- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Printed Electronic Materials Market Size, Share Report, 2033GVR Report cover

![Printed Electronic Materials Market Size, Share & Trends Report]()

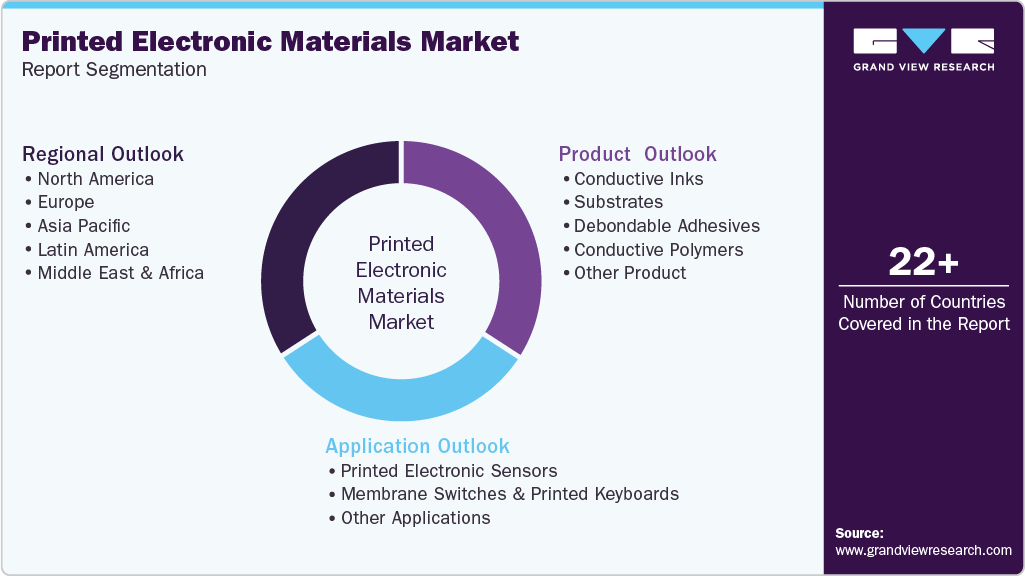

Printed Electronic Materials Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Conductive Inks, Substrates, Debondable Adhesives, Conductive Polymers), By Application (Printed Electronic Sensors, Membrane Switches and Printed Keyboards), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-808-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Printed Electronic Materials Market Summary

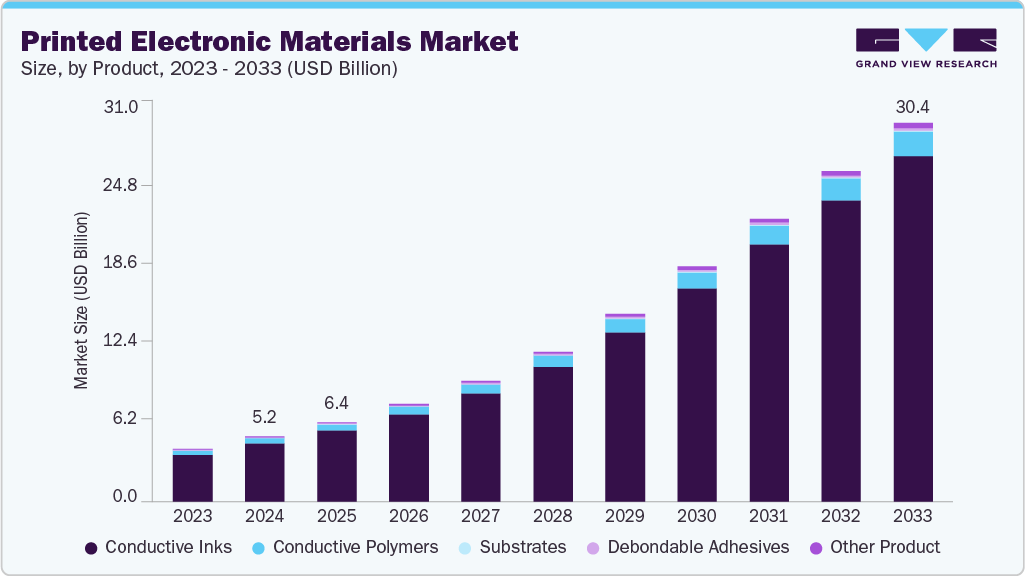

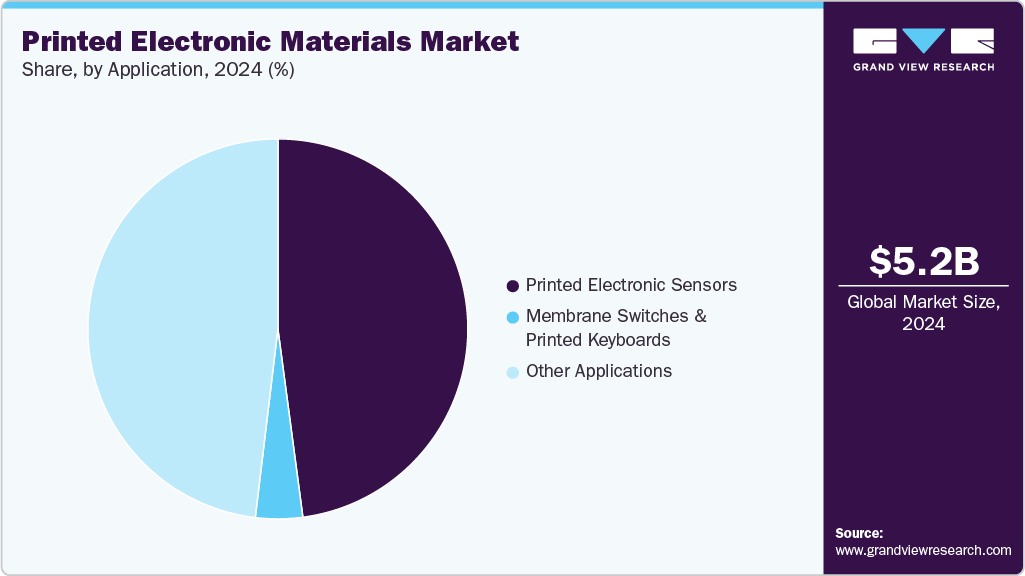

The global printed electronic materials market size was estimated at USD 5,226.7 million in 2024 and is projected to reach USD 30,395.0 million by 2033, growing at a CAGR of 21.5% from 2025 to 2033. Rapid adoption across IoT, flexible sensors, smart labels, and advanced packaging is expanding opportunities.

Key Market Trends & Insights

- Asia Pacific is dominated the global industry in 2024, accounting for a 56.5% global revenue share.

- Europe is expected to grow with the fastest CAGR of 21.7% from 2025 to 2033.

- Based on product, the conductive Inks segment dominated the market and accounted for the largest revenue share of 89.1% in 2024.

- Based on application, the membrane switches and printed keyboards segment is expected to grow with the fastest CAGR of 23.3% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 5,226.7 Million

- 2033 Projected Market Size: USD 30,395.0 Million

- CAGR (2025-2033): 21.5%

- Asia Pacific: Largest market in 2024

The use of cost-effective roll-to-roll printing and improved conductive inks enables manufacturers to produce lightweight, flexible, and energy-efficient components, reshaping applications in healthcare, packaging, automotive, and consumer electronics worldwide. Increasing integration of printed conductive inks, flexible substrates, and thin-film devices that simplify design and reduce assembly complexity. Manufacturers are shifting toward printed methods to lower production costs, enhance energy efficiency, and enable miniaturization. The continued development of silver, copper, and carbon-based inks has improved conductivity and durability, helping printed electronics gain commercial reliability. Roll-to-roll manufacturing processes are also becoming more scalable due to better curing techniques and inline quality inspection systems that ensure performance consistency and reduce post-production waste.

The demand for flexible and sustainable electronics has encouraged both established material suppliers and new entrants to invest in research that improves flexibility, adhesion, and electrical performance under stress. Buyers increasingly evaluate not just material costs but total lifecycle value, including recyclability and environmental impact. Market confidence is also strengthened by collaborations between material suppliers, printing-equipment manufacturers, and electronics integrators. As companies expand production footprints and refine supply chains, economies of scale are expected to stabilize pricing and promote wider adoption in commercial applications such as connected packaging, disposable medical sensors, and automotive interior interfaces.

Opportunities are emerging where traditional rigid electronics cannot perform efficiently, such as in curved or soft surfaces, wearable biometric monitoring, and low-power ambient displays. The combination of improved conductive materials, printable batteries, and flexible substrates allows electronics to be embedded almost anywhere. Success in this space will depend on how effectively material innovators align their offerings with end-user needs, ensuring compatibility with mass-production processes and regulatory standards. Continued innovation in printable materials, smart integration designs, and scalable production methods positions the printed electronics materials market for sustained and diversified growth over the next decade, driven by its unique ability to merge functionality with design flexibility across industries.

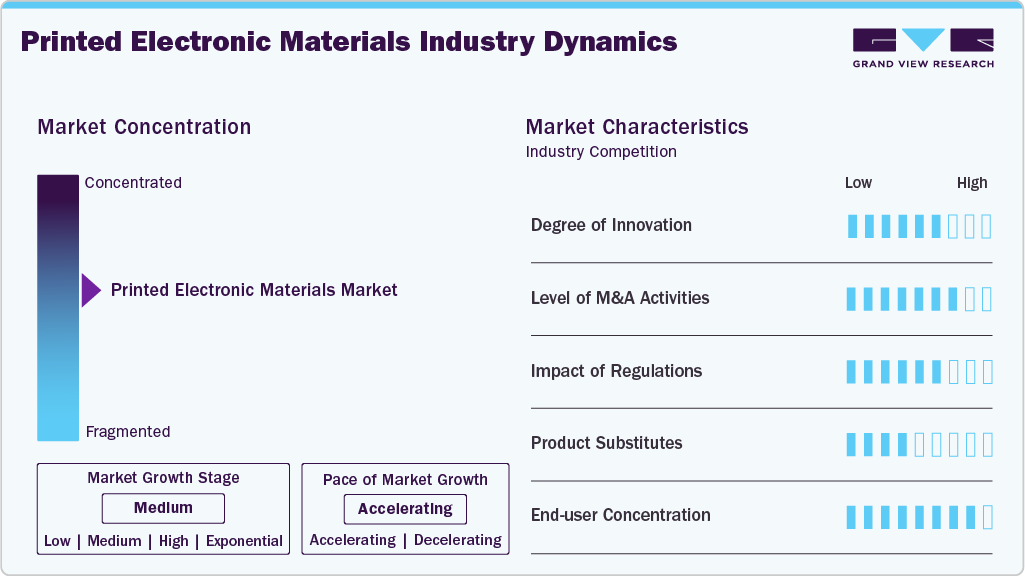

Market Concentration & Characteristics

The industry is moderately consolidated, featuring a mix of large multinational corporations and specialized material innovators. Established chemical and electronics companies focus on conductive inks, dielectric coatings, and flexible substrates, while smaller firms emphasize niche solutions such as printed sensors and stretchable circuits. This balance fosters both competition and collaboration, as major players often partner with startups or research institutions to accelerate material innovation and commercial scaling.

The industry is characterized by high research intensity, evolving manufacturing technologies, and rapid material diversification. Competitive advantage depends on formulation expertise, printability, and end-use compatibility rather than production volume alone. Sustainability, process efficiency, and adaptability to flexible and wearable devices are central to market positioning. Overall, the industry is dynamic, innovation-driven, and increasingly shaped by collaborations that link material science, printing technology, and application design to deliver customized, functional electronic components.

Product Insights

The conductive inks segment dominated the industry in 2024, accounting for the largest revenue share of 89.1%. This dominance is attributed to their extensive use in flexible circuits, RFID antennas, touch sensors, and smart packaging. Their compatibility with scalable printing processes, such as screen and inkjet printing, makes them ideal for mass production. Ongoing improvements in silver, copper, and carbon-based formulations continue to enhance conductivity, stability, and print precision, sustaining their market leadership.

The conductive polymers segment is projected to grow at the fastest rate, with a CAGR of 19.2% from 2025 to 2033. Growth is driven by increasing demand for lightweight, flexible, and cost-efficient materials suitable for wearable electronics, displays, and energy storage applications. These polymers offer tunable conductivity and superior mechanical flexibility, enabling their integration into roll-to-roll manufacturing. Environmental advantages and emerging research in biodegradable conductive materials further strengthen their long-term growth potential.

Application Insights

The printed electronic sensors segment held the largest revenue share of 47.9% in 2024, reflecting their widespread adoption across healthcare, automotive, and industrial applications. Their low power consumption, flexibility, and cost efficiency make them ideal for wearables, environmental monitoring, and smart packaging. Continuous advancements in printed biosensors and pressure sensors are enhancing detection accuracy and responsiveness. The growing integration of sensors into IoT networks is further reinforcing their dominance within the printed electronics landscape.

The membrane switches and printed keyboards segment is anticipated to record the fastest growth, with a projected CAGR of 23.3% from 2025 to 2033. Rising demand for lightweight, durable, and customizable user interfaces in consumer electronics, medical devices, and automotive controls is fueling this expansion. Printed circuitry enables thinner profiles, tactile versatility, and reduced assembly costs. As industries prioritize design flexibility and reliability, printed interface technologies are becoming essential for next-generation control systems.

Regional Insights

Asia Pacific printed electronic materials market dominated the global industry in 2024, accounting for a 56.5% global revenue share. The region’s leadership is supported by its strong electronics manufacturing base, particularly in China, Japan, South Korea, and Taiwan. Expanding semiconductor fabrication, display production, and consumer electronics industries drive large-scale adoption of printed materials. Government incentives for smart manufacturing and increased investments in flexible displays, wearable sensors, and printed batteries further strengthen the region’s market position.

China Printed Electronic Materials Market Trends

The printed electronics materials market in China is expanding rapidly due to its dominant position in global electronics manufacturing and its aggressive push toward self-sufficiency in advanced materials. Massive investments in smart packaging, flexible displays, and low-cost printed circuits are driving demand. Government-backed programs supporting semiconductor and display innovation are accelerating local production capabilities. Strong domestic demand for consumer electronics and growing industrial automation are reinforcing China’s position as a global hub for printed electronics development.

North America Printed Electronic Materials Market Trends

The printed electronics materials market in North America is supported by technological leadership and increasing adoption of printed electronics in smart devices, automotive electronics, and medical diagnostics. Collaboration between material suppliers and OEMs enables early commercialization of new conductive inks and flexible substrates. The region’s regulatory focus on energy-efficient and sustainable materials encourages innovation in eco-friendly formulations. Strategic investments in advanced packaging and IoT infrastructure are also enhancing the competitiveness of the printed electronics ecosystem.

U.S. Printed Electronic Materials Market Trends

The printed electronics materials market in the U.S. benefits from strong R&D capabilities, a robust innovation ecosystem, and close collaboration between universities, startups, and major technology firms. Demand is fueled by the country’s leadership in aerospace, healthcare wearables, and defense electronics, where lightweight and flexible components are essential. Government funding for advanced manufacturing and sustainability-driven innovation supports material development, while the presence of key players in conductive inks and sensors ensures a competitive and evolving domestic supply chain.

Europe Printed Electronic Materials Market Trends

The printed electronics materials market in Europe is projected to experience the fastest growth, with a CAGR of 21.7% from 2025 to 2033. The region’s rapid expansion is driven by its emphasis on sustainable technologies, printed energy solutions, and advanced material innovation. European manufacturers are focusing on eco-friendly conductive inks and biodegradable substrates to support circular economy goals. Collaborative research programs and strong automotive and healthcare sectors are creating favorable conditions for scaling printed electronics applications across industrial and consumer markets.

Latin America Printed Electronic Materials Market Trends

The printed electronics materials market in Latin America is driven by growing demand for cost-effective smart packaging, energy-efficient lighting, and low-cost sensors. Expanding industrial sectors and increasing digitalization across retail and logistics are fostering adoption. Local universities and research centers are beginning to explore flexible printed technologies, while government efforts to modernize manufacturing and strengthen renewable energy systems are encouraging investment in sustainable electronic materials and printed energy devices.

Middle East & Africa Printed Electronic Materials Market Trends

The printed electronics materials market in the Middle East & Africa is gaining traction as countries invest in technological diversification beyond traditional industries. Demand for printed electronics is rising in smart infrastructure, renewable energy, and logistics tracking systems. Governments in the Gulf region are promoting innovation through national transformation programs, creating opportunities for printed sensors and flexible solar materials. Meanwhile, Africa’s growing telecom and healthcare sectors are exploring low-cost printed solutions suitable for remote and emerging markets.

Key Printed Electronic Materials Company Insights

Key players operating in the printed electronics materials market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. The two key dominant manufacturers in the market are DuPont de Nemours, Inc. and Henkel AG & Co. KGaA.

-

DuPont de Nemours, Inc. is a global leader in advanced materials and specialty chemicals, recognized for its pioneering work in printed electronics. The company develops innovative conductive inks, dielectric materials, and flexible substrates used across applications such as sensors, flexible circuits, and photovoltaic systems. Its strong emphasis on R&D and material science integration supports high-performance solutions designed to enhance functionality, efficiency, and reliability in next-generation electronic devices.

-

Henkel AG & Co. KGaA is a leading innovator in printed electronic materials, offering a broad range of conductive inks, adhesives, and encapsulants tailored for flexible and wearable electronics. The company focuses on enabling smarter, more connected technologies for healthcare, mobility, and smart surface applications. Through continuous investment in sustainable chemistry and process optimization, Henkel integrates advanced materials with scalable manufacturing, driving innovation in printed electronics and expanding its global presence in high-value industrial segments.

Key Printed Electronic Materials Companies:

The following are the leading companies in the printed electronic materials market. These companies collectively hold the largest market share and dictate industry trends.

- DuPont de Nemours, Inc.

- BASF SE

- Henkel AG & Co. KGaA

- Nissha Co., Ltd.

- Sun Chemical

- Sigma-Aldrich

- InkTec

- Dycotec Materials

- Novacentrix

- Greatcell Solar Materials Pty Ltd

Recent Developments

-

In February 2025, Henkel AG & Co. KGaA introduced new printed electronics innovations focusing on smart surfaces, smart healthcare, and smart connectivity, showcasing advanced materials and solutions that enable smarter, more sustainable technologies for various end-use applications across multiple industries.

-

In November 2025, Qnity Electronics, Inc. completed its separation from DuPont to become a pure-play global leader in advanced electronics materials. Led by CEO Jon Kemp, Qnity began trading on the NYSE under “Q” and joined the S&P 500.

Printed Electronic Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6,383.0 million

Revenue forecast in 2033

USD 30,395.0 million

Growth rate

CAGR of 21.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Brazil; Argentina; Germany; UK; Italy; Spain; France; China; Japan; South Korea; Saudi Arabia; South Africa

Key companies profiled

DuPont de Nemours, Inc.; BASF SE; Henkel AG & Co. KGaA; Nissha Co., Ltd.; Sun Chemical; Sigma-Aldrich; InkTec; Dycotec Materials; NovaCentrix; Greatcell Solar Materials Pty Ltd

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Printed Electronic Materials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global printed electronic materials market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Conductive Inks

-

Conductive Silver Inks

-

Conductive Copper Inks

-

Nanomaterial Inks

-

Gold Nanoparticle Inks

-

Silver Nanoparticle Inks

-

Copper Nanoparticle Inks

-

Other Nanomaterial Inks

-

-

-

Conductive Polymers Inks

-

Carbon/Graphene Inks

-

Lignin-based Conductive Inks

-

Other Conductive Inks

-

-

Substrates

-

Sustainable Materials

-

Polylactic Acid (PLA)

-

Recycled PET

-

Polyhydroxyalkanoates (PHA)

-

Paper & Paperboard

-

Natural Fiber Textiles

-

Other Sustainable Materials

-

-

Non Sustainable Materials

-

Flexible Polymer Films

-

Polyethylene Terephthalate (PET)

-

Polyethylene Naphthalate (PEN)

-

Polyimide (PI)

-

Polycarbonate (PC)

-

-

Rigid Substrates

-

Other Non-Sustainable Materials

-

-

-

Debondable Adhesives

-

Conductive Polymers

-

Other Product

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Printed Electronic Sensors

-

Conventional

-

Sustainable printed bio-sensors

-

-

Membrane Switches and Printed Keyboards

-

Eco-designed Membrane-based

-

Conventional Membrane-based

-

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Latin America

-

Brazil

-

Argentina

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global printed electronic materials market size was estimated at USD 5,226.7 million in 2024 and is expected to reach USD 6,383.0 million in 2025.

b. The global printed electronic materials market is expected to grow at a compound annual growth rate of 21.5% from 2025 to 2033, reaching USD 30,395.0 million by 2033.

b. The Conductive Inks segment accounted for the largest share of the Printed Electronic Materials Market. This dominance is due to their widespread use in flexible circuits, sensors, RFID antennas, and smart packaging, supported by their high conductivity, versatility, and compatibility with large-scale printing technologies such as screen, gravure, and inkjet printing.

b. Some of the key players operating in the printed electronic materials Market include DuPont de Nemours, Inc., BASF SE, Henkel AG & Co. KGaA, Nissha Co., Ltd., Sun Chemical, Sigma-Aldrich, InkTec, Dycotec Materials, NovaCentrix, Greatcell Solar Materials Pty Ltd.

b. The Printed Electronic Materials Market is driven by growing demand for flexible, lightweight electronics, advancements in conductive inks, expanding IoT and wearable applications, cost-efficient roll-to-roll manufacturing, and increased adoption across healthcare, automotive, packaging, and consumer electronics industries for smart, connected solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.