- Home

- »

- IT Services & Applications

- »

-

Saudi Arabia Enterprise Resource Planning Software Market Report 2033GVR Report cover

![Saudi Arabia Enterprise Resource Planning Software Market Size, Share & Trends Report]()

Saudi Arabia Enterprise Resource Planning Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Function (Finance, HR, Supply Chain), By Deployment (Cloud, On-premise), By Enterprise Size, By Vertical, And Segment Forecasts

- Report ID: GVR-4-68040-789-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Saudi Arabia ERP Software Market Summary

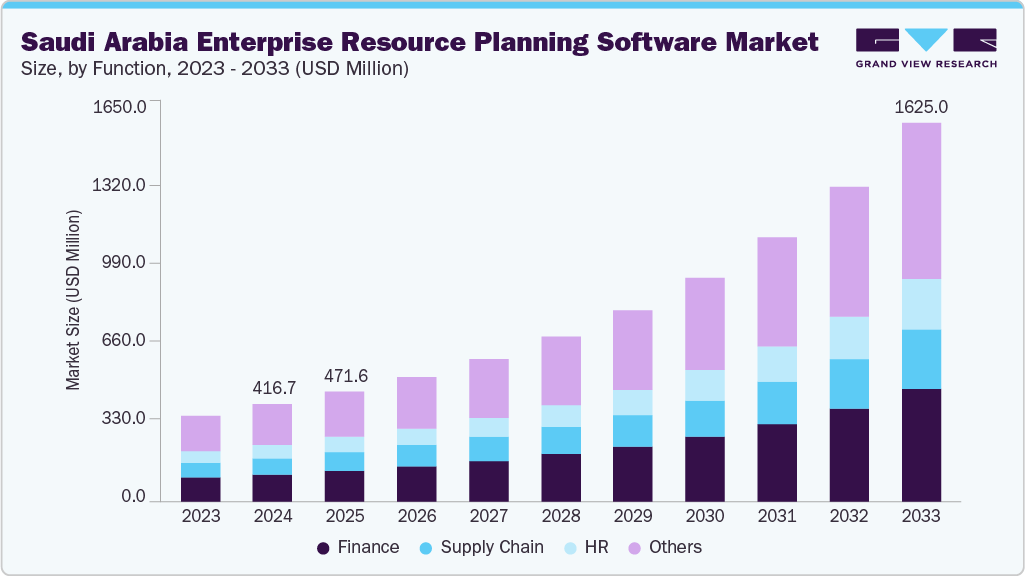

The Saudi Arabia enterprise resource planning (ERP) software market size was estimated at USD 416.7 million in 2024 and is projected to reach USD 1,625.0 million by 2033, growing at a CAGR of 15.2% from 2025 to 2033. The growth is attributed to the growing digital transformation initiatives across both public and private sectors.

Key Market Trends & Insights

- By function, the finance segment led the market and held the largest revenue share of 28.4% in 2024.

- By deployment, the on-premise segment held the dominant position in the market and accounted for the largest revenue share in 2024.

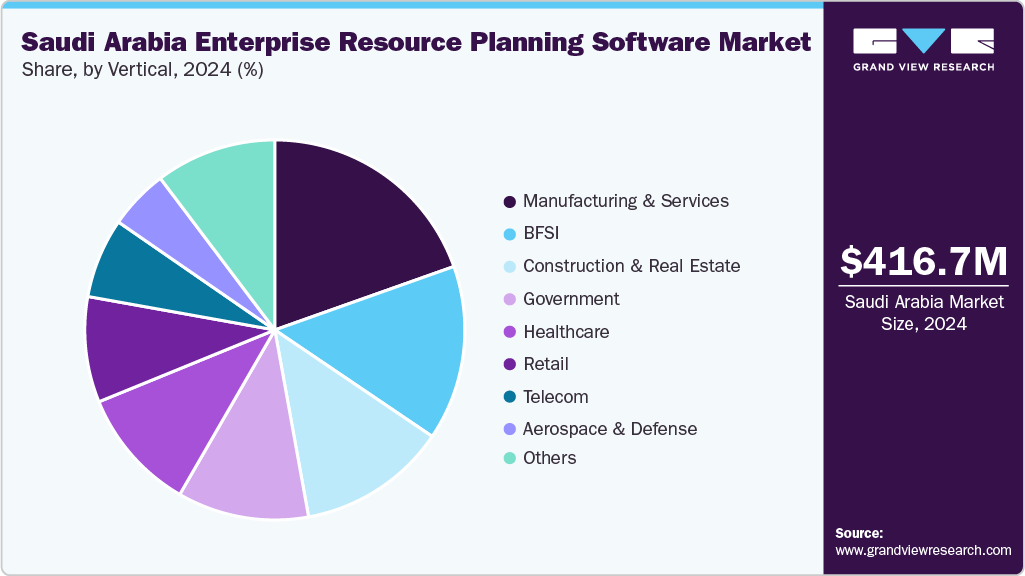

- By vertical, the aerospace & defense segment is expected to grow at the fastest CAGR from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 416.7 Million

- 2033 Projected Market Size: USD 1,625.0 Million

- CAGR (2025-2033): 15.2%

Saudi businesses are investing heavily in modern IT infrastructure to align with global standards, and enterprise resource planning (ERP) solutions are becoming essential in this process. Traditional on-premises systems are gradually being replaced by cloud deployments, which offer greater scalability, lower upfront costs, and enhanced accessibility for geographically distributed operations. In Saudi Arabia, this trend is accelerated by government initiatives under Vision 2030, which promote digital transformation across public and private sectors. Companies such as Saudi Aramco, SABIC, and major banks are increasingly adopting cloud ERP platforms from providers such as SAP, Oracle, and Microsoft to enable real-time data access, improve collaboration, and streamline operations across multiple locations.The accelerating pace of digital workforce adoption increasingly influences the Saudi Arabia enterprise resource planning (ERP) software market. Organizations in the Kingdom are focusing on upskilling employees and integrating digital tools into everyday operations. This shift has created a strong demand for ERP systems that support collaborative workflows, remote access, and mobile functionality. By enabling employees to access real-time data and manage tasks from anywhere, ERP solutions help companies enhance productivity and operational agility. Businesses in sectors such as logistics, retail, and professional services are especially leveraging this trend to improve workforce efficiency and responsiveness in a rapidly evolving business environment.

The stringent financial and corporate governance regulations introduced by the Saudi Capital Market Authority (CMA) and the Ministry of Commerce are another significant regulatory trend. These regulations require enterprises to maintain accurate financial records, implement robust internal controls, and ensure timely disclosure of financial statements. ERP systems provide integrated modules for accounting, auditing, and reporting, helping companies comply with these governance mandates. Large corporations and publicly listed companies, such as Saudi Aramco and Saudi Telecom Company (STC), leverage ERP platforms to streamline compliance, improve transparency, and facilitate efficient reporting to regulators.

Function Insights

The finance segment dominated the market and accounted for the revenue share of 28.4% in 2024, driven by regulatory and tax compliance is one of the strongest factors driving demand for Saudi Arabia ERP software in the finance segment. The Zakat, Tax and Customs Authority (ZATCA) has made e-invoicing (Fatoora) mandatory, rolling it out in phases with increasing technical requirements such as XML formatting, QR codes, and real-time integration with ZATCA’s platform.

The human resource (HR) segment is anticipated to grow at the fastest CAGR during the forecast period. Regulatory compliance and Saudization mandates are among the most powerful drivers of ERP adoption in the HR segment. The Saudi government continues to enforce the Nitaqat program, which sets minimum quotas for Saudi nationals in the workforce across hundreds of professions. Moreover, frequent labor law amendments and wage protection regulations also create demand for robust HR modules.

Deployment Insights

The on-premise segment dominated the market and accounted for the largest revenue share in 2024. Saudi Arabian organizations, particularly in sectors such as government, defense, and critical infrastructure, often prioritize on-premise ERP solutions to maintain control over sensitive data. This approach ensures compliance with local data protection laws and national security regulations, which may impose restrictions on data storage and processing outside the country.

The cloud segment is expected to grow at a significant CAGR during the forecast period. Cloud-based ERP solutions offer businesses in Saudi Arabia the ability to scale their operations quickly and efficiently without the need for significant upfront IT investments. Organizations, particularly in the rapidly growing SME sector, are increasingly favoring cloud deployment because it allows them to expand their ERP capabilities as their business needs evolve.

Enterprise Size Insights

The medium enterprises segment dominated the market and accounted for the largest revenue share in 2024. The financial accessibility and technological advantages of cloud-based ERP solutions have been a game-changer for this segment. Unlike large enterprises that might have the capital for costly on-premise implementations, medium businesses are highly sensitive to upfront costs. The subscription-based Software-as-a-Service (SaaS) model of cloud ERP converts a large capital expenditure (CAPEX) into a predictable operational expense (OPEX), making it financially viable

The small enterprises segment is expected to grow at a significant CAGR during the forecast period due to urgent need for operational efficiency and process integration. Many SMEs initially rely on spreadsheets, basic accounting tools, and manual record-keeping, which quickly become inadequate as business volumes grow, leading to errors, inventory mismanagement, delays in order fulfillment, and difficulties in tracking customer interactions.

Vertical Insights

The manufacturing & services segment dominated the market and accounted for the largest revenue share in 2024. The ongoing Industry 4.0 transformation in Saudi Arabia is fundamentally reforming the manufacturing sector’s digital requirements. As companies invest heavily in automation, robotics, IoT, and data-driven technologies, traditional accounting-focused ERP systems are no longer sufficient. Manufacturers increasingly require integrated platforms that seamlessly connect shop-floor machinery, production lines, and operational data to enterprise-level systems

The aerospace & defense segment is expected to grow at a significant CAGR over the forecast period. Integration with national data initiatives is a critical driver for ERP adoption in Saudi Arabia’s aerospace & defense sector because it enables seamless connectivity and interoperability across multiple government and defense entities. ERP systems that are integrated with centralized national data platforms allow A&D organizations to consolidate information from procurement, inventory management, manufacturing, and project management systems into a unified framework.

Key Saudi Arabia Enterprise Resource Planning Software Company Insights

Key players operating in the Saudi Arabia enterprise resource planning (ERP) software industry are Zumtobel Group AG, Vode Lighting LLC, and Acuity Brands, Inc., and GVA Lighting. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Saudi Arabia Enterprise Resource Planning Software Companies:

- Focus Softnet Pvt Ltd

- Frappe

- IFS AB

- Microsoft

- Odoo

- Oracle

- SAP SE

- Seidor

- Tawatur IT

- Zoho Corporation Pvt. Ltd.

Recent Developments

-

In August 2025, Oracle and Google Cloud have announced an expanded partnership is expected to make Google's Gemini AI models available through Oracle Cloud Infrastructure (OCI).

-

In July 2025, Zoho Corporation Pvt. Ltd. introduced an Agent Marketplace, adding over 25 new Zia Agents across its product suite. These agents are designed to automate tasks in areas such as customer service, sales, and account management, enhancing operational efficiency.

-

In May 2025, Zumtobel Group AG launched the second generation of its continuous-row lighting system, combining advanced functionality, refined design, and ultra-efficient installation. With the launch of TECTON II, the company sets a new benchmark in lighting technology. In collaboration with the engineering firm Pininfarina, Zumtobel has enhanced its universal trunking system with innovative features in technology, design, and sustainability. The system includes quick-to-install track and batten components, all manufactured at the company’s facility in Dornbirn, Austria.

Saudi Arabia Enterprise Resource Planning Software Market Report Scope

Report Attribute

Details

Market size in 2025

USD 471.6 million

Revenue forecast in 2033

USD 1,625.0 million

Growth rate

CAGR of 15.2% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Function, deployment, enterprise size, vertical

Key companies profiled

Focus Softnet Pvt Ltd; Frappe; IFS AB; Microsoft; Odoo; Oracle; SAP SE; Seidor; Tawatur IT; Zoho Corporation Pvt. Ltd.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Saudi Arabia Enterprise Resource Planning Software Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Saudi Arabia enterprise resource planning (ERP) software market report based on function, deployment, enterprise size, and vertical:

-

Function Outlook (Revenue, USD Million, 2021 - 2033)

-

Finance

-

Human Resource (HR)

-

Supply Chain

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprises

-

Medium Enterprises

-

Small Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Manufacturing

-

BFSI

-

Healthcare

-

Retail

-

Government

-

Aerospace & Defense

-

Telecom

-

Construction & Real Estate

-

Others

-

Frequently Asked Questions About This Report

b. The global Saudi Arabia enterprise resource planning software market size was estimated at USD 416.7 million in 2024 and is expected to reach USD 471.6 million in 2025.

b. The global Saudi Arabia enterprise resource planning software market is expected to grow at a compound annual growth rate of 15.2% from 2025 to 2033 to reach USD 1,625.0 million by 2033.

b. The finance segment dominated the market and accounted for the revenue share of 28.4% in 2024, driven by regulatory and tax compliance is one of the strongest factors driving demand for Saudi Arabia ERP software in the finance segment.

b. Some key players operating in the Saudi Arabia ERP software market include Focus Softnet Pvt Ltd, Frappe, IFS AB, Microsoft, Odoo, Oracle, SAP SE, Seidor, Tawatur IT, Zoho Corporation Pvt. Ltd.

b. The growing digital transformation initiatives across the public and private sectors drive the Saudi Arabia enterprise resource planning (ERP) software market. Saudi businesses are investing heavily in modern IT infrastructure to align with global standards, and ERP solutions are becoming essential in this process.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.