- Home

- »

- Renewable Energy

- »

-

Renewable Natural Gas Market Size, Industry Report, 2033GVR Report cover

![Renewable Natural Gas Market Size, Share & Trends Report]()

Renewable Natural Gas Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Landfills, Agricultural Residue, Livestock Manure), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-802-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Renewable Natural Gas Market Summary

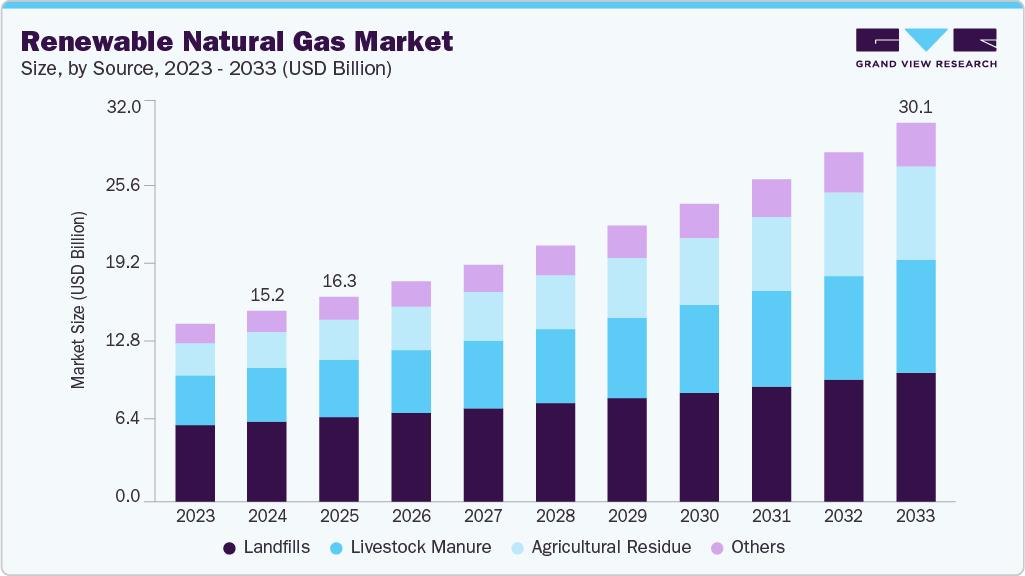

The global renewable natural gas market size was estimated at USD 15.17 billion in 2024 and is projected to reach USD 30.13 billion by 2033, growing at a CAGR of 8.0% from 2025 to 2033. An increasing global emphasis on decarbonization drives the market growth, supported by policy frameworks that encourage the adoption of low-carbon fuels and rising investments in sustainable energy infrastructure.

Key Market Trends & Insights

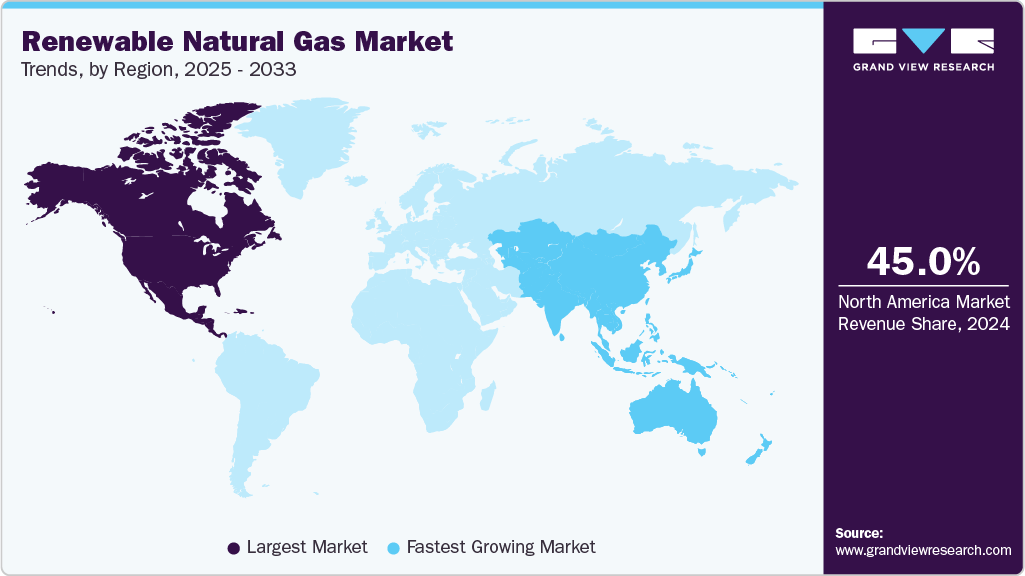

- North America renewable natural gas market held the largest share of 45% of the global market in 2024.

- The renewable natural gas market in the U.S. is expected to grow significantly over the forecast period.

- By source, landfills held the highest market share of 42.21% in 2024.

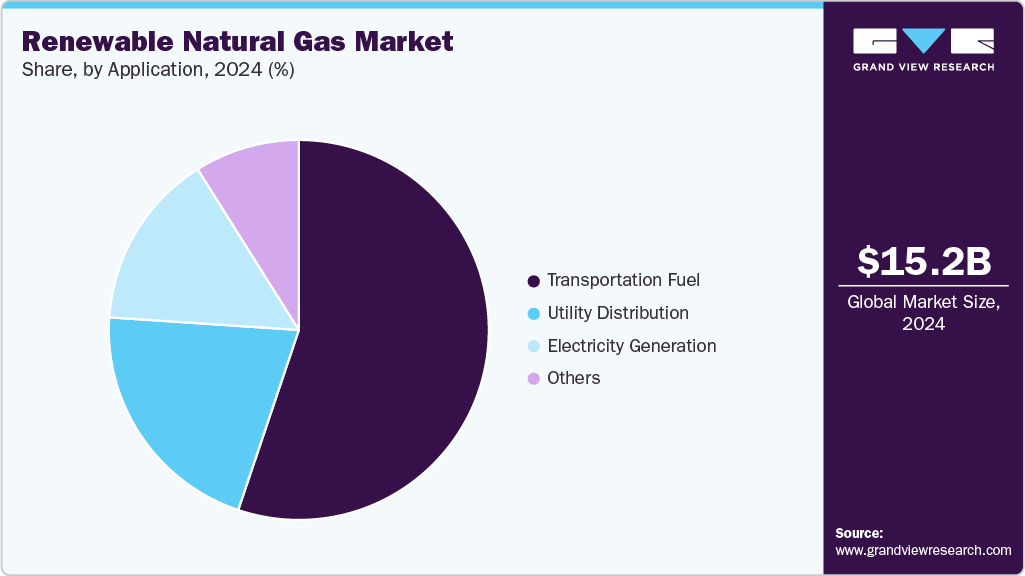

- By application, the transportation fuel segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.17 Billion

- 2033 Projected Market Size: USD 30.13 Billion

- CAGR (2025-2033): 8.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The expanding applications of RNG across the transportation, industrial, and utility sectors, along with advancements in biogas upgrading technologies, are further accelerating market adoption. In addition, growing focus on circular economy models and waste-to-energy initiatives is boosting RNG production from agricultural residues, landfills, and wastewater treatment facilities, positioning the sector for sustained long-term expansion.

In North America, the renewable natural gas (RNG) market is supported by strong climate policies, expanding gas utility procurement programs, and accelerated development of anaerobic digestion and landfill gas upgrading facilities. The U.S. leads regional deployment, driven by federal incentives and state-level programs, such as California’s Low Carbon Fuel Standard (LCFS) and Renewable Fuel Standard (RFS) credits, which encourage the integration of RNG in transportation and industrial energy systems. Corporate decarbonization targets and the push to replace fossil natural gas in manufacturing, power generation, and waste management sectors further support growth. Canada is experiencing a similar momentum, with provincial clean-energy mandates and utility-led RNG injection programs driving increased adoption across residential, commercial, and municipal applications.

Europe represents another prominent market, fueled by ambitious net-zero targets and robust renewable gas strategies. Countries such as Germany, France, the United Kingdom, and Italy are advancing large-scale RNG production through agricultural biogas plants, wastewater treatment facilities, and food-waste digestion projects. The European Union’s renewable energy directives, carbon pricing mechanisms, and biomethane integration targets within gas distribution networks are key enablers of market expansion. Strong infrastructure development, coupled with increasing collaboration between energy utilities, technology providers, and agricultural cooperatives, is enhancing RNG supply capacity. Pilot projects for hydrogen-RNG blends and cross-border biomethane trade platforms further position Europe as a critical growth engine for the global RNG market.

Drivers, Opportunities & Restraints

The increasing emphasis on decarbonization, waste-to-energy initiatives, and the principle of a circular economy primarily drives the global renewable natural gas (RNG) industry. With growing concerns over greenhouse gas emissions and the need to transition away from fossil fuels, industries and utilities are adopting RNG as a low-carbon alternative to conventional natural gas. Supportive government policies, renewable fuel standards, and incentives such as LCFS credits in the U.S. and biomethane injection mandates in Europe are accelerating project development. Growing investments in biogas upgrading technologies, expansion of natural gas vehicle (NGV) fleets, and rising corporate sustainability commitments are further propelling market growth. In addition, the ability to utilize existing gas infrastructure makes RNG an attractive and cost-efficient renewable alternative compared to other low-carbon fuels.

Opportunities in the RNG market are expanding as global waste management, agricultural, and wastewater treatment facilities increasingly recognize the value of biogas upgrading. Emerging applications in hard-to-abate sectors, including industrial manufacturing, heavy transportation, and aviation, present significant growth opportunities. Integration of RNG with hydrogen production and carbon capture solutions is opening new pathways for negative-carbon energy systems.

However, the market faces several restraints, including high capital investment requirements and challenges related to managing the feedstock supply chain. Variability in organic waste availability, competition for agricultural residues, and logistical complexities associated with feedstock collection can limit project viability. Regulatory uncertainty in some regions, complexities in obtaining permitting approvals, and limited long-term offtake agreements pose additional hurdles. Technical challenges related to upgrading efficiencies, controlling methane leakage, and meeting interconnection standards with natural gas networks must also be addressed. Furthermore, competition from other renewable fuels such as green hydrogen and electrification-based solutions may impact adoption in certain sectors. Mitigating these challenges through policy harmonization, financial support mechanisms, and continued technological innovation likely to unlock the full potential of RNG market.

Source Insights

The landfills segment held the largest revenue share, around 43%, in 2024, solidifying its position as the leading source in the global renewable natural nas (RNG) market. This dominance stems from the significant volume of municipal solid waste generated worldwide and the established infrastructure for capturing, processing, and upgrading landfill gas. Governments across key regions have implemented stringent regulations to curb methane emissions from landfills, which has accelerated investments in landfill gas recovery projects.

Moreover, rising corporate sustainability commitments and voluntary biomethane procurement programs are strengthening market demand. While competing feedstocks such as agricultural and food waste are gaining traction, landfill RNG remains a pivotal pathway for renewable gas deployment due to its cost-effectiveness, reliability, and contribution to reducing greenhouse gas emissions.

Application Insights

The transportation fuel segment held the largest market share, approximately 56%, in 2024 within the global renewable natural gas (RNG) industry, driven by strong adoption across heavy-duty vehicles, public transit systems, and commercial fleets. RNG has emerged as a preferred alternative fuel solution due to its ability to significantly reduce greenhouse gas emissions, particularly in hard-to-abate transport sectors where electrification remains challenging. Policy incentives, including low-carbon fuel standards, renewable fuel credits, and federal and state-level clean mobility programs, have played a pivotal role in boosting demand.

The rising penetration of compressed natural gas (CNG) and liquefied natural gas (LNG) vehicles, along with the expansion of biogas upgrading facilities, likely to support market growth. Moreover, emerging opportunities in the marine and aviation sectors, where RNG-derived fuels such as bio-LNG and synthetic methane are gaining attention, are likely to broaden the adoption landscape. Continued development of refueling networks, long-term supply agreements, and corporate net-zero commitments is expected to be key catalysts, positioning RNG as a vital transitional fuel in the global sustainable transportation ecosystem.

Regional Insights

North America renewable natural gas (RNG) market held the largest share, approximately 45%, of the global renewable natural gas (RNG) industry in 2024, driven by strong federal and state policy frameworks, the expansion of biogas upgrading capacity, and the increasing adoption of low-carbon fuel programs. The U.S. leads the region with significant RNG production from landfills, livestock waste, and wastewater treatment facilities, supported by incentives under the renewable fuel standard (RFS) and California’s Low Carbon Fuel Standard (LCFS). Rapid deployment in transportation fleets, particularly heavy-duty trucks, transit buses, and refuse vehicles, has further fueled demand, as fleet operators seek to reduce emissions while leveraging existing natural gas infrastructure.

U.S. Renewable Natural Gas (RNG) Market Trends

The U.S. renewable natural gas (RNG) market is one of the fastest-growing globally, driven by strong federal and state-level decarbonization policies, robust incentive programs, and expanding waste-to-energy infrastructure. Strategic investments from energy developers, agricultural cooperatives, and private equity firms, coupled with growing corporate sustainability commitments, are enabling rapid capacity expansion. As methane-reduction regulations tighten and renewable gas integration increases across industrial and commercial sectors, the U.S. is expected to remain a dominant force in the global RNG landscape, supported by technological innovation, abundant feedstock availability, and continued policy support.

Europe America Renewable Natural Gas (RNG) Market Trends

Europe represents a highly advanced and policy-driven renewable natural gas (RNG) industry, supported by ambitious decarbonization targets, stringent methane-reduction regulations, and strong incentives for integrating renewable gas into national energy systems. Countries such as Germany, France, the UK, Denmark, and Italy are leading deployment, leveraging agricultural waste, municipal solid waste, and wastewater resources to scale biomethane production and grid injection. EU initiatives under RED II/III, carbon pricing frameworks, and the growth of green gas certification and trading schemes have accelerated investment in biogas upgrading facilities and pipeline infrastructure.

Asia-Pacific Renewable Natural Gas (RNG) Market Trends

The Asia-Pacific region is emerging as a high-growth market, contributing roughly a 20% share in 2024, driven by rapid industrialization, expanding waste-to-energy initiatives, and increasing policy focus on methane reduction and the adoption of clean fuels. Countries such as China, Japan, India, and South Korea are investing heavily in biogas upgrading facilities and supportive regulatory frameworks to integrate RNG into transportation and industrial energy systems. The growing generation of organic waste from agriculture, food processing, and urban municipalities, combined with an increasing emphasis on circular economy models, is prompting local governments and private developers to scale RNG projects. As regional economies strengthen their sustainability targets and energy security priorities, the Asia-Pacific is poised for sustained growth and increased global influence in the RNG market.

Latin America Renewable Natural Gas (RNG) Market Trends

The Latin America renewable natural gas (RNG) industry is gaining momentum, supported by rising interest in waste-to-energy projects, expanding agricultural and livestock sectors, and increasing government focus on decarbonization and circular economy strategies. Supportive policies for renewable fuels, growing investment from international energy players, and partnerships between agricultural cooperatives and technology providers are accelerating infrastructure development and pipeline injection projects.

Middle East & Africa Renewable Natural Gas (RNG) Market Trends

The Middle East & Africa renewable natural gas (RNG) market is at a nascent but rapidly developing stage, supported by rising commitments to decarbonization, circular economic initiatives, and diversification of energy portfolios beyond fossil fuels. Growing interest from utilities, international energy companies, and technology providers, paired with regional ambitions to lead in low-carbon fuels and renewable gas innovation, is further boosting market activity. While infrastructure development and regulatory frameworks are still in their early stages, increasing public-private partnerships, rising demand for clean transportation fuels, and emerging green financing mechanisms position the region as a strategic future growth opportunity for the global RNG market.

Key Renewable Natural Gas (RNG) Company Insights

Some of the key players operating in the global renewable natural gas (RNG) market include Clean Energy Fuels Corp., Archaea Energy Inc. (a subsidiary of BP), Montauk Renewables Inc., Brightmark LLC, Xebec Adsorption Inc., Ameresco Inc., Waste Management Inc., Air Liquide S.A., FortisBC Energy Inc., and Renewi PLC. These companies are actively engaged in developing, producing, and distributing renewable natural gas from organic waste, landfill gas, and agricultural residues.

Key Renewable Natural Gas (RNG) Companies:

The following are the leading companies in the renewable natural gas (RNG) market. These companies collectively hold the largest market share and dictate industry trends.

- Clean Energy Fuels Corp.

- Archaea Energy Inc.

- Xebec Adsorption Inc.

- Brightmark LLC

- Ameresco Inc.

- Montauk Renewables Inc.

- Waste Management Inc.

- Renewi PLC

- Air Liquide S.A.

- FortisBC Energy Inc.

Recent Developments

- In March 2025, Clean Energy Fuels Corp. announced the opening of a new renewable natural gas (RNG) production facility in Tulare County, California, developed in partnership with local dairy farms. The project is designed to capture methane emissions from dairy manure and convert them into clean RNG for transportation use. Once fully operational, the facility is expected to produce over 2.5 million gallons of RNG annually, reducing approximately 25,000 metric tons of CO₂-equivalent emissions each year-supporting California’s Low Carbon Fuel Standard (LCFS) and the company’s goal of achieving a carbon-negative fuel network across North America.

Renewable Natural Gas (RNG) Market Report Scope

Report Attribute

Details

Market Definition

Capital spending by energy producers, utilities, and waste management companies directly targeting the production, upgrading, and distribution of Renewable Natural Gas (RNG) from organic waste feedstocks such as agricultural residues, landfills, and wastewater

Market size value in 2025

USD 16.30 billion

Revenue forecast in 2033

USD 30.13 billion

Growth rate

CAGR of 8.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD Million/Billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Source, application and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Clean Energy Fuels Corp.; Archaea Energy Inc.; Xebec Adsorption Inc.; Brightmark LLC; Ameresco Inc.; Montauk Renewables Inc.; Waste Management Inc.; Renewi PLC; Air Liquide S.A.; FortisBC Energy Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Renewable Natural Gas (RNG) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global renewable natural gas (RNG) market report based on source, application, and region.

-

Source Outlook (Revenue, USD Million, 2021-2033)

-

Landfills

-

Agricultural Residue

-

Livestock Manure

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021-2033)

-

Transportation Fuel

-

Electricity Generation

-

Utility Distribution

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021-2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global renewable natural gas market size was estimated at USD 15.17 billion in 2024 and is expected to reach USD 30.13 billion in 2025.

b. The global renewable natural gas market is expected to grow at a compound annual growth rate of 7.98% from 2025 to 2033 to reach USD 30.13 billion by 2033.

b. Based on the source segment, landfills held the largest revenue share of more than 42% in 2024.

b. Some of the key players operating in the RNG market include Clean Energy Fuels Corp.; Archaea Energy Inc.; Xebec Adsorption Inc.; Brightmark LLC; Ameresco Inc.; Montauk Renewables Inc.; Waste Management Inc.; Renewi PLC; Air Liquide S.A.; and FortisBC Energy Inc.

b. The renewable natural gas (RNG) market is primarily driven by rising decarbonization mandates, increasing adoption of waste-to-energy solutions, and strong policy incentives supporting renewable fuel integration. Growing corporate sustainability commitments and expanding applications in transportation, industrial processes, and utility gas networks are further accelerating market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.