- Home

- »

- Agrochemicals & Fertilizers

- »

-

Middle East Phosphoric Acid Market Size, Share Report, 2033GVR Report cover

![Middle East Phosphoric Acid Market Size, Share & Trends Report]()

Middle East Phosphoric Acid Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Diamonium Hydrogenphosphate (DAP), Monoammonium Dihydrogenphosphate (MAP)), By Country (Saudi Arabia, UAE, Qatar, Israel), And Segment Forecasts

- Report ID: GVR-4-68040-729-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Phosphoric Acid Market Summary

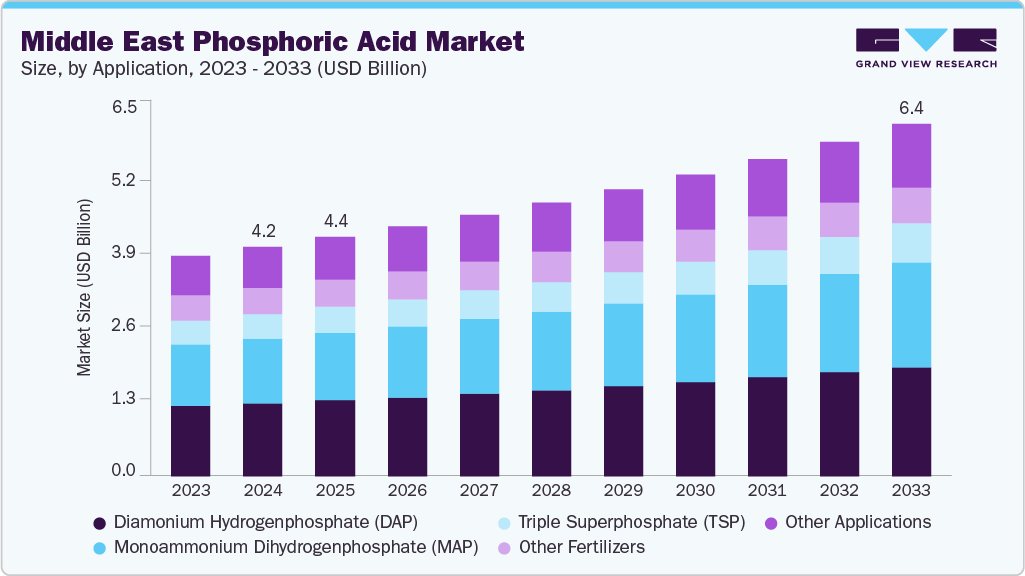

The Middle East phosphoric acid market size was estimated at USD 4,188.5 million in 2024 and is projected to reach USD 6,425.8 million by 2033, growing at a CAGR of 4.9% from 2025 to 2033. The market is driven by the increasing demand for phosphate-based fertilizers, particularly DAP, MAP, and TSP, as Middle Eastern nations focus on enhancing agricultural productivity and ensuring food security.

Key Market Trends & Insights

- The phosphoric acid market in Saudi Arabia is expected to grow at the fastest CAGR of 4.1% from 2025 to 2033 in terms of volume.

- The phosphoric acid market in Saudi Arabia is expected to grow at the fastest CAGR of 5.3% from 2025 to 2033 in terms of revenue.

- By application, the monoammonium dihydrogenphosphate (MAP) segment is expected to grow at the fastest CAGR of 4.4% from 2025 to 2033 in terms of volume.

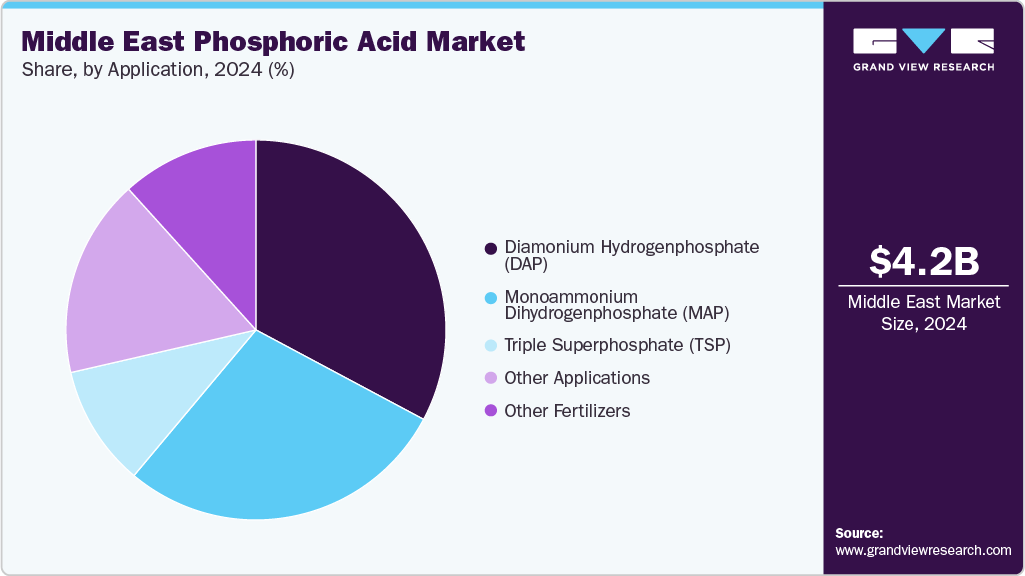

- By application, the Diamonium Hydrogenphosphate (DAP) segment held the largest share of 32.1% in terms of volume.

Market Size & Forecast

- 2024 Market Size: USD 4,188.5 Million

- 2033 Projected Market Size: USD 6,425.8 Million

- CAGR (2025-2033): 4.9%

Large-scale investments in integrated phosphate mining and processing facilities in countries such as Saudi Arabia and Jordan further strengthen supply security and reduce reliance on imports. Additionally, the rising adoption of precision agriculture and specialty fertilizers in high-value crops is fueling the demand for water-soluble and specialty phosphates.Significant opportunities lie in expanding domestic production capacities to achieve import substitution and enhance export potential, particularly in Saudi Arabia, Jordan, and Israel. The growing demand for specialty phosphates, including food-grade and water-soluble fertilizers for precision farming, presents a lucrative growth avenue. Additionally, advancements in circular economy practices, such as phosphogypsum valorization and low-emission production technologies, can create new revenue streams while meeting sustainability targets.

The market faces challenges from feedstock price volatility, especially in phosphate rock and sulfur, which directly influence production costs and pricing stability. Environmental concerns related to phosphogypsum waste management and regulatory pressures on industrial emissions also pose significant operational risks. Furthermore, geopolitical tensions, fluctuating fertilizer subsidies, and trade restrictions can disrupt regional supply chains and hinder cross-border trade of phosphoric acid and its derivatives.

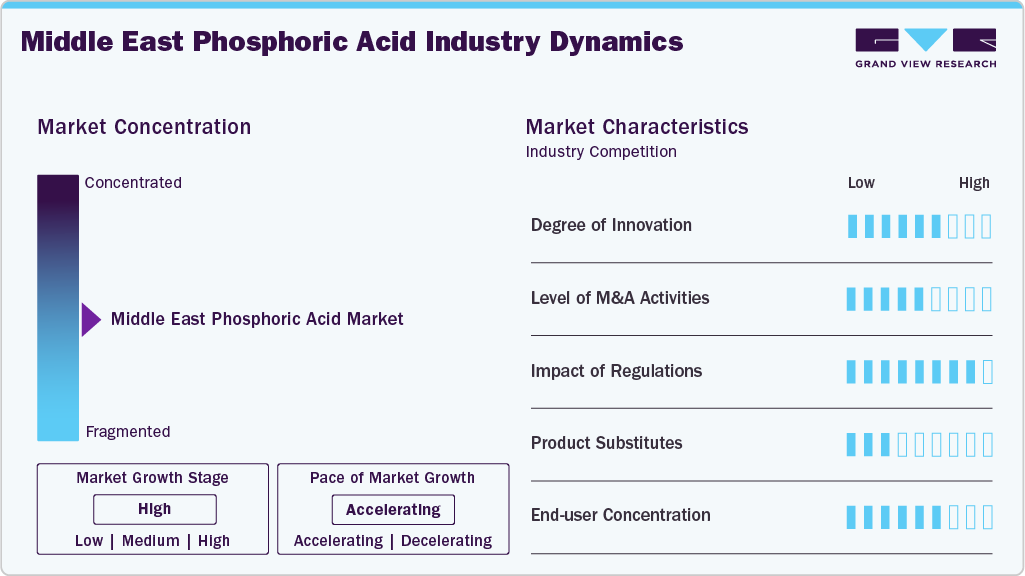

Market Concentration & Characteristics

The Middle East phosphoric acid market is moderately fragmented. It is mainly controlled by a few integrated companies that have strong control over phosphate rock resources and downstream processing facilities. Major companies include Maaden, Jordan Phosphate Mines Co., PLC, ICL, and OCP, along with regional traders and fertilizer producers in Turkey and the UAE. Maaden leads with large-scale integrated phosphate projects backed by government investments, focusing on high-capacity production and global export channels. JPMC uses its strategic phosphate reserves and coastal access at Aqaba to serve regional and international markets, while ICL focuses on specialty phosphates and food-grade derivatives, catering to both domestic demand and export markets.

To strengthen their market position, these companies are pursuing strategies centered on vertical integration, capacity expansion, and product diversification. Ma’aden and JPMC are expanding their phosphoric acid and fertilizer production through joint ventures and strategic partnerships to enhance supply chain security and reduce reliance on imports. ICL focuses on high-value specialty products, including food-grade phosphoric acid and water-soluble fertilizers, to target niche segments with higher margins. Additionally, leading players are investing in sustainability initiatives such as low-emission production technologies and phosphogypsum valorization to comply with environmental regulations and meet international standards, while also expanding their export footprints to leverage growing demand in Asia and Africa.

Application Insights

The diammonium hydrogenphosphate segment led the market with the largest revenue share of 31.9% in 2024, mainly because of its high nutrient content (both nitrogen and phosphorus) and its widespread use in large-scale cereal and grain farming across the Middle East. DAP is favored in the region due to its balanced nutrient profile, easy application, and compatibility with various soil types, making it a key part of national agricultural subsidy programs and food security initiatives. The growing adoption of modern farming practices, supported by government incentives for phosphate-based fertilizers, further boosted DAP’s market leadership. The presence of integrated production facilities in Saudi Arabia and Jordan ensured a reliable supply, reducing reliance on imports and stabilizing prices in major consumer countries.

The monoammonium dihydrogenphosphate and triple superphosphate segments also hold significant shares, with MAP witnessing growing demand in horticulture and precision farming due to its suitability for fertigation and greenhouse applications, while TSP remains a preferred option where ammonia availability is limited but phosphate-rich fertilizers are required. The Other Fertilizers segment, including NPK blends and water-soluble grades like MKP, is expanding as the region shifts towards high-value crops and modern irrigation systems. Other Applications, such as industrial, food-grade, and metal treatment uses, account for a smaller portion of the market but command higher margins due to their specialized nature and stringent quality standards.

Country Insights

Middle East Phosphoric Acid Market Trends

The Middle East phosphoric acid market is witnessing steady growth driven by increasing fertilizer demand, expanding agricultural activities, and rising government efforts to improve food security. Regional production is supported by integrated facilities in countries such as Saudi Arabia, Jordan, and Israel, which supply both local and export markets, while other nations mostly depend on imports. Strategic investments in fertilizer production, especially for DAP and MAP, along with infrastructure improvements at ports and blending facilities, are strengthening supply chain resilience. Additionally, the growing focus on specialty fertilizers and water-soluble phosphates for high-value crops and precision agriculture is opening opportunities for higher-margin products throughout the region.

Saudi Arabia Phosphoric Acid Market Trends

Saudi Arabia holds a dominant position in the Middle East phosphoric acid market due to its extensive phosphate reserves and large-scale integrated production capacities. The country is spearheaded by Maaden’s investments in phosphoric acid and phosphate-based fertilizers, enabling it to cater to both domestic consumption and global export markets. Government-backed initiatives focusing on agricultural development and downstream value addition have enhanced self-sufficiency while reducing import dependency. Saudi Arabia’s strategic location, combined with its ongoing capacity expansions and sustainability-focused projects, positions it as a key regional hub for phosphoric acid and its derivatives over the forecast period.

Key Middle East Phosphoric Acid Company Insights

Some of the key players operating in the Middle East Phosphoric Acid market include Maaden, Jordan Phosphate Mines Co., PLC, ICL, OCP.

-

Maaden is a leading player in the Middle East phosphoric acid market, operating as an integrated mining and fertilizer producer with a strong presence across the phosphate value chain. The company leverages its extensive phosphate reserves in the Kingdom of Saudi Arabia to produce high-quality phosphoric acid, which serves as a critical feedstock for diammonium phosphate (DAP), monoammonium phosphate (MAP), and other fertilizer products. Through its joint ventures and strategic partnerships, Ma’aden has significantly expanded its production capacities and export footprint, positioning itself as a key supplier to global agricultural markets. The company’s strategy emphasizes vertical integration, downstream value addition, and sustainability initiatives, including investments in low-emission technologies and efficient resource utilization, to strengthen its competitive advantage and align with Saudi Arabia’s Vision 2030 objectives.

Key Middle East Phosphoric Acid Companies:

- Maaden

- Jordan Phosphate Mines Co.

- PLC

- ICL

- OCP

- Nutrien Ltd

- Quadra Groups

- Solvay

- Merck

- Prayon

Middle East Phosphoric Acid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,368.0 million

Revenue forecast in 2033

USD 6,425.8 million

Growth rate

CAGR of 4.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, country

Country scope

Oman; Kuwait; Saudi Arabia; UAE; Qatar; Bahrain; Isael; Jordan; Turkey; Rest of Middle East

Key companies profiled

Maaden; Jordan Phosphate Mines Co.; PLC; ICL; OCP; Nutrien Ltd; Quadra Groups; Solvay; Merck; Prayon

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Phosphoric Acid Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the Middle East phosphoric acid market report based on application, and country.

-

Application Outlook (Revenue, USD Billion; Volume, Kilotons, 2018 - 2033)

-

Diamonium Hydrogenphosphate (DAP)

-

Monoammonium Dihydrogenphosphate (MAP)

-

Triple Superphosphate (TSP)

-

Other Fertilizers

-

Other Applications

-

-

Country Outlook (Revenue, USD Billion; Volume, Kilotons, 2018 - 2033)

-

Oman

-

Kuwait

-

Saudi Arabia

-

UAE

-

Qatar

-

Bahrain

-

Israel

-

Jordan

-

Turkey

-

Rest of Middle East

-

Frequently Asked Questions About This Report

b. The Middle East phosphoric acid market size was estimated at USD 4,188.5 million in 2024 and is expected to reach USD 4,368.0 million in 2025.

b. The Middle East phosphoric acid market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2033 to reach USD 6,425.8 million by 2033.

b. The diammonium hydrogenphosphate segment dominated the market in 2024 due to its high nutrient content, cost-effectiveness, and widespread adoption in large-scale grain and cereal cultivation across the Middle East. Strong government support and integrated local production further reinforced its leading position.

b. Some of the key players operating in the Middle East Phosphoric Acid market include Maaden, Jordan Phosphate Mines Co., PLC, ICL, OCP, Nutrien Ltd, Quadra Groups, Solvay, Merck, and Prayon.

b. The market is driven by rising demand for phosphate-based fertilizers to enhance agricultural productivity and ensure food security, coupled with significant investments in integrated phosphate mining and processing facilities across the Middle East.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.