- Home

- »

- Drilling & Extraction Equipments

- »

-

Middle East Mining Chemicals Market, Industry Report, 2033GVR Report cover

![Middle East Mining Chemicals Market Size, Share & Trends Report]()

Middle East Mining Chemicals Market (2025 - 2033) Size, Share & Trends Analysis Report By Ore (Powder Gold, Iron, Copper, Phosphate), By Application (Mineral Processing, Explosives and Drilling, Water Treatment), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-738-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Mining Chemicals Market Summary

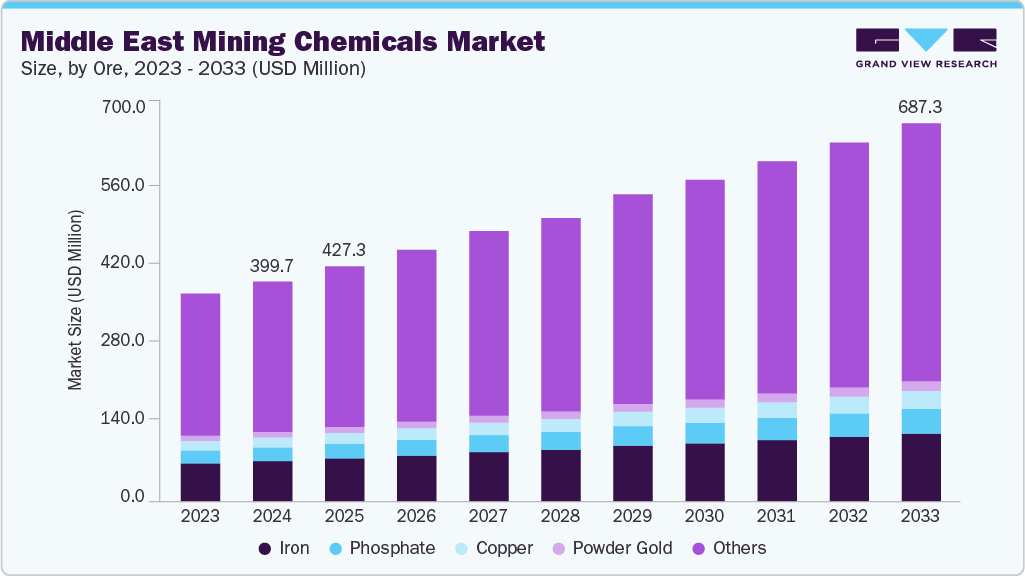

The Middle East mining chemicals market size was estimated at USD 399.7 million in 2024 and is projected to reach USD 687.3 million by 2033, growing at a CAGR of 6.1% from 2025 to 2033. This growth is attributed to a growing demand for minerals in various end user industries such as electronics, medical equipment, paints & coatings, and others.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East mining chemicals industry with the largest revenue share of 61.5% in 2024.

- By ore, the phosphate segment is expected to grow at the fastest CAGR of 6.9% from 2025 to 2033.

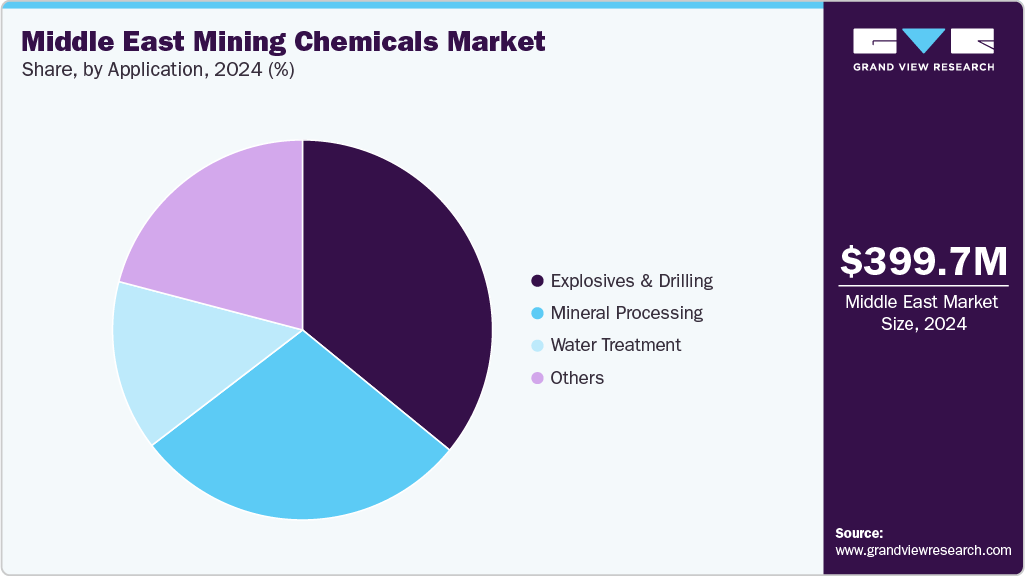

- By application, the explosives and drilling segment held the largest revenue share of 35.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 399.7 Million

- 2033 Projected Market Size: USD 687.3 Million

- CAGR (2025-2033): 6.1%

- Saudi Arabia: Largest market in 2024

Saudi Arabia’s industrial transformation initiatives, robust regulatory reforms, and major investments are redefining the mining sector as a pillar of economic diversification under Vision 2030.

In March 2020, a World Bank article projected that the production of minerals such as graphite, cobalt, and lithium would increase by 500% by 2050, fueled by the rising demand for clean energy technologies. Thus, increasing demand for minerals boosts the demand for mining chemicals. In addition, the Public Investment Fund (PIF) has allocated over USD 182 million for exploration incentives and granted 33 new mining licenses in 2024, supporting long-term resilience and technology adoption in the industry. These developments ensure that mining chemicals are used extensively for mineral processing, explosives, water treatment, and environmental management, and remain in high demand.

Ore Insights

The iron ore segment dominated the market with a revenue share of 18.3% in 2024. Iron ore mining chemicals are critical to enhancing the efficiency of extraction, beneficiation, and pelletizing processes, which support the growing steel production industry in the region. This segment benefits from strong domestic mining operations, technological advancements in ore processing, and rising demand for steel in the Middle East's construction, manufacturing, and infrastructure sectors.

The phosphate segment is expected to grow fastest with a CAGR of 6.9% during the forecast period. This growth is driven by increasing demand for phosphate in fertilizer production and industrial applications. This rapid growth is supported by expanding phosphate mining projects, especially in countries like Saudi Arabia and Jordan, which possess significant phosphate reserves. Advances in chemical processing technologies and increasing investments in phosphate mining infrastructure are also key contributors to this growth.

Application Insights

The explosives and drilling segment dominated the market with a revenue share of 35.9% in 2024 and is expected to grow at the fastest CAGR over the forecast period. This robust growth is driven by the increasing scale of mining activities across the region, particularly in Saudi Arabia and other resource-rich Middle East countries, where deeper mining operations require advanced blasting and drilling technologies. The demand for specialized explosives, including emulsions and detonators, and drilling fluids that enhance operational efficiency and safety, is rising sharply. Government initiatives focused on expanding mining infrastructure and accelerating mineral extraction are key factors propelling this segment.

The water treatment segment is expected to grow at the second-fastest CAGR of 6.3% over the forecast period. Water treatment systems are widely used in mineral processing plants for metals such as gold, copper, and others. These systems are vital in reducing corrosion and equipment blockages, enhancing water quality and flow, preventing scaling, and lowering chemical usage and costs. Their demand in the mining industry is growing significantly, driven by concerns over pollutant discharge into natural water bodies and the highly acidic characteristics of mining wastewater.

Country Insights

Saudi Arabia mining chemicals industry dominated the Middle East market with a revenue share of 61.5% in 2024, driven by ambitious government initiatives under Vision 2030 to reduce reliance on oil and drive economic diversification. The country is working to strengthen its mining sector while addressing broader political and economic challenges, including high unemployment, gaps in education quality, and heavy military spending. Saudi Arabia's rich iron, phosphate, gold, and copper deposits drive strong demand for mining chemicals, particularly in mineral processing and explosives applications. The government's support for sustainable mining practices and the rapid modernization of mining infrastructure position Saudi Arabia as a regional leader in mining chemicals consumption and innovation.

The UAE mining chemicals industry is experiencing steady growth, supported by expanding mining operations and favorable industrial policies. Challenges such as the country’s arid climate and limited water resources have accelerated the use of advanced water treatment chemicals and mineral processing, and drilling solutions. Continued investment in infrastructure and the rising demand for metals and minerals across construction, manufacturing, and technology are strengthening the UAE’s role as an important contributor to the Middle East mining chemicals industry.

Key Middle East Mining Chemicals Company Insights

Key players operating in the market include BASF, Arkema, Solvay, among others.

-

Arkema is a global leader in specialty materials, offering high-performance solutions across markets, including mining and metal processing. In the Middle East, Arkema has a strategic presence with headquarters in Dubai and a Saudi joint venture that delivers flotation reagents and custom mining chemicals through the Arkema-ArrMaz operation.

Key Middle East Mining Chemicals Companies:

- Arkema

- Orica Limited.

- BASF

- CLARIANT

- Dow

- Solvay

Recent Developments

- In September 2024, Modern Chemicals Company (MCC) and Orica Digital Solutions signed a strategic collaboration agreement to advance Saudi Arabia’s mining sector by introducing digital technologies aligned with Vision 2030.

Middle East Mining Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 427.3 million

Revenue forecast in 2033

USD 687.3 million

Growth rate

CAGR of 6.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ore, application, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Rest of Middle East

Key companies profiled

Arkema; Orica Limited; BASF; CLARIANT; Dow; Solvay

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Mining Chemicals Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2033. For this study, Grand View Research has segmented the Middle East mining chemicals market report based on ore, application, and country:

-

Ore Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Powder Gold

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

Iron

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

Copper

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

Phosphate

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

Others

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Mineral Processing

-

Explosives and Drilling

-

Water Treatment

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Rest of Middle East

-

-

Frequently Asked Questions About This Report

b. The Middle East mining chemicals market size was estimated at USD 399.7 million in 2024 and is expected to reach USD 427.3 million in 2025.

b. The Middle East mining chemicals market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2033, reaching USD 687.3 million by 2033.

b. The iron ore type segment held the largest revenue share in 2024 due to high regional demand, extensive mining activities, and increasing use of advanced processing chemicals to improve yield and efficiency in extraction processes across key countries.

b. Some of the key players operating in the Middle East mining chemicals market include Arkema, Orica Limited, BASF, CLARIANT, Dow, and Solvay

b. The market growth is driven by rising infrastructure projects, growing demand for iron and other minerals, technological advancements in chemical additives, increasing industrialization, government initiatives supporting mining activities, and the need for cost-effective, efficient, and environmentally safe extraction solutions across the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.