- Home

- »

- Automotive & Transportation

- »

-

Tow Tractor Market Size And Share, Industry Report, 2033GVR Report cover

![Tow Tractor Market Size, Share & Trends Report]()

Tow Tractor Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Rider-Seated Tow Tractors, Stand-In Tow Tractors, Pedestrian Tow Tractors), By Load Capacity, By Power Source, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-738-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Tow Tractor Market Summary

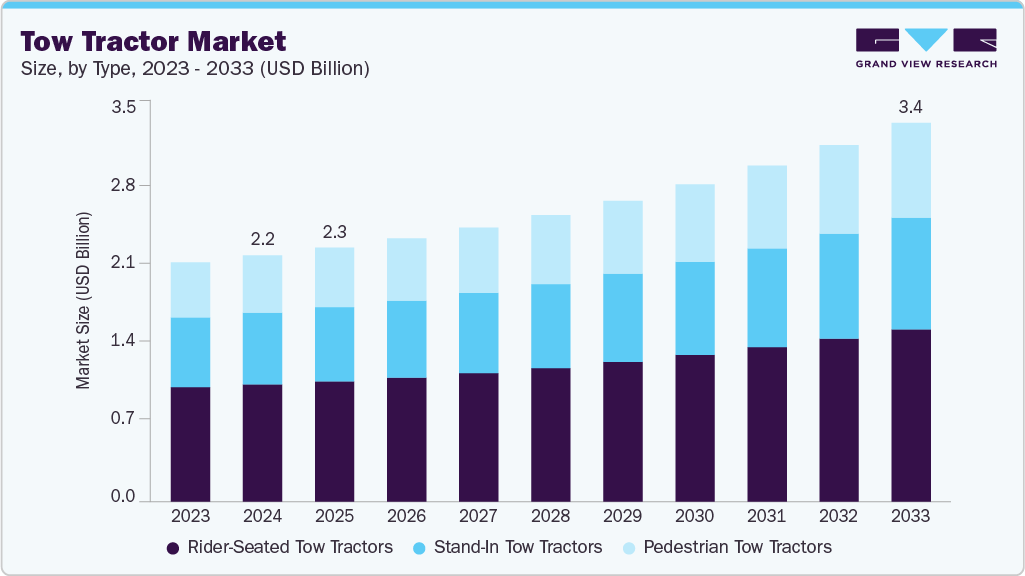

The global tow tractor market size was estimated at USD 2.24 billion in 2024, and is projected to reach USD 3.45 billion by 2033, growing at a CAGR of 5.1% from 2025 to 2033. The industry is gaining momentum, driven by rapid growth in automated warehousing and e-commerce fulfillment, which require efficient, high-throughput material handling solutions.

Key Market Trends & Insights

- North America tow tractor market accounted for a 32.5% share of the overall market in 2024.

- The tow tractor industry in the U.S. held a dominant position in 2024.

- By type, the rider-seated tow tractors segment accounted for the largest share of 47.6% in 2024.

- By load capacity, the below 5 tons segment accounted for the largest share in 2024.

- By power source, the electric segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.24 Billion

- 2033 Projected Market Size: USD 3.45 Billion

- CAGR (2025-2033): 5.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Increasing electrification of ground support equipment (GSE) at airports and transport hubs is fostering sustainable and low-emission operations. Fleet modernization efforts across retail and distribution centers are accelerating the replacement of aging diesel tow tractors with advanced electric and hybrid models that offer improved performance and reduced operational costs. Integration of autonomous driving and telematics technologies presents opportunities to enhance safety, efficiency, and real-time asset management. However, challenges such as limited infrastructure and charging capacity for high-capacity electric tow tractors pose constraints.

The growth of automated stand-in tow tractors is being propelled by the rapid expansion of e-commerce fulfillment operations and the increasing adoption of automation in warehouses and distribution centers. Rising online retail demand requires faster order picking, efficient material movement, and reduced dependency on manual labor. According to the Boston Consulting Group (BCG) and the Retailers Association of India (RAI), India’s retail sector grew from USD 400.9 billion in 2014 to USD 939.8 billion in 2024 at an annual rate of 8.9%. Furthermore, according to the India Brand Equity Foundation (IBEF), the Indian e-commerce market is projected to expand from USD 125 billion in 2024 to USD 345 billion by 2030. Companies are responding to this demand by deploying automated tow tractors to streamline workflows. For instance, in June 2021, Seegrid launched the Palion Tow Tractor Series 8 with Smart Path technology, improving navigation and efficiency in manufacturing, warehousing, and e-commerce logistics.

The electrification of ground support equipment (GSE) at airports and transport hubs is accelerating due to growing environmental mandates, airline sustainability commitments, and the long-term cost advantages of electric systems over diesel models. Electrically driven GSE emits significantly fewer greenhouse gases, up to 48% less CO₂ on average, along with lower noise levels, making them particularly suitable for noise-sensitive and high-traffic areas. Leading ground handling providers, including Swissport, now require that all newly procured GSE must be electric starting from January 2025, aiming for a 55% electric fleet at Zurich by 2025. At Singapore’s Changi Airport, more than 80 electric baggage tractors are already in operation, collectively reducing over 600 tons of CO₂ emissions annually, supported by shared charging facilities. Such initiatives are driving market growth by encouraging investments in electric tow tractors and related infrastructure, fostering innovation in battery technology, and increasing demand for sustainable and efficient airport operations globally.

The integration of autonomous driving and telematics in tow tractors presents a significant opportunity for the market. Key drivers include rising labor shortages prompting automation, increasing demand for operational efficiency, the need to reduce workplace accidents, and advancements in AI and sensor technologies enabling precise vehicle navigation. These smart systems enhance fleet management through real-time data monitoring and predictive maintenance, reducing downtime and costs. For instance, in March 2024, Cyngn unveiled its AI-powered DriveMod Tugger, based on Motrec’s MT-160 tow tractor, at MODEX 2024. This autonomous vehicle offers a 6,000-pound towing capacity (with plans to upgrade to 12,000 pounds), features auto-unhitching to minimize human intervention, and integrates multi-layered safety systems for reliable operations. This example illustrates how autonomous and telematics technologies are revolutionizing tow tractor functionality, driving safer, more efficient, and cost-effective logistics workflows. Overall, this opportunity signals a shift toward smarter, connected fleets that boost productivity and reduce operational risks.

The infrastructure and charging constraints for high-capacity electric tow tractors present a significant challenge to market growth. These tractors demand substantial power and fast charging to maintain operational efficiency in industrial, airport, and logistics environments. However, developing the necessary charging infrastructure requires considerable investment and coordination with energy providers to ensure grid capacity can support the load. For example, in the U.S., the National Renewable Energy Laboratory (NREL) is actively working on expanding fast-charging networks for commercial electric vehicles to address such needs. Similarly, in the U.K., industry groups are urging governments to accelerate the development of heavy vehicle charging infrastructure, including depot charging facilities. These constraints can lead to longer charging downtimes and restricted operational hours, reducing overall productivity. Addressing this challenge will require collaboration among manufacturers, infrastructure developers, and regulators to implement scalable, reliable charging solutions. Successfully overcoming these barriers is essential for widespread adoption and unlocking the full benefits of high-capacity electric tow tractors in key industries.

Type Insights

The rider-seated tow tractors segment accounted for the largest share of 47.6% in 2024. These vehicles are preferred in industrial plants, airports, and large-scale distribution centers where efficiency and operator productivity are paramount. Factors such as the increasing adoption of high-volume material handling, rising demand for ergonomic operator comfort, enhanced towing capacity for heavy loads, and integration of advanced safety features are supporting the segment growth. Ongoing electrification trends and the shift toward sustainable operations are further accelerating their uptake across industries.

The pedestrian (walk-behind) tow tractors segment is expected to grow at the highest CAGR from 2025 to 2033, driven by their suitability for maneuvering in confined spaces, lower acquisition and maintenance costs, enhanced safety for short-distance operations, and adaptability across diverse industrial environments. These compact and agile machines are increasingly favored in warehouses, manufacturing units, and retail distribution facilities for efficient handling of lighter loads. Their ease of operation and minimal licensing requirements further support widespread adoption, particularly in facilities with frequent staff turnover or seasonal workforce changes.

Load Capacity Insights

The below 5 tons segment accounted for the largest share in 2024, supported by its extensive deployment across diverse operational settings. These tow tractors are widely used in retail distribution hubs for replenishing store inventory, hospitals for transporting medical supplies and laundry, and postal and courier sorting centers for moving mail carts with speed and precision. Their compact design and exceptional maneuverability make them ideal for navigating congested environments, while their ability to handle frequent stop-and-go operations enhances overall productivity. Additionally, growing adoption in warehouse order-picking operations, baggage handling at small- to mid-sized airports, in-plant logistics for automotive assembly lines, and material movement in food & beverage production facilities is further fueling demand. This versatility across both indoor and outdoor applications underscores their critical role in streamlining material handling workflows.

The above 25 tons segment is expected to grow at a significant CAGR during the forecast period, driven by increasing demand for high-capacity towing solutions in large-scale industrial operations, rising adoption in port container handling and heavy manufacturing plants, expansion of mining and steel industry logistics, and the need for efficient yard management in mega distribution centers. These heavy-duty tow tractors are critical for moving oversized loads, streamlining bulk material transfers, and reducing operational turnaround times in high-throughput environments. Companies are actively introducing advanced models to meet these demands. For instance, in September 2024, BYD launched its EYT 2.0 Electric Yard Tractor at IAA Transportation in Europe, offering up to 64.8-ton towing capacity, a robust design, and the long-lasting Blade Battery, enabling 16-hour operation and rapid DC charging to support sustainable logistics in ports and distribution centers. This trend highlights a strong shift toward high-capacity, eco-friendly solutions that combine productivity with environmental compliance.

Power Source Insights

The electric segment accounted for the largest share in 2024. These tow tractors are increasingly preferred in sectors such as airports, warehouses, manufacturing plants, and healthcare facilities, where sustainability and operational efficiency are top priorities. Increasing adoption of zero-emission vehicles to meet stringent environmental regulations, rising fuel cost savings compared to diesel-powered models, advancements in battery technology enabling longer operational hours, and the growing demand for low-noise equipment in indoor and urban logistics environments are contributing to the segment’s growth. Companies are actively introducing advanced models to cater to this demand. For instance, in May 2023, Toyota Material Handling introduced an electric Industrial Tow Tractor with a 15,000-pound towing capacity, electric power steering, and regenerative plugging for enhanced efficiency. Designed for warehouses and distribution centers, it offers improved ergonomics, compatibility with lithium-ion batteries, and optional features for tailored operational needs.

The hybrid segment is expected to register a notable CAGR from 2025 to 2033, driven by the need for an extended operational range without compromising on reduced emissions, increasing adoption in facilities with both indoor and outdoor operations, and growing demand from ports and large manufacturing plants where mixed-duty cycles require fuel flexibility. These tow tractors are particularly valued in operations where charging infrastructure is limited or continuous uptime is essential, as they combine the benefits of electric propulsion with the reliability of internal combustion backup.

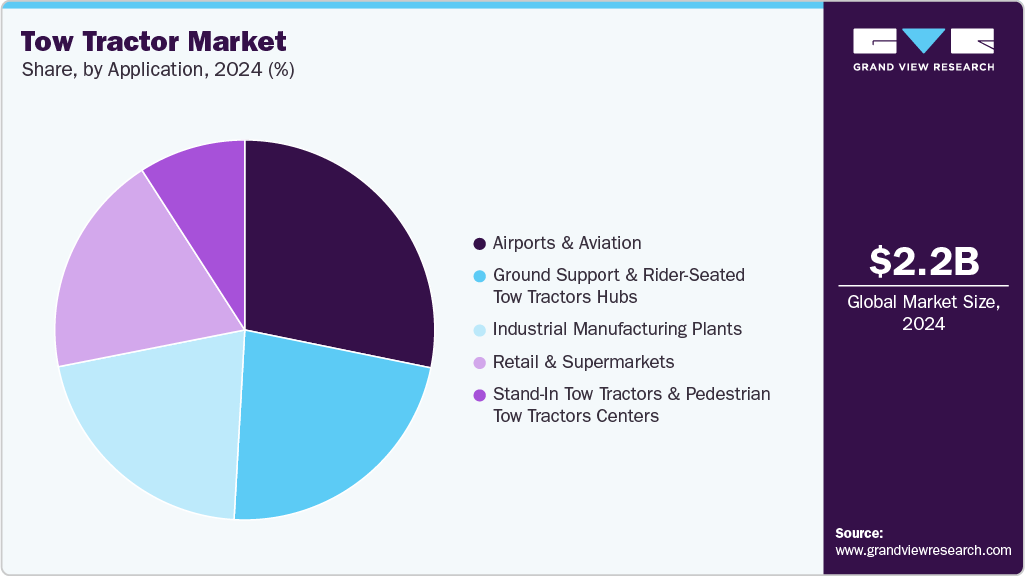

Application Insights

The airports & aviation segment accounted for the largest share in 2024, driven by increasing air passenger traffic leading to higher baggage handling volumes, rising cargo movement through air freight, growing investments in ground support equipment modernization, and the need for efficient, low-emission towing solutions to meet airport sustainability targets. Tow tractors in this segment are extensively used for tasks such as transporting baggage carts, towing cargo dollies, and shuttling ground service equipment across terminals and tarmacs.

Companies are focusing on integrating autonomous navigation systems, enhancing vehicle energy efficiency, and adopting electric or hybrid powertrains to reduce emissions and improve operational safety. For instance, in September 2024, TractEasy deployed its EZTow autonomous tow tractor with dnata at Dubai’s Al Maktoum International Airport to optimize ground handling efficiency. The project will assess operational demands, refine autonomous technology, and enhance safety, sustainability, and precision in cargo and luggage transport across airport environments.

The ground support & rider-seated tow tractors hubs segment is expected to register a notable CAGR from 2025 to 2033, owing to its high efficiency in handling heavy loads over long distances, superior operator comfort for extended shifts, adaptability to both indoor and outdoor operations, and the capability to integrate advanced telematics and safety systems. These tractors are widely used in large-scale logistics hubs, seaports, manufacturing facilities, and airport ground operations where reliability and productivity are critical.

Regional Insights

North America tow tractor market accounted for 32.5% of the global share in 2024. The market is driven by significant investments in airport modernization and infrastructure upgrades, supported by government initiatives such as the Biden-Harris Administration's Bipartisan Infrastructure Law. Over USD 20 million in grants were awarded in 2024 to improve airport facilities across 14 states and Puerto Rico, funding projects like baggage system upgrades, sustainability efforts, and terminal expansions that boost demand for advanced ground support equipment such as tow tractors. North America’s strong e-commerce growth fuels the need for efficient automated warehousing and material handling solutions, further increasing tow tractor adoption in distribution centers. The region also leads in adopting electric and autonomous vehicle technologies, driven by stringent emissions regulations and sustainability goals.

U.S. Tow Tractor Industry Trends

The tow tractor industry in the U.S. held a dominant position in 2024. The tow tractor market in the U.S. is witnessing a significant transformation, driven by increasing demand from expanding e-commerce and retail distribution centers requiring efficient material handling solutions. Growing investments in airport infrastructure modernization are boosting the adoption of advanced ground support equipment, including electric and autonomous tow tractors. Also, stringent environmental regulations and sustainability goals are accelerating the shift toward zero-emission vehicles. Rising consumer retail sales, forecasted to grow between 2.5% and 3.5% in 2024 according to the National Retail Federation, further fuel demand for reliable and high-capacity tow tractors to support fast-paced logistics operations.

Canada tow tractor market is propelled by rising investments in cold storage logistics facilities and the steady expansion of automotive manufacturing hubs. The country’s strong emphasis on sustainability and the implementation of government incentives to promote electrification are further accelerating market adoption. Also, increasing demand for advanced material handling solutions in warehousing and distribution centers, coupled with stringent environmental regulations, is encouraging operators to upgrade to more efficient and eco-friendly tow tractors.

Europe Tow Tractor Market Industry Trends

The tow tractor industry in Europe was identified as a lucrative region in 2024. The European tow tractor market is witnessing a significant transformation, driven by rising investments in airport modernization and sustainable ground support equipment to comply with stringent EU emission regulations. Increasing focus on alternative fuel technologies, including hydrogen fuel cells, is accelerating the shift toward zero-emission operations at airports and logistics hubs. Also, the growing automation and digitalization of warehousing and distribution centers are fueling demand for tow tractors equipped with autonomous navigation and telematics systems. For instance, in September 2024, TLD joined the TULIPS consortium to develop a hydrogen-powered tow tractor using Ballard’s 100kW FCmove-HD+ fuel cell engine, designed to move wide-body aircraft, with operational trials planned at Schiphol Airport in summer 2025. These developments highlight Europe’s strong commitment to greener, smarter logistics solutions, propelling market growth and technology adoption.

Germany tow tractor market is being shaped by its booming e-commerce sector, which demands highly efficient and reliable material handling solutions to keep pace with growing online retail activities. According to the U.S. Department of Commerce, Germany’s e-commerce revenue reached USD 100.6 billion in 2024, with internet penetration and user numbers expected to increase steadily. This surge in e-commerce accelerates warehouse automation and distribution center expansion, driving demand for advanced tow tractors that can enhance throughput and operational efficiency. Coupled with stringent environmental regulations encouraging the shift to electric and low-emission vehicles, these factors are pushing manufacturers and logistics providers to adopt innovative, sustainable tow tractor technologies.

The tow tractor market in the UK is witnessing robust growth, driven by major investments in airport expansions and infrastructure upgrades. For instance, the GBP 1.1 billion (approximately USD 1.35 billion) funding announced in October 2024 for the expansion of London Stansted Airport will increase terminal capacity and significantly boost passenger and cargo handling volumes. This development is expected to drive demand for efficient ground support equipment, including tow tractors. Additionally, the U.K.’s strong focus on sustainability, highlighted by Stansted’s 14.3-megawatt solar farm and new electric vehicle charging facilities, is accelerating the adoption of electric and low-emission tow tractors. Growing air traffic, increased e-commerce logistics activities, and government initiatives supporting green technology and infrastructure modernization further contribute to market growth in the country.

Asia Pacific Tow Tractor Market Industry Trends

The tow tractor industry in Asia Pacific was identified as a lucrative region in 2024, driven by rapid industrialization, expanding e-commerce and retail sectors, and increasing investments in logistics infrastructure. Growing urbanization and the rise of smart warehouses are boosting demand for efficient material handling solutions across manufacturing, transportation, and distribution centers. Several countries in the region are implementing stricter environmental regulations to reduce emissions, encouraging the adoption of electric and hybrid tow tractors. For example, China’s National New Energy Vehicle Plan promotes the electrification of industrial vehicles to meet sustainability targets. These factors collectively position the Asia Pacific as a high-growth market for advanced tow tractor technologies that enhance operational efficiency while supporting green initiatives.

China tow tractor industry held a substantial market share in 2024. According to the U.S. Department of Commerce’s International Trade Administration, China generated nearly 50% of the world’s e-commerce transactions, with forecasts projecting online retail revenue to reach USD 3.56 trillion by 2024. This immense e-commerce volume is a key driver of the country's tow tractor market growth, as efficient material handling and logistics solutions become critical to meet rising demand. Rapid urbanization and industrial automation are further accelerating the adoption of tow tractors in manufacturing and distribution sectors. Government policies promoting sustainability are pushing the shift toward electric and hybrid tow tractors to reduce environmental impact. Also, the expansion of cold chain logistics and modern warehouse infrastructure is increasing the need for high-capacity, reliable tow tractors.

The tow tractor industry in Japan held a significant share in 2024. In Japan, the market is influenced by steady advancements in automation technologies, increasing demand for efficient airport ground handling equipment, and a strong focus on sustainability through the electrification of fleet vehicles. The country's aging workforce is also driving the adoption of autonomous and ergonomic tow tractors to improve operational safety and productivity.

Japan’s emphasis on modernizing logistics infrastructure supports the integration of smart material handling solutions across distribution centers and manufacturing facilities. For instance, in March 2021, ANA partnered with Toyota Industries to test a newly developed autonomous tow tractor at Tokyo Haneda Airport, featuring enhanced location tracking, improved towing capacity, and advanced 3D LiDAR navigation for efficient airport cargo transport. Such trends highlight Japan’s commitment to leveraging innovation and sustainability to maintain efficiency in its tow tractor market.

Key Tow Tractor Companies Insights

Key players operating in the tow tractor market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Tow Tractor Companies:

The following are the leading companies in the tow tractor market. These companies collectively hold the largest market share and dictate industry trends.

- Toyota Material Handling, Inc.

- Jungheinrich AG

- KION Group AG

- Crown Equipment Corporation

- Taylor-Dunn

- Motrec International Inc.

- TLD Group (TractEasy Division)

- Clark Material Handling Company

- Alke’ S.r.l.

- Hyster-Yale Group, Inc.

Recent Developments

-

In May 2025, TractEasy deployed its EZTow Level 4 autonomous tow tractor at Airbus' Saint-Nazaire site in France to automate standardized logistics between facilities, enhancing operational efficiency and replacing manually driven units in aerospace manufacturing.

-

In May 2025, Oxa partnered with Bradshaw EV to integrate its Oxa Driver autonomous software into Bradshaw’s T800, an 8-tonne tow tractor, for light logistics in airports, factories, and distribution centres. The collaboration aims to deliver scalable, safe, and efficient autonomous towing and industrial transport solutions.

-

In August 2024, Goldhofer secured a framework agreement with EFM GmbH to supply 14 Phoenix E battery-electric towbar-less aircraft tractors to Munich Airport by 2028, supporting zero-emission ground handling for aircraft up to 352 tonnes.

Tow Tractor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.31 billion

Revenue Forecast in 2033

USD 3.45 billion

Growth rate

CAGR of 5.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, load capacity, power source, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Toyota Material Handling, Inc.; Jungheinrich AG; KION Group AG; Crown Equipment Corporation; Taylor-Dunn; Motrec International Inc.; TLD Group (TractEasy Division); Clark Material Handling Company; Alke’ S.r.l.; Hyster-Yale Group, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tow Tractor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global tow tractor market report based on type, load capacity, power source, application, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Rider-Seated Tow Tractors

-

Stand-In Tow Tractors

-

Pedestrian Tow Tractors

-

-

Load Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

Below 5 Tons

-

5-10 Tons

-

11-25 Tons

-

Above 25 Tons

-

-

Power Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Electric

-

Diesel

-

LPG

-

Hybrid

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Airports & Aviation

-

Ground Support & Transportation Hubs

-

Retail & Supermarkets

-

Industrial Manufacturing Plants

-

Warehousing & Distribution Centers

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tow tractor market size was estimated at USD 2.24 billion in 2024, and is projected to reach USD 3.45 billion by 2033.

b. The global tow tractor market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2033 to reach USD 3.45 billion by 2033.

b. The North America tow tractor market accounted for 32.5% of the global share in 2024. North America’s strong e-commerce growth fuels the need for efficient automated warehousing and material handling solutions, further increasing tow tractor adoption in distribution centers. The region also leads in adopting electric and autonomous vehicle technologies, driven by stringent emissions regulations and sustainability goals.

b. Some key players operating in the tow tractor market include Toyota Material Handling, Inc., Jungheinrich AG, KION Group AG, Crown Equipment Corporation, Taylor-Dunn, Motrec International Inc., TLD Group (TractEasy Division), Clark Material Handling Company, Alke’ S.r.l., Hyster-Yale Group, Inc.

b. Key factors that are driving the market growth include rapid growth in automated warehousing and e-commerce fulfillment, which require efficient, high-throughput material handling solutions. Increasing electrification of ground support equipment (GSE) at airports and transport hubs is fostering sustainable and low-emission operations. Fleet modernization efforts across retail and distribution centers are accelerating the replacement of aging diesel tow tractors with advanced electric and hybrid models that offer improved performance and reduced operational costs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.