- Home

- »

- Network Security

- »

-

Ransomware Protection Market Size, Industry Report, 2033GVR Report cover

![Ransomware Protection Market Size, Share & Trends Report]()

Ransomware Protection Market (2025 - 2033) Size, Share & Trends Analysis By Component (Solutions, Services), By Deployment (On Premise, Cloud), By Organization Size, By Application (Endpoint Protection, Email Protection), By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-693-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ransomware Protection Market Summary

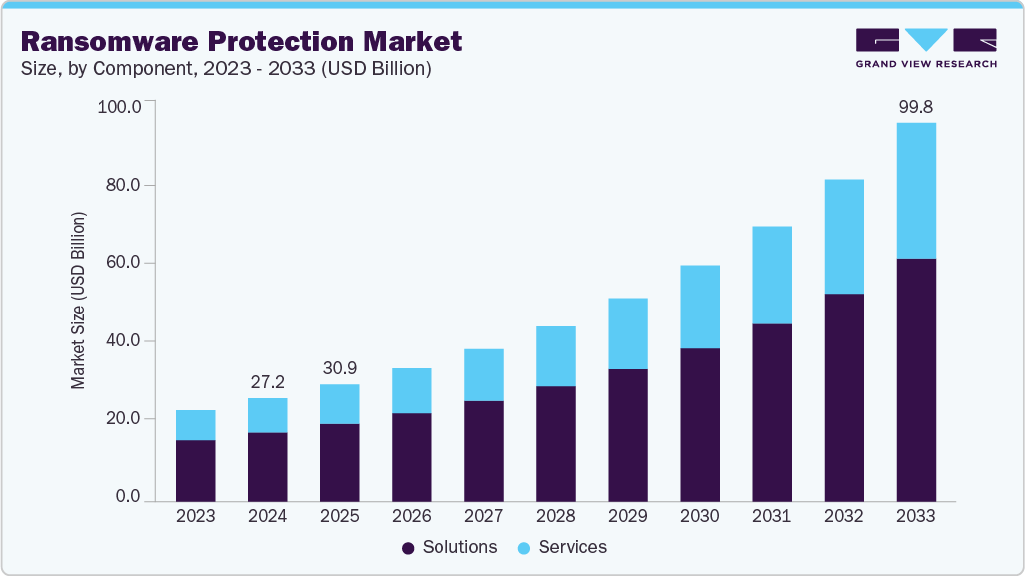

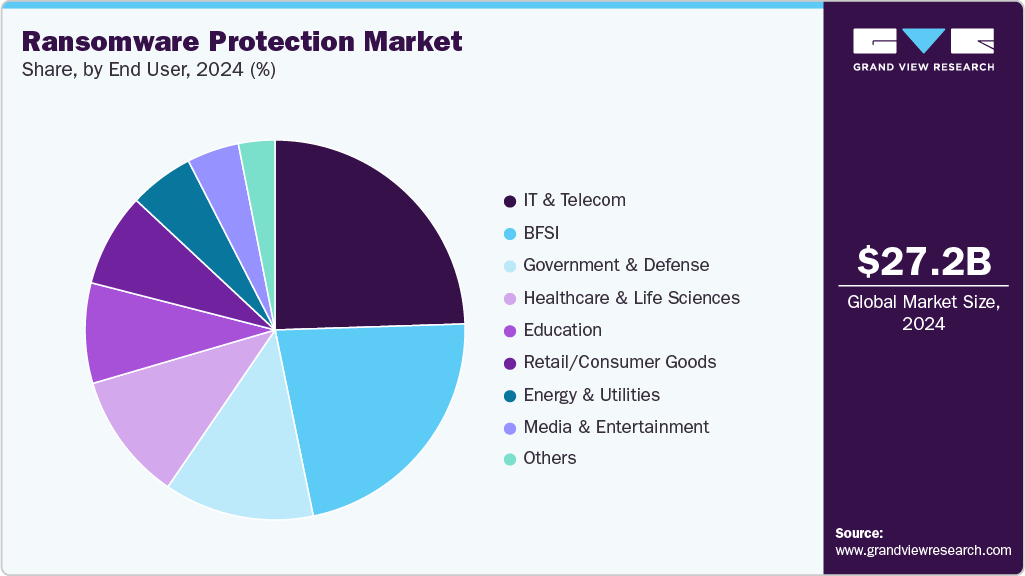

The global ransomware protection market size was estimated at USD 27.23 billion in 2024 and is projected to reach USD 99.85 billion by 2033, growing at a CAGR of 15.8% from 2025 to 2033. The global ransomware protection market is witnessing significant growth as organizations across industries face an escalating frequency of targeted ransomware attacks that disrupt operations and compromise sensitive data.

Key Market Trends & Insights

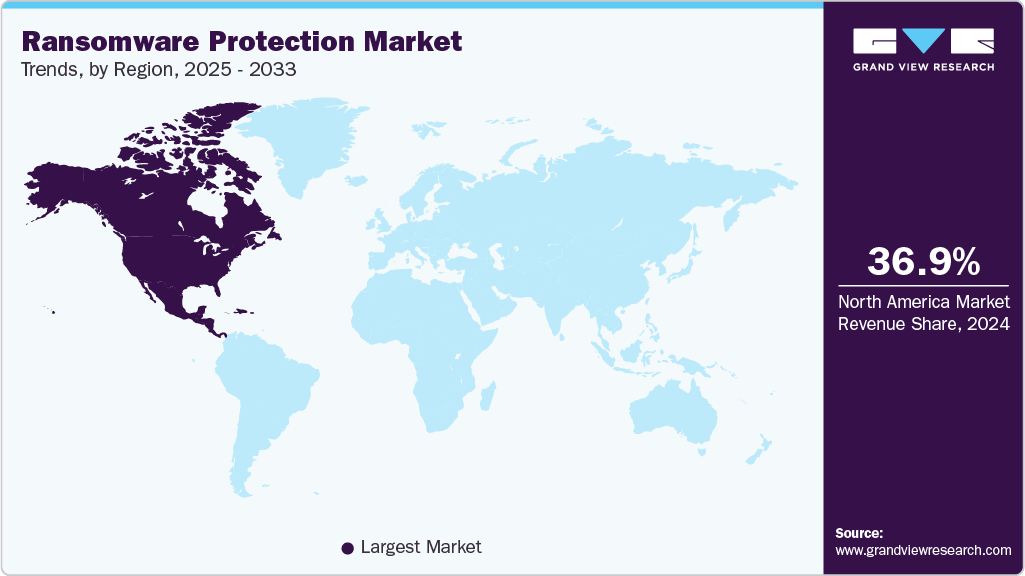

- North America held a 37.96% revenue share of the global ransomware protection market in 2024.

- In the U.S., the market is driven by the increasing shift towards adopting AI-powered threat detection, zero-trust security architectures, and endpoint detection and response (EDR) solutions to counter sophisticated attack methods like double extortion and ransomware-as-a-service (RaaS).

- By component, the solutions segment held the largest revenue share of 66.95% in 2024.

- By organization size, the large enterprises segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 27.23 Billion

- 2033 Projected Market Size: USD 99.85 Billion

- CAGR (2025-2033): 15.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Organizations are adopting a multi-layered cybersecurity approach that combines endpoint protection, network security, email filtering, and application control to safeguard their digital assets. Regulatory frameworks such as the General Data Protection Regulation (GDPR), the NIS2 Directive in Europe, and industry-specific compliance standards in banking, healthcare, and government sectors are further accelerating the adoption of ransomware protection solutions. Additionally, enterprises are also adopting managed security services and professional consulting to implement zero-trust architectures and ensure regulatory alignment. This trend is particularly notable among small and medium-sized enterprises (SMEs) that are adopting cloud-based ransomware protection platforms due to their scalability, cost-efficiency, and ease of deployment.

Additionally, the market is also transitioning from traditional reactive models to proactive, AI-powered cybersecurity frameworks that emphasize early detection, continuous monitoring, and faster recovery from ransomware incidents. Organizations are increasingly adopting behavioral analytics, automated rollback features, and real-time threat intelligence to strengthen cyber resilience. For instance, in February 2025, Halcyon launched its Ransomware Detection and Recovery (RDR) platform, designed to offer around-the-clock ransomware prevention, detection, and automated recovery, enhancing enterprise capabilities to neutralize ransomware attacks with minimal downtime. The introduction of such specialized, AI-enabled solutions reflects a broader industry shift toward intelligence-driven security architectures that prioritize operational continuity and rapid response to evolving ransomware threats.

Component Insights

The solutions segment accounted for the largest revenue share of 66.95% in 2024 in the ransomware protection market, driven by the increasing demand for comprehensive and integrated security platforms that address the growing sophistication of ransomware threats across digital ecosystems. With enterprises accelerating cloud adoption, hybrid work models, and connected IT infrastructures, there is a rising preference for cybersecurity solutions that offer end-to-end protection, real-time threat detection, automated response, and regulatory compliance. These solutions encompass anti-ransomware software, endpoint detection and response (EDR), secure web gateways, threat intelligence, and application control tools tailored to diverse industry requirements.

For instance, in July 2025, Morphisec launched its Adaptive Recovery technology to revolutionize full-spectrum ransomware resilience, offering autonomous recovery features that block encryption attempts and enable rapid system restoration without reliance on external backups, thereby reducing downtime and minimizing business impact. In conclusion, the growing need for scalable, intelligence-driven, and self-healing cybersecurity frameworks is driving the robust growth of the solutions segment in the global ransomware protection market.

The services segment is expected to grow at the fastest CAGR of 16.9% during the forecast period in the ransomware protection market, driven by the increasing reliance on managed and professional services to combat the rising complexity of ransomware attacks and address internal cybersecurity skill shortages. As organizations face evolving ransomware tactics such as double extortion, fileless malware, and ransomware-as-a-service (RaaS), they are adopting managed detection and response (MDR), incident response, and consulting services to ensure continuous threat monitoring, rapid response, and regulatory compliance.

These services offer tailored expertise, real-time visibility, and proactive remediation capabilities, especially crucial for small and medium-sized enterprises (SMEs) lacking dedicated cybersecurity teams. Therefore, the growing demand for cost-effective, expert-driven, and scalable cybersecurity support is fueling the accelerated growth of the services segment in the global ransomware protection market.

Deployment Insights

The on-premises segment accounted for the largest revenue share of 63.92% in 2024 in the ransomware protection market, driven by the strong preference for localized control, compliance, and tailored security management in regulated industries. Organizations handling sensitive data increasingly favor on-premises deployments to retain direct oversight of encryption keys, isolate critical assets, and configure security protocols to meet strict regulatory requirements. These deployments integrate endpoint detection and response (EDR), intrusion detection/prevention systems, application control, and recovery mechanisms directly within organizational infrastructure for maximum operational control and rapid threat containment.

For instance, in May 2023, Nebulon introduced its TripLine solution, an on-premises ransomware encryption early-warning system that monitors storage arrays and autonomously alerts when abnormal encryption begins, enabling precise detection of ransomware onset within isolated environments. Subsequently, the emphasis on enhanced visibility, data sovereignty, and custom security architectures is sustaining the dominance of the on-premise segment in the global ransomware protection market.

The cloud segment is expected to grow at a CAGR of 16.5% over the forecast period in the ransomware protection market, driven by the rapid adoption of cloud-first strategies, remote work models, and the need for scalable cybersecurity solutions that can protect expanding digital environments. Organizations across industries are increasingly migrating workloads to cloud platforms and adopting SaaS applications, which increases the demand for cloud-native ransomware protection capable of securing distributed assets, providing real-time threat intelligence, and enabling faster incident response.

Cloud deployments offer cost-efficiency, simplified management, and faster updates, making them particularly attractive to small and medium-sized enterprises (SMEs) seeking agile ransomware defense. For instance, in July 2023, Sophos launched Sophos Managed Detection and Response (MDR) for Microsoft 365, a fully cloud-delivered service that combines proactive threat hunting, automated ransomware detection, and rapid remediation specifically tailored for cloud and hybrid environments. In conclusion, the rising need for flexible, always-updated, and AI-driven security frameworks is propelling the fast-paced growth of the cloud segment in the global ransomware protection market.

Organization Size Insights

The large enterprises segment accounted for the largest revenue share of 70.81% in 2024, driven by the vast attack surface, high-value data, and compliance pressures characteristic of major organizations. Large enterprises manage extensive, complex infrastructures including multi-cloud environments, remote workforces, and intricate supply chains becoming prime targets for sophisticated ransomware operations such as double extortion and APT-linked campaigns. To combat these threats, they are heavily investing in enterprise-grade ransomware protection that integrates endpoint detection and response (EDR), threat intelligence, network segmentation, and automated remediation tools capable of delivering real-time visibility and rapid operational recovery. For instance, in January 2025, CrowdStrike announced that its Falcon platform achieved 100% detection, protection, and accuracy in the 2024 SE Labs Enterprise Advanced Security ransomware test, earning the top AAA rating by stopping all known and unknown ransomware threats with no false positives and demonstrating full breach visibility at every attack stage. In conclusion, the combination of increased threat sophistication, regulatory compliance requirements, and the operational stakes of large organizations is sustaining the dominance of the large enterprises segment.

The Small and Medium-sized Enterprises (SMEs) segment is projected to register the fastest CAGR of 16.5% during the forecast period, primarily driven by the rising frequency of ransomware attacks targeting vulnerable smaller businesses with limited cybersecurity resources. Increasing awareness of cyber risks, coupled with growing regulatory compliance pressures, is prompting SMEs to adopt affordable and scalable ransomware protection solutions, particularly cloud-based platforms that offer endpoint security, automated backups, and threat detection without heavy infrastructure costs. Additionally, the rising availability of managed detection and response (MDR) services and subscription-based cybersecurity offerings is further accelerating adoption among SMEs by providing enterprise-grade security capabilities in a cost-effective and easy-to-deploy manner.

Application Insights

The endpoint protection segment accounted for the largest revenue share of 33.15% in 2024 in the ransomware protection market, driven by the increasing exploitation of endpoint devices such as laptops, desktops, and mobile devices for ransomware attacks. With the growing adoption of hybrid work environments, bring-your-own-device (BYOD) policies, and distributed IT infrastructures, organizations are prioritizing endpoint security solutions that offer advanced threat prevention, real-time detection, and automated response. These solutions typically integrate anti-ransomware software, endpoint detection and response (EDR), behavioral analytics, and rollback features to prevent encryption and minimize operational disruption.

For instance, SentinelOne announced enhancements to its Singularity Platform with expanded autonomous ransomware mitigation capabilities, enabling organizations to detect, isolate, and recover infected endpoints without manual intervention. In conclusion, the growing demand for proactive, AI-driven, and recovery-ready endpoint protection solutions is reinforcing the dominance of the endpoint protection segment in the global ransomware protection market.

The email protection segment is expected to grow at the highest CAGR of 16.8% during the forecast period in the ransomware protection market, primarily driven by the persistent use of phishing emails as the most common vector for ransomware delivery and initial access breaches. With cybercriminals utilizing socially engineered phishing campaigns, business email compromise (BEC), and malicious attachments or links to gain unauthorized access to organizational networks, enterprises are prioritizing the deployment of advanced email security solutions. These solutions incorporate AI-powered phishing detection, real-time URL and attachment scanning, sandboxing, and domain spoofing protection to mitigate ransomware risks effectively.

Furthermore, the widespread adoption of remote work and cloud-based email platforms such as Microsoft 365 and Google Workspace has further intensified the demand for cloud-native email security technologies. For instance, in October 2022, Proofpoint expanded its Threat Protection Platform with enhanced AI-driven detection to block emerging ransomware phishing campaigns targeting cloud email services. Therefore, the growing complexity of email-borne ransomware threats and the shift to cloud email environments are accelerating the adoption of next-generation email protection solutions, driving the fastest growth within this segment.

End User Insights

The IT & telecom segment accounted for the largest revenue share of 24.50% in 2024 in the ransomware protection market, driven by the increasing cyber risk exposure faced by technology and telecommunications companies due to their expansive digital infrastructure and critical role in delivering uninterrupted services. Additionally, the rapid growth of 5G networks, cloud computing, and connected devices has expanded the attack surface, making IT and telecom providers frequent targets of sophisticated ransomware campaigns aimed at disrupting essential operations and accessing sensitive data. Moreover, to address these threats, organizations in this sector are investing heavily in integrated cybersecurity solutions that offer endpoint detection and response (EDR), network segmentation, AI-powered threat detection, and rapid incident response across complex hybrid environments. For instance, in April 2025, Trellix reported a significant surge in cyber activity targeting the U.S. telecom sector, highlighting the increasing need for proactive ransomware protection strategies and advanced threat monitoring among telecom operators. Subsequently, the rising threat landscape combined with the operational and regulatory demands of IT and telecom firms is driving the sustained dominance of this segment in the global ransomware protection market.

The healthcare & life sciences segment is expected to grow at the highest CAGR of 17.0% during the forecast period, driven by the increasing volume of cyberattacks targeting healthcare providers due to their reliance on sensitive patient data, connected medical devices, and time-critical operations. Also, the accelerated adoption of electronic health records (EHRs), telehealth platforms, and cloud-based clinical systems has expanded cybersecurity vulnerabilities, making hospitals and life sciences firms frequent ransomware targets with significant operational and reputational risks.

Additionally, stringent regulatory requirements such as HIPAA, GDPR, and evolving data privacy mandates are prompting healthcare organizations to strengthen their cybersecurity postures with advanced ransomware prevention, detection, and recovery solutions. For instance, in July 2023, Healthcare Triangle launched a dedicated ransomware protection initiative focused on safeguarding healthcare providers through AI-driven threat intelligence, proactive ransomware defense, and rapid incident response services. Consequently, the growing digitalization of healthcare services, combined with heightened threat exposure and regulatory compliance needs, is fueling the rapid growth of the healthcare & life sciences segment in the global ransomware protection market.

Regional Insights

North America ransomware protection market accounted for the largest revenue share of 36.96% in 2024, driven by the escalating frequency of targeted ransomware attacks on critical infrastructure, healthcare systems, and financial institutions across the United States and Canada. The region is witnessing a significant rise in double-extortion and ransomware-as-a-service (RaaS) campaigns, prompting organizations to increase investments in advanced endpoint security, AI-powered threat detection, and zero-trust architectures. Additionally, strict regulatory frameworks such as the U.S. Executive Order on Improving the Nation’s Cybersecurity, HIPAA, and Canada’s Personal Information Protection and Electronic Documents Act (PIPEDA) are accelerating the adoption of comprehensive ransomware defense strategies. Moreover, the growing deployment of managed detection and response (MDR) services, rapid adoption of cyber insurance policies, and rising public-private collaboration, such as initiatives by the Cybersecurity and Infrastructure Security Agency (CISA) are further shaping the market.

U.S. Ransomware Protection Market Trends

The U.S. ransomware protection market is witnessing strong growth, driven by the rising incidence of targeted ransomware attacks on critical sectors such as healthcare, financial services, energy, and government infrastructure. There is an increasing shift towards adopting AI-powered threat detection, zero-trust security architectures, and endpoint detection and response (EDR) solutions to counter sophisticated attack methods like double extortion and ransomware-as-a-service (RaaS). Regulatory initiatives such as the Executive Order on Improving the Nation’s Cybersecurity and sector-specific mandates like HIPAA are accelerating cybersecurity investments. Additionally, there is a growing focus on cyber insurance adoption, expanded use of managed detection and response (MDR) services, and increasing collaboration through public-private partnerships like those led by the Cybersecurity and Infrastructure Security Agency (CISA), all contributing to heightened demand for advanced ransomware protection solutions across the U.S.

Europe Ransomware Protection Market Trends

The ransomware protection market in Europe is anticipated to register considerable growth from 2025 to 2033. The growth is driven by the increasing regulatory pressure from frameworks such as the NIS2 Directive and GDPR, which are compelling organizations to strengthen ransomware defenses and incident reporting mechanisms. In addition, the region is experiencing ransomware threats targeting critical infrastructure sectors, including healthcare, energy, and transportation, leading to increased adoption of network segmentation, operational technology (OT) protection, and anomaly detection systems. Moreover, European enterprises are focusing on cross-border cyber resilience through initiatives led by ENISA and national CSIRTs, which promote real-time threat intelligence sharing and coordinated response strategies.

Furthermore, there is a notable rise in managed detection and response (MDR) adoption among mid-sized firms, while cloud sovereignty regulations such as GAIA-X are encouraging investment in regionally hosted ransomware protection platforms that comply with European data privacy standards.

The UK ransomware protection market is experiencing strong growth, driven by a significant increase in high-impact ransomware incidents targeting key sectors such as retail, healthcare, and critical infrastructure. According to the National Cyber Security Centre, the number of nationally significant cyberattacks has doubled, with prominent ransomware cases affecting major organizations including Marks & Spencer, Co-op, and Harrods. In response to this growing threat landscape, the UK government is advancing cybersecurity regulations through the upcoming Cyber Security and Resilience Bill, which proposes stricter ransomware reporting requirements and restrictions on ransom payments for public sector and critical infrastructure operators.

Additionally, rising cyber insurance premiums, particularly in sectors like retail, are compelling organizations to strengthen their ransomware defenses by implementing secure backups, advanced threat detection, and tested recovery procedures. The increased use of AI-generated phishing and ransomware campaigns has further prompted UK enterprises to accelerate the adoption of AI-powered email protection and threat mitigation solutions, contributing to the robust growth of the ransomware protection market in the country.

Germany ransomware protection market is gaining momentum, driven by a sharp 30% increase in attacks between mid‑2023 and mid‑2024, with the manufacturing sector particularly impacted. These threats are compelling companies across industries to strengthen backup protocols, invest in real-time threat intelligence, and integrate automated detection and recovery systems. In response to attacks on nearly a thousand public institutions in 2024, the German government is advancing its Cyber Resilience Act and NIS2 transposition efforts under the "Cybernation Germany" initiative, bolstering incident reporting mandates and risk management standards.

Furthermore, the resurgence of state-aligned, pro‑Russian cyber incursions targeting federal and public sector infrastructure has prompted federal law enforcement and cybersecurity authorities to coordinate more closely with enterprises in response, driving demand for managed detection and continuous monitoring services.

Asia Pacific Ransomware Protection Market Trends

The Asia Pacific ransomware protection market is expected to register the fastest CAGR of 16.9% from 2025 to 2033, driven by the increasing adoption of cloud services and growing ransomware threats targeting critical infrastructure, financial services, and healthcare sectors. Countries such as China, India, Japan, and Australia are witnessing a sharp rise in ransomware campaigns, including double extortion and supply chain attacks, prompting organizations to accelerate investments in endpoint protection, threat intelligence, and managed detection and response (MDR) services.

Regulatory developments like India’s CERT-In cybersecurity guidelines, Japan’s Cybersecurity Strategy, and Australia’s Security of Critical Infrastructure Act are compelling enterprises to implement robust ransomware protection and incident response frameworks. Additionally, the expansion of small and medium-sized enterprises (SMEs) and growing cyber insurance adoption in the region are further contributing to the demand for affordable, scalable, and AI-powered ransomware defense solutions.

Japan’s ransomware protection market is experiencing strong growth, driven by a sharp increase in sophisticated ransomware attacks and evolving regulatory initiatives. The introduction of the Active Cyberdefence Law has enabled government agencies to proactively monitor and mitigate cyber threats targeting critical infrastructure sectors such as healthcare, logistics, and public utilities, leading to increased demand for advanced ransomware protection solutions.

Additionally, the country has recorded a significant rise in ransomware incidents, with hospitals, universities, and manufacturing companies among the most frequently targeted organizations, prompting greater investment in endpoint security, backup solutions, and endpoint detection and response technologies. Additionally, the ongoing shortage of skilled cybersecurity professionals is accelerating the adoption of automated security platforms and managed security services, allowing organizations to strengthen their ransomware defenses despite limited internal resources.

China’s ransomware protection market is witnessing robust growth, driven by widespread digital transformation in key provinces like Beijing, Shanghai, Guangdong, Zhejiang, and Shenzhen, where government agencies, financial institutions, manufacturing hubs, and tech firms are increasing their investments in ransomware defense solutions.

High-profile ransomware incidents targeting critical sectors, along with rising threats linked to Ransomware-as-a-Service operations, are prompting organizations to deploy advanced endpoint security, network protection, email filtering, and scalable backup and recovery systems aligned with China's Cybersecurity Law and PIPL. Furthermore, the country’s transition toward cloud-native security architectures, coupled with the integration of AI/ML threat detection and real-time data privacy enforcement, is accelerating demand for next-generation, compliance-oriented ransomware protection offerings across both enterprise and SME segments in China.

India’s ransomware protection market is experiencing rapid growth driven by a substantial surge in ransomware attacks and increasing digital transformation across industries. CERT‑In data shows a steep 51% rise in ransomware incidents during 2023, with the manufacturing, telecommunications, and technology sectors being most affected. Additionally, high-profile breaches such as ransomware disruptions at small banks and healthcare institutions have increased focus on robust endpoint security, zero-trust architectures, and comprehensive backup and recovery frameworks.

Moreover, the emergence of Ransomware-as-a-Service (RaaS) platforms in India has lowered barriers to entry for threat actors, increasing the frequency and sophistication of attacks, particularly those involving double- and triple-extortion tactics. Therefore, Indian organizations are rapidly adopting cloud-native security solutions, managed detection and response (MDR) services, and AI-enhanced threat intelligence to strengthen their ransomware posture.

Key Ransomware Protection Company Insights

Key players operating in the ransomware protection industry are Bitdefender, Check Point Software, Cisco, and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2025, OPSWAT formed an OEM partnership with SentinelOne to integrate SentinelOne’s AI-powered detection capabilities into OPSWAT’s Metascan Multiscanning platform, significantly enhancing multi-layered malware defense, including ransomware and zero-day threats. The collaboration combines SentinelOne’s autonomous, cloud-independent AI/ML detection engines with Metascan’s over-30 anti-malware scanning framework, delivering over 99 percent detection accuracy across Windows and Linux environments.

-

In April 2025, Veeam partnered with CrowdStrike to enhance ransomware protection by integrating Veeam Data Platform backup insights with CrowdStrike’s Falcon Next-Gen SIEM and LogScale solutions, enabling organizations to gain unified visibility of backup events and potential indicators of compromise. This collaboration aims to improve ransomware resilience by allowing security teams to detect, investigate, and respond to ransomware incidents more effectively while ensuring the integrity of critical backup data.

-

In March 2025, ESET introduced enhancements to its ransomware protection suite at ESET World 2025, including a new Ransomware Remediation module and AI Advisor functionality. The remediation module enables automatic detection and rollback of malicious file encryption, allowing endpoints to revert to clean versions promptly, significantly reducing downtime. Currently, the AI Advisor provides predictive risk analysis and actionable guidance to users by leveraging machine learning insights.

-

In January 2024, Trellix unveiled its Advanced Ransomware Detection and Response solution, designed to deliver comprehensive protection against increasingly sophisticated ransomware attacks. The platform incorporates real-time behavioral analytics, automated playbook-driven remediation, and rapid rollback capabilities to detect and neutralize encryption threats before they spread across networks. By integrating endpoint, network, and cloud telemetry within a unified response framework, this solution enables organizations to significantly reduce incident response times and operational disruption.

Key Ransomware Protection Companies:

The following are the leading companies in the ransomware protection market. These companies collectively hold the largest market share and dictate industry trends.

- Bitdefender

- Check Point Software

- Cisco

- CrowdStrike

- ESET

- Trellix

- Fortinet

- Kaspersky Lab

- Malwarebytes

- McAfee

- Microsoft

- Palo Alto Networks

- SentinelOne

- Sophos

- Trend Micro

Ransomware Protection Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 30.88 billion

Revenue forecast in 2033

USD 99.85 billion

Growth rate

CAGR of 15.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast Period

2025 - 2033

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Scope

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments Covered

Component, deployment, organization size, application, end user, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Bitdefender; Check Point Software; Cisco; CrowdStrike; ESET; Trellix; Fortinet; Kaspersky Lab; Malwarebytes; McAfee; Microsoft; Palo Alto Networks; SentinelOne; Sophos; Trend Micro

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ransomware Protection Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global ransomware protection market report based on component, deployment, organization size, application, end user, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solutions

-

Standalone Anti‑Ransomware Software

-

Secure Web Gateways

-

Application Control

-

IDS/IPS

-

Threat Intelligence

-

Web Filtering

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-premise

-

Cloud

-

Hybrid

-

-

Organization Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small and Medium-sized Enterprises (SMEs)

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Endpoint Protection

-

Network Protection

-

Email Protection

-

Database Protection

-

Web Protection

-

-

End User Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

IT & Telecom

-

Government & Defense

-

Healthcare & Life Sciences

-

Education

-

Retail/Consumer Goods

-

Energy & Utilities

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ransomware protection market size was estimated at USD 27.23 billion in 2024 and is expected to reach USD 30.88 billion in 2025.

b. The global ransomware protection market is expected to grow at a compound annual growth rate of 15.8% from 2025 to 2033 to reach USD 99.85 billion by 2033.

b. The endpoint protection segment accounted for the largest share of 33.15% in 2024 in the ransomware protection market, driven by the increasing exploitation of endpoint devices such as laptops, desktops, and mobile devices for ransomware attacks.

b. Some key players operating in the market include Bitdefender, Check Point Software, Cisco, CrowdStrike, ESET, Trellix, Fortinet, Kaspersky Lab, Malwarebytes, McAfee, Microsoft, Palo Alto Networks, SentinelOne, Sophos, Trend Micro and Others

b. Factors such as escalating frequency of targeted ransomware attacks that disrupt operations and compromise sensitive data plays a key role in accelerating the ransomware protection market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.