- Home

- »

- Organic Chemicals

- »

-

Middle East Specialty Chemicals Market Size Report, 2033GVR Report cover

![Middle East Specialty Chemicals Market Size, Share & Trends Report]()

Middle East Specialty Chemicals Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (CASE, Food & Feed Additives, Institutional & Industrial Cleaners), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-714-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Specialty Chemicals Market Summary

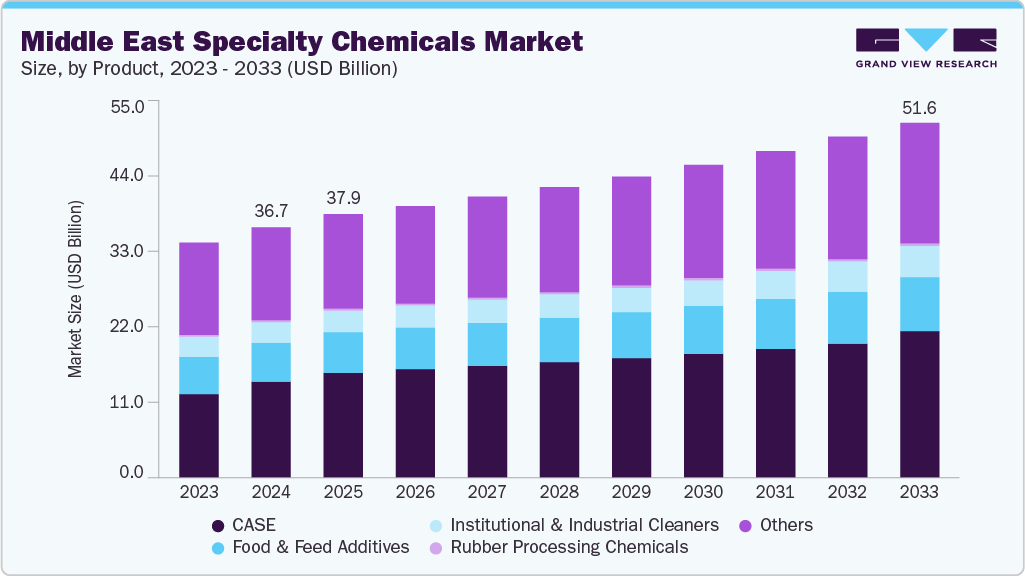

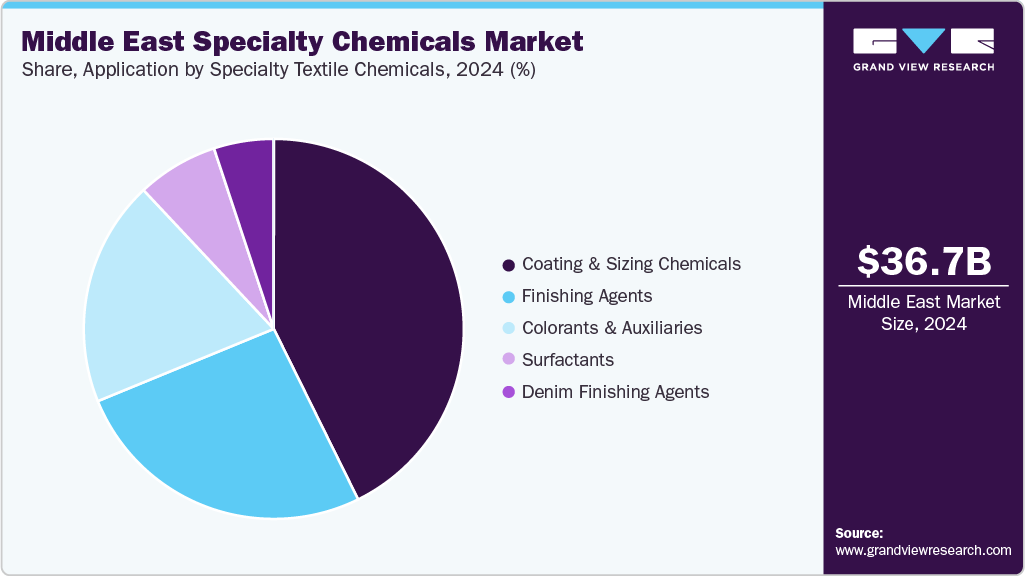

The Middle East specialty chemicals market size was estimated at USD 36.71 billion in 2024 and is projected to reach USD 51.59 billion by 2033, growing at a CAGR of 3.9% from 2025 to 2033. The growth is primarily driven by robust industrial expansion across the GCC, strong demand from the oil & gas sector, and large-scale infrastructure development under national diversification programs such as Saudi Vision 2030 and the UAE’s Operation 300bn.

Key Market Trends & Insights

- The Middle East specialty chemicals market is projected to grow at a CAGR of 3.9% from 2025 to 2033.

- By product, the institutional & industrial cleaners segment is expected to grow at the fastest CAGR of 5.2% from 2025 to 2033 in terms of revenue.

- By product, the CASE (Coatings, Adhesives, Sealants & Elastomers) segment dominated the market with the largest revenue share of 39.9% in 2024.

- By application, the CASE segment captured the largest revenue share of 32.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 36.71 Billion

- 2033 Projected Market Size: USD 51.59 Billion

- CAGR (2025-2033): 3.9%

Rising investments in water treatment facilities, growing consumption of high-performance chemicals in construction and manufacturing, and increased localization of specialty chemical production to reduce import dependence further stimulate the growth of the Middle East specialty chemicals industry. Additionally, supportive government policies, abundant feedstock availability, and strategic proximity to export markets in Asia and Europe enhance the region’s competitive advantage.

Significant growth opportunities lie in the development of value-added specialty chemicals tailored for regional applications, such as advanced oilfield chemicals for enhanced oil recovery, eco-friendly construction additives for green building projects, and high-purity water treatment chemicals for desalination plants. Expanding downstream petrochemical capacity in Saudi Arabia, the UAE, and Oman opens avenues for integrated specialty chemical production. Furthermore, the increasing focus on sustainable solutions, including bio-based and low-VOC products, presents scope for technology partnerships and innovation. The rising pharmaceutical manufacturing base, driven by healthcare investments, and the expansion of food processing industries across the Middle East offer further untapped demand potential for specialty additives.

Despite strong market fundamentals, the Middle East specialty chemicals sector faces challenges such as volatility in crude oil prices, which can impact feedstock costs and downstream investment sentiment. High reliance on imports for certain advanced specialty products creates supply chain vulnerabilities, particularly during geopolitical tensions or logistics disruptions. Stringent environmental regulations and evolving safety standards require continuous R&D and compliance investments, while intense competition from global major players and low-cost Asian imports pressures margins. Additionally, talent shortages in specialized chemical engineering and formulation expertise can slow the pace of innovation and localized manufacturing growth.

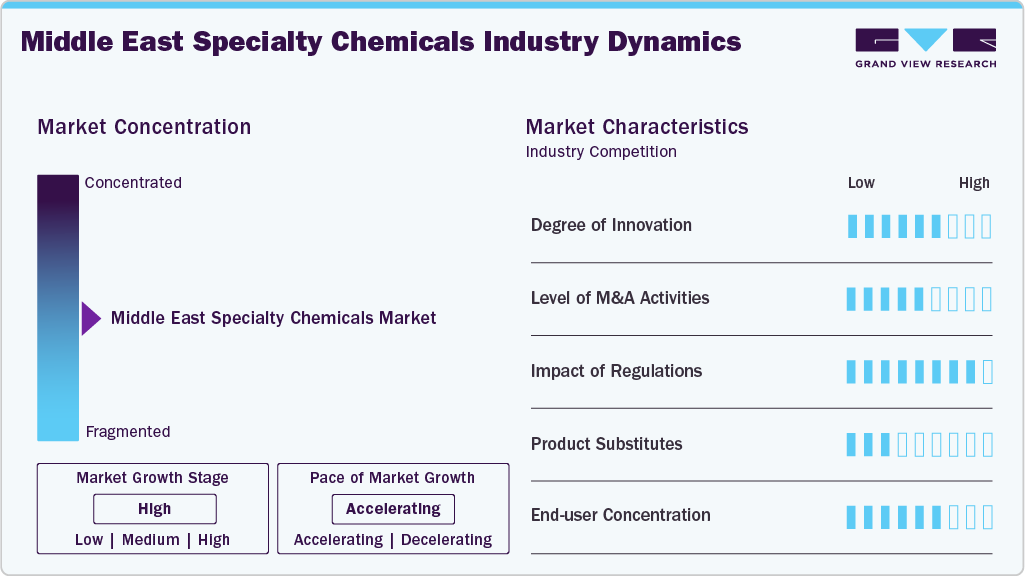

Market Concentration & Characteristics

The Middle East specialty chemicals market is moderately fragmented, with leadership held by several large, vertically integrated chemical manufacturers. Leading market players are pursuing strategies centered on local manufacturing expansion, portfolio diversification, and strategic partnerships to capture growing regional demand. Global majors such as BASF, Dow, and Clariant are investing in joint ventures with regional petrochemical companies to establish production facilities closer to end-use industries, ensuring cost efficiency and supply security. Many are also aligning their product portfolios with regional priorities such as oilfield performance chemicals, high-durability construction additives, and advanced water treatment solutions, supported by targeted R&D centers within the GCC to adapt formulations to local climatic and operational conditions.

These companies are adopting sustainability-driven and customer-centric approaches to strengthen market positioning. This includes the development of bio-based and low-VOC products to meet evolving environmental regulations, digitalizing supply chains for faster delivery, and offering technical service support to end-users in sectors like construction, oil & gas, and food processing. Strategic mergers, acquisitions, and collaborations with local distributors are also being leveraged to expand geographic reach, enhance distribution networks, and penetrate niche high-growth segments such as pharmaceutical additives and specialty coatings. These strategies enable players to maintain a competitive edge in a market characterized by rising local content requirements and increasing demand for high-performance, application-specific solutions.

Product Insights

The CASE (Coatings, Adhesives, Sealants, and Elastomers) segment led the Middle East specialty chemicals industry with the largest revenue share of 39.9% in 2024, driven by surging demand from construction, automotive, and industrial manufacturing sectors. Large-scale infrastructure projects, urban development initiatives, and industrial diversification programs under frameworks such as Saudi Vision 2030 and the UAE’s Operation 300bn have significantly boosted the consumption of high-performance coatings and adhesives. Moreover, the region’s growing automotive assembly and maintenance industries, combined with the need for durable, weather-resistant sealants and elastomers to withstand harsh climatic conditions, have further propelled demand. The segment also benefits from strong investment in oil & gas and marine infrastructure, where protective coatings are critical for asset longevity and operational efficiency.

Beyond CASE, other product segments are witnessing robust, sector-specific growth. Institutional & industrial cleaners are in high demand due to heightened hygiene standards across healthcare, hospitality, and manufacturing, while rubber processing chemicals are gaining traction with expanding automotive and tire manufacturing in regional industrial hubs. Food & feed additives are experiencing steady growth with the expansion of food processing industries. At the same time, cosmetic chemicals benefit from the rising personal care market driven by a young, affluent consumer base.

Oilfield chemicals remain a strategic growth driver due to continuous upstream exploration and enhanced oil recovery projects. In contrast, water treatment chemicals are critical for desalination plants and industrial water reuse programs. Niche segments such as electronic chemicals and pharmaceutical additives are also emerging as high-potential areas, supported by regional diversification into advanced manufacturing and healthcare production. Collectively, this diverse material mix positions the Middle East specialty chemicals industry for steady, broad-based growth.

Application Insights

The CASE (Coatings, Adhesives, Sealants, and Elastomers) segment led the Middle East specialty chemicals market with the largest revenue share of 32.0% in 2024, underpinned by its indispensable role across construction, automotive, packaging, and industrial manufacturing industries. Massive infrastructure developments, iconic real estate projects, and industrial expansion in GCC economies have significantly boosted demand for protective coatings and high-performance adhesives. At the same time, sealants and elastomers are increasingly used in building facades, transport equipment, and oil & gas installations to ensure durability and operational safety. The segment also benefits from a growing shift toward advanced, eco-friendly formulations that meet stringent environmental regulations, creating opportunities for premium product adoption and strengthening its revenue dominance.

Other applications are contributing strongly to market growth through sector-specific demand drivers. Institutional & industrial cleaners are expanding rapidly due to heightened sanitation standards across healthcare, hospitality, and food industries. Construction chemicals are gaining momentum with large-scale infrastructure pipelines, while oilfield chemicals continue to see sustained demand from upstream and midstream activities. Food & feed additives are supported by the growth of domestic food processing and livestock sectors, and cosmetic chemicals benefit from rising personal care consumption in high-income demographics.

Water treatment chemicals remain essential for desalination and industrial water recycling, while pharmaceuticals & nutraceutical additives are emerging as a growth hotspot due to increased local manufacturing. Niche areas such as specialty pulp & paper chemicals, textile chemicals, and mining chemicals are also witnessing steady growth as regional diversification drives investment in non-oil sectors, adding depth to the application landscape.

Country Insights

Middle East Specialty Chemicals Market Trends

The Middle East specialty chemicals market is experiencing robust growth, supported by large-scale infrastructure development, ongoing diversification of economies beyond oil, and rising investments in downstream petrochemicals and advanced manufacturing. Key demand stems from oilfield operations, water treatment projects, and construction megaprojects across the GCC, while emerging sectors such as pharmaceuticals, cosmetics, and food processing are creating new opportunities for specialty additives. The region’s strategic location as a global trade hub, coupled with increasing focus on sustainable and high-performance formulations, positions the Middle East as a dynamic growth market for specialty chemical producers.

Saudi Arabia Specialty Chemicals Market Trends

Saudi Arabia dominates the Middle East specialty chemicals industry, driven by its expansive oil & gas sector, significant downstream integration through entities like SABIC, and ambitious infrastructure initiatives under Vision 2030. Strong demand for oilfield chemicals, construction additives, and water treatment solutions is being fueled by major industrial and urban development projects, including NEOM and the Red Sea Project. The government’s push for local content development and diversification into pharmaceuticals, food processing, and advanced materials further strengthens Saudi Arabia’s position as the largest and most influential market for specialty chemicals in the region.

Key Middle East Specialty Chemicals Company Insights

Some of the key players operating in the Middle East Specialty Chemicals market include Kemira, Croda International PLC, and Albemarle Corp.

-

Croda International PLC is a UK-based specialty chemicals company with a global presence, including a strategic regional hub in the Jebel Ali Free Zone, UAE, which anchors its operations in the Middle East. The company delivers high-value, application-specific ingredients across sectors such as cosmetic chemicals, pharmaceutical excipients, and industrial specialties, leveraging its innovation-driven "smart science" strategy and focusing on sustainability to meet local demand. Through its Middle East base, Croda enhances customer collaboration, offers agile technical support, and ensures efficient supply and compliance, positioning the company as a preferred partner for regional formulators pursuing performance-driven and eco-sensitive specialty chemical solutions.

Key Middle East Specialty Chemicals Companies:

- Kemira Oyj

- Croda International PLC

- Albemarle Corp

- Clariant AG

- Lanxess AG

- Akzo Nobel NV

- Solvay SA

- The Lubrizol Corp

Middle East Specialty Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 37.96 billion

Revenue forecast in 2033

USD 51.59 billion

Growth rate

CAGR of 3.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Country scope

Oman; Kuwait; Saudi Arabia; UAE; Qatar; Bahrain; Israel; Rest of Middle East

Key companies profiled

Kemira Oyj; Croda International PLC; Albemarle Corp; Clariant AG; Lanxess AG; Akzo Nobel NV; Solvay SA; The Lubrizol Corp.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Specialty Chemicals Market Report Segmentation

This report forecasts the volume & revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the Middle East specialty chemicals market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

Institutional & Industrial Cleaners

-

General Purpose Cleaners

-

Disinfectants and Sanitizers

-

Laundry Care Products

-

Vehicle Wash Products

-

Others

-

-

Rubber Processing Chemicals

-

Anti-degradants

-

Accelerators

-

Flame Retardants

-

Processing Aid/ Promoters

-

Others

-

-

Food & Feed Additives

-

Flavors & Enhancers

-

Sweeteners

-

Enzymes

-

Emulsifiers

-

Preservatives

-

Fat Replacers

-

Others

-

-

Cosmetic Chemicals

-

Surfactants

-

Emollients & Moisturizers

-

Film-Formers

-

Colorants & Pigments

-

Preservatives

-

Emulsifying & Thickening Agents

-

Single-Use Additives

-

Others

-

-

Oilfield Chemicals

-

Inhibitors

-

Demulsifiers

-

Rheology Modifiers

-

Friction Reducers

-

Biocides

-

Surfactants

-

Foamers

-

Others

-

-

Specialty Pulp & Paper Chemicals

-

Basic Chemicals

-

Functional Chemicals

-

Bleaching Chemicals

-

Process Chemicals

-

-

Specialty Textile Chemicals

-

Coating & Sizing Chemicals

-

Colorants & Auxiliaries

-

Finishing Agents

-

Surfactants

-

Denim Finishing Agents

-

-

Water Treatment Chemicals

-

Coagulants & Flocculants

-

Biocide & Disinfectant

-

Defoamer & Defoaming Agent

-

pH & Adjuster & Softener

-

Scale & Corrosion Inhibitor

-

Others

-

-

Construction Chemicals

-

Electronic Chemicals

-

Mining Chemicals

-

Pharmaceutical & Nutraceutical Additives

-

CASE (Coatings, Adhesives, Sealants & Elastomers)

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

Institutional & Industrial Cleaners

-

Commercial

-

Food Service

-

Retail

-

Healthcare

-

Laundry Care

-

Institutional Buildings

-

Others

-

-

-

Manufacturing

-

Food & Beverage Processing

-

Metal Manufacturing & Fabrication

-

Electronic Components

-

Others

-

-

Rubber Processing Chemicals

-

Tire

-

Non-Tire

-

-

Construction Chemicals

-

Residential

-

Non-residential & Infrastructure

-

-

Food & Feed Additives

-

Bakery & Confectionery

-

Beverages

-

Convenience Foods

-

Dairy & Frozen Desserts

-

Spices, Condiments, Sauces & Dressings

-

Livestock Feed

-

Others

-

-

Cosmetic Chemicals

-

Skin Care

-

Hair Care

-

Makeup

-

Oral Care

-

Fragrances

-

Others

-

-

Oilfield Chemicals

-

Drilling

-

Production

-

Cementing

-

Workover & Completion

-

-

Specialty Pulp & Paper Chemicals

-

Packaging

-

Labeling

-

Printing

-

Others

-

-

Specialty Textile Chemicals

-

Apparel

-

Home Furnishing

-

Technical Textiles

-

Others

-

-

Water Treatment Chemicals

-

Power

-

Oil & Gas

-

Chemical Manufacturing

-

Mining & Mineral Processing

-

Municipal

-

Food & Beverage

-

Pulp & Paper

-

Others

-

-

Mining Chemicals

-

Mineral Processing

-

Explosives and Drilling

-

Water Treatment

-

Others

-

-

Electronic Chemicals

-

Pharmaceutical & Nutraceutical Additives

-

CASE (Coatings, Adhesives, Sealants & Elastomers)

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

Middle East

-

Oman

-

Kuwait

-

Saudi Arabia

-

UAE

-

Qatar

-

Bahrain

-

Israel

-

-

Frequently Asked Questions About This Report

b. The Middle East specialty chemicals market size was estimated at USD 36,711.5 million in 2024 and is expected to reach USD 37,962.1 million in 2025.

b. The Middle East specialty chemicals market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2033 to reach USD 51,596.9 million by 2033.

b. The CASE (Coatings, Adhesives, Sealants, and Elastomers) segment led the Middle East specialty chemicals market in 2024 due to strong demand from large-scale infrastructure projects, automotive manufacturing, and industrial applications requiring durable, weather-resistant, and high-performance materials. Its dominance was further reinforced by rising adoption of advanced, eco-friendly formulations aligned with regional sustainability and regulatory goals.

b. Some of the key players operating in the Middle East specialty chemicals market include Kemira Oyj, Croda International PLC, Albemarle Corp, Clariant AG, Lanxess AG, Akzo Nobel NV, Solvay SA, The Lubrizol Corp.

b. The market growth is driven by expanding industrial and infrastructure investments across the GCC, rising demand from oil & gas, construction, and water treatment sectors, and increasing localization of specialty chemical production to reduce import dependence. Supportive government policies, abundant feedstock availability, and a growing shift toward sustainable, high-performance formulations further strengthen the market outlook.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.