- Home

- »

- Consumer F&B

- »

-

Middle East Meat Extract Market Size, Industry Report, 2033GVR Report cover

![Middle East Meat Extract Market Size, Share & Trends Report]()

Middle East Meat Extract Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Chicken, Pork, Beef, Fish, Turkey), By Form (Powder, Paste, Liquid, Granules), By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-815-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Meat Extract Market Summary

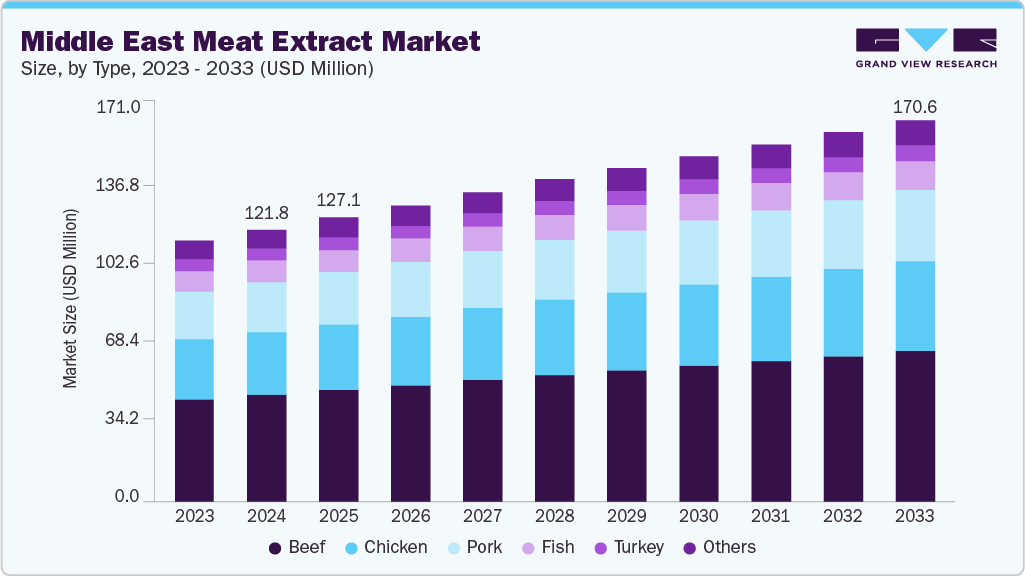

The Middle East meat extract market size was estimated at USD 121.8 million in 2024 and is projected to reach 170.6 million in 2033, growing at a CAGR of 3.8% from 2025 to 2033. The meat industry in the Middle East is constantly evolving, driven by shifting consumer preferences, population growth, and economic development.

Key Market Trends & Insights

- South Africa dominated the Middle East meat extract market in 2024 with a revenue share of 46.4%.

- By type, the beef extracts segment accounted for a share of 39.3% in 2024.

- By form, the powdered meat extract segment dominated with a revenue share of 48.5% in 2024.

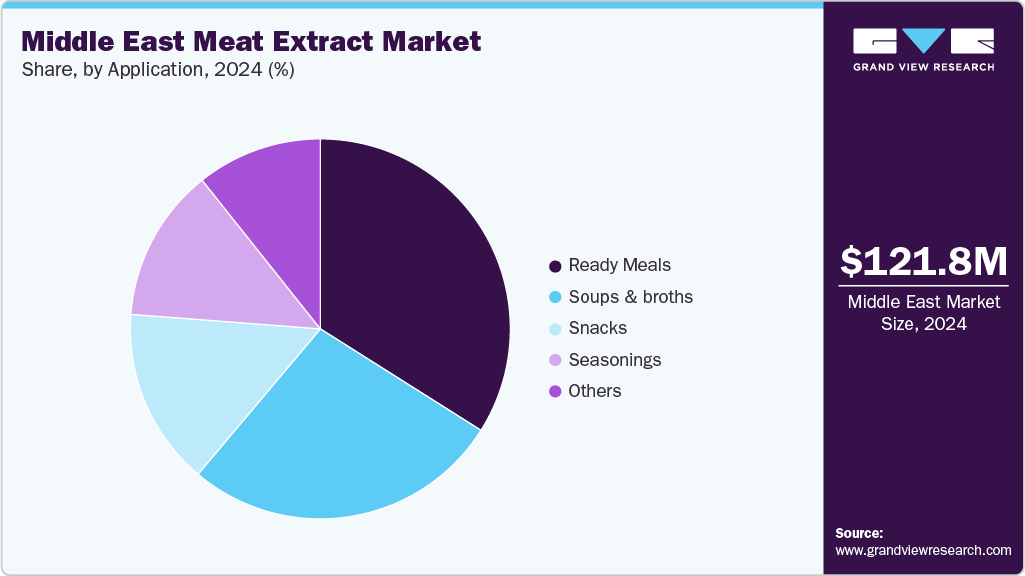

- By application, the ready meals segment dominated with a revenue share of over 34.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 121.8 Million

- 2033 Projected Market Size: USD 170.6 Million

- CAGR (2025-2033): 3.8%

Despite grappling with issues such as water scarcity, environmental concerns, and reliance on imports, meat producers in the region are utilizing innovation, investment, and technological advancements to meet demand and ensure food security. Through the adoption of contemporary production techniques, sustainable initiatives, and strategic market expansion, the meat sector in the Middle East is primed for sustained growth and success in the foreseeable future.Poultry-based extracts are considered the most attractive segment owing to rising health awareness among consumers in GCC countries. Consumers are shifting from the consumption of red meat to poultry due to its high cholesterol content. The growing popularity of chicken-based extracts among the younger generation and the increasing demand for organic food products are the primary factors driving the overall meat extract market. Furthermore, increasing consumer awareness of animal protein intake and the wide variety of meat extracts available at lower prices is projected to drive regional growth.

The increase in imports of meat products in Saudi Arabia has contributed to a rise in the demand for meat extract. With the increase in meat imports, Saudi Arabia has gained access to a wider variety of meat sources, including beef, lamb, and possibly exotic meats. This variety prompts a corresponding demand for meat extract that can capture and enhance the unique flavors of these different meats. In January 2024, Saudi Arabia announced the resumption of meat imports from South Africa following the lifting of a 20-year ban. This decision is part of Saudi Arabia's investment efforts in South Africa, the most developed economy on the continent. The Food and Drug Administration of Saudi Arabia lifted the prohibition on South African meat imports in August 2023. Subsequently, final approvals have been granted for the shipment of halal cuts to Saudi Arabia, marking the beginning of beef and lamb product imports from South Africa.

Type Insights

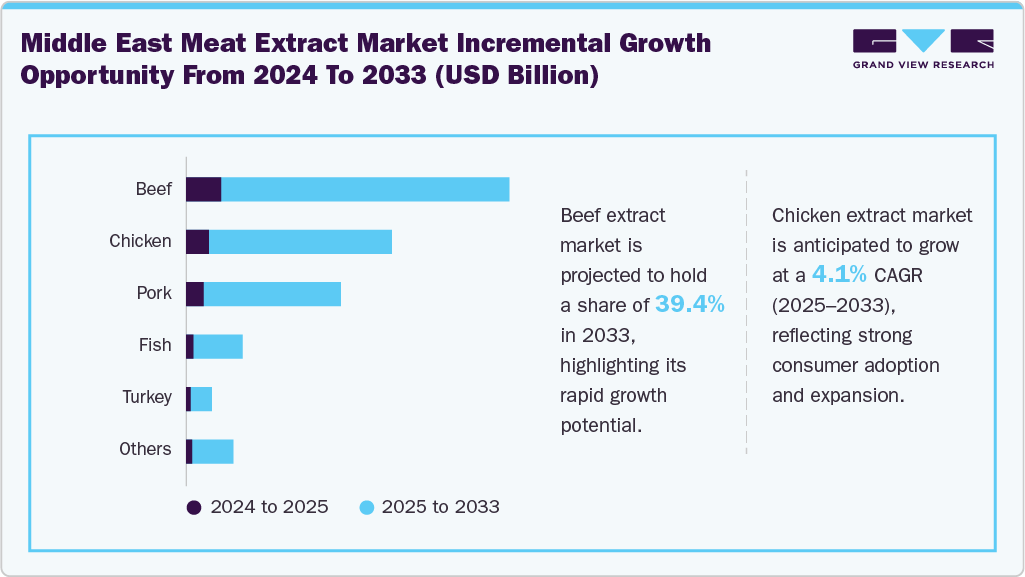

In terms of revenue, the beef extract segment led the market and accounted for a share of 39.3% in 2024, primarily due to its strong regional demand and versatility across diverse food applications. Beef is already a major part of local diets, making it a natural choice for manufacturers seeking to align with familiar flavors and culinary traditions. Its rich umami taste and adaptability in soups, sauces, ready meals, and bouillons further enhance its appeal. The rapid expansion of the foodservice and convenience food sectors, supported by well-established halal-certified supply chains, has boosted their industrial use. Additionally, beef extract’s availability in stable, cost-effective paste and powder forms makes it ideal for large-scale processing and products with long shelf lives.

Chicken extract is anticipated to witness a CAGR of 4.1% from 2025 to 2033. Consumers across the region are increasingly shifting toward lighter, leaner proteins, viewing chicken as a healthier alternative to red meat. This has led to a surge in demand for chicken-based flavor enhancers in soups, sauces, instant noodles, and ready-to-eat meals. Additionally, the growing quick-service restaurant (QSR) and processed food sectors rely heavily on chicken extracts to create consistent flavor profiles in products such as marinades, broths, and seasonings. Chicken extract is also gaining traction due to its mild, universally accepted taste that blends easily with various cuisines popular in the Middle East, including Arabic, Mediterranean, and fusion dishes.

Form Insights

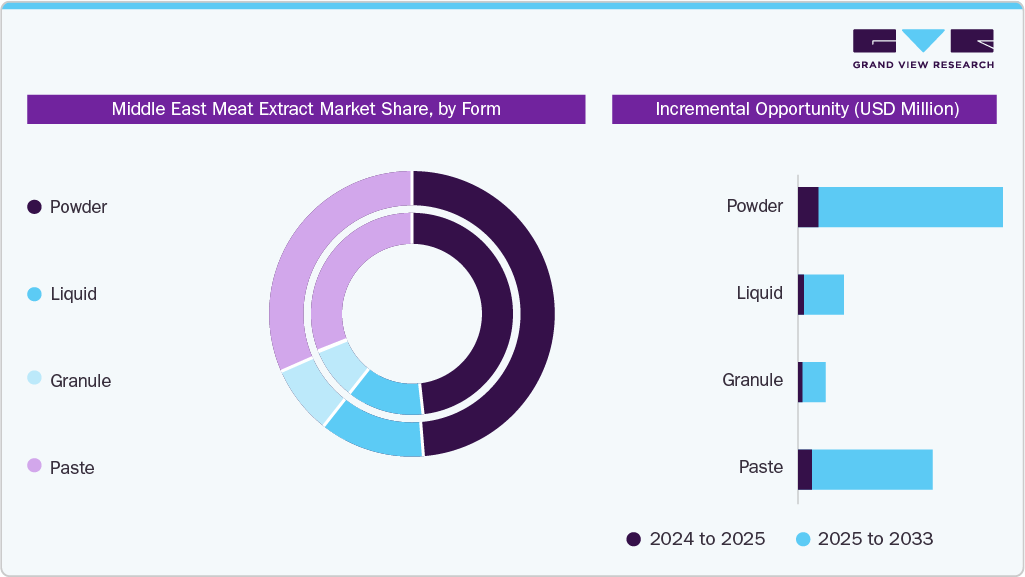

The powder segment accounted for the largest share of 48.5% of the revenue in 2024, mainly due to its superior convenience, stability, and suitability for large-scale food manufacturing. Powdered extracts have a long shelf life, are easy to store and transport in the region’s hot climate, and maintain consistent flavor quality without refrigeration, making them ideal for both industrial and household use. Food manufacturers, particularly those producing soups, sauces, seasonings, snacks, and ready-to-eat meals, prefer powder form because it dissolves easily, ensures precise flavor control, and simplifies mixing during production. The format also reduces wastage and is more cost-efficient compared to liquid or paste alternatives.

Meat extract pastes are anticipated to witness a CAGR of 4.0% from 2025 to 2033. Paste forms of meat extract deliver a richer, more concentrated flavor and texture, closely mimicking the qualities of freshly cooked meat, which appeal strongly to restaurants, hotels, and gourmet food manufacturers aiming to provide high-quality taste experiences. As Middle Eastern cuisine relies heavily on stews, marinades, and sauces, paste extracts integrate well into traditional cooking methods, offering depth of flavor and ease of blending.

Application Insights

The ready meals segment led the Middle East meat extract industry, with the largest revenue share of 34.0% in 2024. With more people in the region living in cities and balancing busy work schedules, consumers are increasingly turning to ready-to-eat and heat-and-serve meals for convenience. Meat extract serves as a key flavor enhancer in these products, providing rich, authentic taste and aroma without the need for fresh meat, which simplifies large-scale food production.

The soup and broths segment is projected to grow at the fastest CAGR of 4.3% from 2025 to 2033, primarily driven by rising health consciousness, evolving culinary habits, and the increasing popularity of convenient, flavor-rich meal options. Consumers are increasingly seeking nutrient-dense, protein-rich foods that offer both comfort and nourishment, and soups and broths are well-suited to meet this preference. Meat extracts, particularly those derived from beef and chicken, are widely utilized to enrich the flavor, aroma, and nutritional value of these products, eliminating the need for fresh meat or lengthy cooking times.

Country Insights

South Africa Meat Extract Market Trends

The South Africa meat extract market accounted for a revenue share of 46.4% in 2024. Consumer preference for on-the-go options, particularly among individuals who lead busy lifestyles or seek quick energy boosts, has fueled the consumption of ready meals, meat snacks, soups, and similar products. The substantial protein content in these offerings is appealing to health-conscious consumers seeking a satisfying and protein-rich snack or treat in South Africa. South Africa has become an important market for U.S. beef variety meat, showing promising potential for beef muscle exports as well. In 2024, South Africa’s average annual per capita meat consumption was approximately 58–64 kg per person, with poultry (mainly chicken) accounting for around 60% of total meat intake. The annual per capita consumption of chicken was specifically about 35 kg, making it by far the most popular meat in the country. Additionally, popular global brands Royco and Knorr, owned by Unilever, have a strong presence in South Africa, producing meat extract and flavoring products. Their range includes both liquid and powder forms of meat extract, which home cooks and food manufacturers use.

UAE Meat Extract Market Trends

The UAE is renowned for its diverse culinary scene, with influences from diverse regions, including the Middle East, Asia, and the West. This diversity has led to a wide range of meat-based dishes that cater to various tastes and preferences. However, beef is a significant part of the UAE’s diverse meat market, and poultry and mutton lead overall red meat consumption by share. The demand for beef remains steady, supported by the large expatriate population and strong consumer preference for halal and premium imported meats.

Meat extracts are used extensively by food manufacturers to replicate and enhance the flavors of these dishes. The growing consumption of meat and the shift toward meat-centric diets in the UAE have created a substantial market for meat extract. These extracts play a vital role in meeting consumer demand for flavorful, convenient, and nutritionally balanced food options, especially in processed and ready-to-eat meals.

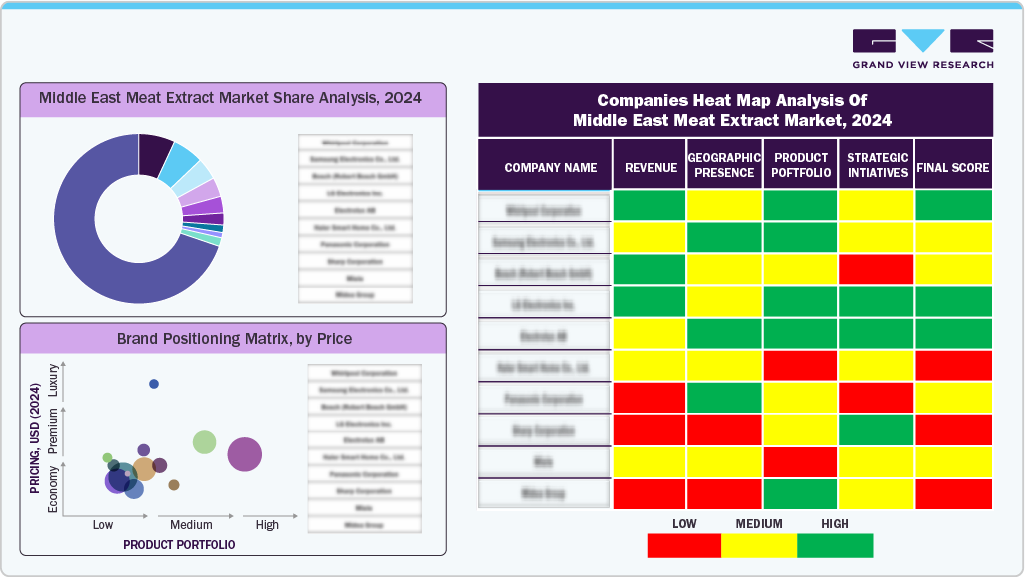

Key Middle East Meat Extract Company Insights

Leading companies in the Middle East meat extract industry are strengthening their presence through advanced flavor development, wide distribution networks, and vertically integrated supply chains that span from livestock sourcing to extraction and processing. Key players, such as Givaudan, Essentia Protein Solutions, Maverick Biosciences, and Diana Food S.A.S., utilize their technological expertise and operational efficiency to meet the increasing demand for natural and high-quality protein ingredients. Meanwhile, specialized firms like International Dehydrated Foods and Nikken Foods focus on tailoring flavor profiles to suit regional cuisines and halal requirements. The market is also witnessing an increase in mergers and acquisitions, strategic partnerships, and investments in modern extraction technologies, with a focus on clean-label, sustainable, and traceable production.

Key Middle East Meat Extract Companies:

- Givaudan

- Essentia Protein Solutions

- HACO Holding AG

- Brenntag S.p.A.

- PT Foodex Inti Ingredients

- PT Jinyoung

- Maverick Biosciences

- Diana Food S.A.S.

- Carnad A/S

- Colin Ingredients

Recent Developments

- In September 2025, Kemin Food Technologies expanded its “Olessence” natural flavor range by introducing Olessence P Dry (a dry plant-extract blend for meat & poultry) and Olessence G Liquid (a liquid flavoring for sauces, dips, and bakery) aimed at the EMEA region. These launches respond to the growing demand for clean-label, natural ingredient solutions, enabling manufacturers to meet consumer expectations for transparency, recognizable ingredients, and extended shelf life.

Middle East Meat Extract Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 127.1 million

Revenue forecast in 2033

USD 170.6 million

Growth rate

CAGR of 3.8% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form, application, country

Country scope

South Africa; UAE

Key companies profiled

Givaudan; Essentia Protein Solutions; HACO Holding AG; Brenntag S.p.A.; PT Foodex Inti Ingredients; PT Jinyoung; Maverick Biosciences; Diana Food S.A.S.; Carnad A/S; Colin Ingredients

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Meat Extract Market Report Segmentation

This report forecasts volume & revenue growth at the regional and country levels, providing an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East meat extract market report based on type, form, application, and country:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Chicken

-

Pork

-

Beef

-

Fish

-

Turkey

-

Others

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Powder

-

Liquid

-

Granule

-

Paste

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Ready Meals

-

Snacks

-

Soups & broths

-

Seasonings

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

South Africa

-

UAE

-

Frequently Asked Questions About This Report

b. The Middle East meat extracts market was estimated at USD 121.8 million in 2024 and is expected to reach USD 127.05 million in 2025.

b. The Middle East meat extracts market is expected to grow at a compound annual growth rate of 3.8% from 2025 to 2033 to reach USD 170.6 million by 2033.

b. beef extract is the largest segment, accounting for a share of 39.26% in 2024. due to its strong regional demand and versatility across diverse food applications. Beef is already a major part of local diets, making it a natural choice for manufacturers seeking to align with familiar flavours and culinary traditions.

b. Some of the key players in the Middle East meat extracts market is Givaudan; Essentia Protein Solutions; HACO Holding AG; Brenntag S.p.A.; PT Foodex Inti Ingredients; PT Jinyoung; Maverick Biosciences; Diana Food S.A.S.; Carnad A/S; Colin Ingredients

b. The meat industry in the Middle East is constantly evolving, influenced by shifting consumer tastes, population expansion, and economic progress. Despite grappling with issues like water scarcity, environmental concerns, and reliance on imports, meat producers in the region are utilizing innovation, investment, and technological advancements to satisfy demand and guarantee food security.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.