- Home

- »

- Consumer F&B

- »

-

Taiwan Nutraceuticals Market Size, Industry Report, 2033GVR Report cover

![Taiwan Nutraceuticals Market Size, Share & Trends Report]()

Taiwan Nutraceuticals Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Dietary Supplements, Functional Food, Functional Beverages, Infant Formula), By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-802-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Taiwan Nutraceuticals Market Summary

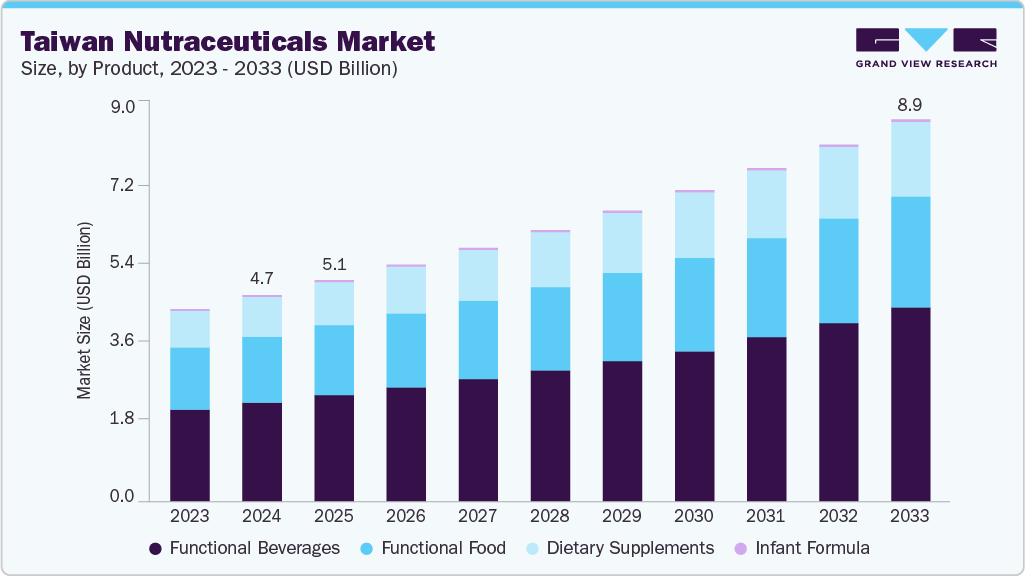

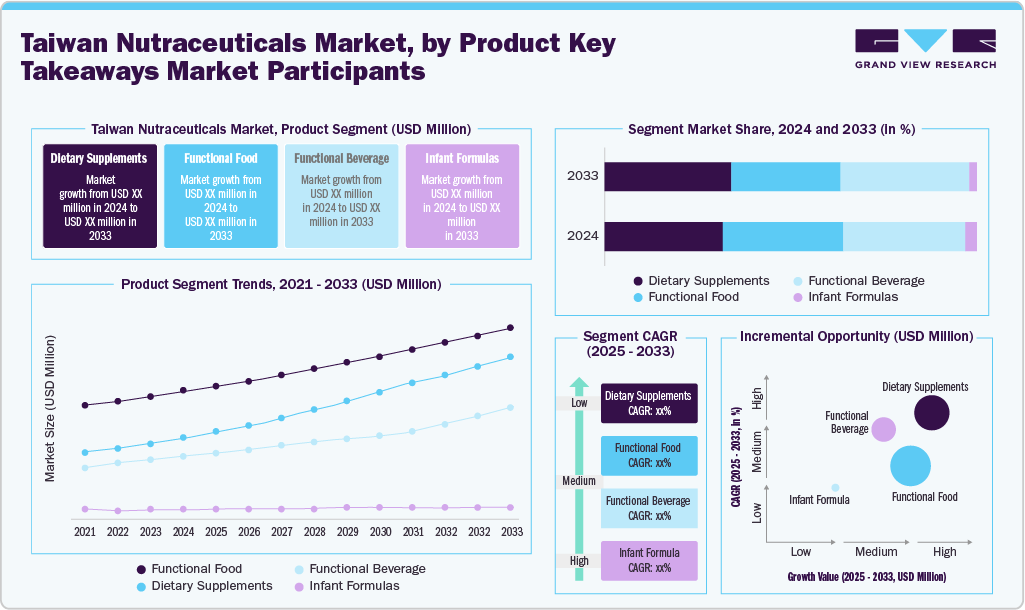

The Taiwan nutraceuticals market size was estimated at USD 4.79 billion in 2024 and is projected to reach USD 8.87 billion by 2033, growing at a CAGR of 7.1% from 2025 to 2033. The growth is primarily fueled by rising health awareness, growing focus on preventive healthcare, declining birth rate, and shifting trend toward plant-based and natural ingredients nationwide.

Key Market Trends & Insights

- By product, the functional beverages segment held the largest market share of 47.9% in 2024.

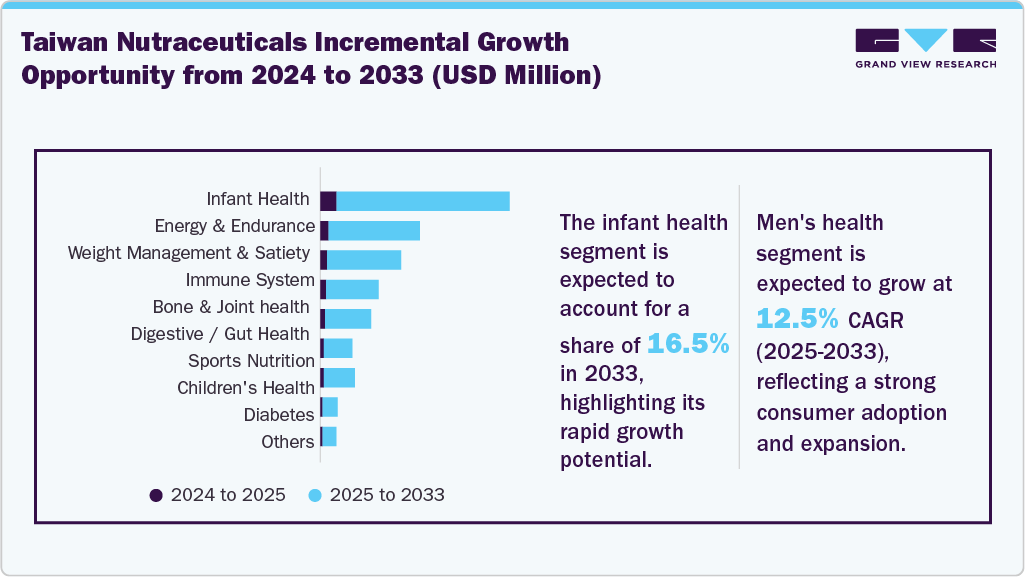

- Based on application, the weight management & satiety segment held the largest market share in 2024.

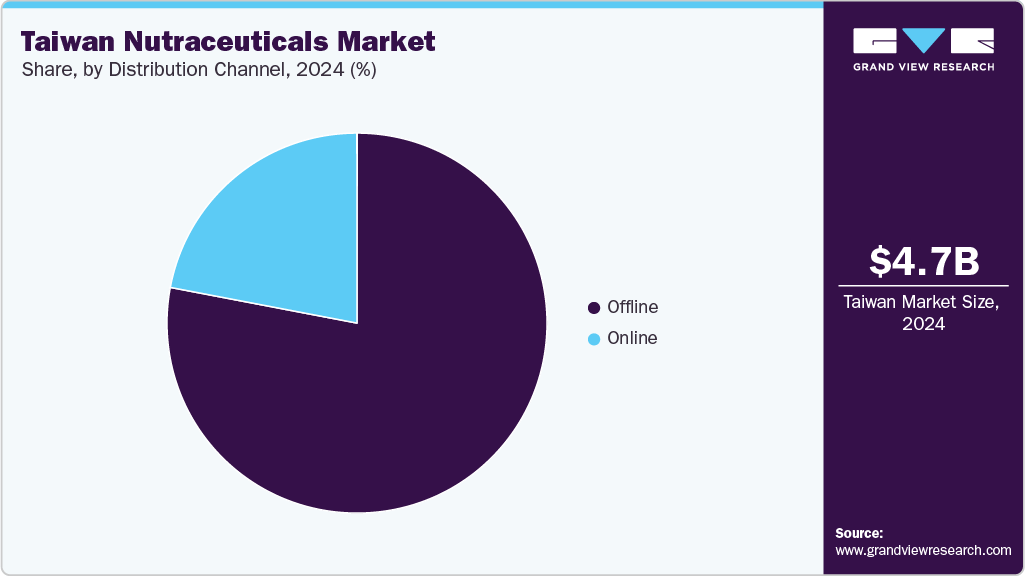

- By distribution channel, the offline segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.79 Billion

- 2033 Projected Market Size: USD 8.87 Billion

- CAGR (2025-2033): 7.1%

According to the news published by the Taipei Times in January 2025, the National Development Council indicated that by 2025, over 20% of the population will be aged 65 or older in the country. This demographic shift results in the demand for products addressing age-related health concerns like joint, bone, and cognitive health. Moreover, the declining birth rate in the country also contributes to the rising demand for nutraceuticals. According to a report published by XINHUANET.com in January 2025, the number of newborns in Taiwan fell to 134,856 in 2024, marking the lowest figure ever recorded since the beginning of official statistics.

The heightened consumer demand is directly reflected in the performance of key local players. For instance, Grape King Bio, a leading domestic manufacturer, reported record-high revenue of over USD 335.39 million (NT$11 billion) in 2024, showcasing its dominance with a 32% market share in probiotics and 59% in medicinal mushrooms. The convergence of an aging population seeking to maintain health, wellness-oriented consumer mindset, and robust local industry are expected to drive the market growth over the coming years.

Consumer Insights

In Taiwan's nutraceuticals market, consumer behavior is fundamentally shaped by an acute awareness of health, rapidly aging demographic, and a firm belief in preventive healthcare. Rooted in cultural heritage continue to have a strong and trusted appeal, particularly among older generations who value their holistic approach.

Consumer Demographics

New consumption patterns are emerging, led by younger, trend-conscious consumers. There is a growing preference for plant-based, vegan, and clean-label formulations, reflecting a global shift toward transparency and natural ingredients. The younger demographic, particularly professionals aged 25-40, is also drawn to functional products like probiotics, multivitamins, and beauty-from-within supplements such as collagen to navigate demanding urban lifestyles.

Product Insights

Based on product, the functional beverages segment dominated the market with a revenue share of 47.9% in 2024 and is projected to register the fastest CAGR of 7.8% during the forecast period. Strong consumer demand for convenience, as busy lifestyles necessitate on-the-go health solutions that are both effective and enjoyable, mitigating issues like pill fatigue, plays a key role in the growth of this segment. This trend is reinforced by the country’s rising health consciousness and rapidly aging population, which together create demand for a wide array of products. These products range from energy drinks and protein shakes for younger adults to ready-to-drink collagen for beauty and fortified chicken essence for vitality.

The dietary supplements segment in Taiwan is expected to grow from 2025 to 2033, driven by increasing availability, rising consumer awareness, and a proactive approach to health management. For instance, in December 2024, NutriLeads B.V. announced a strategic distribution partnership with Toong Yeuan Enterprise Co., Ltd. to expand the availability of Benicaros in Taiwan. Benicaros is a low-dose precision prebiotic derived from upcycled carrot pomace, designed to promote the growth of beneficial gut bacteria. In addition, Taiwanese consumers are transitioning from a reactive approach to healthcare to a more preventive mindset. This shift leads them to seek products that enhance overall wellness, strengthen immunity, and proactively address health concerns before they become chronic. Institutional efforts further support this evolving health consciousness.

Application Insights

The weight management and satiety segment accounted for the largest revenue share of Taiwan’s nutraceutical market in 2024, driven by rising obesity rates and growing health consciousness. As reported by Focus Taiwan in April 2025, nearly half of Taiwan’s adult population is affected by overweight or obesity, highlighting a significant public health concern. This has led to increased demand for natural weight control solutions, with consumers increasingly opting for nutraceuticals formulated with metabolism-boosting ingredients such as green tea extract and appetite-suppressing fibers. The rising popularity of personalized nutrition is fueling interest in tailored supplements that align with individual metabolic needs. With greater public awareness and supportive government health initiatives, the weight management segment is expected to maintain strong growth and continue to play a key role in the expansion of Taiwan’s nutraceuticals market.

The men's health segment in Taiwan nutraceutical market is expected to register the fastest CAGR from 2025 to 2033. Rising awareness of male-specific health concerns such as hair & skin issues, low testosterone, prostate health, reproductive wellness, and micronutrient deficiencies are expected to create significant demand in this segment over the coming years. This growth reflects a broader shift among Taiwanese men toward proactive health management and preventive care beyond traditional medical treatments. The increasing demand for nutraceuticals tailored to men's unique physiological needs is further supported by market players focusing on male wellness solutions.

Distribution Channel Insights

In 2024, the offline distribution channel held the largest share in Taiwan nutraceutical market, supported by a strong network of pharmacies, drugstores, supermarkets, hypermarkets, convenience stores, and health food stores. Market participants typically supply products to local distributors who deliver them to retail outlets. Larger suppliers may also supply directly to big retail chains. One of the key growth drivers of this segment is the expansion of physical stores. For instance, in March 2024, EverRise Biomedical Co. Ltd. announced that Tin Tin Pharmacy, which currently runs 92 stores across Taiwan, plans to grow its network to 100 stores, highlighting strong momentum in retail expansion.

The online segment is anticipated to experience the fastest CAGR from 2025 to 2033. The rapid growth of this segment is driven by high internet penetration, tech-savvy consumers, and growing health awareness. Consumers increasingly seek niche supplements online, especially for gut health or women's wellness. E-commerce platforms like Shopee Taiwan, PChome 24h, and Momo are gaining traction by offering convenience, broad product choices, and personalized health solutions.

Key Companies & Market Share Insights

Some key players in the Taiwan nutraceuticals market include GRAPE KING BIO LTD; Amway Products Co., Ltd.; Standard Foods Group; and Chambio Co., Ltd.

- GRAPE KING BIO LTD operates through retail distribution, direct sales, and OEM/ODM business segments. The company is renowned for its core nutraceutical product line, which includes medicinal mushrooms like Antrodia cinnamomea and Ganoderma, as well as a popular range of probiotics.

Key Taiwan Nutraceuticals Companies:

- GRAPE KING BIO LTD

- Standard Foods Group

- Chambio Co., Ltd.

- Nestlé Health Science

- Amway Products Co., Ltd.

- GlaxoSmithKline plc. (GSK plc)

Recent Developments

-

In January 2025, GRAPE KING BIO LTD received the 21st National Innovation Award for its exclusive patented probiotic GKM3. GKM3 is the primary TFDA-approved probiotic product recognized for its effectiveness in supporting weight loss.

-

In March 2024, Taiwan-based nutraceutical company SunWay Biotech and Gnosis by Lesaffre announced a strategic partnership to launch a new product named ANKASCIN/MenaQ7. MenaQ7 Vitamin K₂ as MK‑7 is clinically proven to support bone and cardiovascular health.

Taiwan Nutraceuticals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.13 billion

Revenue forecast in 2033

USD 8.87 billion

Growth rate

CAGR of 7.1% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, and distribution channel

Key companies profiled

GRAPE KING BIO LTD; Standard Foods Group; Chambio Co., Ltd., Nestlé Health Science; Amway Products Co., Ltd.; GlaxoSmithKline plc. (GSK plc)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Taiwan Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Taiwan nutraceuticals market report based on product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Dietary Supplements

-

Tablets

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Capsules

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Soft Gels

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Powders

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Gummies

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Liquid

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Others

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

-

Functional Food

-

Vegetable and Seed Oil

-

Sweet Biscuits, Snack Bars and Fruit Snacks

-

Dairy

-

Baby Food

-

Breakfast Cereals

-

Others

-

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others (Functional dairy based beverages, kombucha, kefir, probiotic drinks, and functional water)

-

-

Infant Formula

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Allergy & Intolerance

-

Healthy Ageing

-

Bone & Joint health

-

Cancer Prevention

-

Children's Health

-

Cognitive Health

-

Diabetes

-

Digestive/Gut Health

-

Energy & Endurance

-

Eye Health

-

Heart Health

-

Immune System

-

Infant Health

-

Inflammation

-

Maternal Health

-

Men's Health

-

Nutricosmetics

-

Oral care

-

Personalized Nutrition

-

Post Pregnancy Health

-

Sexual Health

-

Skin Health

-

Sports Nutrition

-

Weight Management & Satiety

-

Women's Health

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Supermarkets & Hypermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Grocery Stores

-

Others

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.