- Home

- »

- Plastics, Polymers & Resins

- »

-

Stainless Steel-Filled Polymer Filaments Market Report, 2030GVR Report cover

![Stainless Steel-Filled Polymer Filaments Market Size, Share & Trends Report]()

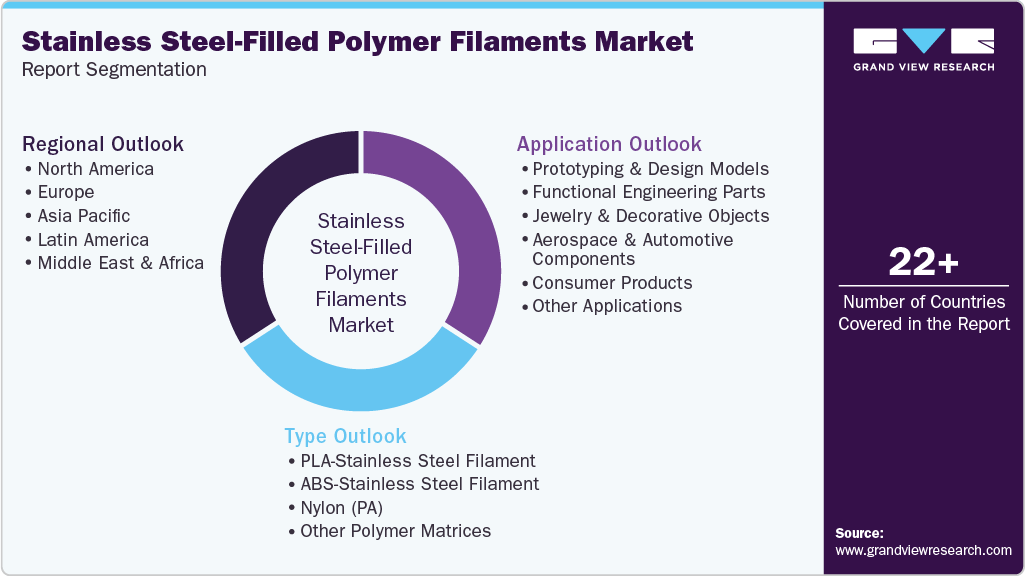

Stainless Steel-Filled Polymer Filaments Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (PLA-Stainless Steel Filament, ABS-Stainless Steel Filament, Nylon (PA)), By Application (Prototyping & Design Models, Functional Engineering Parts), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-813-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Stainless Steel-Filled Polymer Filaments Market Summary

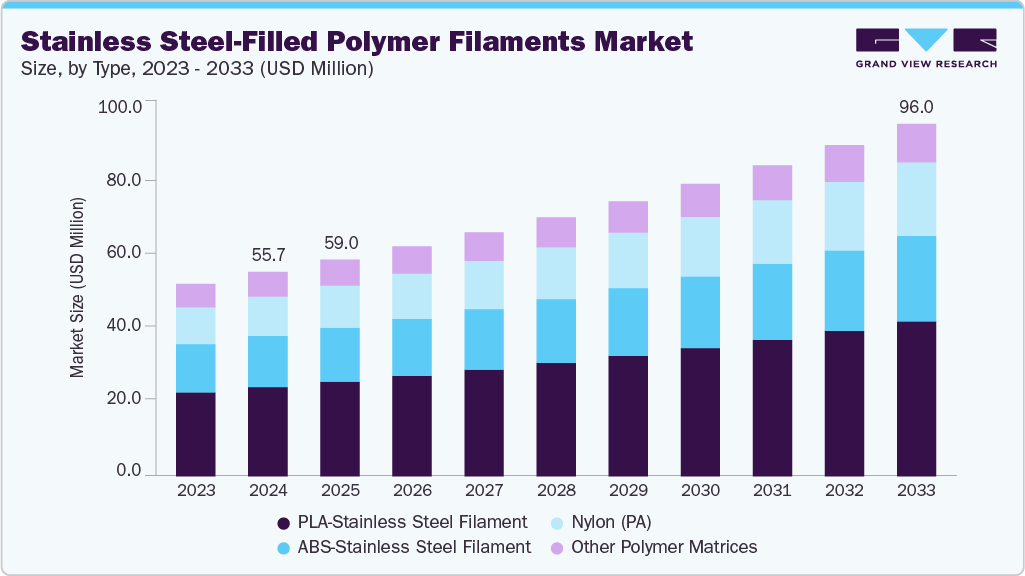

The global stainless steel-filled polymer filaments market size was estimated at USD 55.7 million in 2024 and is projected to reach USD 96.0 million by 2033, growing at a CAGR of 6.3% from 2025 to 2033. The growing demand for customized consumer products and functional prototyping is driving the use of stainless steel-filled polymer filaments, as designers seek metallic aesthetics with improved printability.

Key Market Trends & Insights

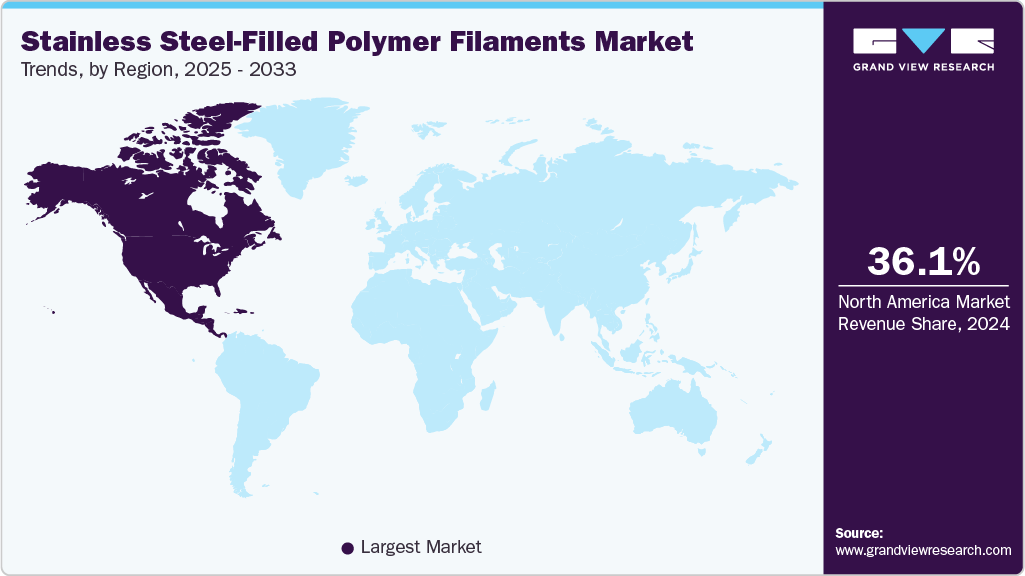

- North America dominated the stainless steel-filled polymer filaments market with the largest revenue share of 36.14% in 2024.

- The stainless steel-filled polymer filaments industry in Canada is expected to grow at a substantial CAGR of 8.1% from 2025 to 2033.

- By type, the PLA-stainless steel filament segment dominated the stainless steel-filled polymer filaments industry, accounting for a revenue share of 43.72% in 2024.

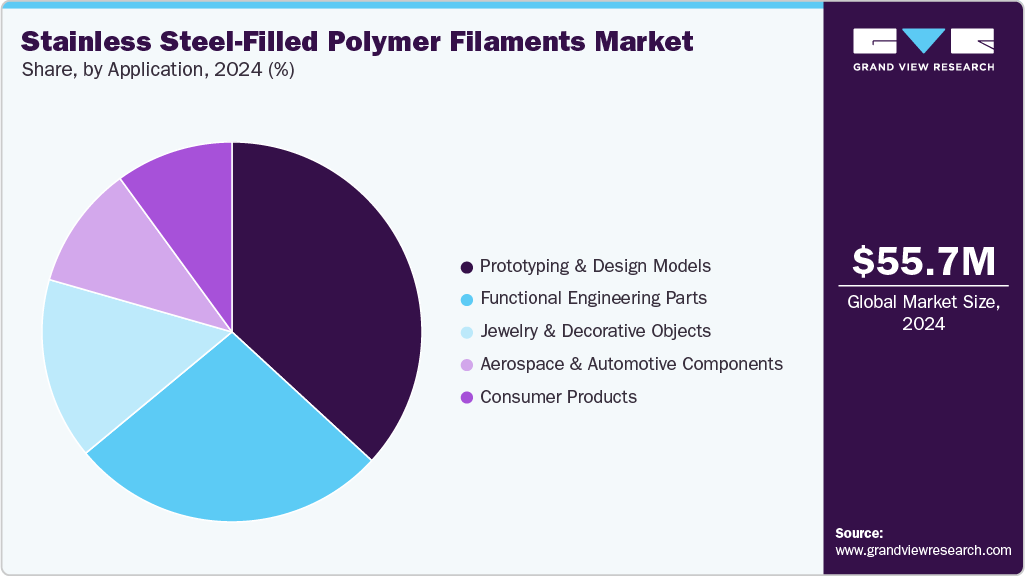

- By application, the prototyping & design models segment dominated the market, accounting for a revenue share of 34.79% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 55.7 Million

- 2033 Projected Market Size: USD 96.0 Million

- CAGR (2025 - 2033): 6.3%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

The ability to produce durable, lightweight parts for tools, gadgets, and hardware applications also supports wider industrial adoption. Stainless steel-filled polymer filaments are shifting the stainless steel-filled polymer filaments industry from purely aesthetic metal-look prints to functionally engineered parts that approximate metal properties while retaining polymer processability. Demand is rising for filaments that deliver higher stiffness, thermal stability and surface conductivity without full metal printing costs, creating a bridge between polymer extrusion and metal additive manufacturing. This trend is reinforced by robust growth in both the metal and filament segments as industrial users adopt hybrid workflows.

Drivers, Opportunities & Restraints

A primary commercial driver is adoption by aerospace, automotive and tooling sectors that require complex geometries, localized metal-like performance and rapid iteration for low-volume parts. These industries value the shorter lead times and lower capital intensity of filament extrusion relative to powder-bed metal processes, enabling faster prototyping and functional validation before committing to metal production. The shift is supported by academic and industrial studies demonstrating viable stainless-steel particle-reinforced filaments for engineering use.

There is a clear opportunity to capture mid-market applications through improved composite formulations and post-print finishing workflows. Manufacturers can differentiate by developing higher metal-loading chemistries, tailored particle sizes and binder systems that reduce porosity and improve mechanical performance. Adjacent value-chain services, pre-compounded feeds, nozzle systems designed for abrasive blends, and certified finishing/sintering partnerships, can create new revenue streams and speed industrial uptake. Market analysts highlight product and formulation innovation as a major growth vector.

Widespread adoption is limited by higher material costs, accelerated tool wear from abrasive metal particles, and complex post-processing to reach consistent, certifiable performance. Many industrial buyers require material and process qualification for safety-critical parts; metal-filled polymers often fall short of the mechanical and thermal benchmarks of wrought or fully sintered metal. These technical and certification challenges, combined with volatile raw-material pricing and limited large-scale supply, constrain rapid scaling.

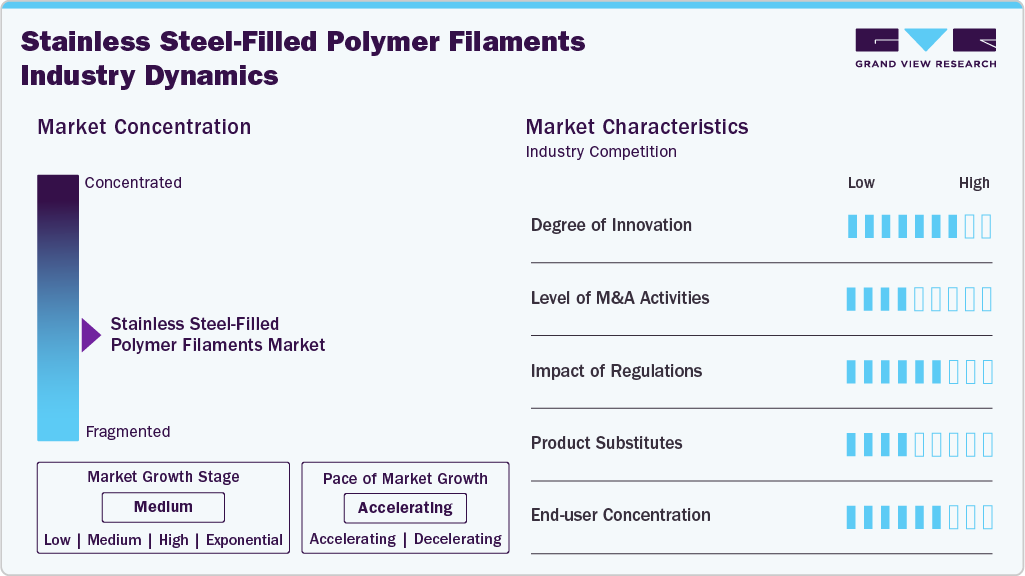

Market Characteristics

The growth stage of the stainless steel-filled polymer filaments market is high, and the pace is accelerating. The market exhibits slight fragmentation, with key players dominating the industry landscape. Major companies like ProtoPlant, BASF SE, The Virtual Foundry, Nobufil, Zetamix, Fiberlogy, Wan Hao 3D, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Innovation in stainless steel-filled polymer filaments is concentrated in both materials and process engineering. Manufacturers are increasing metal loading while refining particle size and binder chemistry to boost density, polishability and thermal stability. Parallel advances in post-processing, tailored debinding and sintering workflows and improved mechanical finishing, are closing the performance gap with metal parts. Equipment-level changes, such as hardened nozzles and print-parameter toolchains, further expand usable applications and reduce failure modes.

Several established technologies compete directly with stainless steel-filled filaments for metallic-look or metal-performance parts. Powder-bed metal printing and binder-jetting deliver true metal properties and certification paths for safety-critical applications. Alternative filament strategies include bronze-, copper- and aluminum-filled polymers, carbon-fiber reinforced polymers, and metal plating or vacuum metallization applied to printed plastics for authentic surface finish. Finally, photo-curable metal-filled resins and emerging lithography-based metal AM provide high-resolution metal parts that reduce the need for composite filaments in precision applications.

Type Insights

PLA-Stainless steel filament dominated the stainless steel-filled polymer filaments industry, accounting for a revenue share of 43.72% in 2024 and is forecasted to grow at a 6.3% CAGR from 2025 to 2033. PLA-based stainless steel filaments are driven by their ease of processing on standard desktop FDM printers. Manufacturers can achieve high metal loading while keeping printing temperature and warpage low. Designers and small-scale manufacturers prize the heavy, polishable finish for jewelry, props and consumer goods. This accessibility lowers the barrier to metal-look parts for non-industrial users.

The nylon (PA) segment is anticipated to grow at a substantial CAGR of 7.2% through the forecast period. Nylon matrices loaded with stainless steel particles attract engineering users because of Nylon’s intrinsic strength, toughness and wear resistance. When combined with metal powder, these filaments offer improved stiffness and thermal endurance versus PLA blends. The result is a printable feedstock suitable for functional prototypes that need mechanical robustness. This makes metal-filled Nylon attractive for performance-focused, low-volume applications.

Application Insights

Prototyping & design models dominated the stainless steel-filled polymer filaments market, accounting for a revenue share of 34.79% in 2024 and is forecasted to grow at a 6.4% CAGR from 2025 to 2033. Demand for realistic, production-representative prototypes is driving adoption in design studios and contract manufacturers. Metal-filled polymer filaments deliver both the look and the mass of metal while avoiding complex metal printing workflows. Teams use these materials to validate form, fit and perceived quality before committing to expensive metal tooling. The approach shortens iteration cycles and reduces early-stage program costs.

The functional engineering parts segment is expected to expand at a substantial CAGR of 6.9% through the forecast period. Industry adoption for tooling, jigs and low-volume end parts is rising because metal-filled filaments enable rapid, economical production of load-bearing components. Research shows polymer-metal composites can be used for production tooling after appropriate post-processing. This capability supports on-demand manufacturing in sectors with sporadic part needs and helps decouple lead time from traditional metal supply chains.

Regional Insights

The North America stainless steel-filled polymer filaments market held the largest revenue share of 36.14% in 2024 and is expected to grow at the fastest CAGR of 6.4% over the forecast period. Uptake is led by industrial OEMs in aerospace, automotive and advanced tooling that need metal-like parts with lower lead times. These sectors use stainless steel-filled filaments for rapid validation and low-volume fixtures before committing to metal production. Heavy R&D and capital availability in the region accelerate material qualification and end-use trials.

Regional supply-chain resilience and onshoring trends favor polymer-metal composites as a near-term substitute for slower metal supply lines. Firms deploy filament-based workflows to shorten procurement cycles and reduce dependence on overseas metal finishing. Investment by tooling shops and contract manufacturers in filament-capable printers supports broader commercialization.

U.S. Stainless Steel-Filled Polymer Filaments Market Trends

In the U.S., defense and aerospace procurement standards and rapid prototyping programs stimulate demand for metal-like printed parts. Government-backed AM initiatives and industrial grants underwrite qualification work and pilot production using metal-filled polymers. This creates an early-adopter ecosystem where certified use cases can emerge faster than in markets with lower R&D funding.

Europe Stainless Steel-Filled Polymer Filaments Market Trends

European demand is driven by a dense network of SMEs and contract manufacturers seeking sustainable, low-waste production methods. Metal-filled filaments enable mass-customized components with reduced machining waste and faster iteration cycles. National manufacturing strategies and a strong materials-science base in Germany and the Netherlands support commercial trials and supplier partnerships.

Asia Pacific Stainless Steel-Filled Polymer Filaments Market Trends

The growth of the Asia Pacific stainless steel-filled polymer filaments industry is powered by large-scale industrialization and aggressive adoption of additive manufacturing across China, Japan and India. High-volume electronics and automotive suppliers use metal-filled filaments to accelerate product cycles and cut tooling costs. The region’s manufacturing scale and lower-cost supply chains make it a prime market for volume-oriented filament innovations and localized finishing services.

Key Stainless Steel-Filled Polymer Filaments Company Insights

The stainless steel-filled polymer filaments market is highly competitive, with several key players dominating the landscape. Major companies include ProtoPlant, BASF SE, The Virtual Foundry, Nobufil, Zetamix, Fiberlogy, and Wan Hao 3D. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Stainless Steel-filled Polymer Filaments Companies:

The following are the leading companies in the stainless steel-filled polymer filaments market. These companies collectively hold the largest market share and dictate industry trends.

- ProtoPlant

- BASF SE

- The Virtual Foundry

- Nobufil

- Zetamix

- Fiberlogy

- Wan Hao 3D

Recent Developments

-

In October 2024, a research team at University of Sheffield published work showing continuous stainless steel fibre bundles embedded in a PLA matrix filament can be 3D printed to yield enhanced mechanical strength and electrical conductivity, representing a next-gen variant of metal-filled polymer filament.

Stainless Steel-Filled Polymer Filaments Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 59.0 million

Revenue forecast in 2033

USD 96.0 million

Growth rate

CAGR of 6.3% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD thousand/million, volume in tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

ProtoPlant; BASF SE; The Virtual Foundry; Nobufil; Zetamix; Fiberlogy; Wan Hao 3D

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Stainless Steel-filled Polymer Filaments Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the stainless steel-filled polymer filaments market report based on type, application, and region:

-

Type Outlook (Volume, Tons; Revenue, USD Thousand, 2021 - 2033)

-

PLA-Stainless Steel Filament

-

ABS-Stainless Steel Filament

-

Nylon (PA)

-

Other Polymer Matrices

-

-

Application Outlook (Volume, Tons; Revenue, USD Thousand, 2021 - 2033)

-

Prototyping & Design Models

-

Functional Engineering Parts

-

Jewelry & Decorative Objects

-

Aerospace & Automotive Components

-

Consumer Products

-

Other Applications

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.