- Home

- »

- Organic Chemicals

- »

-

Pharmaceutical Solvents Market Size, Industry Report, 2033GVR Report cover

![Pharmaceutical Solvents Market Size, Share & Trends Report]()

Pharmaceutical Solvents Market (2025 - 2033 ) Size, Share & Trends Analysis Report By Product (Alcohols, Hydrocarbons), By Application (Active Pharmaceutical Ingredient (API) Manufacturing, Pharmaceutical Formulation), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-806-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Solvents Market Summary

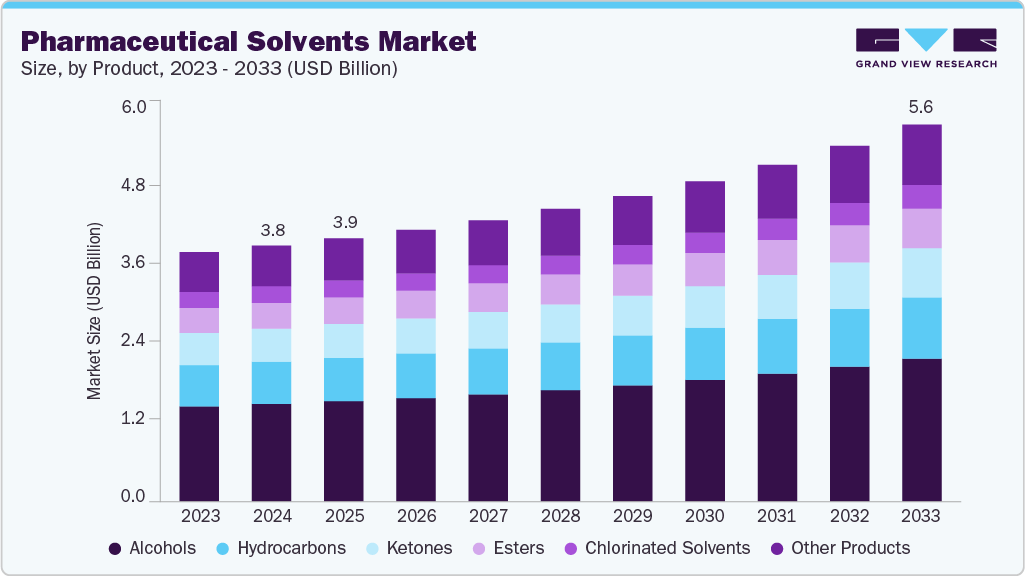

The global pharmaceutical solvents market size was estimated at USD 3,784.6 million in 2024 and is projected to reach USD 5,573.5 million by 2033, growing at a CAGR of 4.6% from 2025 to 2033. The growth of the global pharmaceutical solvents market is primarily driven by the expanding pharmaceutical manufacturing base, increasing demand for active pharmaceutical ingredients (APIs), and rising formulation activities across both developed and emerging economies.

Key Market Trends & Insights

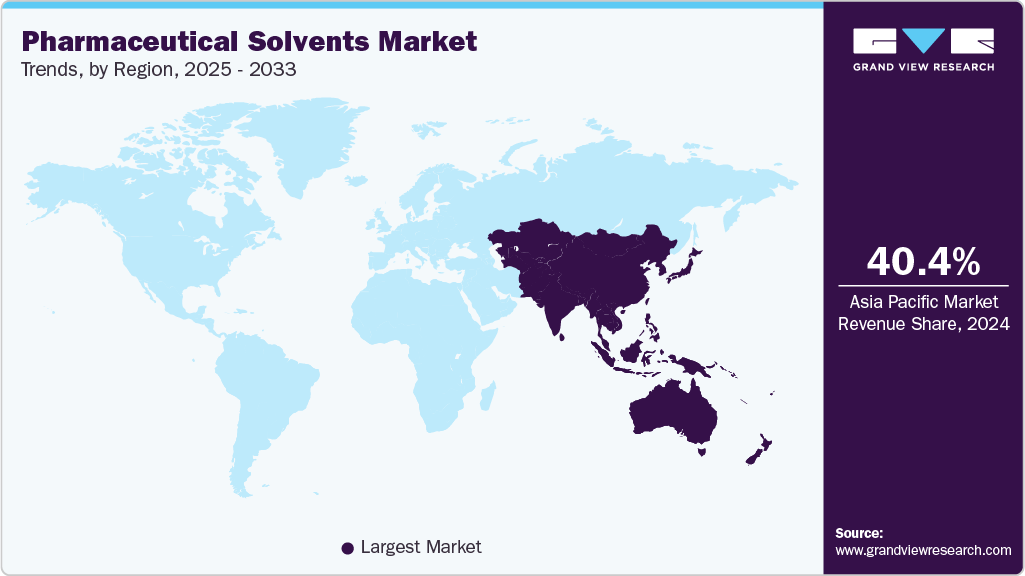

- Asia Pacific dominated the pharmaceutical solvents market with the largest revenue share of 40.4% in 2024.

- The market in China is expected to grow at the fastest CAGR of 5.1% from 2025 to 2033.

- By product, the alcohols segment dominated the global market with the largest revenue share of 38.1% in 2024.

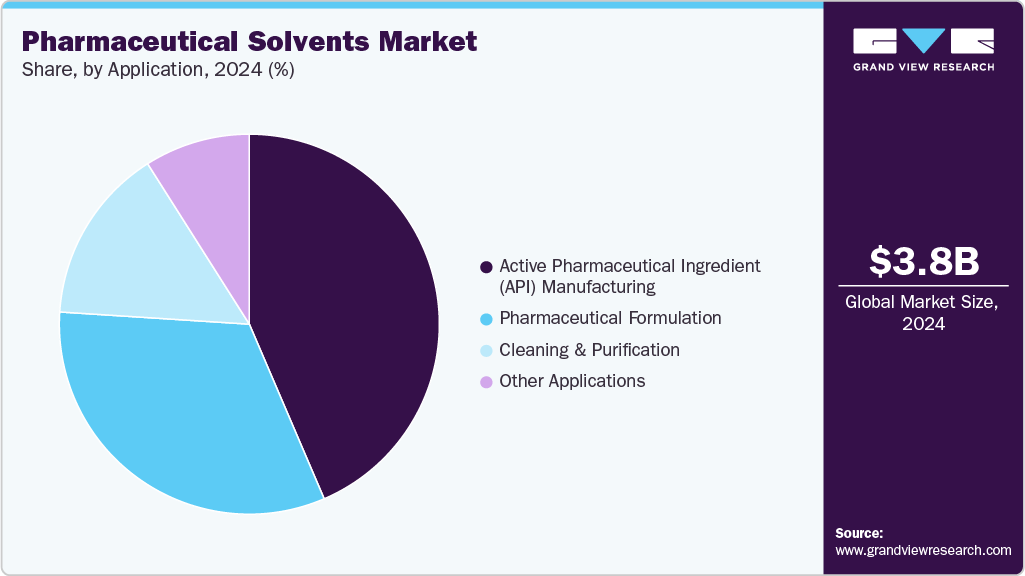

- By application, the active pharmaceutical ingredient (API) manufacturing segment accounted for the largest revenue share of 43.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3,784.6 million

- 2033 Projected Market Size: USD 5,573.5 million

- CAGR (2025-2033): 4.6%

- Asia Pacific: Largest market in 2024

The surge in chronic diseases and lifestyle-related disorders has led to higher production of APIs and finished dosage forms, directly fueling solvent consumption in synthesis, extraction, purification, and formulation processes. Moreover, regulatory emphasis on high-purity, low-toxicity, and environmentally sustainable solvents, aligned with ICH Q3C and USP 467 guidelines, has accelerated the shift toward pharmaceutical-grade and green solvent alternatives. The growing investments in contract manufacturing and outsourcing to Asia-Pacific countries such as China and India are bolstering the overall market expansion.Key opportunities in the pharmaceutical solvents market stem from the rising adoption of bio-based and green solvents, driven by sustainability goals and tightening environmental regulations. Innovation in solvent recovery and recycling technologies is creating cost-efficient and eco-friendly solutions for pharmaceutical manufacturers. The increasing demand for solvents compatible with biologics, cell, and gene therapy formulations presents a new growth frontier, as traditional solvents often fail to meet biocompatibility standards. The global trend of reshoring pharmaceutical manufacturing in North America and Europe, along with the expansion of contract development and manufacturing organizations (CDMOs) in Asia, is creating lucrative opportunities for suppliers offering compliant, high-purity solvent systems and integrated supply solutions.

The market faces several challenges, including stringent regulatory compliance requirements and the high cost of maintaining solvent purity standards for pharmaceutical applications. Increasing environmental concerns related to volatile organic compound (VOC) emissions and the disposal of toxic chlorinated solvents have intensified scrutiny under frameworks such as REACH and EPA regulations. The fluctuating raw material prices and supply chain vulnerabilities, especially for petrochemical-derived solvents, pose cost pressures on manufacturers. The transition toward greener, bio-based solvents also demands significant R&D investments and reformulation efforts, which can limit short-term profitability. Moreover, regional differences in quality standards and regulatory approvals continue to complicate global trade and market harmonization.

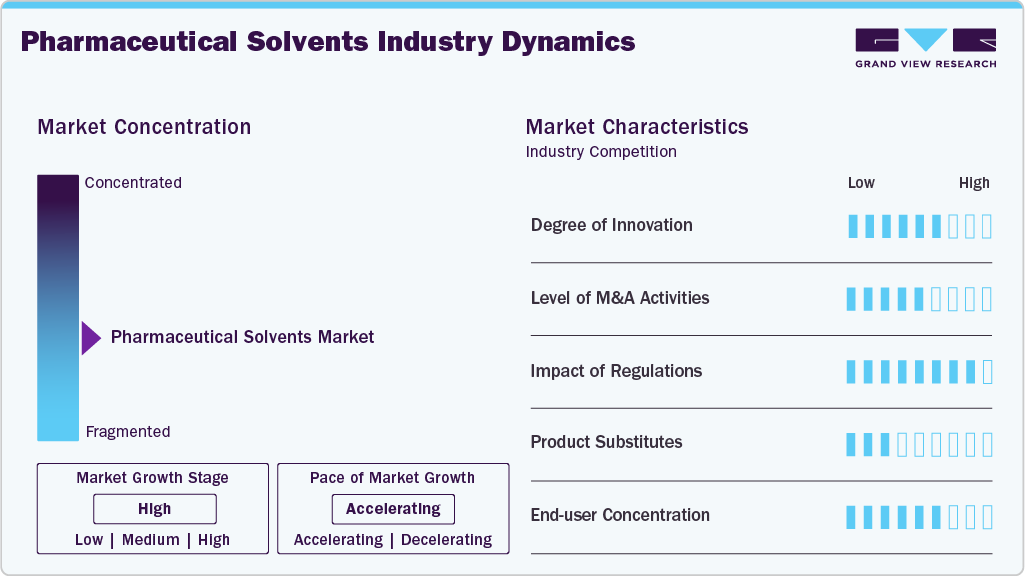

Market Concentration & Characteristics

The global pharmaceutical solvents market is moderately consolidated, characterized by the presence of several multinational chemical companies with well-established production, distribution, and purification capabilities. Leading players such as Merck KGaA, BASF SE, The Dow Chemical Company, ExxonMobil Corporation, and Eastman Chemical Company dominate the market through their extensive product portfolios, high-purity solvent offerings, and global supply networks. These companies leverage advanced purification technologies and regulatory compliance expertise to cater to pharmaceutical manufacturers operating under stringent quality frameworks such as ICH, USP, and GMP. Strategic integration across the value chain, from raw material sourcing to solvent recovery systems, enables these players to ensure consistent supply reliability and cost efficiency.

In addition, companies such as AkzoNobel N.V., Royal Dutch Shell PLC, Mitsubishi Chemical Corporation, Bayer AG, and Nouryon are focusing on product differentiation through innovation in eco-friendly, low-VOC, and bio-based solvents. Collaborations with pharmaceutical manufacturers and CDMOs for customized solvent systems and sustainability-focused initiatives are gaining traction. Continuous investments in R&D, solvent recycling infrastructure, and regional manufacturing expansions, particularly across Asia-Pacific and North America, are reinforcing market competitiveness. Overall, the competitive landscape is shifting toward environmentally responsible formulations and technology-driven solvent management solutions, as market leaders seek to align growth strategies with evolving regulatory and sustainability mandates.

Product Insights

The alcohols segment dominated the global pharmaceutical solvents market with the largest revenue share of 38.1% in 2024, primarily driven by its extensive utilization in both API manufacturing and pharmaceutical formulation processes. Alcohols such as ethanol, isopropanol, and methanol are preferred due to their excellent solvency characteristics, low toxicity, and regulatory acceptance across major pharmacopoeias (USP, EP, JP). Ethanol is widely used as a reaction medium, disinfectant, and extraction solvent, making it indispensable for both synthesis and cleaning operations. The rising production of high-purity and denatured ethanol, coupled with the increasing demand for pharma-grade isopropanol in cleaning and disinfection applications, continues to support segment growth. Furthermore, the global shift toward bio-based and sustainable alcohols, derived from renewable feedstocks such as corn and sugarcane, aligns with pharmaceutical companies’ sustainability objectives and enhances the long-term outlook for this segment.

Other key product categories, including Hydrocarbons, Ketones, Esters, and Chlorinated Solvents, also contribute significantly to the market’s growth. Hydrocarbons (such as toluene and hexane) are primarily used for extraction and crystallization in API synthesis but face regulatory pressure due to environmental and toxicity concerns. Ketones, led by acetone and methyl ethyl ketone, serve as versatile solvents in formulation and purification stages due to their excellent volatility and solubility. Esters such as ethyl acetate are gaining traction as greener alternatives, driven by favorable evaporation rates and lower residue levels. Meanwhile, Chlorinated solvents like dichloromethane remain essential for specialized reactions but are gradually being phased down under REACH and EPA directives. The Other Products category, including ethers and glycols (e.g., tetrahydrofuran and propylene glycol), represents a smaller yet high-value segment, supported by growing demand from biologics and specialty drug formulations. Overall, the market is gradually transitioning toward low-toxicity, high-purity, and environmentally compliant solvent systems, reflecting the evolving regulatory and sustainability landscape of the global pharmaceutical industry.

Application Insights

The active pharmaceutical ingredient (API) manufacturing segment accounted for the largest revenue share of 43.6% in 2024, driven by the expanding global production of APIs and intermediates across both regulated and emerging markets. Pharmaceutical solvents play a critical role in reaction chemistry, extraction, crystallization, and purification processes involved in API synthesis. The segment’s growth is underpinned by the increasing demand for small-molecule drugs, a strong pipeline of generics, and the growing outsourcing of API manufacturing to contract organizations in countries such as India and China. The regulatory push toward high-purity, low-residual solvent systems in compliance with ICH Q3C guidelines has further elevated the demand for premium-grade solvents such as ethanol, methanol, acetone, and ethyl acetate. The technological advancements in solvent recovery, purification, and green chemistry practices are enhancing cost efficiency and environmental performance in large-scale API production, reinforcing the segment’s dominance.

The pharmaceutical formulation segment represents another major application area, supported by rising production of oral, topical, and injectable dosage forms requiring solvents as dissolution media, coating agents, and stabilizers. Growing emphasis on biocompatible and non-toxic solvent systems is driving the use of ethanol and propylene glycol in formulations, particularly for sensitive drug products. The Cleaning and Purification segment also holds a significant share, driven by the mandatory use of high-purity solvents like isopropanol and ethanol for equipment cleaning, sterilization, and contamination control under Good Manufacturing Practice (GMP) standards. Meanwhile, the Other Applications category, covering analytical R&D, laboratory testing, and biologics processing, is projected to record the fastest growth during the forecast period due to the expanding biopharmaceutical sector and increased CRO/CDMO activities worldwide. Overall, the application landscape reflects a sustained reliance on solvents across all stages of the pharmaceutical value chain, with a clear industry shift toward sustainable, compliant, and process-optimized solvent solutions.

Regional Insights

Asia Pacific dominated the global pharmaceutical solvents market with a 40.4% revenue share in 2024, primarily driven by the robust expansion of the pharmaceutical manufacturing sector in countries such as China, India, and South Korea. The region benefits from cost-effective production capabilities, availability of raw materials, and favorable government policies promoting local drug production. The growing demand for generics and biosimilars, coupled with increasing investments in R&D activities by regional and global pharmaceutical companies, has significantly boosted solvent consumption across the region. The rising adoption of advanced drug formulation technologies and expanding export-oriented pharmaceutical operations further consolidate Asia Pacific’s leading market position.

China accounted for a dominant 48.2% share of the Asia Pacific pharmaceutical solvents market in 2024, underscoring its position as a global manufacturing hub for active pharmaceutical ingredients (APIs) and formulations. The strong presence of domestic chemical manufacturers, integrated production facilities, and government initiatives to strengthen the pharmaceutical value chain have accelerated market growth. Moreover, the country’s large-scale adoption of green chemistry and sustainable solvent production practices is reshaping its competitive edge in global trade. Rising domestic healthcare spending and continuous innovation in formulation processes have further amplified the demand for solvents in API synthesis and drug formulation.

North America Pharmaceutical Solvents Market Trends

North America held a substantial 28.3% revenue share in 2024, driven by the region’s strong pharmaceutical R&D infrastructure, stringent regulatory standards, and high consumption of specialty and high-purity solvents. The presence of leading pharmaceutical and biotechnology firms in the U.S. and Canada has sustained consistent demand for advanced solvents in both drug formulation and manufacturing processes. Furthermore, increasing focus on sustainable production, along with ongoing efforts toward solvent recycling and substitution of hazardous chemicals, continues to shape market dynamics in the region.

U.S. Pharmaceutical Solvents Market Trends

The U.S. dominated the North American pharmaceutical solvents market with an 82.2% share in 2024, supported by its highly developed pharmaceutical manufacturing ecosystem and strong pipeline of innovative drug development activities. The presence of key global players, significant investments in biologics and specialty drug formulations, and a robust regulatory framework have reinforced the country's leadership position. Moreover, the rising trend toward personalized medicine and continuous manufacturing processes is increasing solvent utilization in high-value pharmaceutical applications. The U.S. market also benefits from strong initiatives in green solvent technologies, further driving industry transformation.

Europe Pharmaceutical Solvents Market Trends

Europe captured a 21.1% share of the global market in 2024, supported by the presence of leading multinational pharmaceutical and chemical companies and stringent EU environmental standards driving the transition toward eco-friendly solvents. Countries such as Germany, Switzerland, and the UK remain key contributors due to their strong pharmaceutical manufacturing bases and advanced research facilities. The region’s growing focus on solvent recovery, regulatory compliance under REACH, and investments in sustainable chemistry are further propelling market growth. The rising demand for high-purity solvents in biologics and vaccine production has added momentum to the European market.

Germany represents one of the most significant pharmaceutical solvent markets in Europe, benefiting from its well-established pharmaceutical and specialty chemicals industries. The country’s emphasis on precision manufacturing, high regulatory compliance, and technological innovation in drug synthesis supports solvent demand across API and formulation applications. Moreover, major global companies such as BASF SE and Merck KGaA contribute to the local supply of high-performance and sustainable solvent solutions. Germany’s commitment to green chemistry and solvent recovery technologies positions it as a frontrunner in the shift toward environmentally responsible pharmaceutical production.

Middle East & Africa Pharmaceutical Solvents Market Trends

The Middle East & Africa market is in a developing phase but shows promising growth potential driven by increasing investments in local pharmaceutical manufacturing and expanding healthcare infrastructure. Countries such as Saudi Arabia, the UAE, and South Africa are emerging as strategic hubs for regional drug formulation and packaging. Government-led initiatives aimed at enhancing self-sufficiency in drug production and diversifying industrial portfolios are further propelling solvent consumption. Moreover, growing collaborations with global pharmaceutical players and technology transfer agreements are expected to strengthen the region’s long-term market outlook.

Latin America Pharmaceutical Solvents Market Trends

Latin America’s pharmaceutical solvents market is experiencing steady growth, primarily driven by rising pharmaceutical production in countries such as Brazil and Mexico. Government policies encouraging local drug manufacturing, coupled with the expansion of generics and over-the-counter medicine markets, are key growth enablers. The region is witnessing increasing foreign direct investment from global chemical and pharmaceutical companies seeking to leverage cost efficiencies and untapped demand. In addition, growing awareness about sustainable solvent alternatives and ongoing modernization of manufacturing facilities are expected to enhance the region’s competitive positioning over the forecast period.

Key Pharmaceutical Solvents Company Insights

Key players, such as Merck KGaA, BASF SE, The Dow Chemical Company, ExxonMobil Corporation, Akzonobel N.V., and Royal Dutch Shell PLC are dominating the market.

Merck KGaA is one of the key players in the pharmaceutical solvents market, recognized for its extensive portfolio of high-purity and performance-optimized solvents catering to applications in active pharmaceutical ingredient (API) synthesis, formulation, and purification. The company leverages its advanced R&D capabilities and strong focus on green chemistry to develop sustainable solvent solutions that align with evolving regulatory and environmental standards. Through its Life Science segment, Merck delivers customized solvent systems supporting precision manufacturing and biopharmaceutical applications. Strategic investments in production capacity expansion, coupled with digitalized supply chain operations and stringent quality control, have enabled Merck to maintain a competitive edge and strengthen its presence across key markets, including Europe, North America, and Asia Pacific.

Key Pharmaceutical Solvents Companies:

The following are the leading companies in the pharmaceutical solvents market. These companies collectively hold the largest Market share and dictate industry trends.

- Merck KGaA

- BASF SE

- The Dow Chemical Company

- ExxonMobil Corporation

- Akzonobel N.V.

- Royal Dutch Shell PLC

- Mitsubishi Chemical Corporation

- Eastman Chemical Company

- Bayer AG

- Nouryon

Pharmaceutical Solvents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,890.5 million

Revenue forecast in 2033

USD 5,573.5 million

Growth rate

CAGR of 4.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Merck KGaA; BASF SE; The Dow Chemical Company; ExxonMobil Corporation; Akzonobel N.V.; Royal Dutch Shell PLC; Mitsubishi Chemical Corporation; Eastman Chemical Company; Bayer AG; Nouryon

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Solvents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global pharmaceutical solvents market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2033)

-

Alcohols

-

Hydrocarbons

-

Ketones

-

Esters

-

Chlorinated Solvents

-

Other Products

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2033)

-

Active Pharmaceutical Ingredient (API) Manufacturing

-

Pharmaceutical Formulation

-

Cleaning And Purification

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical solvents market size was estimated at USD 3,784.6 million in 2024 and is expected to reach USD 3,890.5 million in 2025.

b. The global pharmaceutical solvents market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2033 to reach USD 5,573.5 million by 2033.

b. The alcohols segment dominated the pharmaceutical solvents market with a 38.1% revenue share in 2024, primarily due to its widespread use as a solvent and reagent in API manufacturing and formulation processes, driven by its high solubility, low toxicity, and regulatory acceptance across diverse pharmaceutical applications.

b. Some of the key players operating in the pharmaceutical solvents market include Merck KGaA, BASF SE, The Dow Chemical Company, ExxonMobil Corporation, Akzonobel N.V., Royal Dutch Shell PLC, Mitsubishi Chemical Corporation, Eastman Chemical Company, Bayer AG, and Nouryon

b. The growth of the pharmaceutical solvents market is primarily driven by the expanding pharmaceutical and biopharmaceutical industries, increasing demand for high-purity solvents in API and formulation manufacturing, and the rising adoption of green and bio-based solvents to meet stringent environmental and safety regulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.