- Home

- »

- Clothing, Footwear & Accessories

- »

-

Middle East Quartz Watch Market Size, Industry Report 2033GVR Report cover

![Middle East Quartz Watch Market Size, Share & Trends Report]()

Middle East Quartz Watch Market (2025 - 2033) Size, Share & Trends Analysis Report By Price (Economy, Premium), By End Use (Men, Women), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-790-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Quartz Watch Market Summary

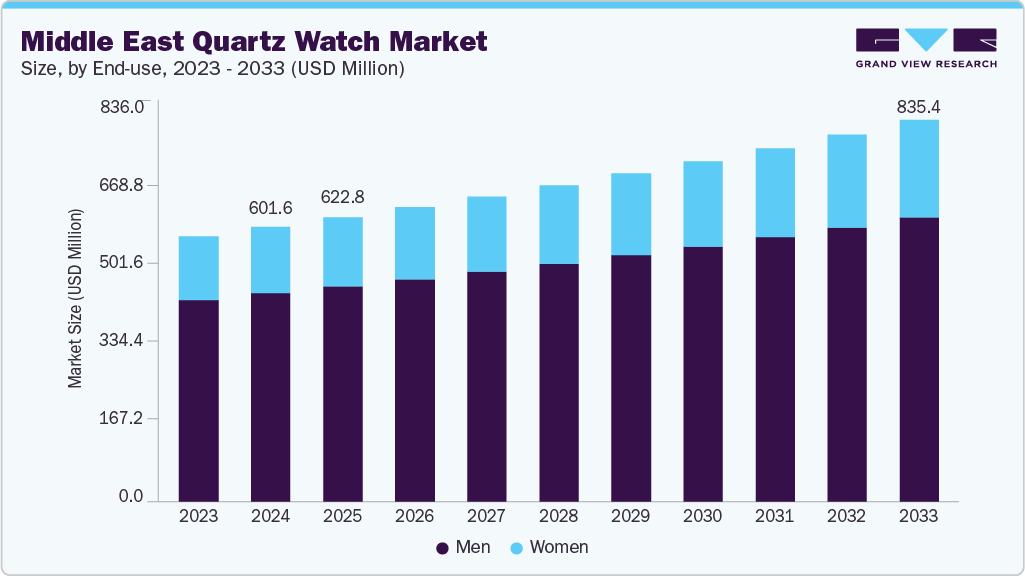

The Middle East quartz watch market size was estimated at USD 601.6 million in 2024 and is projected to reach USD 835.4 million by 2033, growing at a CAGR of 3.7% from 2025 to 2033. The expansion is fueled by rising demand for trendy and value-for-money watches among youths and growing retail penetration in premium consumer markets such as the UAE and Saudi Arabia.

Key Market Trends & Insights

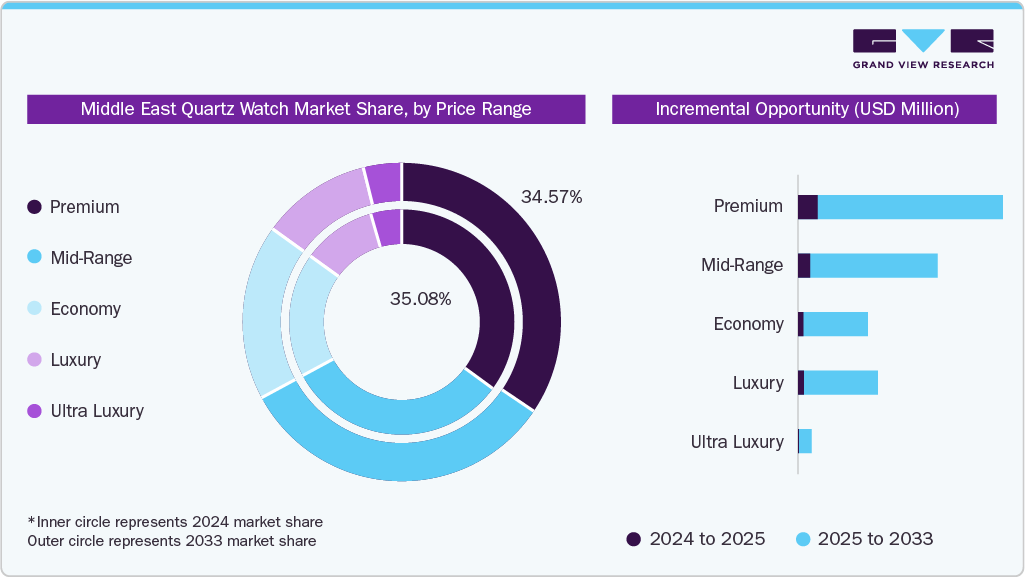

- The premium quartz watches segment led the market with the largest revenue share of 35.08% in 2024.

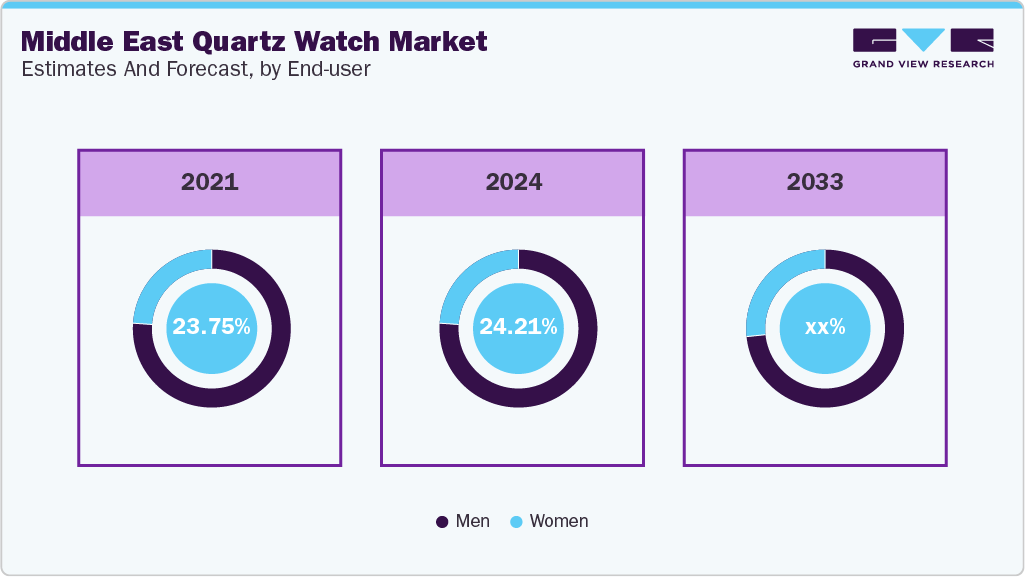

- By end use, the men segment led the market with the largest revenue share of 75.79% in 2024.

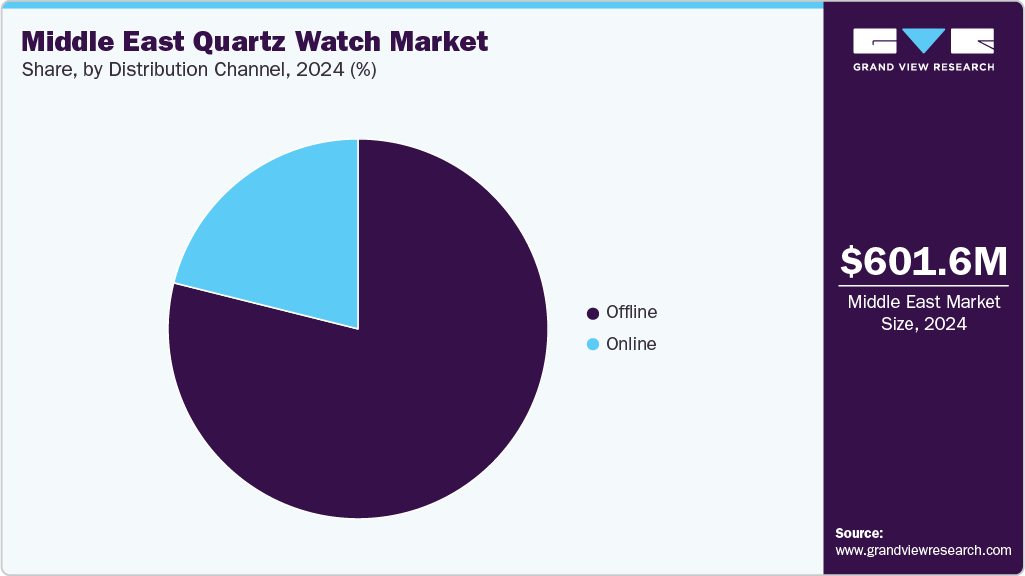

- By distribution channel, the offline sales accounted for the largest market revenue share in 2024.

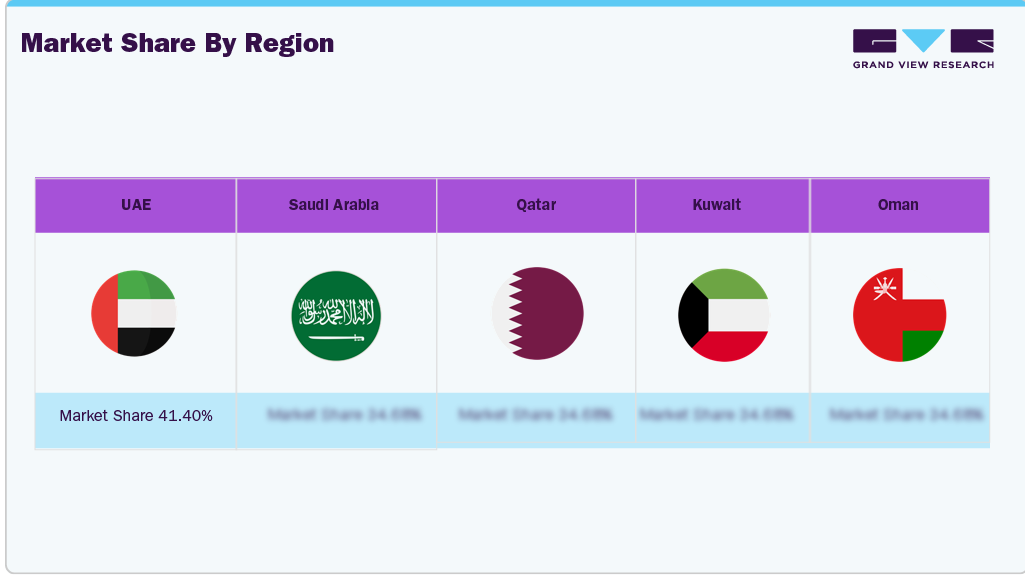

- The UAE dominated the Middle East quartz watch market with the largest revenue share of 41.40% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 601.6 Million

- 2033 Projected Market Size: USD 835.4 Million

- CAGR (2025-2033): 3.7%

Rising tourism and gifting trends fuel steady market growth. A notable trend in the Middle East quartz watch industry is the increasing demand for slim, streamlined quartz watches from firms such as Seiko, Tissot, and Casio due to consumers seeking understated luxury and high-accuracy timekeeping at reasonable prices. Dubai and Riyadh retailers observe stronger sales of these advanced designs as consumers move from flashy mechanical watches to convenient, everyday quartz watches.A key driver of the Middle East quartz watch industry is the growing middle class and expatriate population, especially in the UAE, Saudi Arabia, and Qatar. These consumers are increasingly turning to brands like Citizen, Casio, Seiko, and Fossil for reliable and stylish watches that have global appeal without the high price of mechanical models. The affordability and accuracy of quartz watches make them particularly appealing to expatriates from South Asia and Europe living in the Gulf. Consumers often see these watches as everyday essentials or practical gifts. Brands like Titan and Orient have also gained popularity in mid-tier retail shops targeting this expanding demographic.

Another critical factor driving the market is the rapid growth of organized retail and duty-free channels. Retailers such as Rivoli Group, Ahmed Seddiqi & Sons, and Hour Choice have increased their presence in busy malls across Dubai, Riyadh, and Doha, offering a wide selection of quartz brands. In addition, duty-free zones like Dubai Duty Free and Qatar Duty Free have become major sales points for quartz models from brands like Tissot, Longines, and Guess, particularly among Asian and European tourists. The surge of visitors during major events like the Dubai Shopping Festival and Formula 1 races in Abu Dhabi has further boosted quartz watch sales at these retail locations.

In the Middle East, watches have long symbolized power and prestige, as noted in the Watches of Espionage article, where luxury timepieces often serve diplomatic or identity-driven roles among leaders and elites. This cultural connection has trickled down to everyday consumers, increasing the demand for quartz watches that mimic the style and status of mechanical models but at more affordable prices. The region’s strong gifting culture, especially during Ramadan, weddings, and corporate events, also supports steady quartz sales, as these watches are dependable yet budget-friendly gifts. In addition, a growing trend among younger buyers toward personal style instead of status drives interest in minimalist quartz designs from brands like Daniel Wellington, Skagen, and Tissot. This shift is transforming the market from one based on symbolism to one focused on practical fashion and self-expression.

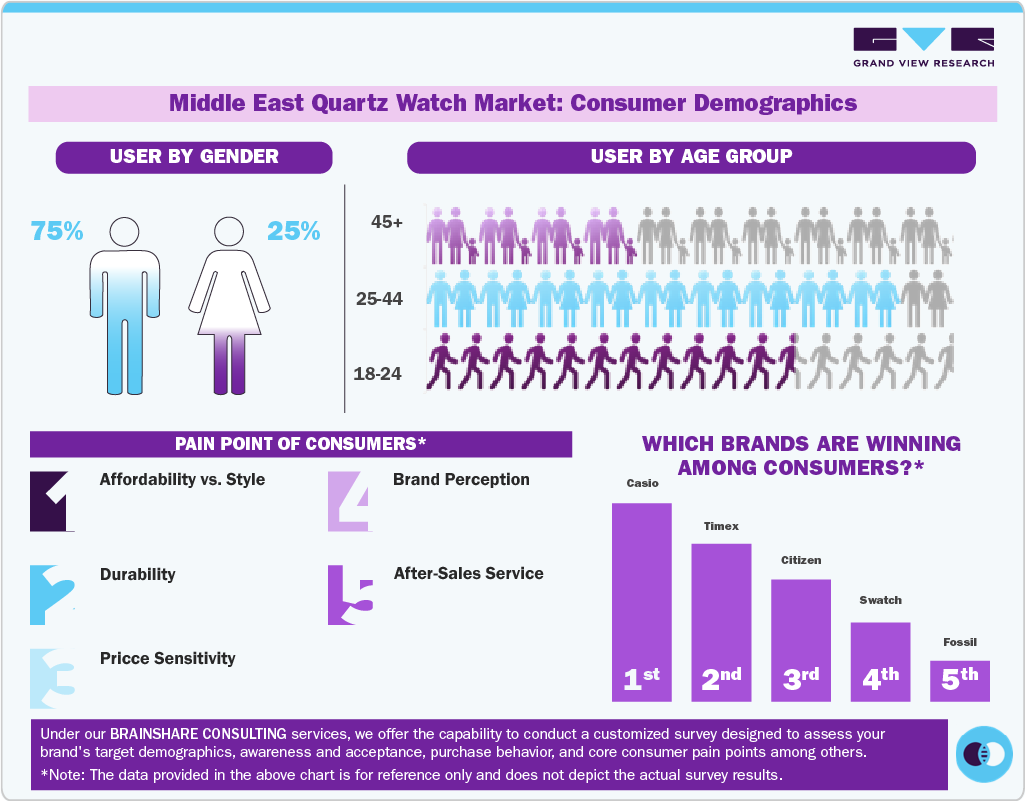

Consumer Insights

Men hold a significant share of the Middle East quartz watch industry at 75%. They prefer rugged and reliable watches that fit professional, outdoor, and luxury settings. Women, making up 25% of the market, mainly shop in urban areas like Dubai and Riyadh. They look for stylish yet affordable models that align with current fashion trends.

Younger shoppers aged 18 to 24 are often price-sensitive and inspired by trends on social media. The 25 to 44 age group seeks a balance between style, brand image, and practicality. Older consumers aged 45 and up prioritize durability and reliability, as well as after-sales support. They tend to choose established international brands.

Key consumer concerns include the high prices of premium designs, worries about durability in hot and dry conditions, and the necessity for reliable after-sales service in various cities and countries throughout the region.

Casio, Timex, Citizen, Swatch, and Fossil are popular among consumers in the market. These brands offer affordable prices, strong brand recognition, and designs that match regional tastes. Casio and Timex are known for their functional and durable watches, while Citizen, Swatch, and Fossil attract buyers looking for modern styles.

Price Insights

The premium quartz watches segment led the market with the largest revenue share of 35.08% in 2024. This is mainly due to urban buyers in markets like the UAE and Saudi Arabia who prefer high-end, stylish timepieces that signify status while staying more affordable than luxury mechanical watches. Strong demand comes from professionals and young, wealthy consumers who favor internationally known brands offering durability, modern designs, and features such as water resistance and energy efficiency.

The luxury quartz watches segment is anticipated to grow at the fastest CAGR of 4.5% from 2025 to 2033, driven by rising demand from affluent consumers in urban centers like Dubai, Riyadh, and Doha. These consumers seek prestigious, stylish, and reliable timepieces at a lower entry point than mechanical luxury watches. The growth is further supported by increasing exposure to global fashion trends.

End Use Insights

The men segment led the market with the largest revenue share of 75.79% in 2024. This can be attributed to the strong cultural and professional focus on wristwatches as both a status symbol and a practical accessory. Male consumers, especially in cities like Dubai, Riyadh, and Doha, prefer durable, stylish, and branded watches for work, meetings, and social events. The high demand for rugged but premium models from brands like Casio, Citizen, and Timex further strengthens the male-dominated share in the region.

The women segment is anticipated to witness at the fastest CAGR of 4.4% from 2025 to 2033. More urban women, especially in the UAE and Saudi Arabia, are looking for versatile watches that mix fashion with modest designs. This growth comes as brands introduce collections tailored for the region. These include smaller sizes, elegant metallic finishes, and gem accents. These styles attract women who attend professional, social, and cultural events. However, the limited availability of durable, stylish, mid-priced options has kept adoption low.

Distribution Channel Insights

The offline segment led the market with the largest revenue share of 77.40% in 2024, as consumers in the region rely heavily on in-store experiences for assessing design, quality, and authenticity before purchase. High-value purchases, especially branded watches, are often made at malls, authorized retailers, and duty-free outlets in cities like Dubai, Riyadh, and Lagos, where shoppers can try on watches, receive personalized service, and access warranties.

The online segment is expected to grow at the fastest CAGR of 5.3% from 2025 to 2033, owing to the younger and tech-savvy consumers in major cities such as Dubai, Riyadh and Doha. These consumers prefer the convenience of online platforms for browsing international brands, comparing prices, and accessing exclusive online deals.

Country Insights

The UAE dominated the Middle East quartz watch market with the largest revenue share of 41.40 % in 2024, owing to its high per-capita income, strong tourism-driven retail sector, and extensive presence of luxury and mid-range watch retailers such as Rivoli and Ahmed Seddiqi & Sons. Moreover, Dubai’s status as a regional shopping hub, duty-free sales to international travelers, and a large expatriate population seeking affordable yet stylish watches drive significant demand for quartz models.

The quartz watch market in Qatar is projected to grow at the fastest CAGR of 4.5% from 2025 to 2033. This can be attributed to the country’s affluent expatriate population and high-income locals who prefer practical yet stylish timepieces for everyday use. Brands like Tissot and Seiko have capitalized on this by expanding their presence in Doha’s luxury malls such as Villaggio and Doha Festival City. At the same time, Qatar Duty Free also boosts sales among tourists and business travelers, making quartz watches a popular choice for gifting and personal wear.

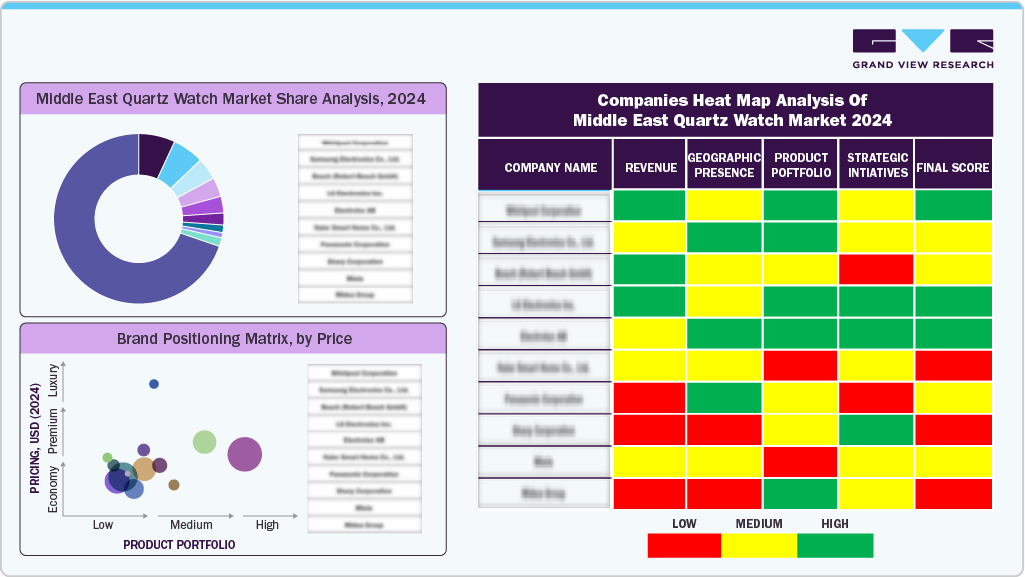

Key Middle East Quartz Watch Company Insights

The quartz watch market in the Middle East features a diverse mix of global giants, regional specialists, and emerging brands, each shaping the market in its own way. International names like Tissot, Seiko, and Citizen lead the mid- to premium segments, offering dependable timekeeping and widely recognized designs. Brands focused on performance, such as Casio G-Shock and Suunto, attract younger and more active buyers who value durability and multifunctional features.

Regional players, including Ahmed Seddiqi & Sons’ proprietary collections and boutique labels like Q&Q, cater to affluent locals and expatriates, offering designs that reflect regional tastes while remaining relatively accessible. This varied brand landscape supports strong market reach across luxury shopping destinations in Dubai as well as broader retail channels in Saudi Arabia and Qatar.

Key Middle East quartz watch Companies:

- Tissot

- Seiko

- Citizen

- Casio

- Fossil

- Daniel Wellington

- Skagen

- G-Shock

- Ahmed Seddiqi & Sons

- Q&Q

Recent Developments

-

In September 2025, Citizen announced that it will be launching three new quartz-powered Eco-Drive Promaster Skyhawk watches in October 2025, featuring the Caliber U830 movement. Housed in 43mm stainless steel cases with sapphire glass, they are priced between USD 795 and USD 850.

-

In September 2023, Fossil launched its "Made For This" campaign, marking a significant evolution in the brand's identity. This initiative emphasizes the shared value between Fossil and its consumers: the ownership of one's time, highlighting the intentional and purposeful use of time. The campaign includes a complete overhaul of Fossil's creative expression across all touchpoints, featuring a modernized brand image and premium product assortment.

Middle East Quartz Watch Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 622.8 million

Revenue forecast in 2033

USD 835.4 million

Growth rate

CAGR of 3.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Price, end use, distribution channel, country

Region scope

Middle East

Country scope

UAE; Saudi Arabia; Qatar; Kuwait; Oman

Key companies profiled

Tissot; Seiko; Citizen; Casio; Fossil; Daniel Wellington; Skagen; G-Shock; Ahmed Seddiqi & Sons; Q&Q

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Quartz Watch Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East quartz watch market report based on the price range, end use, distribution channel and country.

-

Price Outlook (Revenue, USD Million, 2021 - 2033)

-

Economy

-

Mid-range

-

Premium

-

Luxury

-

Ultra Luxury

-

-

End Use Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Men

-

Women

-

-

Distribution Channel (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

UAE

-

Saudi Arabia

-

Qata

-

Kuwait

-

Oman

-

Frequently Asked Questions About This Report

b. The Middle East quartz watch market size was estimated at 601.6 million in 2024 and is expected to reach USD 835.4 million in 2025.

b. The Middle East quartz watch market is expected to grow at a compound annual growth rate (CAGR) of 3.7% from 2025 to 2033 to reach USD 835.4 million by 2033.

b. Premium quartz watches held a 35.08% share of revenue in 2024. This is mainly due to urban buyers in markets like the UAE and Saudi Arabia who prefer high-end, stylish timepieces that signify status while staying more affordable than luxury mechanical watches.

b. Some key players in the Middle East quartz watch market include Tissot; Seiko; Citizen; Casio; Fossil; Daniel Wellington; Skagen; G-Shock; Ahmed Seddiqi & Sons; Q&Q

b. The Middle East quartz watch market growth expansion is fueled by rising demand for trendy and value-for-money watches among youths and growing retail penetration in premium consumer markets such as the UAE and Saudi Arabia. Rising tourism and gifting trends fuel steady market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.