- Home

- »

- Personal Care & Cosmetics

- »

-

Surfactants Market Size And Share, Industry Report, 2033GVR Report cover

![Surfactants Market Size, Share & Trends Report]()

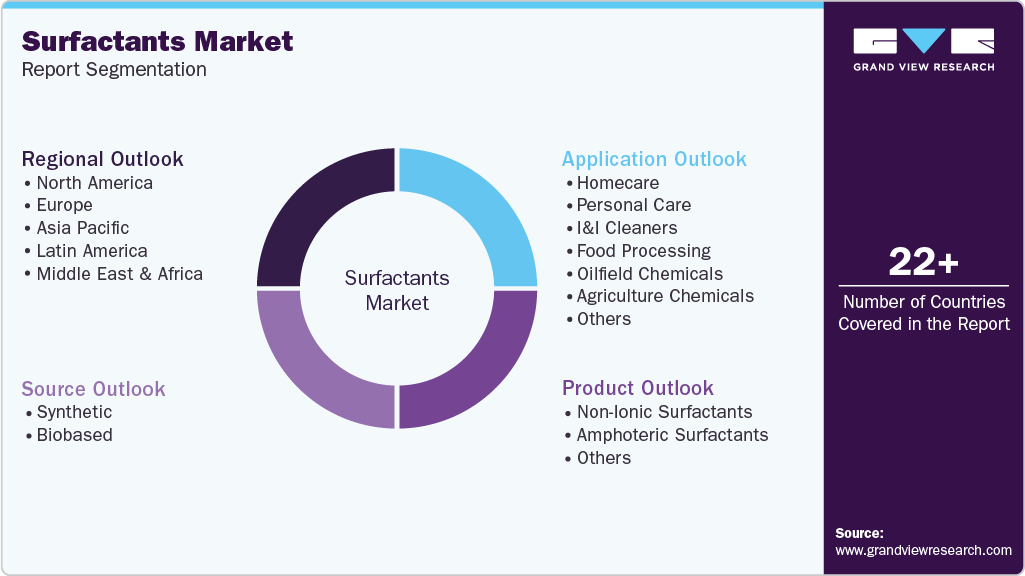

Surfactants Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Synthetic, Biobased), By Product (Non-Ionic, Amphoteric), By Application (Homecare, Personal Care, I&I Cleaners, Food Processing, Oilfield Chemicals), By Region, And Segment Forecasts

- Report ID: 978-1-68038-592-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Surfactants Market Summary

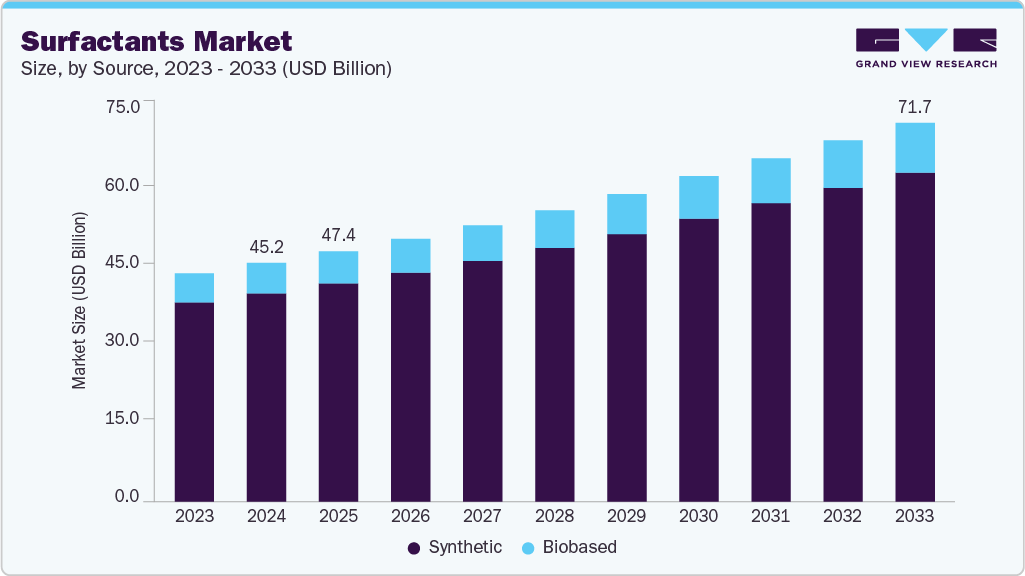

The global surfactants market size was estimated at USD 45,199.4 million in 2024 and is projected to reach USD 71748.70 million by 2033, growing at a CAGR of 5.3% from 2025 to 2033. The global preference for surfactants is being significantly shaped by their expanding role across various industries and rising consumer awareness of sustainable practices.

Key Market Trends & Insights

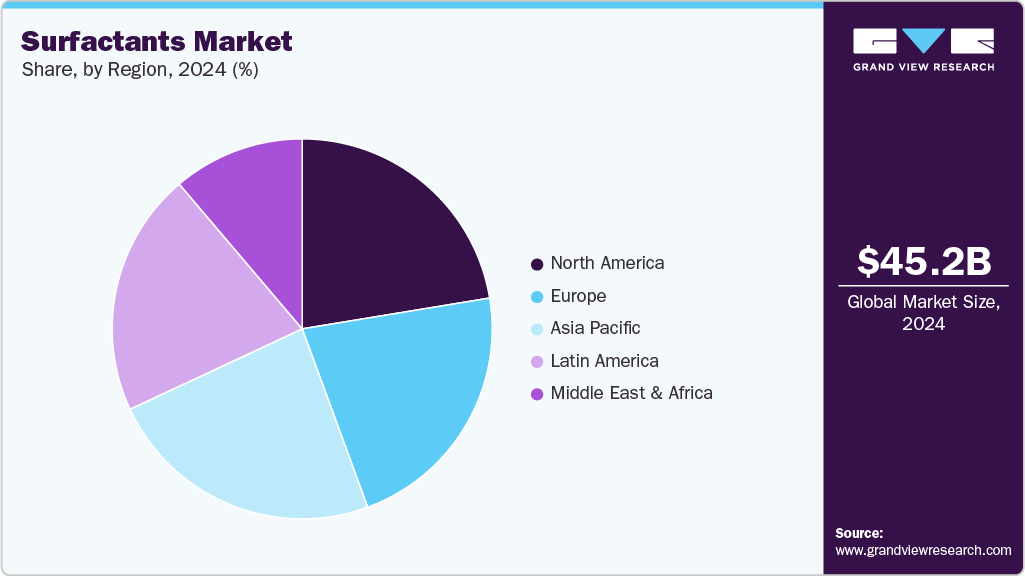

- The Asia Pacific surfactants market accounted for the dominant market share of 35.07% in 2024.

- China held over 42.8% revenue share of the Asia Pacific surfactants market.

- By source, the biobased market is expected to witness the fastest growth of 5.7% from 2025 to 2033.

- By product, non-ionic surfactants dominated the market with a revenue share of 13.5% in 2024.

- By application, homecare dominated the market with a revenue share of 38.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 45,199.4 Million

- 2033 Projected Market Size: USD 71,748.7 Million

- CAGR (2025-2033): 5.3%

- Asia Pacific: Largest market in 2024

Increasing application of renewable energy technologies and eco-friendly product formulations. As consumers and governments push for sustainability, the demand for bio-based surfactants, derived from renewable resources, has grown substantially. These green alternatives are not only environmentally safe but also align with global regulatory standards for sustainable manufacturing and product safety, creating strong incentives for industries to shift toward their usage.Another major factor propelling surfactant demand is their indispensable role in industries such as personal care, pharmaceuticals, and chemicals. In these sectors, surfactants act as critical components in emulsification, foaming, and dispersing processes, enhancing product performance and stability. The personal care industry, in particular, has seen a surge in demand for surfactant-based products like shampoos, face cleansers, and lotions, driven by increasing consumer focus on hygiene and grooming. Industrial and institutional cleaning applications have grown, further expanding the surfactants market, as companies seek efficient and compliant formulations to meet hygiene and safety standards.

Industries such as healthcare, hospitality, retail, and education have also contributed to the growing consumption of surfactants due to their emphasis on cleanliness and sanitation. In settings with direct human interaction, cleanliness is non-negotiable, making surfactants crucial in cleaning solutions for their ability to break down oils, dirt, and microbes effectively. This widespread applicability, combined with mounting demand for biodegradable and high-performance formulations, has created a competitive yet opportunity-rich market. As leading manufacturers continue to invest in innovation and sustainable chemistry, the global surfactants market is expected to maintain a strong growth trajectory driven by both industrial necessity and environmental responsibility.

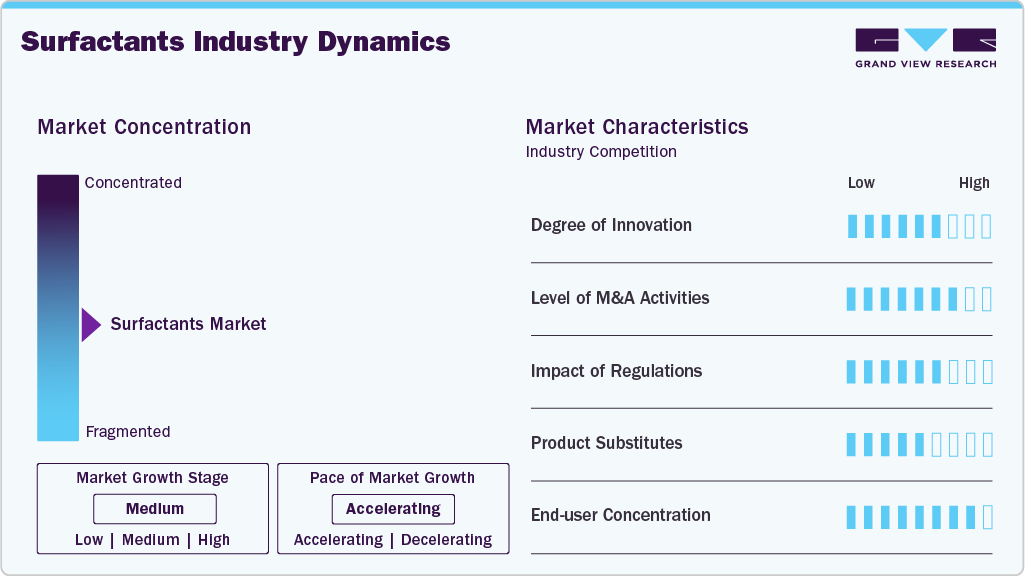

Market Concentration & Characteristics

The surfactants market is a fragmented landscape, with a large number of global and regional players competing for market share. While no single company dominates, major players like BASF, Dow, Solvay, and Evonik hold significant portions of the market through diversified product portfolios and strong global distribution networks. These leading manufacturers are increasingly focusing on expanding production capacities, especially in regions with growing demand, such as the Asia-Pacific. Strategic initiatives such as mergers, acquisitions, partnerships, and investments in green chemistry and sustainable production are common as companies strive to strengthen their positions. There is a growing emphasis on technological innovation and R&D to develop high-performance and environmentally friendly surfactant formulations that meet evolving consumer and regulatory expectations.

In emerging markets such as India, Southeast Asia, Latin America, and parts of Africa, a new wave of local and mid-sized manufacturers is entering the surfactants space. The rising demand draws these players for personal care, home care, and industrial cleaning products, driven by urbanization, population growth, and increased hygiene awareness. The relatively low entry barriers, availability of raw materials, and supportive government policies toward local manufacturing make this sector attractive to startups and smaller companies. Many of these new entrants are focusing on bio-based or niche surfactant segments, catering to the rising preference for sustainable and localized solutions, while also taking advantage of lower production and labor costs.

Despite strong growth prospects, the surfactants market faces several challenges and restraints. Volatility in raw material prices, especially for petrochemical-based surfactants, can impact profit margins. Additionally, strict environmental regulations, especially in developed economies, put pressure on manufacturers to invest heavily in sustainable practices. Competition is intense, and brand loyalty can be difficult to build in commodity segments. Furthermore, the rising cost of innovation, coupled with increasing scrutiny on chemical safety, may limit the ability of smaller players to scale effectively. These factors pose significant hurdles for companies aiming to sustain long-term growth in a rapidly evolving market.

Source Insights

The synthetic segment secured the dominant revenue share of 87.5% in 2024, owing to its low production costs and easy availability. Anionic surfactants, in particular, gained prominence for their affordability and widespread use in household detergents, shampoos, and cleaning products. However, environmental concerns have posed significant challenges related to metal toxicity and non-degradability. Ongoing research and development efforts in improving the performance and environmental profile of surfactants are expected to mitigate these environmental consequences, driving market growth.

The biobased segment is expected to register the fastest CAGR of 5.7% during the forecast period. The demand for sustainable technologies has led to the increased adoption of bio-based surfactants. Bio-surfactants, derived from renewable resources such as sugar and oil, gained prominence due to their eco-friendliness and reduced environmental impact. The shifting consumer preference to sustainable options, with the rising per-capita spending capacity, drove demand for natural and organic products in personal care and household cleaning goods. These surfactants found versatile applications as emulsifying agents, biocides, and anticorrosive agents. Their compatibility with various products, including detergents, cosmetics, and industrial formulations, contributed to market growth.

Product Insights

The non-ionic surfactants segment dominated with 13.5% of the revenue share in 2024. These surfactants are favored for their excellent emulsifying, wetting, and dispersing properties. They are chemically stable, function effectively in hard water, and are compatible with a wide range of formulations. Non-ionic surfactants are mild on skin and less likely to cause irritation, making them ideal for personal care and household cleaning products. Their low toxicity and biodegradability also align with increasing environmental regulations and consumer preference for sustainable products. This versatility across industries and superior performance characteristics contributed to their leading market share in 2024.

Amphoteric surfactants are expected to emerge as the fastest-growing segment with a CAGR of 5.7% over the forecast period. Their dual nature, exhibiting both anionic and cationic behavior depending on pH, makes them highly adaptable in formulations. They offer mild cleansing, excellent foaming, and conditioning properties, making them suitable for sensitive-skin applications such as baby products and facial cleansers. Growing demand for eco-friendly, biodegradable, and gentle surfactants is accelerating their adoption in the personal care and cosmetic industries. As consumer awareness of product safety and sustainability increases, amphoteric surfactants are positioned as an attractive solution, driving their rapid market expansion in the coming years.

Application Insights

The homecare segment dominated with a revenue share of 38.4% in the surfactants market. This was primarily driven by the increasing demand for household cleaning products such as laundry detergents, dishwashing liquids, surface cleaners, and disinfectants. Rising hygiene awareness, especially following the COVID-19 pandemic, has boosted the consumption of surfactant-based products in residential and commercial spaces. Urbanization and the growing middle-class population in emerging economies have fueled product usage. Manufacturers are also introducing innovative, eco-friendly, and multifunctional cleaning solutions to meet consumer preferences, further strengthening the segment’s position. The essential role of surfactants in cleaning efficacy contributed significantly to this dominant market share.

The personal care segment is expected to emerge as the fastest-growing segment with a CAGR of 6.1% over the forecast period. This growth is driven by increasing consumer awareness of personal hygiene, grooming, and skincare. Surfactants play a crucial role in products such as shampoos, facial cleansers, body washes, and toothpaste, offering foaming, cleansing, and emulsifying benefits. The rising demand for mild, skin-friendly, and sulfate-free formulations is pushing manufacturers toward innovative and natural surfactant solutions. Growing disposable incomes, especially in Asia-Pacific and Latin America, combined with the influence of beauty trends and self-care routines, are propelling strong demand for high-performance and safe personal care products.

Regional Insights

The Asia Pacific surfactants marketis witnessing rapid growth due to rising urbanization, increasing disposable incomes, and heightened awareness of hygiene and personal care. Countries like China and India are experiencing strong demand for products such as detergents, shampoos, and surface cleaners, which heavily rely on surfactants. For example, companies like Unilever and P&G are expanding operations in India to meet growing consumption. Industrial development across sectors like textiles, agriculture, and food processing further boosts demand for surfactants. The shift toward bio-based and eco-friendly formulations, driven by environmental regulations, is also encouraging innovation and investment in the regional market.

China surfactants market is expanding rapidly due to surging demand from household detergents and personal care products fueled by rising incomes, urbanization, and a growing middle class. Companies like Unilever, P&G, and local giants such as Sinopec and Galaxy Surfactants China have expanded production to meet this demand and export volume. Moreover, expanding industrial usage in textiles, agriculture, and oilfield chemicals is boosting surfactant consumption for applications such as emulsification and enhanced oil recovery. Tightening environmental regulations and government-led initiatives promoting green chemistry are accelerating the shift toward biodegradable and bio-based surfactants, driving innovation and investment.

Europe Surfactants Market Trends

The surfactants market in Europe held 24.0% of the global revenue share in 2024, driven by strong demand from the personal care, home care, and industrial cleaning sectors. Growing consumer preference for eco-friendly and biodegradable products has led companies like BASF, Clariant, and Evonik to invest in green surfactant technologies. Stringent EU regulations on chemical safety and sustainability are encouraging the use of bio-based and low-toxicity surfactants across applications. Additionally, Europe's mature cosmetics and pharmaceutical industries rely heavily on high-quality surfactants for product formulation. The region’s focus on sustainability, innovation, and circular economy practices continues to fuel steady market growth.

North America Surfactants Market Trends

The North America surfactants market secured 26.2% of the revenue share in 2024, driven by high demand across personal care, home care, and industrial applications. The region's well-established consumer goods industry, led by companies like Procter & Gamble and Colgate-Palmolive, fuels consistent use of surfactants in detergents, shampoos, and skincare products. Additionally, increased focus on hygiene post-COVID and rising demand for eco-friendly, sulfate-free formulations are driving innovation in bio-based surfactants. The presence of advanced R&D infrastructure and supportive regulatory frameworks further accelerates product development. Industrial sectors such as agriculture, textiles, and oil & gas also contribute significantly to market growth.

U.S. Surfactants Market Trends

The U.S. surfactants market is growing steadily, fueled by strong consumer demand for high-performance personal care and home cleaning products. American brands like Procter & Gamble, Unilever USA, and SC Johnson are driving surfactant usage in products such as Tide detergents, Head & Shoulders shampoo, and Dawn dish soap. Additionally, the U.S. oil and gas industry utilizes surfactants in enhanced oil recovery processes, especially in Texas and North Dakota. The market is also influenced by increasing demand for sulfate-free and plant-based formulations, with regulations like the Toxic Substances Control Act (TSCA) and California’s Proposition 65 pushing companies toward greener, safer ingredients.

Middle East & Africa Surfactants Market Trends

The Middle East and Africa surfactants market is gaining momentum due to growing industrialization, urban expansion, and rising hygiene awareness. In the Gulf countries, particularly Saudi Arabia and the UAE, surfactants are heavily used in enhanced oil recovery (EOR) processes, driving industrial demand. Meanwhile, in African nations like South Africa, Nigeria, and Kenya, population growth and improved access to personal care products are fueling demand for soaps, detergents, and shampoos. Multinational and regional manufacturers are increasingly investing in localized production to meet rising consumption. Environmental regulations and consumer preferences are gradually shifting the market toward greener, bio-based alternatives.

Latin America Surfactants Market Trends

Latin America surfactant demand is rising swiftly thanks to expanding hygiene awareness, urbanization, and growing consumption of household and personal care products. Countries like Brazil and Mexico lead due to booming markets for detergents, soaps, shampoos, and skincare. Brazil’s strong agrochemical and food processing sectors also fuel demand, using surfactants to enhance pesticide efficiency and beverage solubilization. Companies such as Oxiteno, BASF, and regional innovators offer bio-based and sustainable surfactants to meet evolving consumer and regulatory demands. Additionally, rising investment in local production facilities, enhanced oil recovery applications, and a move toward green chemistry all bolster regional market expansion.

Key Surfactants Company Insights

Some key players operating in the surfactants market include BASF SE and Stepan Company.

-

BASF SE is a global leader in surfactants, offering a broad portfolio for personal care, home care, industrial cleaning, and technical applications. Its products include eco-friendly surfactants like Plantapon®, Texapon®, and Dehyton®, known for biodegradability and renewable sourcing. BASF emphasizes sustainability by using RSPO-certified palm oil and soy-based ingredients, while also investing in digital tools and innovation to support safe, efficient, and sustainable product formulation.

-

Stepan Company is a global specialty chemicals leader and one of the world’s largest merchant producers of surfactants, offering anionic, cationic, nonionic, amphoteric surfactants, blends, and custom solutions. Its products serve personal care, industrial cleaning, agriculture, and enhanced oil recovery markets. Stepan’s global network includes 20 production sites and 14 R&D centers.

Evonik Industries AG Controls is an emerging market participant in the surfactants market.

-

Evonik Industries AG is a global leader in specialty chemicals and has positioned itself at the forefront of sustainable surfactant innovation. The company focuses on developing high-performance, bio-based surfactants using renewable raw materials and advanced fermentation technologies. These surfactants are fully biodegradable, non-toxic, and skin-friendly, making them ideal for eco-conscious personal care and household cleaning applications. Evonik operates one of the few industrial-scale biosurfactant production facilities in Europe, enabling efficient large-scale supply. Strategic partnerships with major consumer goods companies and a strong commitment to green chemistry have helped Evonik gain recognition as a pioneer in environmentally responsible surfactant solutions.

Key Surfactants Companies:

The following are the leading companies in the surfactants market. These companies collectively hold the largest market share and dictate industry trends.

- Akzonobel N.V

- BASF SE

- Evonik Industries AG

- Solvay S.A

- Clariant AG

- Huntsman International LLC

- Dow

- Kao Corporation

- Henkel Adhesives Technologies India Private Limited

- Bayer AG

- Godrej Industries Limited

- Stepan Company

Recent Developments

-

In May 2025, Pilot Chemical Company announced an exclusive partnership with Novvi LLC to introduce CalCare® AOS, a new biobased alpha olefin sulfonate surfactant technology, to the North American market. This sustainable innovation targets the household, industrial and institutional (I&I), and personal care (PC) sectors, offering high performance while supporting sustainability goals. The partnership combines Novvi’s bio-based alpha olefin feedstock expertise with Pilot’s sulfonation capabilities and market presence. As the exclusive sulfonator and distributor, Pilot will produce CalCare® AOS at its Middletown, Ohio, facility, making it the first to commercialize this sustainable surfactant technology at scale in North America.

-

In January 2024, Nouryon announced the launch of Berol® Nexus surfactant at the ACI Annual Meeting and Industry Convention in Orlando, Florida. This next-generation, multifunctional hydrotrope is specifically designed for the North American cleaning market, offering enhanced performance as a cosurfactant. Berol® Nexus is optimized for household and industrial & institutional (I&I) cleaning applications, with a particular focus on low-temperature laundry, supporting sustainability goals. Suzanne Carroll, Senior Vice President of Home and Personal Care at Nouryon, emphasized the company’s commitment to delivering innovative, sustainable ingredient solutions that help customers create superior and eco-friendly formulations across various cleaning segments.

Global Surfactants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 47,369.0 million

Revenue forecast in 2033

USD 71,748.7 million

Growth rate

CAGR of 5.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Akzonobel N.V.; BASF SE; Evonik Industries AG; Solvay S.A.; Clariant AG; Huntsman International LLC; Dow; Kao Corporation; Henkel Adhesives Technologies India Private Limited; Bayer AG; Godrej Industries Limited; Stepan Company

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surfactants Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global surfactants market report based on source, product, application, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Synthetic

-

Biobased

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Non-Ionic Surfactants

-

Alcohol Ethoxylates

-

Fatty Alcohol Ethoxylates

-

Lauryl Alcohol Ethoxylates

-

Ceto Stearyl Alcohol Ethoxylates

-

Behenyl Alcohol Ethoxylate

-

Other Alcohol Ethoxylates

-

-

Alkyl Phenol Ethoxylates

-

Fatty Acid Esters

-

Fatty Amine Ethoxylates

-

(EO-PO) co-ethoxylates

-

Other Non-Ionic Surfactants

-

-

Amphoteric Surfactants

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Homecare

-

Personal Care

-

I&I Cleaners

-

Food Processing

-

Oilfield Chemicals

-

Agriculture Chemicals

-

Textiles

-

Emulsion Polymers

-

Paints & Coatings

-

Construction

-

Other Application

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global surfactants market size was estimated at USD 45,199.4 million in 2024 and is expected to reach USD 47,369.0 million in 2025.

b. The global surfactants market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2033, reaching USD 71,748.7 million by 2033.

b. The biobased surfactants segment held the largest revenue share in 2024 due to growing consumer demand for sustainable, non-toxic, and environmentally friendly products, coupled with strict regulatory pressures encouraging the use of biodegradable ingredients. Their application across personal care, homecare, and industrial cleaning sectors has expanded rapidly as manufacturers shift toward green chemistry and renewable raw materials.

b. Some of the key players operating in the global surfactants market include Akzonobel N.V, BASF SE, Evonik Industries AG, Solvay S.A, Clariant AG, Huntsman International LLC, Dow, Kao Corporation, Henkel Adhesives Technologies India Private Limited, Bayer AG, Godrej Industries Limited, and Stepan Company

b. The surfactants market is driven by rising demand in personal care, homecare, and industrial cleaning sectors, increased focus on hygiene, growing preference for bio-based products, technological advancements, and expanding applications in pharmaceuticals, agriculture, and enhanced oil recovery.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.