- Home

- »

- Animal Health

- »

-

Middle East Companion Animal Health Market Report, 2033GVR Report cover

![Middle East Companion Animal Health Market Size, Share & Trends Report]()

Middle East Companion Animal Health Market (2025 - 2033) Size, Share & Trends Analysis Report By Animal (Dogs, Cats, Horses, Pet Birds), By Product (Biologics, Pharmaceuticals), By Distribution Channel (E-commerce, Retail), By End Use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-818-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Companion Animal Health Market Summary

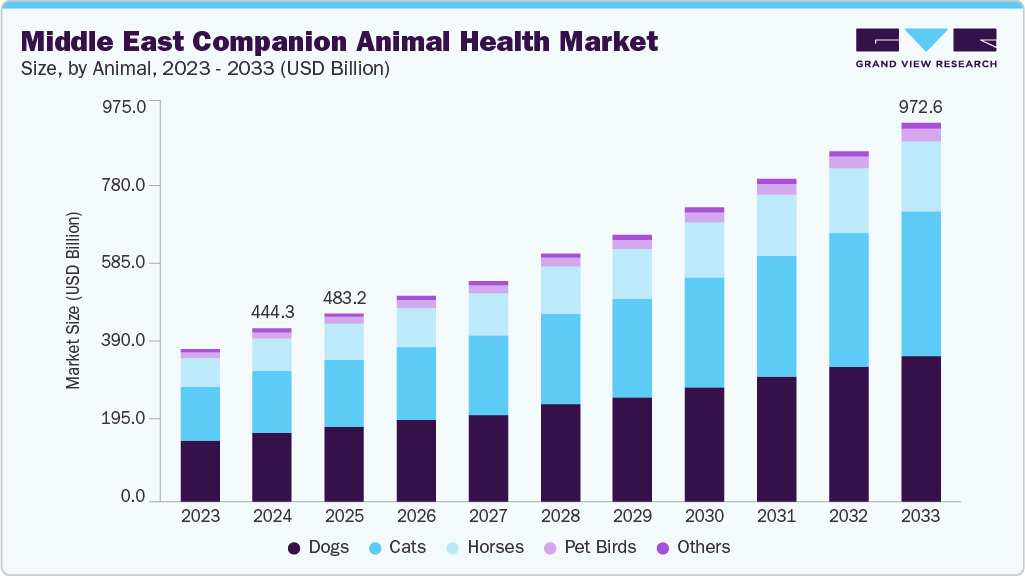

The Middle East companion animal health market size was estimated at USD 444.3 million in 2024 and is projected to reach USD 972.6 million by 2033, growing at a CAGR of 9.14% from 2025 to 2033. The market is advancing, driven by the expansion of veterinary infrastructure, increasing awareness of pet healthcare, and growing demand for advanced therapeutics and diagnostics.

Key Market Trends & Insights

- The Saudi Arabia companion animal health market held the largest revenue share of 52.19% in 2024.

- By animal, the dog segment held the largest market share of 39.95% in 2024.

- By product, the pharmaceuticals segment held the largest market share in 2024.

- By distribution channel, the hospital/ clinic pharmacy segment held the largest market share in 2024.

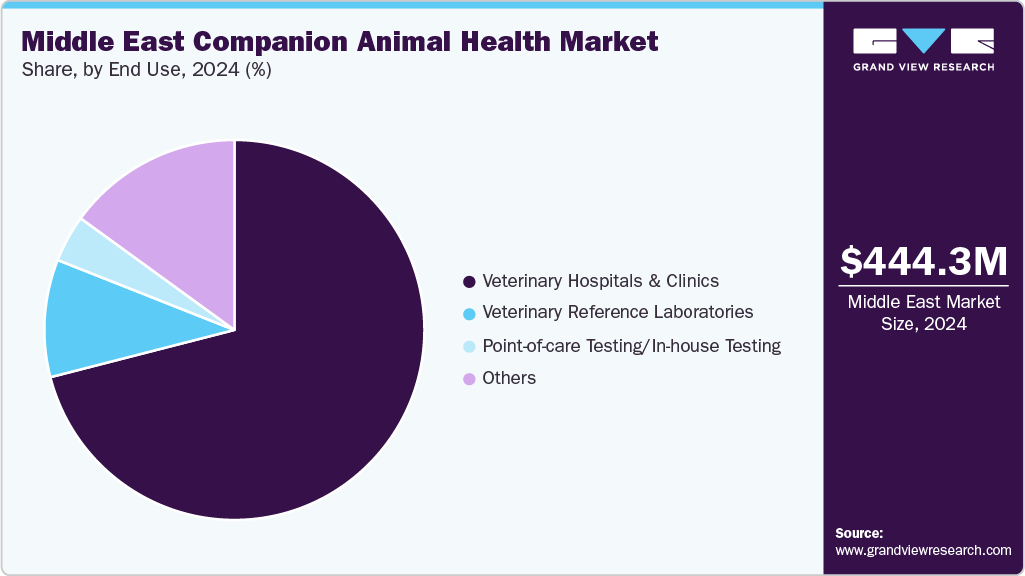

- By end use, the veterinary hospitals & clinics segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 444.3 Million

- 2033 Projected Market Size: USD 972.6 Million

- CAGR (2025-2033): 9.14%

- Saudi Arabia: Largest market in 2024

- Qatar: Second fastest growing market

The rising expansion of veterinary infrastructure is one of the primary growth drivers for the Middle East companion animal health industry. Governments and private investors are establishing new veterinary clinics, hospitals, and specialty centers, along with upgrading existing facilities with advanced diagnostic and treatment equipment. For instance, in November 2025, the Thumbay Group launched a comprehensive veterinary ecosystem in the UAE, comprising clinics, hospitals, laboratories, pharmacies, and a veterinary college, which supports education and research, as well as One Health initiatives, amid rising regional demands for pet and livestock care. Improved veterinary infrastructure enhances access to high-quality care for companion animals, encouraging pet owners to seek routine and specialized services.In May 2025, Oman inaugurated its first university-affiliated veterinary hospital at A’Sharqiyah University, enhancing animal healthcare, public awareness, and veterinary education with advanced labs, surgical facilities, and student training programs. As a result, veterinary hospital networks increase the reach of veterinary products, creating economies of scale. Thus, the development of modern infrastructure supports professional training and the adoption of international standards of care, directly stimulating the growth of the Middle East companion animal health market.

In addition, the rising prevalence of chronic diseases, infections, and lifestyle-related disorders in pets is driving the need for advanced diagnostics and therapeutics. According to a study published in October 2024 on gastrointestinal parasites of cats in the Middle East (2000-2023), it was found that Hydatigera taeniaeformis, a common feline cestode, had the highest prevalence in Qatar, ranging from 73.6% to 75.8%. In contrast, Kuwait reported the lowest prevalence at just 0.8%. Such disease prevalence in Middle East encourages pet owners to access effective treatment options, such as biologics, specialty pharmaceuticals, vaccines, and advanced imaging. Thus, veterinary clinics are adopting diagnostic equipment, such as digital X-rays, ultrasound, and lab analyzers, to provide timely and accurate care. The demand for innovative therapeutics and diagnostics incentivizes pharmaceutical and medical device companies to introduce new products, accelerating market expansion.

Furthermore, another factor boosting the industry growth is the growing awareness of pet healthcare in the region. Various mediums such as educational campaigns, social media, and veterinary outreach programs are improving pet owners’ knowledge about animal wellness, preventive care, and disease management. For instance, in May 2023, the UAE Ministry of Climate Change and Environment, in collaboration with WOAH, collaborated, focusing on the “One Health Approach for Sustainability,” uniting global experts to advance animal health and welfare.

In July 2025, Qatar’s Ministry of Municipality met with a Belarusian delegation to enhance cooperation in veterinary vaccine and medicine development, focusing on technology exchange, epidemic prevention, and strengthening national animal health security. Such initiatives encourage routine veterinary visits, vaccinations, diagnostic testing, and timely treatment for illnesses. As pet owners increasingly focus on preventive care, there is a growing demand for veterinary medications, diagnostic tools, and specialized services. Moreover, clinics and hospitals are enhancing their investments in advanced imaging, laboratory, and surgical technologies to fulfill these expectations. Increased awareness is also fostering the acceptance of innovative therapies, supplements, and nutraceuticals.

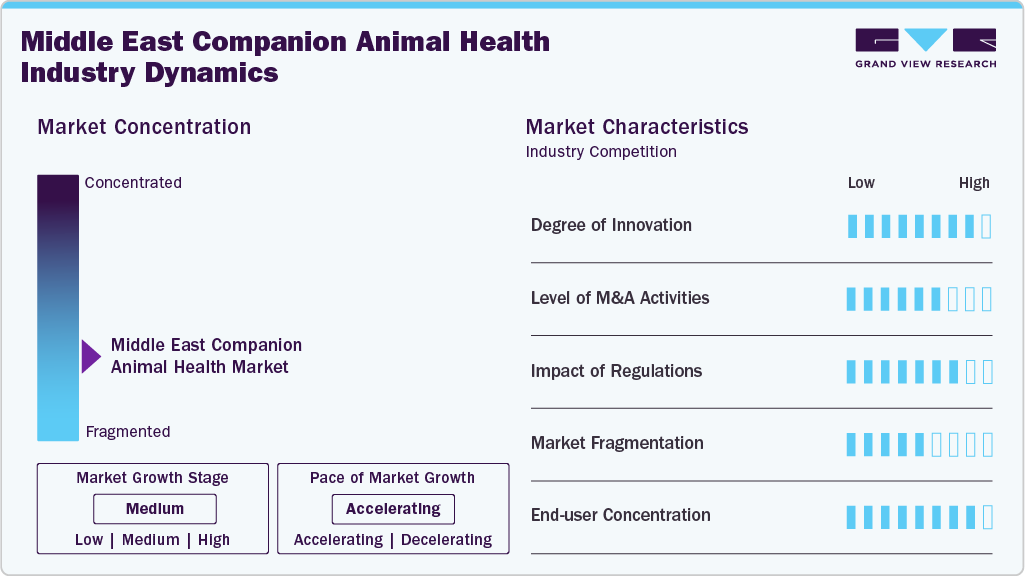

Market Concentration & Characteristics

The Middle East companion animal health market is moderately concentrated, with global players such as Zoetis, Boehringer Ingelheim, Elanco, and IDEXX dominating, alongside emerging regional firms. Strategic partnerships, expanding distribution networks, and increasing investments in veterinary infrastructure and diagnostics strengthen competition, while innovation and localization drive differentiation and market penetration.

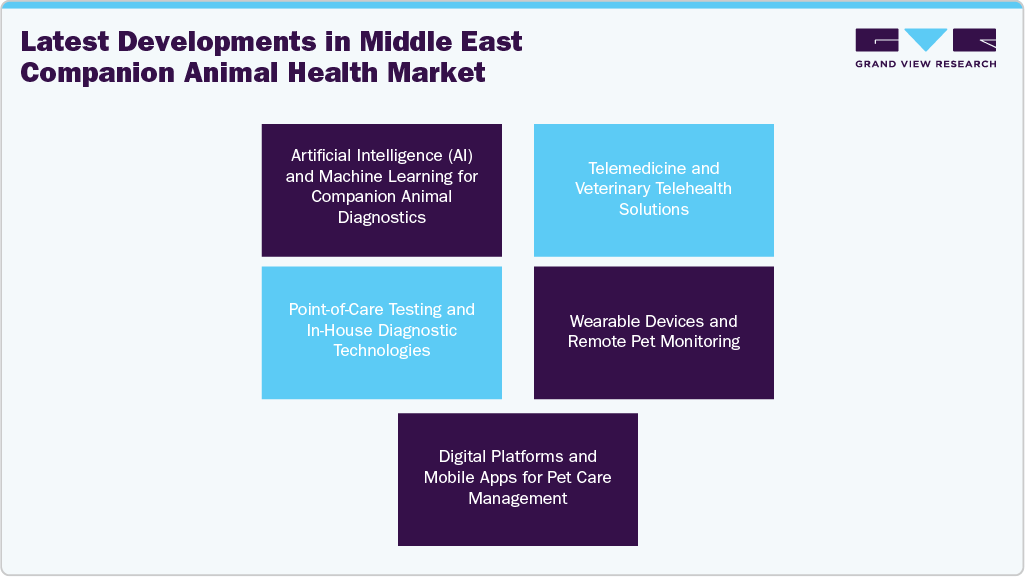

The Middle East companion animal health industry is witnessing steady innovation, driven by rising pet ownership, digital transformation, and increasing demand for preventive care. Companies are introducing advanced diagnostics, telemedicine platforms, and innovative vaccines. Research collaborations and technology transfers from global leaders are accelerating local R&D, whereas universities and government programs are promoting innovation aligned with One Health and sustainability goals.

Mergers and acquisitions are on the rise as multinational firms seek to establish a domestic foothold in the region’s expanding animal health sector. Global players are partnering with regional distributors, veterinary chains, and research institutes to enhance market access. For instance, in September 2025, Sylvester.ai partnered with Dubai-based Nova Vet Family to introduce its AI-powered feline pain detection technology across the Middle East and North Africa, enhancing cat care standards and clinic efficiency.

Regulations are significantly shaping the industry, with a focus on import control, product registration, and veterinary standards. Countries like the UAE and Saudi Arabia are modernizing frameworks to align with WOAH and GCC guidelines. Regulatory harmonization is enhancing product quality and safety, while stricter compliance encourages local manufacturing, technology transfer, and traceability in veterinary pharmaceuticals and biologics.

The Middle East companion animal health market remains moderately fragmented, combining global leaders and numerous regional distributors and clinics. While multinational companies dominate product portfolios such as vaccines, diagnostics, and pharmaceuticals, regional firms are focusing on localized needs, including nutrition and preventive care. Fragmentation persists due to regulatory diversity, differing sector maturity levels, and uneven access to veterinary services across countries, creating opportunities for strategic alliances and consolidation.

End user concentration is increasing as veterinary clinics, hospitals, and government agencies drive most product demand. Companion animal owners, welfare organizations, and university veterinary programs are expanding their influence. Urban centers in the UAE, Saudi Arabia, and Qatar account for major consumption, while the rising awareness and private investments gradually drive the demand across secondary cities and rural areas.

Animal Insights

The dogs segment led the Middle East companion animal health market with the largest revenue share of 39.95% in 2024, owing to rising pet ownership, increasing demand for preventive healthcare, and growing awareness of canine welfare. According to the GlobalPETS publication of March 2025,in Oman, dogs account for about 60% of pets compared to 35% cats. In addition, urbanization and changing lifestyles have led to an increase in families adopting dogs as companions, thereby boosting the demand for advanced veterinary care, vaccinations, and nutritional products.

The cats segment is expected to grow at the fastest CAGR over the forecast period, due to rising urbanization, smaller living spaces, and cultural affinity for feline pets. In countries like Saudi Arabia and the UAE, cats are increasingly favored due to their low-maintenance nature and adaptability to indoor environments. According to the Soluky publication of March 2025, cats dominated in Saudi Arabia, representing 77.4% of all pets, with the monthly expenditure ranging between USD 80 to 220, reflecting their smaller food portions and minimal grooming needs. In addition, veterinary clinics report a surge in feline visits, which account for up to 90% of consultations in some regions. The expanding availability of specialized feline healthcare products, diagnostics, and nutrition solutions further supports the growth.

Product Insights

The pharmaceuticals segment held the largest revenue share of the Middle East companion animal health industry in 2024, driven by growing awareness among pet owners about preventive care, expansion of manufacturing facilities, and the availability of advanced therapeutics through veterinary clinics. For instance, in January 2025, Oman’s Khazaen Economic City will host an animal vaccine facility, producing 2 billion doses annually to strengthen local and regional veterinary medicine, food security, and biosecurity programs. In addition, multinational players are expanding their regional presence through distribution partnerships and product registrations, supporting innovation and accessibility in companion animal pharmaceuticals.

The others segment, which includes veterinary telehealth, veterinary software and livestock monitoring is emerging as the fastest growing segment over the forecast period. The rise of digital transformation in veterinary care, accelerated by increasing smartphone penetration and cloud-based tools, is driving the adoption of remote consultations, digital recordkeeping, and real-time animal health monitoring. For instance, in October 2024, PetWatch launched in the UAE, offering a certified-sitter app that connects pet owners with trusted caregivers, addressing growing pet care concerns amid a rise in ownership and redefining reliability in pet services. Pet owners seek convenient, technology-driven care options, and clinics utilize telehealth platforms to expand their reach and optimize operations.

Distribution Channel Insights

The hospital/clinic pharmacy segment dominated the Middle East companion animal health market with largest revenue share in 2024, due to the growing number of veterinary hospitals and clinics offering comprehensive in-house pharmacy services. Pharmacies within hospitals offer an extensive selection of pharmaceutical products specifically designed for companion animals, making it convenient for pet owners to obtain essential medications for their pets. Furthermore, these pharmacies employ specialized personnel with knowledge in veterinary medicine, offering valuable advice and suggestions to pet owners regarding their pets' health needs.

The e-commerce segment is projected to grow at a significant CAGR over the forecast period. The segment’s growth is driven by the rising internet penetration, smartphone usage, and changing consumer preferences for convenient shopping. Pet owners purchase pet food, medicines, supplements, and healthcare products online, benefiting from home delivery, wider product selection, and competitive pricing. Additionally, enhanced logistics, secure payment systems, and effective promotional strategies continue to drive growth in this market.

End Use Insights

Veterinary hospitals and clinics dominated the Middle East companion animal health market in 2024, with the largest revenue share, due to the growing demand for specialized veterinary services. Urbanization and higher disposable incomes have led to an increasing number of households seeking professional care for their pets, including routine check-ups, vaccinations, diagnostics, and surgeries. In addition, modern hospitals offer advanced diagnostic imaging, in-house pharmacies, and specialized treatment units, enhancing treatment outcomes and client trust.

Point-of-care testing/in-house testing is the fastest-growing segment over the forecast period, driven by the demand for rapid, accurate diagnostics and timely treatment decisions. Veterinary clinics have been adopting portable diagnostic tools for blood tests, infectious disease screening, and biochemical analysis, reducing reliance on external laboratories. POC testing enhances workflow efficiency, improves patient outcomes, and boosts client satisfaction.

Country Insights

Saudi Arabia Companion Animal Health Market Trends

Saudi Arabia companion animal health market dominated the region with a revenue share of 52.19% in 2024. The increasing awareness of animal welfare and growing disposable incomes among urban populations drive the market growth. In addition, the market is witnessing advancements such as AI-powered diagnostics, telehealth platforms, and mobile veterinary services, which are enhancing access to preventive care, early disease detection, and treatment efficiency. Moreover, the market is regulated by the Ministry of Environment, Water, and Agriculture, which enforces veterinary product registration, quality standards, and animal welfare regulations to ensure the safe and effective use of treatments.

Qatar Companion Animal Health Market Trends

The companion animal health market in Qatar is expected to grow at a significant CAGR over the forecast period. The market growth is fueled by rising pet adoption and higher spending on veterinary services. The market is competitive, with global players such as Zoetis, Elanco, and Ceva collaborating with local distributors and veterinary clinics to expand reach and service offerings. In addition, government initiatives promoting animal health and welfare, along with modern veterinary infrastructure, are supporting market expansion and encouraging adoption of innovative healthcare solutions.

Key Middle East Companion Animal Health Company Insights

Key players in the Middle East companion animal health market include Zoetis, Boehringer Ingelheim, Elanco, IDEXX, and Virbac, which collectively hold a significant market share. These companies dominate through product innovation, strategic partnerships, regional distribution networks, and investments in veterinary infrastructure, whereas emerging local firms contribute to market growth and diversification. For instance, in July 2024, Zomedica partnered with Leader Healthcare Group to distribute its veterinary diagnostics and therapeutic products across GCC countries, strengthening its global presence and expanding access to advanced animal healthcare solutions.

Key Middle East Companion Animal Health Companies:

- Boehringer Ingelheim International GmbH

- Elanco

- IDEXX Laboratories, Inc.

- Vetoquinol

- Virbac

- Zoetis Services LLC

- Merck & Co. Inc.

- UNIVET

- A MAZRUI INTERNATIONAL

- HIPRA

- Biogenesis Bago

Recent Developments

-

In November 2025, Thumbay Group launched a dedicated veterinary ecosystem in the UAE, receiving CAA approval for its Doctor of Veterinary Medicine program, enhancing education, research, and clinical services while promoting One Health initiatives.

-

In September 2025, Sylvester.ai partnered with Dubai-based Nova Vet Family to introduce AI-powered feline pain detection across the Middle East and North Africa, elevating feline healthcare standards and supporting clinic growth and client trust.

-

In July 2025, Qatar’s Animal Wealth Department and Belarusian veterinary experts agreed to collaborate on vaccine and medicine development, exchanging technology and expertise to strengthen regional animal health and epidemic prevention capabilities.

Middle East Companion Animal Health Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 483.2 million

Revenue forecast in 2033

USD 972.6 million

Growth rate

CAGR of 9.14% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, product, distribution channel, end use, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Kuwait; Oman; Qatar

Key companies profiled

Boehringer Ingelheim International GmbH; Elanco; IDEXX Laboratories, Inc.; Vetoquinol; Virbac; Zoetis Services LLC; Merck & Co. Inc.; UNIVET; A MAZRUI INTERNATIONAL; HIPRA; Biogenesis Bago

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Companion Animal Health Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East companion animal health market report based on animal, product, distribution channel, end use, and country:

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Dogs

-

Cats

-

Horses

-

Pet Birds

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Biologics

-

Vaccines

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Other Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Medicated Feed Additives

-

Diagnostics

-

Consumables, reagents and kits

-

Instruments and devices

-

Equipment & Disposables

-

Critical Care Consumables

-

Anesthesia Equipment

-

Fluid Management Equipment

-

Temperature Management Equipment

-

Rescue & Resuscitation Equipment

-

Research Equipment

-

Patient Monitoring Equipment

-

-

Others

-

Veterinary Telehealth

-

Veterinary Software

-

Livestock Monitoring

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail

-

E-Commerce

-

Hospital/ Clinic Pharmacy

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Reference Laboratories

-

Point-of-care Testing/In-house Testing

-

Veterinary Hospitals & Clinics

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.