- Home

- »

- Alcohol & Tobacco

- »

-

Middle East Wine Market Size & Share, Industry Report 2033GVR Report cover

![Middle East Wine Market Size, Share & Trends Report]()

Middle East Wine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Table Wine, Dessert Wine, Sparkling Wine), By Distribution Channel (On-Trade, Off-Trade), By Country, and Segment Forecasts

- Report ID: GVR-4-68040-806-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Wine Market Summary

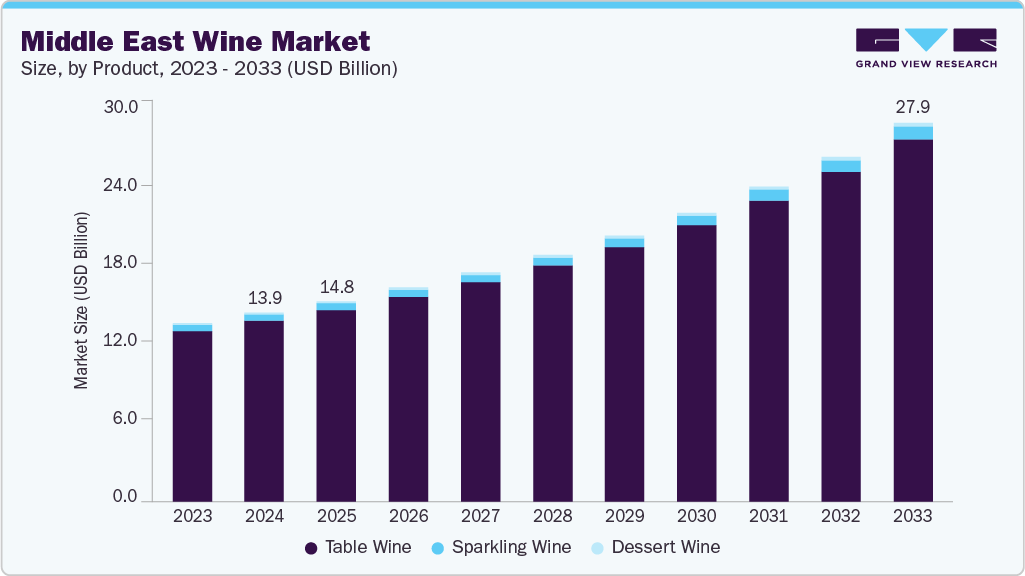

The Middle East wine market size was estimated at USD 13.91 billion in 2024 and is projected to reach USD 27.90 billion by 2033, growing at a CAGR of 8.3% from 2025 to 2033. The market growth is attributed to the rising influx of international tourists, the expansion of luxury hotels and fine dining establishments, and the growing acceptance of premium alcoholic beverages in relatively liberal markets such as the UAE, Israel, and Lebanon.

Key Market Trends & Insights

- By country, the UAE led the wine market with a share of 36.6% in 2024.

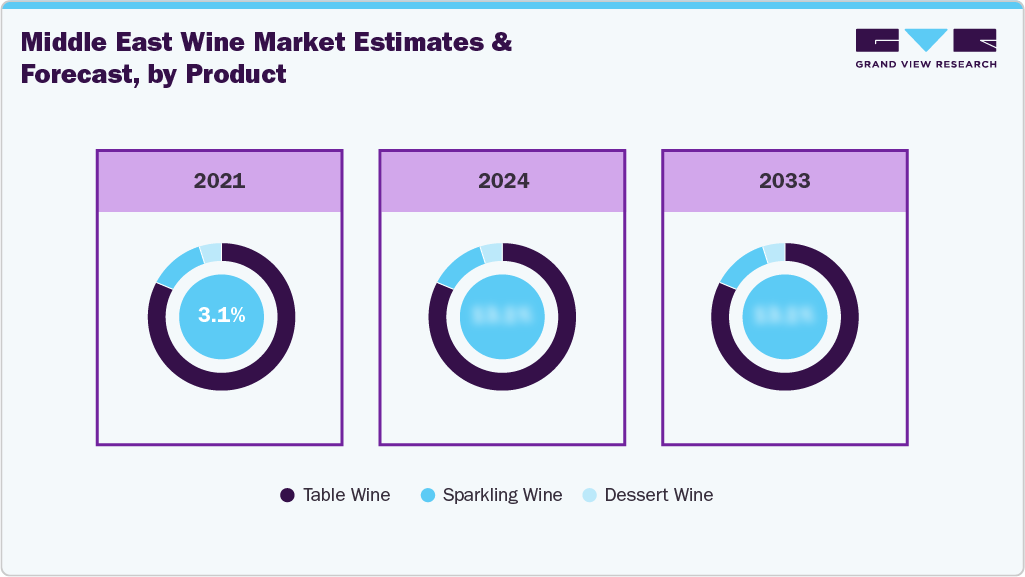

- By product, table wine led the market and accounted for a share of 95.7% in 2024.

- By distribution channel, the off-trade segment led the market, accounting for an 88.2% share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13.91 Billion

- 2033 Projected Market Size: USD 27.90 Billion

- CAGR (2025-2033): 8.3%

In addition, increasing consumer inclination toward high-quality imported and locally produced wines, the emergence of boutique wineries, and the widening availability of diverse wine varieties across retail and on-trade channels are collectively driving the steady growth of the regional market. The Middle East wine industry is witnessing a notable transformation driven by evolving consumer preferences, liberalization trends, and the expanding tourism and hospitality industries. Countries such as the UAE, Israel, and Lebanon are leading this shift, with rising demand for premium and imported wines, as consumers increasingly associate wine consumption with sophistication and lifestyle experiences. The growing influence of Western dining culture, coupled with the proliferation of fine dining restaurants, luxury hotels, and wine bars, has also elevated wine visibility across the region. Besides, boutique and artisanal wine producers are gaining traction, with consumers showing a preference for organic, sustainable, and locally produced wines that reflect authenticity and craftsmanship.

Market growth is further supported by regulatory and social developments that are slowly making alcoholic beverages more accessible in certain markets. Expanding distribution through retail stores, duty-free outlets, and e-commerce platforms is enhancing product availability, particularly for premium and imported labels. Rising disposable incomes, rapid urbanization, and a younger population with more cosmopolitan tastes are encouraging experimentation with new wine varieties and brands. Furthermore, strategic marketing by international producers, collaborations with hospitality chains, and the growing importance of tourism and events in countries like the UAE and Israel are strengthening the regional wine consumption landscape.

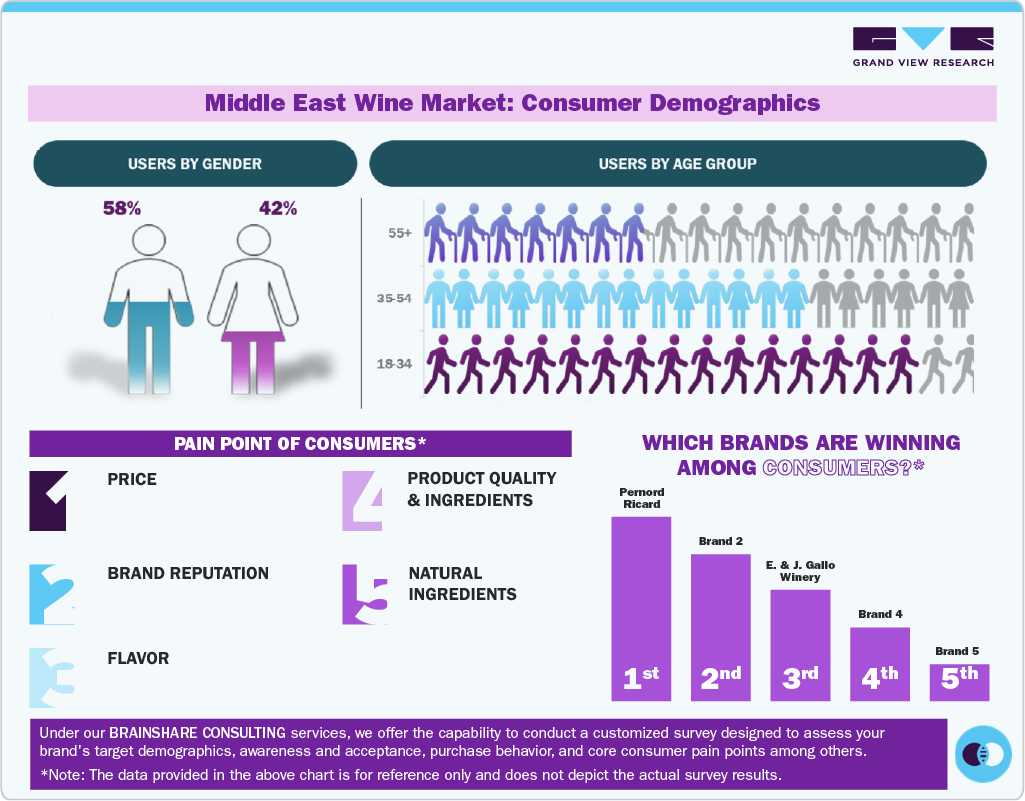

Consumer Insights

Consumer buying behavior in the Middle East wine market varies significantly across demographics such as gender and age group, reflecting shifting social norms and lifestyle influences. Traditionally, wine consumption in the region has been predominantly male-dominated, particularly among expatriates and high-income professionals; however, recent trends indicate a gradual increase in female participation, especially in urban centers such as Dubai, Tel Aviv, and Beirut. Women are increasingly engaging with wine as part of social and dining experiences, favoring lighter varieties such as rosé and white wines, and showing higher interest in premium and boutique labels. In contrast, male consumers often exhibit stronger brand loyalty and a preference for red, full-bodied wines, with their purchasing decisions influenced by factors such as status, taste, and brand reputation.

Age also plays a key role in shaping wine consumption patterns. The 25-44 age group represents the largest consumer base, driven by exposure to global trends, higher disposable income, and active social lifestyles. This segment shows a preference for experiential consumption, including wine tastings, pairing events, and curated collections. Older consumers (45 years and above) tend to favor established brands and classic varieties, valuing quality and tradition over novelty. Meanwhile, younger adults (21-25 years) are emerging as experimental consumers, drawn to accessible price points, online availability, and lifestyle branding.

Product Insights

The table wine segment held the largest market share of 95.7% in 2024. The market for table wine is increasing due to rising consumer preference for casual and affordable wine options for everyday consumption. The growth of wine culture, particularly among millennials and young adults, along with an increase in social drinking occasions, has driven demand. Additionally, the expansion of online wine retail, improved accessibility, and the popularity of food and wine pairings have contributed to market growth. The trend toward organic and sustainably produced wines is also attracting health-conscious consumers, further fueling demand.

The sparkling wine segment is projected to register the fastest CAGR of 9.2% from 2025 to 2033. The market for sparkling wine is increasing due to rising consumer preference for celebratory and casual drinking occasions. Growing demand for premium and diverse sparkling wine varieties, including Prosecco, Champagne, and Cava, has expanded the market. Furthermore, younger consumers are embracing sparkling wine for its refreshing taste and lower alcohol content. The rise of e-commerce and direct-to-consumer sales has further boosted accessibility, while the trend toward food pairings and mixology has increased its appeal in the hospitality sector.

Distribution Channel Insights

The sale of wine through the off-trade segment led the market in 2024, accounting for the largest revenue share of 88.2%. This dominance is primarily attributed to the increasing availability of wine across various retail formats, including supermarkets, hypermarkets, specialty liquor stores, and duty-free outlets. Consumers are increasingly opting to purchase wine for home consumption, private gatherings, and gift-giving purposes due to its convenience and the wider variety of products available. In addition, promotional discounts, attractive packaging, and the expansion of e-commerce platforms offering doorstep delivery have further fueled off-trade wine sales across major Middle Eastern markets, including the UAE, Israel, and Lebanon.

The on-trade delivery channel is expected to account for the fastest CAGR of 9.6% from 2025 to 2033, driven by the rapid expansion of luxury hotels, fine dining restaurants, and upscale bars across key tourism and business hubs in the Middle East. Increasing international visitor arrivals and rising demand for premium dining experiences are driving a surge in wine consumption within the hospitality sector. Moreover, partnerships between global wine brands and high-end restaurants, along with curated wine lists and tasting events, are enhancing consumer exposure and supporting strong growth in on-trade wine sales throughout the forecast period.

Country Insights

UAE Wine Market Trends

The UAE wine industry accounted for a revenue share of 36.6% in 2024, emerging as the largest market in the Middle East. The country’s dominance is primarily driven by its liberalized alcohol policies, strong tourism ecosystem, and the presence of world-class hospitality and retail infrastructure. Cities like Dubai and Abu Dhabi have become regional hubs for luxury dining, international events, and premium lifestyle experiences, all of which contribute to robust wine consumption. The expanding expatriate population and rising disposable incomes have further boosted off-trade and on-trade sales across supermarkets, duty-free outlets, and high-end restaurants. Moreover, increasing availability of global wine brands, strategic imports, and consumer inclination toward premium and artisanal wines continue to strengthen the UAE’s position as a key market for both retail and hospitality-driven wine sales, significantly influencing regional wine trade dynamics and market growth.

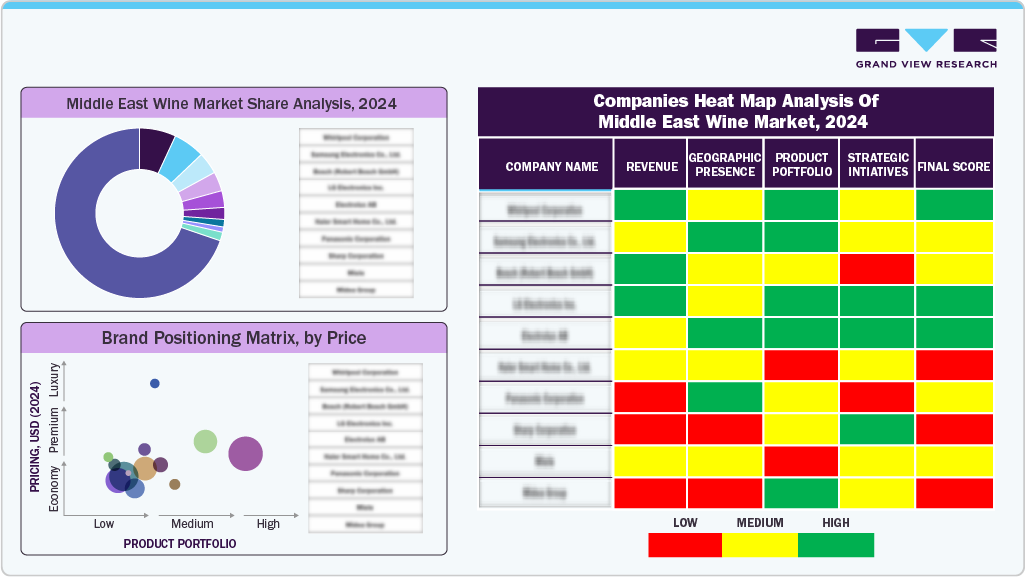

Key Middle East Wine Company Insights

The market is fragmented, with several global and regional competitors present. These companies are investing heavily in acquisitions and promotions to grow their client base and brand loyalty. Furthermore, these firms are leveraging emerging technologies, such as blockchain and artificial intelligence, to enhance the consumer experience and streamline supply chain activities.

Key Middle East Wine Companies:

- E. & J. Gallo Winery

- Constellation Brands, Inc.

- The Wine Group

- Treasury Wine Estates

- Concha Y Toro

- Castel Freres

- Accolade Wines

- Pernod Ricard

- Asahi Group Holdings, Ltd.

- Château Musar

Recent Developments

-

In May 2025, Penfolds and La Chapelle launched the “Grange La Chapelle 2021” limited-edition collectors’ wine in the UAE via African + Eastern.

-

In January 2025, Wild Idol (a luxury alcohol-free sparkling wine brand) announced its expansion into the Middle East, including the UAE.

-

In October 2025, Lay & Wheeler (UK fine-wine merchant) announced a partnership with the UAE’s Truebell Marketing & Trading to enter the Middle Eastern market and will operate as “Lay & Wheeler Middle East”.

Middle East Wine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.77 billion

Revenue forecast in 2033

USD 27.90 billion

Growth rate

CAGR of 8.3% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, country

Country scope

UAE; Israel; Egypt

Key companies profiled

E. & J. Gallo Winery; Constellation Brands, Inc.; The Wine Group; Treasury Wine Estates; Concha Y Toro; Castel Freres; Accolade Wines; Pernod Ricard; Asahi Group Holdings, Ltd.; Château Musar

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Middle East Wine Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the Middle East wine market report on the basis of product, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2021-2033)

-

Table Wine

-

Dessert Wine

-

Sparkling Wine

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021-2033)

-

On-Trade

-

Off-Trade

-

-

Country Outlook (Revenue, USD Million, 2021-2033)

-

UAE

-

Israel

-

Egypt

-

Frequently Asked Questions About This Report

b. The Middle East wine market was estimated at USD 13.91 billion in 2024 and is expected to reach USD 14.77 billion in 2025.

b. The Middle East wine market is expected to grow at a compound annual growth rate of 8.3% from 2025 to 2033 to reach USD 27.90 billion by 2033.

b. Based on product type, table wine dominated the Middle East wine market in 2024 with a share of about 95.67%.

b. Key players in the Middle East wine market are E. & J. Gallo Winery, Constellation Brands, Inc., The Wine Group, Treasury Wine Estates, Concha Y Toro, Castel Freres, Accolade Wines, Pernod Ricard, Asahi Group Holdings, Ltd, and Beijing Yanjing Beer Group Co., among others.

b. Key factors driving Middle East wine market growth include rising tourism, expanding expatriate population, premiumization trends, and growing acceptance of social drinking.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.