- Home

- »

- Medical Devices

- »

-

Middle East Dental Implants Market, Industry Report, 2033GVR Report cover

![Middle East Dental Implants Market Size, Share & Trends Report]()

Middle East Dental Implants Market (2025 - 2033) Size, Share & Trends Analysis Report By Surface Treatment Type (SLA and SLActive, Anodized Surfaces, Nano-Textured Surfaces), By Material (Titanium, Zirconia), By Design (Tapered, Parallel-Walled), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-817-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Dental Implants Market Summary

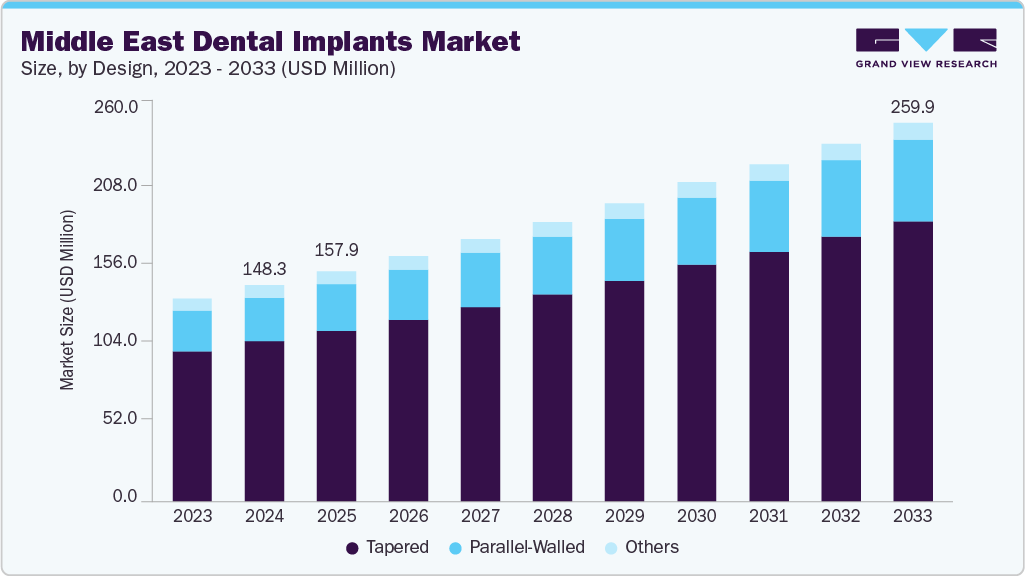

The Middle East dental implants market size was estimated at USD 148.24 million in 2024 and is projected to reach USD 259.98 million by 2033, growing at a CAGR of 6.4% from 2025 to 2033. This growth is fueled by the rising prevalence of tooth decay, periodontal diseases, and tooth loss across all age groups.

Key Market Trends & Insights

- Saudi Arabia dominated the dental implants market in 2024.

- By surface treatment type, the SLA AND SLActive segment held the largest share of the Middle East dental implants market in 2024.

- By material, the zirconia segment is anticipated to register the fastest CAGR from 2025 to 2033.

- By design, the titanium segment dominated the Middle East dental implants market in 2024, accounting for the largest revenue share.

Market Size & Forecast

- 2024 Market Size: USD 148.24 Million

- 2033 Projected Market Size: USD 259.98 Million

- CAGR (2025-2033): 6.4%

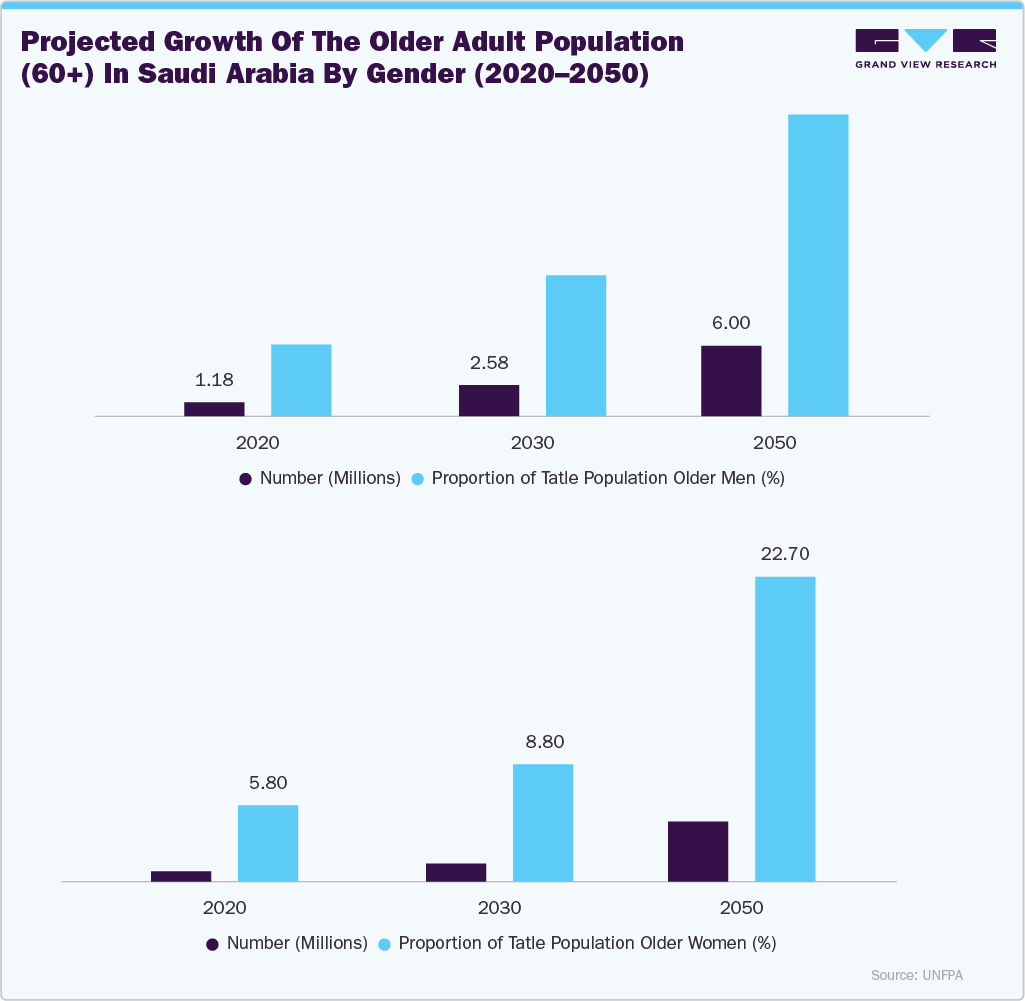

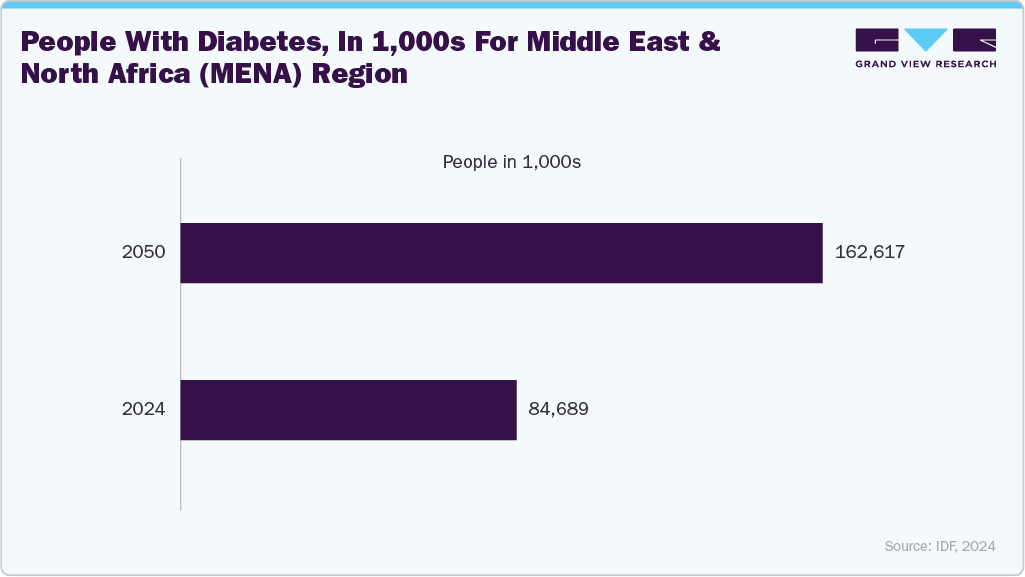

An expanding ageing population, more susceptible to bone resorption and oral health deterioration, continues to generate strong demand for durable restorative solutions such as dental implants. Increasing government investments in healthcare infrastructure, along with supportive regulations and insurance reforms, are further improving access to advanced dental care and driving adoption of digital dentistry and modern implant systems. In addition, a growing pool of trained dental professionals, rapid clinic expansion, and heightened patient awareness regarding the aesthetic and functional advantages of implants are strengthening market momentum across the region. According to data published by WHO in March 2025, oral diseases affect an estimated 3.7 billion people.

A higher density of dentistry personnel significantly drives the Middle East dental implant market by improving access, awareness, and the overall volume of implant procedures performed. As more skilled dentists, oral surgeons, and implant specialists enter the workforce, patients benefit from shorter appointment waiting times, wider availability of advanced treatments, and increased geographical coverage of services across urban and semi-urban areas. Greater practitioner density also supports competitive pricing, encourages adoption of modern technologies such as digital implantology and guided surgery, and enhances clinical training standards. With more professionals trained in implant procedures, clinics are able to offer implants as a routine rather than a specialized service, thereby increasing patient confidence and uptake. This expanding pool of qualified dental experts ultimately fuels market growth by boosting procedural capacity, driving innovation, and elevating the quality of implant care across the region.

Density of dentistry personnel (per 10,000 population)

Country

Density (per 10,000 population)

Year

Qatar

7.4

2023

United Arab Emirates

8.8

2023

Kuwait

8.1

2020

Saudi Arabia

7.8

2023

Oman

3.6

2022

Source: WHO

Government investment plays a crucial role in driving the Middle East dental implant market by strengthening healthcare infrastructure, improving access to advanced dental services, and promoting higher standards of oral care. When governments allocate funding toward public dental programs, hospital upgrades, and technology modernization, clinics are better equipped to adopt digital dentistry tools, CBCT imaging, and implant-specific surgical systems. Many Middle Eastern governments also support healthcare privatization and encourage foreign investment, which leads to the expansion of dental chains, training centers, and specialty implant clinics. Subsidies, insurance reforms, and preventive care initiatives further increase patient affordability and awareness, motivating more individuals to seek long-term solutions, such as implants.

-

Kuwait’s 2024/2025 healthcare budget is USD 10 billion, accounting for 11% of the country’s total budget. Of this, USD 608 million has been allocated for healthcare infrastructure, which includes plans to construct and expand 10 hospitals over the next five years, while USD 56 million has been allocated to support digital transformation initiatives.

-

In April 2025, Oman made a large-scale investment in healthcare infrastructure, with nine new hospitals and multiple expansions underway. These projects increase hospital capacity and integrate advanced equipment, specialized wards, and modern facilities, creating substantial demand for medical technologies. This surge of development is expected to strengthen Oman’s healthcare system, improve patient outcomes, and drive growth opportunities.

Tooth decay and the ageing population are two major factors driving the Middle East dental implant market. As rates of dental caries continue to rise due to lifestyle factors, dietary habits, and inadequate oral hygiene practices, an increasing number of individual’s experience advanced tooth damage or tooth loss, thereby increasing the demand for long-lasting restorative solutions. The ageing population contributes significantly to market growth, as older adults are more prone to periodontal disease, bone loss, and age-related oral health deterioration that often require tooth replacement. Dental implants are preferred over traditional dentures because they offer superior durability, improved chewing efficiency, and greater comfort-qualities that are especially important for elderly patients seeking to maintain their quality of life. The growing burden of tooth decay and the expanding elderly demographic create a large, recurring pool of patients requiring implant procedures, thereby accelerating the market’s growth.The percentage of children aged six to twelve suffering from tooth decay in the Kingdom of Saudi Arabia reached 96% and 93.7%.

Market Concentration & Characteristics

The Middle East dental implants market is in a medium-growth stage, characterized by moderate technological advancement, demand from established healthcare settings, and expanding adoption in outpatient and homecare environments.

Innovation is rapidly transforming the Middle East dental implant market, driven by digital dentistry, advanced imaging, and next-generation surface technologies. Manufacturers are adopting CAD/CAM workflows, guided surgery, 3D-printed prosthetics, and AI-based planning to boost precision and efficiency. Clinicians favor improved osseointegration, faster-healing implants, and minimally invasive kits for more predictable, faster outcomes. Together, these advancements sharpen clinical accuracy, enhance patient experience, and establish innovation as a key competitive edge in the region.

M&A activity in the Middle East dental implant sector has been increasing as global manufacturers seek strategic expansion and regional distributors look to strengthen their portfolios. International implant companies frequently partner with or acquire local distributors to gain direct market access, expand their service networks, and enhance after-sales support.

Regulation is crucial in shaping the Middle East dental implant market. Governments are strengthening quality standards, device approvals, and clinic licensing frameworks to ensure patient safety and the reliability of products. Countries such as the UAE and Saudi Arabia have aligned their medical device regulations with international benchmarks. Implants must meet strict certification standards before entering the market. These measures promote the use of high-quality, clinically validated implant systems and discourage the use of low-cost, uncertified imports.

Surface Treatment Type Insights

The SLA AND SLActive segment held the largest share of the Middle East dental implants market in 2024, driven by their superior surface technology that enhances osseointegration and accelerates healing time. These advanced surface treatments offer improved bone-to-implant contact, stability, and long-term success rates, making them widely preferred among clinicians for both immediate and delayed loading procedures. Their strong clinical track record and proven reliability have positioned SLA and SLActive implants as the gold standard in modern implant dentistry.

The nano-textured surfaces segment is expected to register the fastest CAGR in the Middle East dental implants market over the forecast period, driven by its ability to significantly enhance osseointegration, cellular response, and long-term implant stability. Nano-textured implants feature surface modifications at the nanometer scale that mimic the natural structure of bone tissue, promoting superior osteoblast adhesion, proliferation, and differentiation. This results in faster healing and stronger bone-to-implant integration than conventional surface treatments. In addition, nanotechnology and surface engineering advancements have enabled manufacturers to develop implants with improved biocompatibility, antibacterial properties, and mechanical strength, reducing the risk of peri-implantitis and implant failure. The growing clinical preference for implants that ensure early loading and high success rates, along with increasing R&D investment in next-generation surface modification techniques, is expected to fuel the rapid growth of the nano-textured surfaces segment in the forecast years.

Design Insights

The tapered design segment dominated the Middle East dental implants market in 2024, capturing the most significant share owing to its superior primary stability and versatility in various bone conditions. Tapered implants closely mimic the natural shape of a tooth root, allowing for better adaptation in narrow ridges and extraction sockets, which enhances placement precision and load distribution. Their design facilitates immediate implantation and loading, reducing treatment time and improving patient outcomes. In addition, the growing adoption of minimally invasive and digital-guided implant procedures has further boosted clinicians' preference for tapered implants.

The parallel-walled segment is expected to grow at the fastest CAGR in the Middle East dental implants market over the forecast period, driven by its predictable load distribution, ease of placement, and suitability for dense bone structures. Parallel-walled implants provide a larger surface area for bone contact, promoting excellent osseointegration and long-term stability, especially in cases requiring multiple implants or complex restorations. Their uniform shape allows for greater surgical flexibility and consistency in achieving optimal insertion torque, reducing the risk of micro-movements and implant failure. The increasing adoption of computer-guided and digitally planned implant procedures has also enhanced the precision and efficiency of parallel-walled implant placement. As clinicians seek reliable, stable, and versatile implant options, the parallel-walled segment is poised for rapid growth in the forecast years.

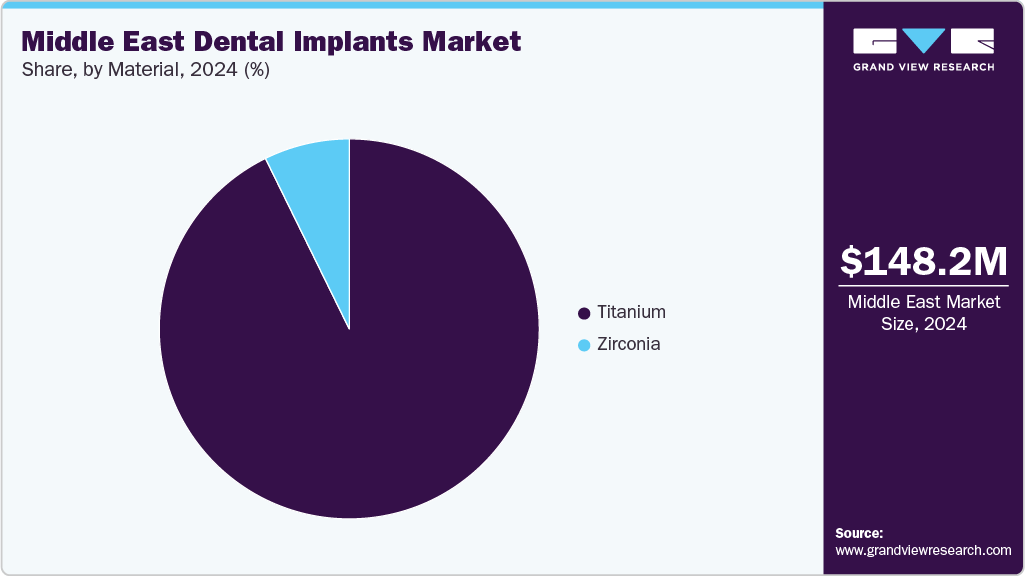

Material Insights

The titanium segment dominated the Middle East dental implants market in 2024, accounting for the largest revenue share due to its exceptional biocompatibility, mechanical strength, and corrosion resistance. Dental professionals widely prefer titanium implants as they offer excellent osseointegration, ensuring long-term stability and durability within the jawbone. Their proven clinical success, extensive research support, and cost-effectiveness compared to newer materials have further strengthened their market position. Moreover, developing titanium alloys and surface-treated variants has enhanced their performance, promoting faster healing and reduced implant failure rates. These advantages continue to make titanium the material for most dental implant procedures globally.

The zirconia segment is expected to grow at the fastest CAGR in the Middle East dental implants market over the forecast period, driven by rising demand for metal-free, highly aesthetic, and biocompatible alternatives to traditional titanium implants. Zirconia implants offer a superior tooth-colored appearance, making them ideal for patients with thin gingival tissue or high esthetic expectations. In addition, their excellent corrosion resistance, low plaque accumulation, and non-allergenic properties make them suitable for individuals with metal sensitivities. Advances in material processing and surface modification technologies have significantly improved zirconia’s mechanical strength and osseointegration capabilities, addressing earlier concerns about brittleness. The growing shift toward minimally invasive and aesthetic dental restorations and increasing clinical validation of zirconia’s long-term performance are expected to propel this segment’s rapid expansion in the forecast years.

Country Insights

UAE Dental Implants Market Trends

Expanding oral, dental, and maxillofacial surgery services in the UAE is fueling dental implant market growth. Specialized clinics and hospital departments equipped with advanced surgical technologies, such as 3D imaging, guided implant placement, and computer-assisted surgical planning, enable more complex procedures to be performed safely and efficiently. These services cater to routine implant placement and cases requiring bone grafts, sinus lifts, or reconstructive surgery, expanding the scope of implantable solutions. The ageing demographic and the increasing availability of advanced surgical expertise create a favorable environment for dental implant adoption, driving demand and encouraging public and private healthcare providers to invest in modern implant technologies and training for skilled professionals.

Qatar Dental Implants Market Trends

The ageing population in Qatar is becoming a major driver of the dental implant market, as rising life expectancy and shifts in demographic structure are increasing the demand for restorative dental solutions. Older adults are more susceptible to tooth loss due to periodontal diseases, bone resorption, and age-related deterioration in oral health. In Qatar, the aging population has been increasing over the past few years. In 2021, the population of individuals aged 60 and above was 32,661, which rose to 36,966 in 2022, 41,755 in 2023, and is projected to reach 47,892 in 2024. This represents significant growth, with the population increasing by approximately 13.2% from 2021 to 2022, 13.0% from 2022 to 2023, and 14.7% from 2023 to 2024. From 2021 to 2024, the aging population in Qatar is expected to grow by 46.7%.

Key Middle East Dental Implants Company Insights

The industry players are undertaking several strategic initiatives such as acquisitions, partnerships and collaborations. Moreover, the launch of novel products is anticipated to boost the competitive rivalry in the dental implants market.

Key Middle East Dental Implants Companies:

- BIOHORIZONS

- NOBEL BIOCARE (ENVISTA)

- ZimVie Inc.,

- OSSTEM IMPLANT

- INSTITUT STRAUMANN AG

- BICON, LLC

- LEADER MEDICA

- DENTSPLY SIRONA

- DENTIS

- DENTIUM CO., LTD

- T-PLUS IMPLANT TECH CO. LTD

- KYOCERA MEDICAL CORP

- DOUBLE MEDICAL TECHNOLOGY INC

- BIOCONCEPT DENTAL IMPLANTS

- NEOSS LTD

- SOUTHERN IMPLANTS

Recent Developments

-

In July 2025, ZimVie Inc. announced a strategic distribution partnership with Osstem Implant Co., Ltd. (“Osstem Implant”), a prominent provider of high-quality dental implants and integrated dental technologies worldwide. This collaboration aims to strengthen ZimVie's global footprint by expanding into the rapidly growing Chinese implant market, which is estimated to exceed 10 million units sold annually, and to improve customer access to its innovative range of implant solutions.

-

In June 2025, INSTITUT STRAUMANN AG is expected to invest USD 76 to 102 million on Villeret site in Switzerland over the next five years. Villeret likely to continue in focusing on the production of high value-added products, including the newly launched iEXCEL high-performance implant system.

-

In January 2025, Osstem Implant announced its major showcase for AEEDC 2025, where the company likely to introduce its advanced fourth-generation SOI (Super Osseointegration) surface technology and a fully streamlined digital workflow experience. The new SOI surface is engineered to outperform traditional sandblasted and acid-etched techniques, reducing the initial bone fusion period by more than 35% compared to Osstem’s SA surface. This offers significantly improved protein adhesion and strong blood clot formation, resulting in faster and more stable osseointegration.

Middle East Dental Implants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 157.94 million

Revenue forecast in 2033

USD 259.98 million

Growth rate

CAGR of 6.4% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Surface treatment type, material, design, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Oman; Qatar; Kuwait

Key companies profiled

BioHorizons; Nobel Biocare (Envista); ZimVie Inc.; Osstem Implant; Institut Straumann AG; Bicon, LLC; Leader Medica; Dentsply Sirona; Dentis; Dentium Co., Ltd.; T-Plus Implant Tech Co. Ltd.; Kyocera Medical Corp; Double Medical Technology Inc.; Bioconcept Dental Implants; Neoss Ltd.; Southern Implants

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Dental Implants Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East dental implants market report based on surface treatment type, material, design, and country.

-

Surface Treatment Type Outlook (Revenue, USD Million, 2021 - 2033)

-

SLA and SLActive

-

Anodized Surfaces

-

Nano-Textured Surfaces

-

Others

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Titanium

-

Zirconia

-

-

Design Outlook (Revenue, USD Million, 2021 - 2033)

-

Tapered

-

Parallel-Walled

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

Frequently Asked Questions About This Report

b. The Middle East dental implants market size was estimated at USD 148.24 million in 2024.

b. The Middle East dental implants market is expected to grow at a compound annual growth rate of 6.43% from 2025 to 2033 to reach USD 259.98 million by 2033.

b. Saudi Arabia dominated the dental implants market in 2024.

b. Some key players operating in the Middle East dental implants market include BioHorizons, Nobel Biocare (Envista), ZimVie Inc., Osstem Implant, Institut Straumann AG, Bicon LLC, Leader Medica, Dentsply Sirona, Dentis, Dentium Co. Ltd., T-Plus Implant Tech Co. Ltd., Kyocera Medical Corp, Double Medical Technology Inc., Bioconcept Dental Implants, Neoss Ltd., and Southern Implants.

b. The Middle East dental implants market is driven by rising oral-health problems (like tooth loss and periodontal disease), a growing elderly population, and increasing demand for cosmetic dentistry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.