Key factors that are driving the market growth include region’s expanding industrial base, diversification from oil dependency, and growing downstream manufacturing in sectors such as construction, packaging, water treatment, and automotive.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.