- Home

- »

- Medical Devices

- »

-

Small Bore Connectors Market Size, Industry Report, 2033GVR Report cover

![Small Bore Connectors Market Size, Share & Trends Report]()

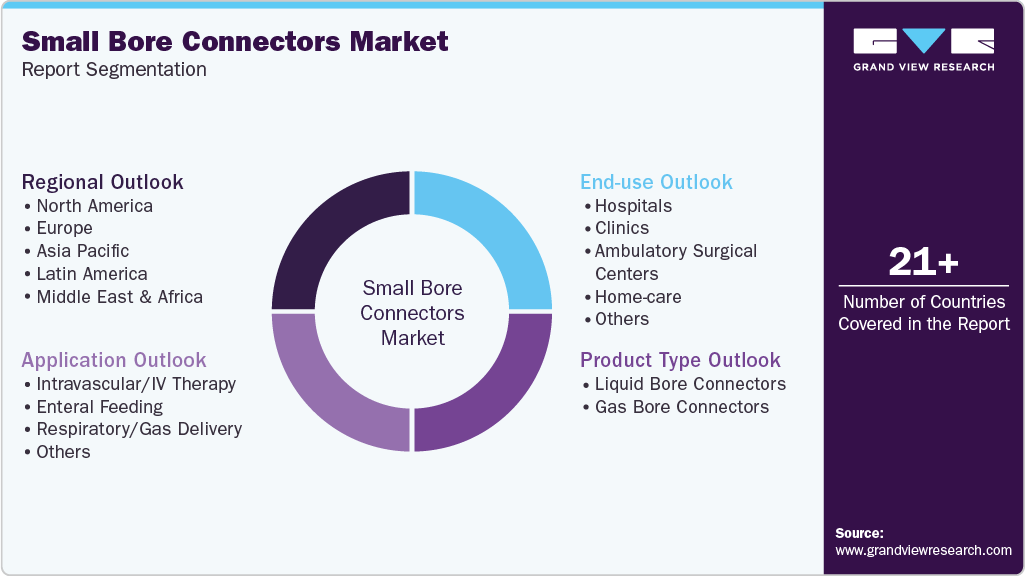

Small Bore Connectors Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Liquid Bore Connectors, Gas Bore Connectors), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-823-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Small Bore Connectors Market Summary

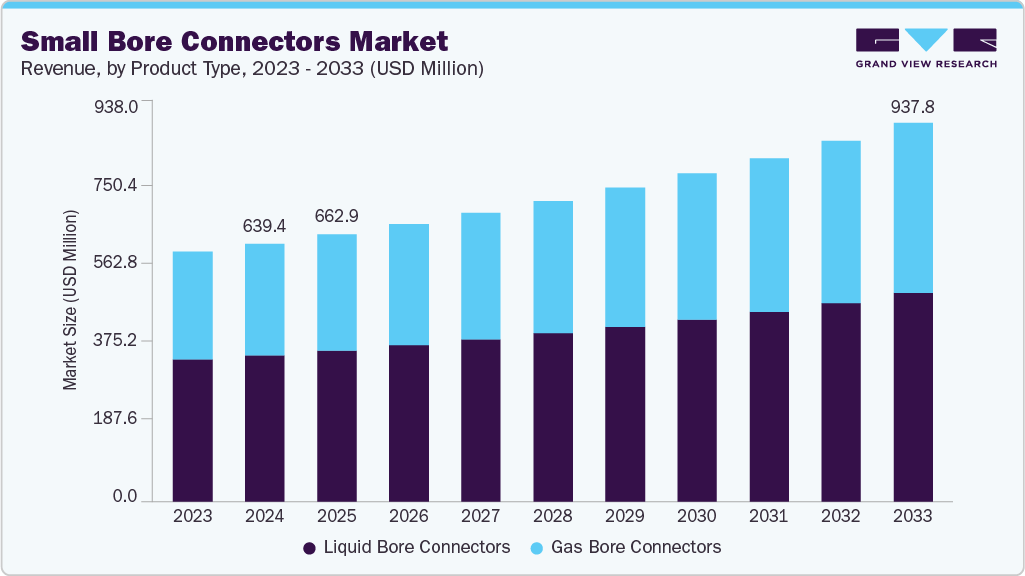

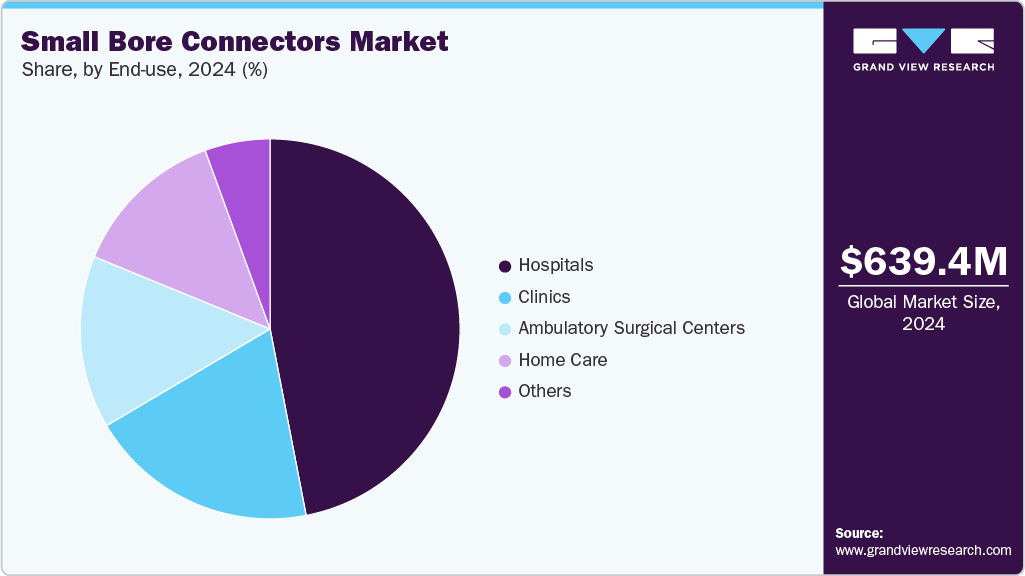

The global small bore connectors market size was estimated at USD 639.37 million in 2024 and is projected to reach USD 937.78 million by 2033, growing at a CAGR of 4.43% from 2025 to 2033. The market is primarily driven by the rising prevalence of chronic diseases that require long-term vascular, enteral, and respiratory therapies, leading to increased use of medical connectors.

Key Market Trends & Insights

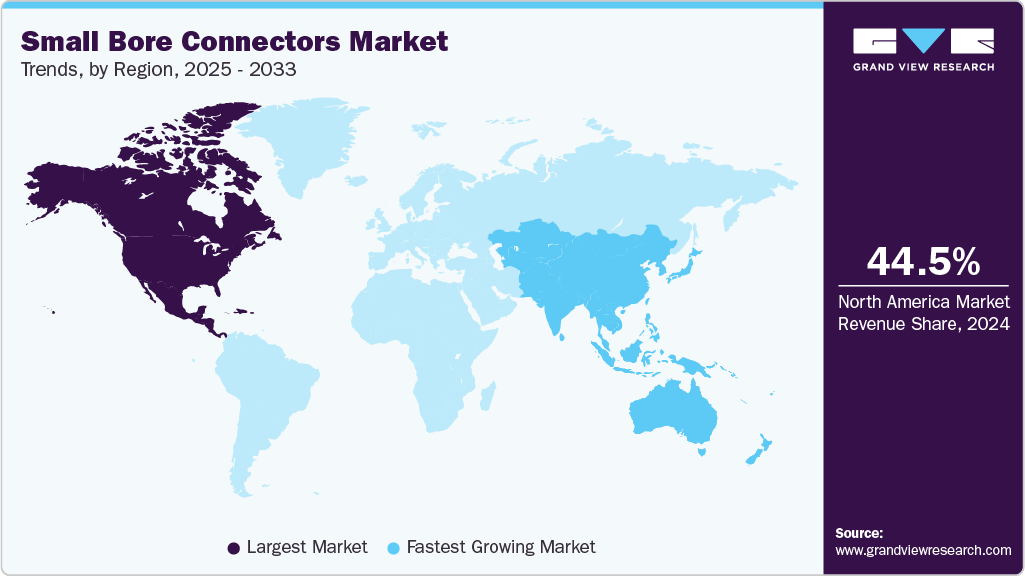

- North America dominated the small bore connectors market with the largest revenue share of 44.53% in 2024.

- The small bore connectors market in the U.S. accounted for the largest market revenue share of 83.49% in North America in 2024.

- Based on product type, the liquid bore connectors segment led the market with the largest revenue share of 56.73% in 2024.

- Based on application, the intravascular / IV therapy segment led the market with the largest revenue share of 29.51% in 2024.

- Based on end use, the hospitals segment led the market with the largest revenue share of 46.96% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 639.37 Million

- 2033 Projected Market Size: USD 937.78 Million

- CAGR (2025-2033): 4.43%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing demand for patient safety and the need to reduce the risk of misconnections have accelerated the adoption of standardized small-bore connectors, like those compliant with ISO 80369. The expansion of hospitals and ambulatory care centers, coupled with advancements in medical device technology, is fueling market growth.

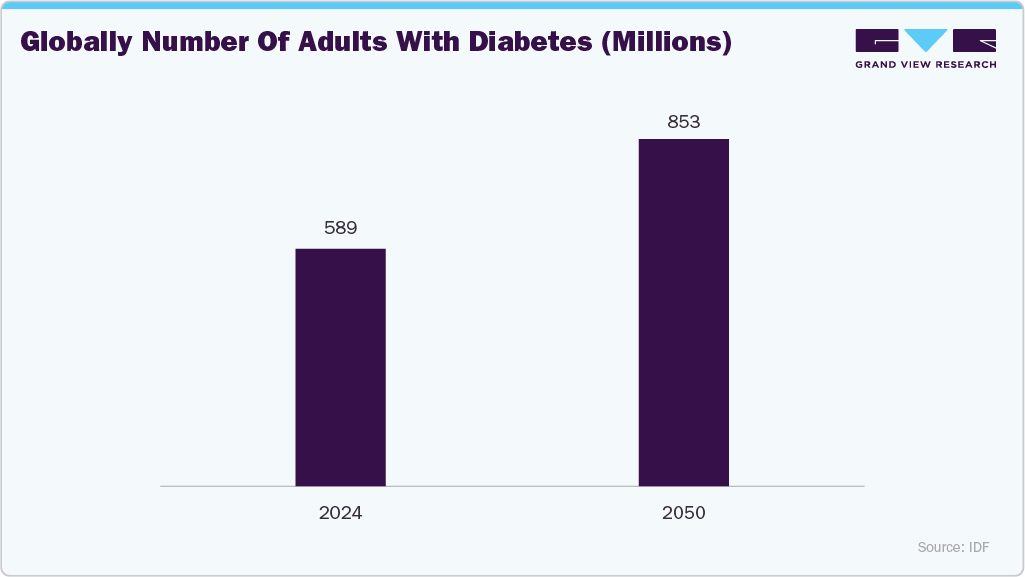

The growing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders is a key factor driving the small-bore connector market. Patients with these conditions often require continuous administration of medications, nutrition, or fluids through intravenous, enteral, or respiratory systems, increasing the demand for reliable connectors. Small-bore connectors ensure safe and efficient delivery of treatments, minimizing the risk of misconnections and contamination. As the global burden of chronic diseases continues to rise, healthcare facilities are increasingly adopting advanced connector systems to enhance patient safety and treatment efficiency.

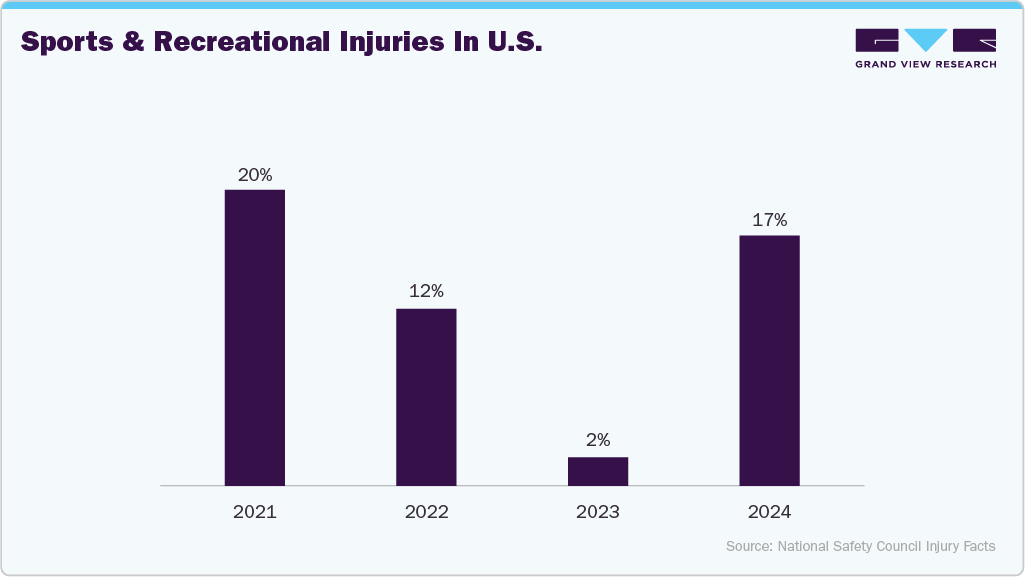

The increasing incidence of sports-related injuries is a significant factor driving the growth of the small bore connector industry. Athletes and active individuals frequently experience fractures, joint dislocations, and soft tissue injuries that require surgical intervention, intravenous therapy, or pain management, all of which rely on safe and efficient fluid and medication delivery systems. Small-bore connectors play a crucial role in ensuring secure connections between medical devices during these treatments, minimizing the risk of misconnections or leakage. As participation in sports and fitness activities rises globally, the demand for reliable and standardized small-bore connectors in hospitals and ambulatory surgical centers continues to grow.

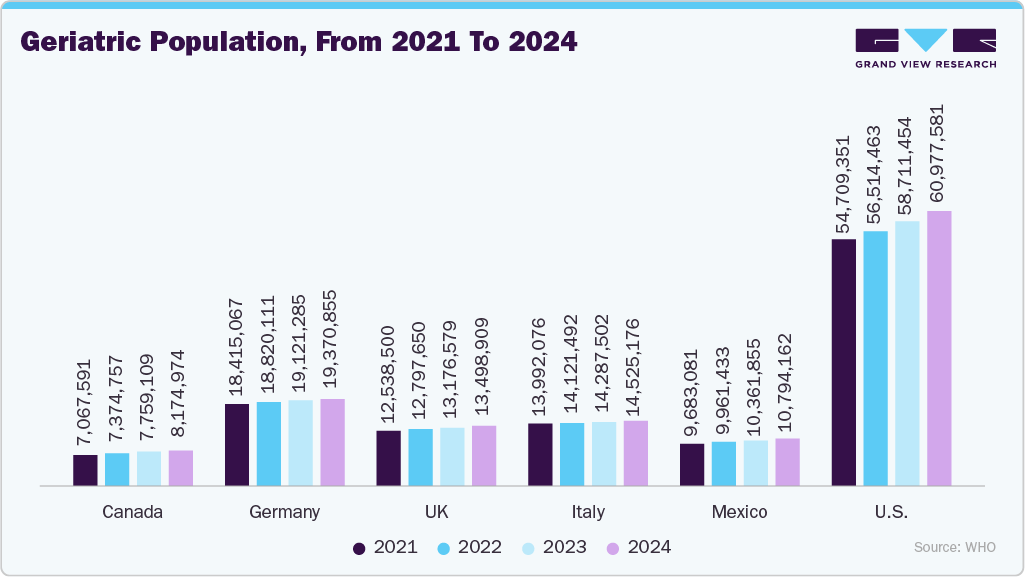

The growing geriatric population is a key factor driving the small bore connectors industry. Elderly individuals are more prone to chronic diseases such as cardiovascular disorders, diabetes, and respiratory illnesses, which often require long-term medical treatments involving intravenous, enteral, or respiratory therapies. Small-bore connectors play a vital role in safely delivering fluids, medications, and nutrition to aging patients. As the global elderly population continues to rise, the demand for reliable, easy-to-use, and standardized connectors in hospitals, home care, and long-term care settings is increasing, thereby propelling market growth.

The growing demand for patient safety is a major driver of the small bore connector industry. Healthcare providers are increasingly focused on reducing medical errors, particularly misconnections between devices that deliver fluids, gases, or medications. Small-bore connectors designed under the ISO 80369 standard help prevent such risks by ensuring incompatible systems cannot be connected incorrectly. This emphasis on safety has led hospitals and surgical centers to adopt advanced, standardized connectors that enhance accuracy and infection control. As global awareness of patient safety standards continues to rise, the demand for reliable and compliant small-bore connectors is growing.

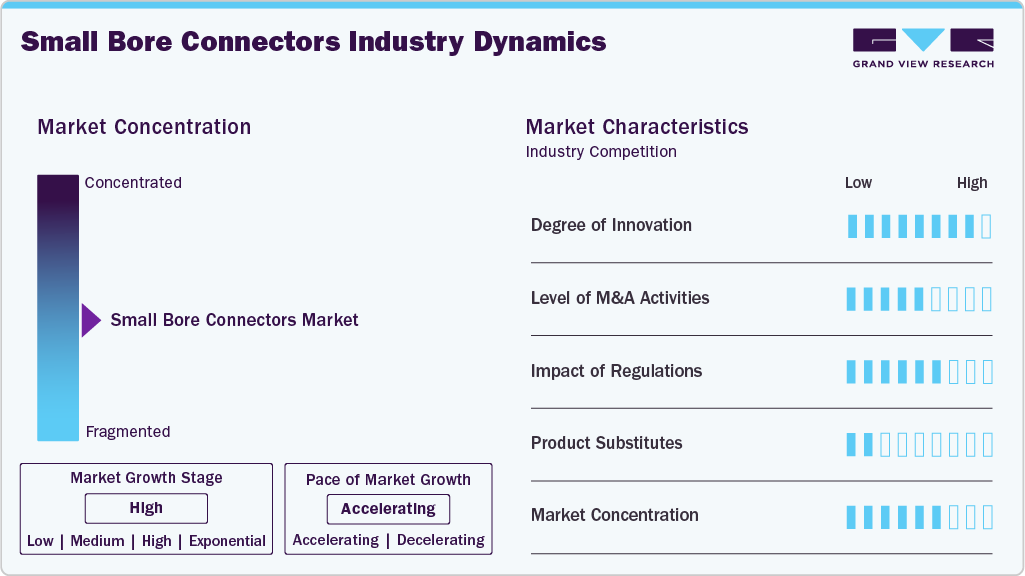

Market Concentration & Characteristics

The small bore connector industry demonstrates a high degree of innovation, driven by the growing need for enhanced patient safety and prevention of misconnections in healthcare settings. Manufacturers are developing connectors with advanced designs, color-coding, and material improvements to ensure compatibility and reliability. Innovations such as needle-free and anti-misconnection technologies are transforming clinical efficiency and reducing the risk of infections. Continuous research and development efforts are also leading to smarter, ergonomically designed connectors that meet evolving regulatory and clinical requirements.

Regulations have a significant impact on the small bore connector industry, as stringent safety standards drive the adoption of standardized connector systems to prevent misconnections. Regulatory frameworks like ISO 80369 have mandated design and testing requirements, ensuring product safety and compatibility across medical applications. These regulations encourage manufacturers to invest in innovation and product development that prioritizes compliance. While regulatory adherence increases manufacturing costs, it ultimately enhances patient safety and market reliability.

The small bore connector industry has witnessed a moderate level of mergers and acquisitions, primarily aimed at expanding product portfolios and strengthening global market presence. Leading medical device companies are acquiring smaller firms with innovative connector technologies to enhance their competitive edge. These strategic moves help integrate advanced safety features and meet evolving regulatory standards. In addition, mergers facilitate greater R&D capabilities and access to new regional markets, supporting overall industry growth and consolidation.

In the small bore connector industry, product substitutes are limited due to the specialized role these connectors play in ensuring safe and precise fluid and gas transfer in medical applications. However, alternatives like luer lock connectors and quick-disconnect fittings are sometimes used in specific procedures. Despite this, small bore connectors remain preferred for their standardized design and compliance with safety regulations. Their ability to minimize misconnections and infection risks makes substitutes less viable in critical healthcare environments.

Product Type Insights

The liquid bore connector segment accounted for the largest market revenue share in 2024. Driven by their widespread use in fluid management, drug delivery, and infusion therapy applications. The growing demand for safe and standardized connectors that prevent cross-contamination and misconnections has strengthened this segment’s position. Hospitals and clinics rely heavily on liquid bore connectors for precise and reliable fluid transfer. In addition, advancements in connector materials and designs have enhanced durability, compatibility, and overall clinical efficiency, further supporting market dominance.

The gas bore connector segment is expected to register at the fastest CAGR from 2025 to 2033, driven by increasing demand for reliable connections in respiratory and anesthesia applications. Growing adoption of advanced medical gas delivery systems in hospitals and clinics is fueling segment growth. Technological advancements focused on safety, leak prevention, and easy identification of gas lines are further boosting market adoption. In addition, the rising number of surgical procedures and expanding critical care infrastructure are supporting the rapid expansion of this segment.

Application Insights

The intravascular/IV therapy segment accounted for the largest market revenue share in 2024, driven by the widespread use of IV systems for medication administration, hydration, and nutrition in hospitals and clinics. The demand for reliable and safe fluid transfer systems has led to the adoption of standardized small bore connectors that reduce the risks of misconnections. The increasing number of surgical procedures and chronic disease treatments has further boosted the use of IV therapy devices. In addition, continuous improvements in connector design and material quality have enhanced safety, efficiency, and overall clinical outcomes.

The enteral feeding segment is anticipated to grow at the fastest CAGR during the forecast period, due to the increasing prevalence of chronic diseases and the rising demand for long-term nutritional support among patients. The adoption of enteral feeding systems with advanced connector designs, like ENFit, is driven by safety regulations aimed at preventing misconnections. Growing awareness of proper enteral nutrition and the expanding geriatric population further support market growth. Continuous technological improvements in feeding devices are enhancing patient safety and fueling segment expansion.

End Use Insights

The hospitals segment accounted for the largest market revenue share in 2024, due to the high volume of medical procedures and the widespread adoption of advanced medical devices. Hospitals require reliable and standardized connectors to ensure safe fluid and medication delivery, driving consistent demand. The growing number of surgeries and increasing focus on infection control have further strengthened the segment’s position. The rising investments in healthcare and the integration of innovative connector technologies have enhanced patient safety and operational efficiency within hospital settings.

The ambulatory surgical centers segment is expected to witness at the fastest CAGR over the forecast period. Driven by the rising preference for minimally invasive and outpatient procedures. These centers increasingly adopt advanced connector systems to ensure patient safety and efficient fluid management during surgeries. Cost-effective treatment options and shorter recovery times have boosted patient inflow, further supporting market growth. In addition, the integration of standardized and safety-compliant connectors enhances procedural accuracy and reduces the risk of medical errors in these facilities.

Regional Insights

North America dominated the small bore connectors market with the largest revenue share of 44.53% in 2024. The growth is driven by increasing adoption of advanced medical devices and stringent regulatory standards for patient safety. The rising prevalence of chronic diseases, coupled with an aging population, is driving the demand for safe and efficient fluid and gas transfer systems in healthcare settings. Technological innovations in connector designs aimed at preventing misconnections are further shaping market trends across the region. In addition, the rising number of surgical procedures and expanding healthcare infrastructure continue to support market growth.

U.S. Small Bore Connectors Market Trends

The small bore connectors market in the U.S. accounted for the largest market revenue share of 83.49% in North America in 2024, primarily driven by the rising demand for advanced and safe medical devices across hospitals and ambulatory surgical centers. The market is benefiting from strong regulatory enforcement promoting the use of standardized connectors to reduce medical errors and enhance patient safety. The increasing incidence of chronic diseases and a growing number of minimally invasive procedures are further fueling demand. Continuous technological advancements in connector design and materials are improving product performance and reliability. The country’s well-established healthcare infrastructure and high investment in medical innovation continue to strengthen market expansion.

Europe Small Bore Connectors Market Trends

The small bore connectors market in Europe is witnessing significant growth, driven by the rising adoption of advanced healthcare technologies and an increasing focus on patient safety. Strict regulatory frameworks established by European health authorities are encouraging the use of standardized connectors to minimize the risk of misconnections in clinical settings. The growing burden of chronic diseases and the expanding elderly population are contributing to higher demand for reliable fluid and gas transfer systems. Furthermore, ongoing advancements in medical device design and manufacturing are supporting market innovation. Strong healthcare infrastructure and government initiatives to improve medical safety standards are further propelling market growth across the region.

The UK small bore connectors market is largely driven due to increasing emphasis on patient safety and compliance with stringent regulatory standards in healthcare facilities. The country’s strong focus on reducing medical errors and preventing misconnections is driving the adoption of standardized small-bore connectors. The rising prevalence of chronic illnesses and an aging population are also boosting demand for advanced medical devices. In addition, the growing number of surgical procedures and expanding use of infusion and monitoring systems are supporting market growth. Continuous innovation by domestic and international manufacturers is further enhancing the efficiency and reliability of small-bore connectors in the UK healthcare sector.

Asia Pacific Small Bore Connectors Market Trends

The small bore connectors market in the Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2033. Fueled by growing healthcare infrastructure and rising investments in medical device manufacturing. The increasing prevalence of chronic diseases, coupled with a growing geriatric population, is driving the demand for safe and efficient fluid management systems. Countries such as China, India, and Japan are witnessing higher adoption of advanced connectors in hospitals and clinics. Moreover, rising awareness about patient safety and the implementation of international quality standards are boosting market growth. Continuous technological advancements and the presence of cost-effective manufacturing capabilities further strengthen the region’s position in the global market.

The China small bore connectors market is experiencing significant growth, driven by the rapid expansion of healthcare facilities and increasing government initiatives aimed at enhancing medical safety standards. The rising demand for advanced medical devices and infusion systems is driving the adoption of high-quality small-bore connectors. The growing prevalence of chronic diseases and an aging population further contribute to market expansion. Domestic manufacturers are increasingly focusing on product innovation and compliance with international standards to compete effectively in the global market. Favorable manufacturing conditions and rising healthcare investments are positioning China as a key player in the global market.

Latin America Small Bore Connectors Market Trends

The small bore connectors market in Latin America is growing moderately, driven by the expanding healthcare sector and a growing focus on patient safety. The rising incidence of chronic diseases and growing demand for advanced medical devices are driving the adoption of standardized small-bore connectors across hospitals and clinics. Countries such as Brazil and Mexico are leading the market due to their improving healthcare infrastructure and government initiatives aimed at enhancing medical standards. In addition, increasing awareness of infection control and prevention of misconnections is supporting market demand. The presence of global and regional manufacturers introducing cost-effective and innovative products further contributes to market growth in the region.

Middle East Africa Small Bore Connectors Market Trends

The small bore connectors market in the Middle East and Africa is anticipated to witness at a significant CAGR during the forecast period, driven by expanding healthcare infrastructure and rising investments in medical technology. The increasing prevalence of chronic and lifestyle-related diseases is fueling the demand for reliable and safe fluid management systems. Governments across the region are emphasizing healthcare modernization and patient safety, which is promoting the use of standardized small-bore connectors. The market is also supported by the growing adoption of advanced medical devices in hospitals and specialty clinics. Furthermore, collaborations with international manufacturers and the establishment of local production facilities are enhancing market accessibility and driving regional growth.

Key Small Bore Connectors Company Insights

The small-bore connectors industry is competitive, driven by key players focusing on innovation, safety, and ISO 80369 compliance. Companies are investing in R&D, product launches, and strategic collaborations to enhance patient safety and expand their global presence. Continuous advancements and emphasis on standardization define the market landscape.

Key Small Bore Connectors Companies:

The following are the leading companies in the small bore connectors market. These companies collectively hold the largest market share and dictate industry trends.

- Baxter International Inc.

- B. Braun

- BD

- Smiths Medical - Smiths Group Company

- ICU Medical Inc

- Merit Medical Systems, Inc.

- Elcam Medical

- Nordson Corporation

- CPC (Colder Products Company)

Recent Developments

- In September 2021, CPC (Colder Products Company), a division of Dover and manufacturer of a wide range of single-use connectors, today announced the launch of the new MicroCNX Series Connectors. These ultra-compact sterile connectors provide biopharmaceutical manufacturers with a much-needed alternative to tube welding for small-volume, closed, aseptic processes. Designed as the industry’s first aseptic connectors for small-format assemblies, MicroCNX Series Connectors provide a simple and efficient solution for connecting tubing.

Small Bore Connectors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 662.89 million

Revenue forecast in 2033

USD 937.78 million

Growth rate

CAGR of 4.43% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, end use,region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE.

Key companies profiled

Baxter International Inc.; B. Braun; BD; Smiths Medical - Smiths Group Company; ICU Medical Inc; Merit Medical Systems, Inc.; Elcam Medical; Nordson Corporation; CPC (Colder Products Company)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Small Bore Connectors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global small bore connectors market report based on the product type, application, end use, and region:

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Liquid Bore Connectors

-

Gas Bore Connectors

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Intravascular / IV Therapy

-

Enteral Feeding

-

Respiratory / Gas Delivery

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

Home-care

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global small bore connectors market size was estimated at USD 639.37 million in 2024 and is projected to reach USD 662.89 million by 2025.

b. The global small bore connectors market is expected to growt at a CAGR of 4.43% from 2025 to 2033.

b. The liquid bore connector segment accounted for the largest revenue share of 56.73% in the small bore connectors market in 2024 driven by their widespread use in fluid management, drug delivery, and infusion therapy applications.

b. Some of the key players operating in the market include Baxter International Inc., B. Braun, BD, Smiths Medical - Smiths Group Company, ICU Medical Inc, Merit Medical Systems, Inc., Elcam Medical, Nordson Corporation, and CPC (Colder Products Company), among others.

b. The small bore connectors market is primarily driven by the rising prevalence of chronic diseases that require long-term vascular, enteral, and respiratory therapies, leading to increased use of medical connectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.