- Home

- »

- Electronic & Electrical

- »

-

North America Range Cooker Market, Industry Report, 2033GVR Report cover

![North America Range Cooker Market Size, Share & Trends Report]()

North America Range Cooker Market (2025 - 2033) Size, Share & Trends Analysis Report By Product, By Size, By Fuel Type, By Material, By Technology, By Price Range, By End User, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-730-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Range Cooker Market Summary

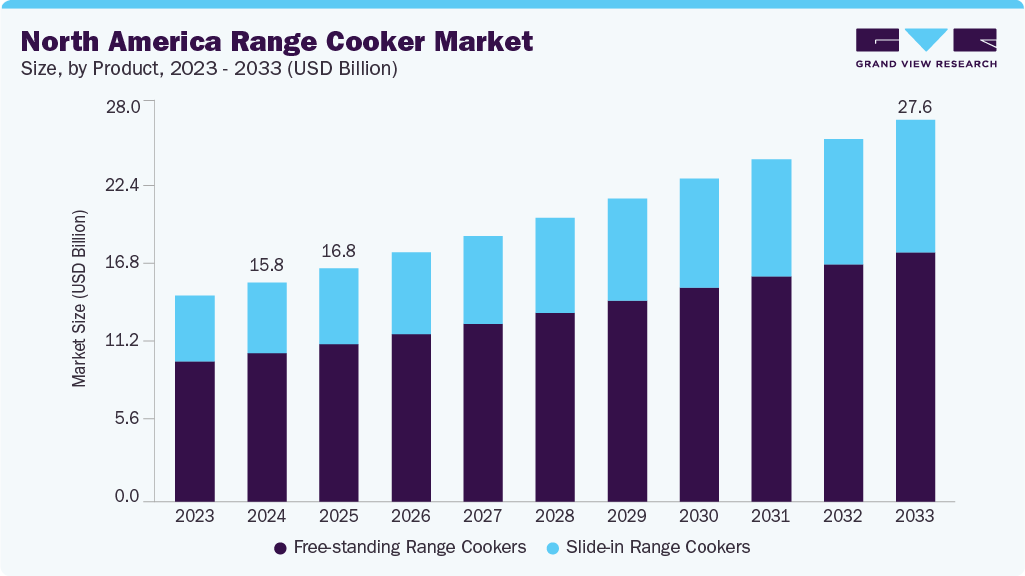

The North America range cooker market size was estimated at USD 15.81 billion in 2024, and is projected to reach USD 27.55 billion by 2033, growing at a CAGR of 6.4% from 2025 to 2033. The market growth is driven by a growing demand for premium kitchen appliances, interest in home cooking and gourmet food preparation, and kitchen remodeling activities.

Key Market Trends & Insights

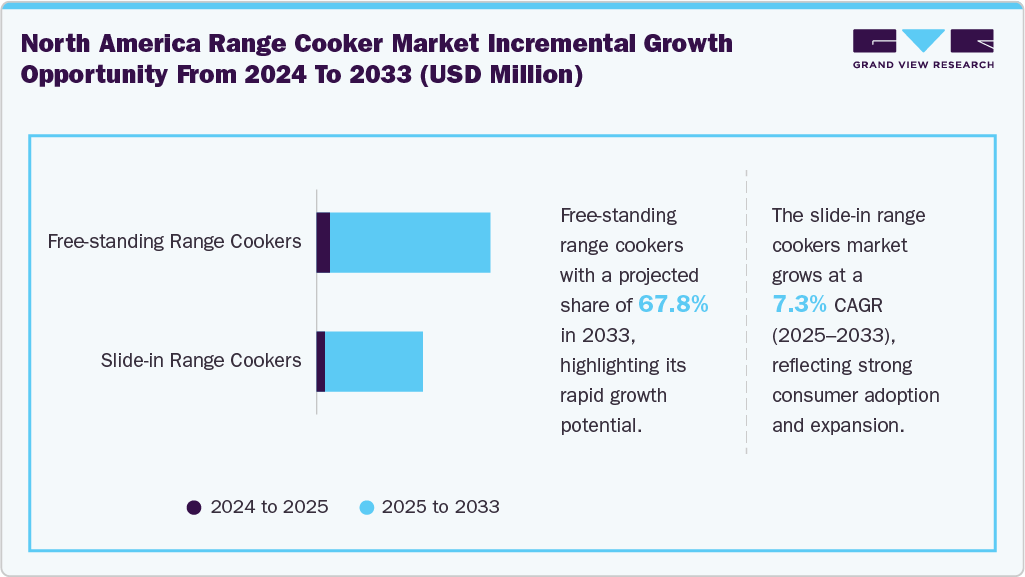

- By product, the free-standing range cookers segment led with a market share of 67.8% in 2024.

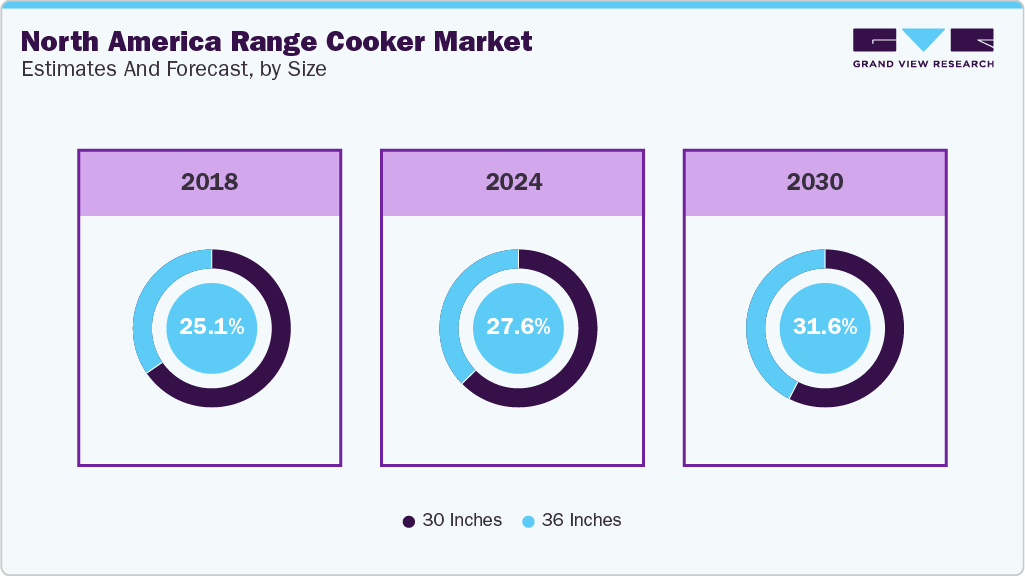

- By size, the 36-inch range cookers segment is expected to grow at a significant CAGR of 8.0% from 2025 to 2033.

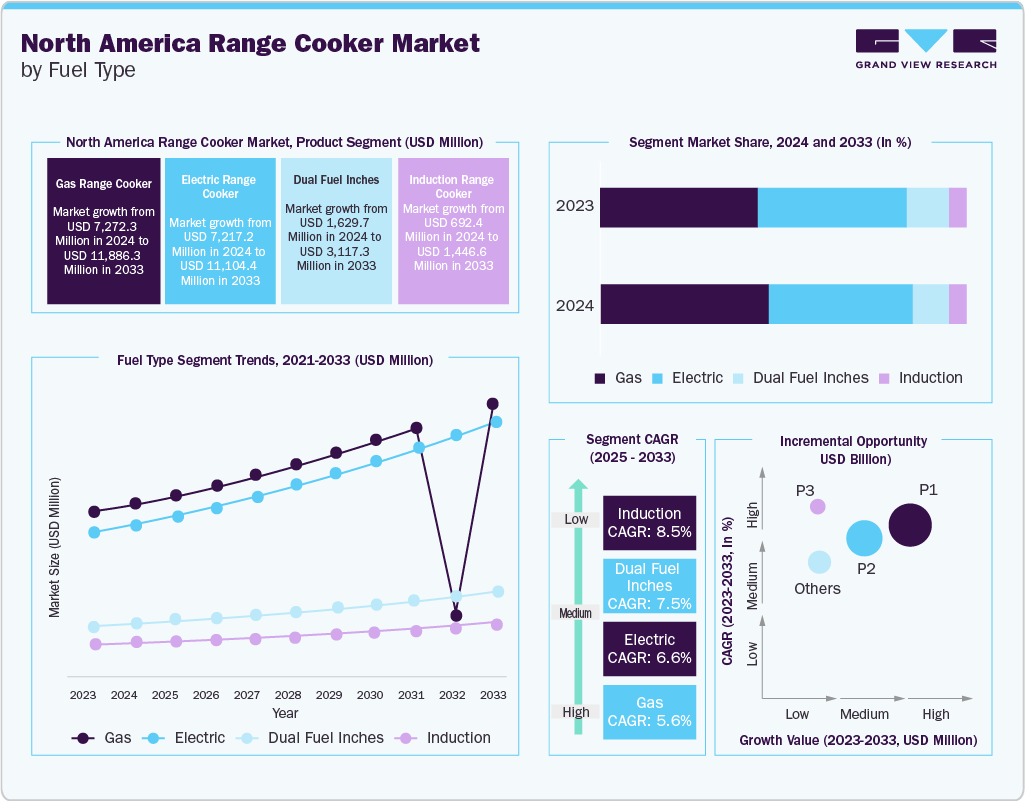

- By fuel type, the induction range cookers segment is expected to grow at a significant CAGR of 8.5% from 2025 to 2033.

- By material, the stainless steel segment led with a market share of 91.2% in 2024.

- By technology, the conventional range cookers led the market with a share of 85.3% in 2024.

Key Market Trends & Insights

- 2024 Market Size: USD 15.81 Billion

- 2033 Projected Market Size: USD 27.55 Billion

- CAGR (2025-2033): 6.4%

- U.S.: Largest Market in 2024

The market is further fueled by technological advancements, such as smart and energy-efficient cooking solutions, along with a strong consumer preference for multifunctional and aesthetically appealing kitchen equipment. The increasing adoption of smart home technologies and connected appliances propels the North America range cooker industry’s growth. Consumers’ growing focus on energy efficiency and sustainable cooking solutions also plays a significant role. Additionally, the rising popularity of open-concept kitchens boosts demand for stylish, high-performance range cookers. The expanding food delivery culture encourages home cooking, driving appliance upgrades. Lastly, easy availability of diverse fuel options, such as gas, electric, and dual-fuel models, supports market growth.The North America range cooker market’s growth is driven by the rising trend of customizable and professional-grade cooking appliances among culinary enthusiasts. Increasing disposable income enables consumers to invest in premium, durable kitchen equipment. The influence of celebrity chefs and cooking shows inspires demand for high-performance range cookers. Additionally, advancements in safety features and user-friendly designs attract a broader customer base. Growing urbanization and compact living spaces also encourage the preference for versatile, space-saving range cookers. For instance, according to the Houzz data published in March 2024, the kitchen area is the most renovated interior room with 29% followed by guest bathrooms and primary bathrooms.

The market benefits from increased demand for appliances that offer precise temperature control and faster cooking times. Rising consumer preference for appliances with advanced features such as touch controls and self-cleaning functions is boosting sales. The influence of smart kitchen integration for enhanced convenience is gaining traction. Brands such as THERMADOR have responded to this demand by offering smart range cookers equipped with features such as Smart Partner Integration, remote control functionality, voice command support, and compatibility with platforms such as Apple Watch, IFTTT, and Crestron. Additionally, government incentives promoting energy-efficient appliances support market expansion. The surge in real estate development and new housing projects also contributes to the growing demand for modern kitchen appliances.

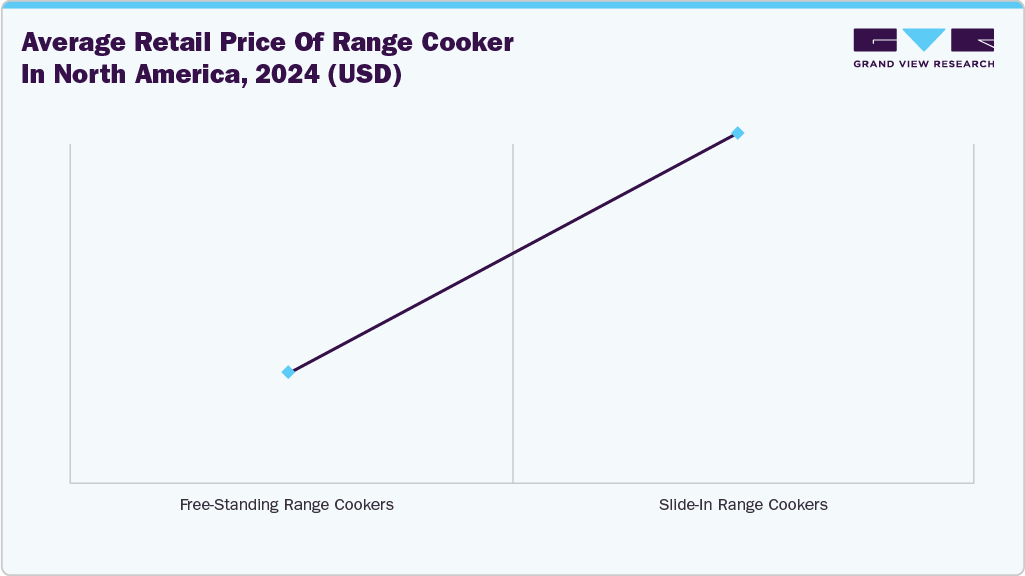

Pricing Analysis

Pricing analysis of the North America range cooker industry reveals a diverse and competitive landscape shaped by varying consumer budgets and regional demands. Premium range cookers equipped with features such as smart connectivity, professional-grade burners, and sleek designs appeal primarily to affluent buyers and cooking enthusiasts. The mid-range segment captures a large market share by offering a blend of advanced functionality and affordability suited for average households. Entry-level models attract budget-conscious consumers and first-time homeowners seeking reliable, basic cooking appliances. Promotional strategies such as holiday sales, extended warranties, and bundled accessory offers are frequently used to drive purchases and build customer loyalty in this mature market.

Product Insights

The free-standing range cooker market in North America accounted for the largest revenue share of 67.8% in 2024. Free-standing range cookers remain highly popular in North America, largely because they align well with common housing designs. Many homes, particularly in suburban and rural regions, feature kitchen layouts or pre-existing cutouts specifically made to fit these standard appliances. As a result, free-standing ranges easily integrate with traditional cabinetry without requiring any alterations, making them a convenient option for both homeowners and contractors during installations or replacements.

The slide-in range cooker segment is projected to grow at the fastest CAGR of 8.0% from 2025 to 2033. Rising demand for upscale, open-concept kitchens in North America has driven strong growth in the slide-in range segment. Designed to sit flush with countertops, these cookers eliminate gaps that typically trap food particles, offering a sleek, built-in look. According to the data published by Whirlpool, the sleek and aesthetic appeal of the slide-in ranges makes them a popular choice for remodels and kitchen islands. Their seamless integration enhances the overall aesthetic, making them a preferred choice in modern and luxury homes where clean lines and cohesive design are essential.

Size Insights

The 30-inch range cooker segment led the North America range cooker market with the largest revenue share of 67.8% in 2024. The 30-inch range cooker continues to be the most prevalent size in North American households, primarily because it fits seamlessly with standard kitchen layouts and cabinetry. As the go-to option for both new builds and appliance replacements, it remains a top choice among builders, renovators, and everyday consumers. Its standardized dimensions make it ideal for remodeling projects, requiring no structural modifications. What sustains demand in this segment is the broad selection available across all price tiers, from entry-level gas models to advanced, smart-enabled induction units. The 30-inch category also serves as a testing ground for innovation, with manufacturers frequently launching new features such as air fry, Wi-Fi connectivity, and dual-fuel capabilities here before expanding them to other sizes.

The 36-inch range cooker segment of the North America range cooker industry is projected to grow at the fastest CAGR of 8.0% from 2025 to 2033. Homeowners upgrading their kitchens for better performance and style are increasingly choosing the 36-inch range cooker. This model usually offers a wider cooktop with additional burners or cooking zones, providing enhanced flexibility when preparing meals. According to Orville's Home Appliances data published in March 2025, a major reason for preferring the 36-inch range cooker is the extra cooking surface, as most models include five to six burners, suitable for multitasking or hosting. This makes it especially attractive to cooking enthusiasts, families who cook large meals, and hosts who entertain often and require additional capacity.

Fuel Type Insights

The gas range cooker segment led the North America range cooker market with the largest revenue share of 67.8% in 2024. Gas range cookers are popular in many homes, primarily because of their superior cooking performance and precise control. Both professional chefs and home cooking enthusiasts prefer gas ranges for their instant heat adjustment, ability to provide moist heat ideal for baking, and energy efficiency, since gas is generally less expensive than electricity. For instance, according to the Direct Energy (Canada) data published in January 2024, gas is inexpensive for baking compared to electricity, as gas-fueled ovens have humid air, helping to reduce the cooking time for some dishes.

The induction range cooker market is projected to grow at the fastest CAGR of 8.5% from 2025 to 2033. Induction range cookers are rapidly becoming popular in North America due to their efficiency, safety, and eco-friendly benefits. Unlike traditional cooktops, induction heats cookware directly through magnetic fields, leading to faster boiling and improving energy transfer. The precise temperature control, combined with the absence of flames or exposed heating elements, makes induction especially appealing for families with children or elderly members, highlighting its safety and ease of cleaning. According to the U.S. Department of Energy data published in May 2023, nearly 70% people surveyed in Consumer Reports 2022 national representative survey said they would consider induction fuel type for their next range purchase.

Material Insights

The stainless-steel range cooker market in North America accounted for the largest revenue share of 67.8% in 2024. Stainless steel is a top material choice for range cookers in the North American market, mainly due to its sleek, modern look and hygienic qualities. Consumers in North America frequently prefer a clean, contemporary kitchen style, and stainless steel provides an attractive finish that aligns well with popular design trends. Its smooth, non-porous surface not only resists smudges and fingerprints but also makes cleaning quick and effortless, an important feature in open-concept kitchens where appliances are always in view.

The cast iron range cooker market in the North America region is projected to grow significantly at a CAGR of 5.2% from 2025 to 2033. Cast iron is a favored material for range cookers in the North American market because of its excellent heat retention and even heat distribution. It keeps a steady high temperature across its surface, making it perfect for cooking methods that require consistent heat, such as searing and simmering. Beyond its performance benefits, cast iron also enriches the cooking experience for those who appreciate traditional, durable results. In colder parts of North America, where external temperatures can impact kitchen performance, cast iron’s thermal mass provides a clear advantage by maintaining stable cooking temperatures despite changing conditions.

Technology Insights

The conventional range cookers segment led the North America range cooker industry with the largest revenue share of 85.3% in 2024. Conventional range cookers continue to be popular in North America because of their dependability and easy operation. Many users prefer tactile controls such as knobs and analog dials, which provide instant feedback and are less likely to experience software issues. This straightforward design appeals to older generations and budget-conscious consumers who value practicality over advanced technology. Additionally, the mechanical setup is often more intuitive for those who are less comfortable with digital interfaces or app-controlled appliances.

The smart range cooker market is projected to grow at the fastest CAGR of 8.2% from 2025 to 2033. A major factor driving the adoption of smart range cookers in the North American market is their effortless compatibility with connected home ecosystems. With the growing popularity of smart devices such as Alexa, Google Home, and smart thermostats, consumers increasingly expect their kitchen appliances to offer the same level of connectivity. Brands such as THERMADOR have responded to this demand by offering smart range cookers equipped with features such as Smart Partner Integration, remote control functionality, voice command support, and compatibility with platforms such as Apple Watch, IFTTT, and Crestron.

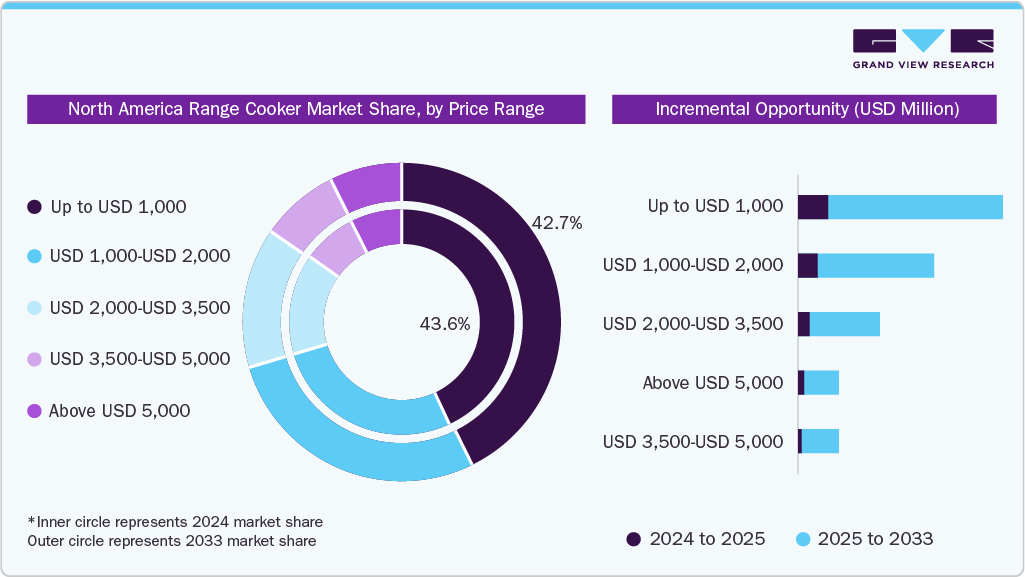

Price Range Insights

The price range of up to USD 1,000 in the North America range cooker market accounted for the largest revenue share of 43.6% in 2024. In North America, prices up to USD 1,000 cover entry-level and budget-friendly models. These cookers are typically aimed at first-time homeowners, small families, or individuals looking for basic cooking capabilities. Key factors fueling this segment include affordability, practicality, and simplicity. Many brands focus on offering essential features such as standard gas or electric burners, straightforward designs, and average oven capacities. Demand in this price range is primarily driven by cost-conscious consumers who seek good value without the need for advanced features.

Range cookers priced above USD 5,000 in the North America range cooker industry are projected to grow at the fastest CAGR of 7.4% from 2025 to 2033. Range cookers priced above USD 5,000 represent the pinnacle of luxury cooking appliances in North America. Bespoke design elements, cutting-edge technology, and high-performance capabilities typically characterize these models. The driving factors for this price segment include the growing trend toward culinary mastery, where consumers are looking for appliances that can cater to complex cooking tasks with unparalleled precision and speed. High-net-worth individuals, celebrity chefs, and homeowners of luxury properties are key target demographics in this category.

End User Insights

The range cookers for residential use in the North America range cooker market accounted for the largest revenue share of 80.8% in 2024. In North America, the demand for residential range cookers is largely fueled by the rising preference for high-performance kitchen appliances in contemporary homes. Homeowners in the region are placing greater emphasis on cooking efficiency, design appeal, and versatility in their kitchens. Range cookers attract those who enjoy cooking or entertaining at home by offering features such as dual-fuel capabilities, multiple oven compartments, and precise temperature control. Furthermore, the growing popularity of open-concept kitchens and upscale home renovations has driven the adoption of premium, large-format range cookers, serving not only as practical appliances but also as stylish focal points in kitchen design. According to the data published in January 2024, major kitchen remodeling in the U.S. increased by 22% in 2023 to USD 55,000.

The range cookers for commercial use in the North America market are projected to grow significantly at a CAGR of 5.6% from 2025 to 2033. The commercial segment encompasses end users such as hotels, restaurants, bakeries, catering services, and institutional kitchens that need high-capacity, durable cooking equipment. Commercial range cookers prioritize durability, heavy-duty performance, and the capability to run for long hours while maintaining consistent results. In North America, the booming foodservice industry, particularly in urban centers, drives strong demand for these appliances to accommodate large-scale meal production and varied cooking needs.

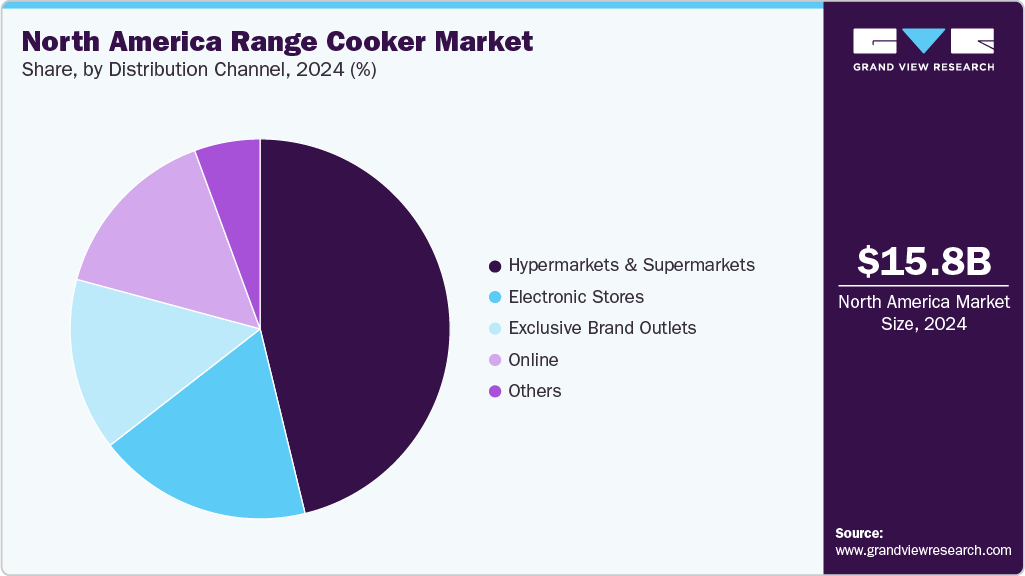

Distribution Channel Insights

The sales of range cookers through the hypermarkets & supermarkets channel accounted for the largest revenue share of 46.2% in 2024. In North America, major retailers such as Walmart and Costco act as key distribution centers for home appliances, including range cookers. These stores attract customers by offering a broad selection of models in one location, often at competitive prices thanks to economies of scale. Additionally, the convenience of shopping for appliances alongside other household items helps sustain consistent customer traffic.

The sales of range cookers through the online distribution channel in North America are projected to grow at the fastest CAGR of 8.4% from 2025 to 2033. The online distribution channel for range cookers in North America is driven by growing consumer preference for convenient, contactless shopping. Easy access to a wide variety of brands and models, detailed product information, and customer reviews enhances purchasing confidence. Competitive pricing and frequent promotions available online further attract buyers. According to the data published in March 2024, about 25% of the major appliances were made through online channels. Additionally, fast home delivery and flexible return policies improve the overall shopping experience. The increasing internet penetration and smartphone usage continue to boost online sales in this market.

Regional Insights

The North American range cooker market growth is driven by rising consumer demand for high-performance and multifunctional kitchen appliances. Increasing home renovations and the popularity of open-concept kitchens boost the adoption of premium and large-format models. Growing interest in cooking and entertaining at home further fuels market growth. Additionally, advancements in energy-efficient and smart technologies attract modern homeowners. The expanding foodservice industry also contributes to the demand for commercial-grade range cookers.

U.S. Range Cooker Market Trends

The range cooker market in the U.S. held the largest share of 88.3% in 2024, driven by increasing consumer preference for high-performance and versatile kitchen appliances. Growing home renovation projects and the trend toward open-concept kitchens have boosted demand for premium and large-format range cookers. Additionally, rising interest in home cooking and entertaining supports market growth. Technological advancements, including energy efficiency and smart features, further attract buyers. The expanding commercial foodservice sector also contributes to the strong demand. Manufacturers are introducing new models, for instance, in March 2024, GE Appliances (GEA), a Haier company, launched a robust product portfolio of slide-in gas and electric ranges, with its top-of-the-line models being a 30-inch Slide-In Electric Convection Range. The range is designed for effortless cleaning, reduces cooking time, and is equipped with cooking modes developed by the company’s food scientists.

Canada Range Cooker Market Trends

The Canada range cooker market is expected to grow at a significant CAGR of 7.0% from 2025 to 2033, driven by high consumer demand for multifunctional and efficient kitchen appliances. In Canada, the market is propelled by increasing home renovations and a growing trend toward modern, open-concept kitchens. Canadian consumers are also prioritizing energy-efficient and smart kitchen solutions, boosting demand for advanced range cookers. Moreover, increasing awareness of sustainable cooking methods is driving the demand for eco-friendly range cooker models. These developments, alongside other key factors, continue to influence the market’s growth and spur innovation. According to the Made in Canada data published in January 2025, homeowners, when asked what renovations would yield the best return on their money, about 70% respondents stated modernizing large spaces such as the kitchen would yield the best return for their money.

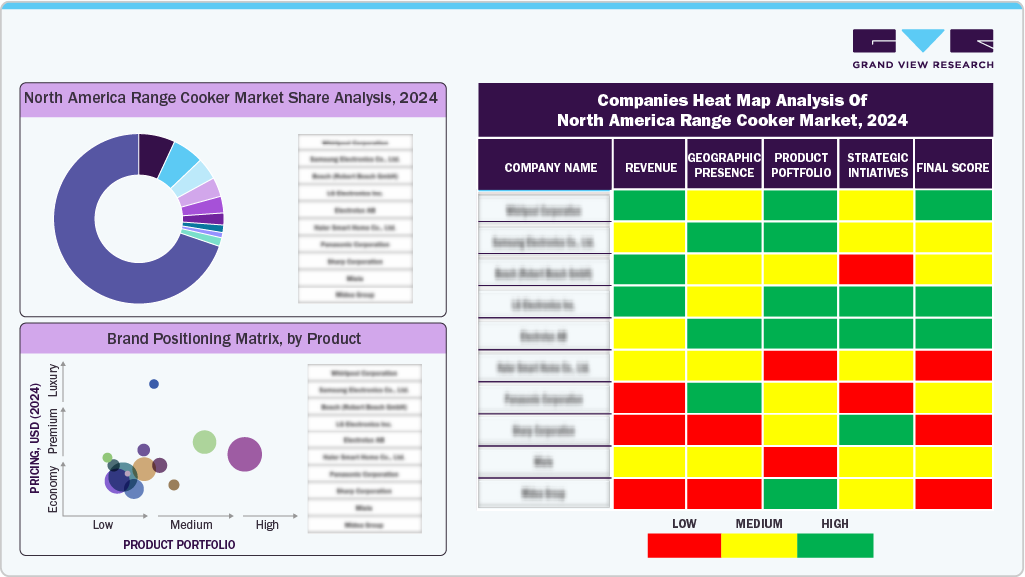

Key North America Range Cooker Company Insights

The North America range cooker market is experiencing steady growth, driven by increasing consumer demand for high-performance and multifunctional kitchen appliances, rising disposable incomes, and the trend toward modern home designs. Leading brands in the region are heavily investing in innovation, offering features such as dual-fuel options, smart temperature controls, multiple oven cavities, and energy-efficient technologies to appeal to tech-savvy and quality-conscious consumers.

Key North America Range Cooker Companies:

- Whirlpool Corporation

- GE Appliances (Haier)

- Samsung Electronics

- LG Electronics

- Viking Range, LLC

- Wolf (Sub-Zero Group, Inc.)

- Bosch (BSH Home Appliances)

- KitchenAid

- Frigidaire (Electrolux)

- Maytag

- Fulgor Milano

- Thermador

- Prizer-Painter Stove Works, Inc. (Blue Star)

- Bertazzoni

- Monogram

- Ilve SPA

- Fisher & Payke

- Superiore

Recent Developments

-

In June 2025, GE Appliances, a Haier company, expanded its smart induction cooking lineup with a 30-inch Smart Slide-In Induction and Convection Range, manufactured in Georgia and ENERGY STAR certified, delivering speed, precision, and responsiveness to consumers.

-

In November 2024, ZLINE Kitchen and Bath launched four new professional freestanding ranges under its Classic Series (CDR and CGR) and Select Series (HDR and HGR), featuring gas and dual-fuel options available in 30-inch, 36-inch, and 48-inch sizes. These ranges are often bundled into luxury kitchen packages, further reinforcing their appeal in upscale remodels, custom builds, and the aspirational “chef-at-home” lifestyle prevalent in North America’s affluent demographics.

-

In September 2024, Fulgor Milano announced a partnership with Mode Distributing to expand its presence in the U.S. market. Starting September 20, 2024, Mode Distributing will manage the distribution and service of Fulgor Milano’s high-end kitchen appliances in California, Nevada, Utah, Colorado, and Arizona, boosting the brand's presence in these regions.

North America Range Cooker Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 16.83 billion

Revenue forecast in 2033

USD 27.55 billion

Growth rate

CAGR of 6.4% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, thousand units, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, size, fuel type, material, technology, price range, end user, distribution channel, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Whirlpool Corporation; GE Appliances (Haier); Samsung Electronics; LG Electronics; Viking Range, LLC; Wolf (Sub-Zero Group, Inc.); Bosch (BSH Home Appliances); KitchenAid; Frigidaire (Electrolux); Maytag; Fulgor Milano; Thermador; Prizer-Painter Stove Works, Inc. (Blue Star); Bertazzoni; Monogram; Ilve SPA; Fisher & Payke; Superiore

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Range Cooker Market Report Segmentation

This report forecasts volume & revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 - 2033. For this study, Grand View Research has segmented the North America range cooker market report based on product, size, fuel type, material, technology, price range, end user, distribution channel, and region:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Free-standing Range Cookers

-

Slide-in Range Cookers

-

-

Size Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Up to 24 inches

-

30 inches

-

36 inches

-

40 inches

-

48 inches

-

Above 48 inches

-

-

Fuel Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Electric

-

Gas

-

Induction

-

Dual Fuel inches

-

-

Material Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Cast Iron

-

Stainless Steel

-

-

Technology Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Smart Range Cookers

-

Conventional Range Cookers

-

-

Price Range Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Up to USD 1,000

-

USD 1,000 - USD 2,000

-

USD 2,000 - USD 3,500

-

USD 3,500 - USD 5,000

-

Above USD 5,000

-

-

End User Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Hypermarkets & Supermarkets

-

Electronic Stores

-

Exclusive Brand Outlets

-

Online

-

Others

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.