- Home

- »

- Biotechnology

- »

-

Pharmaceutical Microbiology QC Testing Market Report, 2033GVR Report cover

![Pharmaceutical Microbiology QC Testing Market Size, Share & Trends Report]()

Pharmaceutical Microbiology QC Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Instruments, Reagents & Kits), By Test Type (Traditional/Conventional Testing, Rapid Testing), By Technique, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-811-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Microbiology QC Testing Market Summary

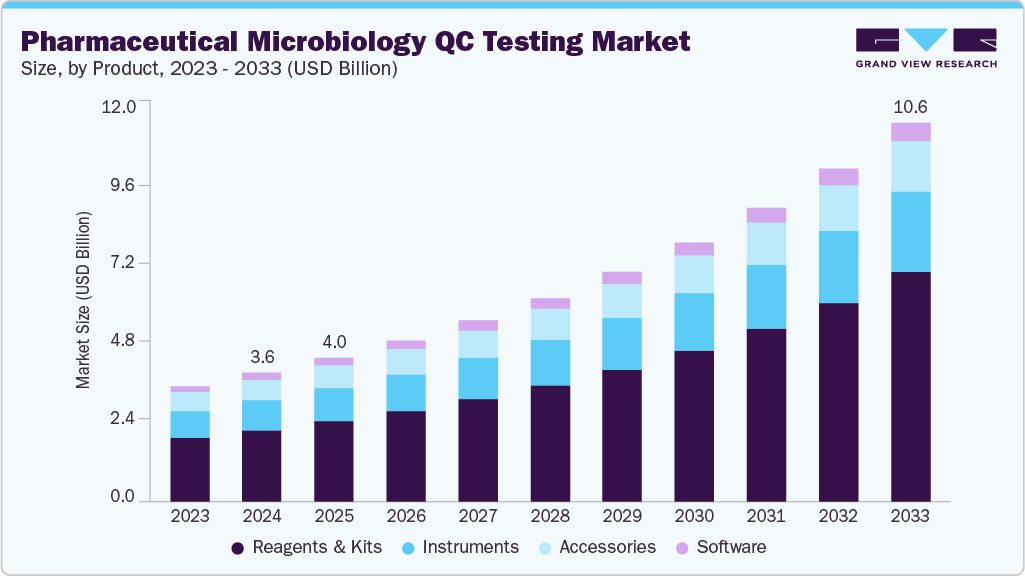

The global pharmaceutical microbiology QC testing market size was estimated at USD 3.61 billion in 2024 and is projected to reach USD 10.60 billion by 2033, expanding at a CAGR of 12.86% from 2025 to 2033. The market is experiencing significant growth, driven by a combination of technological advancements, regulatory pressures, and an increasing emphasis on patient safety and product quality.

Key Market Trends & Insights

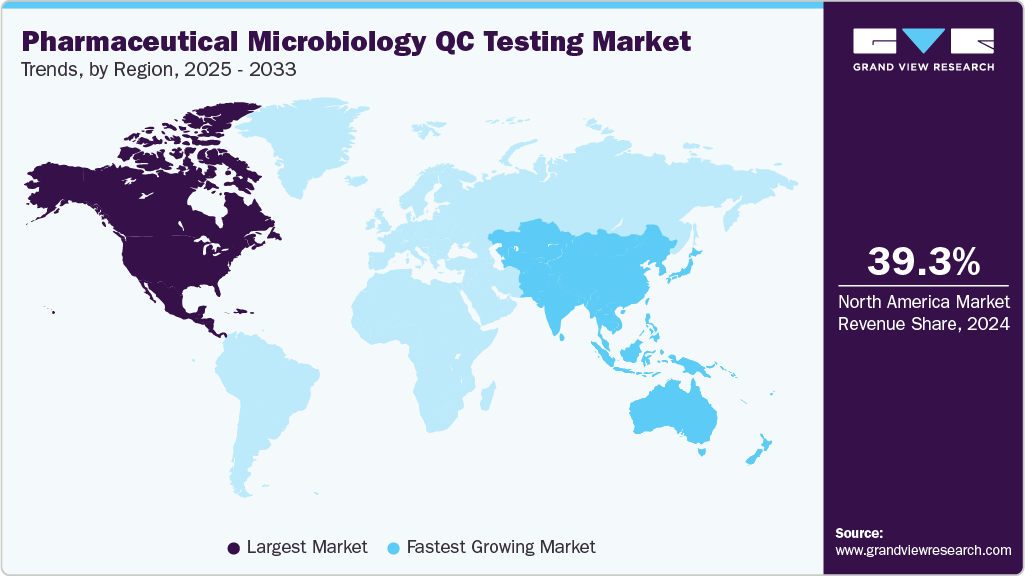

- The North America pharmaceutical microbiology QC testing market held the largest share of 39.29% of the global market in 2024.

- The pharmaceutical microbiology QC testing industry in the U.S. is expected to grow significantly over the forecast period.

- By products, the reagents & kits segment held the highest market share of 55.76% in 2024.

- Based on test type, the traditional/conventional testing segment held the highest market share in 2024.

- By technique, the growth-based testing segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.61 Billion

- 2033 Projected Market Size: USD 10.60 Billion

- CAGR (2025-2033): 12.86%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing focus on quality control and rising microbiology testing needsStronger emphasis on quality control and growing microbiology testing needs in the pharmaceutical manufacturing sector are driving the market for pharmaceutical microbiology QC testing. Drug manufacturers are increasingly implementing rapid microbial detection systems that provide quicker, more accurate, and compliant quality-testing results in response to increased regulatory scrutiny surrounding sterility assurance, contamination control, and data integrity.

Principal microbiological testing approaches used in pharmaceutical quality control,

Name of Microbial Test

Tested For

Sample Types

Remarks

Sterility Testing

Presence or absence of viable microorganisms (bacteria, fungi)

Parenteral drugs, ophthalmic solutions, implantable devices, sterile APIs and excipients

Critical for sterile products; failure results in batch rejection. False positives may occur due to contamination; aseptic validation essential.

Bacterial Endotoxin Testing (BET)

Bacterial endotoxins (lipopolysaccharides from Gram-negative bacteria)

Injectable drugs, sterile water, medical devices, dialysis fluids, implantable materials

Highly sensitive; validation for inhibition/enhancement required. Recombinant Factor C (rFC) emerging as non-animal alternative.

Microbial Limit Testing (MLT)

Quantitative microbial count and presence of objectionable microorganisms

Non-sterile products (tablets, syrups, creams, herbal/nutraceuticals)

Required for non-sterile QC; interference testing essential. Limits depend on formulation type and intended use.

Antimicrobial Effectiveness / Preservative Efficacy Testing (PET)

Effectiveness of preservatives in preventing microbial proliferation

Multi-dose pharmaceuticals, topical, ophthalmic, otic, cosmetics

Ensures preservative efficiency during use; must be validated for formulation-specific neutralization.

Pathogen Identification and Characterization

Identification and classification of objectionable or pathogenic microorganisms

Raw materials, in-process and finished products, environmental samples

Essential for root cause analysis in contamination events; molecular methods offer higher specificity and faster results.

Antibiotic Resistance Profiling

Detection of antimicrobial resistance (AMR) in isolates

Clinical pathogens, environmental/raw material isolates, manufacturing contaminants

Critical for risk assessment; supports infection control, antibiotic manufacturing safety, and contamination investigations.

Source: International Journal of Current Microbiology and Applied Sciences, Presentation, Secondary Research, Grandview Resaerch.inc

Rapid microbiology techniques that enable accelerated batch-release timelines without sacrificing product safety are becoming increasingly necessary as complex biologics, such as cell and gene therapies, and other time-sensitive biomanufacturing workflows gain traction. Moreover, the move to real-time microbial surveillance and automation-enabled QC is speeding up the adoption of rapid testing platforms that can deliver actionable results in a matter of hours.

Technological advancements in rapid testing

Pharmaceutical quality control is being revolutionized by rapid microbiology testing technologies, which offer quicker, more accurate, and automated substitutes for conventional culture-based systems. Microbial detection can now be performed in hours rather than days, owing to platforms that utilize ATP bioluminescence, molecular amplification, flow cytometry, microfluidics, and automated imaging. This improves sensitivity, reduces the need for manual intervention, and accelerates batch-release schedules.

Market expansion is supported by the growing complexity of biopharmaceutical pipelines, including biologics, sterile injectables, and cell and gene therapies, which demand accelerated sterility assurance and continuous microbial monitoring.

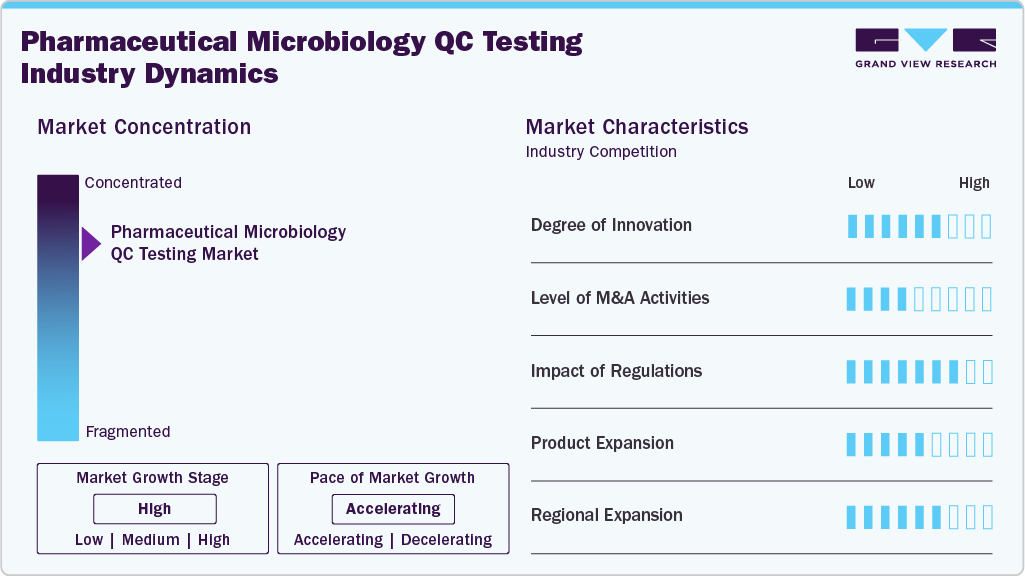

Market Concentration & Characteristics

The pharmaceutical microbiology QC testing industry exhibits a high degree of innovation, driven by the adoption of rapid microbial methods, automation, and digital tools, including AI and LIMS integration. For instance, in October 2025, INTEGRA Biosciences launched advanced liquid-handling technology to automate media preparation, sample handling, and nucleic acid workflows, enhancing throughput, consistency, and efficiency in pharmaceutical microbiology labs while supporting the shift toward rapid, automated microbial testing.

The level of M&A activity in the global pharmaceutical microbiology QC testing industry is moderate as companies are actively acquiring small firms with rapid microbial detection, automation, and molecular QC technologies to improve portfolios and expand regional presence. While large-scale deals are limited, steady strategic and private equity investments indicate a focused push toward technological integration and market expansion.

The pharmaceutical microbiology QC testing industry is heavily influenced by regulations, with stringent standards from the FDA, EMA, and WHO encouraging the use of validated, GMP-compliant, and rapid testing techniques.

The adoption of rapid microbial detection systems, automated platforms, and molecular assays drives product expansion in the pharmaceutical microbiology QC testing industry. These innovations enhance accuracy, reduce testing time, and enable companies to meet regulatory standards while improving competitiveness.

Regional expansion in the pharmaceutical microbiology QC testing industry is driven by companies establishing new facilities and forming partnerships in emerging markets, such as the Asia Pacific and Latin America. The growth of pharmaceutical manufacturing, regulatory harmonization, and increased demand for quality assurance are encouraging global players to strengthen their presence and distribution networks across high-growth regions.

Product Insights

The reagents & kits segment dominated the global pharmaceutical microbiology QC testing market in 2024, with a share of 55.76%, and is expected to register the fastest CAGR during the forecast period. Its growth is driven by expanding biologics and cell & gene therapy pipelines, where contamination risks are higher and timelines are compressed. Demand is rising for cartridge-based systems, lyophilized assay kits, and endotoxin-free reagents optimized for high-throughput and in-process testing.

The software segment is expected to grow at a significant rate during the forecast period. With increasing emphasis on electronic batch-release systems and traceable microbiology records, software adoption continues to accelerate across global GMP-regulated facilities.

Test Type Insights

In 2024, the traditional/conventional testing segment was projected to capture the highest market share. Market growth for traditional testing is driven by the expansion of sterile manufacturing, rising biologics and injectable production, and regulatory reliance on culture-based methods for validation. Ongoing environmental monitoring needs, higher QC testing volumes, and stricter contamination control in aseptic facilities further sustain demand for conventional microbiology techniques.

The rapid testing segment is expected to witness the fastest growth during the forecast period. Growth is fueled by expanding biologics production, focusing on aseptic processing, and regulatory support, as rapid testing enables faster decisions, reduced inventory, and greater product assurance.

Technique Insights

The growth-based testing segment led the pharmaceutical microbiology QC testing industry in 2024 with a 56.31% share, supported by strong regulatory acceptance, reliability, and validation across sterility, bioburden, and environmental testing. Despite rapid method advances, manufacturers continue to rely on these proven systems for their accuracy, broad organism detection, and compliance with pharmacopeial standards, especially amid the rise of biologics and sterile injectable production.

The nucleic acid-based testing segment is expected to register the fastest growth during the forecast period, driven by the increasing use of molecular workflows for sterility testing, adventitious agent screening, and in-process contamination monitoring.

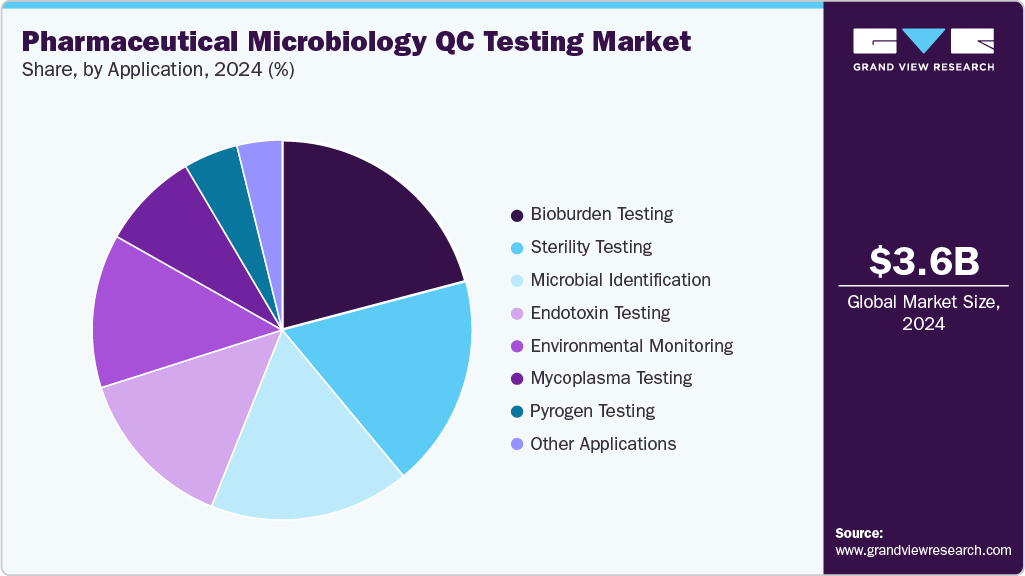

Application Insights

In 2024, bioburden testing accounted for the largest share of the pharmaceutical microbiology QC testing market at 20.89%, primarily driven by the increasing emphasis on contamination control and product quality across sterile drug manufacturing. Rising production of biologics, vaccines, and advanced therapies has intensified the demand for precise and rapid microbial load detection to ensure product safety and regulatory compliance.

The mycoplasma testing segment is expected to register the fastest growth during the forecast period, driven by the rising production of biologics, cell and gene therapies, and vaccines that require stringent contamination control. Mycoplasma contamination poses significant risks to product quality, safety, and regulatory compliance, prompting pharmaceutical manufacturers to adopt rapid, highly sensitive detection technologies.

Regional Insights

In 2024, the pharmaceutical microbiology QC testing industry was led by North America, accounting for the largest revenue share of 39.29%. This growth is driven by stringent regulatory standards, a strong pharmaceutical manufacturing base, and the growing adoption of advanced testing technologies. The U.S. FDA’s emphasis on sterility assurance, data integrity, and real-time release testing has accelerated the transition from conventional microbiology to validated rapid methods across biopharmaceutical and sterile product facilities

U.S. Pharmaceutical Microbiology QC Testing Market Trends

The U.S. dominates the regional pharmaceutical microbiology QC testing (RMT) quality control market, driven by stringent regulatory requirements, advanced manufacturing infrastructure, and continuous innovation in analytical and microbiological technologies.

Europe Pharmaceutical Microbiology QC Testing Market Trends

Europe is experiencing steady growth, supported by a strong regulatory framework and increasing emphasis on sterility assurance and contamination prevention. The European Medicines Agency (EMA) and national regulatory bodies have encouraged the implementation of validated rapid methods under Good Manufacturing Practice (GMP) guidelines, driving broader adoption across biopharmaceutical and sterile product facilities.

The UK pharmaceutical microbiology QC testing industry is experiencing steady growth, driven by the sector’s increasing focus on modernization, speed, and compliance in pharmaceutical manufacturing. The country’s strong biopharmaceutical ecosystem, supported by expanding investments in biologics, vaccines, and cell and gene therapies, is creating demand for advanced microbial detection systems that ensure sterility assurance and contamination control.

Germany represents one of the most mature and innovation-driven markets for pharmaceutical microbiology QC testing (RMT) in quality control, supported by a strong pharmaceutical manufacturing base, robust regulatory environment, and high adoption of advanced testing technologies.

Asia Pacific Pharmaceutical Microbiology QC Testing Market Trends

The Asia Pacific region is expected to register the fastest CAGR of 15.62% from 2025 to 2033, fueled by improving pharmaceutical manufacturing capabilities, supportive government initiatives, and increasing regulatory alignment with global GMP standards. The rising prevalence of contract manufacturing organizations (CMOs) and the focus on reducing product release timelines are further encouraging the shift toward automation-driven RMT solutions.

China’s pharmaceutical microbiology QC testing market is witnessing robust growth, primarily driven by the expansion of domestic pharmaceutical manufacturing and biopharmaceutical production capabilities. The market is also being driven by government-backed programs that encourage pharmaceutical innovation and the growth of biomanufacturing, as well as the growing use of molecular assays and viability-based detection platforms.

Japan’s pharmaceutical microbiology QC testing (RMT) quality control market is witnessing steady growth, driven by the country’s strong pharmaceutical manufacturing ecosystem, stringent regulatory standards, and emphasis on innovation in biologics and advanced therapeutics.

MEA Pharmaceutical Microbiology QC Testing Market Trends

The Middle East & Africa region is experiencing a rise in interest and demand for pharmaceutical microbiology QC testing. Key growth drivers include the establishment of new pharmaceutical and vaccine manufacturing facilities, increased awareness of microbial contamination control, and a growing shift toward automated and digitalized testing systems.

The pharmaceutical microbiology QC testing industry in Kuwait is gaining momentum as local manufacturers and regional GMP finishers align with Gulf regulatory frameworks and global supply-chain expectations.

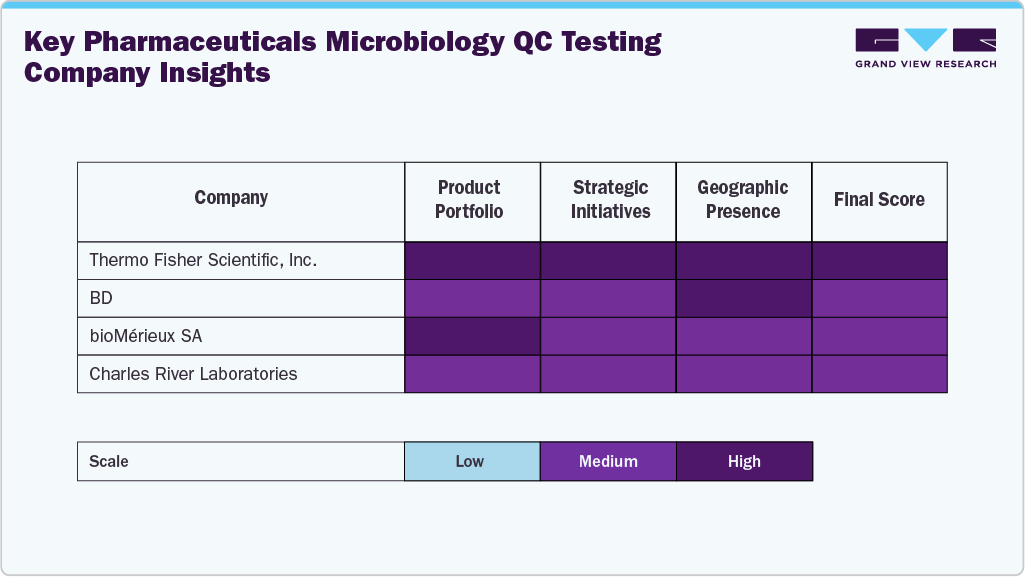

Key Pharmaceuticals Microbiology QC Testing Company Insights

The pharmaceutical microbiology QC testing industry is characterized by the presence of several established players that dominate through robust product portfolios, global reach, and continuous investment in technological innovation. Leading companies such as Thermo Fisher Scientific, Inc., Merck KGaA, BD, bioMérieux SA, Charles River Laboratories, Danaher, and Sartorius AG maintain strong market positions because of strong portfolio.

Emerging and mid-sized players such as Rapid Micro Biosystems, Inc., HiMedia Laboratories, and Hardy Diagnostics are expanding their footprints by offering specialized testing products, contract QC services, and customized media solutions designed to meet the evolving needs of biologics and sterile manufacturing operations.

Companies that successfully blend scientific innovation with compliance-driven solutions are poised to sustain competitive advantage and deliver long-term value in this evolving landscape.

Key Pharmaceuticals Microbiology QC Testing Companies:

The following are the leading companies in the pharmaceuticals microbiology QC testing market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc

- Merck KGaA

- BD

- bioMérieux SA

- Danaher

- Sartorius AG

- Rapid Micro Biosystems, Inc.

- Charles River Laboratories

- HiMedia Laboratories

- Hardy Diagnostics

Recent Developments

-

In November 2025, BWT and bNovate introduced the AQU Sense MB system for real-time microbial monitoring in pharmaceutical water systems, enabling rapid detection in around 20 minutes and supporting accelerated contamination-control workflows in pharma manufacturing.

-

In October 2025, Nelson Labs launched its RapidCert biological indicator sterility testing service, enabling product-release decisions in approximately 48 hours compared to traditional multi-day methods. This offer exemplifies the pharmaceutical microbiology QC testing market’s shift toward faster, automated sterility assurance solutions

Pharmaceuticals Microbiology QC Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.03 billion

Revenue forecast in 2033

USD 10.60 billion

Growth rate

CAGR of 12.86% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, test type, technique, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc; Merck KGaA; BD; bioMérieux SA; Danaher; Sartorius AG; Rapid Micro Biosystems, Inc.; Charles River Laboratories; HiMedia Laboratories; Hardy Diagnostics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Pharmaceuticals Microbiology QC Testing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the pharmaceutical microbiology QC testing market on the basis of product, test type, technique, application, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Reagents & Kits

-

Accessories

-

Software

-

-

Test Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Traditional/Conventional Testing

-

Rapid Testing

-

-

Technique Outlook (Revenue, USD Million, 2021 - 2033)

-

Traditional/Conventional Testing

-

Growth-based Testing

-

Nucleic Acid-based Testing

-

Cellular Component-based Testing

-

Viability-based Testing

-

Other Techniques

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Bioburden testing

-

Sterility testing

-

Environmental monitoring

-

Endotoxin testing

-

Pyrogen testing

-

Mycoplasma testing

-

Microbial identification

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.