- Home

- »

- Advanced Interior Materials

- »

-

North America Industrial Valves Market, Industry Report 2033GVR Report cover

![North America Industrial Valves Market Size, Share & Trends Report]()

North America Industrial Valves Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Gate valve, Globe Valve, Ball Valve, Butterfly Valve, Safety Valve, Plug Valve), By Application (Automotive, Oil & Gas, Chemical), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-822-7

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Industrial Valves Market Summary

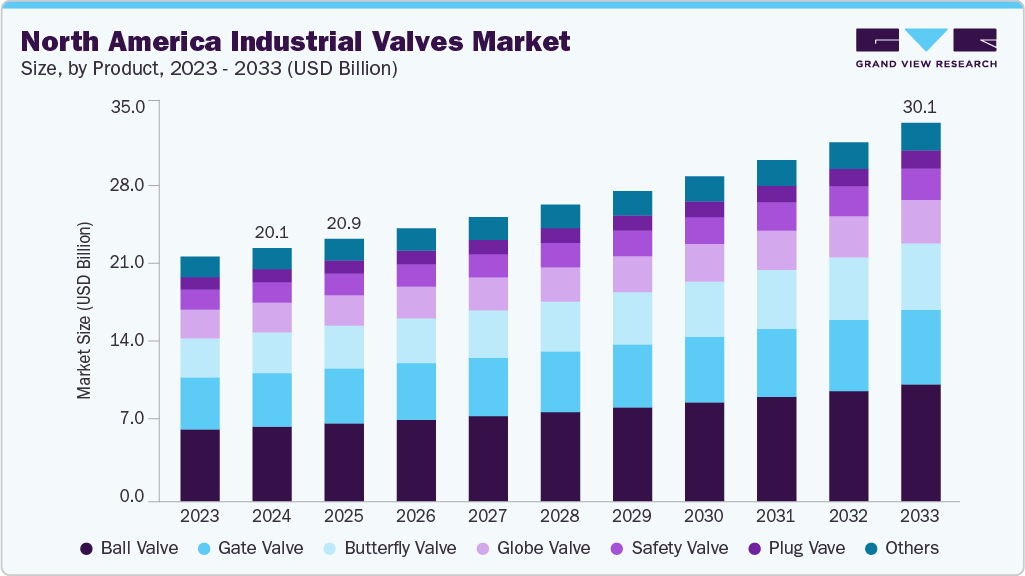

The North America industrial valves market size was estimated at USD 20.14 billion in 2024 and is projected to reach USD 30.11 billion by 2033, growing at a CAGR of 4.7% from 2025 to 2033, driven by the sustained growth of the oil and gas and petrochemical sectors. Increasing exploration, production, and refining activities in the United States and Canada necessitate reliable and high-performance valves to manage the flow of oil, gas, and chemical products.

Key Market Trends & Insights

- U.S. dominated the North America industrial valves market with the largest revenue share of 82.9% in 2024.

- By product, the butterfly valve segment is expected to grow at the fastest CAGR of 5.7% over the forecast period.

- By application, the water & wastewater segment is expected to grow at the fastest CAGR of 5.5% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 20.14 Billion

- 2033 Projected Market Size: USD 30.11 Billion

- CAGR (2025-2033): 4.7%

- U.S.: Largest market in 2024

- Mexico: Fastest growing market

The demand for advanced control, safety, and pressure-regulating valves is particularly high in upstream, midstream, and downstream operations. Investments in modern infrastructure and plant expansions are further fueling the need for durable and efficient valve solutions across the region.Technological advancements and the increasing adoption of automation in industrial processes are accelerating market growth. Smart valves equipped with sensors, actuators, and real-time monitoring systems improve process control, reduce downtime, and enhance operational safety. Industries such as chemical processing, water treatment, and pharmaceuticals are investing in automated valve systems to optimize production efficiency. These innovations also drive demand for high-precision and digitally integrated valve solutions across North American facilities.

Regulatory compliance and stringent safety standards are significant factors driving demand for industrial valves in North America. Standards set by organizations such as ASME, API, and ANSI ensure that valves meet strict performance, reliability, and safety criteria. Industries are increasingly prioritizing certified and durable valves to prevent operational failures and mitigate environmental risks. Compliance with environmental and workplace safety regulations encourages the adoption of advanced, high-quality valve solutions, further expanding the market across diverse industrial sectors.

Market Concentration & Characteristics

The North American industrial valves industry exhibits a moderately consolidated structure, with a mix of leading global manufacturers and regional players controlling significant market share. Key companies focus on continuous innovation, developing smart, automated, and high-performance valve solutions for diverse industrial applications. Mergers and strategic partnerships are common, enabling firms to expand product portfolios, enter new segments, and enhance technological capabilities. Investment in R&D is critical, as innovation in materials, design, and automation directly influences competitive positioning and customer preference within the market.

Regulatory frameworks in North America, including ASME, API, and ANSI standards, strongly impact market operations, driving the adoption of certified and reliable valve solutions. While alternative flow control systems, such as pumps and flexible piping solutions, can act as substitutes in certain applications, valves remain essential in high-pressure, high-temperature, and chemically sensitive processes. End-user concentration is moderate to high, with the majority of demand originating from oil & gas, chemical, power generation, and water treatment industries. This concentration underscores the market’s dependence on a few key industrial sectors, while specialized applications foster continuous demand for tailored valve solutions.

Product Insights

The ball valve segment accounted for the largest revenue share of 29.5% in 2024, driven by its wide applicability across high-pressure and high-temperature operations, particularly in oil & gas, chemical, and power industries. Its compact design, tight shutoff capability, and ease of automation make it a preferred choice for modern fluid-control systems. The rise of smart industrial facilities is further increasing demand for automated and corrosion-resistant ball valves. In addition, ongoing upgrades of pipelines and refinery infrastructure support consistent adoption of advanced ball valve solutions across the region.

Butterfly valve is expected to grow at the fastest CAGR of 5.7% over the forecast period, driven by its cost-effectiveness, lightweight construction, and suitability for large-diameter flow systems. These valves are extensively used in HVAC, water distribution, and industrial processing owing to their quick operation and lower installation requirements. The growth of municipal infrastructure and industrial cooling systems continues to strengthen demand. Moreover, advancements in materials and sealing technologies are enhancing durability, making butterfly valves more competitive for both general and critical-service applications.

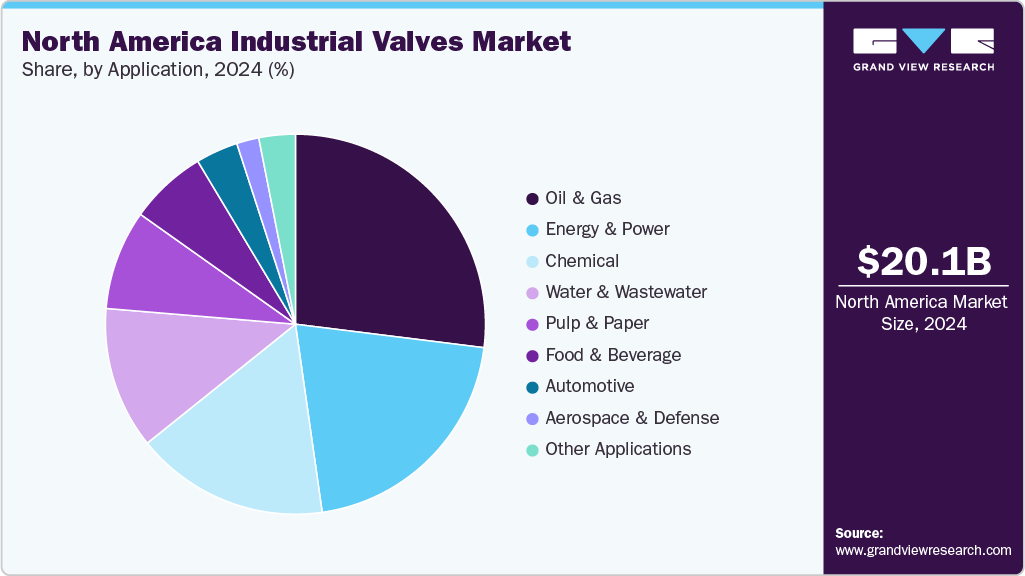

Application Insights

The oil & gas segment accounted for the largest revenue share of 27.0% in 2024, driven by expanding exploration activities, pipeline expansions, and refinery modernization. High-performance valves are essential for managing extreme conditions, controlling pressure, and ensuring operational safety across upstream, midstream, and downstream processes. Increasing investments in liquefied natural gas (LNG) infrastructure and shale oil extraction are also driving adoption. Enhanced regulatory scrutiny has further boosted demand for certified and reliable valve systems that ensure protection against leaks and equipment failures.

The water & wastewater segment is expected to grow at the fastest CAGR of 5.5% over the forecast period, driven by rising investments in municipal water systems, aging infrastructure replacement, and increasing environmental compliance requirements. Industrial valves play a critical role in regulating flow, maintaining water quality, and improving system efficiency in treatment plants and distribution networks. Growing urbanization and population pressures are pushing utilities to upgrade and expand their networks. In addition, the adoption of corrosion-resistant and low-maintenance valve solutions supports long-term operational reliability in essential water management applications.

Country Insights

U.S. Industrial Valves Market Trends

In the United States, the market is fueled by extensive investments in oil & gas exploration, refining, and petrochemical projects. The transition toward automated and digitally controlled industrial systems is increasing the adoption of smart valves with real-time monitoring and control capabilities. Aging infrastructure in the energy and water sectors creates opportunities for valve replacement and upgrades. Stringent federal and state-level regulations for safety, emissions, and process efficiency further drive demand. In addition, the growth of renewable energy projects, including wind and solar, is stimulating the need for specialized valves.

Canada Industrial Valves Market Trends

The industrial valves market in Canada is largely driven by the development of the oil sands, natural gas, and hydroelectric power sectors. Investments in pipeline construction, mining operations, and chemical processing plants are increasing the demand for high-performance valves capable of handling extreme conditions. Regulatory compliance for environmental protection and occupational safety ensures widespread adoption of certified and durable valve solutions. Technological advancements in automation and remote monitoring are also encouraging industrial players to upgrade existing systems. Furthermore, Canada’s focus on energy efficiency and infrastructure modernization supports market growth.

Mexico Industrial Valves Market Trends

The industrial valves market in Mexico is propelled by increasing investments in petrochemical plants, refineries, and manufacturing facilities. Rising industrialization and urban infrastructure development create consistent demand for valves in water treatment, energy, and chemical sectors. Government incentives for industrial modernization and adherence to safety standards are promoting the use of advanced valve solutions. Adoption of automated and smart valves for improved process efficiency is gaining momentum. In addition, the growing presence of multinational industrial players is fostering technology transfer and market expansion across the country.

Key North America Industrial Valves Company Insights

Some of the key players operating in the market include Emerson Electric Co. and Flowserve Corporation.

-

Emerson Electric offers a broad portfolio of industrial valves, including control, safety, and isolation valves, supported by its automation and flow‑control business units. It integrates smart technologies like sensors and actuators to improve process efficiency and reliability.

-

Flowserve hasa strong focus on critical-flow applications. Its valve portfolio spans ball, butterfly, gate, globe, and control valves tailored to sectors such as petrochemicals, power generation, and water management.

Crane Co. and Velan Inc. are some of the emerging market participants in the market.

-

Crane Co.'s Process Flow Technologies segment manufactures a wide array of high‑performance valves, such as check, plug, lined, ball, butterfly, and diaphragm valves. These products serve demanding industries including chemical processing, oil & gas, biotech, power, and wastewater.

-

Velan is a specialist in industrial steel valves, producing gates, globe, check, ball, triple-offset butterfly, knife gate, and severe-service valves. The company has a strong North American manufacturing footprint and is known for durable designs that operate under extreme conditions, including cryogenic and nuclear environments.

Key North America Industrial Valves Companies:

- Emerson Electric Co.

- Flowserve Corporation

- Crane Co.

- Velan Inc.

- CIRCOR International, Inc.

- Schlumberger Limited

- Mueller Water Products, Inc.

- Kitz Corporation

- Curtiss‑Wright Corporation

Recent Developments

-

In September 2024, Bray International, Inc. announced a strategic sales and distribution partnership with Aquestia, aimed at expanding the availability of Aquestia’s air valves and hydraulic control valves across North America and other global markets. The collaboration strengthens Bray’s product portfolio and enhances its position in the mining, metals, and water management sectors, enabling customers to access a broader range of high-performance flow control solutions.

North America Industrial Valves Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.88 billion

Revenue forecast in 2033

USD 30.11 billion

Growth rate

CAGR of 4.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Emerson Electric Co.; Flowserve Corporation; Crane Co.; Velan Inc.; CIRCOR International; Schlumberger Limited; Mueller Water Products; Kitz Corporation; Curtiss‑Wright Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Industrial Valves Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the North America industrial valves market report based on product, application, and country:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Gate Valve

-

Globe Valve

-

Ball Valve

-

Butterfly Valve

-

Safety Valve

-

Plug Vave

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Aerospace and Defense

-

Automotive

-

Oil & Gas

-

Chemical

-

Energy & Power

-

Water & Wastewater

-

Pulp & Paper

-

Food & Beverage

-

Other Applications

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America industrial valves market size was estimated at USD 20.14 billion in 2024 and is expected to reach USD 20.88 billion in 2025.

b. The North America industrial valves market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2033 to reach USD 30.11 billion by 2033.

b. The oil & gas segment accounted for the largest revenue share of 27.0% in 2024, driven by expanding exploration activities, pipeline expansions, and refinery modernization

b. Key players operating in the market are Emerson Electric Co.; Flowserve Corporation; Crane Co.; Velan Inc.; CIRCOR International; Schlumberger Limited; Mueller Water Products; Kitz Corporation; Curtiss‑Wright Corporation

b. The key factors that are driving the North America industrial valves include increasing exploration, production, and refining activities in the United States and Canada necessitate reliable and high-performance valves to manage the flow of oil, gas, and chemical products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.