- Home

- »

- Renewable Chemicals

- »

-

Oleanolic Acid Market Size And Share, Industry Report, 2033GVR Report cover

![Oleanolic Acid Market Size, Share & Trends Report]()

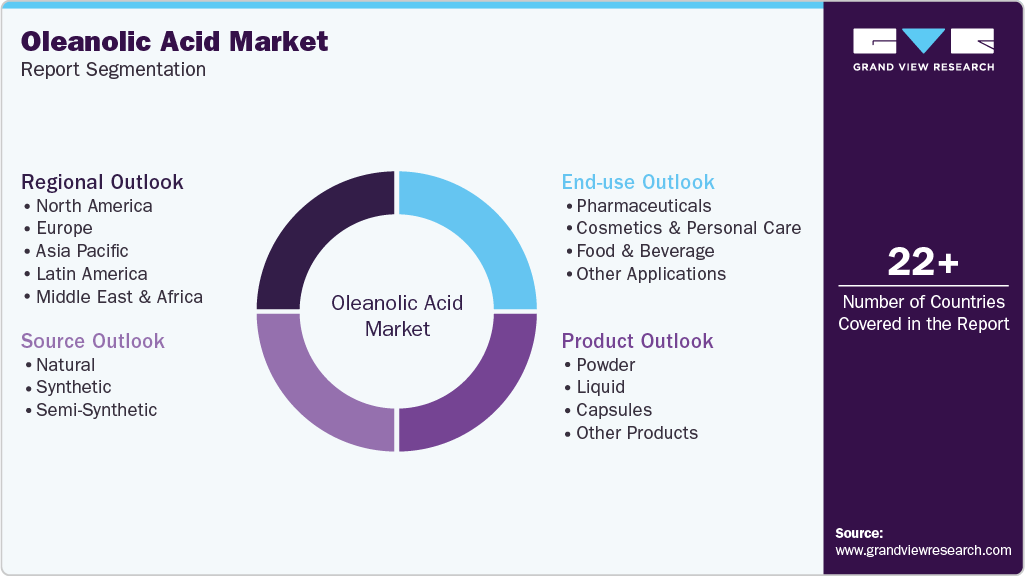

Oleanolic Acid Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Natural, Synthetic, Semi-synthetic), By Product (Powder, Liquid, Capsules), By End-use (Pharmaceuticals, Cosmetics & Personal Care, Food & Beverage), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-779-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oleanolic Acid Market Summary

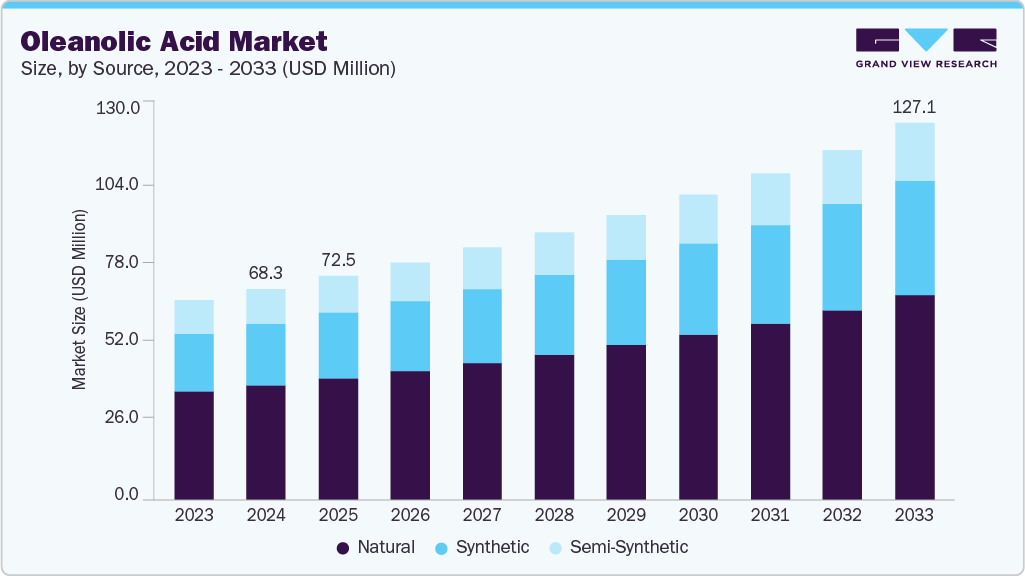

The global oleanolic acid market size was estimated at USD 68.28 million in 2024 and is projected to reach USD 127.10 million by 2033, growing at a CAGR of 7.3% from 2025 to 2033. The industry is experiencing steady growth, mainly driven by the rising demand for natural, plant-based ingredients in pharmaceuticals and cosmetics as consumers move away from synthetic chemicals.

Key Market Trends & Insights

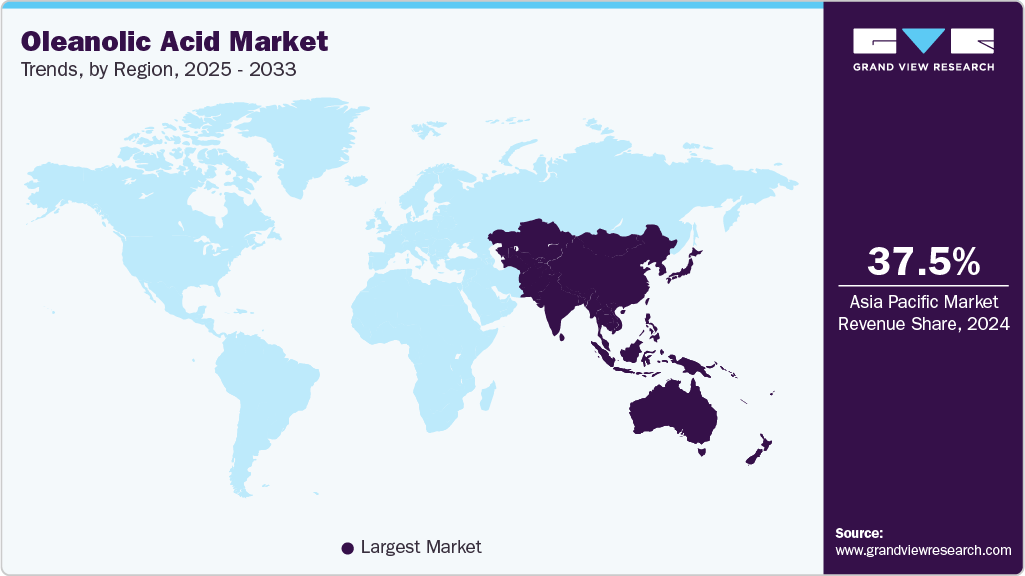

- Asia Pacific led the oleanolic acid market with the largest revenue share of 37.54% in 2024.

- China is expected to grow the fastest with a CAGR of 7.8% from 2025 to 2033.

- By source, the natural segment dominated the market and accounted for the largest revenue share of 54.34% in 2024.

- By end-use, the pharmaceuticals segment is expected to grow the fastest, with a CAGR of 7.4% from 2025 to 2033.

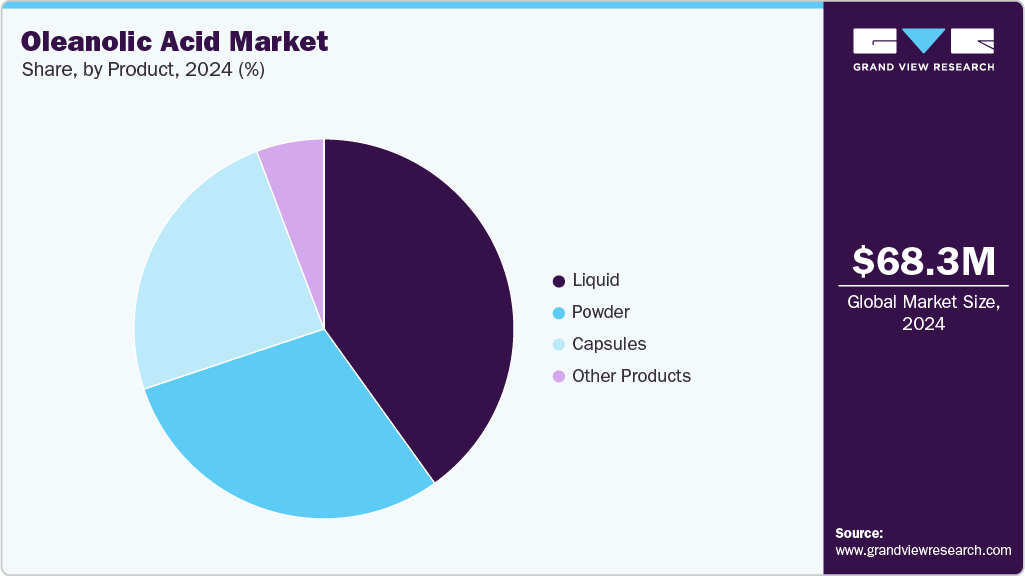

- By product, the liquid segment dominated the market with a revenue share of 40.10% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 68.28 Million

- 2033 Projected Market Size: USD 127.10 Million

- CAGR (2025-2033): 7.3%

- Asia Pacific: Largest market in 2024

Manufacturers are using it more for its proven health benefits, such as reducing inflammation, fighting oxidation, and protecting the liver. Growing research and clinical studies showing its potential to help with chronic diseases like diabetes and liver problems are further boosting its use and value.The expansion of the oleanolic acid industry is being driven by the escalating use of botanical actives in nutraceutical formulations and herbal therapeutics, particularly as consumers prioritize preventive healthcare and holistic wellness. Growing interest in natural compounds that support metabolic balance and immune modulation is prompting manufacturers to integrate oleanolic acid into dietary supplements and functional beverages. In addition, the rising preference for traditional medicine systems such as Ayurveda and Traditional Chinese Medicine, where oleanolic acid-rich plant extracts are widely used, is strengthening its commercial relevance and widening its global acceptance across health and wellness sectors.

However, the market growth is challenged by the limited scalability of extraction processes and fluctuations in raw material availability due to dependence on specific plant species. Inefficient supply chain management and the seasonal nature of cultivation often disrupt continuous production, resulting in inconsistent pricing and product shortages. Furthermore, the lack of global regulatory harmonization regarding purity standards and clinical safety validation acts as a major constraint, reducing market entry opportunities for small and medium-sized producers and restricting product penetration in highly regulated regions such as North America and Europe.

Despite existing challenges, emerging technological innovations in bioengineering and green chemistry are opening new avenues for sustainable and high-yield synthesis of oleanolic acid. The adoption of enzyme-assisted extraction and molecular modification techniques is expected to improve product efficacy and stability, enhancing its potential use in advanced pharmaceuticals and cosmeceuticals. Furthermore, expanding applications in anti-aging skincare, metabolic health supplements, and chronic disease management create a fertile ground for product diversification, while the growing investments in natural ingredient research across the Asia Pacific present significant opportunities for strategic collaborations and market expansion.

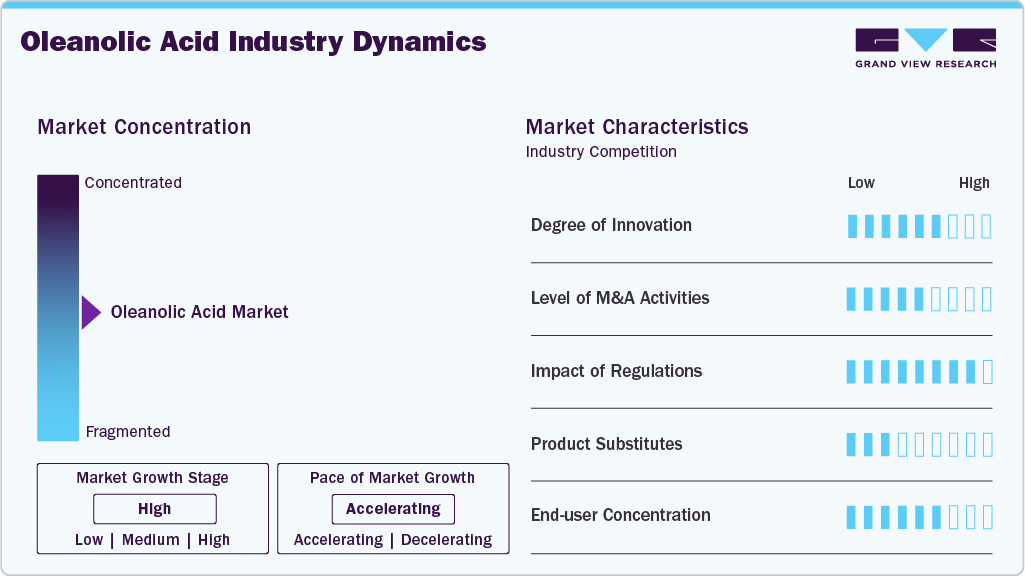

Market Concentration & Characteristics

The industry shows moderate concentration, led by integrated manufacturers managing sourcing, extraction, and formulation to ensure quality and scale. It is highly research-driven, with companies focusing on purity improvement, clinical validation, and regulatory compliance to enhance credibility. Strategic partnerships between research institutes and industry players are expanding therapeutic applications. Overall, competition is shifting toward innovation and standardized quality rather than volume-based production.

SimSon Pharma Limited and Chemicea Limited are among the prominent global manufacturers leading the oleanolic acid industry, known for their advanced extraction capabilities and strict quality control standards. Their consistent supply of high-purity oleanolic acid supports a broad spectrum of pharmaceutical, nutraceutical, and cosmetic applications worldwide. The overall market is shaped by increasing emphasis on product standardization, regulatory compliance, and evidence-based validation of natural actives. Manufacturers are focusing on enhancing production efficiency through green extraction technologies and traceable sourcing systems. These advancements collectively strengthen the reliability and global competitiveness of oleanolic acid, driving its wider adoption across therapeutic and preventive health formulations.

Source Insights

The natural segment dominated with a revenue share of 54.34% in 2024. The growth is driven by rising confidence in plant-based actives with proven performance and clean-label appeal, making them the preferred choice for pharmaceutical and cosmetic applications.This dominance is reinforced by the ability of natural extraction processes to preserve the compound’s bioactivity and therapeutic integrity, allowing manufacturers to offer high-performance, biocompatible ingredients that meet both regulatory and sustainability standards, thereby ensuring continued preference and long-term market leadership of naturally sourced oleanolic acid.

The synthetic segment is the fastest-growing segment with a projected CAGR of 7.8% during the forecast period. It is driven by technological advancements that enable precise chemical synthesis with enhanced purity and scalability. The controlled production process allows manufacturers to overcome the limitations of natural sourcing, such as variability in yield and dependence on seasonal crops. This consistency in quality and supply has made synthetic variants highly attractive for pharmaceutical formulations and industrial applications requiring uniform bioactivity. Moreover, ongoing R&D efforts aimed at optimizing synthesis efficiency and reducing production costs are expanding its commercial viability, positioning synthetic oleanolic acid as a key growth engine within the overall market landscape.

End-use Insights

The pharmaceutical segment spearheaded with a revenue share of 45.67% in 2024. The market is primarily driven because of its strong therapeutic potential and extensive clinical validation in treating chronic liver and metabolic disorders, which has established it as a reliable and scientifically backed compound in drug formulations. Its proven bioactivity, coupled with regulatory acceptance and consistent therapeutic outcomes, has positioned oleanolic acid as an indispensable ingredient in pharmaceutical research and production, ensuring the segment’s sustained market leadership.

The cosmetics and personal care segment is the fastest-growing end use with an expected CAGR of 7.3% during the forecast period. Growth is driven by the increasing integration of oleanolic acid in advanced skincare formulations for its potent anti-inflammatory and antioxidant properties that effectively combat acne, oxidative stress, and skin aging. As global consumers and brands shift toward natural yet high-performance bioactive, oleanolic acid’s efficacy and clean-label appeal have made it a preferred ingredient in next-generation cosmetic innovations, fueling rapid segment expansion.

Product Insights

The liquid segment dominated with a revenue share of 40.10% in 2024. The market is primarily fueled because of its superior solubility, ease of formulation, and high bioavailability, which make it the preferred form for pharmaceutical and cosmetic applications requiring rapid absorption and consistent performance. Its compatibility with diverse formulation bases, such as serums allows manufacturers to achieve uniform dosage and stability, strengthening its commercial appeal. This adaptability, combined with efficient blending in production processes, continues to make the liquid form the most practical and industry-preferred format across end-use sectors.

The powder segment is expected to grow at a CAGR of 7.4%, during the forecast period. This growth is spurred by the product’s longer shelf life, easier handling, and suitability for bulk manufacturing of nutraceuticals and dietary supplements. The rising demand for concentrated, standardized extracts that ensure dosage precision and extended product stability has accelerated its adoption among producers. Moreover, the powder form supports flexible integration into tablets, capsules, and functional foods, making it increasingly favored for high-volume, cost-efficient applications that align with expanding global nutraceutical trends.

Regional Insights

The North America oleanolic acid market is being supported by partnerships between biotechnology startups and major pharmaceutical companies that are integrating natural actives into chronic disease management solutions. The region’s innovation-led healthcare environment and increasing private investment in botanical clinical trials enhance scientific validation and product credibility. These developments, supported by growing demand for non-synthetic ingredients, position North America as a steadily advancing region within the global industry.

U.S. Oleanolic Acid Market Trends

The U.S. oleanolic acid industryis witnessing robust growth through its dominance in nutraceutical R&D and advanced product formulation technologies. The country’s biotechnology hubs in California and Massachusetts are developing high-yield, bioengineered synthesis methods that reduce reliance on plant extraction, lowering production costs and improving scalability. Growing public interest in holistic wellness and natural liver-support supplements further boosts commercial adoption. The combination of scientific innovation, industrial capacity, and consumer sophistication sustains the U.S. as a high-value growth engine.

Asia Pacific Oleanolic Acid Market Trends

The Asia Pacific oleanolic acid industry dominated the market with the largest revenue share of 37.54% in 2024. The regional growth is strengthened by expanding herbal pharmaceutical manufacturing and strong government initiatives supporting traditional medicine integration into modern healthcare. National programs such as India’s AYUSH Mission and China’s TCM modernization policy emphasize clinical validation and scientific standardization of botanical ingredients, strengthening product credibility. Growing R&D investments from both public and private sectors are accelerating innovation in plant-based drug formulations and natural health products. Supported by abundant medicinal plant resources and advanced extraction facilities, the region is becoming a global hub for high-purity oleanolic acid production.

The China oleanolic acid industry dominated with a revenue share of 37.87% in 2024 and registered the fastest CAGR of 7.8% during the forecast period. China’s strong manufacturing base and focus on technological modernization are reinforcing its dominance in oleanolic acid production. The Ministry of Industry and Information Technology (MIIT), under its “14th Five-Year Plan for the Bioeconomy,” promotes green extraction and purification technologies for bioactive compounds. These initiatives improve production efficiency, ensure product purity, and reduce environmental impact. With provinces like Sichuan and Yunnan expanding herbal cultivation zones, China benefits from stable raw material access and competitive cost structures, positioning it as a global leader in natural triterpenoid manufacturing.

Europe Oleanolic Acid Market Trends

The oleanolic acid industry in Europe continues to grow due to its early adoption of sustainable bioprocessing technologies and its leadership in green chemistry research. The region’s industrial clusters in France, Germany, and Switzerland have pioneered eco-efficient extraction methods that minimize solvent use and waste generation, aligning with the EU’s Green Deal and Bioeconomy Strategy. This alignment of environmental regulation with innovation incentives has attracted investment in natural actives and improved manufacturing efficiency.

The Germany oleanolic acid industry continues to grow because it integrates applied biotechnology and herbal pharmacology within its healthcare and research framework. Institutions such as the Fraunhofer Society and German Research Foundation (DFG) actively fund bio-extraction projects, enhancing the scientific base for oleanolic acid development. The country’s precise quality control standards and domestic expertise in formulation science allow consistent output of standardized, pharmaceutical-grade actives. This combination of technological sophistication and regulatory credibility strengthens Germany’s position as Europe’s key production and innovation center for oleanolic acid.

Latin America Oleanolic Acid Market Trends

The Latin America oleanolic acid industry is expanding steadily, supported by its rich biodiversity and government-backed efforts to develop sustainable herbal product industries. Countries like Brazil and Peru are investing in biodiversity-based bioproduct development under national bioeconomy policies, which enhance access to raw botanical resources. Local universities and public health agencies are collaborating on pharmacological studies to validate traditional plant species containing oleanolic acid. This blend of natural wealth and rising scientific engagement is helping Latin America transition from raw material supplier to an emerging manufacturing base for standardized natural compounds.

Middle East & Africa Oleanolic Acid Market Trends

The Middle East & Africa oleanolic acid industry is driven by growing investment in the herbal extraction and natural cosmetics industries. Gulf countries such as the UAE and Saudi Arabia are expanding local pharmaceutical manufacturing capacity as part of their economic diversification goals under Vision 2030 initiatives. Simultaneously, African nations with rich medicinal flora, such as South Africa and Morocco, are exploring value addition through controlled extraction and export of plant-based actives. With increasing awareness of plant therapeutics and supportive industrial policies, the region is poised for gradual but steady growth.

Key Oleanolic Acid Company Insights

SimSon Pharma Limited and Chemicea Limited dominate the oleanolic acid industry due to their advanced extraction technologies, strict quality control, and ability to deliver high-purity, standardized compounds that meet global pharmaceutical and cosmetic standards.

-

SimSon Pharma Limited, a manufacturer in the oleanolic acid market, is known for its advanced extraction technologies and strict quality control that ensure consistent, high-purity output for pharmaceutical and nutraceutical applications. The company’s strength lies in its vertically integrated operations, from raw material sourcing to API-grade production, offering customized formulations that meet global regulatory standards. With a focus on innovation, process optimization, and sustainable sourcing, SimSon continues to expand its international presence, reinforcing its position as a trusted supplier of high-quality botanical actives.

-

Chemicea Limited has established itself as a key producer of oleanolic acid by delivering premium-grade extracts backed by strong analytical validation and compliance with international quality norms. The company’s portfolio includes high-purity oleanolic acid powders and intermediates for pharmaceuticals, cosmetics, and nutraceuticals, emphasizing precision and purity. Through export-oriented manufacturing, consistent batch quality, and efficient global supply, Chemicea has achieved steady growth and built a strong reputation as a reliable supplier in the natural ingredients industry.

Key Oleanolic Acid Companies:

The following are the leading companies in the oleanolic acid market. These companies collectively hold the largest market share and dictate industry trends.

- SimSon Pharma Limited

- Chemicea Limited

- Otto Chemie Pvt. Ltd.

- Fengchen Group Co.,Ltd

- Xi'an Fengzu Biological Technology Co.,Ltd

- Nutragreenlife Biotechnology Co.,Ltd

- Symrise AG

- Martin Bauer GmbH & Co. KG

- Sensient Technologies Corporation

- Euromed S.C.A.

Recent Developments

-

In April 2025, Sabinsa introduced “Olepent,” a novel pentapeptide linked with plant-derived oleanolic acid, designed to stimulate collagen production, minimize enzyme degradation, and support skin regeneration in advanced cosmetic formulations.

Oleanolic Acid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 72.47 million

Revenue forecast in 2033

USD 127.10 million

Growth rate

CAGR of 7.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Source, end-use, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

SimSon Pharma Limited; Chemicea Limited; Otto Chemie Pvt. Ltd.; Fengchen Group Co.,Ltd; Xi'an Fengzu Biological Technology Co.,Ltd; Nutragreenlife Biotechnology Co.,Ltd; Symrise AG; Martin Bauer GmbH & Co. KG; Sensient Technologies Corporation; Euromed S.C.A.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oleanolic Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global oleanolic acid market report based on source, end-use, product, and region.

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Natural

-

Synthetic

-

Semi-Synthetic

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Pharmaceuticals

-

Cosmetics & Personal Care

-

Food & Beverage

-

Other Applications

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Powder

-

Liquid

-

Capsules

-

Other Products

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global oleanolic acid market size was estimated at USD 68.28 million in 2024 and is expected to reach USD 127.10 million in 2033.

b. The global oleanolic acid market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2033 to reach USD 127.10 million by 2033.

b. Asia Pacific dominated the oleanolic acid market with a share of 37.54% in 2024.

b. Some key players operating in the oleanolic acid market include SimSon Pharma Limited, Chemicea Limited, Otto Chemie Pvt. Ltd., Fengchen Group Co.,Ltd, Xi'an Fengzu Biological Technology Co.,Ltd, Nutragreenlife Biotechnology Co.,Ltd, Symrise AG, Martin Bauer GmbH & Co. KG, Sensient Technologies Corporation, Euromed S.C.A.

b. The oleanolic acid market is experiencing steady growth, mainly driven by the rising demand for natural, plant-based ingredients in pharmaceuticals and cosmetics as consumers move away from synthetic chemicals. Manufacturers are using it more for its proven health benefits such as reducing inflammation, fighting oxidation, and protecting the liver. Growing research and clinical studies showing its potential to help with chronic diseases like diabetes and liver problems are further boosting its use and value.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.