- Home

- »

- Agrochemicals & Fertilizers

- »

-

Middle East Phosphate Fertilizer Market Size Report, 2033GVR Report cover

![Middle East Phosphate Fertilizer Market Size, Share & Trends Report]()

Middle East Phosphate Fertilizer Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP)), By Application (Cereals & Grains, Oilseeds & Pulses), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-741-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Phosphate Fertilizer Market Summary

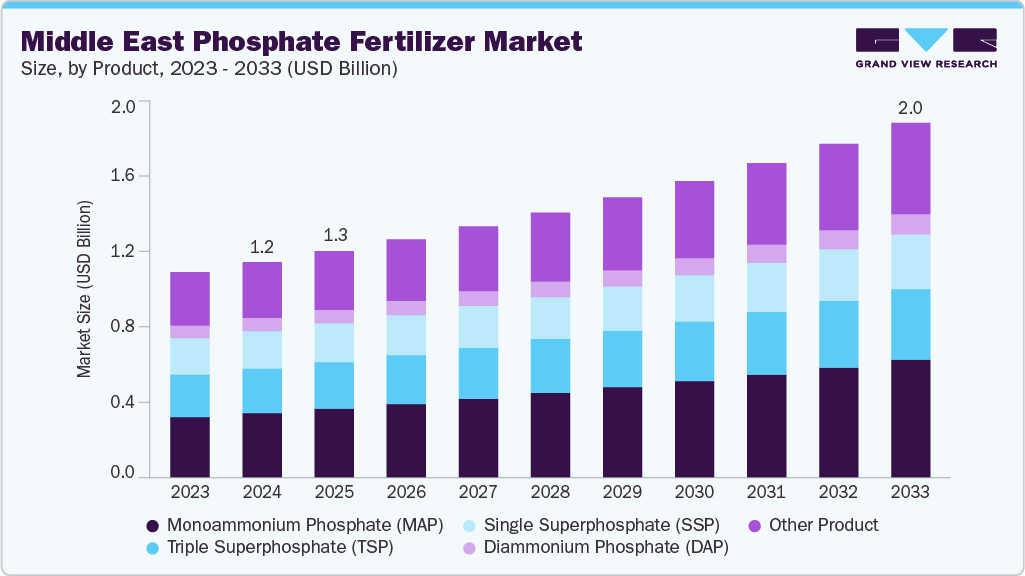

The Middle East phosphate fertilizer market size was estimated at USD 1,232.5 million in 2024 and is projected to reach USD 2029.0 million by 2033, growing at a CAGR of 5.8% from 2025 to 2033. The market is characterized by a combination of resource abundance and rising agricultural demand.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East market with the largest revenue share of 52.9% in 2024.

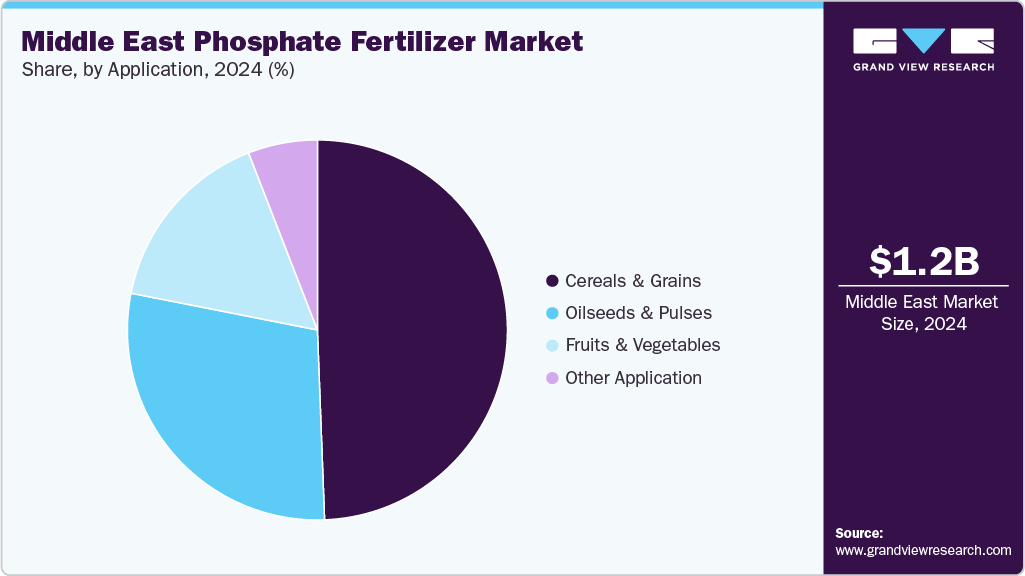

- By product, the monoammonium phosphate (MAP) segment held the largest revenue share of 30.0% in 2024.

- By application, fruits & vegetables are expected to grow at the fastest CAGR of 6.1% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1,232.5 Million

- 2033 Projected Market Size: USD 2,029.0 Million

- CAGR (2025-2033): 5.8%

The region’s dynamics are shaped by the presence of major phosphate rock producers such as Saudi Arabia, Jordan, and Tunisia, alongside consumer markets driven by food security policies and the expansion of high-value crop cultivation. Governments are increasingly integrating fertilizer strategies into broader agricultural and economic diversification agendas, making phosphate fertilizers strategically important in both local consumption and export flows.Saudi Arabia plays a pivotal role as the region’s anchor market due to its vertically integrated phosphate industry and strong government backing, which allows it to influence supply security and regional trade flows. Israel, while smaller in scale, demonstrates strong demand in specialty applications, with phosphate-based fertilizers used intensively in horticulture and high-value crop cultivation. In contrast, GCC countries such as the UAE, Qatar, Kuwait, Oman, and Bahrain have relatively modest agricultural bases, but their controlled-environment farming, landscaping, and food security initiatives still sustain consistent fertilizer demand. Product preference across the region leans toward MAP and DAP, given their balanced nutrient composition, with TSP and SSP serving cost-sensitive and soil-specific needs.

Growth prospects are uneven but promising in selected markets. Tunisia and Jordan are focused on revitalizing and expanding phosphate production to increase exports and meet rising domestic requirements, while Saudi Arabia continues to invest in integrated projects that strengthen its global presence. Demand trends will be shaped by policies promoting food self-sufficiency, infrastructure for logistics and trade, and investment in value-added fertilizers for higher efficiency. As regional agriculture modernizes, opportunities exist not only in bulk fertilizers but also in specialized blends for high-value crops, positioning the Middle East as both a key producer and evolving consumer of phosphate fertilizers.

Product Insights

The monoammonium phosphate segment dominated the market with a revenue share of 30.0% in 2024. This dominance is attributed to MAP’s balanced nutrient profile, supplying readily available phosphorus with moderate nitrogen, which suits a wide range of crops. Its high solubility and efficiency make it ideal for drip irrigation and precision farming practices increasingly adopted in the Middle East. In addition, MAP’s lower risk of nitrogen burn and compact logistics advantage strengthen its widespread preference.

The triple superphosphate segment is expected to grow fastest with a CAGR of 5.3% during the forecast period. TSP’s growth is driven by its high phosphorus concentration, which reduces application and transport costs per nutrient unit, critical in regions with high logistics expenses. Farmers are increasingly addressing soil nutrient depletion, particularly phosphorus deficiencies, making TSP a cost-effective solution. Government-led soil fertility restoration projects and the expansion of intensive cropping systems further support rising adoption, giving TSP strong growth prospects in the Middle East market.

Application Insights

The cereals & grains segment dominated the market with a revenue share of 49.4% in 2024. Cereals and grains hold the largest share due to their expansive cultivation area and central role in food security programs across the Middle East. These crops demand continuous phosphorus input to support root growth and yield stability, particularly in arid soils. Subsidy structures and government policies often prioritize fertilizers for staple crops, ensuring consistent phosphate fertilizer usage. The scale of production and policy backing drive cereals’ dominance in phosphate fertilizer demand.

The fruits & vegetables segment is expected to grow fastest with a CAGR of 6.1% during the forecast period. Growth in fruits and vegetables is propelled by expanding greenhouse farming, horticulture investments, and export-oriented agribusiness initiatives across the region. These crops require targeted nutrient management, with phosphate fertilizers enhancing flowering, fruit set, and overall quality. Precision irrigation and protected cultivation increase per-hectare fertilizer intensity, boosting phosphate demand. Rising consumer demand for fresh, high-quality produce further encourages the adoption of high-efficiency fertilizers, making fruits and vegetables the fastest-growing application segment.

Country Insights

UAE Phosphate Fertilizer Market Trends

The UAE phosphate fertilizer industry is relatively small but steadily growing, supported by controlled-environment agriculture, greenhouse farming, and landscaping projects. Food security strategies drive demand for high-efficiency phosphate products, particularly MAP and DAP, suitable for drip irrigation and hydroponics. The market emphasizes specialty and water-soluble fertilizers tailored to high-value fruits and vegetables. Imports dominate supply, as the UAE lacks large-scale production capacity. Growth is linked to rising investment in vertical farming, sustainable agriculture, and advanced agritech solutions, making fertilizers essential for maintaining productivity in the country’s arid climate.

Saudi Arabia Phosphate Fertilizer Market Trends

Saudi Arabia phosphate fertilizer industry leads the Middle East market, underpinned by its abundant phosphate rock reserves and large integrated production facilities. The country’s vertically integrated value chain, from mining to finished fertilizers, supports both domestic consumption and export leadership. Demand is driven by expanding agricultural projects and food security programs that prioritize cereals and grains. MAP and DAP dominate usage, aligning with broadacre farming needs. Ongoing investments by Ma’aden and other players in capacity expansion and export-oriented projects strengthen Saudi Arabia’s global market position, making it the region’s anchor market for phosphate fertilizers.

Key Middle East Phosphate Fertilizer Company Insights

Key players operating in the market include Ma’aden Phosphate Company and Jordan Phosphate Mines Company.

-

Ma’aden Phosphate Company is the largest integrated phosphate fertilizer producer in the Middle East and among the world’s leading players. Supported by Saudi Arabia’s vast phosphate reserves, it operates across the full value chain from mining to MAP and DAP production. Strong government backing, strategic joint ventures with Mosaic and SABIC, and large-scale export capacity position Ma’aden as a key driver of regional supply, innovation, and global market competitiveness.

-

Jordan Phosphate Mines Company is a major global supplier of phosphate rock and fertilizers, leveraging the country’s abundant reserves. It operates four mines and produces DAP, phosphoric acid, and phosphate rock for domestic and international markets. Through joint ventures like Fauji Jordan Fertilizer, JPMC strengthens its export reach, particularly in Asia and Africa. Its strategic role, strong export orientation, and established production capacity make it a cornerstone of the Middle East phosphate fertilizer industry.

Key Middle East Phosphate Fertilizer Companies:

- Ma’aden Phosphate Company

- Wa’ad Al Shamal Phosphate Co.

- Jordan Phosphate Mines Company (JPMC)

- Fauji Jordan Fertilizer Company

- ICL Group

- Groupe Chimique Tunisien (GCT)

- OCP Group (Morocco)

Recent Developments

-

Indian importers IPL, Kribhco, and Coromandel signed a five-year offtake deal with Saudi Arabia for 3.1mn t/yr of DAP and NPS, surpassing 2024 imports, amid reduced Chinese exports and India’s declining inventories.

Middle East Phosphate Fertilizer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,295.1 million

Revenue forecast in 2033

USD 2,029.0 million

Growth rate

CAGR of 5.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Country scope

Saudi Arabia; UAE; Qatar; Oman; Israel; Kuwait; Bahrain

Key companies profiled

Ma’aden Phosphate Company; Wa’ad Al Shamal Phosphate Co.; Jordan Phosphate Mines Company (JPMC); Fauji Jordan Fertilizer Company; ICL Group; Groupe Chimique Tunisien (GCT); OCP Group

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Phosphate Fertilizer Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each segment from 2018 to 2033. For this study, Grand View Research has segmented the Middle East phosphate fertilizer market report based on product, application, and country.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Monoammonium Phosphate (MAP)

-

Diammonium Phosphate (DAP)

-

Single Superphosphate (SSP)

-

Triple Superphosphate (TSP)

-

Other Product

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Other Application

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Saudi Arabia

-

UAE

-

Qatar

-

Oman

-

Israel

-

Kuwait

-

Bahrain

-

Frequently Asked Questions About This Report

b. The Middle East phosphate fertilizers market size was estimated at USD 1,232.5 million in 2024 and is expected to reach USD 1,295.1 million in 2025.

b. The Middle East phosphate fertilizers market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2033, reaching USD 2,029.0 million by 2033.

b. The monoammonium phosphate segment dominated the market with a revenue share of 30.0% in 2024. This dominance is attributed to MAP’s balanced nutrient profile, supplying readily available phosphorus with moderate nitrogen, which suits a wide range of crops. Its high solubility and efficiency make it ideal for drip irrigation and precision farming practices increasingly adopted in the Middle East.

b. Some of the key players operating in the Middle East phosphate fertilizers market include Ma’aden Phosphate Company, Wa’ad Al Shamal Phosphate Co., Jordan Phosphate Mines Company (JPMC), Fauji Jordan Fertilizer Company, ICL Group, Groupe Chimique Tunisien (GCT), OCP Group

b. The Middle East phosphate fertilizers market is driven by growing food security concerns, rising population, expansion of arable land, government support for agriculture, increasing adoption of modern farming techniques, and strong demand for high-yield crops in water-scarce regions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.