- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Tire Pyrolysis Products Market Size, Industry Report, 2033GVR Report cover

![Tire Pyrolysis Products Market Size, Share & Trends Report]()

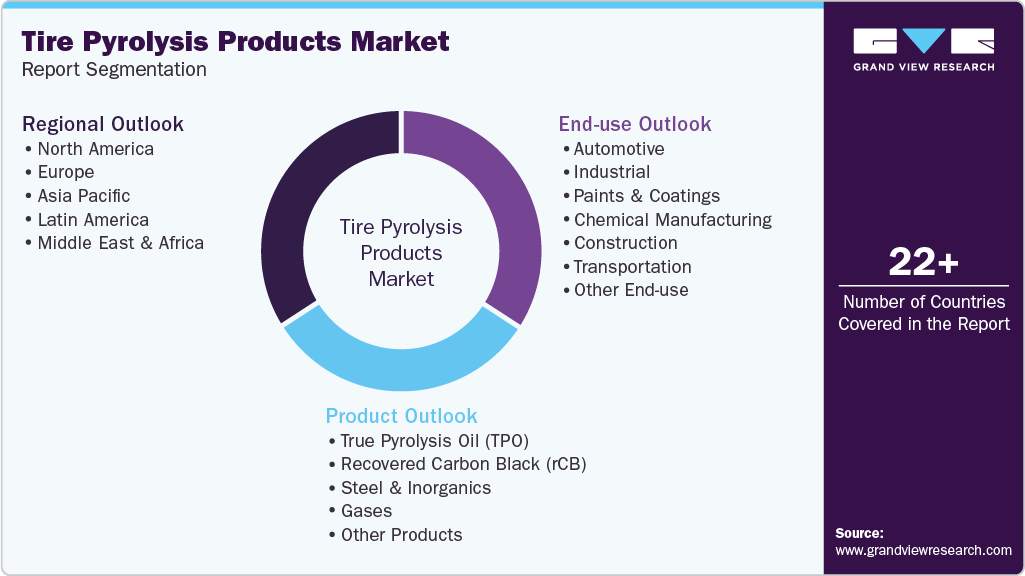

Tire Pyrolysis Products Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (True Pyrolysis Oil (TPO), Recovered Carbon Black (rCB), Steel & Inorganics, Gases), By End-use (Automotive, Industrial, Chemical Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-799-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tire Pyrolysis Products Market Summary

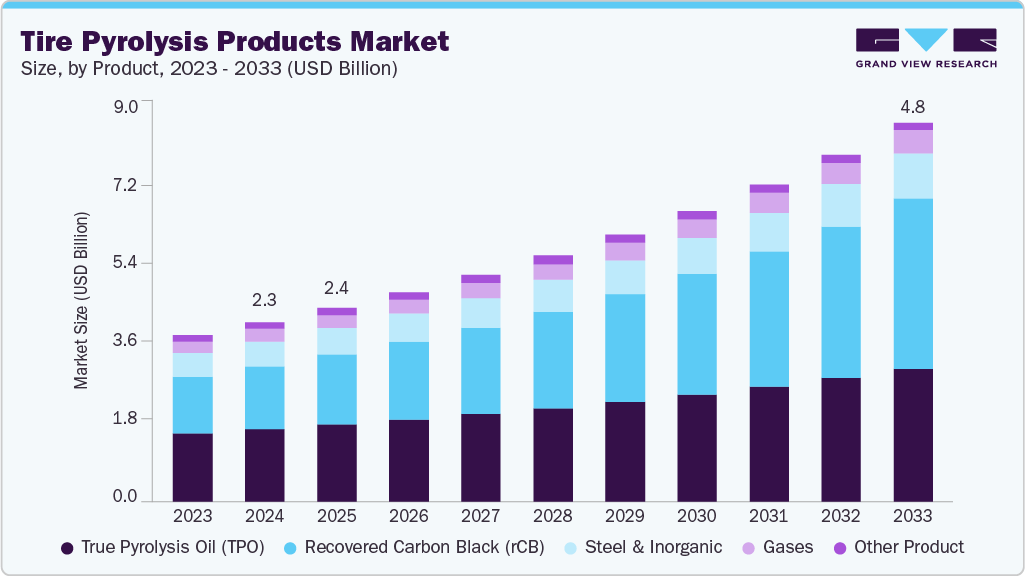

The global tire pyrolysis products market size was estimated at USD 2,253.0 million in 2024 and is projected to reach USD 4,759.2 million by 2033, growing at a CAGR of 8.7% from 2025 to 2033. The growing global emphasis on sustainable waste management and circular economy practices.

Key Market Trends & Insights

- Asia Pacific dominated the global tire pyrolysis products market with the largest revenue share of 42.1% in 2024.

- Tire pyrolysis products market in China accounts for a significant share of 37.9% in 2024.

- By product, the true pyrolysis oil (TPO) segment held the largest market share of 40.5% in 2024 in terms of revenue.

- By end use, chemical manufacturing segment is expected to grow at the fastest CAGR of 13.9% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 2,253.0 Million

- 2033 Projected Market Size: USD 4,759.2 Million

- CAGR (2025 - 2033): 8.7%

- Asia Pacific: Largest Market in 2024

- Europe: Fastest Growing Market

With an estimated one billion end-of-life tires (EoLT) generated annually worldwide, the environmental burden of improper disposal, through landfilling or incineration, has become a critical concern. Pyrolysis offers a technically viable and environmentally safer alternative to recover value-added products such as tire pyrolysis product oil (TPO), recovered carbon black (rCB), steel, and gases.Regulatory pressure in developed regions, including the European Union’s landfill bans and strict emission standards, has accelerated the adoption of tire pyrolysis product as part of national waste diversion strategies. Additionally, government incentives for recycling infrastructure and renewable fuel production have encouraged investment in large-scale pyrolysis facilities, positioning the technology as a key enabler of resource recovery from end-of-life tires.

The rising demand for recovered carbon black and alternative fuels from industrial and automotive sectors. Recovered carbon black has gained attention as a sustainable and cost-effective substitute for virgin carbon black in rubber compounding, plastics, and coatings end uses. Tire manufacturers and automotive OEMs are increasingly integrating rCB into new tire formulations to achieve corporate sustainability targets and reduce dependency on petrochemical-derived materials. Parallelly, TPO has found growing demand as an industrial fuel and as a refining feedstock for chemical manufacturing, given its high calorific value and composition similarity to conventional hydrocarbons. The ability of pyrolysis oil to displace fossil-derived fuels supports its economic attractiveness, particularly amid fluctuating crude prices and rising global energy demand.

The technological advancements and strategic industry collaborations are propelling commercial scalability and product quality improvements. Innovations in continuous pyrolysis systems, advanced condensers, and post-processing technologies have enhanced yield efficiency and product consistency, overcoming earlier quality concerns that limited large-scale adoption. Partnerships between tire manufacturers, recycling firms, and technology developers, especially in Europe and North America, are facilitating the integration of pyrolysis outputs into mainstream industrial supply chains. Companies are also investing in refining and upgrading units to produce higher-grade oils and performance-grade rCB, expanding end-use potential in high-value sectors such as chemicals, coatings, and new tire manufacturing.

Market Concentration & Characteristics

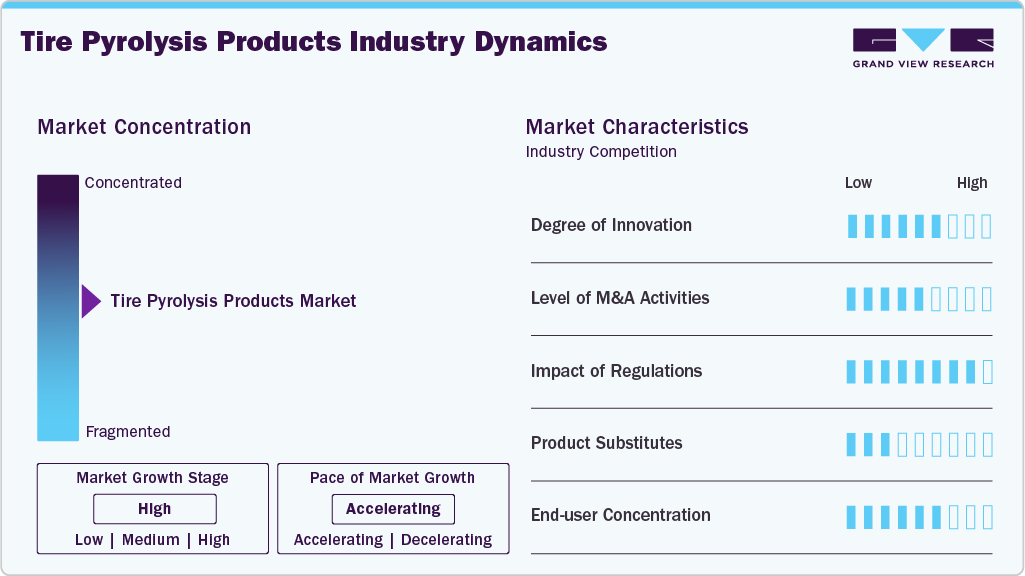

The tire pyrolysis product market is moderately concentrated, characterized by the presence of a limited number of established technology providers and integrated recyclers operating alongside several small and medium-scale regional players. The industry is still in a developmental phase, with only a handful of companies achieving large-scale, continuous operations capable of meeting industrial-grade product quality and environmental compliance standards. Leading players, primarily in Europe and North America, such as Pyrum Innovations AG, Enviro Systems AB, and Scandinavian Enviro Systems, have set benchmarks in commercial production capacity, rCB upgrading, and partnerships with tire manufacturers. These companies leverage proprietary process technologies, strong feedstock supply agreements, and collaborations with major OEMs to secure a competitive advantage. Conversely, in emerging markets such as India, China, and Southeast Asia, the landscape remains highly fragmented, with numerous small-scale operators focusing on low-cost TPO production and facing regulatory and quality-control challenges

Market concentration is gradually increasing as regulatory compliance requirements, capital intensity, and technological complexity drive consolidation. The shift toward continuous pyrolysis systems, higher product purity standards, and stricter environmental norms has created barriers to entry for unorganized players. Major tire manufacturers and investors are increasingly partnering with select pyrolysis technology providers to ensure quality assurance and circular material traceability, which is leading to the emergence of integrated value chains. As financing and permitting favor larger, compliant facilities, the market is expected to witness a steady transition from a fragmented ecosystem to a more consolidated structure dominated by a few globally active players capable of producing high-grade recovered carbon black and upgraded pyrolysis oil.

Products Insights

The true pyrolysis oil (TPO) segment led the market and accounted for the largest revenue share of 40.5% in 2024. Tire Pyrolysis Product Oil is the liquid fraction obtained from the thermal decomposition of end-of-life tires. It possesses a high calorific value and is used as an alternative industrial fuel or as a refinery feedstock after upgrading. The growing emphasis on renewable and circular energy sources, coupled with volatile crude oil prices, is driving demand for TPO across industrial and chemical manufacturing sectors.

The recovered carbon black segment is anticipated to grow at the fastest CAGR of 11.8% during the forecast period. Recovered Carbon Black is the solid carbon residue produced during tire pyrolysis product and serves as a sustainable alternative to virgin carbon black in rubber, plastics, and coatings end uses. It offers cost and environmental advantages by reducing dependence on petrochemical-based inputs. With major tire manufacturers incorporating rCB to meet circularity goals, it has emerged as the fastest-growing and most value-added product segment within the tire pyrolysis product market.

End Use Insights

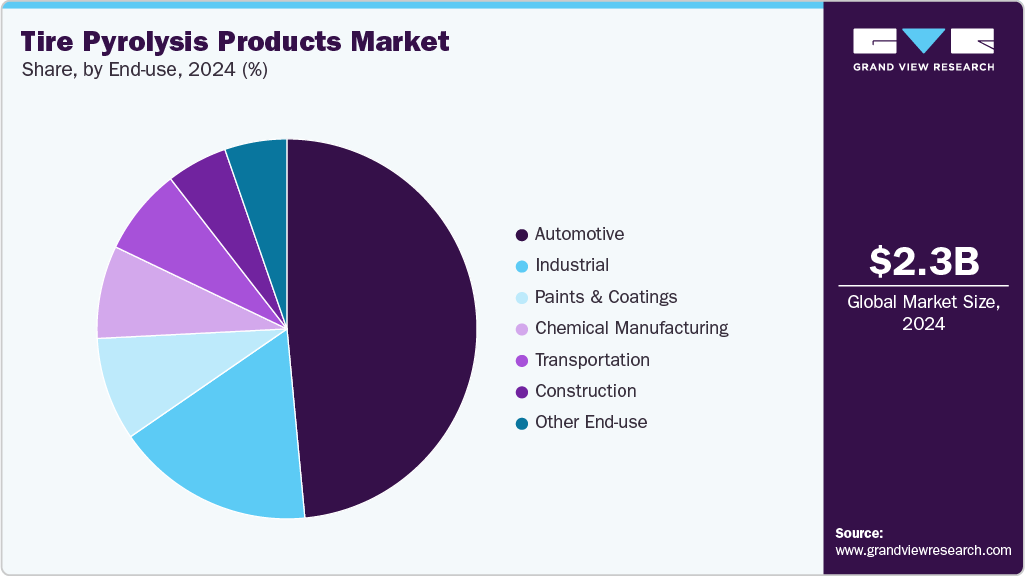

The automotive segment led the tire pyrolysis product industry with the largest revenue share of 48.5% in 2024. The automotive segment is the largest end use segments for tire pyrolysis product products, particularly recovered carbon black (rCB). rCB is increasingly being adopted in tire manufacturing and other rubber components to replace a portion of virgin carbon black, supporting OEMs’ sustainability and recycled-content targets. This segment benefits from growing circular economy commitments by major tire brands and regulatory pressure to integrate recycled materials into vehicle components.

The chemical manufacturing segment is expected to grow at the fastest CAGR of 13.9% from 2025 to 2033. In chemical manufacturing, tire pyrolysis product oil (TPO) is utilized as a feedstock for producing various petrochemical derivatives, solvents, and specialty chemicals. The segment is witnessing rapid growth as refiners and chemical producers explore TPO upgrading technologies to enhance quality and compatibility with existing refining systems. Rising global demand for sustainable chemical inputs and decarbonization initiatives within the chemical industry are key factors driving expansion in this segment

Regional Insights

The Asia Pacific tire pyrolysis products market accounted for the largest revenue share of 42.1% in 2024. The growth is attributed to the high end-of-life tire (EoLT) generation, a large automotive manufacturing base, and growing industrial fuel demand. Countries such as China and India are major contributors due to their extensive tire production and recycling capacities. However, while the region leads in volume, environmental and quality compliance challenges have limited large-scale commercialization compared to Europe and North America.

China Tire Pyrolysis Products Market Trends

Tire pyrolysis products market in China accounts for a significant share of global tire pyrolysis product output, driven by vast end-of-life tire availability and low feedstock costs. The government’s increasing emphasis on green manufacturing and waste valorization is boosting interest in large-scale pyrolysis units. However, inconsistent environmental standards and uneven technology adoption across regions pose operational challenges for uniform product quality.

North America Tire Pyrolysis Products Market Trends

North America is witnessing strong growth driven by technological advancements, favorable recycling regulations, and increasing adoption of recovered carbon black (rCB) by major tire manufacturers. The U.S. leads the region with multiple commercial-scale pyrolysis facilities and strong research initiatives in product upgrading and refining. Strategic partnerships between recyclers and tire producers are further supporting market formalization and investment in continuous pyrolysis plants.

The U.S. is emerging as a major hub for high-quality pyrolysis oil and recovered carbon black production, backed by advanced process technologies and strong industry partnerships. Federal and state-level recycling initiatives, along with sustainability commitments from tire manufacturers, are promoting large-scale facility expansions. The country’s robust industrial infrastructure and investment in upgrading technologies position it for long-term growth in the tire pyrolysis product market.

Europe Tire Pyrolysis Products Market Trends

Europe represents one of the most mature markets, propelled by stringent environmental legislation, circular economy mandates, and active investment in industrial-scale tire pyrolysis product projects. Germany, in particular, is a key hub, hosting several advanced facilities and pilot projects supported by OEMs and material science companies. The region’s focus on sustainability and closed-loop tire recycling is creating a premium market for high-quality recovered carbon black and upgraded pyrolysis oil.

Tire pyrolysis product market in Germany is a frontrunner in Europe’s tire pyrolysis product market, supported by strict recycling regulations, active government support, and collaboration with tire and chemical industries. German companies are at the forefront of developing continuous pyrolysis and rCB upgrading technologies that meet stringent quality and emission standards. The nation’s leadership in circular material innovation and industrial decarbonization continues to attract both domestic and cross-border investments in the sector.

Latin America Tire Pyrolysis Products Market Trends

The Latin American tire pyrolysis product market is in its early stage but is gradually expanding due to rising waste management awareness and growing energy recovery applications. Countries such as Brazil and Mexico are investing in small- to medium-scale pyrolysis units aimed at reducing landfill dependency. However, limited regulatory enforcement and financing constraints still restrict the market’s scalability and product quality standardization.

Middle East & Africa Tire Pyrolysis Products Market Trends

In the Middle East & Africa, tire pyrolysis product development is supported by the need for alternative energy sources and waste reduction strategies. Gulf countries, in particular, are showing interest in pyrolysis as part of sustainability goals under circular economy frameworks. Nonetheless, the market remains nascent, characterized by smaller pilot projects and limited integration of advanced upgrading technologies.

Key Tire Pyrolysis Products Company Insights

Some of the key players operating in the market include TCI Chemicals, Bridgestone, Klean Industries, and Atkin Chemicals.

- Neste is a chemical manufacturing company with a presence across Asia Pacific, North America, Central & South America, Europe, and the Middle East & Africa. The company operates through six business segments, namely chemical, material, industrial solutions, surface technologies, agricultural solutions, and nutrition & care. The chemical segment includes petrochemicals and intermediaries. The material segment comprises performance polymers and monomers.

Key Tire Pyrolysis Products Companies:

The following are the leading companies in the tire pyrolysis products market. These companies collectively hold the largest Market share and dictate industry trends.

- Bolder Industries

- Pryolyx

- Klean Industries

- Bridgestone

- Metso

- Bioenergy AE Cote-Nord

- Green Fuel Nordic Oy

- New Hope Energy

- Marubeni Corporation

- Contec S.A.

- Neste

- Revolve Carbon Materials

Recent Developments

- In April 2024, Neste announced successful conclusion of its first processing run with pyrolysis oil from discarded tires. Neste sourced pyrolysis oil derived from discarded vehicle tires by Scandinavian Enviro Systems, a Swedish company developing technologies to recover materials from end-of-life products. The goal of Neste’s pilot run was to evaluate the potential of chemical recycling beyond plastic waste to potentially broaden the pool of waste streams that could be processed into high-quality products. The aim is to improve the chemical recycling of Neste across the globe.

Tire Pyrolysis Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,434.6 million

Revenue forecast in 2033

USD 4,759.2 million

Growth rate

CAGR of 8.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific: Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Bolder Industries; Pryolyx; Klean Industries; Bridgestone; Metso; Bioenergy AE Cote-Nord; Green Fuel Nordic Oy; New Hope Energy; Marubeni Corporation; Contec S.A.; Revolve Carbon Materials, Neste

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tire Pyrolysis Products Market Report Segmentation

This report forecasts volume & revenue growth at the global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global tire pyrolysis products market report based on product, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

True Pyrolysis Oil (TPO)

-

Recovered Carbon Black (rCB)

-

Steel & Inorganics

-

Gases

-

Other Products

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Automotive

-

Industrial

-

Paints & Coatings

-

Chemical Manufacturing

-

Construction

-

Transportation

-

Other End Use

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tire pyrolysis market size was estimated at USD 2,253.03 million in 2024 and is expected to reach USD 2,434.6 million in 2025.

b. The global tire pyrolysis market is expected to grow at a compound annual growth rate of 8.7% from 2025 to 2033 to reach USD 4,759.2 million by 2033.

b. The Asia Pacific tire pyrolysis market accounted for the largest revenue share of 42.1% in 2024. The growth is owing to high end-of-life tire (EoLT) generation, a large automotive manufacturing base, and growing industrial fuel demand.

b. Some key players operating in the tire pyrolysis market include Bolder Industries; Pryolyx; Klean Industries; Bridgestone; Metso; Bioenergy AE Cote-Nord; Green Fuel Nordic Oy; New Hope Energy; Marubeni Corporation; Contec S.A.; Revolve Carbon Materials, and Neste

b. The growing global emphasis on sustainable waste management and circular economy practices. With an estimated one billion end-of-life tires (EoLT) generated annually worldwide, the environmental burden of improper disposal—through landfilling or incineration—has become a critical concern.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.