- Home

- »

- Plastics, Polymers & Resins

- »

-

Polypropylene Rigid Food Containers Market Size Report, 2033GVR Report cover

![Polypropylene Rigid Food Containers Market Size, Share & Trends Report]()

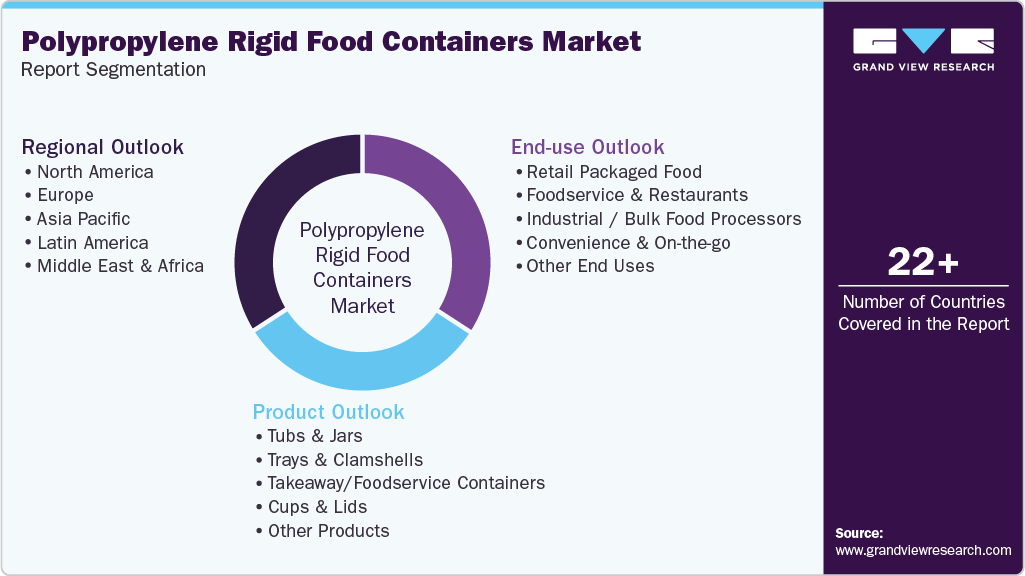

Polypropylene Rigid Food Containers Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Tubs & Jars, Trays & Clamshells, Takeaway/Foodservice Containers, Cups & Lids), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-824-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polypropylene Rigid Food Containers Market Summary

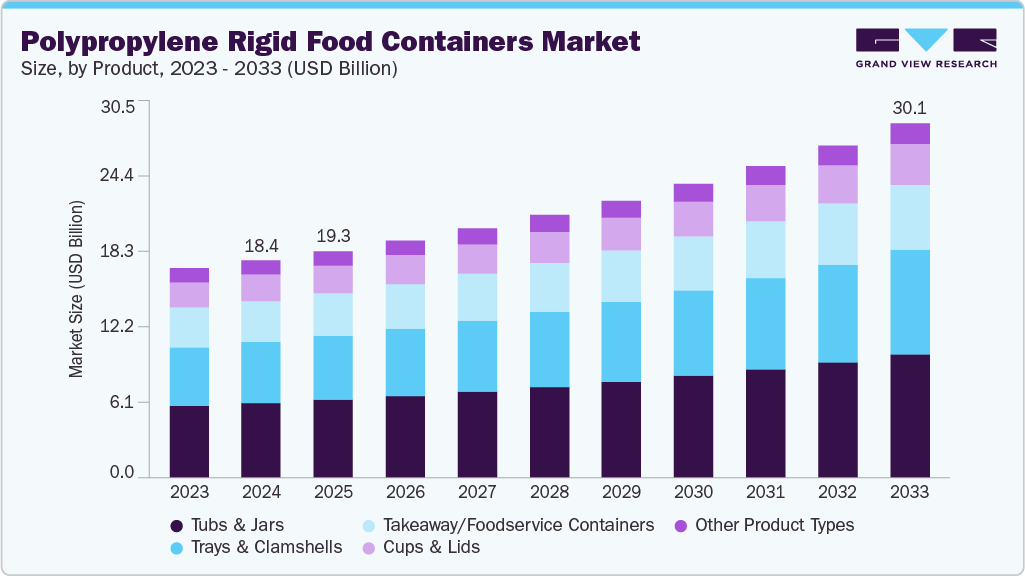

The global polypropylene rigid food containers market size was valued at USD 18.44 billion in 2024 and is projected to reach USD 30.08 billion by 2033, growing at a CAGR of 5.7% from 2025 to 2033. Polypropylene is favored for its toughness, chemical resistance, low density, and relatively low cost; it also tolerates heat for microwaveable applications and can be produced with a range of barrier and surface finishes.

Key Market Trends & Insights

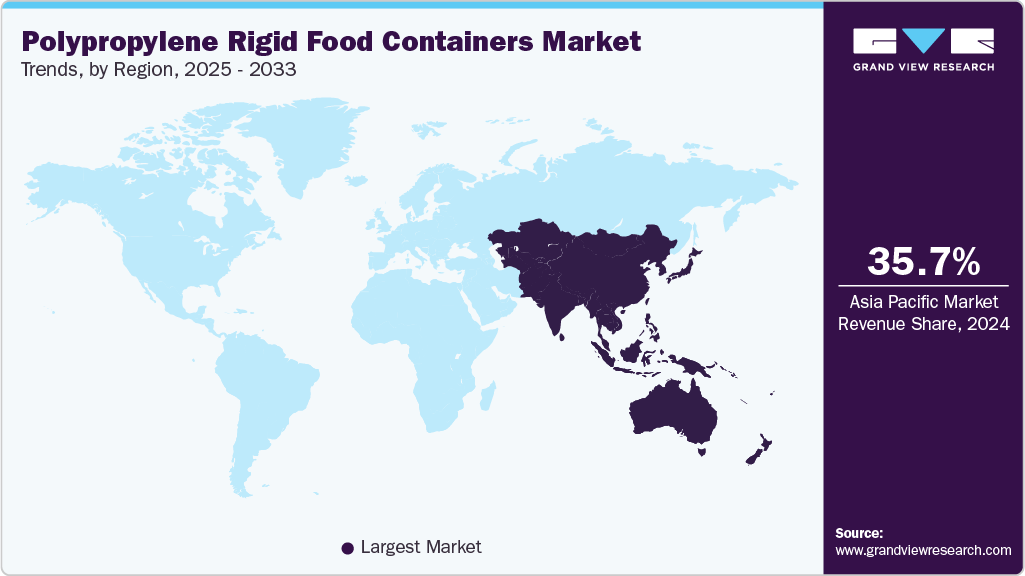

- Asia Pacific dominated the polypropylene rigid food containers market with the largest revenue share of over 35.65% in 2024.

- The polypropylene rigid food containers market in China is expected to grow at a substantial CAGR of 6.7% from 2025 to 2033.

- By product, the trays & clamshells segment is expected to grow at a considerable CAGR of 6.3% from 2025 to 2033 in terms of revenue.

- By end use, the convenience & on-the-go segment is expected to grow at a considerable CAGR of 6.6% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 18.44 Billion

- 2033 Projected Market Size: USD 30.08 Billion

- CAGR (2025-2033): 5.7%

- Asia Pacific: Largest market in 2024

Typical product formats include clamshells, portion cups, bakery trays, and deli containers, produced by global converters and local packagers for retail brands, food processors, and foodservice operators. Market growth is driven by the combination of packaged food demand, growth in convenience and on-the-go eating, and supply-chain efficiencies that favor lightweight, stackable packaging. Geographically, mature markets show steady replacement and value-add demand, while emerging markets emphasize basic, low-cost trays and tubs. The market is characterized by mid-to-high volume production, seasonal demand spikes, and a diverse supplier base from commodity moulders to specialty film-weld converters.

Furthermore, convenience and changing consumer lifestyles are principal market drivers as consu that require robust, micr mers increasingly buy ready meals, single-serve items, and take-away foods owave-safe, and resealable packaging. The capability of PP to be produced in lightweight, thin-gauge formats also helps lower transportation costs and aligns with retailer sustainability targets for packaging weight reduction.

Innovation around improved barrier properties, recycled-content PP, and design-for-recyclability presents a clear growth pathway. Brands seeking to meet ESG commitments want containers that either incorporate PCR (post-consumer recycled) PP or are easier to recycle in existing municipal streams. Additionally, premiumization - higher-clarity, embossed, or multi-compartment formats targeted at premium ready-meal and fresh-prep segments can command higher margins.

However, regulatory pressure and recycling infrastructure limitations restrain some growth avenues, while PP is technically recyclable, collection, sorting and market demand for PP recyclate are inconsistent across regions, complicating widespread PCR integration and raising cost or certification hurdles. Where regulators push for higher recycled content mandates or packaging taxes, smaller converters may struggle to adapt quickly due to capital needs for validated PCR supply and processing adjustments.

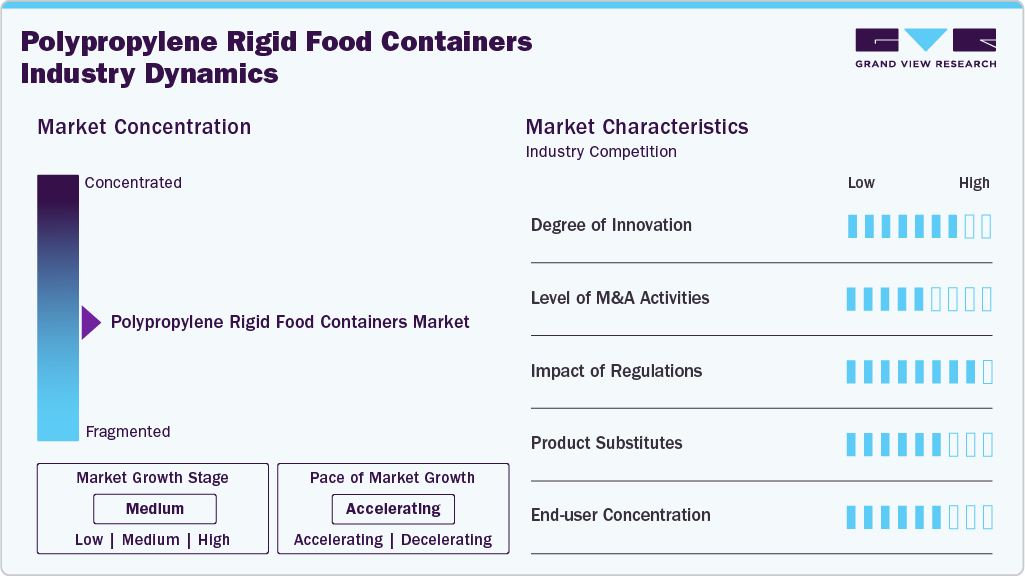

Market Concentration & Characteristics

The industry shows steady, application-driven innovation rather than disruptive change. Most technical advances are incremental: improved PP grades with better haze/clarity, enhanced heat resistance for microwavability, and compatibilized blends for PCR use. Process innovations and value-added finishing deliver commercial differentiation, however fully new polymer systems or radically different formats are rare as cost and food-safety compliance are high barriers.

M&A activity tends to be concentrated among converters and packaging groups seeking geographic reach, scale, or capabilities. Strategic acquisitions often target regional moulders, thermoforming facilities, or converters with strong retail accounts. Large chemical/film firms occasionally divest or acquire packaging assets to realign portfolios, but blockbuster deals are uncommon because commodity margins and high capex in tooling make deals more tactical than transformational.

Food-contact safety regulations and extended producer responsibility (EPR) or recycled-content mandates materially influence formulation choices and cost structures. Regulations also drive demand for traceability and compliant documentation, increasing administrative burdens. However, implementation varies by country and region, so regulatory impact is patchwork: in jurisdictions with strong recycling systems and mandates, demand for PCR and recyclable designs rises; elsewhere, legacy single-use formats remain prevalent.

PET and APET trays, polystyrene for low-cost disposables, and emerging fiber-based/bio-based rigid containers for certain applications. Flexible packaging competes strongly in convenience and shelf-life applications due to lower material use and transport efficiency. The choice of substitute depends on barrier needs, temperature resistance, clarity, and cost as PET tends to be used where clarity and stiffness matter, while flexible pouches edge in lightweight and shelf-stable use-cases.

The market’s end users include large food manufacturers, branded ready-meal companies, grocery retailers, and foodservice chains; a relatively small number of major food processors and retailers account for a large share of volume in many regions, giving them bargaining leverage over converters. However, a long tail of local food producers, bakeries, and caterers creates demand diversity. This structure means suppliers often balance a few large, high-volume contracts with numerous smaller, flexible accounts to stabilize utilization and revenue.

Product Insights

The tubs & jars segment recorded the largest revenue share in 2024.Tubs and jars made from polypropylene are widely used for dairy products, spreads, ready-to-eat meals, and premium deli items due to their durability, heat resistance, and good sealing properties. They offer branding-friendly surfaces, compatibility with snap-fit or tamper-evident lids, and the ability to withstand microwave reheating, making them a preferred choice for products requiring both convenience and protection. Their versatility in size and shape also supports portion control trends and retail-ready packaging formats.

The trays & clamshells segment is expected to grow at the fastest CAGR of 6.3% during the forecast period. PP trays and clamshells are staple packaging formats for fresh produce, bakery goods, meat, poultry, and chilled ready meals, offering rigidity, food safety, and high stacking strength for efficient logistics. Their ability to incorporate modified-atmosphere packaging (MAP) or barrier coatings enhances shelf life, while clear or semi-clear PP grades support strong product visibility.

Polypropylene takeaway containers maintain structural integrity under heat, resist leaks from saucy or oily foods, and are suitable for both refrigeration and reheating. These containers are essential for a booming delivery and quick-service restaurant (QSR) ecosystem, where durability, stackability, and tamper-evident design are critical.

PP cups and lids are popularly used in cold beverages, desserts, yogurts, and single-serve snacks thanks to their clarity, impact resistance, and compatibility with high-speed filling lines. Lightweight and cost-efficient, they support convenience-driven consumption and are adaptable to features such as dome lids, sipping spouts, and printed branding. In foodservice, PP cups are increasingly replacing polystyrene due to higher recyclability, regulatory pressure, and a shift toward safer, microwave-capable materials.

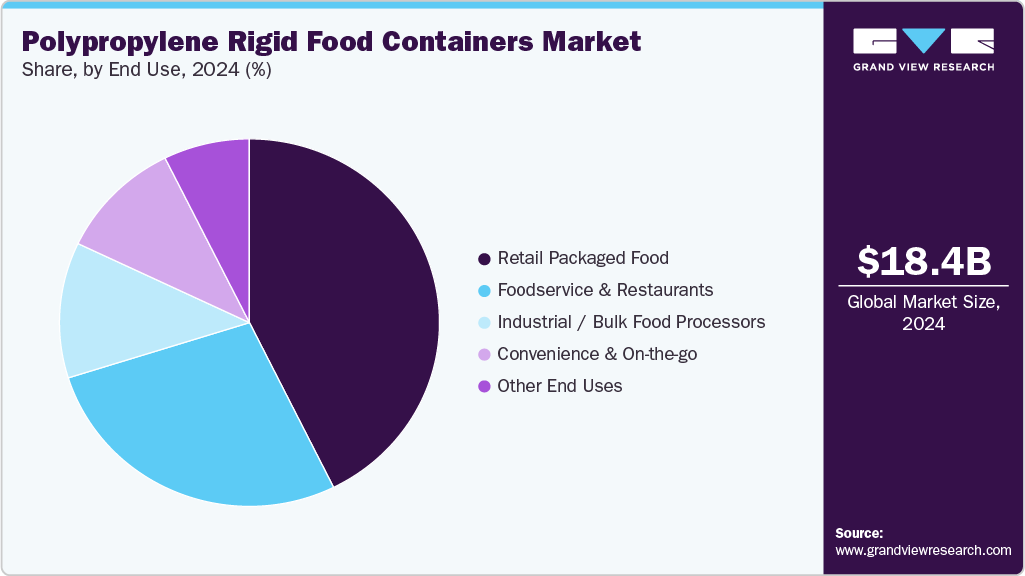

End Use Insights

The retail packaged food segment recorded the largest share of over 42.70% in 2024, driven by supermarkets’ reliance on durable, shelf-stable packaging for chilled meals, bakery items, snacks, and fresh produce. Retailers value PP’s low cost, high customization potential, and ability to meet sustainability targets through lightweighting and monomaterial design. Shelf visibility, tamper evidence, and extended shelf-life features make PP formats well aligned with private-label expansion and SKU proliferation across retail shelves.

Restaurants, cafés, and QSR chains use PP containers extensively for dine-out, delivery, and takeaway formats that require leak resistance and heat tolerance. The rise of app-based delivery platforms has further increased demand for rigid, stackable PP packaging that protects food integrity during transport. Operators also prefer PP because it can support reusable-system pilots and withstand microwaving, making it a practical bridge between convenience and sustainability expectations.

Bulk food processors rely on PP rigid containers for ingredient storage, semi-prepared foods, sauces, dips, and intermediate packaging that needs hygiene, robustness, and compatibility with automated filling and sealing systems. PP’s chemical resistance and durability make it ideal for large-volume tubs, pails, and insert trays used in commercial kitchens and manufacturing.

The convenience & On-the-go segment is projected to grow at the fastest CAGR of 6.6% during the forecast period. Convenience and on-the-go consumption continue to surge as consumers seek portable, portioned, and ready-to-eat foods that fit busy lifestyles. PP containers cater perfectly to this need with lightweight designs, resealable features, and microwave compatibility. From snack cups to small meal trays, PP formats enhance portability and reduce spillage, making them indispensable for retail snacking, airport meals, vending, and urban grab-and-go channels. Sustainability messaging around recyclable PP further strengthens this segment’s appeal.

Region Insights

Asia Pacific dominated the industry and accounted for the largest revenue share of over 35.65% in 2024 and is expected to grow at the fastest CAGR of 6.4% during the forecast period. Asia Pacific is driven by surging packaged food consumption, urbanization, and the expansion of organized retail and quick-service restaurant (QSR) chains. High population density and rising disposable incomes accelerate demand for ready meals, dairy products, and takeaway foods - all strong application areas for PP tubs, trays, cups, and clamshells. The region’s strong manufacturing base and cost-effective production capabilities further position APAC as both a consumption and export hub for PP rigid packaging.

China leads regional demand thanks to its massive food processing industry, extensive e-commerce grocery ecosystem, and the world’s largest QSR and food-delivery networks. Domestic converters benefit from large-scale manufacturing, low tooling costs, and strong integration between PP resin producers and packaging manufacturers. Sustainability reforms - especially recycling targets and restrictions on non-recyclable plastics - are also pushing adoption of monomaterial PP solutions as alternatives to PS and multilayer formats.

India’s market is growing rapidly due to expanding modern retail, rising penetration of packaged snacks, dairy, and bakery products, and explosive growth in online food delivery. Small and mid-scale processors increasingly adopt PP trays, tubs, and takeaway packs for hygiene, shelf-life improvement, and branding. Government initiatives around food safety compliance (FSSAI standards) and movement toward recyclable materials are accelerating the transition from unbranded disposable plastics to standardized PP rigid packaging.

North America Polypropylene Rigid Food Containers Market Trends

The polypropylene rigid food containers market in North America shows steady, innovation-driven demand for PP rigid food containers, supported by well-established foodservice chains, meal-kit providers, and packaged food brands. Consumer preference for convenience, resealable packaging, and microwaveable containers favors PP formats, while sustainability pressure pushes brands toward recyclable monomaterial designs. High automation in food processing and stringent food-contact standards also reinforce PP’s position as a reliable, high-performance packaging substrate.

U.S. Polypropylene Rigid Food Containers Market Trends

The polypropylene rigid food containers market in the U.S. is propelled by large packaged-food companies, dominant QSR chains, and strong momentum in grocery delivery and ready-to-eat meals. Retailers increasingly prefer PP for its recyclability potential as states adopt stricter packaging mandates. Innovation in high-clarity PP grades and PCR (post-consumer recycled) integration has accelerated, supported by investments in advanced sorting, chemical recycling, and closed-loop programs led by major CPG brands.

Europe Polypropylene Rigid Food Containers Market Trends

The PP rigid food container market in Europe is shaped heavily by sustainability regulations, including recycled-content mandates and extended producer responsibility (EPR) schemes. Food processors and retailers are shifting rapidly toward recyclable PP trays and cups to phase out PS and multi-material formats. Demand is strong in ready meals, dairy, fresh produce, and premium private-label food categories. High consumer preference for sustainable packaging and mature recycling infrastructure in some countries support steady market growth.

Germany is one of Europe’s largest markets, driven by a strong packaged-food sector, advanced recycling systems, and strict sustainability policies encouraging monomaterial packaging choices. Retailers and private-label brands actively adopt PP trays, tubs, and cups with recycled content to meet circular-economy targets. High automation and stringent food-safety standards in German processing plants also promote the use of durable, high-quality PP rigid containers in both chilled and ambient food categories.

Latin America Polypropylene Rigid Food Containers Market Trends

The polypropylene rigid food containers market in Latin America is expanding as food packaging rapidly formalizes, especially in urban centers where consumption of processed and convenience foods is rising. PP rigid containers benefit from demand for economical, lightweight packaging suited to hot climates and long distribution routes. While recycling systems remain underdeveloped in many countries, food processors increasingly shift toward PP due to its balance of cost, durability, and food-contact safety.

Brazil leads the region with significant uptake of PP containers across dairy, bakery, ready meals, and QSR segments. Growth is fueled by expanding supermarket chains, rising middle-class consumption, and increased preference for hygienically packaged food. Local converters benefit from access to domestic resin production, while regulatory discussions around waste management are beginning to influence the adoption of recyclable PP formats over polystyrene and mixed plastics.

Middle East & Africa Polypropylene Rigid Food Containers Market Trends

The polypropylene rigid food containers market in the Middle East & Africa shows stable but steadily rising demand, driven by urbanization, growth of modern retail complexes, and a strong foodservice culture, particularly in the GCC countries. PP’s heat resistance and durability make it suitable for hot climate distribution and takeaway-heavy consumption patterns. However, recycling infrastructure is still developing, so adoption of monomaterial and lightweight PP solutions is often driven more by cost-efficiency than sustainability mandates.

Saudi Arabia leads the GCC region with high consumption of packaged dairy, bakery, and ready-to-eat foods, supported by strong retail modernization and the rapid expansion of international and local foodservice chains. PP rigid containers are preferred for their robustness, hygiene, and ability to withstand high temperatures during distribution. Government initiatives under Vision 2030 - including waste-management reforms and packaging standardization - are gradually increasing interest in recyclable PP formats.

Key Polypropylene Rigid Food Containers Company Insights

Key players operating in the polypropylene rigid food containers market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

The industry is dominated by a mix of large, vertically integrated global packaging groups and many regional/specialist converters. Global players bring scale, broad resin-sourcing power, advanced automation, and multinational customer relationships, allowing them to win large retail and CPG contracts where volume, supply security and regulatory compliance matter.

At the same time, numerous medium and small regional thermoformers and injection-molders compete fiercely on lead time, customization, and local service; this two-tier structure keeps overall margins under pressure and makes customer retention, via service, quality and sustainability credentials-critical.

-

In September 2025, Prevented Ocean Plastic launched a food-safe recycled polypropylene (rPP) in partnership with Innovia Films (CCL), Spectra Packaging, Bantam Materials UK, and PETMAN, using Starlinger Viscotec recycling technology. The initiative is designed to divert large volumes of PP from polluting the oceans: in its first year, it’s projected to recycle enough material to avoid 500 million PP cups entering marine environments, when laid end to end, that’s enough plastic to circle the Earth 1.25 times.

-

In March 2025, LyondellBasell introduced Pro-fax EP649U, a high-performance polypropylene impact copolymer designed for thin-walled injection molding in rigid food packaging. The grade offers high flow, fast crystallization, high stack strength, and improved processing for high-speed production lines.

Key Polypropylene Rigid Food Containers Companies:

The following are the leading companies in the polypropylene rigid food containers market. These companies collectively hold the largest market share and dictate industry trends.

- Cosmo Films

- Amcor plc

- Berry Global, Inc.

- Pactiv Evergreen Inc.

- Plastipak Holdings, Inc.

- ALPLA Group

- Huhtamäki Oyj

- Sonoco Products Company

- Silgan Holdings Inc.

- Graham Packaging

Polypropylene Rigid Food Containers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.25 billion

Revenue forecast in 2033

USD 30.08 billion

Growth rate

CAGR of 5.7% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Cosmo Films; Amcor plc; Berry Global, Inc.; Pactiv Evergreen Inc.; Plastipak Holdings, Inc.; ALPLA Group; Huhtamäki Oyj; Sonoco Products Company; Silgan Holdings Inc.; Graham Packaging

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polypropylene Rigid Food Containers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global polypropylene rigid food containers market report based on product, end use and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Tubs & Jars

-

Trays & Clamshells

-

Takeaway/Foodservice Containers

-

Cups & Lids

-

Other Products

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail Packaged Food

-

Foodservice & Restaurants

-

Industrial / Bulk Food Processors

-

Convenience & On-the-go

-

Other End Uses

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.