- Home

- »

- Electronic & Electrical

- »

-

Tankless Water Heater Market Size, Industry Report, 2033GVR Report cover

![Tankless Water Heater Market Size, Share & Trends Report]()

Tankless Water Heater Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Electric, Gas), By Application (Residential, Commercial), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-3-68038-635-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Tankless Water Heater Market Summary

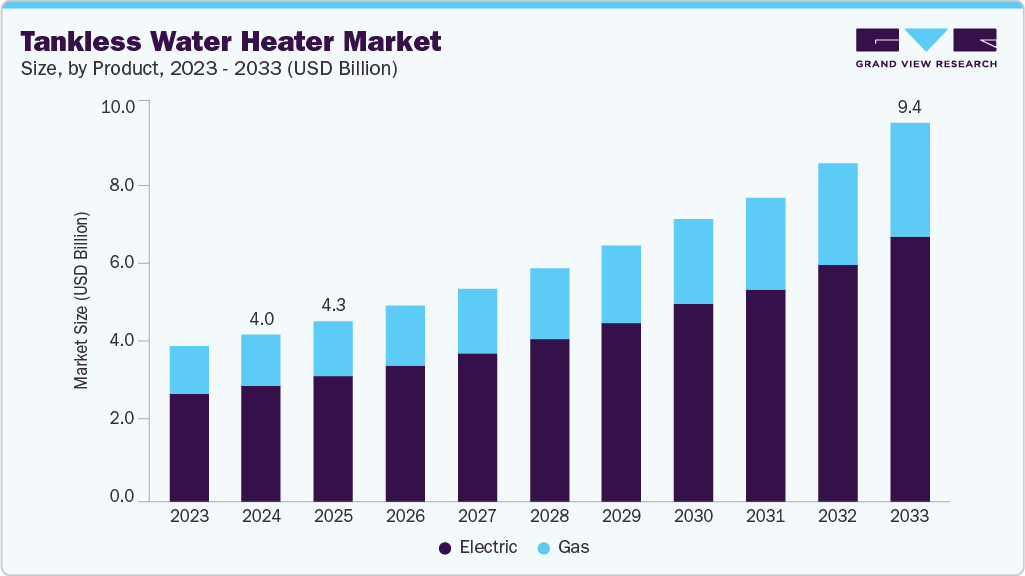

The global tankless water heater market size was estimated at USD 4.02 billion in 2024 and is expected to reach USD 9.41 billion by 2033, growing at a CAGR of 10.2% from 2025 to 2033. The tankless water heater market is primarily driven by the rising demand for energy-efficient, on-demand hot water systems that reduce utility costs.

Key Market Trends & Insights

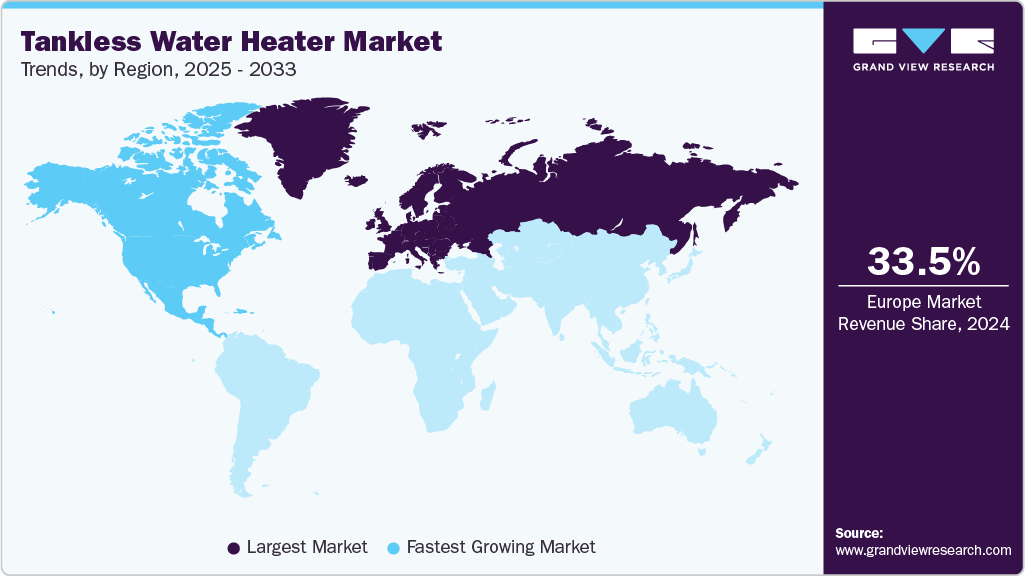

- Europe held the largest share of the tankless water heater market in 2024, accounting for 33.5%.

- In the UK, the push to phase out gas boilers by 2035 under the government’s net-zero carbon strategy is propelling interest in alternatives such as tankless heaters.

- By product, the electric tankless water heater market held the largest share of 69.2% in 2024.

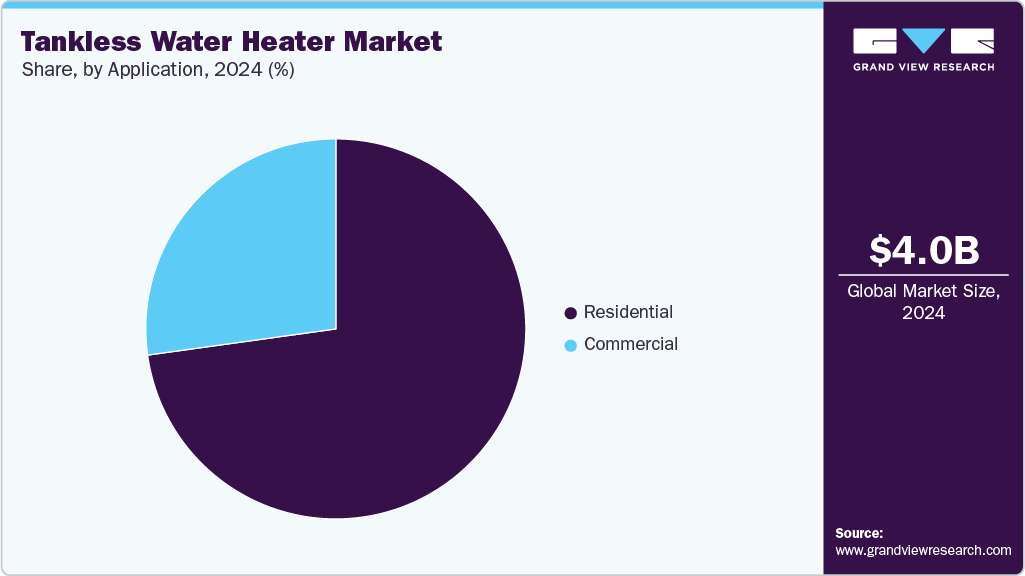

- By application, residential tankless water heaters led the market and accounted for a share of 72.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.02 Billion

- 2033 Projected Market Size: USD 9.41 Billion

- CAGR (2025-2033): 10.2%

- Europe: Largest market in 2024

- North America: Fastest growing market

The tankless water heater market is primarily driven by advancements in heating technologies that offer improved performance and longevity. Growing environmental awareness is pushing consumers toward eco-friendly alternatives to traditional water heaters. Government incentives and rebates for energy-efficient appliances are also encouraging adoption. Moreover, the compact design of tankless systems makes them ideal for urban housing with limited space.The increasing preference for smart home integration and remote-control features primarily drives the tankless water heater market. Rising disposable incomes and changing lifestyles are leading consumers to invest in premium home appliances. The hospitality industry's demand for continuous hot water supply is also fueling market growth. Furthermore, the need to replace aging traditional water heaters is accelerating the shift toward tankless alternatives.

The tankless water heater market is primarily driven by growing awareness of water conservation and the need for sustainable living solutions. Rapid urbanization and the expansion of residential infrastructure in developing economies are creating new market opportunities. Technological innovations enabling faster heating and better temperature control are attracting tech-savvy consumers. In addition, rising energy costs are pushing both households and businesses to seek more cost-effective water heating options.

Product Insights

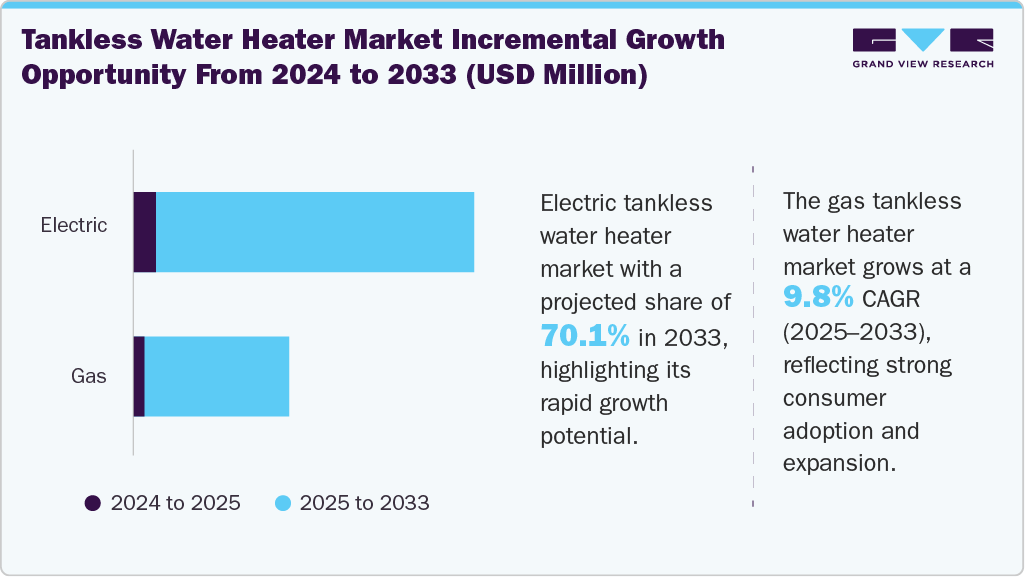

The electric tankless heaters in the tankless water heater market accounted for the largest share of 69.2% of the revenue in 2024. The electric tankless water heater market is driven by factors such as the increasing shift toward cleaner energy sources and the phasing out of gas-based systems in many regions. Rising electricity access in remote and developing areas is expanding the customer base for electric models. Consumers are also drawn to their lower installation costs and minimal maintenance compared to gas units. Supportive government policies promoting electrification and energy efficiency are further accelerating adoption. In addition, advancements in smart thermostats and digital controls enhance user convenience, fueling market growth. Companies such as Bosch and A. O. Smith offer electric tankless water heaters for commercial & residential use.

The gas tankless water heater market is projected to grow at the fastest CAGR of 9.8% from 2025 to 2033. The gas tankless water heater market is driven by high heating efficiency and faster water flow rates that appeal to larger households and commercial users. In regions with low natural gas prices, these systems offer a cost-effective alternative to electric models. The durability and long lifespan of gas units also make them a preferred choice for long-term investments. Growing infrastructure development in colder climates, where high-capacity heating is essential, supports demand. Moreover, innovations in low-NOx and condensing technologies are making gas models more environmentally friendly and compliant with stricter emission regulations.

Application Insights

The residential market of tankless water heaters accounted for the largest share of around 72.8% of the global revenue in 2024. The residential application of the tankless water heater market is driven by the growing trend toward space-saving appliances in modern homes and apartments. Homeowners increasingly value the continuous supply of hot water for simultaneous use in multiple bathrooms and kitchens. Rising awareness of long-term cost savings on energy bills is influencing purchasing decisions. The increasing popularity of home improvement and remodeling projects also boosts demand for upgraded water heating systems. In addition, aesthetic preferences for sleek, wall-mounted designs contribute to their appeal in contemporary residential settings.

The residential market of tankless water heaters is projected to grow at a significant CAGR of 10.0% from 2025 to 2033. The commercial application of the tankless water heater market is driven by the need for reliable, high-volume hot water in sectors such as hospitality, healthcare, and food service. Businesses prioritize systems that reduce downtime and ensure consistent performance during peak usage. The scalability of tankless systems allows for customized solutions based on specific operational demands. Increasing regulations on energy efficiency in commercial buildings are also encouraging the shift from traditional heaters. Furthermore, the focus on reducing operational costs and carbon footprints supports wider adoption in commercial settings.

Regional Insights

North America accounted for the market share of 22.6% in 2024. In North America, rising investments in smart grid infrastructure and energy management systems are supporting the adoption of tankless water heaters. Consumers are increasingly attracted to app-controlled and Wi-Fi-enabled models that offer real-time usage monitoring. The aging housing stock presents a large retrofit market for efficient water heating solutions. Environmental certifications and eco-labeling influence consumer preferences across the region. Moreover, the shift toward electrification in line with decarbonization goals is pushing manufacturers to innovate.

U.S. Tankless Water Heater Market Trends

The U.S. led the North American tankless water heater market in 2024, holding the largest market share with 78.4% of the region’s total revenue. In the U.S., aggressive marketing by utility companies and manufacturers is raising awareness about the benefits of tankless systems. Regional building codes are gradually incorporating efficiency standards that favor tankless technologies. Tax incentives and utility rebates in several states are significantly boosting consumer adoption. A growing DIY culture also makes compact, easy-to-install systems more appealing. In addition, high demand for hot water in large suburban homes creates a strong market for high-capacity models.

Europe Tankless Water Heater Market Trends

The tankless water heater market in Europe held the largest market share of 33.5% in the global market. In Europe, the tankless water heater market is driven by stringent EU directives focused on emissions reduction and energy conservation. The popularity of decentralized heating systems in multi-family housing supports localized tankless solutions. Cultural emphasis on sustainable living is increasing demand for low-consumption appliances. Renovation of old buildings under green initiatives is accelerating the replacement of traditional boilers. In addition, rising electricity costs across many EU nations are prompting a shift toward more efficient water heating options.

In the UK, the push to phase out gas boilers by 2035 under the government’s net-zero carbon strategy is propelling interest in alternatives such as tankless heaters. Compact home sizes and space constraints make tankless models more practical compared to bulky tanks. The increased adoption of underfloor heating systems complements tankless solutions for hot water supply. Public funding for low-carbon home upgrades is expanding consumer access. Moreover, a growing rental housing market is demanding quick, cost-efficient heating upgrades.

Asia Pacific Tankless Water Heater Market Trends

The Asia Pacific accounted for a market share of 29.2% in 2024. In Asia Pacific, rapid urbanization and rising middle-class income levels are fueling demand for modern home appliances, including tankless water heaters. The region's high population density and smaller living spaces favor compact heating systems. Government initiatives promoting energy-efficient housing, especially in countries such as Japan, South Korea, and China, are key market drivers. Increasing awareness of hygiene and hot water availability post-COVID-19 is influencing consumer behavior. In addition, domestic manufacturing growth is making tankless units more affordable and accessible.

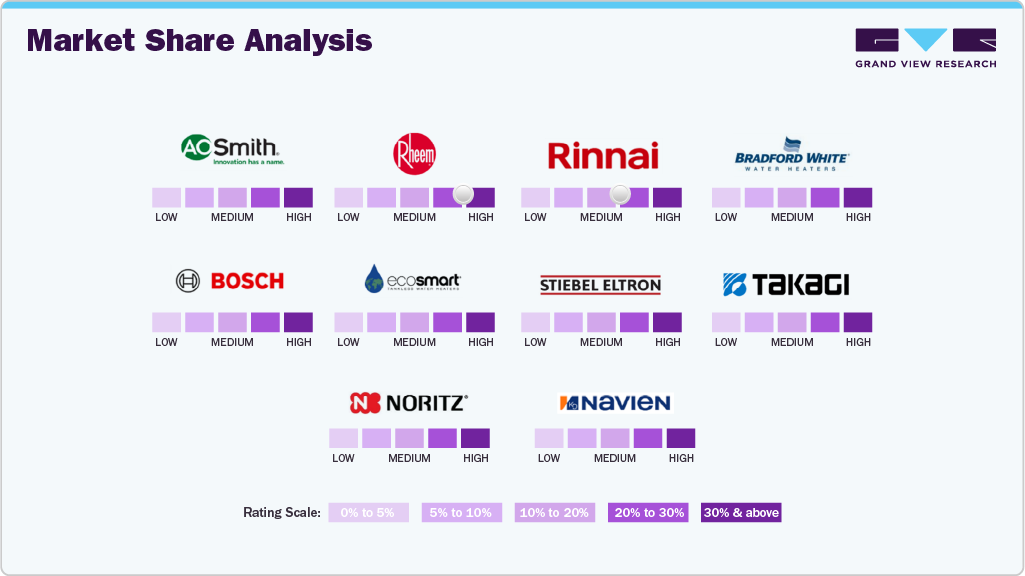

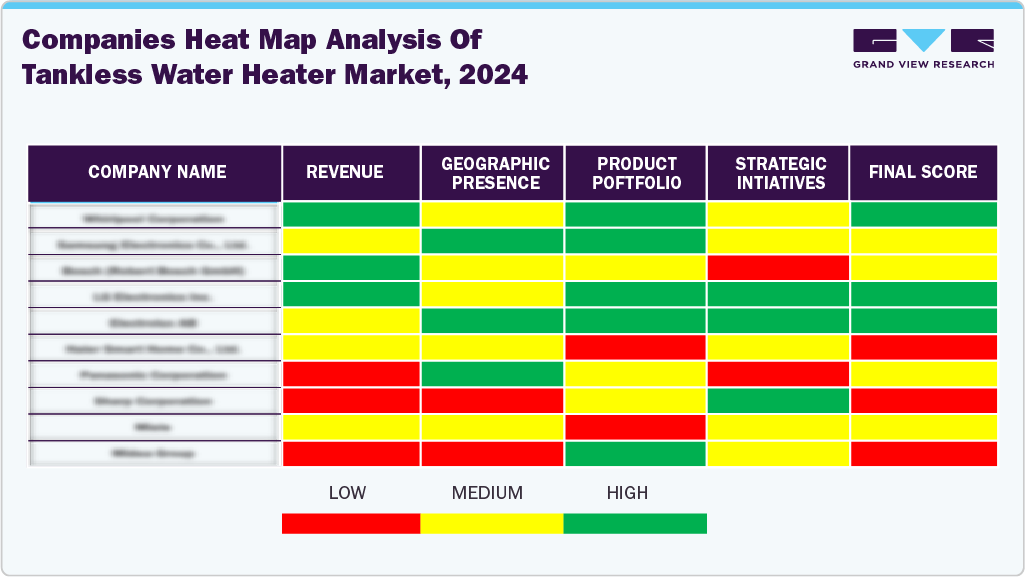

Key Tankless Water Heater Company Insights

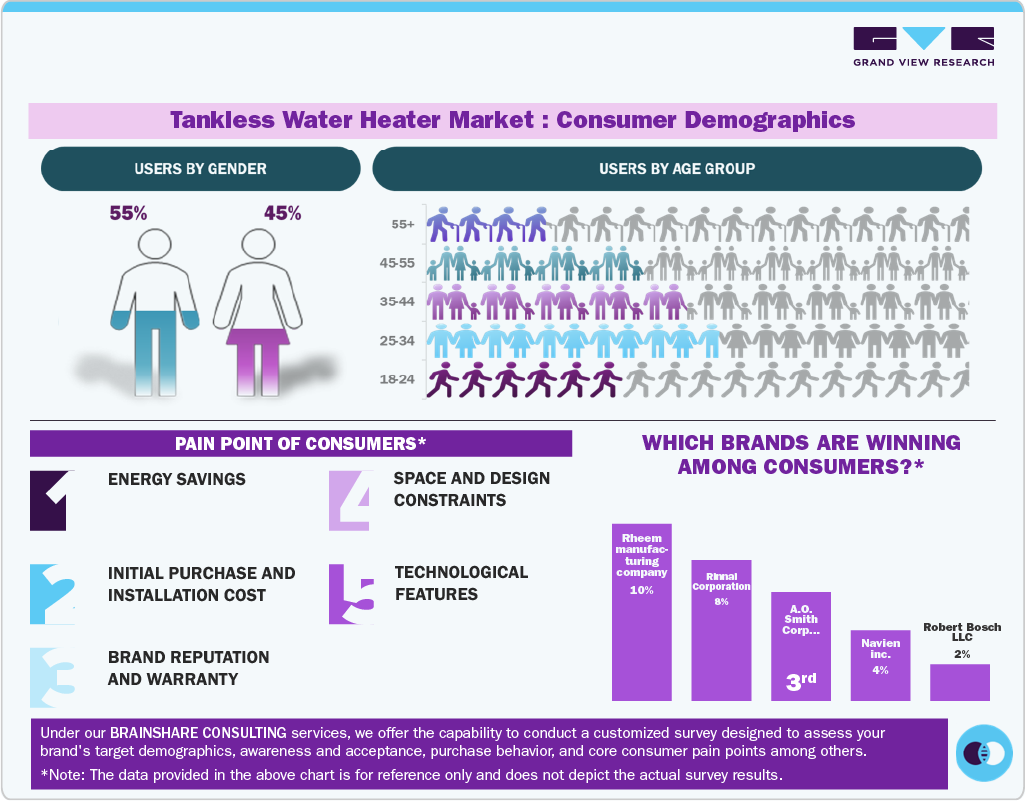

Many brands in the tankless water heater market have recognized untapped opportunities within their product portfolios and are actively working to capitalize on these gaps. This includes launching innovative designs, expanding customization options, and tailoring marketing strategies to align with evolving consumer tastes and cultural trends. By addressing niche segments and emerging preferences, these brands aim to increase their market share and strengthen their competitive positioning worldwide.

Key Tankless Water Heater Companies:

The following are the leading companies in the tankless water heater market. These companies collectively hold the largest market share and dictate industry trends.

- A. O. Smith

- Rheem Manufacturing Company

- Rinnai Corporation

- Bradford White Corporation

- Robert Bosch LLC

- EcoSmart Green Energy Products, Inc.

- Stiebel Eltron Inc.

- Takagi

- Noritz America Corp.

- Navien Inc.

Recent Developments

-

In September 2024, A.O. Smith introduced a new Point-Of-Use (POU) Electric Tankless Water Heater designed for quick installation in light commercial and residential settings. This compact unit requires no venting and includes features like dry fire protection, leak detection with audible alarms, and integrated scale detection to enhance durability and performance.

-

In January 2023, Bosch Thermotechnology launched the Tronic 4000 C and Tronic 6100 C electric tankless water heaters, designed for point-of-use and whole-house applications, respectively. These models offer compact designs, high energy efficiency, and consistent on-demand hot water delivery, catering to both residential and light commercial needs.

Tankless Water Heater Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 4.34 billion

Revenue forecast in 2033

USD 9.41 billion

Growth rate (Revenue)

CAGR of 10.2% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative (Revenue) units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

A. O. Smith; Rheem Manufacturing Company; Rinnai Corporation; Bradford White Corporation; Robert Bosch LLC; EcoSmart Green Energy Products, Inc.; Stiebel Eltron Inc.; Takagi; Noritz America Corp.; Navien Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tankless Water Heater Market Report Segmentation

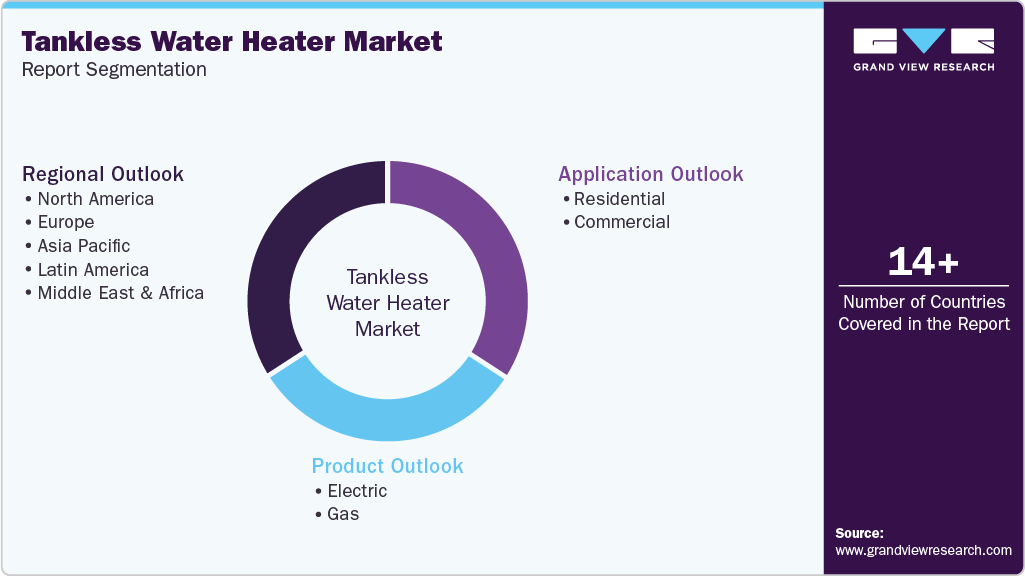

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global tankless water heater market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Electric

-

Gas

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tankless water heater market size was estimated at USD 4.02 billion in 2024 and is expected to reach USD 4.34 billion in 2025.

b. The global tankless water heater market is expected to grow at a compound annual growth rate (CAGR) of 10.2% from 2025 to 2033 to reach USD 9.41 billion by 2033.

b. The electric tankless heaters market accounted for a revenue share of 69.2% in 2024, driven by factors such as the increasing shift toward cleaner energy sources and the phasing out of gas-based systems in many regions.

b. Some key players operating in the tankless water heater market include A. O. Smith, Rheem Manufacturing Company, Rinnai Corporation, Bradford White Corporation, Robert Bosch LLC, EcoSmart Green Energy Products, Inc., Stiebel Eltron Inc., Takagi, Noritz America Corp., and Navien Inc.

b. Key factors driving growth in the tankless water heater market include increasing demand for energy-efficient and space-saving appliances, rising construction of residential and commercial buildings, and growing consumer awareness about sustainable technologies. Technological advancements, such as Wi-Fi-enabled smart controls, also boost adoption. Government incentives for eco-friendly products further support market expansion. Additionally, longer lifespan and lower operational costs attract more consumers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.