- Home

- »

- Next Generation Technologies

- »

-

Photonic Neuromorphic Chip Market Size Report, 2033GVR Report cover

![Photonic Neuromorphic Chip Market Size, Share & Trends Report]()

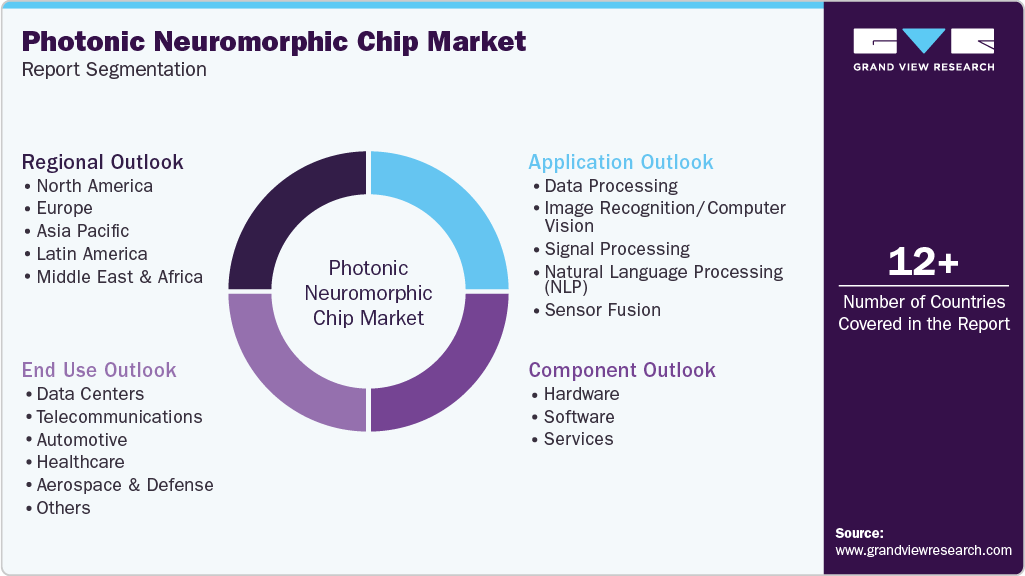

Photonic Neuromorphic Chip Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-822-1

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Photonic Neuromorphic Chip Market Summary

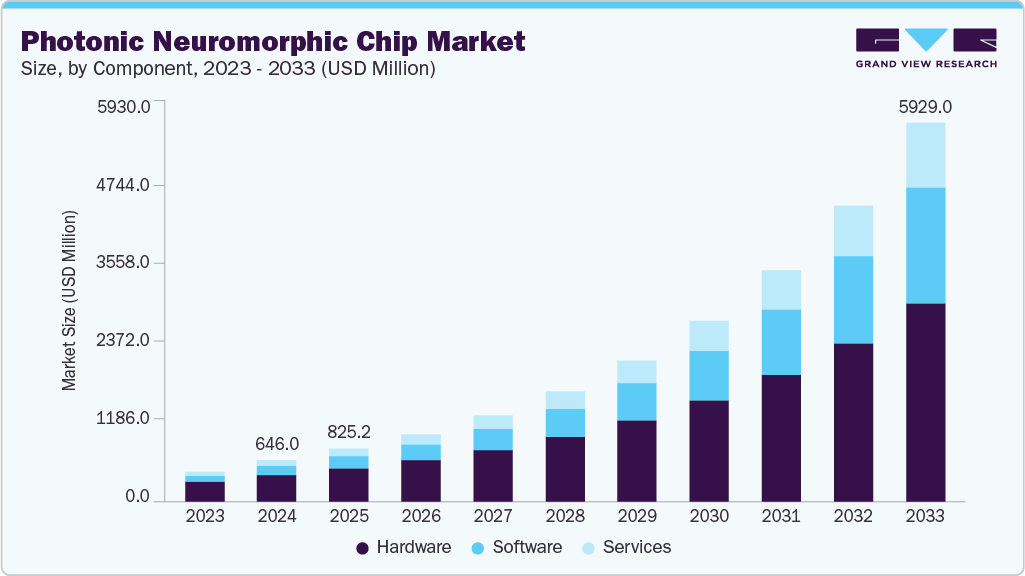

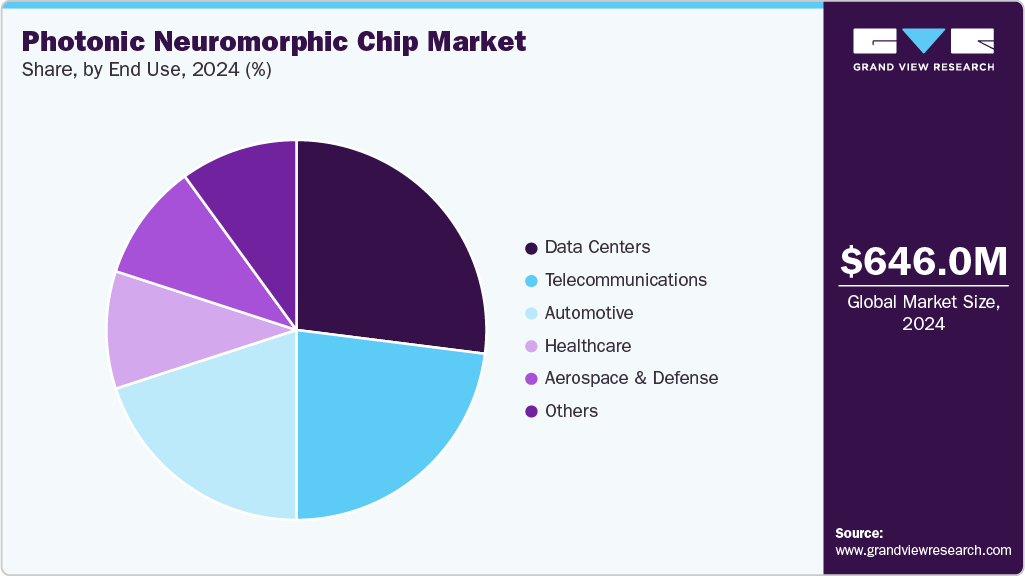

The global photonic neuromorphic chip market size was estimated at USD 646.0 million in 2024 and is projected to reach USD 5,929.9 million by 2033, growing at a CAGR of 28.0% from 2025 to 2033. The market is growing rapidly, driven by the increasing demand for energy-efficient AI hardware.

Key Market Trends & Insights

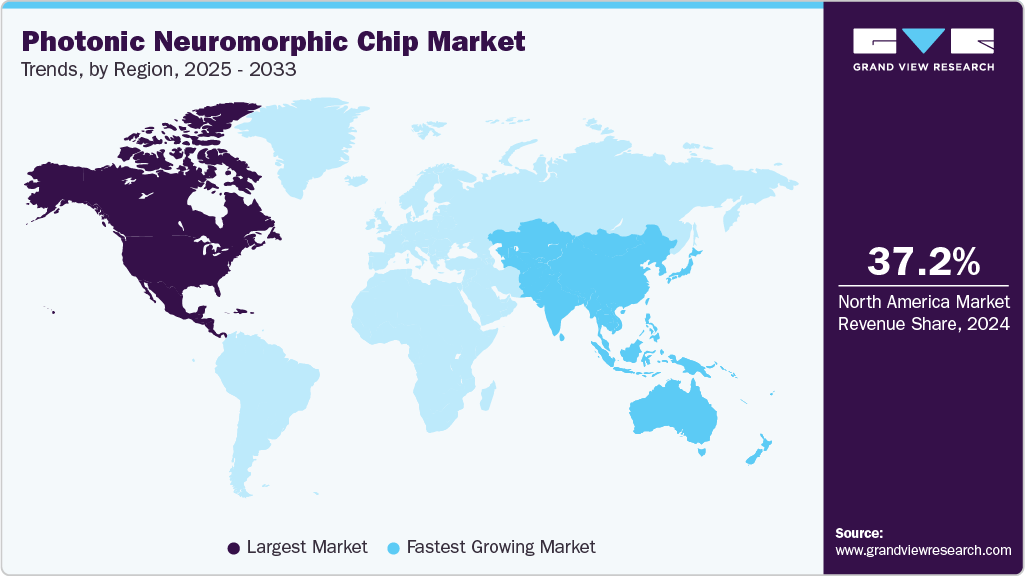

- North America Photonic Neuromorphic Chip dominated the global market with the largest revenue share of 37.2% in 2024.

- The photonic neuromorphic chip market in U.S. led the North America market and held the largest revenue share in 2024.

- By component, hardware segment led the market and held the largest revenue share of 64.2% in 2024.

- By Application, the data processing held the dominant position in the market and accounted for the largest revenue share of 32.2% in 2024.

- By End Use, the data centers segment is expected to grow at the fastest CAGR of 30.0% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 646.0 Million

- 2033 Projected Market Size: USD 5,929.9 Million

- CAGR (2025-2033): 28.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest market in 2024

These chips use light to process data, significantly reducing power consumption compared to traditional electronics. The Application is gaining adoption in data centers, edge devices, and autonomous systems. Continued advances in photonic integration and materials are expected to accelerate market growth. The growing demand for energy-efficient AI hardware is driving the photonic neuromorphic chip market. Companies are seeking solutions that reduce power consumption while handling complex computations. Photonic chips offer significant improvements over traditional electronic processors. They enable faster AI inference and machine learning tasks. This trend is boosting adoption in data centers and high-performance computing environments. For instance, in November 2024, Q.ANT, a German photonic computing startup, launched its first commercial photonic Native Processing Unit (NPU) offering, which boasts at least 30 times greater energy efficiency and faster computation for AI, machine learning, and physics simulations. The NPU integrates with standard servers and AI software stacks, enabling data centers and HPC environments to perform complex calculations using light instead of electrons.The Photonic Neuromorphic Chip market is expanding due to rising demand for high-speed, scalable photonic interconnects, which significantly improve communication between AI accelerators and enable faster, more efficient data transfer in large-scale AI systems. Reduced latency enhances overall system performance, prompting companies to adopt photonic solutions to boost computing efficiency. High-performance computing environments see significant benefits, and data centers are increasingly integrating photonic neuromorphic chips to handle complex workloads. This trend supports energy-efficient AI processing while improving performance, which drives broader adoption across industries. The market growth is fueled by the pressing need for advanced AI infrastructure capable of supporting next-generation applications.

The photonic neuromorphic chip market is witnessing significant growth due to advances in on-chip learning and inference capabilities. Modern photonic designs enable these chips to perform in-situ learning, meaning they can adapt and optimize computations directly on the chip without relying solely on external processors. They utilize optical feedback mechanisms, allowing real-time adjustments during computation, which is crucial for dynamic and complex workloads. Event-driven spiking neural networks are employed to mimic brain-like processing, enabling highly efficient and parallel information handling. This architecture enables chips to adapt quickly to changing data, making them ideal for fast, flexible AI applications. On-chip training and inference reduce energy use and minimize latency, benefiting tasks like autonomous driving, robotics, and edge computing. These improvements make photonic neuromorphic chips more efficient and autonomous.

Component Insights

The hardware segment dominated the photonic neuromorphic chip market in 2024, accounting for a 64.2% share, due to its key role in high-performance computing and AI applications. It includes photonic processing units, integrated circuits, and supporting modules, which enable efficient execution of complex computations. Rising demand for energy-efficient, low-latency hardware in data centers, HPC environments, and edge AI applications reinforces its leadership. Innovations such as optical feedback and spiking neural networks support rapid on-chip learning and inference.

The Software segment in the photonic neuromorphic chip market is expanding rapidly due to rising demand for advanced AI algorithms and simulation tools. It includes software for neural network modeling, photonic circuit design, and system optimization. Growth is driven by the need for seamless integration with hardware to enhance processing efficiency and reduce latency. Increasing adoption of edge AI and cloud-based computing is further fueling software requirements. Investments in AI software platforms and photonic simulation frameworks are supporting this upward trend.

Application Insights

The data processing application dominated in 2024, due to its critical role in managing large-scale computations and accelerating complex algorithm execution. These chips efficiently handle massive datasets in real time, making them indispensable for high-performance computing environments. Their capability to process data with low latency and high energy efficiency reinforces their dominance across industries requiring intensive computational tasks. The growing deployment of data-intensive AI models is further strengthening the demand for photonic data processing solutions. Industries such as telecommunications and finance are increasingly relying on these chips for faster analytics and decision-making.

Natural Language Processing (NLP) is another expanding application, where photonic neuromorphic chips enhance the speed and accuracy of understanding and generating human language. They support tasks such as speech recognition, translation, and sentiment analysis by simulating neural networks more efficiently. Increasing adoption of NLP in sectors like customer service, healthcare, and finance is driving demand for specialized processing capabilities. Advances in NLP algorithms are also boosting the relevance of photonic chips in real-time language applications. Companies are exploring NLP-enabled chatbots and virtual assistants that leverage photonic processing for improved performance.

End Use Insights

Data centers segment dominated with the largest share in 2024, due to their critical need for high-speed, energy-efficient processing of massive amounts of data. These chips enable faster computation, reduced latency, and improved scalability, which are essential for cloud services, AI workloads, and big data analytics. Their integration helps optimize server performance while lowering energy consumption, making them highly attractive to hyperscale and enterprise data centers. Increasing reliance on AI-driven applications in cloud platforms is further reinforcing their dominance. The growing demand for real-time data processing and high-throughput computing continues to support the expansion of photonic solutions in this space.

Healthcare is a growing end use area, where photonic neuromorphic chips enhance medical imaging, diagnostics, and patient data analysis. These chips provide faster and more accurate processing of complex datasets, supporting applications such as MRI analysis, genomics, and predictive diagnostics. Adoption of AI-driven healthcare solutions is increasing the demand for efficient, low-latency processing capabilities. Research institutions and hospitals are exploring photonic chips to improve real-time monitoring and personalized treatment plans. Growing investments in digital healthcare infrastructure are accelerating the use of these chips in clinical and research settings. This expansion positions healthcare as a significant emerging market for photonic neuromorphic technology.

Regional Insights

North America photonic neuromorphic chip market holds the largest share in the respective global market, accounted for 37.2% in 2024. The region benefits from strong investments in advanced computing and AI infrastructure. Major technology companies and research institutes continue to accelerate adoption of photonic architectures. Demand for high-performance and energy-efficient processors remains a key growth driver. The presence of robust semiconductor ecosystems further strengthens the region’s overall market position. Ongoing government and private sector funding is supporting continued innovation in photonic computing.

U.S. Photonic Neuromorphic Chip Market Trends

The U.S. Photonic Neuromorphic Chip market is emerging as a major hub for advanced research and commercial adoption. It benefits from strong federal and private investments in AI, photonics, and semiconductor innovation. Leading universities and national labs are accelerating breakthroughs in neuromorphic architectures. Major tech companies are actively integrating photonic computing into high-performance and edge AI systems.

Europe Photonic Neuromorphic Chip Market Trends

Europe’s Photonic Neuromorphic Chip market is moving toward advanced R&D programs supported by strong public-private funding across major countries. The region is focusing on energy-efficient photonic architectures that support high-performance AI workloads in data centers, automotive systems, and edge devices. Growing collaboration between research institutes and semiconductor companies is pushing faster development of integrated photonic platforms.

Asia Pacific Photonic Neuromorphic Chip Market Trends

Asia Pacific is emerging as the fastest-growing region in the Photonic Neuromorphic Chip market due to strong government investments in AI infrastructure across China, Japan, and South Korea. The region’s established electronics-manufacturing base enables rapid development and scaling of photonic integrated circuits. Demand is rising from applications in smart cities, autonomous systems, and industrial automation, which require low-latency and energy-efficient processing.

Key Photonic Neuromorphic Chip Company Insights

Some of the key companies in the Photonic Neuromorphic Chip industry include Hewlett Packard Enterprise Development LP, IBM Corporation, Intel Corporation, Lightelligence, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Intel Corporation is advancing photonic neuromorphic development through its work on energy-efficient architectures for AI acceleration. The company’s Loihi-based research supports faster neural computation with lower power consumption. Intel is exploring photonic integration to enhance bandwidth and reduce latency in future neuromorphic systems. These initiatives position the company at the front of next-generation computing innovation.

-

Lightelligence is developing hybrid optoelectronic platforms that use photonic pathways to improve AI processing efficiency. Its Hummingbird architecture integrates an optical network-on-chip to deliver faster and more scalable data movement. The company focuses on reducing latency and power usage for demanding AI workloads. This progress strengthens its role in advancing photonic neuromorphic technologies.

Key Photonic Neuromorphic Chip Companies:

The following are the leading companies in the photonic neuromorphic chip market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices, Inc.

- Ayar Labs, Inc.

- BrainChip, Inc.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Intel Corporation

- Lightelligence

- Lightmatter

- PsiQuantum

- Xanadu

Recent Developments

-

In December 2024, Lightmatter, a U.S.-based silicon-photonics hardware company, joined the UALink Consortium to help develop standardized, high-speed photonic interconnects for large-scale AI systems, utilizing its 3D-stacked Passage platform. This collaboration aims to enable unprecedented accelerator-to-accelerator communication, boosting efficiency and scalability in AI clusters and high-performance computing.

Photonic Neuromorphic Chip Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 825.2 million

Revenue forecast in 2033

USD 5,929.9 million

Growth rate

CAGR of 28.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Component, application, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Advanced Micro Devices, Inc.; Ayar Labs Inc.; BrainChip, Inc.; Hewlett Packard Enterprise Development LP; IBM Corporation; Intel Corporation; Lightelligence; Lightmatter; PsiQuantum; Xanadu

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Photonic Neuromorphic Chip Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global photonic neuromorphic chip market in terms of component, application, end use, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Data Processing

-

Image Recognition / Computer Vision

-

Signal Processing

-

Natural Language Processing (NLP)

-

Sensor Fusion

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Data Centers

-

Telecommunications

-

Automotive

-

Healthcare

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.