- Home

- »

- Electronic Devices

- »

-

Multifunctional Printer Market Size, Industry Report, 2033GVR Report cover

![Multifunctional Printer Market Size, Share & Trends Report]()

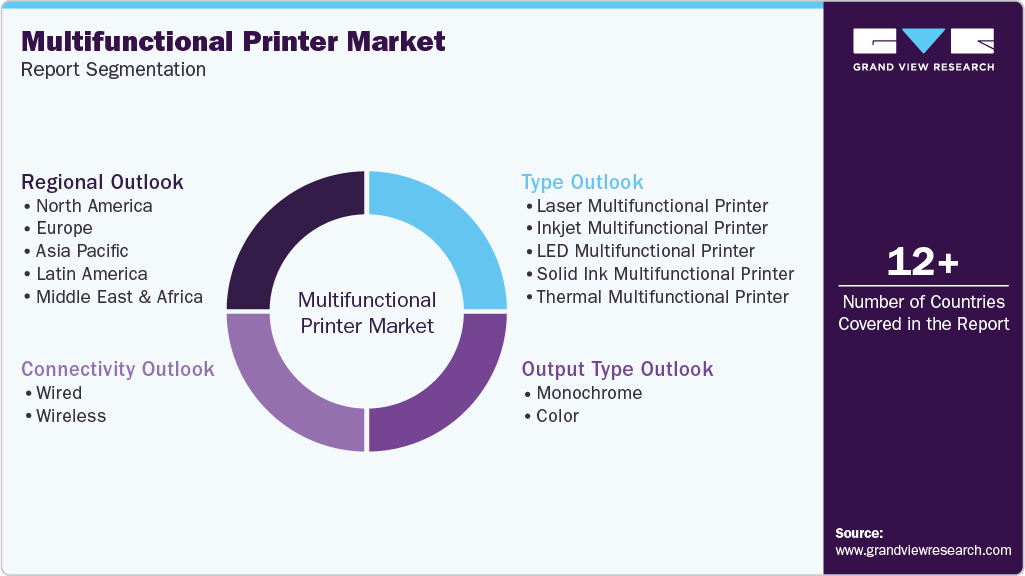

Multifunctional Printer Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Laser, Inkjet, LED, Solid Ink, Thermal), By Output Type (Monochrome, Color), By Connectivity (Wired, Wireless), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-708-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Multifunctional Printer Market Summary

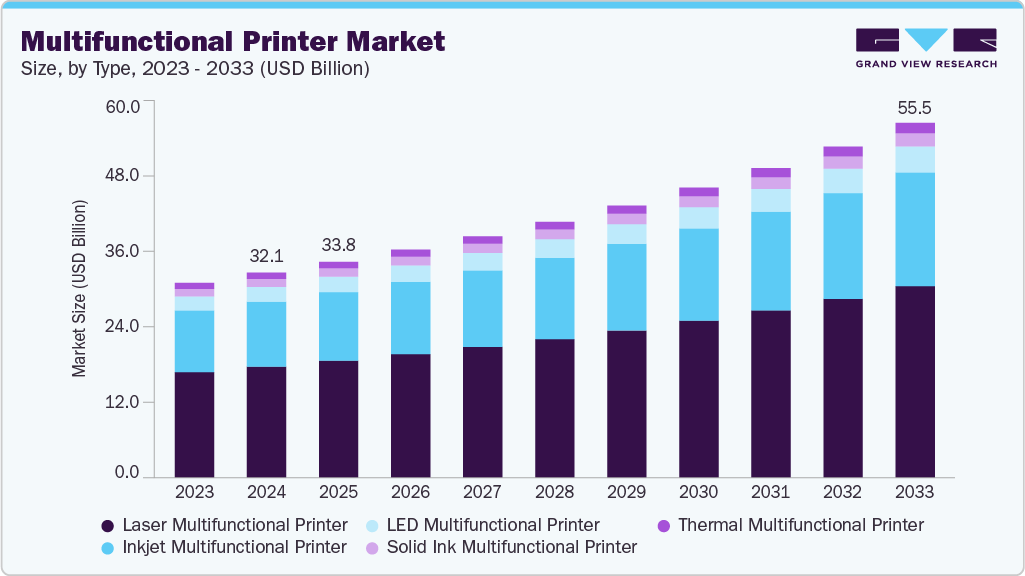

The global multifunctional printer market size was estimated at USD 32.09 billion in 2024 and is projected to reach USD 55.54 billion by 2033, growing at a CAGR of 6.4% from 2025 to 2033, driven by increasing demand for wireless and cloud-enabled printing solutions, rising adoption of multifunctional devices among SMEs and home offices, and the expansion of managed print services across enterprise environments.

Key Market Trends & Insights

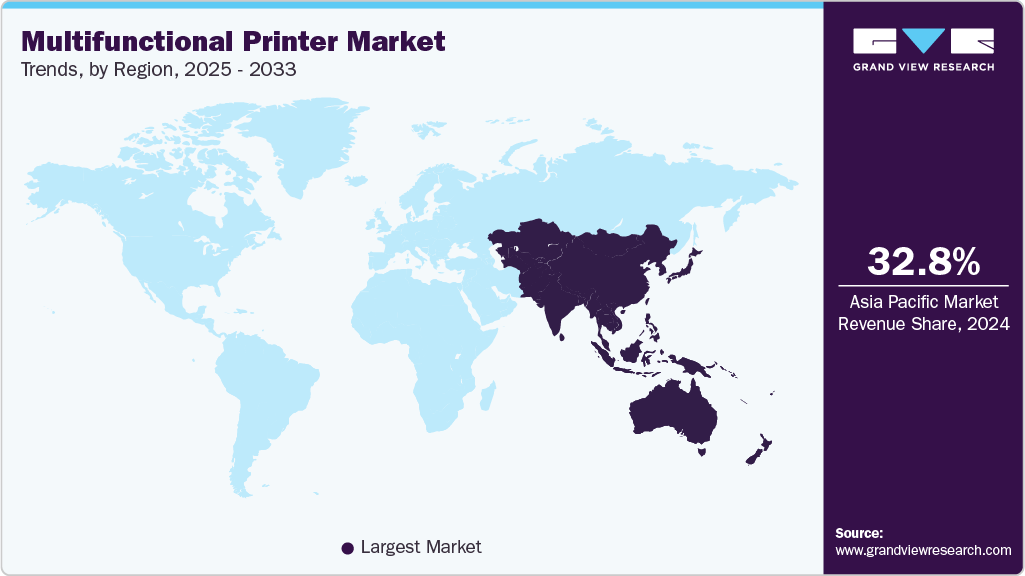

- Asia Pacific dominated the multifunctional printer market with the largest revenue share of 32.8% in 2024.

- The multifunctional printer market in China accounted for the largest market revenue share in 2024.

- By type, the laser multifunctional printer segment led the market with the largest revenue share of 54.3% in 2024.

- By output type, the monochrome segment accounted for the largest market revenue share in 2024.

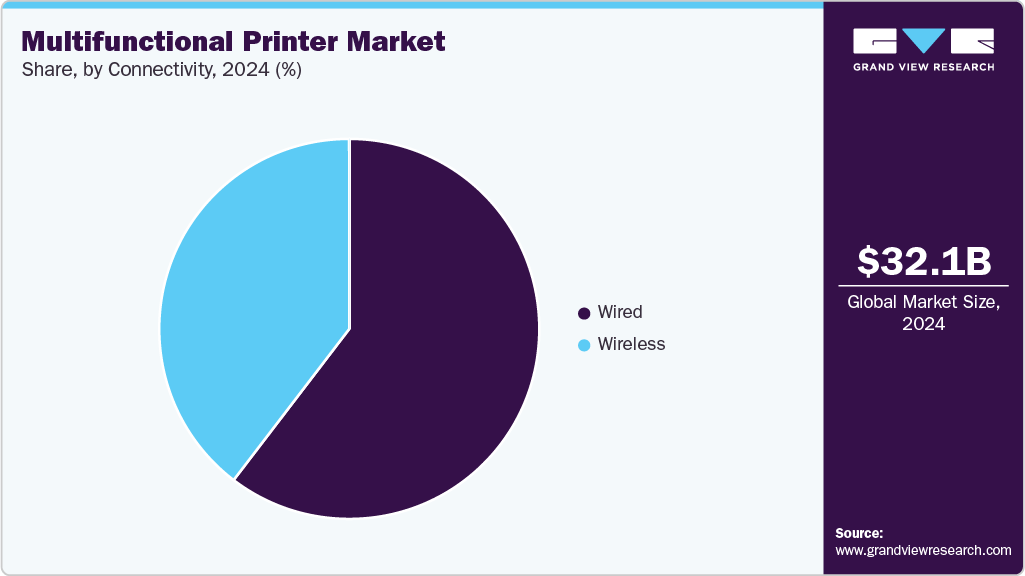

- By connectivity, the wired segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 32.09 Billion

- 2033 Projected Market Size: USD 55.54 Billion

- CAGR (2025-2033): 6.4%

- Asia Pacific: Largest market in 2024

In addition, growing digitalization in emerging markets and the need for cost-effective, space-saving, and energy-efficient printing solutions are further accelerating market growth. The global multifunctional printer industry is being significantly propelled by a combination of workplace transformation, regulatory mandates, and technological convergence. One of the most impactful trends is the expansion of remote and hybrid work environments across both public and private sectors. This shift has extended enterprise printing needs beyond the traditional office, prompting the formalization of remote-printing policies. For instance, U.S. federal guidelines now restrict unsanctioned home printing and enforce strict approval and disposal protocols for printed materials. These measures are influencing product design, pushing OEMs to embed encrypted print queues, mobile-controlled release features, and remote monitoring capabilities into modern MFPs. This evolution is not only addressing security concerns but also aligning with the decentralized nature of today’s workforce, thereby boosting demand across both enterprise and small office/home office segments.

Simultaneously, the market is experiencing a surge in sustainability-driven innovation. Increasing environmental regulations and corporate ESG commitments are compelling manufacturers to develop energy-efficient MFPs that meet stringent benchmarks. Regulatory frameworks like the EPA’s Energy Star program have continually revised operational efficiency requirements, encouraging manufacturers to reduce power consumption in sleep and idle modes and prioritize features such as automatic duplex printing. In response, OEMs have integrated power-saving firmware, recyclable toner cartridges, and lower-emission components, resulting in greener product portfolios that resonate with environmentally conscious buyers. These developments are further enhancing purchasing decisions in markets like Europe and North America, where sustainability is a strategic priority.

The growing shift toward managed print services (MPS) is another transformative force in the multifunctional printer industry. Enterprises are increasingly outsourcing their print infrastructure under comprehensive MPS agreements to reduce operational costs, streamline consumables management, and improve device uptime. This transition is fueling demand for intelligent MFPs embedded with analytics modules, remote diagnostics, and automated supply provisioning. Organizations are now seeking printers that can seamlessly integrate into broader IT ecosystems, offer fleet-level visibility, and support usage-based billing models. This service-led transformation is contributing to a rise in recurring revenue models for vendors and is particularly strong in mature markets where cost control and environmental reporting are key operational goals.

Cybersecurity has also become a critical driver of innovation in the MFP landscape. In the wake of high-profile print subsystem vulnerabilities such as the 2021 PrintNightmare exploit, organizations are imposing stricter security controls on all networked devices, including printers. National cybersecurity agencies have mandated the disabling of vulnerable print services, restricted the use of external peripherals, and required encrypted communications to mitigate data loss risks during remote printing. These heightened security demands have led manufacturers to incorporate advanced protection features such as secure boot mechanisms, digitally signed firmware, self-healing operating systems, and real-time threat monitoring. As a result, multifunctional printers are evolving into secure endpoints within zero-trust architectures, particularly in sectors like finance, healthcare, and government, where data integrity is paramount.

The convergence of multifunctional printers with cloud platforms and digital workflows is redefining their value proposition. In alignment with digital-first government and enterprise initiatives, multifunctional printers are now expected to integrate with identity management systems, enable encrypted print job delivery through cloud services, and support mobile printing without the need for local drivers or servers. These capabilities have transformed multifunctional printers from simple output devices into critical nodes in digital document ecosystems. They now serve as enablers of paper-to-digital conversion, collaborative editing, and real-time document routing, features increasingly essential in distributed and fast-paced work environments.

Type Insights

The laser multifunctional printer segment led the market with the largest revenue share of 54.3% in 2024, due to their ability to handle high-volume print jobs efficiently, making them a staple in enterprise, government, and educational institutions. Their print accuracy, speed, and long-term cost benefits outweigh the higher upfront investment, especially in environments where reliability and bulk printing are prioritized. As businesses adopt more centralized print infrastructure under managed print services (MPS), laser MFPs remain the core workhorse due to their robust duty cycles and network compatibility.

The LED multifunctional printer segment is projected to grow at the fastest CAGR over the forecast period. The LED multifunctional printer offers reduced mechanical failure rates and quieter operation, which appeals to modern office spaces and co-working environments. Their compact form factor and lower power consumption are positioning them as a practical alternative in small business setups, especially in APAC and parts of Europe, where energy efficiency regulations are tightening.

Output Type Insights

The monochrome segment accounted for the largest market revenue share in 2024. Industries like finance, law, logistics, and healthcare rely heavily on fast and economical printing of contracts, invoices, or reports, functions where color adds little value. These devices are especially popular in developing markets and public administration sectors, where the cost per page is a key purchasing criterion, and grayscale printing meets day-to-day functional needs without overextending budgets.

The color segment is projected to grow at the fastest CAGR over the forecast period. Color MFPs are growing rapidly as visual communication becomes more integral across sectors. From marketing departments to classrooms and creative agencies, the demand for vibrant, high-resolution, in-house printing is pushing companies to upgrade. The falling costs of color toner and ink, combined with software improvements in color calibration and mobile printing, are making color MFPs increasingly viable even for small businesses and schools, particularly in North America and East Asia.

Connectivity Insights

The wired segment accounted for the largest market revenue share in 2024 and is projected to grow at a significant CAGR over the forecast period. Wired MFPs remain prevalent in enterprise IT ecosystems where security, stability, and network control are crucial. These devices are typically preferred in government offices, financial institutions, and compliance-driven sectors, where document integrity and access control require robust, closed-loop systems. Wired MFPs also appeal to legacy infrastructure settings, where investments in structured cabling and network hardware are already sunk costs.

The wireless segment is projected to grow at the fastest CAGR over the forecast period. Wireless MFPs are experiencing surging demand as workforces become more mobile and distributed. The shift to hybrid work models and the proliferation of BYOD (Bring Your Own Device) policies are prompting businesses to invest in flexible printing solutions that support smartphones, tablets, and remote desktops. Wireless connectivity, combined with cloud printing platforms, is enabling print-on-demand capabilities for remote teams, educators, and small businesses. As 5G and Wi-Fi 6 adoption grows, the performance gap between wired and wireless setups continues to shrink, positioning wireless MFPs as the future-ready choice for dynamic, decentralized workplaces.

Regional Insights

The multifunctional printer market in North America is anticipated to grow at the fastest CAGR during the forecast period. The multifunctional printer industry in North America is undergoing a strategic transformation driven by hybrid work adoption and rising cybersecurity concerns. Organizations are no longer simply buying hardware; they're restructuring print ecosystems. In 2024, managed print services (MPS) subscriptions saw a jump in North America, with SMBs leading the uptake as they sought cost predictability amid fluctuating office occupancy. In particular, government contracts in the U.S. and Canada, such as the General Services Administration’s updated IT Schedule 70 framework, have expanded the procurement of energy-efficient MFPs with built-in document encryption. Sustainability and compliance are becoming core buying criteria, especially after California’s aggressive energy-efficiency mandates for office equipment took effect in late 2023.

U.S. Multifunctional Printer Market Trends

The multifunctional printer market in the U.S. is seeing a growing divide between enterprise adoption of smart multifunctional printers and a slowdown in consumer-level sales. Enterprises are equipping work hubs with AI-enabled multifunctional printers that monitor usage and optimize toner deployment, with Canon’s uniFLOW Online and HP’s Wolf Security integration gaining traction.

Europe Multifunctional Printer Market Trends

The multifunctional printer market in Europe is anticipated to grow at a substantial CAGR during the forecast period. Europe's multifunctional printer landscape is deeply shaped by ESG reporting requirements and the Right to Repair legislation enforced by the EU in 2023. This regulation has prompted OEMs to design modular, serviceable MFPs, accelerating sales of longer-lifecycle devices. In Western Europe, enterprise procurement is shifting toward leasing rather than ownership, driven by tax incentives and flexibility. Central and Eastern Europe, meanwhile, are witnessing government-led digitization campaigns, which are pushing ministries to adopt cloud-ready color multifunctional printers for digital archiving and high-speed scanning.

The Germany multifunctional printer market stands at the intersection of industrial print demand and data protection compliance. As a key manufacturing hub, the German Mittelstand (small and medium industrial firms) are major buyers of monochrome laser multifunctional printers for documentation and logistics workflows. GDPR compliance has shaped how multifunctional printers are configured, with secure document release features and automatic data purge functionalities becoming standard across installations.

The multifunctional printers market in the UK is evolving post-Brexit with a lean toward local procurement and refurbished devices. Rising import duties and currency fluctuations prompted many public sector bodies, including the NHS and regional councils, to extend the lifecycle of existing printers through MPS contracts. Meanwhile, private education and legal sectors are investing in color multifunctional printers with OCR and multilingual scanning tools to serve increasingly diverse populations.

Asia Pacific Multifunctional Printer Market Trends

Asia Pacific dominated the multifunctional printer market with the largest revenue share of 32.8% in 2024. APAC is the most diverse and fastest-evolving region for multifunctional printer’s adoption, shaped by the digital maturity gap between developed and emerging economies. Across the region, smart campus initiatives, government e-documentation drives, and the digitalization of SMEs are fueling adoption. While high-speed color laser multifunctional printers are gaining popularity in Singapore, South Korea, and Australia, entry-level LED models dominate the Indian subcontinent and Southeast Asia due to their affordability. Moreover, Japanese and Korean OEMs are increasingly using APAC as a testbed for IoT-enabled multifunctional printers integrated with smart office platforms. The integration of printers into wider building management systems is beginning to emerge as a regional differentiator.

The multifunctional printer market in China accounted for the largest market revenue share in Asia Pacific in 2024.The Chinese market is pivoting toward domestically manufactured brands amid a broader push for technological self-sufficiency. Lenovo, Pantum (a Ninestar brand), and Xiaomi have rapidly increased market share in state-owned enterprises and provincial government offices, especially after the central government’s directive to replace foreign IT hardware by 2027. Moreover, the rollout of “digital government zones” in cities like Shenzhen and Hangzhou has led to a spike in demand for multifunctional printers with built-in security chips, biometric access, and blockchain-compatible firmware. Cloud-native MFPs that comply with China's Data Security Law are increasingly replacing older legacy machines.

The multifunctional printer market in Japan is anticipated to grow at a significant CAGR during the forecast period. In Japan, where office culture values order, quiet operation, and space efficiency, LED-based compact multifunctional printers are seeing strong momentum, especially among startups and regional offices. However, larger corporations are embracing AI-enhanced multifunction systems with predictive maintenance and usage analytics to reduce energy use and downtime. Moreover, aging population dynamics are influencing printer UI/UX models, with larger touchscreen controls and simplified workflows gaining favor in government departments and public-facing offices.

Key Multifunctional Printer Company Insights

Some of the major players in the multifunctional printer industry include HP Development Company, L.P., Canon Inc., Xerox Corporation, Brother Industries, Ltd., Konica Minolta, Inc., among others, due to their strong R&D capabilities, wide product portfolios, consistent innovation in wireless and cloud-enabled printing solutions, and long-standing partnerships with enterprise and government sectors across the globe. These companies also maintain a competitive advantage through sustainable practices, robust after-sales service networks, and adaptive strategies in response to evolving workplace digitization and hybrid work models.

-

Canon is a major innovator in the multifunctional printer (MFP) industry, known for its exceptional print quality, durability, and efficient performance. The company’s imageRUNNER and imageCLASS series offer robust printing, scanning, copying, and faxing capabilities, making them ideal for both enterprise environments and small businesses. Canon continues to evolve its MFP lineup with features such as mobile device compatibility, cloud integration, and advanced document security. Its focus on sustainable printing and low-power consumption solutions has gained strong traction among environmentally conscious users, particularly in regions with high regulatory compliance.

-

HP plays a vital role in the global multifunctional printer industry, offering a diverse portfolio that spans home, office, and enterprise segments. Its popular multifunctional printer lines, like LaserJet and OfficeJet, are known for their speed, user-friendly interfaces, and advanced security protocols. HP has consistently led in developing smart printing ecosystems that support mobile connectivity and remote device management. With the increasing demand for flexible and secure print solutions, HP continues to invest in AI-driven diagnostics and eco-friendly cartridges, reinforcing its reputation as a reliable and forward-thinking multifunctional printer provider.

Key Multifunctional Printer Companies:

The following are the leading companies in the multifunctional printer market. These companies collectively hold the largest market share and dictate industry trends.

- Brother Industries, Ltd.

- Canon Inc.

- HP Development Company, L.P.

- Konica Minolta, Inc.

- Lexmark International, Inc.

- Ricoh

- Seiko Epson Corporation

- Sharp Corporation

- Toshiba TEC Corporation

- Xerox Corporation

Recent Developments

-

In March 2025, HP unveiled the Color LaserJet Enterprise MFP 8801 and Mono MFP 8601, built on a new ASIC chip designed with quantum-resistant cryptography. These printers verify firmware integrity using post-quantum digital signatures, protecting print fleets from future quantum-computer attacks, a world’s first in the printing industry.

-

In March 2025, Canondisclosed CVE-2025-1268, a critical buffer-overflow vulnerability in its Generic Plus PCL6/UFR II/LIPS print drivers used by production and office MFPs. Canon released driver updates (version 3.15 and later) across all affected models, mitigating exploit risk and preventing unauthorized code execution.

Multifunctional Printer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 33.81 billion

Revenue forecast in 2033

USD 55.54 billion

Growth rate

CAGR of 6.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, output type, connectivity, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Brother Industries, Ltd.; Canon Inc.; HP Development Company, L.P.; Konica Minolta, Inc.; Lexmark International, Inc.; Ricoh; Seiko Epson Corporation; Sharp Corporation; Toshiba TEC Corporation; Xerox Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Multifunctional Printer Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global multifunctional printer market report based on type, output type, connectivity, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Laser Multifunctional Printer

-

Inkjet Multifunctional Printer

-

LED Multifunctional Printer

-

Solid Ink Multifunctional Printer

-

Thermal Multifunctional Printer

-

-

Output Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Monochrome

-

Color

-

-

Connectivity Outlook (Revenue, USD Million, 2021 - 2033)

-

Wired

-

Wireless

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global multifunctional printer market size was estimated at USD 32.09 billion in 2024 and is expected to reach USD 33.81 billion in 2025.

b. The global multifunctional printer market size is expected to grow at a significant CAGR of 6.4% to reach USD 55.54 billion in 2033.

b. Asia Pacific held the largest market share of 32.8% in 2024. APAC is the most diverse and fastest-evolving region for multifunctional printers adoption, shaped by the digital maturity gap between developed and emerging economies.

b. Some of the players in the multifunctional printer market are Brother Industries, Ltd., Canon Inc., HP Development Company, L.P., Konica Minolta, Inc., Lexmark International, Inc., Ricoh, Seiko Epson Corporation, Sharp Corporation, Toshiba TEC Corporation, and Xerox Corporation.

b. The key driving trend in the multifunctional printer (MFP) market is the rapid shift toward cloud-based printing and connected workflows, driven by the rise of hybrid and remote work environments. This trend enables users to print and manage documents from any location, enhances security through centralized controls, and simplifies device and fleet management. Additionally, growing demand for eco-friendly features, AI-powered automation, and managed print services further supports the adoption of smart, efficient, and secure MFP solutions across enterprises and SMEs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.