- Home

- »

- Catalysts & Enzymes

- »

-

Release Agents Market Size & Share, Industry Report, 2033GVR Report cover

![Release Agents Market Size, Share & Trends Report]()

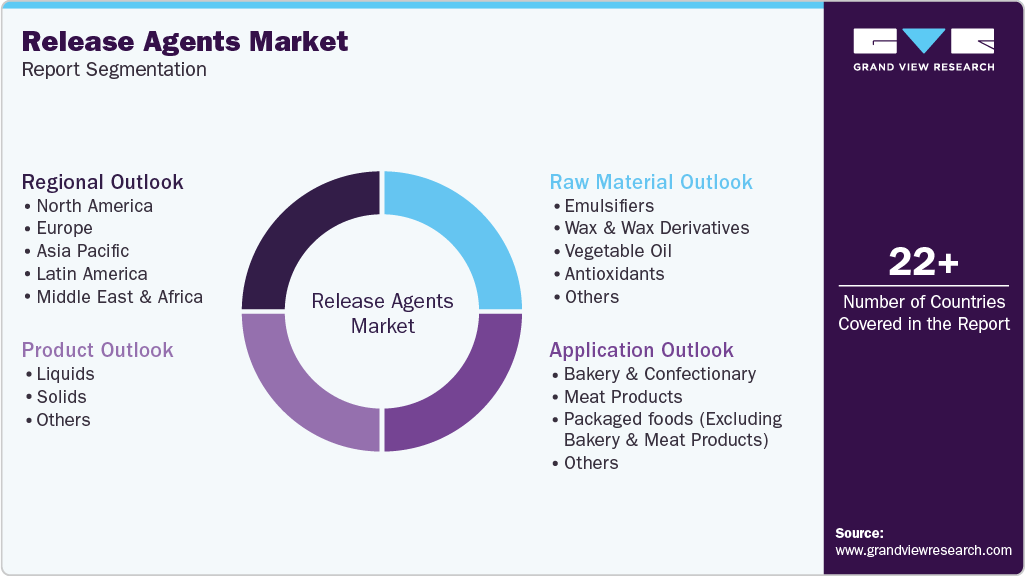

Release Agents Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Liquids, Solids), By Raw Material (Emulsifiers, Vegetable Oils, Antioxidants), By Application (Bakery & Confectionery, Meat Products), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-809-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Release Agents Market Summary

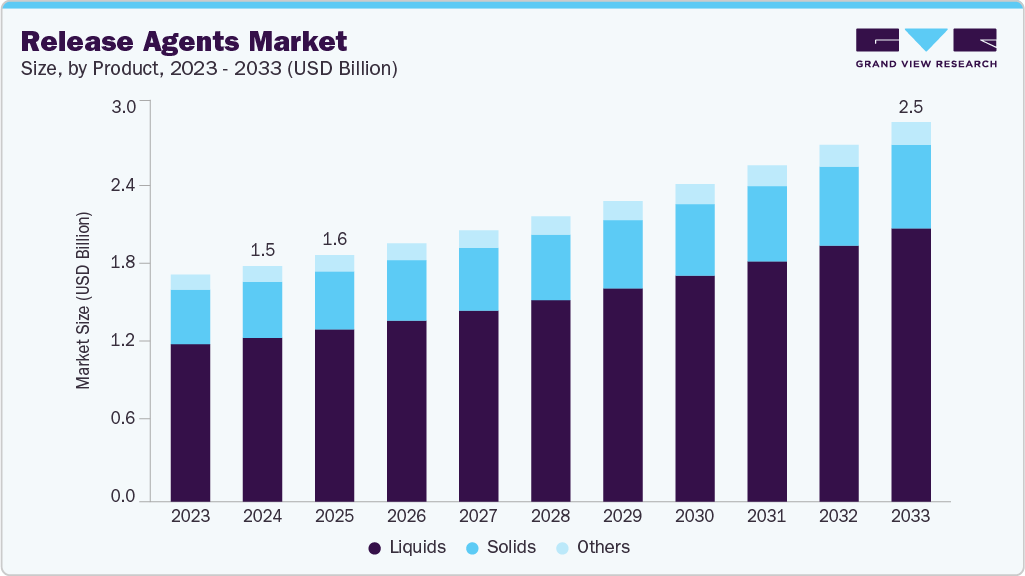

The global release agents market size was estimated at USD 1,568.4 million in 2024 and is projected to reach USD 2528.5 million by 2033, growing at a CAGR of 5.5% from 2025 to 2033. The market growth is driven by the expansion of key industries such as automotive, construction, and packaging.

Key Market Trends & Insights

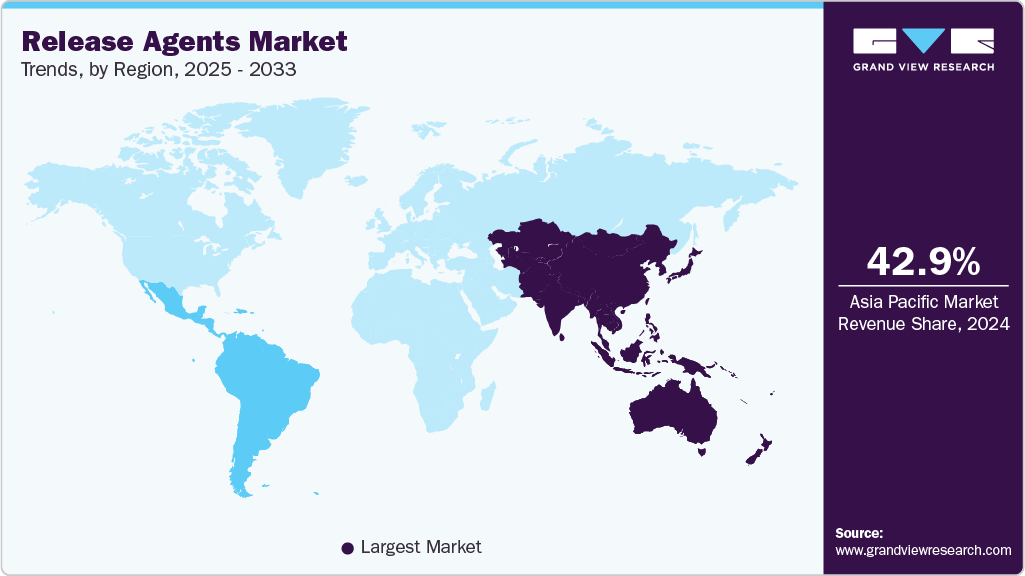

- Asia Pacific release agents industry dominated the global market with a revenue share of 42.9% in 2024.

- China registered highest CAGR of 6.3%, in terms of revenue, during the review period.

- By product, the liquid segment dominated the market with a revenue share of 69.6% in 2024.

- By raw material, the wax and wax derivatives segment dominated the market with a revenue share of 25.9% in 2024.

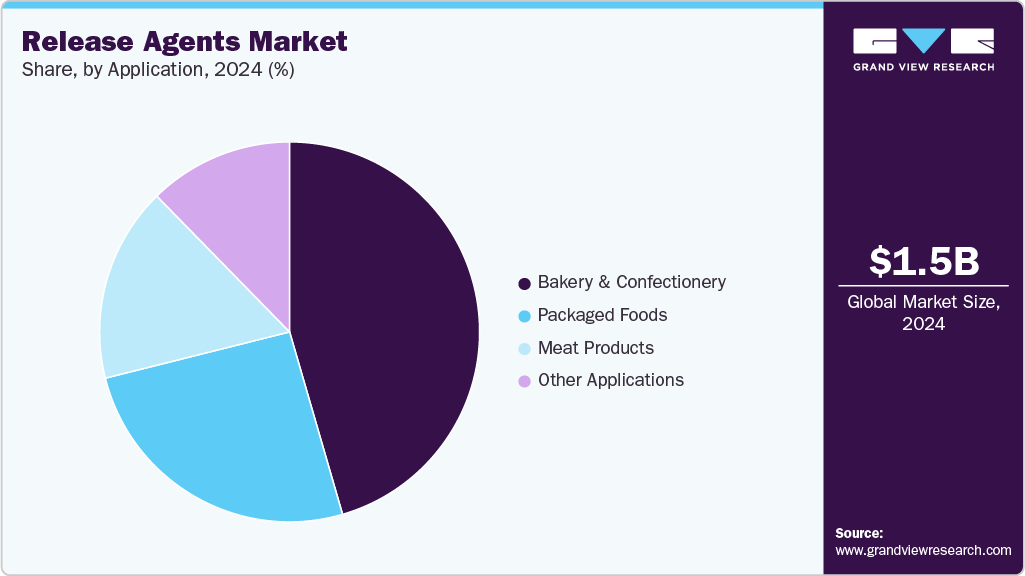

- By application, the bakery and confectionery segment dominated the market with a revenue share of 45.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,568.4 Million

- 2033 Projected Market Size: USD 2,528.5 Million

- CAGR (2025-2033): 5.5%

- Asia Pacific: Largest market in 2024

- Latin America: Fastest growing market

These agents play a vital role in improving manufacturing efficiency by preventing sticking, reducing downtime, and ensuring smooth product removal from molds. As global industrial output continues to rise, manufacturers are increasingly adopting release agents to enhance product quality and extend equipment life. This trend is particularly strong in developing regions with rapidly advancing manufacturing infrastructure.

Sustainability trends are encouraging the use of water-based and biodegradable release agents instead of solvent-based options. These eco-friendly solutions reduce VOC emissions and improve workplace safety, aligning with global environmental regulations. Many companies are investing in research to develop green formulations without compromising performance. This shift is fostering innovation and creating new growth opportunities in the release agents industry.

Rapid urbanization and large-scale infrastructure projects are creating strong opportunities for release agent manufacturers. Increasing concrete production for buildings, bridges, and precast structures boosts the demand for effective mold-release solutions. The use of advanced, eco-friendly release agents in construction helps achieve smooth finishes and reduces cleaning and labor costs, supporting market growth in this sector.

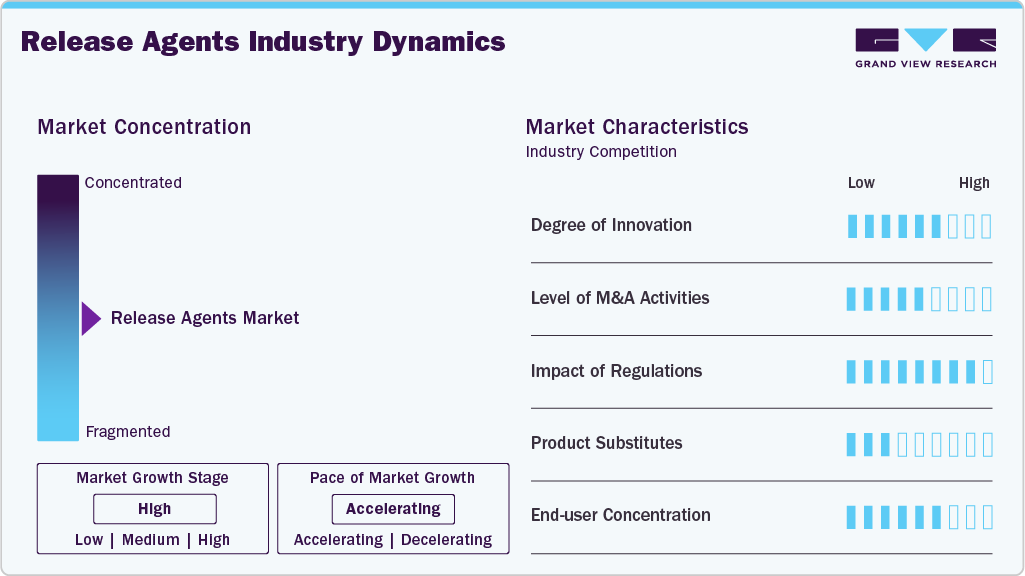

Market Concentration & Characteristics

The release agents industry is moderately concentrated, led by major players like Dow, BASF, Wacker Chemie, Chem Trend, and Henkel. Regional and niche manufacturers add fragmentation, serving specialized industrial applications across key markets.

The market is driven by demand for high-performance, eco-friendly, and innovative release solutions in automotive, construction, food, and composites. Companies compete through product differentiation, sustainability, and technological advancements.

Product Insights

The liquid segment dominated the market with a revenue share of 69.6% in 2024, due to its ease of application, uniform coverage, and compatibility with various molding materials. These formulations enable faster production cycles and superior surface finishes, making them ideal for automotive, construction, and food processing industries. Their versatility and ability to perform under diverse temperature conditions continue to strengthen their market position.

The solid segment is the significantly growing segment with a CAGR of 4.7% during the forecast period, driven by rising demand for clean, residue-free, and environmentally friendly alternatives. These products offer better control, reduced waste, and longer-lasting performance, appealing to high-precision applications like composites and rubber molding. Increasing focus on sustainability and reduced VOC emissions further supports their adoption.

Raw Material Insights

The wax and wax derivatives segment dominated the market with a revenue share of 25.9% in 2024, due to their excellent lubricity, high thermal stability, and cost-effectiveness. They provide superior mold release performance across industries such as rubber, plastics, and concrete. Their ability to deliver smooth surface finishes and consistent quality makes them a preferred choice for large-scale manufacturing operations.

The vegetable oils segment is the fastest-growing segment with a CAGR of 7.6% during the forecast period, driven by rising demand for bio-based and sustainable release agents. These oils offer effective release properties while reducing environmental impact and VOC emissions. Increasing regulatory pressure and consumer preference for eco-friendly solutions are encouraging manufacturers to shift toward plant-derived formulations.

Application Insights

The bakery and confectionery segment dominated the market with a revenue share of 45.5% in 2024, because of its high-volume production and continuous demand for non-stick, high-efficiency solutions. Release agents ensure smooth product removal, maintain texture integrity, and enhance equipment lifespan. Their role in improving productivity and product quality keeps this segment at the forefront of market demand.

The packaged foods are the fastest growing segment with CAGR of 7.4%, driven by rising consumer demand for convenience and processed food products. Manufacturers are increasingly adopting advanced release agents to optimize production speed, reduce waste, and ensure consistent product quality. The growth in frozen, ready-to-eat, and snack categories further accelerates adoption in this segment.

Regional Insights

Asia Pacific release agents industry dominated the global market with a revenue share of 42.9% in 2024, driven by rapid expansion of the automotive manufacturing sector. The region has become a global hub for vehicle production, with countries such as China, India, and Japan investing heavily in large-scale manufacturing facilities. Release agents are essential in producing high-quality rubber, plastic, and metal components used in vehicles, ensuring smooth molding and surface precision. This surge in automotive output continues to fuel consistent demand for advanced release solutions across the region.

China registered highest CAGR of 6.3%, in terms of revenue during the review period. The release agents industry in China is driven mainly by the rapid infrastructure development. Large-scale construction projects, including smart cities, transport systems, and industrial zones, are significantly boosting the use of concrete molds and precast elements. Release agents play a critical role in achieving smooth finishes and faster mold turnover, improving overall construction efficiency. The country’s ongoing investments in urban expansion continue to create strong growth opportunities for market players.

North America Release Agents Market Trends

The release agents industry in North America is primarily driven by the rising adoption of sustainable and low-VOC manufacturing practices. Strict environmental regulations have prompted industries to shift from solvent-based to water-based and biodegradable release agents. This transition aligns with the growing corporate emphasis on cleaner production and carbon reduction goals. As a result, eco-friendly release formulations are seeing strong uptake across major industrial applications.

U.S. Release Agents Market Trends

The U.S. release agents industry is driven by the increasing adoption of automation and advanced manufacturing technologies. Industries are integrating high-precision molding and casting systems that require reliable, high-performance release agents to maintain production efficiency. These technologies enhance product consistency and reduce downtime, strengthening competitiveness in sectors such as automotive, aerospace, and industrial machinery. The trend toward smart manufacturing continues to accelerate demand for premium release solutions.

Europe Release Agents Market Trends

European release agents industry’s major driver is the region’s strong emphasis on technological innovation in materials engineering. Continuous R&D efforts are enabling the development of high-performance, heat-resistant, and durable release agents suited for complex manufacturing processes. This focus on innovation supports Europe’s advanced automotive, aerospace, and composite industries. Consequently, demand for precision-engineered release solutions continues to rise across the region.

Germany’s release agents industry is driven by its advanced automotive engineering and emphasis on product quality. The country’s strong manufacturing base relies heavily on precision molding and surface finishing processes, where high-performance release agents are essential. Continuous improvement in production standards and quality certification requirements further amplify their use. As German manufacturers pursue excellence in material performance, demand for specialized release agents remains robust.

Latin America Release Agents Market Trends

Latin America release agents industry is anticipated to be the fastest growing market with a CAGR of 6.8% over the forecast period, driven by growing automotive and manufacturing industries. Increasing vehicle production and industrial output in countries like Brazil and Mexico are boosting demand for mold-release solutions. Manufacturers are adopting high-performance and durable agents to improve efficiency and product quality. This trend is creating opportunities for both global and regional suppliers.

Middle East & Africa Release Agents Market Trends

Middle East and Africa release agents industry is driven by rapid infrastructure development and industrialization. Large-scale construction projects and growing manufacturing sectors in countries such as the UAE, Saudi Arabia, South Africa, and Nigeria are boosting demand for mold-release solutions. High-performance agents help improve efficiency, ensure smooth product removal, and reduce labor and maintenance costs. This trend is creating significant growth opportunities for both global and regional suppliers.

Key Release Agents Company Insights

Dow Inc. and BASF SE dominate the release agents industry due to their strong global presence, advanced R&D capabilities, and broad product portfolios. Their focus on innovation, sustainability, and high-performance solutions enables them to meet diverse industry needs and maintain a competitive edge worldwide.

-

Dow Inc. is a leading player in the release agents industry, offering high-performance and sustainable solutions for automotive, plastics, and construction industries. Its strong R&D capabilities allow continuous innovation in eco-friendly and specialized formulations. The company’s global manufacturing footprint ensures efficient supply and rapid market response. Dow’s focus on advanced technologies positions it as a preferred partner for industrial manufacturers worldwide.

-

BASF SE holds a dominant position in the release agents industry with a diverse portfolio serving rubber, plastics, and food-processing sectors. Its global presence and chemical expertise support the development of efficient, high-quality, and eco-friendly release solutions. Continuous innovation enables BASF to meet evolving industry standards and regulatory requirements. The company’s strategic investments in sustainable technologies strengthen its leadership across key industrial markets.

Key Release Agents Companies:

The following are the leading companies in the release agents market. These companies collectively hold the largest market share and dictate industry trends.

- Dow Inc.

- BASF SE

- Henkel AG & Co. KGaA

- Chem Trend L.P.

- Wacker Chemie AG

- Evonik Industries AG

- Momentive Performance Materials Inc.

- Shin-Etsu Chemical Co., Ltd.

- Daikin Industries Ltd.

- ROCOL (ITW)

Recent Developments

-

On 6 August 2025, ROCOL introduced its Ultimate Silicone Spray, a versatile mold-release and lubricant designed for industrial use. The quick-drying, residue-free spray supports plastic and rubber molding, food packaging, and automotive production, operating in extreme temperatures from -50°C to +200°C. It is NSF H1 certified, chemically inert, and reduces maintenance downtime, ensuring efficient and precise operations.

-

In May 2024, Kao Corporation launched LUNAFLOW RA, a water based mold release agent using cellulose nanofibers, solvent and fluorine free, targeting rubber and resin molding.

Release Agents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,641.8 million

Revenue forecast in 2033

USD 2,528.5 million

Growth rate

CAGR of 5.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, raw material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Dow Inc.; BASF SE; Henkel AG & Co. KGaA; Chem Trend L.P.; Wacker Chemie AG; Evonik Industries AG; Momentive Performance Materials Inc.; Shin-Etsu Chemical Co., Ltd.; Daikin Industries Ltd.; ROCOL (ITW)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Release Agents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global release agents market report based on product, raw material, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Liquids

-

Solids

-

Others

-

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Emulsifiers

-

Mono, Diglycerides & Derivatives

-

Lecithin

-

Sorbitan Esters

-

Stearoyl Lactylates

-

Others

-

-

Wax & Wax Derivatives

-

Vegetable Oil

-

Antioxidants

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Bakery & Confectionary

-

Rolls & Breads (Including Pizza)

-

Cookies & Biscuits

-

Desserts

-

Others

-

-

Meat Products

-

Packaged foods (Excluding Bakery & Meat Products)

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global release agents market size was estimated at USD 1,568.4 million in 2024 and is expected to reach USD 1,641.8 million in 2025.

b. The global release agents market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2033 to reach USD 2,528.5 million by 2033.

b. Asia Pacific dominated the market with revenue share of 42.9% in 2024 , driven by rapid expansion of the automotive manufacturing sector. The region has become a global hub for vehicle production, with countries like China, India, and Japan investing heavily in large-scale manufacturing facilities.

b. Some key players operating in the release agents market include Dow Inc., BASF SE, Henkel AG & Co. KGaA, Chem Trend L.P., Wacker Chemie AG, Evonik Industries AG, Momentive Performance Materials Inc., Shin-Etsu Chemical Co., Ltd., Daikin Industries Ltd., ROCOL (ITW).

b. The market is driven by the expansion of key industries such as automotive, construction, and packaging. These agents play a vital role in improving manufacturing efficiency by preventing sticking, reducing downtime, and ensuring smooth product removal from molds.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.