- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Middle East Paints And Coatings Market Size Report, 2033GVR Report cover

![Middle East Paints And Coatings Market Size, Share & Trends Report]()

Middle East Paints And Coatings Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Radiation-cured Coatings, Powder Coatings, Waterborne Coatings, Solvent-borne Coatings), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-716-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Paints And Coatings Market Summary

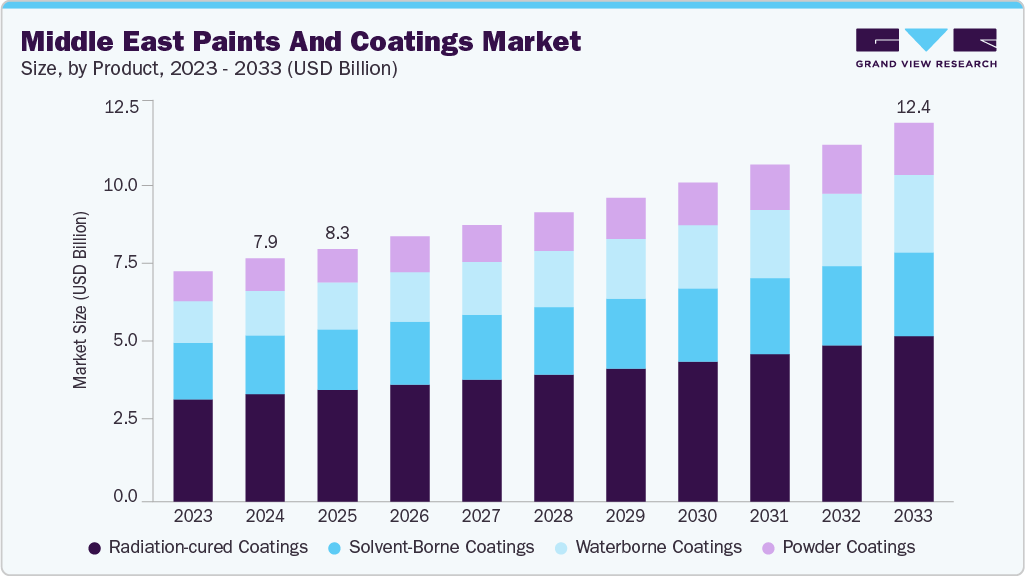

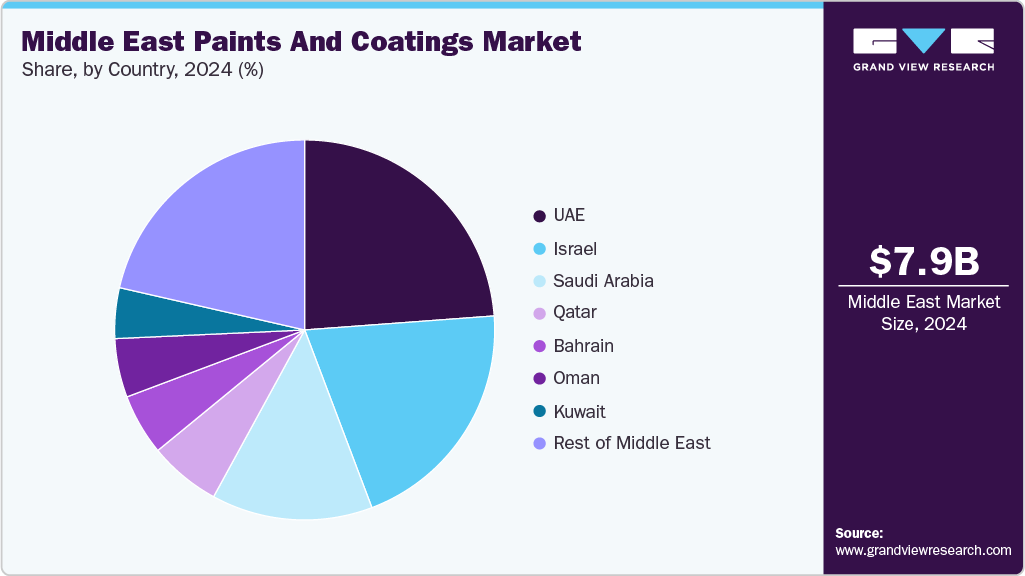

The Middle East paints and coatings market size was estimated at USD 7.96 billion in 2024 and is projected to reach USD 12.42 billion by 2033, growing at a CAGR of 5.2% from 2025 to 2033. The market growth is primarily driven by large-scale infrastructure development, rapid urbanization, and government-backed megaprojects such as Saudi Arabia’s Vision 2030 and the UAE’s smart city initiatives, which are fueling demand for decorative and protective coatings.

Key Market Trends & Insights

- The paints & coatings market in Bahrain is expected to grow at the fastest CAGR of 7.8% from 2025to 2033 in terms of revenue.

- By product, the radiation-cured coatings segment dominated the market with the largest revenue share of 44.4% in 2024.

Market Size & Forecasts

- 2024 Market Size: USD 7.96 Billion

- 2033 Projected Market Size: USD 12.42 Billion

- CAGR (2025-2033): 5.2%

Additionally, the dominance of the oil & gas and petrochemical sectors sustains strong demand for high-performance protective coatings, while rising consumer preference for sustainable, low-VOC, and durable products is accelerating the shift toward waterborne and powder coatings.Significant opportunities exist in the market through the growing adoption of eco-friendly and high-performance coating technologies, supported by tightening environmental regulations across the region. Increasing investment in smart coatings, nanotechnology-based formulations, and advanced protective systems for harsh climatic and industrial conditions offers avenues for differentiation. Furthermore, the localization of manufacturing and strategic collaborations with regional developers and contractors present global players with strong growth potential in a market heavily influenced by national infrastructure and housing expansion initiatives.

The market faces challenges from raw material price volatility, particularly in resins, pigments, and solvents, which impact production costs and profitability. Stringent environmental regulations targeting VOC emissions are pressuring manufacturers to reformulate and invest in new technologies, increasing R&D expenses. Moreover, the reliance on large-scale government-funded projects makes the market highly sensitive to shifts in oil revenues and public spending. At the same time, intense competition among global and regional players adds pricing pressure and margin constraints.

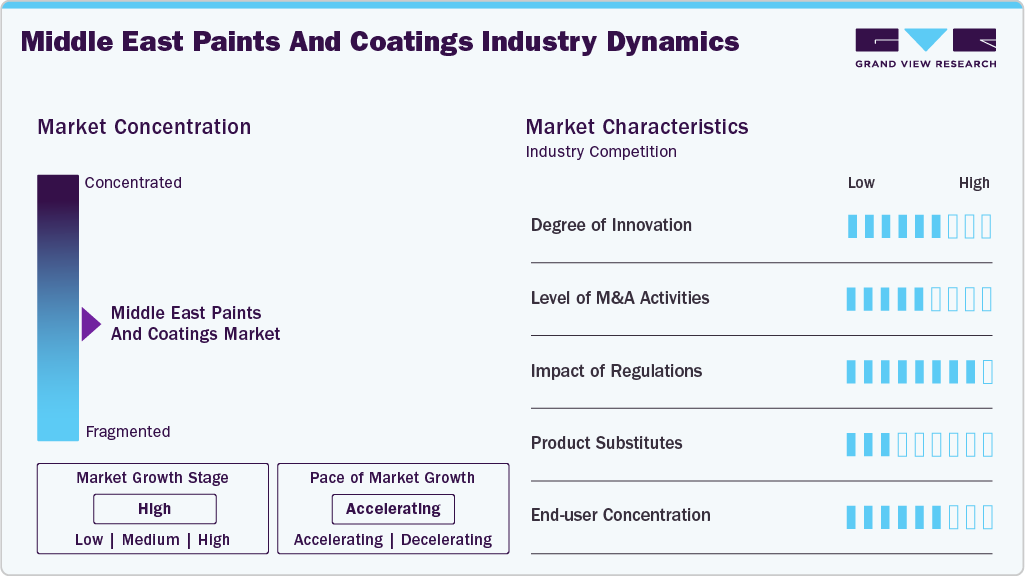

Market Concentration & Characteristics

The Middle East paints & coatings market is moderately fragmented. Leading players in the industry are pursuing strategies focused on localization, product innovation, and sustainability to strengthen their market position. Global majors such as JOTUN, AkzoNobel, Altakamol International Co., Ltd., and HEMPEL are expanding local production facilities to reduce supply chain dependencies and align with government initiatives promoting domestic manufacturing. These companies are also investing in R&D to introduce low-VOC, waterborne, and powder coating solutions that cater to the region’s increasing regulatory emphasis on environmental compliance. The partnerships with construction companies and government-backed megaprojects in Saudi Arabia, the UAE, and Qatar allow these players to secure long-term contracts and enhance brand visibility.

The regional players, such as National Paints and Asian Paints Berger, are strengthening their competitive edge through portfolio diversification and market penetration strategies. They are focusing on offering cost-effective solutions tailored to local climatic conditions, such as high-durability coatings for extreme heat and corrosion resistance for oil & gas infrastructure. Strategic acquisitions, distribution network expansion, and customer-centric approaches are also enabling players to capture a broader consumer base. Collectively, these strategies ensure that both global and regional players remain competitive while capitalizing on the region’s robust construction pipeline and growing demand for sustainable coating technologies.

Product Insights

The radiation-cured coatings segment held the largest revenue share of 44.4% in 2024 due to its superior performance attributes, rapid curing capability, and compliance with the region’s growing emphasis on sustainable and low-VOC solutions. These coatings, which include UV- and EB-cured formulations, have gained widespread adoption in industries such as wood finishing, automotive, electronics, and packaging, where durability, chemical resistance, and high-quality finishing are critical. Their ability to meet stringent environmental regulations while delivering enhanced productivity has positioned them as the preferred choice across high-growth end-use sectors, particularly in the UAE and Saudi Arabia, where advanced manufacturing and industrial diversification are accelerating demand.

In comparison, powder coatings are witnessing robust uptake owing to their eco-friendly, solvent-free nature and high durability, making them attractive for architectural applications, oil & gas equipment, and automotive components. Waterborne coatings represent another high-growth category, supported by tightening VOC regulations and rising demand in decorative paints for residential and commercial construction projects. Meanwhile, solvent-borne coatings continue to maintain relevance in heavy-duty and protective applications, especially within the oil & gas and marine sectors, due to their proven performance in harsh Middle Eastern climates. Together, these product categories reflect a market increasingly balancing performance, cost efficiency, and sustainability, with radiation-cured coatings leading the transformation toward advanced, eco-conscious solutions.

Country Insights

The Middle East paints and coatings market is experiencing sustained growth, driven by massive infrastructure investments, rapid urbanization, and diversification efforts across energy and industrial sectors. Countries such as the UAE, Qatar, and Kuwait are channeling significant resources into residential, commercial, and industrial projects, boosting demand for decorative and protective coatings alike. The region is also witnessing a marked shift toward eco-friendly solutions, with powder and waterborne coatings gaining traction under stricter environmental regulations. Moreover, the dominance of oil & gas and marine industries continues to generate steady demand for high-performance protective coatings, making the Middle East a dynamic and evolving market for both global and regional players.

UAE Paints And Coatings Market Trends

The UAE paints and coatings market is witnessing strong growth, supported by large-scale real estate developments, smart city projects, and sustained investment in commercial and residential infrastructure. Dubai and Abu Dhabi continue to drive demand for decorative coatings, while the country’s robust automotive, aerospace, and marine industries are fueling the adoption of high-performance and specialty coatings. In line with its sustainability agenda, the UAE is accelerating the shift toward waterborne and powder-based solutions, creating opportunities for eco-friendly product innovations.

Key Middle East Paints And Coatings Company Insights

Some of the key players operating in the Middle East Paints & Coatings market include AkzoNobel, Altakamol International Co., Ltd., Alva Paints, and JOTUN.

-

AkzoNobel is a leading global paints and coatings manufacturer with a strong presence in the Middle East, leveraging its extensive portfolio of decorative paints, powder coatings, and performance coatings to serve diverse sectors such as construction, automotive, marine, and oil & gas. The company is strategically focused on sustainability, offering low-VOC, waterborne, and powder-based solutions that align with the region’s tightening environmental regulations and green building initiatives. In Saudi Arabia and the UAE, AkzoNobel has expanded its footprint through localized production facilities and partnerships with large-scale infrastructure and real estate projects, enabling it to meet rising demand while reducing supply chain complexities. By combining innovation-driven product development with strategic collaborations across giga-projects and industrial applications, AkzoNobel continues to strengthen its competitive position and capture growth opportunities in the rapidly evolving Middle Eastern paints and coatings market.

Key Middle East Paints And Coatings Companies:

- AkzoNobel

- Altakamol International Co., Ltd.

- Alva Paints

- asian paints

- AXALTA

- CAPAROL

- HEMPEL

- JOTUN

- NATIONAL PAINTS FACTORIES CO. LTD.

- PPG Industries, Inc.

Middle East Paints And Coatings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.27 billion

Revenue forecast in 2033

USD 12.42 billion

Growth rate

CAGR of 5.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, country

Country scope

Oman; Kuwait; Saudi Arabia; UAE; Qatar; Bahrain; Israel; Rest of Middle East

Key companies profiled

AkzoNobel; Altakamol International Co., Ltd.; Alva Paints; asian paints; AXALTA; CAPAROL; HEMPEL; JOTUN; NATIONAL PAINTS FACTORIES CO. LTD.; PPG Industries, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Paints And Coatings Market Report Segmentation

This report forecasts volume & revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the Middle East paints and coatings market report based on product, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Radiation-cured Coatings

-

Powder Coatings

-

Waterborne Coatings

-

Solvent-borne Coatings

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Oman

-

Kuwaita

-

Saudi Arabia

-

UAE

-

Qatar

-

Bahrain

-

Israel

-

Rest of Middle East

-

Frequently Asked Questions About This Report

b. The Middle East paints & coatings market size was estimated at USD 7.96 billion in 2024 and is expected to reach USD 8.27 billion in 2025.

b. The Middle East paints & coatings market is expected to grow at a compound annual growth rate of % 5.2 from 2025 to 2033 to reach USD 12.42 billion by 2033.

b. The radiation-cured coatings segment held the largest revenue share of 44.4% in 2024 owing to its rapid curing capability, superior durability, and low-VOC profile, which align with the Middle East’s increasing demand for high-performance and environmentally compliant solutions. Its strong adoption across automotive, electronics, wood, and packaging applications further reinforced its market dominance.

b. Some of the key players operating in the Middle East paints and coatings market include AkzoNobel, Altakamol International Co., Ltd., Alva Paints, asian paints, AXALTA, CAPAROL, HEMPEL, JOTUN, NATIONAL PAINTS FACTORIES CO. LTD., and PPG Industries, Inc.

b. The Middle East paints and coatings market is driven by large-scale infrastructure and real estate developments, alongside strong demand from oil & gas and industrial sectors. Additionally, a growing shift toward sustainable, low-VOC solutions is accelerating adoption of waterborne, powder, and radiation-cured coatings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.