- Home

- »

- Healthcare IT

- »

-

Pharma Hub And Patient Access Support Service Market Report, 2033GVR Report cover

![Pharma Hub And Patient Access Support Service Market Size, Share & Trends Report]()

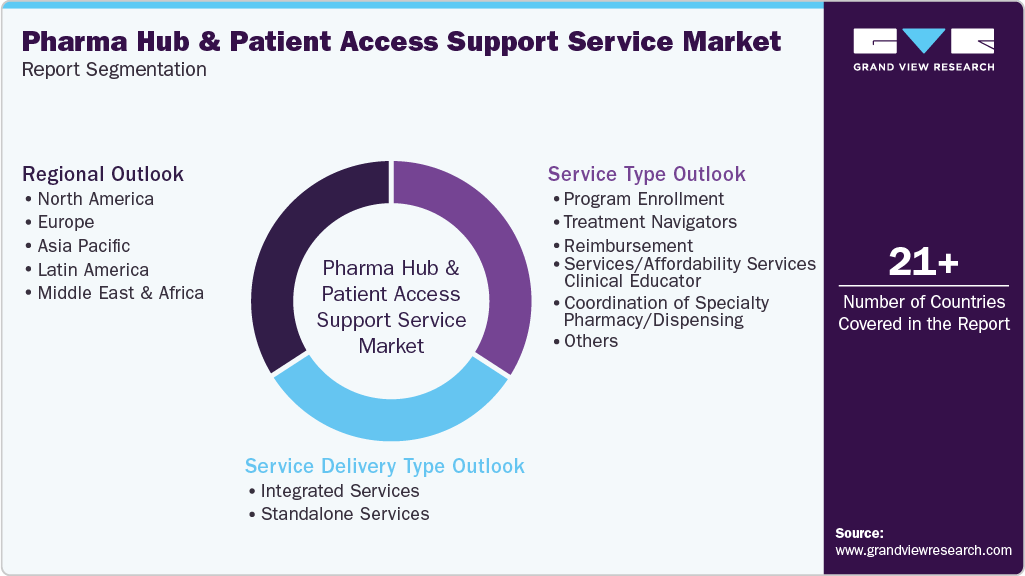

Pharma Hub And Patient Access Support Service Market (2025 - 2033) Size, Share & Trends Analysis Report By Service Type (Program Enrollment, Treatment Navigators, Reimbursement Services/Affordability Services, Clinical Educator), By Service Delivery Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-278-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharma Hub And Patient Access Support Service Market Summary

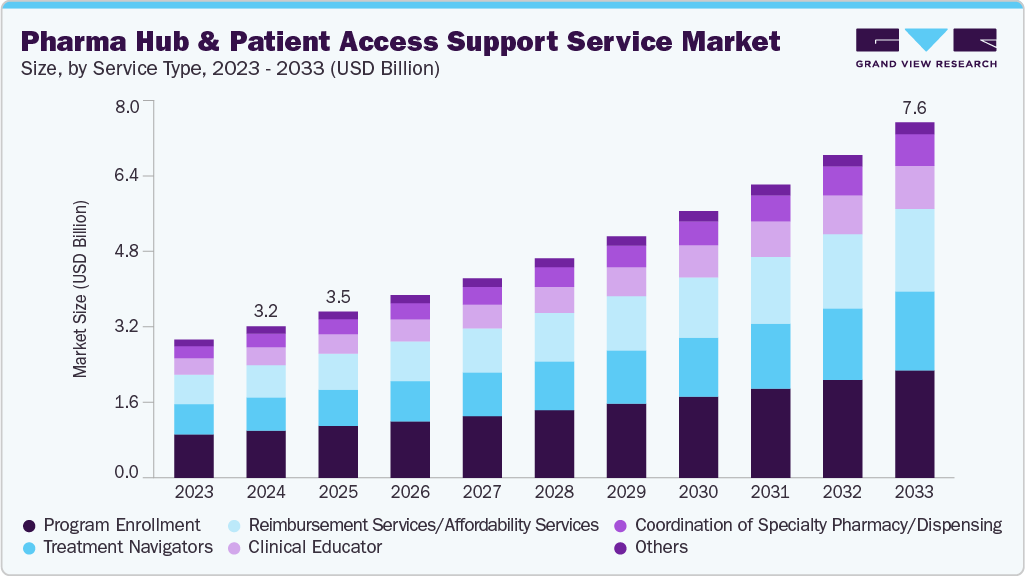

The global pharma hub and patient access support service market size was estimated at USD 3.24 billion in 2024 and is projected to reach USD 7.63 billion by 2033, growing at a CAGR of 10.0% from 2025 to 2033. The growth is attributed to the increasing need to administer new medicines for various specialties and rare & orphan diseases, prioritizing creating a patient-centric ecosystem.

Key Market Trends & Insights

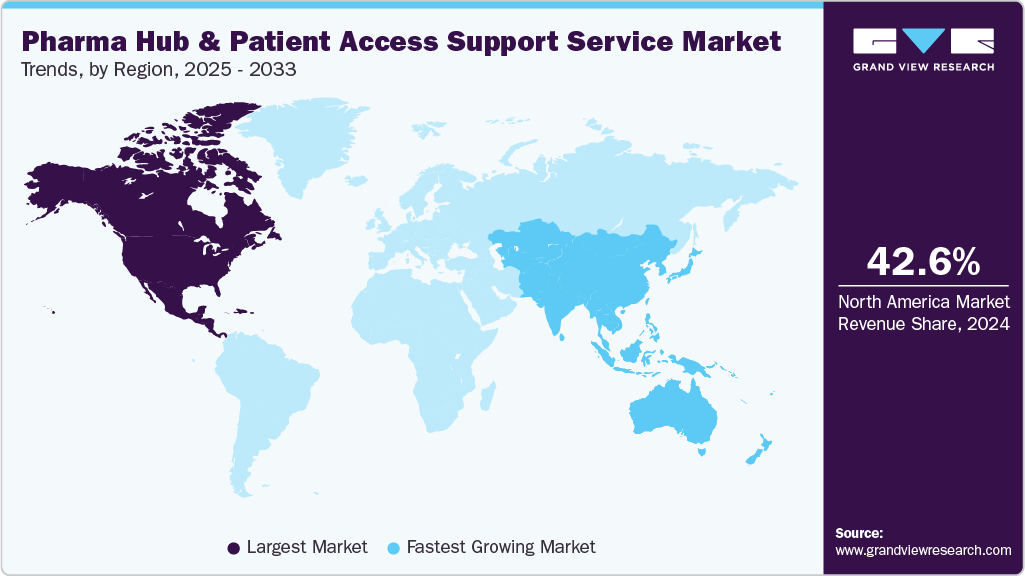

- North America dominated the pharma HUB and patient access support service market with a revenue share of 48.88% in 2024.

- The pharma HUB and patient access support service market in the U.S. dominated the North American region in 2024.

- By service type, the program enrollment segment dominated the market with the largest share of 31.2% in 2024.

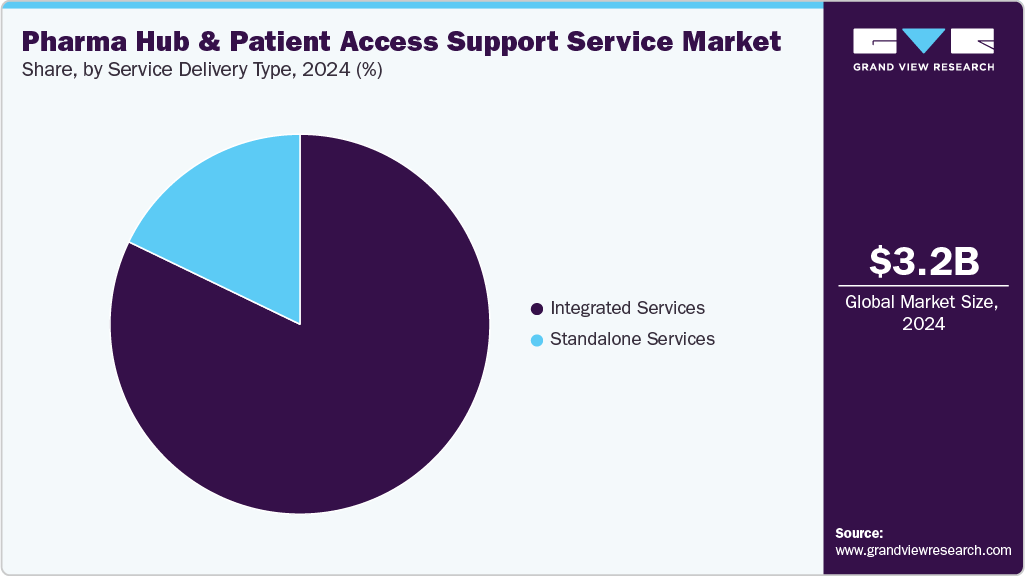

- By service delivery type, the integrated services segment dominated the market with the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.24 Billion

- 2033 Projected Market Size: USD 7.63 Billion

- CAGR (2025-2033): 10.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Payer-side complexity (prior authorizations, specialty drug formularies, and rising claim denials), and tighter affordability controls have pushed manufacturers to outsource patient onboarding, benefiting verification and copay/cost-assistance management to dedicated hub providers.The growing launch of high-cost specialty and rare-disease therapies between 2021 and 2024 has become a key driver for the expansion of pharma hubs and patient access support services. According to the U.S. FDA, 37 novel drugs were approved in 2022, of which 20 around 54% were targeted at rare diseases, while in 2023, 55 new drugs were approved, and over half, 28 drugs, were for rare diseases. These therapies often carry exceptionally high price tags and require complex insurance approvals.

Hemgenix, a gene therapy for hemophilia B approved in 2022, was priced at about USD 3.5 million per dose, and Alzheimer’s drug Leqembi, approved in 2023, costs around USD 26,500 annually. Such launches highlight the growing financial and administrative barriers for patients, encouraging pharmaceutical companies to invest heavily in digital hub platforms, benefit verification systems, prior authorization automation, and patient support programs. As a result, the increasing number of specialized, high-cost therapies is directly driving demand for integrated pharma hub and patient access support solutions to streamline reimbursement, accelerate therapy initiation, and improve adherence outcomes.

The market is further driven by players undertaking several strategic initiatives. For instance, in November 2023, Docquity announced the expansion of its digitized patient access program, DocquityCare PAP, to Thailand. It launched five PAPs in Thailand, supporting 250 authorized HCPs and around 100 enrolled hospitals to enhance patient care for individuals with cancer and additional life-threatening conditions.

The demand for innovative treatments and specialized care for genetic and rare diseases has led to the emergence of dedicated pharma HUBs and patient access support services. These services play a crucial role in facilitating access to life-changing therapies, providing patient education and support, navigating reimbursement processes, and ensuring continuity of care for individuals affected by these conditions.

Furthermore, increasing government support in the form of funding aimed at drug development to cure chronic diseases is also contributing to the market growth. Hence, many prominent pharmaceutical and biotechnological companies are conducting numerous clinical trials due to the clinical urgency of developing high-potency drugs, contributing to market growth. These drugs are further made available to patients as per their needs. The following is the number of clinical trials conducted in various WHO regions.

Integration of AI in Pharma Hub and Patient Access Support Service

AI is transforming pharma hub and patient access support services by automating manual, time-consuming tasks such as benefit verification, prior authorization, and patient onboarding. AI-driven solutions streamline complex payer interactions, predict adherence risks, and enhance patient engagement through intelligent chatbots and analytics. For instance, in August 2025, Wellgistics Health launch HubRx AI, an advanced AI platform integrated with large language models, automating core prescription hub functions, including eligibility checks, claims management, and reimbursement support, illustrating how AI is being embedded into real-world access ecosystems.

Such innovations are enabling faster therapy initiation, reducing administrative burden, and improving the scalability and efficiency of patient support programs, thereby accelerating the digital transformation of pharma hub operations.

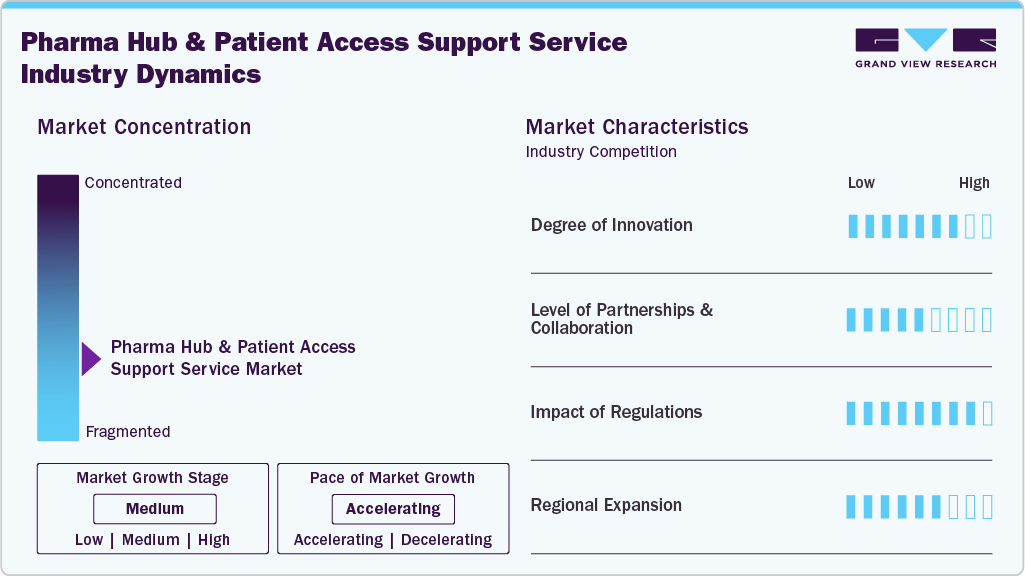

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion.

The degree of innovation in the industry is high, driven by the rising complexity of specialty therapies and the need to simplify access, reimbursement, and adherence processes. Companies are introducing AI-enabled hub platforms that automate benefits verification, prior authorizations, and claims management while integrating predictive analytics and patient engagement tools. These advancements help reduce administrative delays, improve data accuracy, and enable faster therapy initiation, ultimately enhancing the overall patient access experience.

The level of partnerships and collaborations in the industry is moderate, centered on enhancing care coordination and patient access. Companies are partnering with healthcare providers, payers, and tech firms to improve data interoperability, streamline reimbursement processes, and integrate automation into hub operations. For instance, in November 2025 FillPoint Health partnered with Noble (an Aptar Pharma company) to integrate Noble’s patient onboarding and drug-delivery training tools with FillPoint’s provider-centric specialty pharmacy model, aiming to improve therapy initiation, correct medication use, and treatment adherence for patients in therapeutic areas such as cardiology, dermatology, neurology and rare diseases.

Regulations significantly influence the industry by ensuring data privacy, transparency, and compliance in patient handling and reimbursement processes. Frameworks such as HIPAA and GDPR mandate secure management of patient health information, while FDA and CMS guidelines govern promotional practices, co-pay programs, and patient assistance initiatives. These regulations drive vendors to adopt compliant digital platforms, standardized workflows, and audit-ready documentation, which increases operational complexity but also enhances trust, accountability, and quality across hub and access support services.

The industry is expanding as pharmaceutical companies increasingly invest in technology-driven solutions to streamline patient onboarding, reimbursement, and adherence programs. Collaborations between pharma manufacturers, specialty pharmacies, and technology providers are enhancing operational efficiency, improving care coordination, and strengthening patient convenience, supporting the industry’s transition toward a more connected and patient-centric support ecosystem.

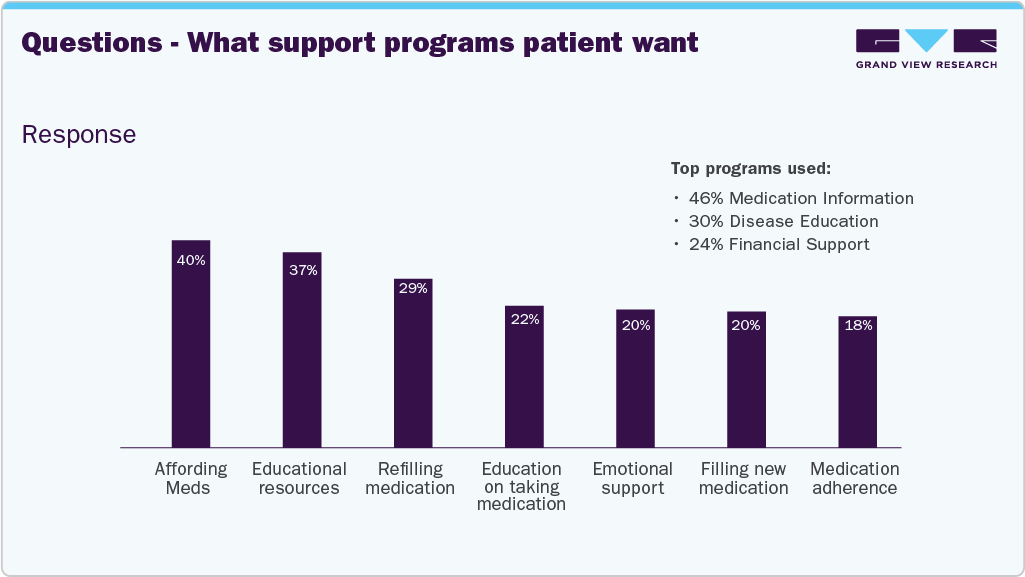

Case Study Insights

Phreesia, a healthcare technology company, conducted a survey of patients who checked in for their doctor's visits on the Phreesia Platform between February 17 and March 2, 2021. The survey aimed to gain insights into patient support programs for medications and understand patients' opinions and experiences with such programs.

-

Result shows: According to a survey conducted on the Phreesia platform, 53% of patients expressed a strong intention to use the copay card, indicating that the content they saw on the platform had a significant impact on their decision-making.

Phreesia's technology solutions help healthcare providers engage with patients in a personalized and effective way by delivering clinically relevant content at every stage of their care journey.

Service Type Insights

The program enrollment segment dominated the market with the largest share of 31.2% in 2024. Program enrollment refers to the procedure of registering patients in specific programs that aim to provide them access to healthcare services, medications, or support required to manage their health conditions. The growing demand for customized solutions and the need to enable better patient outcomes drive the need for patient enrollment services. Several companies are launching new program enrollment solutions, contributing to the market growth. For instance, in December 2022, Pfizer Inc. launched ‘Pfizer PAP India,’ a mobile application designed to enable and accelerate enrolment in Pfizer’s Patient Access Programmes (PAP). Pfizer operated over 10 programs supporting patients undergoing treatments.

The reimbursement services/affordability services segment is expected to grow at the fastest CAGR during the forecast period. Reimbursement services refer to specialized offerings that assist healthcare providers, pharmaceutical companies, and patients in navigating the complex landscape of healthcare reimbursement. These services aim to optimize revenue capture, streamline reimbursement processes, and ensure timely payment for healthcare services and medications. For instance, McKesson RxO's PAP Reimbursement and Revenue Recovery Management solutions are designed to pinpoint revenue-generating opportunities, streamline the review and validation processes of pharmacy revenue cycle data through automation, enhance the collection of revenue for medications administered in clinics, and establish seamless communication between pharmacies and finance departments.

Service Delivery Type Insights

The integrated services segment dominated the market with the largest share in 2024. With the launch of complex pharmaceutical products and the need for effective market access, manufacturers are looking for a comprehensive approach to streamline their services. Integrated solutions offer a unified platform to manage various functions such as patient access support, reimbursement assistance, and pharmacy coordination. To overcome the complexity of the product lifecycle, key manufacturers are focusing on expanding their services. In March 2023, Terebellum (AscellaHealth) expanded its HUB/patient support services for life sciences manufacturers. These services help ensure access to medication, compliance, and improved outcomes for patients. Terebellum's outsourced solutions are known as the best-in-class in the industry.

The standalone services segment is expected to grow at a significant CAGR during the forecast period. As the pharmaceutical industry becomes more complex and regulations keep changing, companies are looking for specialized services that go beyond traditional offerings. Patient access support and pharmaceutical HUB services are customized solutions that address challenges such as market access, reimbursement, and patient engagement. In addition, there is an increasing demand for services that improve patient access, adherence, and overall experience as the pharmaceutical industry is shifting toward patient-centric approaches.

Regional Insights

North America pharma HUB and patient access support service market dominated with a revenue share of 48.88% in 2024. The increasing target population, coupled with the rising prevalence of lifestyle-associated diseases, such as diabetes & cardiovascular disorders, are factors contributing to the market growth. The National Institute of Mental Health’s re-release of funding opportunity announcements for clinical trial-based research is expected to fuel market growth further. Moreover, the presence of major market players and the availability of sophisticated infrastructure are projected to boost growth in this region.

U.S. Pharma HUB and Patient Access Support Service Market Trends

The pharma HUB and patient access support service market in the U.S. dominated the North American region in 2024. Key players in the market are investing to enhance patient access to clinical trials, which is anticipated to fuel market growth over the forecast period. For instance, in June 2022, Parexel, a global clinical research organization, launched the Community Alliance Network. The initiative aimed to enhance the integration of clinical research into community healthcare settings to better serve patients and increase diversity in clinical trials.

Europe Pharma HUB and Patient Access Support Service Market Trends

The pharma HUB and patient access support service market in Europe held a significant revenue share in 2024. As a developed region, Europe has a greater healthcare spending capability, which boosts the demand for pharma HUB and patient access support services. In addition, the growing geriatric population in Europe is leading to an increase in the prevalence of target diseases, which is expected to increase the demand for patient access support services in the region.

The UK pharma HUB and patient access support service market is expected to grow significantly during the forecast period. As the UK continues to prioritize digital health and invest in research & innovation, pharma HUB and patient access support services are expected to play an increasingly critical role in advancing clinical research and improving patient outcomes. Furthermore, the UK has been emphasizing patient-centric approaches in healthcare. Patient access support services with patient engagement features, such as patient portals and ePRO tools, are being adopted to actively involve patients in clinical research.

The pharma HUB and patient access support service market in Germany dominated the European region in 2024. There has been a growing focus on patient-centric approaches in healthcare and clinical research in the country. According to an article published by Cardinal Health in 2022, it was found that more than 90% of physicians are facing patient care delays due to the prior authorization process. The complexities involved have led to about 37% of these physicians abandoning the requests. To ensure patients can access and stay on therapies, it is necessary to adopt technology solutions such as eBV & ePA to compress onboarding time for both prior authorizations and electronic benefit investigations.

Asia Pacific Pharma HUB and Patient Access Support Service Market Trends

The pharma HUB and patient access support service market in Asia Pacific is growing, as high unmet medical needs and the rising prevalence of target chronic diseases such as cancer, cardiovascular conditions, and infectious diseases are stoking the demand for software solutions in the region. As an emerging economy, the growth of the APAC market is largely driven by government funding related to research and drug discovery, which is estimated to enhance its growth over the forecast period.

Japan pharma HUB and patient access support service market is expected to grow significantly during the forecast period. Japan is a significant player in the global pharmaceutical and clinical research industry. The country's pharmaceutical companies and research institutions conduct numerous clinical trials. Therefore, the adoption of eClinical solutions along with pharma HUB and patient access support services has become essential for efficient data collection, management, & analysis during these trials. In addition, the Japanese government supports digital health initiatives and technology adoption in healthcare.

The pharma HUB and patient access support service market in China had a significant market share in 2024. The country has immense growth opportunities owing to improved healthcare facilities and unmet medical needs. According to the Clarivate April 2023 insights, the Chinese government significantly focuses on enhancing access to treatment for rare diseases, driving the adoption of patient HUB & patient access support services. Furthermore, China's regulatory environment is evolving rapidly to accommodate the growing adoption of digital health solutions, including patient access support services, positively impacting market growth.

Latin America Pharma HUB and Patient Access Support Service Market Trends

The pharma hub and patient access support services market in Latin America is growing as regional healthcare systems work to improve access to high-cost specialty and rare disease therapies. Rising diagnosis rates and government initiatives promoting equitable drug access are encouraging pharma companies to establish localized hub models.

Middle East & Africa Pharma HUB and Patient Access Support Service Market Trends

The pharma hub and patient access support services market in the Middle East & Africa is witnessing growth driven by increasing prevalence of chronic and specialty diseases, rising demand for innovative therapies, and efforts by governments to improve healthcare access. Limited healthcare infrastructure in some regions has prompted pharmaceutical companies to implement hub programs that streamline patient enrollment, facilitate reimbursement processes, and provide adherence support.

Key Pharma HUB and Patient Access Support Service Companies Insights

Key players operating in the pharma hub and patient access support service market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Pharma HUB and Patient Access Support Service Companies:

The following are the leading companies in the pharma hub and patient access support service market. These companies collectively hold the largest market share and dictate industry trends.

- Valeris (Formerly PharmaCord)

- Fortrea

- AssistRx

- CareMetx, LLC

- ConnectiveRx.

- Lash Group

- McKesson Corporation

- Engage

- NS Pharma, Inc. (a wholly owned subsidiary of Nippon Shinyaku Co., Ltd.)

- Cardinal Health

- Envoy Health, Inc.

- EVERSANA

- United BioSource LLC

- Mercalis

- Sciensus

Recent Developments

-

In March 2025, PharmaCord and Mercalis merged to create Valeris, one of the largest independent patient access solution providers in the biopharmaceutical industry. This merger combines PharmaCord’s expertise in patient services with Mercalis’s comprehensive commercialization solutions to enhance patient access, affordability, therapy adherence, and overall healthcare delivery. The new entity aims to streamline the commercialization process and improve outcomes for patients and life science companies globally.

“This combination is about more than growth - it’s about impact and transformation to meet evolving manufacturer and patient needs. By uniting PharmaCord’s deep expertise in hub services with Mercalis’s established leadership in end-to-end patient access solutions and robust infrastructure, we are building a next-generation platform that redefines how life science companies bring innovative therapies to market”.

- Robert Truckenmiller, CEO of PharmaCord.

-

In July 2023, Inizio Engage launched the Patient Access Services, a tailored and integrated suite of patient support services designed to enhance the overall patient experience. Specifically crafted to promote adherence and enhance health outcomes in specialty, rare, or orphan diseases, this service is aimed at assisting patients, care partners, HCPs, and their staff. It addresses the complexities faced during the lengthy journey to diagnosis.

“The launch of Patient Access Services is a significant advancement in the capabilities we offer to support their patients on their treatment journey. Partnering education and financial services behind a single point of contact will reduce friction for patients, HCPs and their care partners and improve health outcomes.”

-Greg Flynn, CEO of Inizio Engage

-

In June 2023, AssistRx introduced Advanced Gateway, a single API integration solution. This innovative solution enables the implementation of tech-first, self-service access solutions for patients and healthcare providers. With the single integration, life sciences organizations can access standardized and actionable program data, eliminating the need for multiple vendor partnerships to support the patient journey.

“Imagine standing up patient support technology in a matter of weeks, not months. With Advanced Gateway, life sciences organizations can quickly implement solutions that are modular, scalable and integrated into frontend access channels and backend operations, It’s this level of innovation that puts AssistRx at the forefront of the industry’s efforts to modernize our healthcare system and support patients throughout their journeys.”

- AssistRx President and CEO Jeff Spafford

-

In June 2023, Labcorp announced the spin-off of Fortrea. Fortrea is now an independent CRO that offers patient access, Phase I-IV clinical trial management, and technology solutions to biotechnology & pharmaceutical organizations globally. This strategic move is anticipated to enhance the company’s ability to meet customer needs, unlock shareholder value, and facilitate targeted value-creating investments.

"I want to thank our teams for their tireless work in creating two strong, independent companies through the Fortrea spin. The transaction is intended to better meet customer needs, enable appropriate value-creating investments and unlock shareholder value. Moving forward, Labcorp is well-positioned to deliver on our mission to improve health and improve lives."

- Adam Schechter, chairman and chief executive officer.

-

In January 2022, CareMetx, LLC acquired Human Care Systems, Inc., a company assisting patients in adhering to and benefiting from pharmaceutical & biotechnology products. Its offerings include Resilix, a proprietary technology platform designed to provide patients with a personalized treatment experience. Through this acquisition, CareMetx aims to enhance its capability to support the entire patient journey, spanning from initiation to adherence.

Pharma HUB and Patient Access Support Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.55 billion

Revenue forecast in 2033

USD 7.63 billion

Growth rate

CAGR of 10.0% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, service delivery type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Valeris (Formerly PharmaCord); Fortrea; AssistRx; CareMetx, LLC; ConnectiveRx; Lash Group; McKesson Corporation; Engage; NS Pharma, Inc. (a wholly owned subsidiary of Nippon Shinyaku Co., Ltd.); Cardinal Health; Envoy Health, Inc.; EVERSANA; United BioSource LLC; Mercalis; Sciensus

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharma Hub And Patient Access Support Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global pharma HUB and patient access support service market report based on service type, service delivery type, and region:

-

Service Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Program Enrollment

-

Order processing

-

Application processing

-

Ease of enrollment (through phone, face, portal, or app)

-

Program data

-

-

Treatment Navigators

-

Process flows and standard operating procedures

-

Program literature and scripts

-

Care team training

-

Systems testing and optimization

-

-

Reimbursement Services/Affordability Services

-

Clinical Educator

-

Coordination of Specialty Pharmacy/Dispensing

-

Others

-

-

Service Delivery Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Integrated Services

-

Standalone Services

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharma HUB and patient access support service market was valued at USD 3.24 billion in 2024 and is expected to reach 3.55 billion in 2025.

b. The global pharma HUB and patient access support service market is expected to grow at a compound annual growth rate of 10.0% from 2025 to 2033 to reach USD 7.63 billion by 2033.

b. North America dominated the pharma HUB and patient access support service market with a revenue share of 48.88.

b. Some key players operating in pharma HUB and patient access support service market include Valeris (Formerly PharmaCord); Fortrea; AssistRx; CareMetx, LLC; ConnectiveRx; Lash Group; McKesson Corporation; Engage; NS Pharma, Inc. (a wholly owned subsidiary of Nippon Shinyaku Co., Ltd.); Cardinal Health; Envoy Health, Inc.; EVERSANA; United BioSource LLC; Mercalis; Sciensus

b. Key factors driving the market are increasing need to administer new medicines for various specialties and rare & orphan diseases, prioritizing creating a patient-centric ecosystem.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.