- Home

- »

- Technology

- »

-

Online Gaming Market Size & Share, Industry Report, 2030GVR Report cover

![Online Gaming Market Size, Share & Trends Report]()

Online Gaming Market (2025 - 2030) Size, Share & Trends Analysis Report By Genre (Action & Adventure, Multiplayer Online Battle Arena, Real-time strategy, Role-playing games, Shooter), By Device (Computers, Smartphones & Tablets, Gaming Consoles), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-814-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Research

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Online Gaming Market Summary

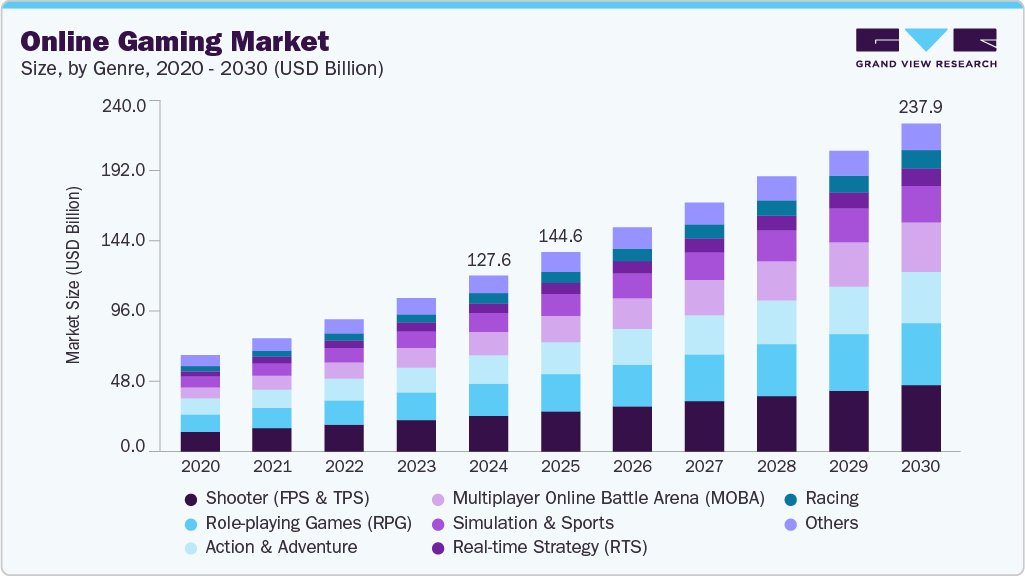

The global online gaming market size was valued at USD 127,578.1 million in 2024 and is projected to reach USD 237,922.4 million by 2030, growing at a CAGR of 10.5% from 2025 to 2030. The industry is driven by the rapid expansion of high-speed internet connectivity and the widespread adoption of smartphones, which have made gaming more accessible and affordable for a diverse global audience.

Key Market Trends & Insights

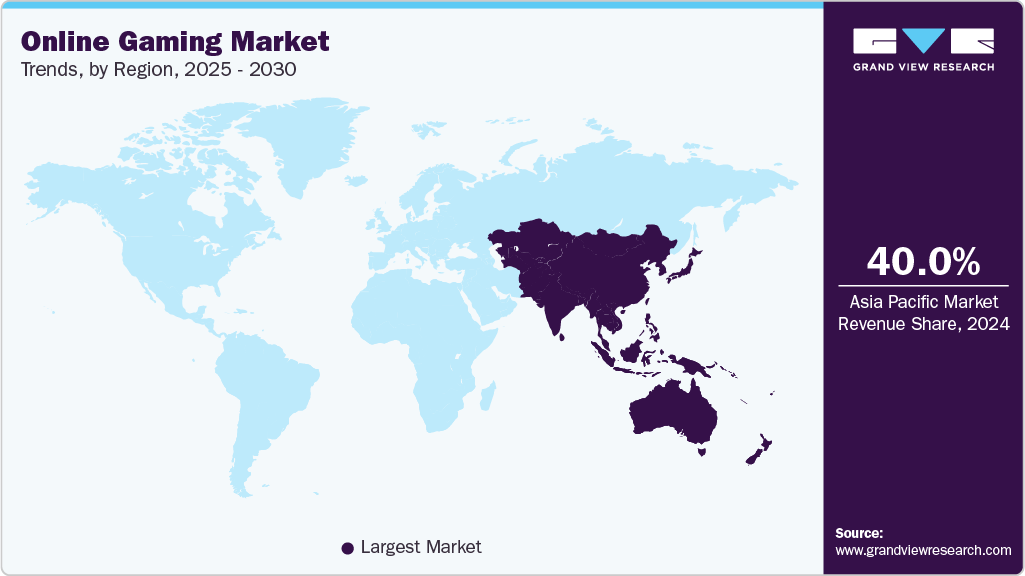

- The online gaming market in the Asia Pacific accounted for the largest revenue share of over 40% in 2024.

- The U.S. online gaming market dominated the North American region with a share of over 77% in 2024.

- Based on genre, the shooter segment accounted for the largest revenue share of over 20% in 2024.

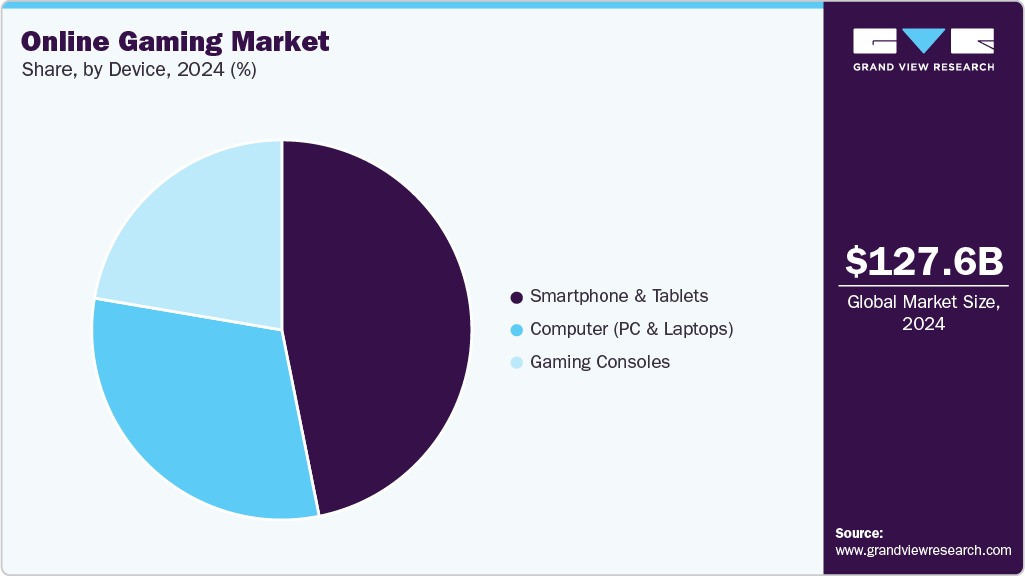

- Based on device, the smartphone & tablets segment is expected to register the highest CAGR of 12.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 127,578.1 Million

- 2030 Projected Market Size: USD 237,922.4 Million

- CAGR (2025-2030): 10.5%

- Asia Pacific: Largest market in 2024

Additionally, advances in technology, including the rollout of 5G networks, cloud gaming platforms, virtual reality (VR), and augmented reality (AR), are also transforming the user experience, enabling smoother gameplay, enhanced graphics, and interactive features, which are expected to drive the online gaming industry in the coming years.

Additionally, the growing adoption of mobile gaming, expanding digital infrastructure, and rising disposable incomes in emerging economies are the key factors accelerating online gaming industry growth. The widespread availability of affordable smartphones and the migration of popular titles such as PUBG, Fortnite, and Call of Duty to mobile platforms have democratized gaming access. Cloud gaming platforms such as NVIDIA GeForce Now and Xbox Cloud Gaming are also lowering entry barriers by removing the need for expensive consoles.

Additionally, the widespread availability of smartphones has significantly democratized gaming, granting access to digital entertainment across diverse income groups and regions. Budget-friendly devices equipped with powerful processors now enable users to engage in sophisticated, high-quality gaming experiences previously limited to expensive consoles or PCs. This affordability has broadened the gamer demographic, attracting a wider audience ranging from casual to hardcore players, and facilitating online gaming industry expansion, particularly in emerging economies where smartphone penetration is rapidly increasing.

Furthermore, continuous advancements in graphics and visual fidelity have significantly heightened gamer expectations and opened new market opportunities. Techniques such as real-time ray tracing, physically based rendering, and ultra-high-definition displays enable developers to create increasingly lifelike and immersive game worlds. This mutual reinforcement between hardware and software advancements creates a self-sustaining cycle, where progress in one area propels rapid development in the other, driving the expansion and evolution of the gaming industry. For instance, in January 2025, NVIDIA Corporation launched the GeForce RTX 50 Series GPUs, featuring fifth-generation Tensor Cores and real-time ray tracing, which delivered dramatic improvements in graphics quality and rendering speed.

Moreover, companies are investing heavily in advanced technologies such as cloud gaming infrastructure and AI-driven personalization to enhance player experience and operational efficiency. Investments also focus on building immersive experiences through augmented reality (AR) and virtual reality (VR), expanding mobile-first gaming platforms, and developing robust monetization models, including free-to-play games, battle passes, and microtransactions, thus driving sustained revenue growth in the online gaming industry.

Genre Insights

The shooter segment dominated the market with a share of over 20% in 2024, due to high-paced competition, realistic graphics, and continuous live-service updates. Companies are leveraging large-scale multiplayer ecosystems and user-generated modes to sustain engagement. The integration of cross-platform functionality and regular content updates keeps the experience fresh. For instance, in August 2025, Epic Games, Inc. introduced a major content expansion for its online shooter with new tactical modes and themed collaborations. The combination of accessibility, innovation, and community engagement ensures shooters remain the most dominant segment in the market.

The multiplayer online battle arena (MOBA) segment is expected to register the fastest CAGR of over 13% from 2025-2030. The segmental growth is driven by real-time team-based competition, evolving esports tournaments, and interactive spectator modes that enhance engagement. Publishers are incorporating AI-driven matchmaking systems and character customization to maintain balanced gameplay. Continuous updates, battle passes, and event-driven content foster loyalty and encourage microtransactions. For instance, in July 2025, Tencent’s multiplayer online battle arena title introduced a global seasonal championship with exclusive digital rewards, significantly boosting participation across mobile and PC platforms.

Device Insights

The smartphones & tablets segment dominated the market in 2024, owing to widespread accessibility, affordable internet, and quick content updates. Companies such as Apple, Inc., Gameloft SE, and Tencent Holdings Limited are focusing on mobile-first design with cloud integration and localized content. In-app purchases, event-based monetization, and AR-based gaming continue to expand the mobile ecosystem. For instance, in May 2025, Tencent launched a major mobile update that integrated social mini-games and augmented reality missions to boost user engagement.

The gaming consoles segment is expected to register significant growth from 2025 to 2030. Companies are focusing on digital game libraries, cross-console online access, and immersive multiplayer experiences. Cloud syncing and social gaming hubs are further strengthening console ecosystems. The console segment continues to evolve as a premium access point for immersive and socially connected online gaming.

Regional Insights

North America accounted for a significant share of over 26% in 2024, driven by high disposable incomes coupled with a mature console and PC ecosystem. Robust broadband and 5G roll-outs support real-time multiplayer and streaming services, boosting engagement. Subscription-based gaming services are increasingly common and encourage longer retention. The strong esports infrastructure and streaming culture further deepen participation and monetization.

U.S. Online Gaming Market Trends

The U.S. online gaming market dominated the region with a share of over 77% in 2024, driven by widespread broadband and mobile penetration enabling high-quality multiplayer experiences, as well as strong adoption of cloud-based game streaming services by gamers. Rising esports viewership and the shift toward in-game social features are encouraging longer play sessions and more in-game monetization.

Europe Online Gaming Market Trends

The online gaming market in Europe accounted for a share of over 22% in 2024, characterized by widespread high-speed internet access, a strong mobile and console gamer base, and digital distribution dominance, where digital purchases accounted for gaming revenues. The region benefits from vibrant esports tournaments, cross-platform launches and localization across multiple languages, helping major players to address diverse markets.

Germany online gaming market is expected to grow in the coming years, driven by the growing time spent on online gaming platforms, especially console and mobile. Investment by gaming startups, competitive gaming events, and the annual Gamescom trade show creates visibility and drives user engagement.

The online gaming market in the UK is rapidly expanding, with strong disposable incomes, sophisticated monetization strategies employed by publishers and advanced infrastructure including widespread fiber broadband and 5G rollout. A well-developed esports ecosystem, prominent streaming culture, and high smartphone penetration drive uptake of competitive and social gaming.

Asia Pacific Online Gaming Market Trends

The online gaming market in Asia Pacific is expected to grow at the fastest CAGR of 12.5% from 2025 to 2030, owing to massive smartphone penetration, large young populations and strong gaming cultures in countries such as China, Japan, South Korea and India. The region is seeing rapid adoption of live-service models, mobile-first gaming design, in-game microtransactions and cloud gaming. Advanced mobile infrastructure (4G/5G) and rising disposable incomes are enabling more immersive and socially connected gaming experiences.

China online gaming market is driven by massive smartphone and 5G adoption, and the global success of locally developed IPs. Free-to-play monetization models and player spending underpin revenue growth. Growth of premium console/PC titles, global expansion by Chinese studios and integration of AI innovations into gaming platforms further drive the market.

The online gaming market in Japan is rapidly expanding, driven by a long-standing video game culture, high console and mobile adoption, and strong consumer willingness to pay for premium content and season-based game models. Major players regularly launch titles that dominate domestic charts and often perform strongly overseas. The rise of mobile-only games and cloud-enabled experiences is expanding reach beyond traditional console players.

Key Online Gaming Company Insights

Key players operating in the online gaming market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the market include Apple, Inc., and Microsoft Corporation, among others.

-

Apple, Inc. is a technology company renowned for its seamless integration of hardware, software, and services across a wide range of devices. The company continues to expand its presence in the online gaming market by leveraging its unified ecosystem, which includes iPhone, iPad, Mac, Apple TV, and the Vision Pro. Apple’s dedicated Games app offers a centralized platform for game discovery, social interaction, and multiplayer connectivity, while Apple Arcade delivers a curated library of exclusive titles. Advanced technologies such as Metal 4 graphics API, real-time cloud savers, and cross-device synchronization enhance gaming performance and player experience.

-

Microsoft Corporation drives the online gaming market through Xbox Cloud Gaming, Game Pass, and cross-platform multiplayer integration. Its ecosystem blends console, PC, and mobile play, providing seamless access via the cloud. Strategic acquisitions and investments in metaverse technologies enhance engagement, making Microsoft a pivotal enabler of connected entertainment experiences.

KRAFTON, Inc. and Bandai Namco Entertainment Inc, are some of the emerging market participants in the online gaming market.

-

KRAFTON, Inc. is a gaming company that develops and publishes innovative, engaging, and memorable gaming experiences across various platforms, including mobile, console, and PC. The company leads the online battle royale segment through evolving content ecosystems within PUBG and Battlegrounds Mobile India. Its focus on localization, live events, and player-driven engagement enhances platform revenue streams. The company’s expansion into tactical and extraction shooters positions Krafton as a core innovator, shaping competitive online gaming markets globally.

-

Bandai Namco Entertainment Inc. is a global publisher and developer leveraging its vast portfolio of intellectual properties and strong multiplayer network capabilities. The company drives user engagement across its online platforms with a hybrid approach that includes live-service releases and esports-ready titles, fostering vibrant, persistent communities around flagship franchises such as Tekken and Dragon Ball. Emphasizing digital content expansions and transmedia integration, Bandai Namco maximizes interactive revenue streams and bolsters its position in the competitive online gaming market.

Key Online Gaming Companies:

The following are the leading companies in the online gaming market. These companies collectively hold the largest market share and dictate industry trends.

- Apple, Inc.

- Bandai Namco Entertainment Inc.

- Electronic Arts, Inc.

- Epic Games, Inc.

- Gameloft SE

- Krafton Inc.

- Microsoft Corporation

- Nintendo Co., Ltd.

- Peak Games

- Rovio Entertainment Corporation

- Sony Interactive Entertainment, Inc.

- Tencent Holdings Limited

- Ubisoft Entertainment SA

- Warner Bros. Entertainment Inc.

- Zhejiang Century Huatong Group Co., Ltd.

Recent Developments

-

In September 2025, Electronic Arts, Inc. partnered with New York City FC to connect fans to their favorite football players and club through the EA SPORTS FC platform, focusing on content collaboration and immersive fan experiences. This renewal strengthens EA SPORTS' engagement with sports fans through digital and gaming platforms.

-

In August 2025, Tencent Holdings Limited showcased its largest-ever lineup at Gamescom 2025, emphasizing collaboration with global studios and innovation, particularly toward sustainability and enhanced player engagement globally. This presence underlines Tencent’s international ambitions and innovation drive.

-

In May 2025, Apple, Inc., completed its acquisition of a video-game studio when it bought RAC7. The acquisition is positioned as a targeted move to strengthen Apple Arcade content and bring experienced internal creators into Apple’s gaming/content teams rather than signaling a broad change to Apple’s M&A strategy.

Online Gaming Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 144,631.2 million

Revenue forecast in 2030

USD 237,922.4 million

Growth rate

CAGR of 10.5% from 2025 to 2030

Base Year of estimation

2024

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Genre, device, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East; and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Apple Inc.; Bandai Namco Entertainment Inc.; Electronic Arts Inc.; Epic Games Inc.; Gameloft SE; Krafton Inc.; Microsoft Corporation; Nintendo Co., Ltd.; Peak Games; Rovio Entertainment Corporation; Sony Interactive Entertainment Inc.; Tencent Holdings Limited; Ubisoft Entertainment SA; Warner Bros. Entertainment Inc.; Zhejiang Century Huatong Group Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Online Gaming Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global online gaming market report based on genre, device, and region:

-

Genre Outlook (Revenue, USD Million, 2018 - 2030)

-

Action & Adventure

-

Multiplayer Online Battle Arena (MOBA)

-

Real-time strategy (RTS)

-

Role-playing games (RPG)

-

Shooter (FPS and TPS)

-

Simulation and Sports

-

Racing

-

Others

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Computer (PC & Laptops)

-

Smartphone & Tablets

-

Gaming Consoles

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global online gaming market was estimated at USD 127,578.1 million in 2024 and is expected to reach USD 144,631.2 million in 2025.

b. The global online gaming market is expected to grow at a compound annual growth rate of 10.5% from 2025 to 2030, and is expected to reach USD 237,922.4 million by 2030.

b. The shooter (FPS and TPS) segment dominated the market, with a share of over 20% in 2024, driven by high-paced competition, realistic graphics, and continuous live-service updates.

b. Key players operating in the online gaming market include Key companies profiled Apple Inc., Bandai Namco Entertainment Inc., Electronic Arts Inc., Epic Games Inc., Gameloft SE, Krafton Inc., Microsoft Corporation, Nintendo Co., Ltd., Peak Games, Rovio Entertainment Corporation, Sony Interactive Entertainment Inc., Tencent Holdings Limited, Ubisoft Entertainment SA, Warner Bros. Entertainment Inc., and Zhejiang Century Huatong Group Co., Ltd.

b. Key factors driving the online gaming market include the rapid expansion of high-speed internet connectivity, the widespread adoption of smartphones, and advances in technology, such as the rollout of 5G networks, cloud gaming platforms, virtual reality (VR), and augmented reality (AR).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.