- Home

- »

- Renewable Energy

- »

-

Middle East Renewable Energy Market Size Report, 2033GVR Report cover

![Middle East Renewable Energy Market Size, Share & Trends Report]()

Middle East Renewable Energy Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Hydropower, Wind, Solar, Bioenergy), By Application (Industrial, Commercial, Residential), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-704-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Renewable Energy Market Summary

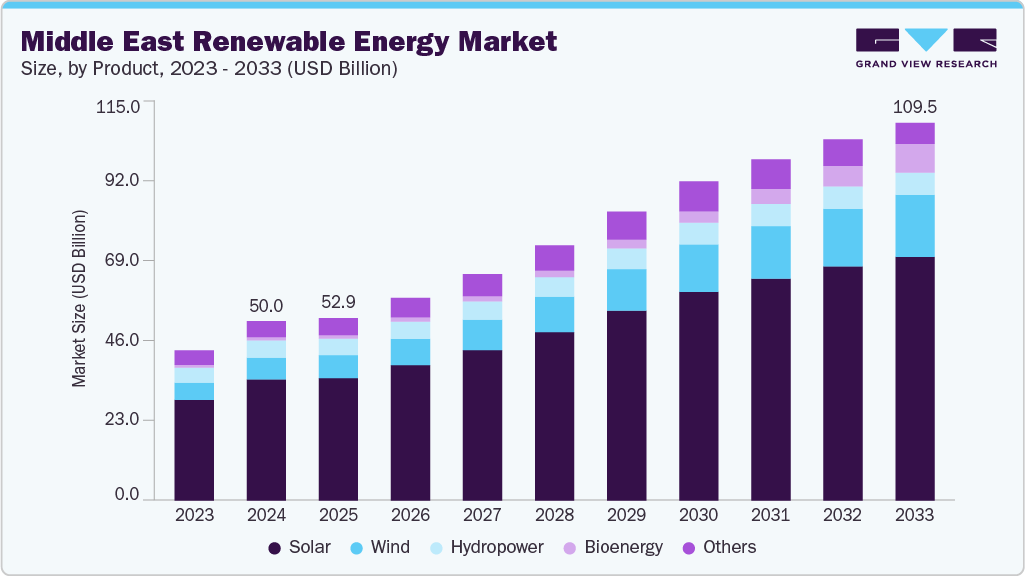

The Middle East renewable energy market size was valued at USD 52.03 billion in 2024 and is projected to reach USD 109.56 billion by 2033, growing at a CAGR of 9.5% from 2025 to 2033. Renewable energy in the region includes solar, wind, hydro, and bioenergy technologies aimed at diversifying energy sources, reducing reliance on fossil fuels, and meeting sustainability goals under national visions such as Saudi Vision 2030 and the UAE’s Energy Strategy 2050.

Key Market Trends & Insights

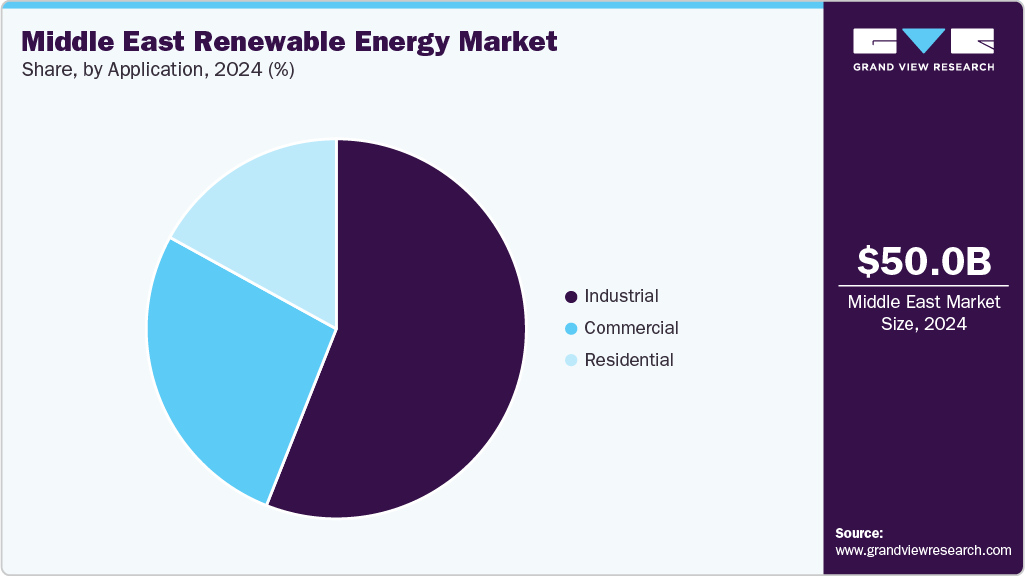

- Based on application, the industrial segment held the highest market share of 56.01% in 2024.

- Based on product, the solar segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 52.03 Billion

- 2033 Projected Market Size: USD 109.56 Billion

- CAGR (2025-2033): 9.5%

These initiatives are reshaping the regional energy landscape by promoting large-scale renewable projects, encouraging foreign investment, and deploying modern grid infrastructure to integrate variable renewable resources. Countries across the Gulf Cooperation Council (GCC), Turkey, Israel, and Egypt are actively scaling up clean energy capacities to meet domestic and export-oriented energy demands.

The industry is driven by abundant solar resources, declining levelized costs of renewables, and heightened governmental support through power purchase agreements (PPAs), auctions, and green financing. Technologies like photovoltaic (PV) panels and concentrated solar power (CSP) are particularly dominant, with hybrid systems and grid storage solutions gaining interest in improving dispatchability. The rise of green hydrogen in markets like Oman and the UAE, along with interconnection plans such as the GCC grid expansion and Egypt-Europe links, further accelerates demand. Smart grid development, digital monitoring tools, and energy efficiency retrofits in buildings and industries enhance the region’s renewable ecosystem. With key players including Masdar, ACWA Power, and EDF Renewables active in megaprojects, the Middle East renewable energy market is positioned for sustained, transformative growth over the next decade.

Drivers, Opportunities & Restraints

The industry is driven by strategic government initiatives, favourable policy frameworks, and a pressing need to diversify energy portfolios amid rising demand. Countries such as the UAE, Saudi Arabia, Egypt, and Oman actively pursue national targets for renewable energy adoption under long-term visions emphasizing sustainability and economic diversification. The region’s abundant solar irradiance and growing interest in wind and green hydrogen production make it well-positioned to become a global hub for clean energy. Rapid population growth, urbanization, and increased industrial activity also accelerate demand for reliable and sustainable electricity generation, prompting large-scale investments in utility-scale solar parks, wind farms, and hybrid renewable systems.

Opportunities are emerging in areas such as floating solar, distributed solar installations, and the development of green hydrogen export corridors. Integrating digital solutions like AI-driven energy management, remote monitoring, and predictive analytics into renewable assets presents new avenues for operational efficiency and grid optimization. International collaborations and public-private partnerships also open the market to advanced technology transfers and cross-border renewable trading. However, the market faces restraints such as intermittent energy supply challenges, limited grid infrastructure in remote areas, and the high capital costs associated with energy storage systems and hydrogen technologies. Moreover, slow regulatory approvals and policy fragmentation across countries can hinder streamlined development and delay project execution, impacting investor confidence in certain markets.

Product Insights

The solar segment emerged as the dominant product category in the Middle East renewable energy market, accounting for a revenue share of over 67.57% in 2024. It is expected to maintain its lead throughout the forecast period, supported by the region's exceptional solar radiance, vast expanses of available land, and falling levelized electricity costs (LCOE). Utility-scale solar photovoltaic (PV) projects are driving massive capacity additions, particularly in Saudi Arabia, the UAE, and Egypt. In contrast, concentrated solar power (CSP) continues gaining ground in select markets for storage and dispatch capabilities. Flagship projects such as the Mohammed bin Rashid Al Maktoum Solar Park and Sakaka PV plant illustrate the scale and ambition of solar deployment in the region.

The growing prominence of solar energy in national energy strategies is further supported by favorable policy environments, long-term power purchase agreements (PPAs), and international partnerships. Integrating solar with grid storage, smart meters, and hybrid systems enhances the sector's adaptability to grid needs and peak demand fluctuations. Moreover, the rapid expansion of distributed solar systems across rooftops, commercial facilities, and remote communities reflects solar solutions' versatility and scalability in urban and off-grid areas. While intermittency and land use challenges persist, advancements in high-efficiency modules, bifacial panels, and tracking systems reinforce the solar segment's cost-effectiveness and long-term viability in the Middle East's energy transition.

Application Insights

The industrial segment accounted for the largest revenue share of over 56.01% in the Middle East renewable energy market in 2024 and is expected to retain its dominance over the forecast period. This application segment is witnessing robust growth due to the region’s strategic push to decarbonize energy-intensive sectors such as oil & gas, petrochemicals, desalination, and heavy manufacturing. Large-scale renewable installations are increasingly being deployed to power industrial zones and export-oriented infrastructure, particularly in Saudi Arabia, the UAE, and Oman. Initiatives like integrating solar PV and wind energy into industrial parks, refineries, and ports drive demand for reliable and cost-efficient clean energy solutions tailored to high-load operations.

The surge in industrial demand is further fuelled by the rising interest in green hydrogen production, which requires vast amounts of renewable electricity and has become a focal point of national strategies across several Middle Eastern countries. Renewable energy also plays a key role in powering mining operations, water desalination plants, and the aluminium smelters sector, which has historically relied on fossil fuels. With growing regulatory pressure and international trade considerations around carbon emissions, industries are adopting renewable energy to reduce operating costs and meet environmental compliance and ESG standards. As industrial energy consumption continues to grow, the sector is set to remain the cornerstone of renewable energy demand in the Middle East, bolstered by long-term power purchase agreements and government-backed infrastructure initiatives.

Country Insights

Saudi Arabia renewable energy market held the largest revenue share of 40.18% in the Middle East region in 2024, driven by its aggressive energy diversification strategy under Vision 2030 and its commitment to becoming a global leader in clean energy. The Kingdom is investing heavily in large-scale solar, wind, and green hydrogen projects, with flagship initiatives like NEOM, the Red Sea Project, and Sakaka PV plant serving as cornerstones of its renewable expansion. The Renewable Energy Project Development Office (REPDO) continues to lead structured auctions that attract international developers and ensure transparent, competitive pricing. These efforts are significantly boosting the installed renewable capacity across various regions in the Kingdom.

Saudi Arabia’s resource potential, especially in solar irradiance and wind corridors in the northwest, is among the highest in the region. While utility-scale solar remains the dominant segment, wind projects are gaining traction, supported by strong data and feasibility studies. The Kingdom is also making bold strides in green hydrogen, with NEOM’s USD 8.4 billion green hydrogen plant slated to become a global benchmark. Well-defined policy frameworks, investor-friendly regulations, and sovereign-backed funding mechanisms reinforce Saudi Arabia’s regional renewable energy market leadership position. With growing momentum in project execution and international collaboration, the country is set to maintain its dominant position throughout the decade.

UAE Renewable Energy Market Trends

The UAE holds a significant share of the Middle East renewable energy market in 2024, anchored by its long-standing leadership in solar power deployment and sustainability-driven national policies under the UAE Energy Strategy 2050. The country has made major strides in scaling up utility-scale solar PV and Concentrated Solar Power (CSP) projects, including the Mohammed bin Rashid Al Maktoum Solar Park, one of the world’s largest integrated solar facilities. Abu Dhabi and Dubai continue to lead in clean energy adoption, digital grid enhancements, and distributed solar systems through initiatives like Shams Dubai and the Abu Dhabi Clean Energy Strategy.

Beyond solar, the UAE is positioning itself as a key player in the green hydrogen economy. Export-oriented hydrogen projects are gaining traction in partnership with international firms. The country benefits from strong regulatory support, low project financing costs, and an open market for foreign investment.

Egypt Renewable Energy Market Trends

Egypt’s renewable energy market is expanding steadily due to strong government backing, international financing, and vast untapped solar and wind resources. The Benban Solar Park, one of the largest solar installations globally, highlights the country’s commitment to renewable integration. The government’s Integrated Sustainable Energy Strategy (ISES) targets 42% renewable energy in the national mix by 2035. In addition to large-scale solar and onshore wind projects, Egypt is positioning itself as a clean energy corridor connecting Africa, the Middle East, and Europe, supported by cross-border grid interconnection plans. The rise of Independent Power Producers (IPPs) and clear regulatory frameworks enhances investor confidence, making Egypt a significant contributor to regional renewable capacity.

Oman Renewable Energy Market Trends

Oman is emerging as a promising renewable energy market in the Middle East, with a strategic focus on solar, wind, and green hydrogen. The government’s Oman Vision 2040 aims to derive 30% of electricity from renewables by 2030. The country’s vast deserts offer ideal conditions for solar PV, while the southern Dhofar region presents strong wind potential. Oman is also one of the frontrunners in developing green hydrogen at scale, supported by the Hydrogen Oman (Hydrom) initiative, which has already attracted multiple international consortia. While grid capacity and policy implementation remain developmental challenges, ongoing regulatory improvements and pilot projects are laying the groundwork for robust long-term growth.

Qatar Renewable Energy Market Trends

Qatar’s renewable energy efforts are gaining pace, with the country integrating clean energy into its broader sustainability and carbon neutrality goals under the Qatar National Vision 2030. The 800 MW Al Kharsaah Solar PV Plant, inaugurated in 2022, marks a major milestone in Qatar’s transition to renewable sources. The country is also exploring hydrogen and carbon capture opportunities, aiming to reduce emissions in its gas-heavy power sector. While fossil fuels still dominate Qatar’s energy mix, the government is gradually strengthening regulatory support for renewable energy investments, especially in preparation for future power demand driven by urban expansion and industrial diversification. Continued policy alignment and international collaboration are key to unlocking further potential in Qatar’s renewable energy market.

Key Renewable Energy Companies Insights

Key players operating in the renewable energy market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Renewable Energy Companies:

- ACME Group

- ACWA Power International

- AMEA Power LLC

- EDF Renewables

- Engie

- First Solar, Inc.

- JinkoSolar Holding Co., Ltd.

- Masdar

- Siemens Energy AG

- TotalEnergies

Recent Developments

-

In January 2025, Masdar announced the commencement of construction on a 1.5 GW solar PV project in Saudi Arabia as part of a joint venture under the country’s National Renewable Energy Program. The project, located in the Al Shuaibah region, is expected to power over 250,000 homes and reduce carbon emissions by approximately 2.9 million tons annually. This development aligns with Masdar’s strategy to scale renewable energy assets across the Middle East and reinforces its role in supporting regional decarbonization goals through large-scale, clean energy infrastructure investments.

Middle East Renewable Energy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 52.91 billion

Revenue forecast in 2033

USD 109.56 billion

Growth rate

CAGR of 9.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Volume in TWh; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, and country

Country scope

UAE; Saudi Arabia; Egypt; Oman; Qatar

Key companies profiled

Masdar; ACWA Power International; EDF Renewables; Engie; TotalEnergies; JinkoSolar Holding Co., Ltd.; First Solar, Inc.; AMEA Power LLC; ACME Group; Siemens Energy AG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Renewable Energy Market Report Segmentation

This report forecasts volume & revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East renewable energy market report on the basis of product, application, and country:

-

Product Outlook (Volume, TWh; Revenue, USD Million, 2021 - 2033)

-

Hydropower

-

Wind

-

Solar

-

Bioenergy

-

Others

-

-

Application Outlook (Volume, TWh; Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Commercial

-

Residential

-

-

Country Outlook (Volume, TWh; Revenue, USD Million, 2021 - 2033)

-

Middle East

-

UAE

-

Saudi Arabia

-

Egypt

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The Middle East renewable energy market size was estimated at USD 52.03 billion in 2024 and is expected to reach USD 52.91 billion in 2025.

b. The Middle East renewable energy market is expected to grow at a compound annual growth rate of 9.5% from 2025 to 2033 to reach USD 109.56 billion by 2033.

b. Based on the application segment, Industrial held the largest revenue share of 56.01% in the Middle East renewable energy market in 2024, driven by the region’s growing emphasis on clean energy adoption within heavy industries and manufacturing hubs. As countries like Saudi Arabia, the UAE, and Oman accelerate efforts to decarbonize key sectors such as oil & gas, petrochemicals, and desalination, the integration of solar and wind energy into industrial operations has become a strategic priority.

b. Some of the key vendors operating in the Middle East renewable energy market include Masdar, ACWA Power International, EDF Renewables, Engie, and Siemens Energy AG, among others.

b. The key factors driving the Middle East renewable energy market include ambitious government initiatives, increasing energy demand, and the region’s strategic pivot away from fossil fuels. Countries like the UAE and Saudi Arabia are investing heavily in utility-scale solar PV, onshore wind, and green hydrogen projects as part of long-term energy diversification plans.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.