- Home

- »

- Healthcare IT

- »

-

Orthopedic Surgical Planning Software Market Report, 2033GVR Report cover

![Orthopedic Surgical Planning Software Market Size, Share & Trends Report]()

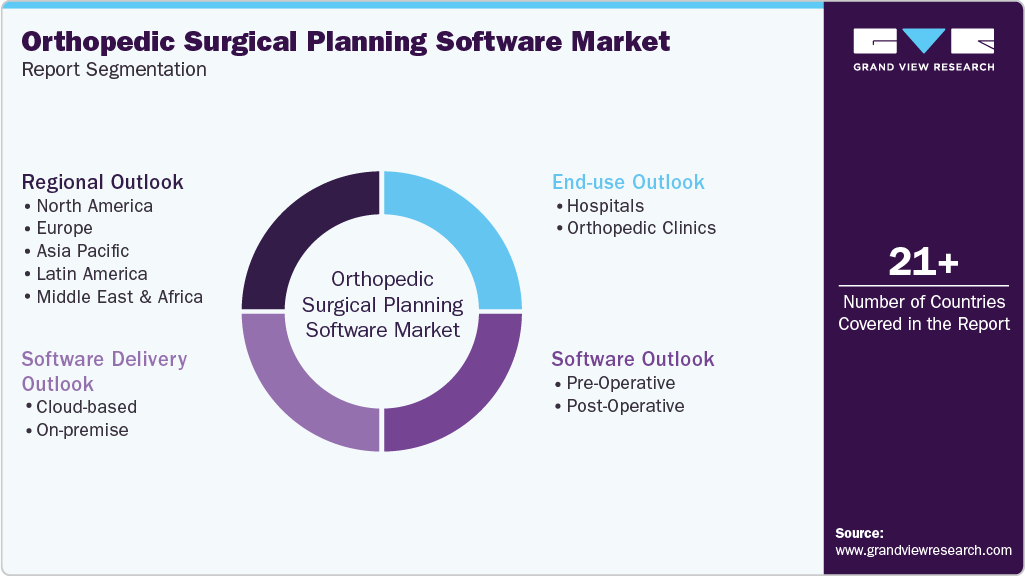

Orthopedic Surgical Planning Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Software Delivery (Cloud-based, On-premise), By Software (Pre-Operative, Post-Operative), By End Use (Hospitals, Orthopedic Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-066-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Orthopedic Surgical Planning Software Market Summary

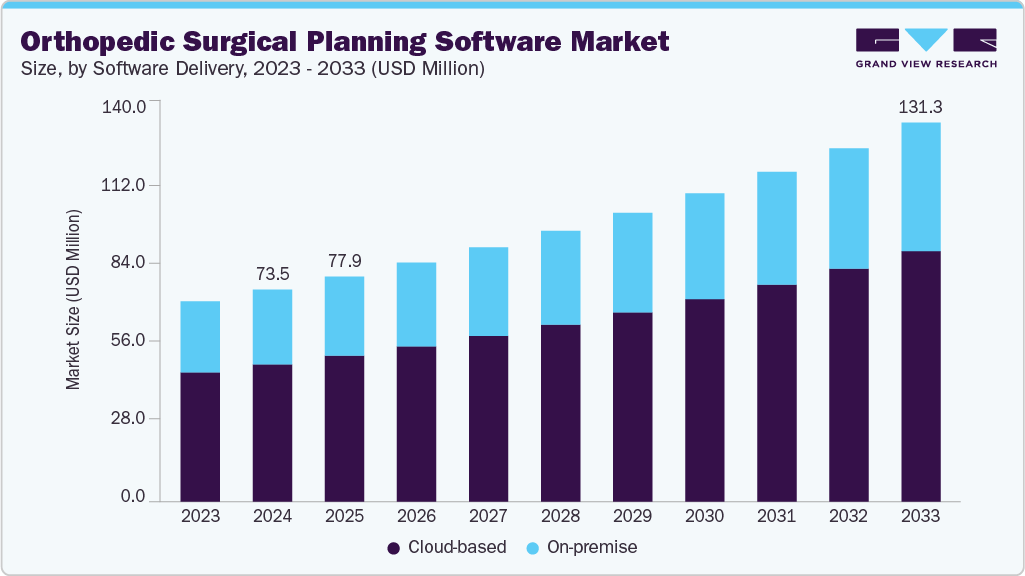

The global orthopedic surgical planning software market size was estimated at USD 73.49 million in 2024 and is projected to reach USD 131.27 million by 2033, growing at a CAGR of 6.73% from 2025 to 2033, driven by advancements in medical imaging technologies and the increasing adoption of digital solutions in pre- & postoperative care. The rising prevalence of orthopedic disorders such as osteoarthritis, rheumatoid arthritis, and traumatic injuries, coupled with the growing number of joint replacement and spinal surgeries, fuels demand for these solutions.

Key Market Trends & Insights

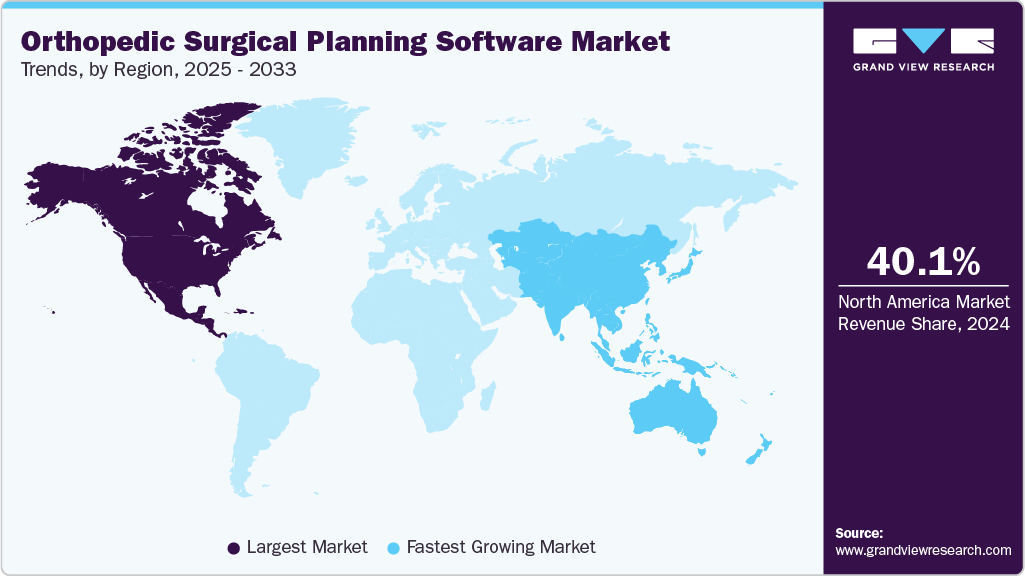

- North America region dominated the global orthopedic surgical planning software industry in 2024 and accounted for the largest revenue share of 40.10%.

- Canada is anticipated to register the fastest growth rate during the forecast period in the North American region.

- In terms of software delivery, the cloud-based segment held the largest revenue share in 2024.

- In terms of end use, the hospitals segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 73.49 Million

- 2033 Projected Market Size: USD 131.27 Million

- CAGR (2025-2033): 6.73%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Enhanced surgical precision, reduced operative time, and improved patient outcomes are key factors driving adoption. In December 2024, Smith+Nephew launched CORIOGRAPH Pre-Op Planning and Modeling Services for total hip arthroplasty, FDA-cleared, for use with the CORI Surgical System. The software enables patient-specific surgical planning using X-rays or CT scans to optimize implant placement and outcomes in orthopedic hip procedures.As the global population ages, there is a substantial rise in the prevalence of age-related orthopedic conditions, such as osteoarthritis, degenerative joint diseases, fractures, and osteoporosis. As per the WHO report, by the year 2030, one in every six individuals globally will be 60 years or older. At that time, the percentage of the population aged 60 and up will rise from 1 billion in 2020 to 1.4 billion. By the year 2050, the global population of those aged 60 years and above will be twice as large, reaching 2.1 billion. This demographic is particularly vulnerable to orthopedic conditions due to the natural degeneration of bones and joints over time, along with decreased mobility and muscle mass.

The increasing volume of orthopedic procedures creates a significant demand for innovative technologies, such as orthopedic surgical planning software. For instance, information from the 2023 Annual Report of the American Joint Replacement Registry (AJRR) indicates that there were 3,149,042 primary and revision procedures for hip and knee arthroplasty conducted between 2012 and 2022, with primary knee arthroplasty accounting for the majority at 51.0% and primary hip arthroplasty at 33.4%.

TABLE 1 Top 10 most common orthopedic surgeries

Rank

HCPCS/CPT code

HCPCS/CPT description

% total procedures

1

20610

Drainage/injection into joint or bursa without ultrasound guidance

21.80%

2

36415

Routine venipuncture

5.50%

3

27447

Total knee arthroplasty

4.90%

4

20611

Drainage/injection into joint or bursa with ultrasound guidance

3.30%

5

27130

Total hip arthroplasty

The complete table will be shared in the final report.

6

29881

Knee arthroscopy/surgery

7

20550

Injection into tendon sheath/ligament

8

29826

Arthroscopy, shoulder, surgical decompression of subacromial space with partial acromioplasty

9

29827

Shoulder arthroscopy

10

64721

Carpal tunnel surgery

Source: Definitive Healthcare, LLC.

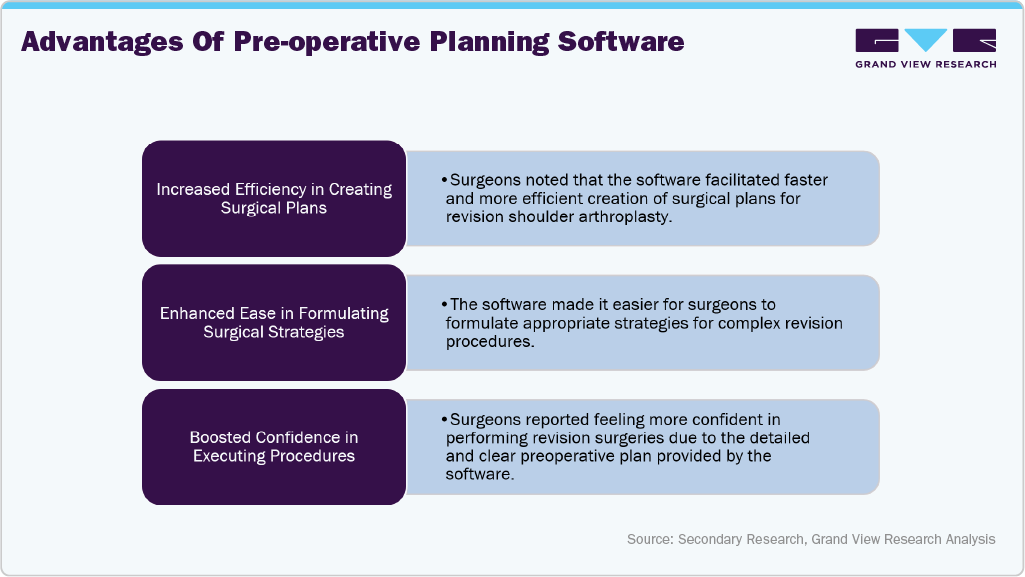

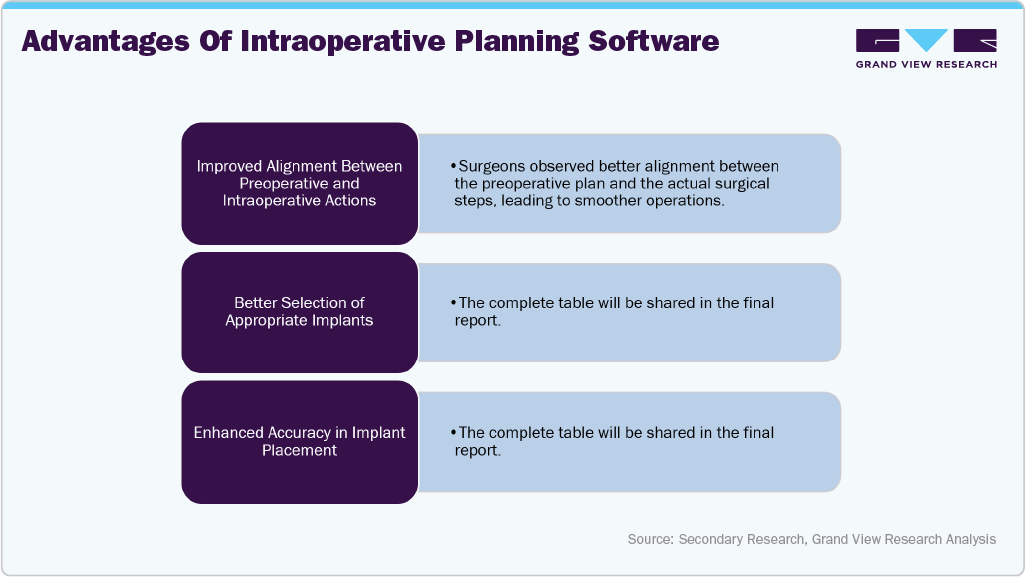

Case Study: Use of Pre-operative 3D Planning Software for Revision Shoulder Arthroplasty: Clinical Experience Data from a Survey in a Real-World Setting

Background:

Preoperative 3D planning is frequently used in primary shoulder arthroplasty, as it offers important insights and precision for surgical procedures. However, the complexities and challenges associated with revision shoulder arthroplasty often render traditional planning methods cumbersome and less practical. In response to this issue, the established preoperative planning software, Blueprint (Stryker, Tornier SAS, Montbonnot-Saint-Martin, France), has been enhanced to support cases of revision shoulder arthroplasty. This study aimed to collect feedback from experienced surgeons regarding their perceptions of this new software feature, with a particular focus on its effectiveness for preoperative 3D planning in revision shoulder arthroplasty.

Methods:

An observational survey was conducted from January 2022 to October 2022 among orthopedic surgeons who perform revision shoulder arthroplasty. The survey was part of the Early Product Surveillance program, designed to collect observational data from real-world surgical experience. A two-stage survey process was implemented, comprising separate questionnaires aimed at gathering feedback in two key areas:

-

Preoperative Planning: Surgeons’ experiences with the software during the planning phase of revision shoulder arthroplasty.

-

Intraoperative Evaluation:

Surgeons’ assessments of the software's effectiveness during the intraoperative phase of surgery

Results:

The survey involved 25 fellowship-trained orthopedic surgeons from the U.S. and Canada. These surgeons provided feedback on 34 revision shoulder arthroplasty cases that were preoperatively planned to use the Blueprint revision planning software. The findings revealed that the surgeons were predominantly favorable toward the revision-specific planning features of the software. The key reported benefits were as follows:- Preoperative Planning:

- Intraoperative Planning:

Conclusion:

The feedback from fellowship-trained shoulder arthroplasty surgeons regarding the use of the Blueprint preoperative 3D planning software for revision shoulder arthroplasty was largely positive. Surgeons reported several perceived benefits, including increased planning efficiency, enhanced confidence, and better intraoperative execution.

Case Study: Improving Joint Replacement Outcomes with Formus Labs’ ACID-Hip Software

Introduction:

Formus Labs aims to enhance patient outcomes in joint replacement surgeries through advanced, AI-driven software that streamlines preoperative planning. This case study, overseen by Dr. Paul Monk, Head of Clinical Advisory Board, exemplifies how this software improves surgical outcomes, even in complex cases.

Patient Overview:

A woman in her late 50s, diagnosed with advanced hip arthritis, required a hip replacement following a traumatic above-the-knee amputation due to a motor vehicle accident. Years of using an artificial lower leg led to excessive pressure on her left hip, which became her primary weight-bearing joint. A hip replacement was essential to restore functionality and improve mobility.

Challenge:

This was a particularly complex case due to the patient’s history of amputation and the unusual weight-bearing dynamics of her hips. A standard hip replacement would not have been adequate, as the preoperative planning needed to account for the traditional elements of hip replacement as well as the unique forces exerted on the patient's left hip due to her altered gait.

Solution: ACID-Hip Software:

Formus Labs’ ACID (Automatic Custom Implant Design)-Hip software was utilized for preoperative planning in this case. ACID provides highly accurate, 3D models of joints, eliminating magnification errors commonly seen with traditional templating methods. This software allowed for a personalized approach, considering the size of the implant cup and anteversion & inclination, tailored to the patient's unique dynamic loading conditions.

Dr. Paul Monk, Head of Clinical Advisory Board at Formus Labs, noted,

"ACID provides valuable peace of mind to both the surgeon and the patient. The software elevates the pre-op planning process, facilitating a more personalized and precise approach. The improved accuracy of implant sizing and alignment is crucial for optimizing surgical outcomes."

Outcome:

The patient was able to mobilize the next day after surgery and remains in excellent condition weeks later. A globally recognized orthopedic surgeon, highlighted that ACID offers crucial peace of mind by providing highly personalized and precise preoperative planning, leading to optimal outcomes.

Expert Insight:

Dr. Monk emphasized that traditional measures for successful surgery, such as avoiding dislocation, fall short of achieving the best outcomes. ACID’s precision goes beyond these basic metrics, ensuring higher success rates through personalized planning.

Conclusion:

This case study highlights the transformative impact of Formus Labs’ ACID-Hip software in the orthopedic surgical planning market, offering personalized, precise solutions for complex joint replacement surgeries.

List of orthopedic platforms/software that helps enhance patient care and educational resources in practice through advanced technology.

App Name

Description

Pros

Cons

Use Cases

Pricing

hipEOS

It is a web-based surgical planning tool designed for primary total hip arthroplasty. Utilizing sitting and standing EOS images, 3D models, and precise measurements enables physicians to effectively identify abnormal spinopelvic relationships.

- Enables precise preoperative planning

- Improves implant alignment and positioning

- Enhances surgical workflow efficiency

- Supports data-driven decision-making- Requires specialized knowledge for accurate use

- Limited to hip arthroplasty planningOrthopedic surgeons planning primary total hip replacements; surgical teams assessing spinopelvic alignment

Subscription-based model

spineEOS

The complete analysis will be available in the final report.

VSP Orthognathic

HipMap and HipCheck

TrueSight

TraumaCad Orthopedic Digital Templating software

Emerging Business Models in the Orthopedic Sector

The orthopedic industry is transitioning from traditional product-sales approaches to more integrated, value-driven business models. These emerging models are designed to meet the demands of cost-efficiency, improved patient outcomes, and technological integration.

Device-as-a-Service (DaaS)

-

What it is: A subscription or pay-per-use model for orthopedic softwares and surgical tools.

-

Why it matters: Reduces upfront capital costs for hospitals and allows access to high-end tools and equipment.

-

Added value: Often bundled with services such as analytics, training, and equipment maintenance.

Outcome-Based Partnerships

-

What it is: Risk-sharing agreements where manufacturers are paid based on patient outcomes.

-

Why it matters: Aligns incentives between platform makers, hospitals, and payers.

-

Focus areas: Metrics such as post-surgical recovery, infection rates, and reoperation avoidance.

Integrated Digital Ecosystems

-

What it is: End-to-end platforms combining diagnostics, surgical planning, intraoperative tools, and post-op monitoring.

-

Why it matters: Streamlines workflows and enhances clinical decision-making.

-

Revenue models: SaaS licensing, platform subscriptions, or bundled device-plus-software packages.

Investments in Orthopedic Surgical Planning Software

Advancements in surgical technology are enabling more personalized approaches to orthopedic care. Innovative platforms and patient-specific tools are gaining traction, improving efficiency and outcomes in clinical practice. Growing investment is helping companies scale these solutions across the US healthcare system. In May 2025, Insight Surgery raised USD 2.5 million to expand its FDA-cleared personalized orthopedic surgery solutions across the US. Their EmbedMed platform enables rapid design and production of patient-specific surgical guides, delivered within 10 days from their ISO 13485-certified facility at Texas Medical Center, Houston.

“Insight’s technology makes it possible for me and my colleagues to operate with greater precision and speed, which directly improves outcomes for patients and reduces the likelihood of costly complications. For hospitals and providers, this means fewer revisions, shorter operative times, and faster recoveries. It’s a rare example of a surgical innovation that’s both clinically and economically compelling.”- leading Musculoskeletal Oncology surgeon.

Orthopedic Surgical Planning Software

Company

Funding Amount (USD)

Funding Round / Type

Date

Description

CustoMED

6 million USD

Seed

29-Oct-25

Raised to scale AI-powered platform creating patient-specific surgical guides and implants; investors include Longevity Venture Partners, Varana Capital, Flag Capital, Israel Innovation Authority, and Avishai Abrahami.

restor3d

104 million USD

Strategic Investment / Growth Capital

22-Aug-25

Raised to expand AI-driven design software, rapid surgical planning, and 3D-printed personalized implants; includes FDA-cleared solutions for shoulder, hip, knee, foot, and ankle.

Insight Surgery

The complete analysis will be shared in the final report

Peek Health S.A.

Formus Labs Ltd

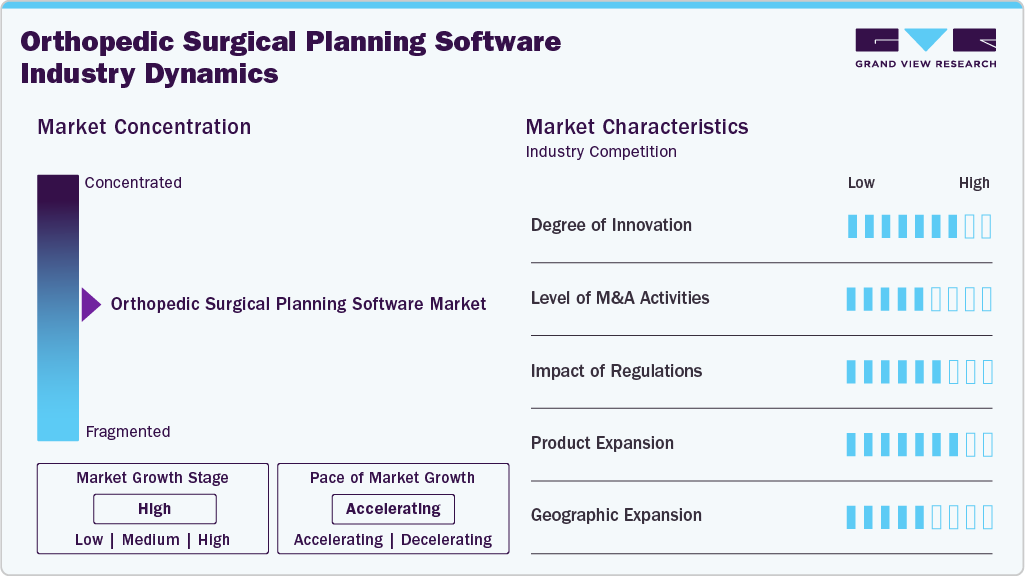

Market Concentration & Characteristics

The orthopedic surgical planning software industry has been significantly enhanced by technological advancements, including 3D printing, patient-specific implants, and AI-driven preoperative planning. These innovations enable precise, customized surgical strategies, reduce reliance on standard implants, and improve clinical outcomes. Continuous R&D investments are driving innovation pipelines and facilitating more complex and efficient orthopedic procedures globally. In June 2024, Corin launched its ApolloKnee application and Apollo robotic platform for total knee arthroplasty, approved in all major markets. The system enables personalized knee balancing with pre-resection planning, robotic-assisted bone cuts, and integrated surgical data learning, improving precision and efficiency in orthopedic knee surgery.

Merger and acquisition activity is active and strategic, reflecting the intent of market leaders to consolidate capabilities, expand product portfolios, and achieve global reach. Acquisitions allow companies to integrate complementary technologies, enhance software offerings, and scale operations efficiently, positioning them to address growing demand and maintain competitive advantage in a rapidly evolving market.

Orthopedic surgical planning software is subject to stringent regulatory oversight to ensure safety, quality, and efficacy. Agencies such as the FDA and EMA impose rigorous approval processes, which, although time-consuming and costly, ensure reliable clinical performance. Compliance with these standards is essential for market entry, commercial adoption, and patient trust.

Alternative non-surgical treatments including physiotherapy, pharmacotherapy, and allied interventions represent moderate substitutes. Despite the presence of these options, advanced surgical planning software retains high clinical adoption due to its ability to optimize surgical precision, reduce intraoperative risks, and support complex orthopedic procedures with established efficacy.

Market players are strategically expanding into new regions to capture untapped demand, strengthen market positioning, and enhance product accessibility. Geographic diversification allows companies to establish local partnerships, improve healthcare infrastructure, and introduce advanced orthopedic solutions to emerging markets, thereby, broadening their global footprint and driving sustainable growth.

Software Delivery Insights

By software delivery, the cloud based segment held the largest market share of 64.37% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period due to its scalability, accessibility, and cost-effectiveness. Cloud-based solutions enable real-time collaboration, seamless data sharing, and integration with other healthcare systems. Increasing adoption by hospitals and clinics for efficient workflow management is driving segment expansion globally. For instance, AI algorithms can analyze historic data to predict surgical outcomes, thereby optimizing surgical strategies. The introduction of products such as Realize Medical's Elucis, which received FDA clearance in January 2024, exemplifies this trend by providing immersive 3D pre-operative planning capabilities that enhance collaboration among medical professionals.

The on-premise segment is anticipated to witness a significant CAGR over the forecast period. An on-premises installation generally requires the hospital to provide the hardware on which the purchased software can be installed. Consequently, it has rolling costs for the local IT system and requires hardware upgrades in the future. As all on-premises software is controlled locally rather than through a subscription to a cloud-based service, there is more flexibility for customization. Furthermore, hospitals have complete control over the security of their database and network as the software is installed on-location. The data will also only be accessible to those who are authorized to do so.

Software Insights

By software, pre-operative segment held the largest market share of 76.94% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The growth is attributed to the rising awareness regarding the benefits associated with the use of pre-operative surgical planning software. The rising interest of healthcare personnel in streamlining surgical interventions and increasing the success rate for surgical outcomes supplement the growth. Rapid advancements in orthopedic surgery have contributed to the segment's growth over the last decade. For instance, in December 2024, Smith+Nephew received FDA clearance for its CORIOGRAPH Pre-Op Planning and Modeling Services. This FDA-cleared software is designed specifically for total hip arthroplasty (THA). It utilizes over 350,000 image-based surgery plans, allowing surgeons to create patient-specific plans using X-ray and CT scan data.

The post-operative segment is expected to register significant growth over the forecast period. Post-operative orthopedic surgical planning software plays a crucial role in enhancing the accuracy and efficiency of surgical procedures. These tools assist surgeons in preoperative planning, intraoperative guidance, and postoperative assessment, ultimately improving patient outcomes. Post-surgical care is being transformed through enhanced monitoring technologies. AI-driven applications enable continuous tracking of patients' recovery processes outside clinical settings. In November 2024, orthopedic surgeons Justin Green and Mike Reed launched a MedTech company, OPCI (Open Predictor Clinical Intelligence). Their OpenPredictor tool uses machine learning to assess patients' risk of post-operative complications, aiding clinical decision-making.

End Use Insights

By end use, the hospitals segment held the largest market share of 51.02% in 2024. Orthopedic surgical planning software is an innovative progression in surgical technology that has greatly enhanced surgical accuracy and predictability. Efficient surgical planning software can help hospitals and clinics increase operational efficiency, automate patient communication, and deliver consistent & transparent perioperative care paths for patients. In advanced surgery, it is more common to implement methods that incorporate the individual features of a patient. In February 2023, PeekMed launched a web-based automated planning solution that utilizes AI for live automatic segmentation of CT scans and X-rays. This software enables rapid planning, providing surgeons with an accurate surgical plan in under 30 seconds.

The orthopedic clinics segment is expected to experience the fastest CAGR over the forecast period. Orthopedic clinics are increasingly focusing on personalized care by utilizing technologies such as telemedicine and wearable devices. These tools enable continuous monitoring of patients' progress post-surgery, allowing for real-time adjustments to treatment plans based on individual recovery trajectories. In February 2022, Formus Labs, an automated 3D planner for joint replacement surgical procedures, declared that it raised USD 5 million in funding and introduced its orthopedic surgery planning solution that offers specialists with an enhanced understanding of the preoperative planning process.

Regional Insights

North America orthopedic surgical planning software industry dominated the global market in 2024 and accounted for the largest revenue share of 40.10%. This large share is due to the rapid advancements in the orthopedic sector and the highly developed health infrastructure of the region. The allocation of funds for medical research and development had a major impact on the growth rate of the North American orthopedic surgical planning software industry in the past few years. The market is expected to rise because of the various health initiatives undertaken by various organizations and institutions. For instance, Realize Medical's Elucis software, which received FDA 510(k) clearance in January 2023, allows for immersive 3D pre-operative planning and collaborative consultations among medical teams.

U.S. Orthopedic Surgical Planning Software Market Trends

The U.S. market for orthopedic surgical planning software is driven by the rise in the number of patients with orthopedic chronic diseases, a rising geriatric population, and increasing healthcare initiatives by the U.S. government. The increase in per capita expenditure on healthcare infrastructure is another factor contributing to the growth of the market in the region. In June 2024, Zimmer Biomet formed a strategic partnership with a healthcare software provider to develop AI-powered preoperative planning tools aimed at improving precision in orthopedic surgeries.

Europe Orthopedic Surgical Planning Software Market Trends

Europe orthopedic surgical planning software industry is anticipated to register significant CAGR during the forecast period. This is attributed to the rising number of orthopedic surgeries. As orthopedic surgeons increasingly adopt this pre-operative planning software before surgery, the market is expected to have substantial growth. Technological advancements have simplified the software's use for patients and surgeons, contributing to the industry's rapid development. In Europe, initiatives such as the European Regional Development Fund and the cohesion strategy for 2021-2027 prioritize the healthcare and life sciences sector.

Germany orthopedic surgical planning software industry is anticipated to register a considerable CAGR during the forecast period. The potential benefits of advanced orthopedic surgical planning software in a clinical care facility are becoming more significant to both patients and healthcare professionals compared to the conventional surgical planning method. For planning treatments for chronic orthopedic conditions and neurological diseases, preoperative planning is crucial In October 2025, mediCAD Hectec GmbH launched mediCAD 8, a new AI-driven orthopedic and trauma planning software that automates landmark detection, image analysis, and implant placement, making surgical planning faster, more precise, and accessible even to less experienced users.

Asia Pacific Orthopedic Surgical Planning Software Market Trends

Asia Pacific orthopedic surgical planning software industry is anticipated to be the fastest-growing region over the forecast period, fueled by increased funding and innovation in the healthcare technology sector. Rising demand for precision in joint replacement surgeries and advancements in digital healthcare solutions drive market expansion. In February 2022, Formus Labs, a provider in automated 3D surgical planning, secured USD 5 million in funding to introduce its state-of-the-art orthopedic surgery planning tool.

The orthopedic surgical planning software industry in Japan is expected to grow over the forecast period driven by significant innovation from players and advancements in technology. Companies such as LEXI Co., Ltd. are player in the field with solutions such as ZedView, which supports pre-operative planning and post-operative assessment. The company’s tools, including ZedHip, enable precise planning for procedures like acetabular cup placement in total hip arthroplasty (THA).

Latin America Orthopedic Surgical Planning Software Market Trends

Latin America orthopedic surgical planning software industry is anticipated to register a considerable growth rate during the forecast period, primarily driven by the rising prevalence of musculoskeletal (MSK) disorders in the region. According to a report published in the Journal of Clinical Rheumatology in January 2024, the Latin American and Caribbean (LAC) region has seen a significant increase in the burden of MSK disorders over the past three decades.

The orthopedic surgical planning software industry in Brazil is expected to grow over the forecast period largely driven by the region's improving surgical performance and the increasing prevalence of musculoskeletal disorders. A September 2023 report by the NIH highlights that osteoarthritis (OA) is the most common musculoskeletal disease in Brazil, affecting 4% of the population. OA is often linked to falls, depression, and obesity, which further exacerbate the healthcare burden.

Middle East and Africa Orthopedic Surgical Planning Software Market Trends

Middle East and Africa orthopedic surgical planning software industry is anticipated to register a considerable growth rate during the forecast period. Governments and healthcare organizations are undertaking initiatives to improve healthcare facilities in the MEA region. For instance, in September 2022, Telefónica Open Innovation, a corporate venture capital firm that invests in startups, and GE Healthcare, a medical technology company based in the U.S., announced a collaboration with seven health technology startups to promote the digital transformation of the healthcare industry across the Middle East & Africa (MEA).

UAE orthopedic surgical planning software industry is anticipated to register a considerable growth rate during the forecast period. Several factors contribute to this growth, including the rising prevalence of orthopedic disorders and an increasing aging population. the rise in road accidents in the country boosts the demand for orthopedic surgical planning software. In 2024, road accidents in the UAE increased by 1.54% compared to 2023, with fatalities increasing by 7.50% and injuries rising by 17.73%.

Key Orthopedic Surgical Planning Software Company Insights

Key participants in the orthopedic surgical planning software industry are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Orthopedic Surgical Planning Software Companies:

The following are the leading companies in the orthopedic surgical planning software market. These companies collectively hold the largest market share and dictate industry trends.

- EOS imaging (ATEC)

- Formus Labs Ltd

- Stryker

- Brainlab AG

- mediCAD

- PEEK HEALTH S.A.

- Radlink, Inc.

- Zimmer Biomet

- DePuy Synthes (Johnson & Johnson Medical Devices Companies)

- Corin Group

- RSA Biomedical

- Enhatch Inc.

Recent Developments

-

In November 2025, Zimmer Biomet received FDA 510(k) clearance for ROSA Knee with OptimiZe, an enhanced robotic-assisted system that personalizes surgical planning and improves accuracy and reproducibility in total knee replacement procedures.

-

In May 2025, Exactech launched its next-generation Shoulder Planning App, featuring advanced osteophyte removal tools, automated measurements, and enhanced preoperative planning reports to improve surgical precision in shoulder replacements, fully integrated with its GPS navigation system for real-time intraoperative guidance.

-

In September 2024, 3D Systems received FDA clearance for TOTAL ANKLE patient-matched guides, designed to work with Smith+Nephew’s total ankle replacement systems. These 3D-printed, patient-specific guides streamline surgery, reduce steps, and improve implant alignment and accuracy, supporting more efficient and precise orthopedic ankle procedures..

Orthopedic Surgical Planning Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 77.95 million

Revenue forecast in 2033

USD 131.27 million

Growth Rate

CAGR of 6.73% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Software delivery, software, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

EOS imaging (ATEC); Formus Labs Ltd; Stryker; Brainlab AG; mediCAD; PEEK HEALTH S.A.; Radlink Inc.; Zimmer Biomet; DePuy Synthes (Johnson and Johnson Medical Devices Companies); Corin Group; RSA Biomedical; Enhatch Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Orthopedic Surgical Planning Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the orthopedic surgical planning software market report based on software delivery, software, end use, and region:

-

Software Delivery Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud-based

-

On-premise

-

-

Software Outlook (Revenue, USD Million, 2021 - 2033)

-

Pre-Operative

-

Post-Operative

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Orthopedic Clinics

-

-

Regional Outlook Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global orthopedic surgical planning software market size accounted for USD 73.49 million in 2024 and is anticipated to reach 77.95 million in 2025.

b. The global orthopedic surgical planning software market is expected to grow at a CAGR of 6.73% from 2025 to 2033 to reach USD 131.27 million by 2033.

b. In 2024, North America dominated the market in terms of the a revenue share of 40.10%. The market's growth in Canada is boosted by the increasing prevalence of orthopedic conditions and rising investment in the R&D by key market players.

b. Some of the key market players positively influencing the orthopedic surgical planning software market are EOS imaging (ATEC); Formus Labs Ltd; Stryker; Brainlab AG; mediCAD; PEEK HEALTH S.A.; Radlink Inc.; Zimmer Biomet; DePuy Synthes (Johnson and Johnson Medical Devices Companies); Corin Group; RSA Biomedical; Enhatch Inc.

b. Key factors contributing towards to the growth of the market include increasing cases of orthopedic disorders, the growing geriatric population, technological advancements, and rising awareness about the benefits associated with the use of orthopedic surgical planning software.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.