- Home

- »

- Specialty Polymers

- »

-

Middle East Waterproofing Chemicals Market Report, 2033GVR Report cover

![Middle East Waterproofing Chemicals Market Size, Share & Trends Report]()

Middle East Waterproofing Chemicals Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Polymer, Bitumen, SBS), By Application, By Country, And Segment Forecasts, Key Companies And Competitive Analysis

- Report ID: GVR-4-68040-721-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Waterproofing Chemicals Market Summary

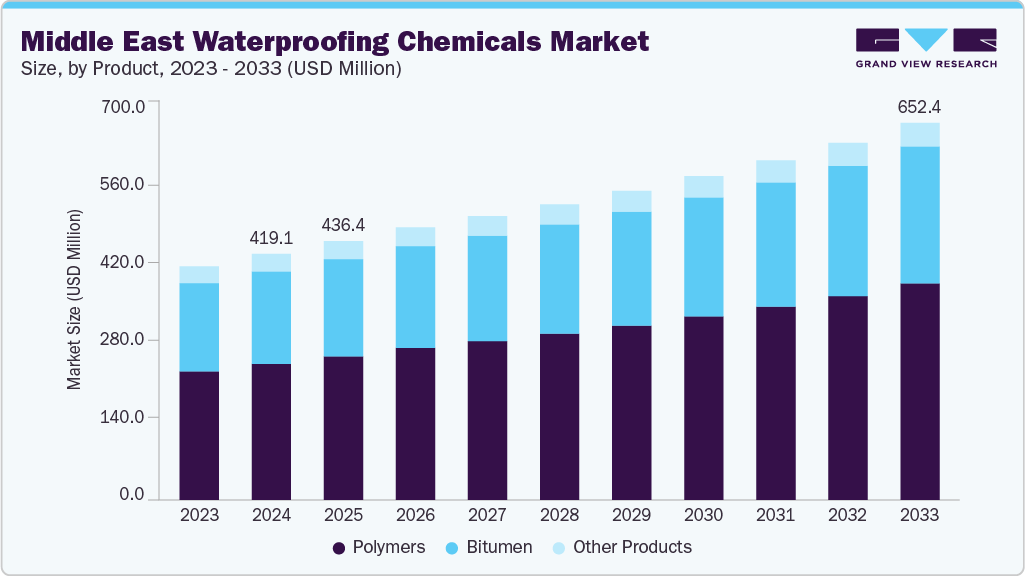

The Middle East waterproofing chemicals market size was estimated at USD 419.1 million in 2024 and is projected to reach USD 652.4 million by 2033, growing at a CAGR of 5.2% from 2025 to 2033. The market is driven by the rapid expansion of infrastructure and construction projects across the Middle East, particularly in Saudi Arabia and the UAE, supported by mega-projects under Vision 2030 and large-scale urban development plans.

Key Market Trends & Insights

- The waterproofing chemicals market in Oman is expected to grow at the fastest CAGR of 6.1% from 2025 to 2033 in terms of revenue.

- By product, the polymers segment is expected to grow at the fastest CAGR of 5.6% from 2025 to 2033 in terms of revenue.

- By product, the polymers segment dominated the market with the largest revenue share of 55.8% in 2024.

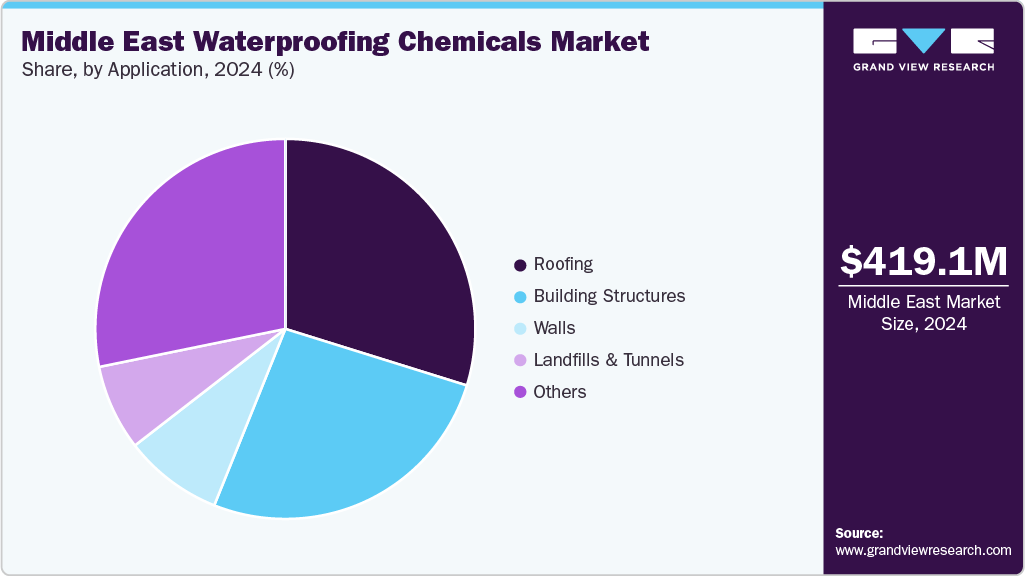

- By application, the roofing segment captured the largest revenue share of 29.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 419.1 Million

- 2033 Projected Market Size: USD 652.4 Million

- CAGR (2025-2033): 5.2%

Rising demand for durable, energy-efficient, and climate-resilient structures is accelerating the adoption of advanced waterproofing solutions, including PVC and TPO membranes. Refurbishing aging infrastructure, increasing investments in water conservation projects such as desalination plants and reservoirs, and stricter regulations on building sustainability and safety standards propel steady market growth. Significant opportunities lie in the rising penetration of polymer-based waterproofing systems, driven by their superior performance in extreme heat and UV conditions prevalent in the Middle East. Growth in logistics hubs, data centers, and industrial complexes offers a high-value segment for single-ply membranes and spray-applied solutions. Moreover, the shift towards green building certifications, reflective roof systems, and sustainable materials creates avenues for innovative products with enhanced energy efficiency and reduced VOC emissions. Expanding geomembrane demand in landfills, tunnels, and water-retaining structures further strengthens long-term market prospects.

The market faces challenges related to high installation costs of advanced polymer systems compared to traditional bitumen, coupled with fluctuating raw material prices for polymers and bitumen derivatives. A shortage of skilled applicators for specialized systems such as TPO, PVC, and spray-applied membranes often leads to inconsistent application quality and warranty claims. In addition, hot-weather constraints, strict hot-works regulations at critical sites, and complex logistics for giga-project deliveries can delay project execution and impact margins for suppliers and contractors.

Market Concentration & Characteristics

The Middle East waterproofing chemicals industry is moderately fragmented. Key players such as BASF SE, Sika AG, Dow, Carlisle Companies Inc., and DuPont dominate the market through extensive product portfolios and strong regional networks. BASF and Sika focus on advanced bitumen-modified and cementitious systems, backed by strong technical services and applicator networks, while Dow and DuPont emphasize high-performance polymer-based solutions, particularly TPO and PVC membranes aligned with green building regulations. Carlisle Companies leverages its expertise in single-ply roofing systems to cater to logistics parks, commercial buildings, and data centers in Saudi Arabia and the UAE.

These players focus on local manufacturing, innovation, and partnerships to strengthen their market share. BASF and Sika invest in regional production and R&D to meet specific climatic and regulatory demands, while Dow and DuPont develop reflective, low-VOC materials to support sustainable construction initiatives. Carlisle enhances market penetration through collaborations with contractors and comprehensive warranty programs. Across the board, training initiatives, digital project support, and warranty-backed systems are central to their strategy in both new-build and refurbishment projects.

Product Insights

The polymers segment held the largest revenue share of 55.8% in 2024 due to its superior performance, durability, and suitability for the Middle East’s extreme climatic conditions. Products such as PVC, TPO, and EPDM membranes are increasingly favored for large-scale commercial, industrial, and infrastructure projects, driven by their heat and UV resistance, flexibility, and long service life. PVC membranes dominate premium roofing and podium deck applications, while TPO has witnessed significant adoption in logistics parks, airports, and data centers due to its reflective properties and environmental compliance. EPDM, though niche, is valued in tunnels, basements, and specialty detailing for its high elongation and chemical resistance. Other polymers, including polyurethane, acrylics, and polyurea, are widely used for spray-applied systems in podiums, wet areas, and complex structures requiring rapid installation and seamless coverage.

The bitumen segment, including SBS and APP-modified membranes, remains a key part of the market due to its cost-effectiveness, established installer base, and suitability for residential, municipal, and low-slope applications. SBS-modified bitumen offers a balance of flexibility and heat tolerance, making it popular for widespread use, while APP-modified bitumen is preferred in regions with higher UV exposure. Other bitumen products, such as self-adhesive sheets and cold-applied emulsions, are gaining traction in areas where hot works are restricted. The other product category, comprising cementitious waterproofing, bentonite mats, silane/siloxane repellents, and HDPE/LLDPE geomembranes, serves critical niche applications in water-retaining structures, landfills, and tunnels, reflecting steady demand from infrastructure and utility projects.

Application Insights

The roofing segment dominated the market with a 29.8% share in 2024, owing to the extensive demand for durable and energy-efficient waterproofing systems in large-scale commercial, industrial, and residential developments across the Middle East. Mega infrastructure projects, logistics hubs, data centers, and urban housing initiatives in Saudi Arabia and the UAE have significantly driven the adoption of advanced polymer-based membranes such as TPO and PVC for their superior UV resistance, reflectivity, and long service life. In addition, refurbishing aging low-slope and flat roofs has further fueled demand, with single-ply membranes and bitumen-based systems widely utilized to enhance structural durability and meet evolving green building standards.

Other key applications include walls, building structures, landfills & tunnels, and miscellaneous areas such as bridges, podium decks, and planters. Walls rely heavily on bituminous emulsions, cementitious coatings, and spray-applied solutions for below- and above-grade protection, while building structures such as basements, wet areas, and water tanks increasingly adopt crystalline and HDPE liner systems for long-term water ingress prevention. Due to ongoing waste management, metro, and utility expansion projects, landfills and tunnels represent a steady demand center for geomembranes, bentonite mats, and polyurea coatings. Miscellaneous applications, including green roofs and solar retrofit detailing, are emerging segments, driven by sustainability targets and enhanced building performance requirements.

Country Insights

The Middle East waterproofing chemicals market is growing steadily, driven by large-scale infrastructure projects, rapid urbanization, and strict sustainability regulations across countries such as the UAE, Qatar, and Oman. Increasing polymer-based membranes like TPO and PVC use in commercial, industrial, and logistics projects, rising refurbishment activities, and expanding water infrastructure boost demand for high-performance and energy-efficient waterproofing systems.

Saudi Arabia Waterproofing Chemicals Market Trends

The waterproofing chemicals market in Saudi Arabia leads the regional market, supported by mega-projects under Vision 2030, including NEOM and The Line, which drive strong demand for bitumen and advanced polymer membranes. The shift toward cold-applied and self-adhesive solutions, growing adoption of TPO and PVC in premium applications, and substantial investments in water and utility infrastructure further strengthen market growth in the country.

Key Middle East Waterproofing Chemicals Company Insights

Some key players operating in the Middle East market include BASF SE, Sika AG, and Dow.

-

BASF SE is a key player in the Middle East market, offering a comprehensive range of solutions, including polymer-modified bitumen membranes, cementitious coatings, and liquid-applied waterproofing systems tailored for the region’s extreme climatic conditions. The company focuses on serving large-scale infrastructure, industrial, and commercial projects, leveraging its strong R&D capabilities and global expertise to deliver durable, energy-efficient, and VOC-compliant products. BASF strengthens its market presence through localized production, strategic partnerships with contractors and applicators, and a robust technical service network. It enables faster project execution and enhanced warranty-backed solutions across applications such as roofing, building structures, and water-retaining systems.

Key Middle East Waterproofing Chemicals Companies:

- Sika AG

- BASF SE

- Dow

- Carlisle Companies Inc.

- DuPont

- Mitsubishi Chemical Group Corporation

- Evonik Industries AG

- Bostik

- Wacker Chemie AG

- MAPEI S.p.A.

Middle East Waterproofing Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 436.4 million

Revenue forecast in 2033

USD 652.4 million

Growth rate

CAGR of 5.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Country scope

Oman; Kuwait; Saudi Arabia; UAE; Qatar; Bahrain; Isael; Rest of Middle East

Key companies profiled

Sika AG; BASF SE; Dow; Carlisle Companies Inc.; DuPont; Mitsubishi Chemical Group Corporation; Evonik Industries AG; Bostik; Wacker Chemie AG; MAPEI S.p.A.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Waterproofing Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the Middle East waterproofing chemicals market report based on product, application, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

Polymer

-

PVC

-

TPO

-

EPDM

-

Other Polymers

-

-

Bitumen

-

SBS

-

APP

-

Other Bitumen

-

Other Products

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

Roofing

-

Walls

-

Building Structures

-

Landfills & Tunnels

-

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

Oman

-

Kuwait

-

Saudi Arabia

-

UAE

-

Qatar

-

Bahrain

-

Israel

-

Rest of Middle East

-

Frequently Asked Questions About This Report

b. The Middle East waterproofing chemicals market size was estimated at USD 419.1 million in 2024 and is expected to reach USD 436.4 million in 2025.

b. The Middle East waterproofing chemicals market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2033 to reach USD 652.4 million by 2033.

b. The polymers segment dominated the market in 2024 due to its superior durability, UV and heat resistance, and suitability for large-scale commercial, industrial, and infrastructure projects in the Middle East. Its growing adoption in energy-efficient roofing and complex structures further strengthened its market share.

b. Some of the key players operating in the Middle East waterproofing chemicals market include Sika AG, BASF SE, Dow, Carlisle Companies Inc., DuPont, Mitsubishi Chemical Group Corporation, Evonik Industries AG, Bostik, Wacker Chemie AG, and MAPEI S.p.A..

b. The market is driven by large-scale infrastructure development, rapid urbanization, and rising demand for durable, energy-efficient waterproofing solutions across commercial, industrial, and residential sectors in the Middle East. The stringent building regulations and increasing refurbishment activities are accelerating product adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.