- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Sweden Liquid Dietary Supplements Market Report, 2030GVR Report cover

![Sweden Liquid Dietary Supplements Market Size, Share & Trends Report]()

Sweden Liquid Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients (Vitamins, Botanicals, Minerals), By Type, By Application, By End User, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-803-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

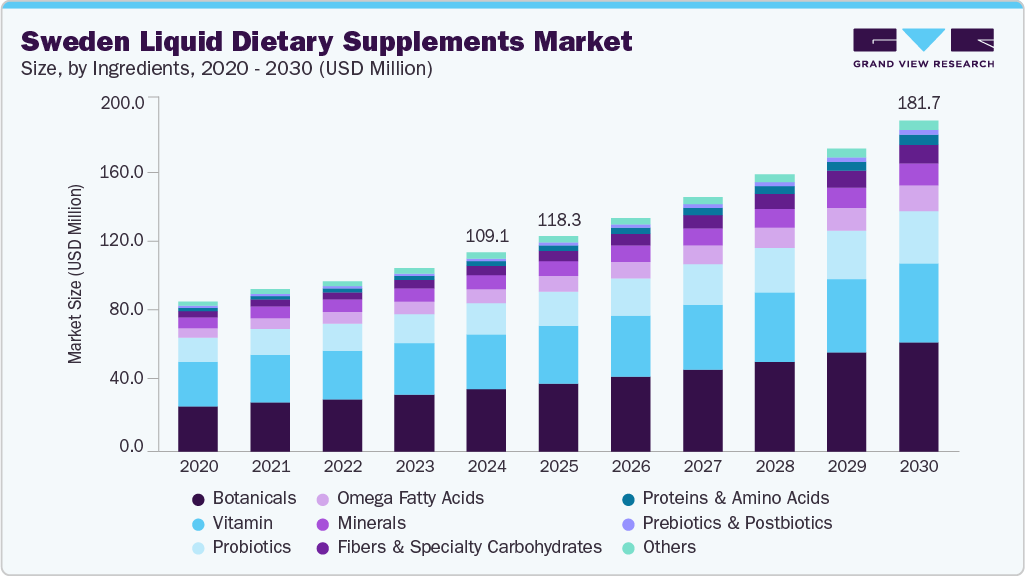

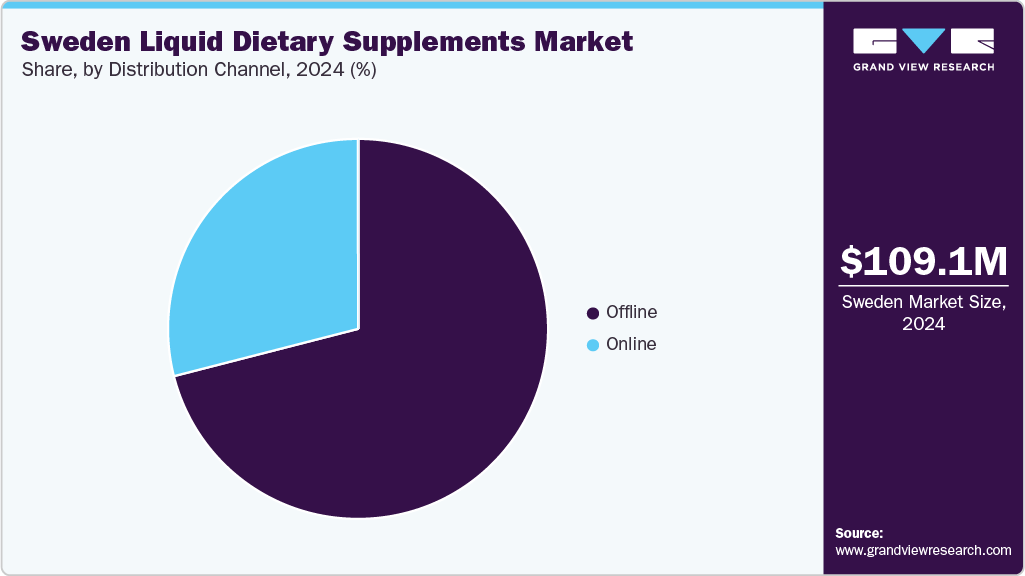

The Sweden liquid dietary supplements market size was estimated at USD 109.1 million in 2024 and is projected to reach USD 181.7 million by 2030, growing at a CAGR of 9.0% from 2025 to 2030. The market is driven by increasing awareness of preventive health measures and the growing significance of nutritional supplementation.

Key Market Trends & Insights

- By ingredients, the botanicals segment held the highest market share of 31.2% in 2024.

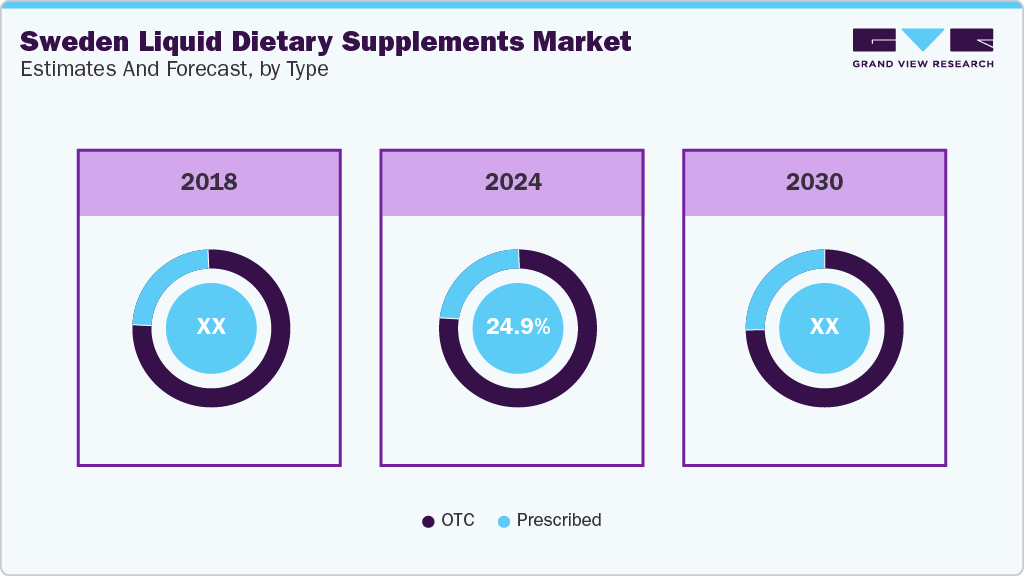

- By type, the OTC segment held the largest market share of 75.1% in 2024.

- By application, the bone & joint health segment held the largest market share of 12.2% in 2024

- By end user, the adults segment accounted for the largest market share of 62.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 109.1 Million

- 2030 Projected Market Size: USD 181.7 Million

- CAGR (2025-2030): 9.0%

Consumers seek easy-to-consume, fast-absorbing products that complement busy lifestyles. The continuously expanding portfolio of liquid supplements, including multivitamins, vitamin C, vitamin E, and fish oil, among others, caters to diverse health needs, further fueling market growth.According to a report published by Trading Economics, in 2024, 20.6% of Sweden’s population was aged 65 or older, highlighting a rapidly aging society with growing nutritional needs. Aging adults often face reduced nutrient absorption from daily meals and experience difficulty in swallowing tablets, making liquid formulations a convenient and more bioavailable option, particularly for vitamin D and calcium, which are essential for bone health. Owing to the convenience and faster absorption, the appeal of liquid dietary supplements is growing among the geriatric population. In addition to such clinical needs, Swedish consumers maintain a strong preventive health culture, favoring clean-label, plant-based, and functional liquid supplements such as immunity shots and fortified tonics. Liquid dietary supplements align precisely with the preferences of health-conscious and time-sensitive consumers, thus encouraging the demand for such supplements.

Considering the necessity of liquid dietary supplements, major players are redesigning their marketing campaigns and shaping the fast-paced industry landscape. Strategic marketing campaigns are key in effectively raising awareness about the benefits of liquid dietary supplements, emphasizing their convenience, absorption efficiency, and health benefits. Such initiatives attract new consumers and foster brand loyalty among existing customers. Additionally, the easy availability of liquid dietary supplements through e-commerce platforms has further supported the market growth in Sweden.

Consumer Insights

According to data from the World Data Bank, Sweden’s population was approximately 10.6 million in 2024. This demographic trend, coupled with a growing health-conscious consumer base, drives the country's demand for dietary liquid supplements. The expanding market is further supported by Sweden’s robust economic indicators, such as net disposable personal income, which was recorded as USD 287.32 thousand in 2023, according to the Trading Economics report. This increase in net disposable income levels enables consumers to prioritize premium health products, including liquid dietary supplements, reflecting a shift toward preventive healthcare and wellness.

Sweden’s employment rate remains high, indicating a continuously expanding workforce. The employment landscape is associated with increased consumer confidence and spending capacity, emphasizing the market potential for health and wellness products. The consumer insights highlight a compelling opportunity for premium liquid dietary supplements in Sweden, driven by demographic growth, economic stability, and evolving health priorities among consumers.

Ingredient Insights

The botanicals segment dominated the market with a revenue share of 31.2 % in 2024. The market is driven by increased public interest in natural health products and comprehensive wellness.This shift is fueled by a broader societal movement toward organic, sustainable, and traditional approaches to health, alongside increased awareness of the potential benefits of botanicals. In addition, marketing campaigns promoting organic supplements often highlight their source from conventional herbal medicine, purity, and scientific backing, which appeals to health-conscious consumers.

The proteins & amino acids segment is expected to register the fastest CAGR of 13.8% from 2025 to 2030. The market is driven by increased benefits of proteins such as overall health, muscle strength, and skin vitality. Market trends indicate a shift toward convenient, on-the-go liquid supplements, such as protein-based beverages and collagen shots, which are perceived as quick and effective ways to boost nutrient intake. The popularity of these products is also reinforced by marketing campaigns emphasizing beauty, anti-aging, and metabolic health, making protein liquids a prominent component of Sweden’s health and wellness industry.

Type Insights

The OTC segment held the largest market share in 2024.The growth of OTC liquid dietary supplements is attributed to the easy accessibility of products without standard prescriptions. Liquid dietary supplements are readily available through pharmacies and supermarkets, facilitating easier consumer access. In addition, increasing consumer confidence and observed health benefits have contributed to a surge in demand for liquid dietary supplements through this medium. Recommendations from family and friends and targeted marketing campaigns have further bolstered consumer trust and incentivized the purchase of liquid supplements.

The prescribed segment is projected to grow at the fastest CAGR over the forecast period. This growth is driven by a general lack of consumer awareness regarding nutritional deficiencies and the importance of supplementation, which healthcare professionals effectively address through prescriptions. Furthermore, strict regulatory guidelines imposed by governmental authorities capping OTC supplements are expected to further enhance the demand for prescribed liquid dietary supplements.

Application Insights

The bone and joint health segment dominated the market in 2024. This segment is driven by the increasing prevalence of bone and joint-associated disorders, including osteoporosis and rheumatoid arthritis. Consequently, there is a notable growth in the demand for liquid dietary supplements aimed at supporting bone health and preventing fractures. This trend reflects the demographic shift toward an aging population and the proactive approach toward mitigating osteoporosis-related morbidity, thereby driving the expansion of the dietary supplement market in Sweden.

Prenatal health is anticipated to record the fastest CAGR over the forecast period. The increasing prevalence of premature births in Sweden, with approximately 115,400 infants born in 2021, highlights a growing demand for maternal health support. In addition, the rising maternal age in 2021 is 29.6 years. These trends contribute to higher incidences of gestational complications, prompting a greater demand for nutritional supplementation in the country. Consequently, demand for additional dietary requirements to support healthy pregnancies and the need to mitigate associated risks support the growing consumption of liquid dietary supplements among pregnant women.

End User Insights

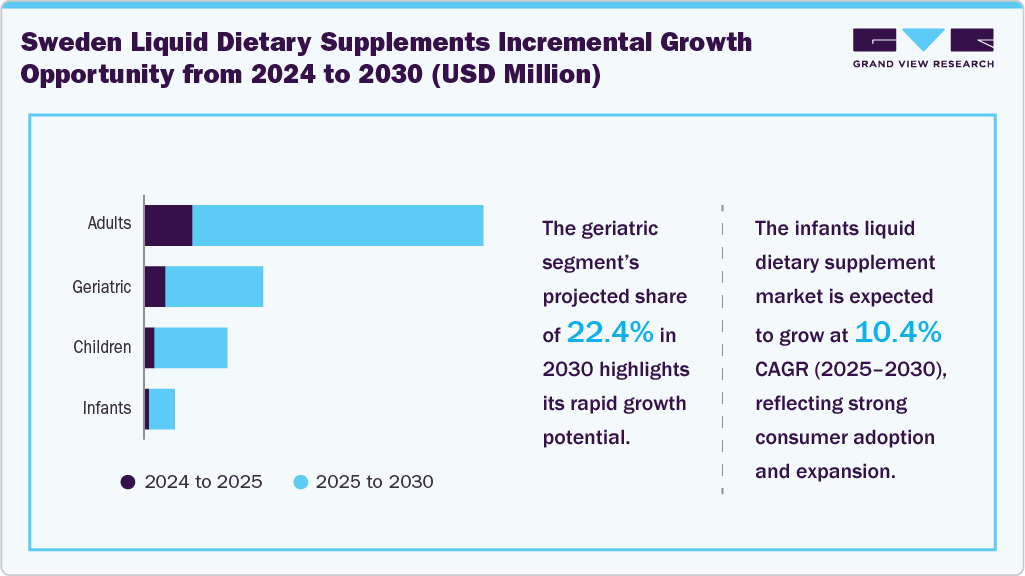

The adults segment held the largest market share in 2024. The growth of this segment is driven by evolving health-conscious behavior and preventative healthcare priorities among working age groups. Increasing awareness of the benefits associated with liquid formulations has significantly contributed to this growth. In addition, the Swedish government actively promotes responsible use of supplements through public health campaigns, underscoring their role in achieving optimal nutrient intake, especially among individuals with dietary restrictions or deficiencies.

The infant segment is anticipated to grow significantly over the forecast period. This growth is driven by increasing parental awareness of infant health and nutrition. There is an increasing demand for specialized, fortified liquid products that support optimal growth. Advancements in infant nutrition science and recommendations from healthcare professionals and pediatricians are further expected to promote the adoption of liquid supplements, particularly for infants with feeding challenges or nutritional deficiencies.

Distribution Channel Insights

The offline distribution channel segment held the largest market share in 2024. The sales growth through this segment is driven by consumers' confidence in offline purchasing, which allows for direct product assessment and immediate purchase. Swedish consumers exhibit a marked preference for purchasing liquid dietary supplements through retail outlets. These channels are favored due to their easy accessibility, extensive product availability, and the capacity for consumers to get recommendations from salespersons before purchase. Such factors make offline stores a preferred channel for consumers seeking convenience and instant access.

Online distribution channels are anticipated to grow at the fastest CAGR from 2025 to 2030. Key factors driving the rapid growth of online distribution channels for liquid dietary supplements include integrating secure payment systems, personalized marketing, and reliable delivery services. As consumer awareness of health and wellness continues to rise, along with governmental initiatives promoting digital health solutions, the growth trajectory of e-commerce platforms within this sector is expected to increase notably over the coming years.

Key Sweden Liquid Dietary Supplements Company Insights

Some key companies operating in the market include New Nordic AB and Amway Corp.

-

New Nordic AB provides natural health and beauty solutions, focusing on promoting healthier lifestyles. Its product portfolio encompasses specialized herbal supplements, vitamins, and advanced skincare formulations.

-

Amway Corp. is a global company that sells products directly to consumers, eliminating the need for intermediaries. The company has a presence in more than 100 countries and offers diverse health, beauty, home, and personal care solutions. It emphasizes innovation, sustainability, and relationship-building and supports millions of independent business owners worldwide.

Key Sweden Liquid Dietary Supplements Companies:

- Amway Corp.

- Herbalife International of America

- Abbott.

- New Nordic AB

- Swedish Nutra AB

Recent Developments

-

In January 2025, Latitude 65 launched its first protein milkshake in Sweden, offering chocolate, strawberry, and vanilla flavors. Each 330 ml bottle provides 25 g of protein and detailed nutritional profiles.

-

In April 2023, Vitamin Well, a healthy and tasty alternative to sodas, juices, and sugary drinks developed in Sweden, was launched in the UK. Four non-carbonated, low-calorie beverages enriched with vitamins and minerals, packaged in 100% recycled plastics, were introduced in the UK market, expanding its market presence.

Sweden Liquid Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 118.3 million

Revenue forecast in 2030

USD 181.7 million

Growth rate

CAGR of 9.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, type, application, end user, distribution channel

Country scope

Sweden

Key companies profiled

Amway Corp.; Herbalife International of America, Inc.; Abbott; New Nordic AB; Swedish Nutra AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Sweden Liquid Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Sweden liquid dietary supplements market report based on ingredients, type, application, end user, and distribution channel:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.