- Home

- »

- Renewable Chemicals

- »

-

Polyester Polyol From Bio-Succinic Acid Market Report, 2033GVR Report cover

![Polyester Polyol From Bio-Succinic Acid Market Size, Share & Trends Report]()

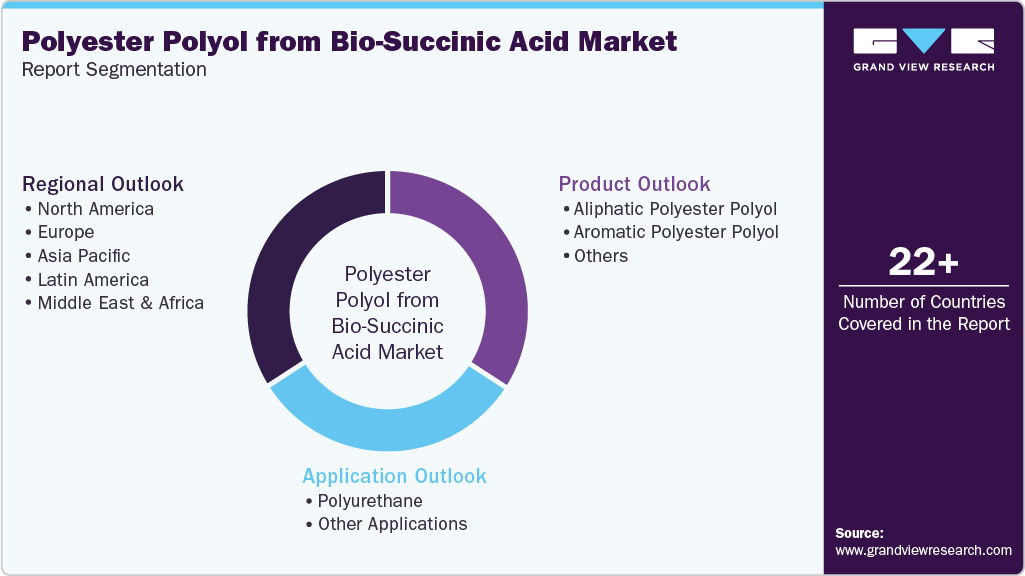

Polyester Polyol From Bio-Succinic Acid Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Aliphatic Polyester Polyol, Aromatic Polyester Polyol), By Application (Polyurethane (Flexible Foam, Rigid Foam, Coatings, Adhesives & Sealants)), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-781-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyester Polyol From Bio-Succinic Acid Market Summary

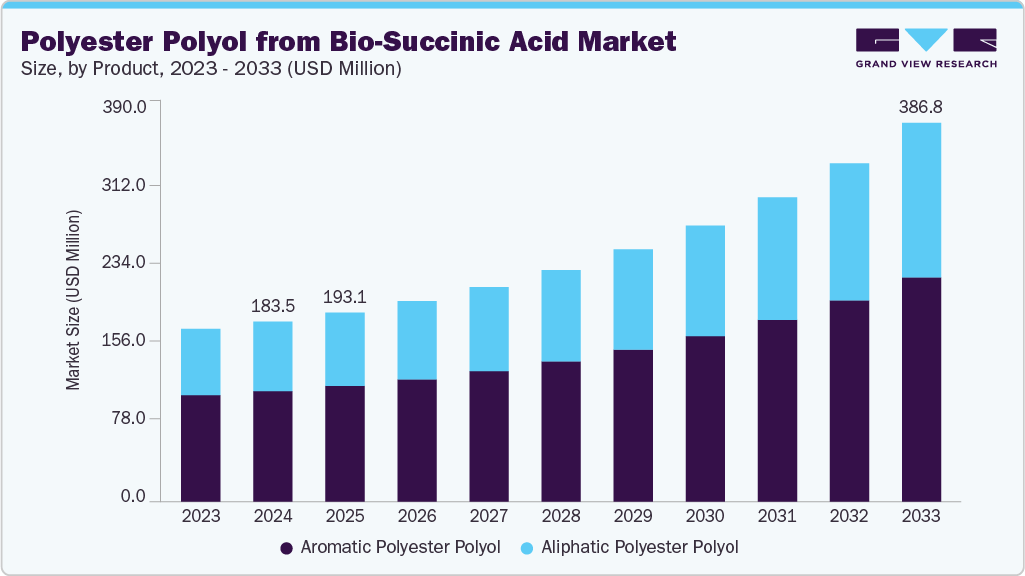

The global polyester polyol from bio-succinic acid market size was estimated at USD 183.5 million in 2024 and is projected to reach USD 386.8 million by 2033, growing at a CAGR of 14.9% from 2025 to 2033. The growth is primarily driven by the increasing demand for sustainable and eco-friendly materials across various industries.

Key Market Trends & Insights

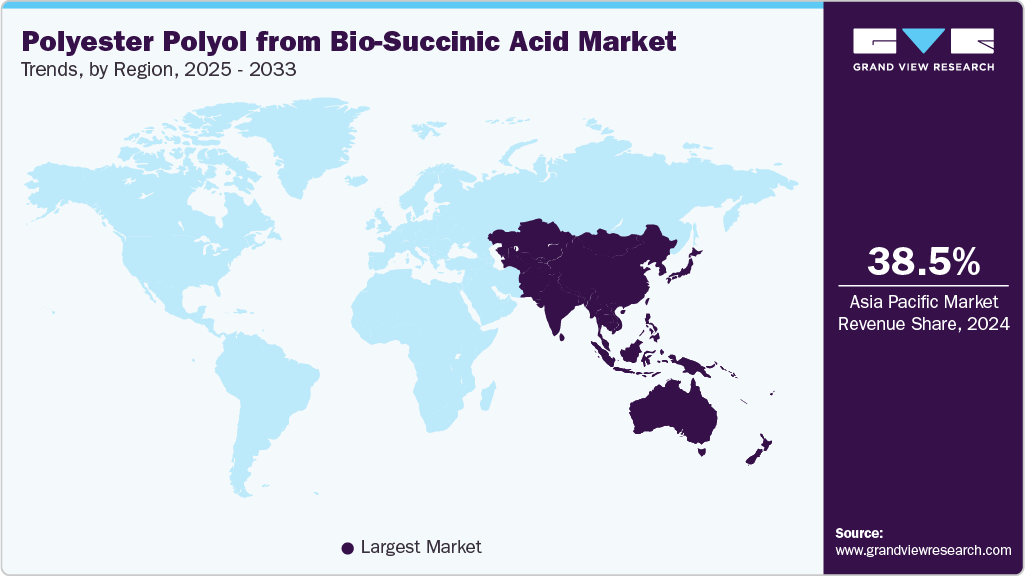

- Asia Pacific dominated the global polyester polyol from bio-succinic acid market with the largest revenue share of 38.5% in 2024.

- The polyester polyol from bio-succinic acid market in U.S. is expected to grow at a substantial CAGR from 2025 to 2033.

- By product, the aromatic polyester polyol segment held the highest market share of 61.4% in 2024 in terms of revenue.

- By application, the polyurethane segment is expected to grow at a significant CAGR of 15% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 183.5 Million

- 2033 Projected Market Size: USD 386.8 Million

- CAGR (2025-2033): 14.9%

- Asia Pacific: Largest market in 2024

The shift toward renewable feedstocks, such as bio-succinic acid, aligns with global initiatives to reduce carbon footprints and dependence on fossil fuels. Additionally, advancements in biotechnological processes have enhanced the efficiency and cost-effectiveness of producing bio-based polyols, further accelerating market adoption. The increasing emphasis on sustainability and the use of bio-based raw materials is accelerating the shift toward renewable intermediates in the production of polyurethanes. Linear polyester polyols made entirely from renewable sources can be synthesized with bio-succinic acid, bio-sebacic acid, bio-1,3-propane diol, and bio-1,4-butane diol. Succinic acid, which is generated through the fermentation of sugars derived from corn, acts as a crucial aliphatic diacid in the polyol structure, delivering enhanced performance and environmental advantages. These bio-derived polyester polyols are particularly suitable for creating polyurethane elastomers, especially when bio-1,4-butanediol is used as a chain extender.

One of the major restraints hindering the widespread adoption of bio-succinic acid-based polyester polyols is their technical and performance limitations, particularly in demanding polyurethane applications. These polyols often exhibit inferior mechanical and thermal properties, especially in rigid applications such as insulation foams and structural components. According to a study published in Polymer Testing (2020) have shown that rigid foams made from succinic acid-derived polyols can display 10-15% lower compressive strength compared to traditional aromatic polyester polyols derived from phthalic anhydride, limiting their suitability for high-load or thermally intense environments.

According to the Directive 2010/75/EU of the European Parliament and of the Council on Industrial Emissions (recast), commonly known as the Industrial Emissions Directive (IED), serves as a foundational regulatory framework to minimize the environmental impact of industrial activities across the European Union. It integrates and streamlines seven earlier directives, including the Integrated Pollution Prevention and Control (IPPC) Directive, to ensure high protection for human health and the environment.

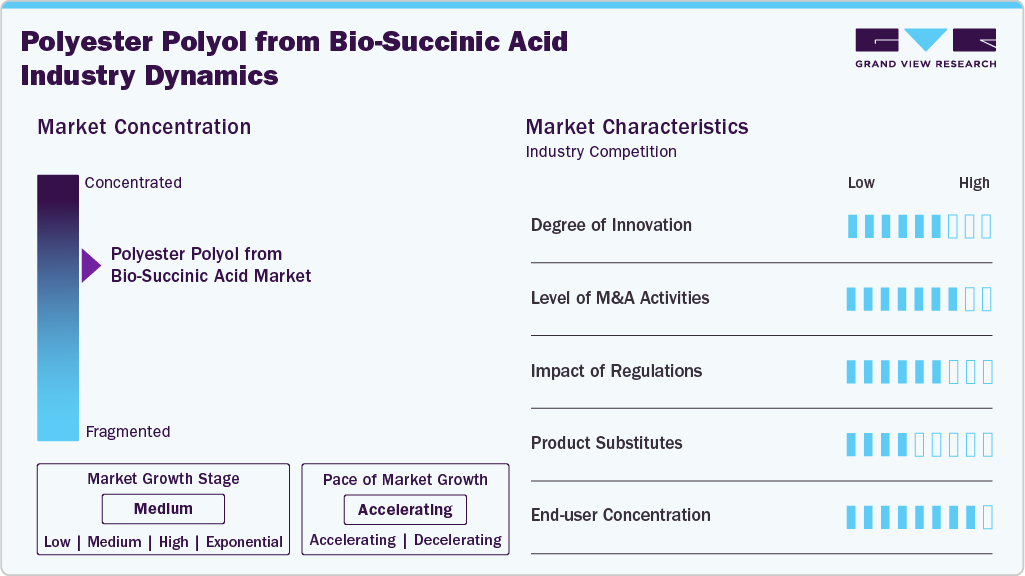

Market Concentration & Characteristics

The industry is moderately concentrated, with a combination of well-established chemical manufacturers and innovative startups focusing on bio-based solutions. Leading companies, including BASF, Covestro, and Succinity, are investing heavily in research and development to improve the performance, sustainability, and versatility of bio-based polyester polyols. These players leverage advanced biotechnological processes to optimize bio-succinic acid production, ensuring consistent quality and compatibility with polyurethane applications.

Emerging players are differentiating themselves by focusing on niche applications, small-batch production, and eco-certified offerings that appeal to sustainability-conscious manufacturers. The market is witnessing gradual consolidation, as larger firms acquire or partner with smaller innovators to expand their product portfolios and technological capabilities. Additionally, the emphasis on regulatory compliance and environmental standards is shaping production practices, pushing the market toward renewable feedstocks, reduced carbon emissions, and circular economy principles.

Product Insights

Aromatic Polyester Polyol accounted for the largest share of 61.4% in 2024. These polyols are synthesized using bio-succinic acid as a key raw material, offering improved environmental profiles compared to traditional petroleum-based polyols. They are utilized in the production of polyurethanes, coatings, adhesives, and sealants. Aromatic polyurethane adhesives are formulated using aromatic isocyanates, which are characterized by their cyclic benzene ring structures. These adhesives are widely known for their high mechanical strength, rigidity, and cost-effectiveness.

The Aliphatic Polyester Polyol segment is projected to register the fastest CAGR from 2025 to 2033. These are derived from bio-based sebacic acid and bio-based 1,4-butanediol and offer a versatile platform for formulating high-performance polyurethanes across various industries. These polyols, with 100% renewable content, exhibit high crystallinity and elevated melting points, making them particularly suitable for producing polyurethane elastomers. Their performance profile supports many applications, including adhesives and sealants, thermoplastic polyurethanes (TPU), polyurethane dispersions (PUD), and cast elastomers.

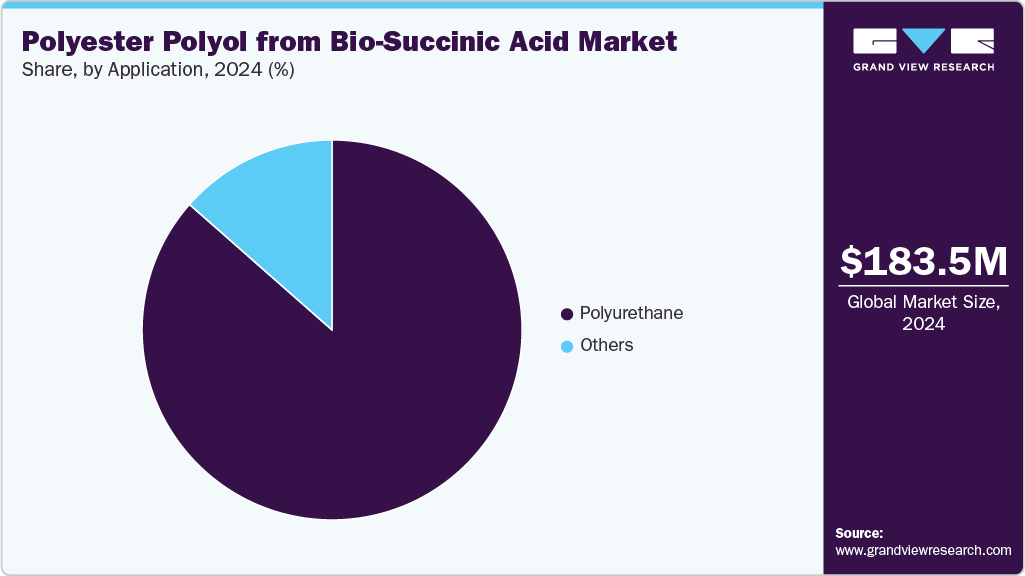

Application Insights

The polyurethane segment dominated the market with an 86.5% share in 2024. Polyurethane adhesives, especially those derived from bio-based sources, have found widespread applications across multiple sectors due to their excellent adhesion, flexibility, and chemical resistance. In the construction industry, they are widely used for bonding materials like wood, ceramics, and concrete in applications such as flooring, wall panels, and tiles, offering high strength and resistance to moisture and temperature fluctuations.

Other applications include thermoplastic polyurethanes (TPUs), which are synthesized from bio-succinic acid-based polyester polyols are emerging as a sustainable alternative to petroleum-derived TPUs, offering environmental and performance benefits. These bio-based TPUs maintain the essential segmented block copolymer structure, comprising soft segments (from long-chain bio-polyester polyols) and hard segments (from diisocyanates and chain extenders like BDO). This allows for tailored mechanical, thermal, and morphological properties through careful control of segmental composition and molecular weight.

Regional Insights

The North America polyester polyol from bio-succinic acid market is expected to grow at a robust CAGR of 15% during the forecast period. This growth is attributed to the region's increasing shift toward sustainable and bio-based materials. Polyester polyols, a core component in polyurethane production, are being reformulated using bio-succinic acid, a renewable platform chemical, as a sustainable alternative to petroleum-based adipic acid. This transition is particularly significant in North America, where regulatory frameworks, corporate sustainability goals, and innovation in green chemistry are propelling demand.

U.S. Polyester Polyol from Bio-Succinic Acid Market Trends

The polyester polyol from bio-succinic acid market in the U.S.is fueled by increasing consumer demand for sustainable products and the U.S. government's support for renewable chemical technologies. The automotive and construction industries are significant contributors to the demand for bio-based polyols, driven by their enhanced performance characteristics and environmental benefits.

Asia Pacific Polyester Polyol from Bio-Succinic Acid Market Trends

Asia Pacific led the market in 2024 with a 38.5% revenue share, supported by rising industrialization, urbanization, and sustainability commitments across key economies such as China, India, Japan, and South Korea. Polyester polyols are essential precursors in polyurethane production, which is widely used in construction, automotive, footwear, and electronics industries. With growing pressure to reduce reliance on petrochemicals, bio-succinic acid, a renewable alternative derived through microbial fermentation, is gaining traction as a sustainable feedstock in polyester polyol manufacturing.

China's polyester polyol from bio-succinic acid market is experiencing significant growth, driven by the increasing demand for sustainable and eco-friendly materials in various industries, including automotive and construction. China's strong manufacturing base and supportive government policies further bolster the adoption of bio-based polyols.

Europe Polyester Polyol from Bio-Succinic Acid Market Trends

Polyester polyols, essential intermediates in the production of polyurethanes, are increasingly being produced from bio-based sources such as bio-succinic acid. This transformation aligns with stringent EU environmental policies, including the European Green Deal and REACH regulations, encouraging reduced dependence on fossil-based feedstocks. The demand for bio-based polyurethane applications, spanning insulation, automotive parts, coatings, adhesives, and textiles, is accelerating the adoption of polyester polyols sourced from renewable chemicals.

In Germany, thegrowth is attributed to its strong emphasis on sustainability and innovation in the chemical industry. The country's robust industrial infrastructure and commitment to reducing carbon emissions drive the demand for bio-based polyols in applications such as coatings and adhesives.

Latin America Polyester Polyol from Bio-Succinic Acid Market Trends

The polyester polyol from bio-succinic acid market in Latin America is driven by increasing environmental awareness, the rise of green building standards, and a growing demand for sustainable materials across industrial sectors. With bio-succinic acid emerging as a viable, renewable substitute for fossil-based adipic acid, the regional market is witnessing early-stage adoption, particularly in Brazil and Argentina, where industrial modernization and sustainability initiatives are gaining ground.

Middle East and Africa Polyester Polyol from Bio-Succinic Acid Market Trends

The polyester polyol from bio-succinic acid market in the Middle East & Africa is still at a developing stage but shows promising long-term potential. As global focus intensifies on sustainable industrial practices, countries in this region are gradually exploring bio-based alternatives to conventional petrochemical inputs. Polyester polyols, widely used in polyurethane applications such as insulation panels, automotive parts, coatings, and adhesives, are beginning to see increased demand, particularly in infrastructure and construction projects linked to national development plans.

Key Polyester Polyol from Bio-Succinic Acid Companies Insights

Key players operating in the polyester polyol from bio-succinic acid market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the market include Arkema, BASF SE, DIC CORPORATION, Huntsman Corporation, Oleon NV, Stepan Company, and others.

-

Alfa Chemicals is a prominent manufacturer and supplier in the polyester polyol market, delivering high-quality specialty chemicals and raw materials to customers across a wide range of industries, including coatings, adhesives, sealants, elastomers (CASE), and polyurethane foams. With a strong presence in the UK and Europe, Alfa Chemicals partners with leading global manufacturers offer an extensive portfolio of polyester polyols tailored for performance, sustainability, and regulatory compliance.

-

Arkema is a global leader in the polyester polyol market, known for its advanced materials and specialty chemicals that serve various industrial applications. With operations in over 55 countries Arkema offers a comprehensive portfolio of polyester polyols under well-established brands, such as Versalis and Ecoatain, tailored for high-performance polyurethane systems. These polyols are used extensively in coatings, adhesives, sealants, elastomers, flexible foams, and insulation materials.

Key Polyester Polyol from Bio-Succinic Acid Companies:

The following are the leading companies in the polyester polyol from bio-succinic acid market. These companies collectively hold the largest market share and dictate industry trends.

- Alfa Chemicals

- Arkema

- Synthesia Technology Group

- BASF SE

- DIC CORPORATION

- Dow

- Evonik Industries AG

- Huntsman Corporation

- Oleon NV

- Gantrade Corporation

- Purinova Sp. z o.o.

- Stepan Company

Recent Development

-

In February 2025, Gatorade launched ECOTRION PO3G polyols-a 100% bio-based, high-performance polyether polyol made from industrial corn, as a sustainable alternative to conventional polyols in polyurethane applications. While ECOTRION products are polyether-based rather than polyester polyols, their superior flexibility, mechanical strength, and resistance to wear and hydrolysis position them as strong contenders in markets traditionally served by polyester polyols.

-

In October 2024, Oleon acquired Brazilian castor oil specialist A.Azevedo Oleos, marking its entry into South America. This move significantly enhances Oleon's access to sustainable, plant-based raw materials, particularly castor oil and its derivatives, which are key building blocks in producing bio-based polyester polyols.

Polyester Polyol From Bio-Succinic Acid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 193.1 million

Revenue forecast in 2033

USD 386.8 million

Growth rate

CAGR of 14.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Saudi Arabia; Brazil; Argentina

Key companies profiled

Alfa Chemicals; Arkema; Synthesia Technology Group; BASF SE; DIC CORPORATION; Dow; Evonik Industries AG; Huntsman Corporation; Gantrade Corporation; Purinova Sp. z o.o.; Stepan Company; Oleon NV.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyester Polyol From Bio-Succinic Acid Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global polyester polyol from bio-succinic acid market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Aliphatic Polyester Polyol

-

Aromatic Polyester Polyol

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Polyurethane

-

Flexible Foam

-

Rigid Foam

-

Coatings

-

Adhesives & Sealants

-

Elastomers

-

Other Applications

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polyester polyol from bio-succinic acid market size was estimated at USD 183.5 million in 2024 and is expected to reach USD 193.1 million in 2025.

b. The global polyester polyol from bio-succinic acid market is expected to grow at a compound annual growth rate of 14.9% from 2025 to 2033 to reach USD 386.8 million by 2033.

b. Asia Pacific dominated the polyester polyol from bio-succinic acid market with a share of 38.3% in 2024. This is attributable to rising industrialization, urbanization, and sustainability commitments across key economies such as China, India, Japan, and South Korea.

b. Some key players operating in the polyester polyol from bio-succinic acid market include Alfa Chemicals, Arkema, Synthesia Technology Group, BASF SE, DIC CORPORATION, Dow, Evonik Industries AG, Huntsman Corporation, Gantrade Corporation, Purinova Sp. z o.o., Stepan Company and Oleon NV.

b. Key factors that are driving the market growth include increasing demand for sustainable and eco-friendly materials across various industries. The shift towards renewable feedstocks, such as bio-succinic acid, aligns with global initiatives to reduce carbon footprints and dependence on fossil fuels.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.