- Home

- »

- Homecare & Decor

- »

-

Middle East Commercial Outdoor Furniture Market, 2033GVR Report cover

![Middle East Commercial Outdoor Furniture Market Size, Share & Trends Report]()

Middle East Commercial Outdoor Furniture Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Seating Sets, Loungers, Dining Sets, Chairs, Table), By End Use, By Distribution Channel, By Country And Segment Forecasts

- Report ID: GVR-4-68040-809-0

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Commercial Outdoor Furniture Market Summary

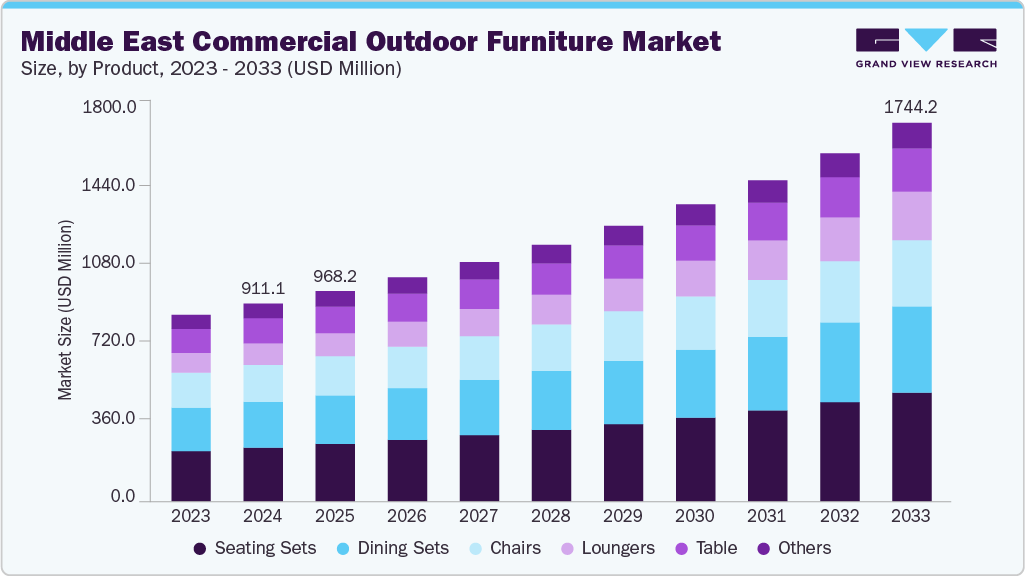

The Middle East commercial outdoor furniture market size was estimated at USD 911.1 million in 2024 and is expected to reach USD 1,744.2 million by 2033, growing at a CAGR of 7.6% from 2025 to 2033. The extreme and diverse weather conditions across the Middle East significantly influence material selection for commercial outdoor furniture.

Key Market Trends & Insights

- By country, Saudi Arabia led the market and accounted for a share of 30.0% in 2024.

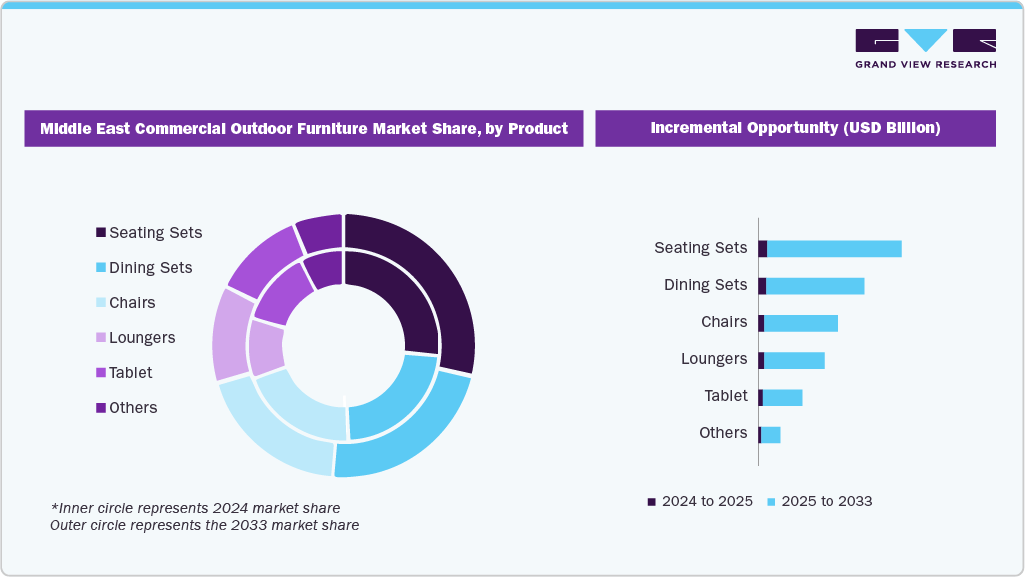

- By product, seating sets led the market and accounted for a share of 27.2% in 2024.

- By end-use, hotels & hospitality led the market and accounted for a share of 42.4% in 2024.

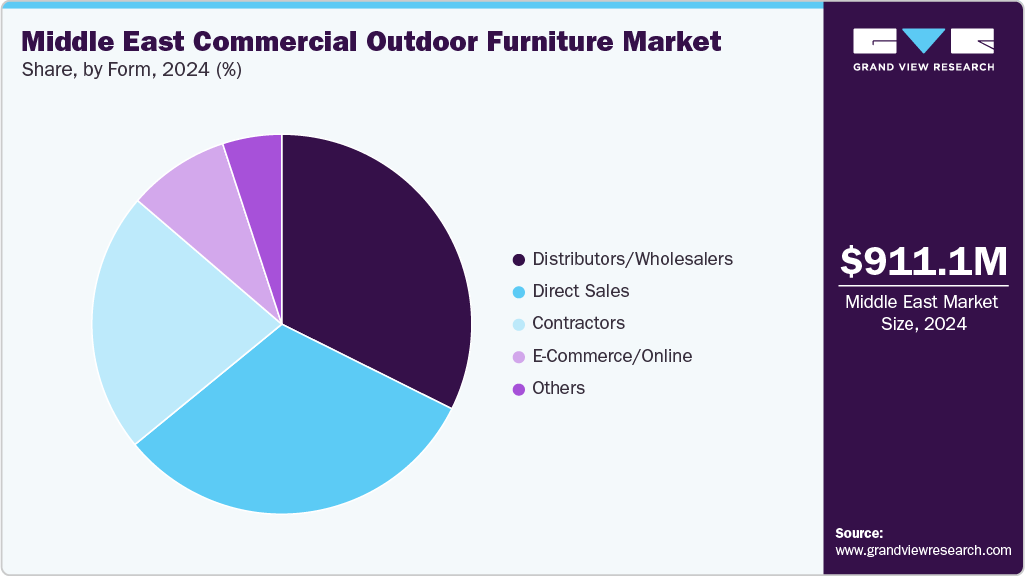

- By distribution channel, the direct sales segment led the market and accounted for a share of 32.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 911.1 Million

- 2033 Projected Market Size: USD 1,744.2 Million

- CAGR (2025-2033): 7.6%

In the Gulf region, where temperatures can exceed 45°C and UV radiation is intense, B2B buyers such as hotels, cafés, and resorts prioritize furniture made from UV-stabilized polymers, powder-coated aluminum, and weatherproof fabrics. These materials resist fading, cracking, and heat absorption better than untreated wood or iron. In coastal areas like Dubai, the high salt content in the air accelerates corrosion, prompting businesses to invest in marine-grade stainless steel, anodized aluminum, and synthetic rattan for longevity.

The commercial outdoor furniture market in the Middle East is rising primarily because of large-scale hospitality and tourism expansion across the region. Countries such as the UAE, Saudi Arabia, Qatar, and Oman are building new hotels, resorts, beach developments, and entertainment districts at an unprecedented pace under national transformation programs like Saudi Vision 2030 and Dubai 2040. Each of these projects requires substantial quantities of outdoor seating, loungers, cabanas, poolside furniture, and dining sets, creating continuous and high-volume demand for commercial outdoor furnishings.

Another major driver is the region’s shift toward outdoor dining and open-air social spaces. Post-pandemic consumer preferences have made terraces, shisha lounges, beachfront cafés, and rooftop restaurants central to F&B strategies. To maximize seating capacity and extend operating hours, restaurants now invest in durable, UV-resistant, heat-resistant, and weather-proof furniture suitable for the Gulf’s extreme climate conditions. This trend is reinforced by advances in material technology, with buyers favoring aluminum, HDPE wicker, teak, Sunbrella fabrics, and other long-life materials that withstand high temperatures and humidity.

Consumer Insights

The commercial outdoor furniture market in the Middle East is rising quickly because the region is in the middle of a major hospitality and tourism expansion. Governments across the GCC are investing in large-scale mixed-use developments, beachfront destinations, and high-end resorts under national transformation programs such as Saudi Arabia’s Vision 2030 and the UAE’s continuous tourism build-out. Every new hotel, café, beach club, and leisure facility requires durable, premium outdoor furniture, and operators increasingly view outdoor areas as core revenue generators rather than secondary spaces. This continuous pipeline of openings is driving sustained procurement across luxury, mid-scale, and boutique segments.

Growth is also being fuelled by a sharp shift in buyer preferences toward materials and designs that can withstand the Gulf climate. Commercial buyers now prioritise furniture made from UV-resistant fabrics, powder-coated aluminium, marine-grade materials, and treated teak that will not fade, warp, or corrode under extreme heat and humidity. These features significantly reduce annual replacement cycles, making high-quality outdoor furniture a more cost-effective choice for hotels and F&B operators.

At the same time, there is a strong trend toward premium outdoor lifestyle experiences. Hotels, malls, and restaurants across the region are redesigning outdoor spaces with modular lounges, cabanas, shaded pods, and visually appealing seating layouts that enhance ambience and guest experience. Earth-tone colours, natural finishes, and resort-style aesthetics are becoming mainstream, especially as operators focus on Instagram-friendly spaces that boost footfall and customer spend. This is reinforcing demand for high-end, design-led outdoor furniture rather than commodity pieces.

Product Insights

Seating sets held the largest share in the Middle East commercial outdoor furniture market, accounting for a share of 27.2% in 2024. Demand for seating sets in Middle East commercial outdoor furniture is rising because businesses are prioritizing comfortable, durable, and aesthetically appealing spaces to attract and retain customers. Hospitality venues, restaurants, hotels, and mixed-use developments are expanding outdoor dining and lounge areas to meet higher consumer preference for open-air environments. Corporate campuses, healthcare facilities, and educational institutions are also investing more in outdoor seating to support wellness, social interaction, and flexible work or waiting spaces. This shift, combined with higher spending on landscaping, renovations, and experiential design, is driving consistent growth in seating-set installations across commercial properties.

Loungers are anticipated to witness a CAGR of 9.7% from 2025 to 2033. Demand for commercial outdoor furniture in the Middle East is rising as hotels, resorts, luxury residences, and mixed-use developments increasingly focus on creating premium outdoor environments. Developers are expanding terraces, pool decks, rooftops, and outdoor dining areas to meet the region’s growing appetite for leisure, wellness, and social spaces. At the same time, customers now expect resort-style comfort, elegant aesthetics, and high durability suited to intense heat, UV exposure, and frequent use. This expectation is pushing commercial operators to upgrade to weather-resistant, low-maintenance, and design-forward outdoor furniture. As a result, hospitality, high-end residential complexes, and recreational facilities are consistently increasing their outdoor furniture procurement to enhance guest experience and differentiate their properties.

End Use Insights

Hotels & hospitality held the largest share in the Middle East commercial outdoor furniture market, accounting for a share of 42.4% in 2024. Hotels are expanding poolside lounges, rooftop decks, patios, and dining terraces to enhance aesthetics and increase revenue-generating spaces. Operators are also investing in durable, weather-resistant furniture to reduce long-term maintenance costs and support year-round outdoor usage. As competition intensifies, high-quality outdoor furnishings have become a key differentiator for improving guest comfort, elevating brand image, and maximizing occupancy and F&B revenue.

Multi-family housing is anticipated to witness a CAGR of 7.9% from 2025 to 2033. Modern tenants expect amenities such as rooftop lounges, poolside seating, fire-pit areas, and landscaped courtyards, which require durable, weather-resistant, and design-forward furniture. The shift toward lifestyle-driven living, increased competition among apartment communities, and a growing preference for outdoor socialization have further accelerated this trend. Property managers also view premium outdoor furniture as a long-term asset that enhances property value and supports higher occupancy and rental rates.

Distribution Channel Insights

Sales of Middle East commercial outdoor furniture through distributors/wholesalers held the largest share, accounting for a share of around 32.4% in 2024. Sales of commercial outdoor furniture through wholesalers and distributors in the Middle East are rising as hotels, resorts, luxury residences, and mixed-use developments accelerate their investment in premium outdoor environments. Developers are expanding terraces, pool decks, rooftops, and outdoor dining spaces, which increases bulk purchasing through established distribution channels. Commercial buyers now expect resort-style comfort, modern aesthetics, and high-durability products that can withstand extreme heat, UV exposure, and heavy usage. Wholesalers and distributors are responding by offering weather-resistant, low-maintenance, and design-driven collections with reliable delivery and after-sales support.

Sales of Middle East commercial outdoor furniture through online/e-commerce are anticipated to witness a CAGR of 9.6% from 2025 to 2033. Demand for commercial outdoor furniture in the Middle East is rising through online channels because businesses increasingly prefer fast, transparent, and cost-efficient procurement. Online platforms offer a wider range of customizable, durable, and weather-resistant products that meet hospitality, corporate, and public-space needs without the delays of traditional showroom buying. Improved digital catalogs, 3D product views, competitive pricing, and nationwide delivery make online purchasing more convenient for hotels, restaurants, universities, and real estate developers. This shift is reinforced by post-pandemic outdoor space investments and the industry’s growing comfort with digital procurement.

Country Insights

Saudi Arabia Commercial Outdoor Furniture Market Trends

The Saudi Arabia commercial outdoor furniture market accounted for a share of around 30.0% in 2024. Demand for commercial outdoor furniture in Saudi Arabia is growing rapidly due to several converging factors. The Kingdom’s Vision 2030 infrastructure push has spurred large-scale investment in hospitality resorts, luxury residential towers, mixed-use developments, and leisure destinations, driving out-of-doors amenity spaces like pool decks, rooftops, and terraces. Additionally, the country’s hot climate requires durable furnishings, weather- and UV-resistant, which raises specification levels for commercial buyers. Rising disposable incomes, tourism growth, and urbanisation further support the trend, while many operators now view outdoor furniture as a key part of guest experience, brand differentiation, and premium positioning. Finally, the growing preference for digital sourcing and project procurement supports greater volume demand via wholesalers and distributors.

Oman Commercial Outdoor Furniture Market Trends

The commercial outdoor furniture market in Oman is expected to grow at a CAGR of 9.8% from 2025 to 2033. Demand for commercial outdoor furniture in Oman is rising as the country accelerates hotel, resort, and mixed-use development under its Vision 2040 agenda. International brands and new luxury properties are expanding pool decks, terraces, and outdoor dining areas, which increases procurement of high-quality outdoor seating, loungers, and shade structures. At the same time, consumers and guests expect resort-style comfort and premium aesthetics, pushing developers to invest in weather-resistant, low-maintenance furniture that can withstand Oman’s heat and UV exposure. Growing tourism inflows, upgrades across high-end residential and leisure facilities, and the government’s ongoing support for hospitality and real-estate investments collectively drive sustained demand for commercial outdoor furniture across the country.

UAE Commercial Outdoor Furniture Market Trends

The commercial outdoor furniture market in the UAE is expected to grow at a CAGR of 6.7% from 2025 to 2033. Demand for commercial outdoor furniture is rising sharply in the UAE as the country continues to expand its hospitality, luxury residential, and mixed-use development sectors. Hotels, resorts, and serviced apartments are upgrading their outdoor spaces to meet growing expectations for high-end leisure, wellness, and social environments. Developers are adding larger terraces, rooftop lounges, pool decks, and outdoor dining areas to differentiate their properties in a competitive market driven by tourism and long-term expatriate residents. At the same time, consumers increasingly prefer resort-style comfort, shaded seating, and premium materials that can withstand extreme heat, UV exposure, and year-round outdoor use. This combination of rapid infrastructure development and evolving consumer expectations is driving steady, sustained growth in the demand for durable, design-focused commercial outdoor furniture across the UAE.

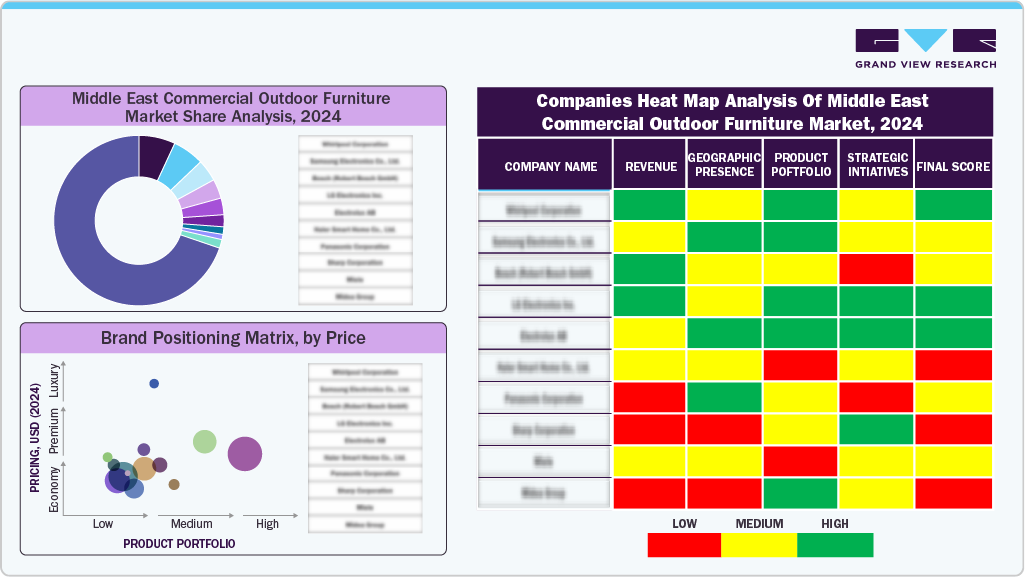

Key Middle East Commercial Outdoor Furniture Company Insights

The Middle East commercial outdoor furniture industry remains highly competitive, with brands expanding their presence across hospitality, corporate, public space, and retail channels. Companies are investing heavily in advanced material engineering, weather-resistant coatings, and ergonomic design technologies to improve durability, outdoor performance, and long-term structural integrity. Rising demand for premium, aesthetically appealing, and low-maintenance furniture, driven by hotels, restaurants, resorts, offices, and luxury residential developments, is further accelerating market adoption. Additionally, the shift toward sustainable materials, recyclable metals, FSC-certified wood, and eco-friendly manufacturing processes continues to support strong, long-term growth opportunities across the Middle East commercial outdoor furniture landscape.

Key Middle East Commercial Outdoor Furniture Companies:

- Intermetal Furnishings LLC

- A to Z Furniture LLC

- Hevea Outdoor Furniture

- Royse Furniture Industries LLC

- Casualife Furniture

- Elite Style Furniture Co. Ltd

- Kellso Hospitality Furniture UAE

- aRaims Factory (aRaims Group)

- FurnitureRoots

- Alkaffary Group

Recent Developments

-

In July 2025, INC Group launched Stulo, a new independent furniture brand focused on tailored, design-led solutions for modern workplaces in the Middle East and Africa. Led by Luke Neale, Stulo offers expertise through a consultative approach, represents international brands, and manufactures bespoke furniture locally in the UAE to support sustainability and quick delivery. Stulo will maintain close collaboration with INC Group, serving end users, architects, and real estate managers, and aims to establish itself as a trusted name in commercial interiors.

-

In December 2024, Bentley Home expanded in the Middle East by opening two new stores in Riyadh and Jeddah, both located within Dar Al Arkan Interiors in Saudi Arabia. These stores showcase Bentley Home’s latest collections and classics, offer bespoke interior design services, and reinforce the brand’s commitment to luxury interiors in the region. The expansion marks Bentley Home’s continued global growth, bringing its total flagship stores to five and highlighting its partnership with Luxury Living Group and Dar Al Arkan Interiors.

Middle East Commercial Outdoor Furniture Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 968.2 million

Revenue forecast in 2033

USD 1,744.2 million

Growth rate

CAGR of 7.6% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, distribution channel, region

Regional scope

Middle East

Country scope

UAE; Saudi Arabia; Oman; Qatar; Kuwait

Key companies profiled

Intermetal Furnishings LLC; A to Z Furniture LLC; Hevea Outdoor Furniture; Royse Furniture Industries LLC; Casualife Furniture; Elite Style Furniture Co. Ltd; Kellso Hospitality Furniture UAE; aRaims Factory (aRaims Group); FurnitureRoots; Alkaffary Group

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Commercial Outdoor Furniture Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the Middle East commercial outdoor furniture market by product, end use, distribution channel, and country.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Seating Sets

-

Loungers

-

Dining Sets

-

Chairs

-

Table

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Corporate Offices

-

Hotels & Hospitality

-

Multi-Family Housing

-

Educational Institutions

-

Senior Living & Care Centers

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Direct Sales

-

Distributors/Wholesalers

-

Contractors

-

E-Commerce/Online

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East

-

UAE

-

Saudi Arabia

-

Qatar

-

Kuwait

-

Oman

-

-

Frequently Asked Questions About This Report

b. The Middle East commercial outdoor furniture market size was estimated at USD 911.1 million in 2024 and is expected to reach USD 968.2 million in 2025.

b. The Middle East commercial outdoor furniture is expected to grow at a compounded growth rate of 7.6% from 2025 to 2030 to reach USD 1,744.2 million by 2033.

b. Hotels & hospitality held the largest share in the Middle East commercial outdoor furniture market, accounting for a share of 42.4% in 2024. Hotels are expanding poolside lounges, rooftop decks, patios, and dining terraces to enhance aesthetics and increase revenue-generating spaces. Operators are also investing in durable, weather-resistant furniture to reduce long-term maintenance costs and support year-round outdoor usage.

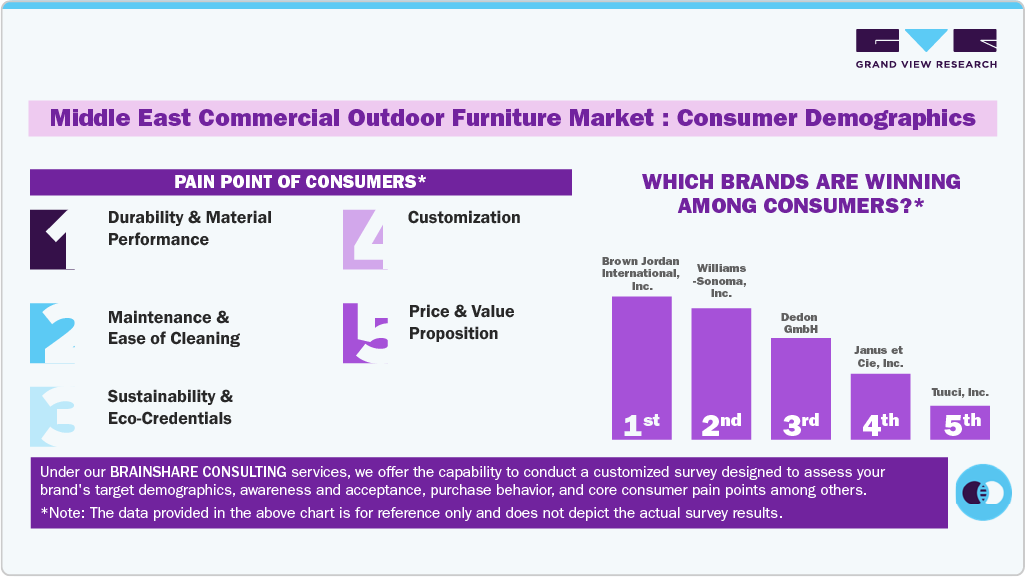

b. Some key players operating in Middle East commercial outdoor furniture market include Brown Jordan International, Inc., Williams-Sonoma, Inc., Dedon GmbH, Janus et Cie, Inc., Tuuci, Inc., Kettal S.A., Harbor Outdoor,

b. Key factors that are driving the market growth include increasing the number of commercial construction projects and growing consumer preference towards aesthetic furniture

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.