- Home

- »

- Catalysts & Enzymes

- »

-

Middle East Refinery Catalysts Market, Industry Report, 2033GVR Report cover

![Middle East Refinery Catalysts Market Size, Share & Trends Report]()

Middle East Refinery Catalysts Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Zeolite, Metallic, Chemical Compound), By Application (FCC Catalyst, Alkylation Catalysts), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-755-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Refinery Catalysts Market Summary

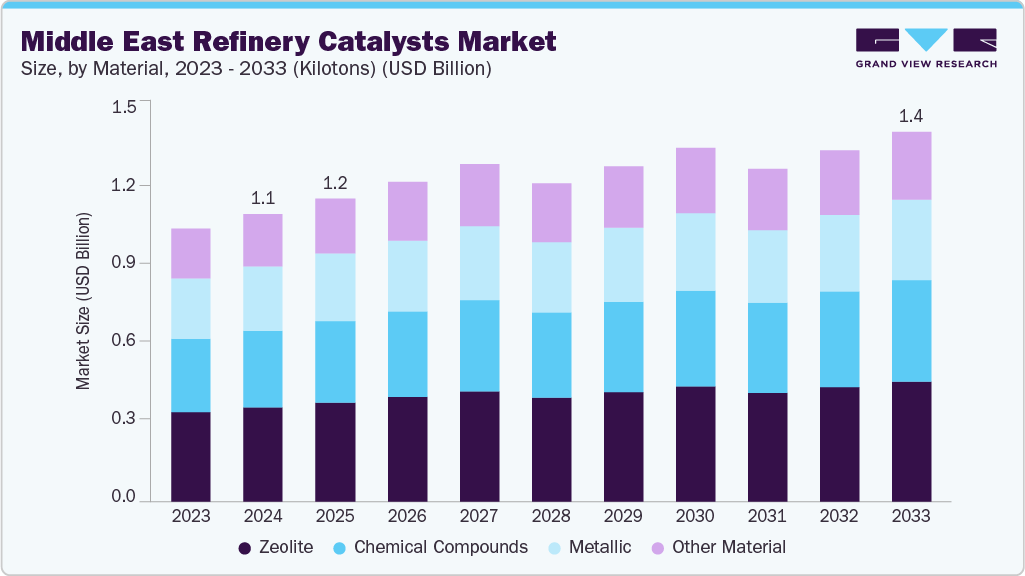

The Middle East refinery catalysts market size was estimated at USD 1,103.94 million in 2024 and is projected to reach USD 1,418.44 million by 2033, growing at a CAGR of 2.5% from 2025 to 2033. Since the Middle East is one of the largest global hubs for crude oil production, refinery catalysts are extensively used to improve process efficiency, enhance product quality, and comply with evolving environmental regulations.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East refinery catalysts market with the largest revenue share of 51.35% in 2024.

- The market in the UAE is expected to grow at a significant CAGR of 2.9% from 2025 to 2033.

- By material, the chemical compound refinery catalysts segment is expected to grow at the highest CAGR of 2.8% from 2025 to 2033 in terms of revenue.

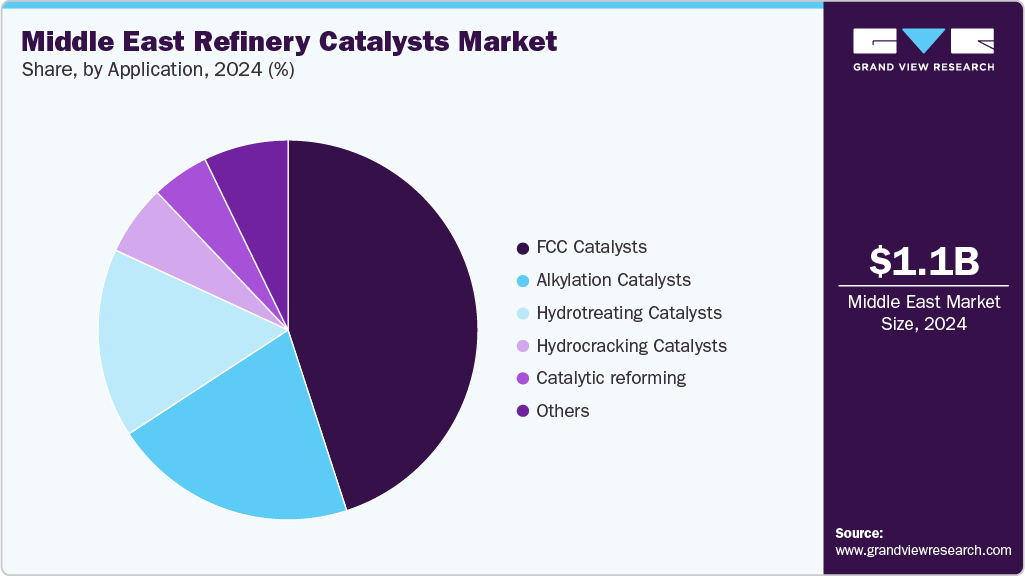

- By application, the hydrotreating catalysts segment held the largest revenue share of 28.6% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 1,103.94 Million

- 2033 Projected Market Size: USD 1,418.44 Million

- CAGR (2025-2033): 2.5%

Catalysts such as fluid catalytic cracking (FCC), hydroprocessing, and alkylation catalysts are widely adopted across refineries to maximize output of high-value products like gasoline, diesel, and jet fuel. Growing investment in refinery expansions and modernization projects is a key factor driving catalyst demand in the regionThe Middle East refinery catalysts industry outlook is also shaped by the region’s strategic shift toward cleaner and higher-value fuels. Countries such as Saudi Arabia, the UAE, and Qatar are investing in upgrading refinery complexes to produce low-sulfur fuels in line with international standards such as IMO 2020. This is increasing the need for advanced hydroprocessing catalysts and desulfurization technologies. Additionally, the rising domestic consumption of petrochemical feedstocks has strengthened demand for catalysts that enhance naphtha production and efficiency in downstream applications.

Furthermore, global energy transition trends are influencing long-term market dynamics. While crude oil remains the backbone of the Middle East economy, refineries are under pressure to adapt to stricter environmental regulations and a gradual shift toward cleaner energy sources. This is expected to accelerate the adoption of next-generation refinery catalysts that enable higher operational flexibility, improved energy efficiency, and reduced carbon footprints. Overall, the Middle East refinery catalysts market is projected to witness steady growth, supported by both short-term refinery capacity expansions and long-term sustainability-driven innovation.

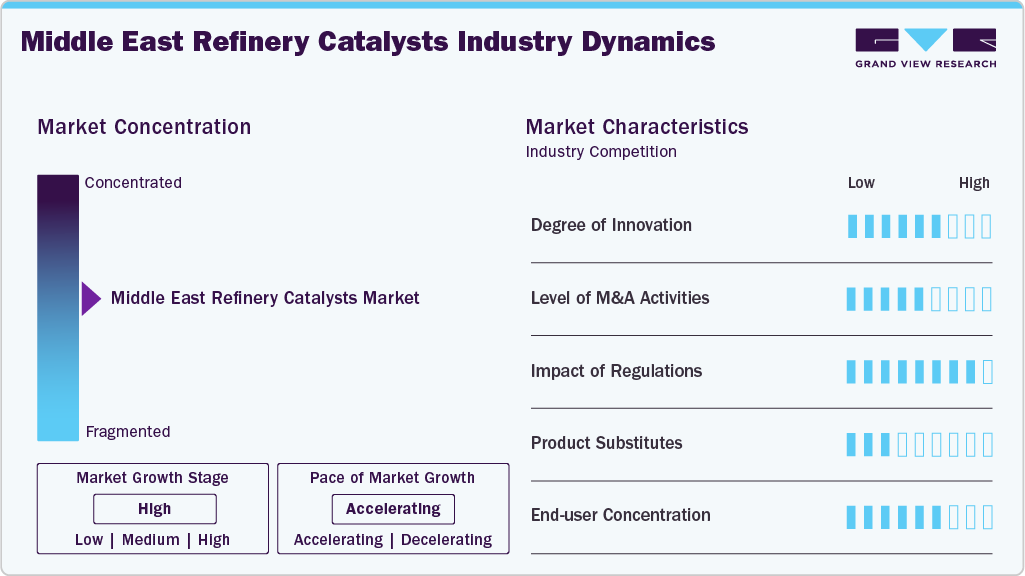

Market Concentration & Characteristics

The Middle East refinery catalysts market is characterized by its strong dependence on the region’s abundant crude oil reserves and extensive refining infrastructure. Countries such as Saudi Arabia, the UAE, and Kuwait host some of the world’s largest and most technologically advanced refineries, making the region a cornerstone of global refining activity. The demand for catalysts is closely tied to these large-scale operations, where fluid catalytic cracking (FCC), hydrocracking, and hydrodesulfurization catalysts are integral in maximizing fuel yield and meeting both domestic and export requirements. The market is also influenced by ongoing refinery expansion and modernization projects aimed at enhancing efficiency and aligning with stricter international fuel quality standards.

Another defining characteristic of this market is its transition toward producing cleaner fuels and petrochemical feedstocks. The implementation of low-sulfur fuel mandates and the push to meet global environmental regulations are driving the adoption of high-performance hydroprocessing and desulfurization catalysts. Additionally, the Middle East is positioning itself as not only an energy exporter but also a downstream petrochemical hub, which further elevates the need for advanced catalyst technologies. The combination of vast resource availability, high capital investment in refining capacity, and evolving regulatory pressures makes the Middle East refinery catalysts industry highly dynamic and strategically significant on a global scale.

Material Insights

The zeolite segment dominated the Middle East refinery catalysts industry with a revenue share of 32.8% in 2024. This is primarily due to its extensive use in fluid catalytic cracking (FCC) units. Refineries in the region rely on zeolite-based catalysts to maximize gasoline and light olefin yields while enhancing fuel quality. With ongoing investments in upgrading refinery infrastructure and the push for higher-value petrochemical outputs, demand for zeolite catalysts is expected to remain strong, making it a key material segment in the regional market.

The chemical compound segment is expected to grow at a CAGR of 2.8% during the forecast period. The growth is driven by their use in hydroprocessing and desulfurization applications, where removing impurities like sulfur and nitrogen is critical. These catalysts, often comprising metals such as cobalt, molybdenum, or nickel, enable refineries to meet stringent fuel quality and emission standards. Growing regulatory pressures and the region’s focus on producing cleaner fuels are expected to sustain steady demand for chemical compound-based catalysts.

Application Insights

The FCC catalysts by application segment dominated the Middle East refinery catalysts market with a revenue share of 45.0% in 2024. The region’s emphasis on maximizing gasoline and light olefin yields from crude oil. These catalysts enhance conversion efficiency and product quality, making them vital for high-capacity refineries. Rising fuel demand, along with ongoing refinery expansions in countries like Saudi Arabia and the UAE, continues to strengthen the adoption of FCC catalysts in the region.

The hydrotreating catalysts application segment is expected to grow at the fastest CAGR of 2.8% from 2025 to 2033. This is driven by the region’s focus on producing cleaner fuels that comply with international sulfur reduction standards. These catalysts are widely used to remove impurities such as sulfur, nitrogen, and metals from feedstock, improving fuel quality and meeting environmental regulations. Growing export-oriented refining capacities and stricter fuel specifications are expected to sustain strong demand for hydrotreating catalysts in the region.

Regional Insights

The Middle East refinery catalysts market is expanding steadily, supported by large-scale refining capacities, rising demand for cleaner fuels, and investments in advanced refinery technologies. The region’s strategic position as a global energy hub and its strong focus on upgrading fuel quality continue to drive catalyst consumption across applications such as FCC, hydrocracking, and hydrotreating.

Saudi Arabia Refinery Catalysts Market Trends

Saudi Arabia dominated the Middle East refinery catalysts market with a revenue share of 51.35% in 2024. The refinery catalyst demand is particularly strong due to the country’s extensive refining infrastructure and its Vision 2030 strategy, which emphasizes modernization and diversification of the downstream sector. Ongoing upgrades to meet Euro-V fuel standards and large export-oriented projects further reinforce the adoption of advanced catalyst technologies in the kingdom.

Key Middle East Refinery Catalysts Company Insights

Key players such as Albemarle Corporation, Arkema, Chevron Corporation, and ExxonMobil Corporation are dominating the market.

-

BASF SE is a chemical production company based in Germany and offers products to several end-use industries, including agriculture, chemicals, construction, electronic & electric, energy & resources, pharmaceuticals, and automotive & transportation. It operates through five business segments, namely performance products, chemicals, agricultural solutions, functional materials & solutions, and oil & gas. The chemicals segment specializes in the manufacturing of products such as petrochemicals, catalysts, intermediates, and monomers. It also provides surface disinfectants for applications, including home care and industrial & institutional, comprising sub-applications such as laundry, dishwashing, food & beverage processing, and industrial cleaning, among others. The company operates through its various subsidiaries and joint ventures in over 80 countries, with more than 353 production sites spread across the globe. It also has 13 operating divisions and around 84 sub-business units worldwide. The company operates in various locations, including Germany, the U.S., Belgium, Brazil, Canada, Chile, the Netherlands, Norway, Poland, Portugal, Korea, Japan, India, Malaysia, the UAE, South Africa, and China.

Key Middle East Refinery Catalysts Companies:

- Albemarle Corporation

- BASF SE

- Johnson Matthey Plc

- W. R. Grace

- Clariant International Ltd.

- Arkema

- Zeolyst International

- Chevron Corporation

- Exxon Mobil Corporation

- Evonik Industries AG

- DuPont

- Haldor Topsoe A/S

Recent Developments

-

In April 2025, Iran is projected to lead Middle East additions in Fluid Catalytic Cracking Unit (FCCU) capacity by 2030, accounting for over 40% of the region's planned and announced increase. This significant growth is primarily driven by the Siraf Refinery Complex project, which alone will contribute a major portion of the new capacity. The expansion is part of a broader regional trend, with Iran, Kuwait, and Oman collectively representing most of the Middle East's forthcoming FCCU capacity. The primary motivation for this investment is to increase domestic production of gasoline and other valuable lighter products, maximizing value from heavier crude oil fractions and enhancing refining self-sufficiency.

Middle East Refinery Catalysts Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,162.84 million

Revenue forecast in 2033

USD 1,418.44 million

Growth rate

CAGR of 2.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, and region

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Qatar; Israel

Key companies profiled

Albemarle Corporation; BASF SE; Johnson Matthey Plc; W. R. Grace; Clariant International Ltd.; Arkema; Zeolyst International; Chevron Corporation; Exxon Mobil Corporation; Evonik Industries AG; DuPont; Haldor Topsoe A/S.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Refinery Catalysts Market Report Segmentation

This report forecasts volume & revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East refinery catalysts market report based on material, application and region.

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Zeolite

-

Metallic

-

Chemical Compounds

-

Other Material

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Alkylation Catalysts

-

FCC Catalysts

-

Hydrotreating Catalysts

-

Hydrocracking Catalysts

-

Catalytic Reforming

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Qatar

-

Israel

-

-

Frequently Asked Questions About This Report

b. The Middle East refinery catalysts market size was estimated at USD 1,103.94 million in 2024 and is expected to reach USD 1,162.84 million in 2025.

b. The Middle East Refinery Catalysts market is expected to grow at a compound annual growth rate of 2.5% from 2025 to 2033 to reach USD 1,418.44 million by 2033.

b. Saudi Arabia refinery catalysts market dominated the MEA market with a revenue share of 51.35% in 2024. The refinery catalysts demand is particularly strong due to the country’s extensive refining infrastructure and its Vision 2030 strategy, which emphasizes modernization and diversification of the downstream sector.

b. Some key players operating in the middle east refinery catalysts market include Albemarle Corporation, BASF SE, Johnson Matthey Plc, W. R. Grace, Clariant International Ltd., Arkema, Zeolyst International, Chevron Corporation, Exxon Mobil Corporation, Evonik Industries AG, DuPont, and Haldor Topsoe A/S

b. The Middle East being one of the largest global hubs for crude oil production, refinery catalysts are extensively used to improve process efficiency, enhance product quality, and comply with evolving environmental regulations. Catalysts such as fluid catalytic cracking (FCC), hydroprocessing, and alkylation catalysts are widely adopted across refineries to maximize output of high-value products like gasoline, diesel, and jet fuel. Growing investment in refinery expansions and modernization projects is a key factor driving catalyst demand in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.