- Home

- »

- Biotechnology

- »

-

Personalized Medicine Market Size, Industry Report, 2033GVR Report cover

![Personalized Medicine Market Size, Share & Trends Report]()

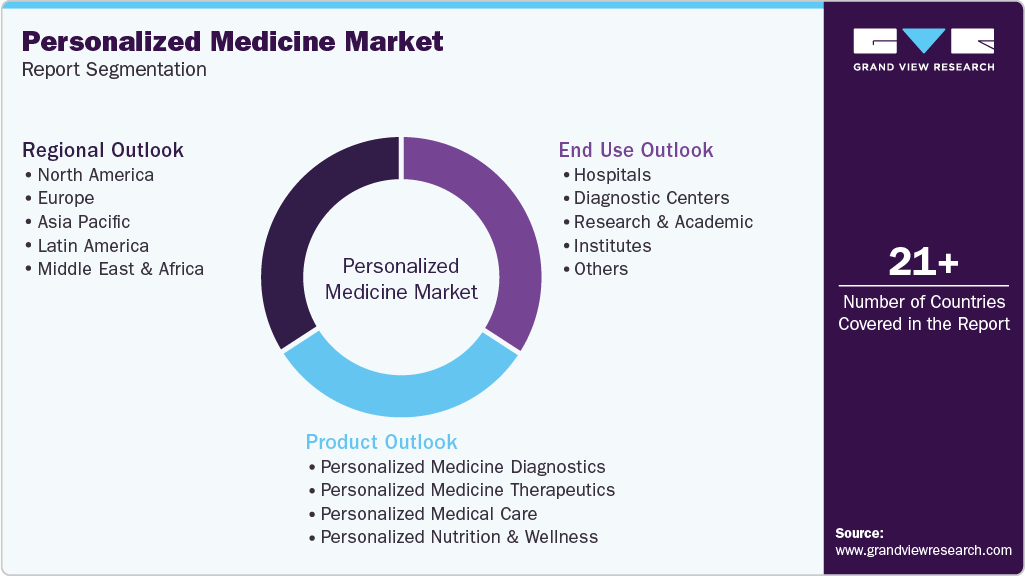

Personalized Medicine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Personalized Medicine Diagnostics, Personalized Medicine Therapeutics), By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-443-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Personalized Medicine Market Summary

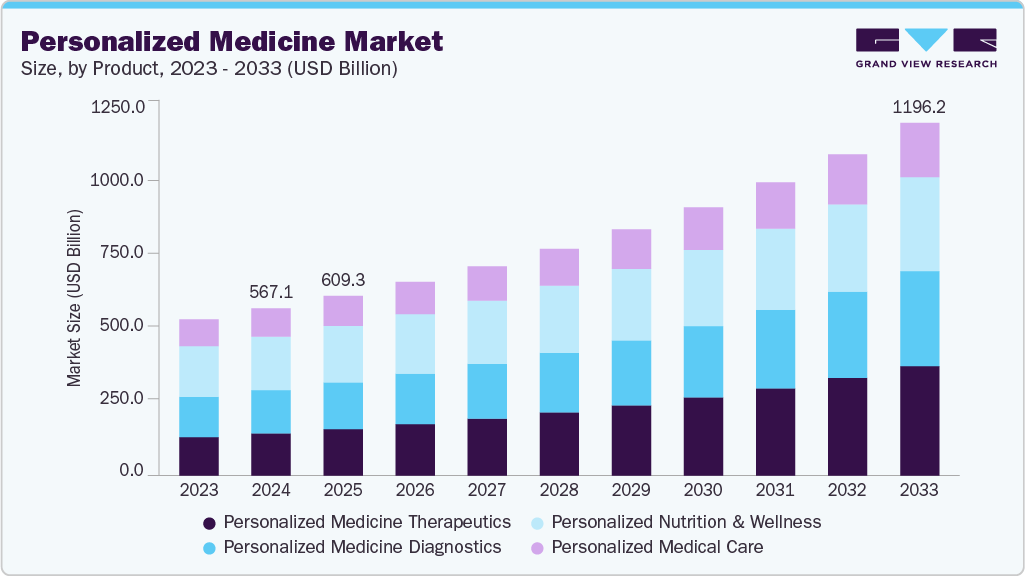

The global personalized medicine market size was estimated at USD 567.10 billion in 2024 and is projected to reach USD 1,196.18 billion by 2033, growing at a CAGR of 8.80% from 2025 to 2033. The growing demand for targeted therapies and precision diagnostics is significantly driving the expansion of the personalized medicine market.

Key Market Trends & Insights

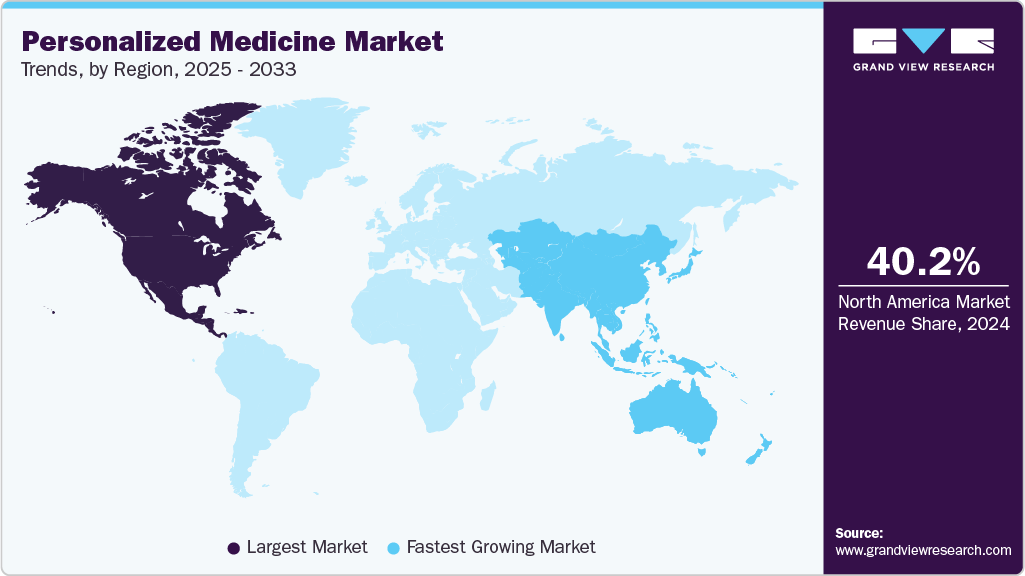

- North America personalized medicine market held the largest share of 40.17% of the global market in 2024.

- The personalized medicine industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the personalized nutrition & wellness segment held the highest market share of 32.0% in 2024.

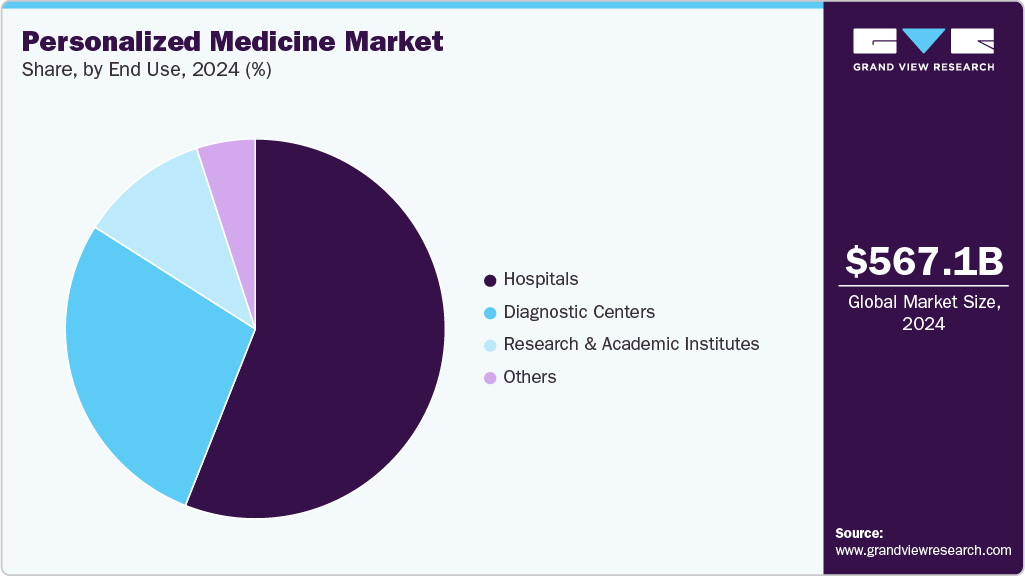

- By end use, the hospitals segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 567.10 Billion

- 2033 Projected Market Size: USD 1,196.18 Billion

- CAGR (2025-2033): 8.80%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Advances in genomic technologies, biomarker identification, and data-driven treatment strategies enable healthcare providers to tailor therapies to individual patient profiles. This approach enhances treatment efficacy, minimizes adverse effects, and supports more efficient use of healthcare resources. As chronic and complex diseases rise globally, the focus on personalized solutions continues to strengthen, fostering innovation and investment across diagnostics, therapeutics, and health data integration platforms. The rise in chronic conditions such as cancer, diabetes, and cardiovascular diseases is prompting healthcare providers to implement individualized treatment strategies.

Personalized diagnostics deliver greater accuracy in disease identification, leading to earlier intervention and better clinical outcomes. Personalized diagnostics delivered greater accuracy in disease identification, as in 2024 when Illumina’s FDA‑approved TruSight Oncology Comprehensive test analyzed over 500 genes to guide targeted cancer treatments. The increasing awareness among patients of genetic predispositions supports the uptake of DNA-based testing services. This movement toward proactive, patient-specific care models continues to expand the market’s potential across medical domains.

Technological advancements in genomics, artificial intelligence, and data analytics further fuel growth in the personalized medicine market. Companies are leveraging next-generation sequencing, biomarker discovery, and bioinformatics to develop innovative solutions tailored to individual patient profiles. AI integration into clinical decision-making is enabling faster analysis of complex datasets, enhancing diagnostic precision and therapy selection. Telemedicine platforms and health IT systems facilitate remote access to personalized care, especially in chronic disease management. These technological innovations are reshaping healthcare delivery and supporting the scalable adoption of customized approaches.

Increasing private sector investments and strategic collaborations are also contributing to market momentum. Pharmaceutical companies are partnering with diagnostics firms to co-develop companion diagnostics for targeted therapies. Startups and biotech firms are entering the market with innovative nutrition, wellness, and genomics offerings. Expanding consumer interest in health optimization and preventive care is boosting demand for direct-to-consumer testing and customized wellness plans. Market players focus on product differentiation, data-driven strategies, and global expansion to strengthen their competitive positions.

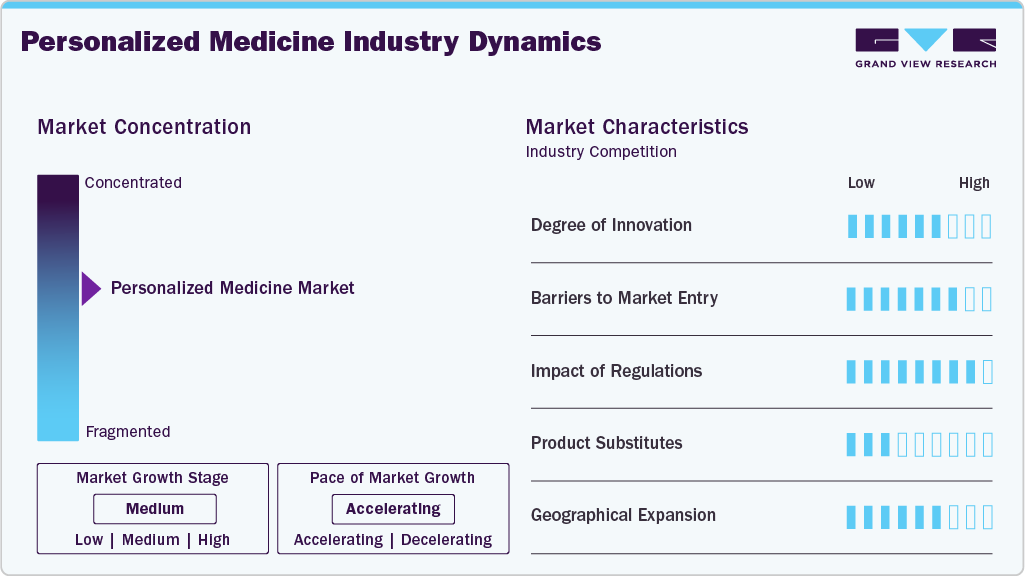

Market Concentration & Characteristics

The personalized medicine market exhibits high innovation fueled by rapid genomics, bioinformatics, and AI-driven diagnostics advancements. Companies such as Illumina and Genelex are consistently expanding capabilities in sequencing and predictive analytics. Innovation is further encouraged by rising demand for targeted therapeutics and precision diagnostics across oncology and rare diseases. Strategic collaborations between tech firms and healthcare companies enhance personalized medical care delivery. This continuous innovation fosters differentiation but also intensifies competition among players.

Significant capital requirements, data integration complexities, and regulatory approvals challenge entry into the personalized medicine market. Establishing genomic testing labs or telemedicine infrastructure demands specialized talent and advanced technology. In addition, intellectual property protection around gene markers and algorithms creates legal hurdles for new entrants. Large players such as GE Healthcare and IBM enjoy economies of scale and established trust, making market penetration difficult for smaller firms. These barriers preserve the dominance of incumbents and limit saturation.

Regulations have a strong influence, especially in genetic testing, DTC diagnostics, and pharmaceutical personalization. Agencies such as the FDA and EMA require rigorous validation of biomarkers and data integrity, slowing time-to-market. In regions such as the U.S. and EU, privacy laws, including HIPAA and GDPR, add layers of complexity to the complexity of compliance. While regulation enhances patient safety and standardization, it also increases operational costs. Firms with deep regulatory experience, such as Abbott and QIAGEN, gain a compliance-based advantage.

The risk of product substitution is moderate, with conventional therapies, general diagnostics, and one-size-fits-all treatments still widely used. However, personalized medicine offers better efficacy and lower side effects, reducing the appeal of traditional alternatives. Over-the-counter supplements or generic diets may still substitute personalized plans for wellness and nutrition. In diagnostics, generic lab services may temporarily replace esoteric or genomic tests due to cost concerns. However, as outcomes improve and costs decline, substitutes become less viable in the long term.

The market shows strong potential for global expansion, particularly in emerging regions where precision health demand is rising. Asia Pacific and Latin America are witnessing increased adoption of genomic medicine and telemedicine, supported by improving digital health infrastructure. Companies such as Biogen and Danaher are actively expanding into these regions via partnerships and localized R&D. Growth is also visible in the Middle East and Africa through public-private collaborations and mobile diagnostics. Geographical diversification is becoming a key strategy to tap into underpenetrated and high-growth areas.

Product Insights

The personalized nutrition & wellness segment dominated the market with the largest revenue share of 32.0% in 2024, driven by increasing consumer interest in preventive health and lifestyle optimization. Rising demand for tailored dietary supplements, fitness plans, and genetic-based wellness insights has significantly boosted segment adoption. For instance, In November 2023, Viome Life Sciences acquired Naring Health, including DiscernDX, to strengthen its personalized health capabilities. The deal enhances Viome’s ability to deliver tailored nutrition and supplement recommendations based on diagnostic insights. This move marks a key advancement in personalized nutrition by enabling early detection and root-cause-based interventions.

The personalized medicine therapeutics segment is projected to grow at the fastest CAGR of 11.28% over the forecast period, fueled by demand for targeted treatments and precision diagnostics. For instance, in November 2024, Foundation Medicine’s FoundationOne Liquid CDx received FDA approval as a companion diagnostic for TEPMETKO in metastatic NSCLC patients. This highlights the growing role of genomics and companion diagnostics in therapy selection. Pharmacogenomics is improving treatment outcomes by minimizing trial-and-error prescribing. Collaborations between drug and diagnostic firms are expanding personalized therapy options. Rising investment in biologics and gene therapies further supports segment growth.

End Use Insights

The hospital segment dominated the market with the largest revenue share in 2024, attributed to the widespread integration of genomic diagnostics and targeted therapies in clinical workflows. Hospitals are primary centers for implementing personalized treatment plans in oncology, cardiology, and chronic disease management. Their access to multidisciplinary teams and electronic health records supports patient-specific care delivery. Large hospitals have advanced lab infrastructure and collaborate with research institutions for clinical trials. The ability to offer in-house biomarker testing and precision therapy monitoring strengthens their market position. Increasing use of AI-driven diagnostic tools is further enhancing hospital-led personalized care.

The diagnostic centers segment is projected to grow at the fastest CAGR over the forecast period due to rising demand for genetic testing, esoteric diagnostics, and non-invasive screening solutions. These centers provide high-efficiency testing services that support early detection and risk assessment. Advances in molecular diagnostics and automation are improving result accuracy and turnaround times. Consumers increasingly turn to diagnostic centers for direct access to personalized health insights. Partnerships with telehealth providers and genomic firms are expanding service portfolios and regional coverage. The flexibility and scalability of diagnostic centers are key factors driving their rapid market growth.

Regional Insights

North America held the largest personalized medicine market share of 40.17% in 2024 due to its advanced healthcare infrastructure and high adoption of genomic technologies. The presence of major companies such as Illumina, IBM, and GE Healthcare drives innovation and market penetration. Increasing investments in molecular diagnostics and targeted therapies further strengthen regional leadership. Strong research collaborations between academic institutions and industry players support the development of personalized therapeutics. The region also benefits from the growing use of telemedicine and health information systems to deliver customized care. High consumer awareness and demand for early detection solutions contribute to the region’s strong market position.

U.S. Personalized Medicine Market Trends

The U.S. holds the largest share of the North American personalized medicine market owing to its robust biotechnology ecosystem and precision medicine research programs. The widespread availability of genetic testing and next-generation sequencing fuels the demand for individualized treatments. Private sector initiatives from companies such as Exact Sciences and QIAGEN continue to expand diagnostic capabilities. Integrating AI and big data into clinical decision-making enhances the effectiveness of personalized care. The rising prevalence of chronic diseases accelerates using tailored therapeutics and health monitoring solutions. High insurance coverage for advanced diagnostics also encourages wider adoption across clinical settings.

Europe Personalized Medicine Market Trends

Europe demonstrates strong market growth, supported by increased clinical integration of personalized medicine approaches. Expanding genomic testing and esoteric lab services across countries enhances diagnostic precision. Pharmaceutical companies across the region are investing in biomarker-driven drug development and personalized oncology treatments. Demand for telemedicine and customized nutrition solutions is rising due to shifting patient preferences. Collaborations among healthcare providers, universities, and technology firms are helping accelerate adoption. The region’s emphasis on precision diagnostics and individualized care models supports sustained market expansion.

The UK personalized medicine market is advancing due to its focus on data-driven healthcare and personalized diagnostics. Implementing national genomic programs has increased access to sequencing and risk profiling services. Health IT platforms are central in managing patient-specific data and treatment plans. The private sector invests in direct-to-consumer genetic testing and wellness services tailored to individual profiles. Academic partnerships with firms such as Genentech are facilitating the development of targeted therapies. Rising demand for customized interventions in cardiology and oncology supports further market growth.

Germany personalized medicine market stands out in Europe for integrating precision diagnostics into routine medical practice. The country has seen rising use of genomic profiling and biomarker testing to personalize therapeutic strategies. Advanced laboratory networks support the delivery of esoteric testing and pharmaceutical customization. The medical devices segment is also growing due to the demand for personalized monitoring tools. Leading biotech firms are expanding clinical pipelines in collaboration with German research institutes. A strong industrial base and digital health initiatives are strengthening the country’s position in the personalized medicine space.France personalized medicine market is expanding steadily through advanced diagnostic integration and growing demand for individualized treatments. Clinical institutions increasingly adopt genomic testing for cancer care and rare disease management. Pharmaceutical firms are partnering with French research centers to develop biomarker-driven therapies. Digital health platforms tailor chronic disease treatment based on patient profiles. Personalized nutrition and wellness services are gaining traction, especially among health-conscious consumers. The country’s strong clinical research environment and advanced lab infrastructure support continued growth in precision healthcare solutions.

Asia Pacific Personalized Medicine Market Trends

Asia Pacific Personalized medicine market is expected to register the fastest CAGR of 12.18% over the forecast period due to expanding diagnostic infrastructure and growing healthcare expenditure. The increasing prevalence of cancer and genetic disorders is driving demand for precision diagnostics and therapies. Countries in the region are rapidly adopting genomic sequencing and telehealth services. Multinational firms are forming partnerships with local providers to introduce personalized health platforms. Rising consumer interest in personalized nutrition and wellness is further stimulating growth. Investment in regional biobanks and health data platforms creates a foundation for long-term expansion.

Japan personalized medicine market is continuing to expand, focusing on aging-related diseases and pharmacogenomics. The country has a high rate of genetic testing integration in hospitals and research centers. Companies such as Biogen and Abbott are actively developing personalized treatments for neurodegenerative and cardiovascular conditions. Health IT and telemedicine are increasingly used to tailor chronic disease management plans. Consumer demand for tailored supplements and wellness programs is also growing. Advanced clinical infrastructure supports the rollout of genomic and precision diagnostics.

China personalized medicine market is growing rapidly due to the increased adoption of genomic technologies and precision oncology. Domestic companies and academic institutions collaborate to develop biomarker-driven diagnostics and targeted treatments. The country is advancing in AI-enabled health platforms that support individualized clinical decisions. Personalized nutrition and alternative medicine are gaining popularity among younger consumers. Investment in medical infrastructure and esoteric laboratory capabilities is rising. A large population with diverse genetic backgrounds provides a strong potential for personalized solutions.

Latin America Personalized Medicine Market Trends

Latin America presents emerging opportunities in the personalized medicine market due to rising awareness of genetic disorders and chronic disease management. Key countries in the region are investing in genomic research and health IT platforms that enable individualized care. The adoption of direct-to-consumer testing and personalized wellness services is increasing in urban areas. Private healthcare providers are introducing esoteric testing and telemedicine for personalized diagnostics. The market is also witnessing the entry of global companies through regional collaborations and distribution networks. Although infrastructure varies by country, the overall trend supports steady market development.

Brazil personalized medicine market is leading in Latin America, driven by its growing biotechnology sector and expanding diagnostics network. Genomic testing is gaining popularity for oncology and rare disease applications in major hospitals. Demand for tailored nutrition and wellness services is increasing among middle- and upper-income populations. Local biotech startups are partnering with international firms to introduce AI-based diagnostics and health monitoring solutions. Clinical laboratories are expanding capabilities in esoteric testing to meet personalized care requirements. Brazil’s urban healthcare centers are playing a critical role in shaping the country’s precision medicine ecosystem.

Middle East & Africa Personalized Medicine Market Trends

The MEA region is gradually adopting personalized medicine due to the rising burden of chronic diseases and interest in precision healthcare. Urban centers are witnessing increased demand for esoteric testing and health IT platforms. Multinational companies are entering the region through collaborations with private hospitals and diagnostics chains. Personalized nutrition and wellness are gaining traction, particularly among affluent populations. Research institutes are exploring genetic markers specific to regional populations. Though growth is uneven, high-potential markets are emerging in select countries.

Saudi Arabia personalized medicine market is expected to grow significantly as it focuses on personalized healthcare solutions in response to rising cases of diabetes, cancer, and cardiovascular disease. Health analytics and digital infrastructure investments support clinical decision-making based on individual risk profiles. Leading hospitals are adopting genetic and biomarker testing for targeted treatments. Personalized nutrition and wellness services are expanding through retail and clinical channels. Public-private partnerships are helping build lab capabilities for esoteric diagnostics. The shift toward precision care reshapes therapeutic and diagnostic delivery in key urban centers.

Key Personalized Medicine Company Insights

Illumina, Inc., and QIAGEN lead the personalized medicine market by providing advanced sequencing platforms and molecular diagnostics tailored for individualized treatment pathways. GE Healthcare and IBM maintain strong positions through integrated health data platforms and AI-driven clinical decision support systems. Exact Sciences Corporation and Danaher Corporation (Cepheid, Inc.) are expanding their reach by offering high-precision diagnostic solutions for oncology and infectious diseases. Abbott and Dako A/S leverage extensive diagnostic product lines and laboratory automation to enhance personalized diagnostic efficiency. Biogen and Genentech, Inc. are advancing targeted therapeutics through focused research in neurodegenerative and oncological diseases. The market remains competitive with growing demand for customized care, expanding applications in predictive medicine, and strategic innovation across diagnostics, therapeutics, and digital platforms.

Key Personalized Medicine Companies:

The following are the leading companies in the personalized medicine market. These companies collectively hold the largest market share and dictate industry trends.

- GE Healthcare

- Illumina, Inc.

- ASURAGEN, INC.

- Abbott

- Dako A/S

- Exact Sciences Corporation

- Danaher Corporation (Cepheid, Inc.)

- Decode Genetics, Inc.

- QIAGEN

- Exagen Inc.

- Precision Biologics

- Celera Diagnostics LLC.

- Biogen

- Genelex

- International Business Machines Corporation (IBM)

- Genentech, Inc.

Recent Developments

-

In September 2023, Agilent Technologies partnered with ACTRIS to enhance cell and gene therapy development in Singapore by deploying advanced cell analysis technologies. The collaboration supports next-generation immunotherapy research and strengthens Agilent’s regional presence through its Singapore innovation hub.

-

In July 2023, Illumina partnered with Pillar Biosciences to expand access to personalized cancer care by integrating Pillar’s oncology assays with Illumina’s NGS platforms. The collaboration aims to improve tumor profiling efficiency, accuracy, and affordability worldwide.

-

In June 2023, GE HealthCare collaborated with DePuy Synthes to combine its OEC 3D Imaging System with cutting-edge spinal surgery technologies across the United States. This partnership focuses on improving the accuracy of intraoperative imaging and advancing minimally invasive spine surgeries in inpatient and ambulatory care environments.

Personalized Medicine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 609.33 billion

Revenue forecast in 2033

USD 1,196.18 billion

Growth rate

CAGR of 8.80% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

GE Healthcare; Illumina, Inc.; ASURAGEN, INC.; Abbott; Dako A/S; Exact Sciences Corporation; Danaher Corporation (Cepheid, Inc.); Decode Genetics, Inc.; QIAGEN; Exagen Inc.; Precision Biologics; Celera Diagnostics LLC.; Biogen; Genelex; International Business Machines Corporation (IBM); Genentech, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Personalized Medicine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global personalized medicine market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Personalized Medicine Diagnostics

-

Genetic Testing

-

Direct-To-Consumer (DTC) Diagnostics

-

Esoteric Lab Services

-

Esoteric Lab Tests

-

-

Personalized Medicine Therapeutics

-

Pharmaceutical

-

Genomic Medicine

-

Medical Devices

-

-

Personalized Medical Care

-

Telemedicine

-

Health Information Technology

-

-

Personalized Nutrition & Wellness

-

Retail Nutrition

-

Complementary & Alternative Medicine

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Diagnostic Centers

-

Research & Academic Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global personalized medicine market size was estimated at USD 567.10 billion in 2024 and is expected to reach USD 609.33 billion in 2025.

b. The global personalized medicine market is projected to grow at a CAGR of 8.80% from 2025 to 2033 to reach USD 1,196.18 billion by 2033.

b. Based on product, personalized nutrition & wellness segment dominated the market with the largest revenue share of 32.0% in 2024, driven by increasing consumer interest in preventive health and lifestyle optimization.

b. Some key players operating in the personalized medicine market include GE Healthcare, Illumina, Inc., ASURAGEN, INC., Abbott, Dako A/S, Exact Sciences Corporation, Danaher Corporation (Cepheid, Inc.), Decode Genetics, Inc.

b. Key factors driving the market growth include advancements in genomics, increasing demand for targeted therapies, rising chronic disease prevalence, improved diagnostics, patient-centric care models, and growing healthcare investments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.