- Home

- »

- Food & Beverages

- »

-

Middle East Sports Supplements Market Size Report, 2033GVR Report cover

![Middle East Sports Supplements Market Size, Share & Trends Report]()

Middle East Sports Supplements Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Capsules/Tablets, Powder, Liquid, Bars), By Source (Animal-based, Plant-based), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-803-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Research

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

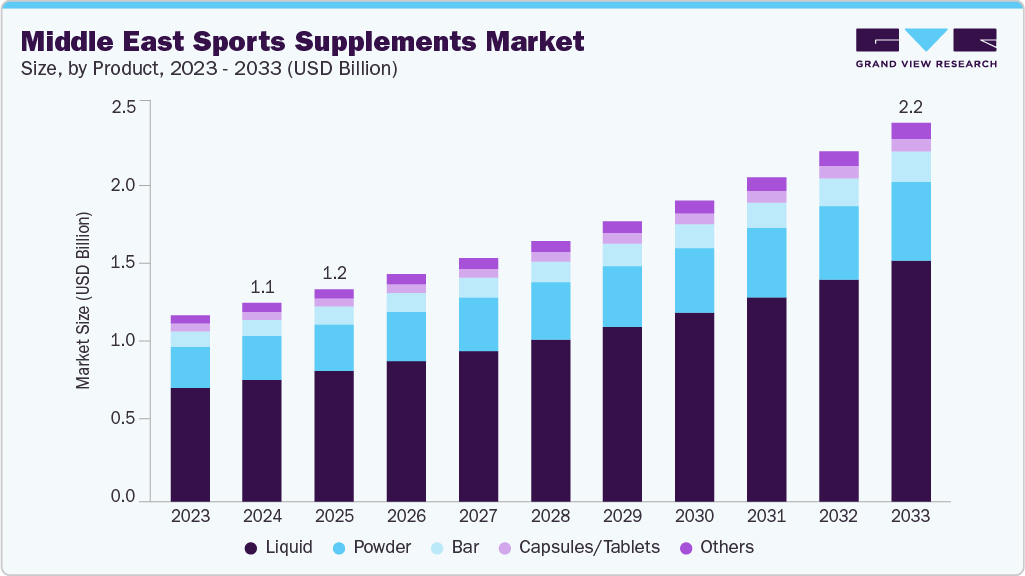

The Middle East sports supplements market size was estimated at USD 1.14 billion in 2024 and is projected to reach USD 2.17 billion by 2033, growing at a CAGR of 7.5% from 2025 to 2033. The consumption of sports supplements in the Middle East is driven by a growing focus on strength, endurance, and body recomposition among fitness-oriented consumers, especially in urban centers across the UAE, Saudi Arabia, and Qatar.

Protein powders, BCAAs, and pre-workout formulas are widely used to support muscle development and recovery as more residents adopt structured training routines through premium gyms and personal coaching platforms. Local participation in marathons, CrossFit events, and combat sports communities has increased supplement adoption among recreational athletes, as well as new gym-goers, turning sports nutrition into part of a broader lifestyle shift rather than a niche performance category.

A key factor behind the surge in demand is the region’s government-backed investment in sports participation and active living. Initiatives such as the Dubai Fitness Challenge and Saudi Arabia’s Vision 2030 sports development program have expanded access to health clubs, community fitness events, and school athletics, creating more regular supplement usage across all age groups. Consumers in the Middle East also tend to associate performance products with visible physical transformation, and this goal-oriented mindset has fuelled uptake among both strength-training users and individuals managing body weight as part of long-term wellness goals.

Clean-label and premium-positioned products are gaining traction across the GCC as consumers increasingly seek formulas free from artificial additives or low-quality fillers. Certifications that guarantee ingredient purity and doping safety are especially valued among semi-professional athletes and fitness enthusiasts preparing for regional competitions. This mirrors a broader lifestyle trend across the Middle East in which shoppers are becoming more label-conscious, seeking transparency in sourcing and manufacturing before committing to a brand. The demand for halal-certified formulations has also increased, prompting international and regional manufacturers to tailor their product lines to local preferences.

Consumer Insights

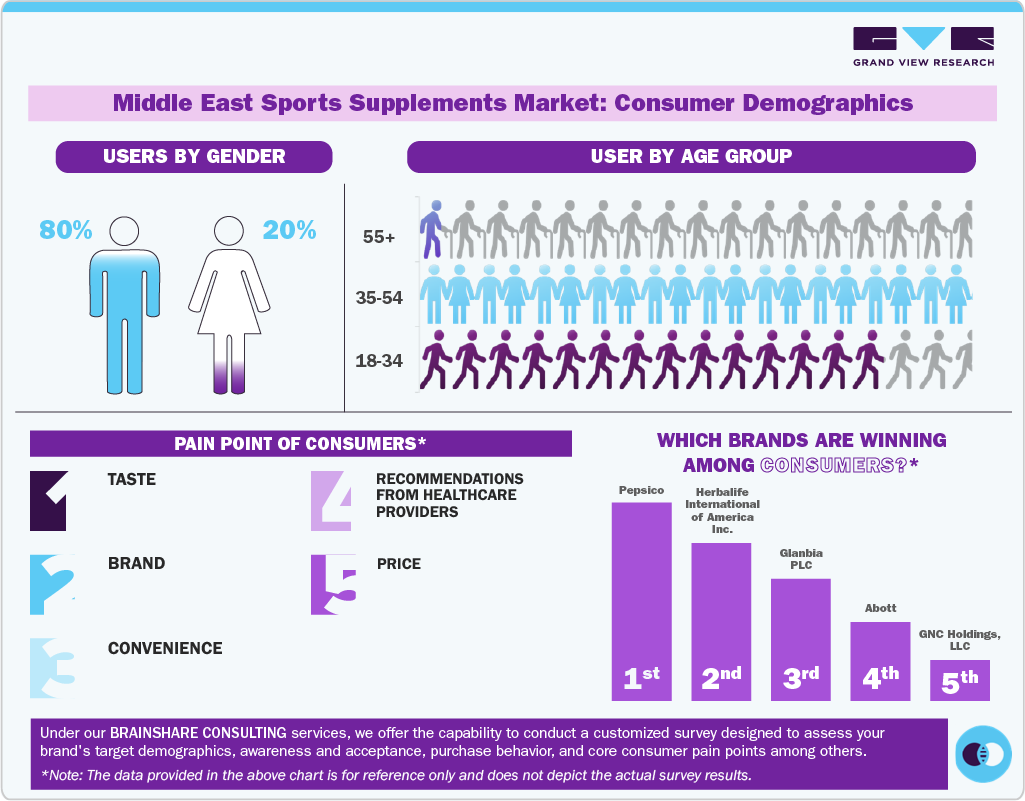

In one recent study, researchers found that among adults attending fitness centers in the Gulf region, the proportion of male gym-goers was substantially higher than that of females, at 80.3% male versus 41.0% female attendees. This gender gap in gym attendance reflects underlying sociocultural, lifestyle, and access differences in the region, where men are more likely to join resistance-training modalities and structured fitness programs.

Within the same population, protein supplement usage was also heavily skewed towards men, with males reporting far greater use of protein formulations compared to females. In fact, the study showed that male gym attendees were twice as likely to consume protein supplements as female attendees. Men’s stronger focus on muscle-building and strength-training goals, whereas female exercisers in the sample were more likely to seek general fitness or health maintenance.

The motivations cited offered further insight: men predominantly endorsed supplement use for muscle gain and hypertrophy, while women’s reasons leaned toward everyday health and nutrition sufficiency. This pattern suggests a segmentation in product demand, where male users are more performance-oriented, which drives higher adoption of protein blends. In contrast, female users may engage more cautiously or with different priorities.

In practical terms, the implication for the sports-supplement market in the Gulf region is that product positioning, communication, and channel strategy should reflect this gender disparity. Brands targeting male gym users may emphasize strength, size, recovery, and training intensity. In contrast, those targeting female exercisers may need to emphasize wellness, balanced nutrition, safe usage, and a lifestyle that suits them.

Product Insights

The liquid sports supplements segment led the Middle East sports supplements industry, accounting for a revenue share of 61.80% in 2024. This underscores the strong preference for ready-to-drink (RTD) formats among gym-goers, recreational athletes, and high-performance professionals. This segment's popularity is closely tied to fast-paced lifestyles, especially in urban hubs, where early-morning and late-night fitness routines demand quick and portable nutrition. RTD offerings, such as Muscle Milk’s shelf-stable protein beverages, exemplify this consumer behavior, delivering instant post-workout recovery without the need for measuring, mixing, or additional equipment.

The demand for other sports supplements is projected to grow at a CAGR of 7.4% over the forecast period, fueled by rising interest in functional nutrition beyond traditional protein powders. Brands are innovating with regionally relevant superfoods, added micronutrients, higher fiber, and reduced sugar to appeal to health-conscious consumers who rely on bars and bites not just for workouts, but as convenient, on-the-go fuel. In markets such as the UAE and Saudi Arabia, active lifestyle enthusiasts and young professionals increasingly view premium protein bars as cleaner, guilt-free alternatives to conventional snacks or sweets, driving steady growth across supermarkets, gyms, and online platforms.

Source Insights

Animal-based sports supplements led the Middle East sports supplements market with a revenue share of 82.61% in 2024, reflecting the region’s strong preference for high-impact, protein-dense formulations. The training culture in countries like Saudi Arabia, the UAE, and Kuwait is centered on resistance training, physique enhancement, and strength-based goals, leading athletes and gym-goers to favor fast-absorbing protein sources such as whey, casein, and egg. These dairy- and egg-derived options continue to dominate post-workout routines, as consumers prioritize quick muscle recovery, lean mass gains, and precise nutrient timing. In the Middle East, whey isolate and egg protein are particularly regarded as premium, performance-oriented choices that deliver effective amino acid delivery and visible results.

Plant-based sports supplements are projected to grow at a CAGR of 9.1% over the forecast period. Pea, rice, and hemp protein blends are increasingly preferred by fitness enthusiasts seeking gentler digestion and sustained energy during post-workout recovery. Although plant proteins naturally offer lower levels of certain essential amino acids compared to whey or egg-derived sources, regional brands have responded by formulating complementary ingredient mixes to provide complete amino acid profiles. Pea protein, in particular, has emerged as one of the fastest-growing vegan bases in the Middle East, valued for its robust amino acid coverage, smooth texture, and reduced likelihood of bloating or gastric discomfort.

Distribution Channel Insights

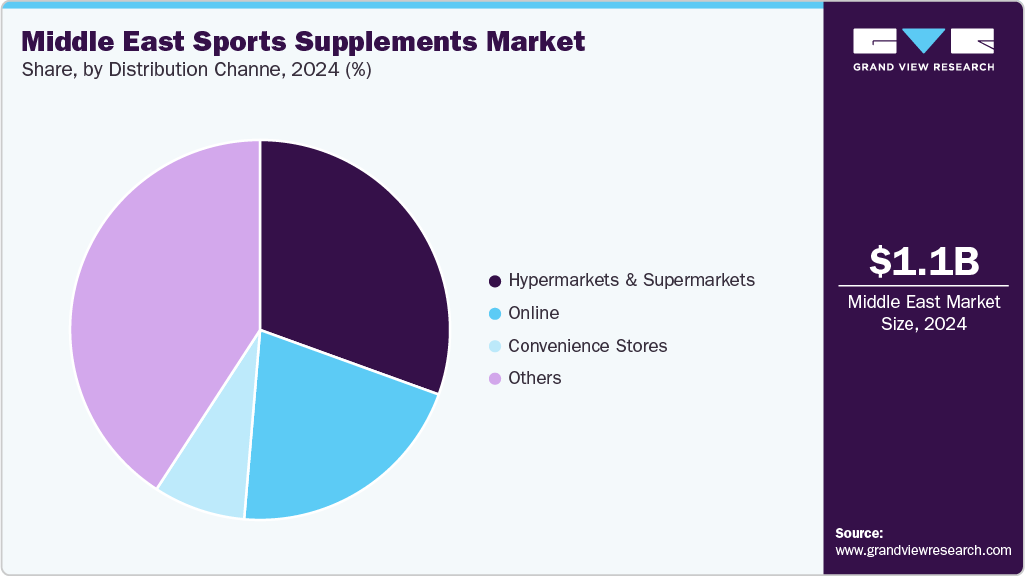

Sports supplements sold through other retail channels accounted for 40.82% of the Middle East sports supplements industry in 2024, driven by the expanding presence of performance nutrition in pharmacies and wellness-focused general stores. Consumers increasingly purchase protein powders, RTD beverages, creatine blends, and electrolyte mixes during routine errands or online shopping sessions, bypassing the need for specialty nutrition outlets. This shift has broadened product exposure, encouraged spontaneous trials, and attracted lifestyle-driven buyers, particularly those seeking convenient and trusted formats from familiar retail environments and digital storefronts.

Online sales of sports supplements are projected to grow at a CAGR of 9.2% over the forecast period, as digital platforms offer shoppers significantly broader access to global and niche performance nutrition brands. E-commerce channels, ranging from leading regional marketplaces to brand-owned webstores, enable Middle East consumers to browse specialized vegan blends, advanced recovery formulas, and limited-edition drops that are rarely stocked in physical retail spaces. The ability to compare ingredient lists, study verified user feedback, and evaluate dosage transparency is a key driver of trust among younger buyers who approach supplement decisions much like they assess wearable tech or athletic gear. For many consumers across the UAE, Saudi Arabia, and Qatar, online shopping has become the preferred method for discovering, personalizing, and restocking performance supplements with consistent ease and precision.

Regional Insights

Saudi Arabia accounted for a 42.44% revenue share of the Middle East sports supplements market in 2024, underscoring the country’s strong inclination toward high-performance, protein-focused nutrition. The nation’s fast-growing gym culture, centered on muscle building, strength training, and aesthetic fitness, has made fast-absorbing protein sources like whey, casein, and egg protein the preferred post-workout choices. These dairy- and egg-derived supplements continue to dominate post-training routines in Saudi Arabia, as fitness enthusiasts place a high value on rapid muscle repair, increased lean mass, and optimal nutrient timing. Within the country, whey isolate and egg protein are widely perceived as premium, results-driven options that support intense training regimens and deliver visible performance gains.

The UAE sports supplements market is projected to grow at a CAGR of 7.2% from 2025 to 2033. Pea, rice, and hemp protein blends are increasingly preferred by fitness enthusiasts seeking gentler digestion and sustained energy during post-workout recovery. Although plant proteins naturally offer lower levels of certain essential amino acids compared to whey or egg-derived sources, regional brands have responded by formulating complementary ingredient mixes to provide complete amino acid profiles. Pea protein, in particular, has emerged as one of the fastest-growing vegan bases in the Middle East, valued for its robust amino acid coverage, smooth texture, and reduced likelihood of bloating or gastric discomfort.

Key Middle East Sports Supplements Company Insights

The Middle East sports supplements industry is characterized by a blend of long-established nutrition brands and fast-growing challengers that compete on the basis of formulation efficacy, ingredient transparency, and performance credibility. Major players continue to prioritise clean-label positioning, third-party testing, and athlete-safe formulations to meet the expectations of both competitive users and mainstream fitness consumers. Distribution is highly diversified in the U.S., with brands scaling through specialty nutrition retailers like GNC and Vitamin Shoppe.

Bulk-value channels, such as Costco, gym partnerships, and digitally native direct-to-consumer (D2C) storefronts, cater to repeat buyers. Sponsorships with college athletics, CrossFit communities, combat sports, and influencer-led fitness ecosystems play a crucial role in brand recall, enabling companies to establish trust more quickly through performance association rather than traditional advertising. The market is also heavily segmented by use case, from whey-based strength and muscle products to vegan recovery blends, electrolyte hydration sticks, and RTD performance beverages, enabling Middle East manufacturers to tailor offerings to highly specific training styles and lifestyle routines within the broader active population.

-

Universal Nutrition is a long-standing brand in the sports supplement market, recognized for its specialized products targeting athletes, bodybuilders, and fitness enthusiasts. Its flagship Animal line includes a diverse range of supplements such as Animal Pak for comprehensive performance nutrition, Animal Cuts for fat metabolism, Animal Pump for pre-workout energy and focus, and Animal Whey for muscle recovery and growth. The company focuses on delivering scientifically formulated blends of high-quality proteins, amino acids, creatine, and essential nutrients to meet the demands of intensive training. With over four decades of industry experience, Universal Nutrition has established a strong credibility by aligning its products with the performance goals of serious athletes, positioning its offerings as essential tools for enhancing strength, endurance, and overall athletic development.

-

GNC Holdings, LLC is a global leader in health and wellness, offering a diverse range of sports supplements designed to enhance performance, endurance, strength, and recovery. Its product portfolio features well-known lines such as GNC AMP Wheybolic, Pro Performance Whey Protein, Beyond Raw LIT pre-workout, AMP Creatine HCl, and AMP BCAA Advanced, addressing the needs of both casual fitness enthusiasts and serious athletes. These formulations combine high-quality proteins, amino acids, creatine, and electrolytes to support energy, muscle development, and post-workout recovery. With a strong focus on scientific innovation and quality, GNC positions its sports nutrition products as essential tools for achieving fitness goals. It reinforces its reputation as a trusted provider of effective, result-driven solutions for active lifestyles.

Key Middle East Sports Supplements Companies:

- The Simply Good Foods Company

- Maxinutrition

- Universal Nutrition

- GNC Holdings, LLC

- Glanbia PLC

- NOW Foods

- SciTec, Inc.

- THG PLC

- PepsiCo

- Abbott

- Herbalife

Recent Developments

-

In October 2025, Iovate Health Sciences officially launched its MuscleTech brand in the Middle East with a debut at the 2025 Dubai Muscle Show. The announcement marks a decisive step in bringing its science-driven sports nutrition products to regional consumers. As part of the launch, MuscleTech introduced new product formats and flavors customized for Middle Eastern preferences, alongside live demonstrations, athlete appearances, and partnerships with local distributors. The move underscores Iovate’s commitment to expanding its footprint in the rapidly growing performance nutrition market of the Middle East and North Africa.

-

In October 2024, BioTechUSA Group announced the establishment of a new regional hub in the UAE to strengthen its presence in the Middle East. The move supports the company’s participation in the Dubai Muscle Show and reflects its strategic intent to leverage the UAE’s logistics and trade advantages to serve neighboring markets. The company cited its halal-certified production, recent entry into Iraq, and upcoming expansion into Saudi Arabia as evidence of its commitment to the region. The regional hub will enable BioTechUSA to streamline distribution, partner development, and event marketing across the Middle East and beyond.

Middle East Sports Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.22 billion

Revenue forecast in 2033

USD 2.17 billion

Growth rate

CAGR of 7.5% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, distribution channel, region

Regional scope

Middle East

Country Scope

Saudi Arabia; UAE; Qatar

Key companies profiled

The Simply Good Foods Company; Maxinutrition; Universal Nutrition; GNC Holdings, LLC; Glanbia PLC; NOW Foods; SciTec, Inc.; THG PLC; PepsiCo; Abott; Herbalife

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Sports Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East sports supplements market report based on product, source, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Capsules/Tablets

-

Powder

-

Liquid

-

Bar

-

Others

-

-

Source Outlook (Revenue, USD Billion, 2021 - 2033)

-

Animal-Based

-

Plant-Based

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Qatar

-

Frequently Asked Questions About This Report

b. The Middle East sports supplements market was estimated at USD 1.14 billion in 2024 and is expected to reach USD 1.22 billion in 2025.

b. The Middle East sports supplements market is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2033 to reach USD 2.17 billion by 2033.

b. Liquid sports supplements accounted for a revenue share of 61.80% in the year 2024 in the Middle East sports supplements industry, largely due to their convenience and suitability for fast-paced, fitness-oriented lifestyles. Their dominance is also driven by increased gym culture, youth athletics, and portability that supports regional demand for quick, hydration-based performance products

b. Key players in the Middle East sports supplements market are The Simply Good Foods Company; Maxinutrition; Universal Nutrition; GNC Holdings, LLC; Glanbia PLC; NOW Foods; SciTec, Inc.; THG PLC; PepsiCo; Abott; Herbalife

b. The Middle East sports supplements market is being propelled by a growing emphasis on fitness and active lifestyles, supported by expanding gym memberships and government-backed wellness initiatives. Additionally, rising disposable income and the influence of global sports nutrition trends are encouraging consumers to adopt premium, performance-focused supplement products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.