- Home

- »

- Clothing, Footwear & Accessories

- »

-

UAE Office Supplies Market Size, Industry Report, 2030GVR Report cover

![UAE Office Supplies Market Size, Share & Trends Report]()

UAE Office Supplies Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Paper Supplies, Writing Supplies, Filling Supplies, Desk Supplies), By Distribution Channel, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-601-0

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UAE Office Supplies Market Size & Trends

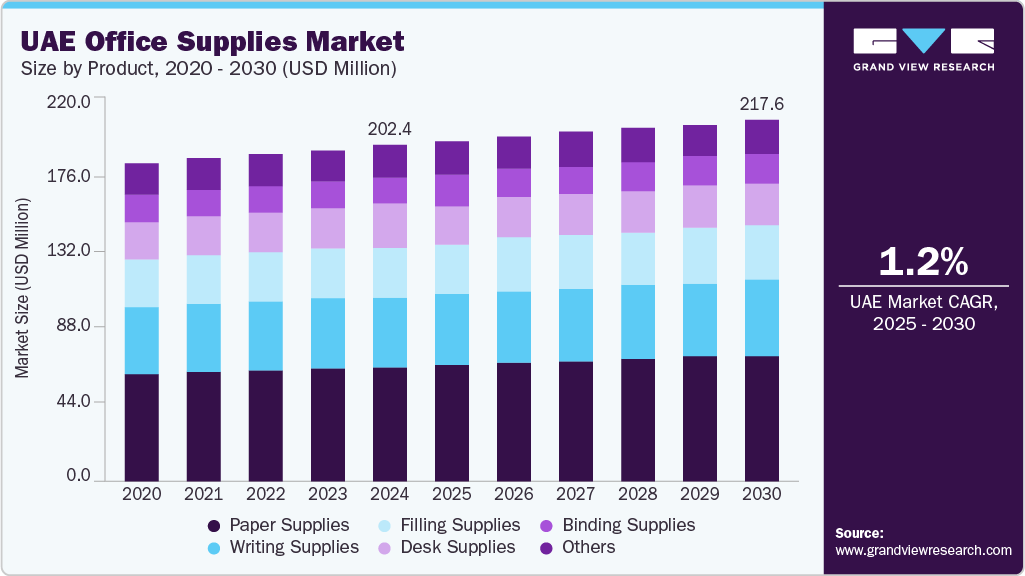

The UAE office supplies market size was estimated at USD 202.4 million in 2024 and is projected to grow at a CAGR of 1.2% from 2025 to 2030. An increase in student enrollment and significant government investments in educational infrastructure are expected to drive market growth in the coming years. In 2022, the UAE Government enacted Federal Decree Law No. 39 on Compulsory Education, making school attendance mandatory. This action aligns with the National Strategy for Higher Education 2030, reflecting the UAE’s commitment to building a knowledge-driven, post-oil economy by equipping future generations with essential skills.

Increased corporate activity and rising commercial projects have been key catalysts for market growth. In January 2024, an article by Realty+ highlighted a significant growth in UAE commercial office spaces. Dubai’s total market stock reached 9.2 million sq. m with 92,000 sq. m added in 2023, and another 44,000 sq. m expected in 2024. Abu Dhabi anticipated 112,000 sq. m of new office space in 2024, reflecting strong demand and expansion, directly necessitating increased procurement of paper products, writing utensils, and equipment. The continuous inflow of multinational corporations establishing regional offices further solidifies this demand within the corporate sector.

Economic diversification and the proliferation of business events also contribute significantly to market expansion. The UAE’s strategic pivot away from oil dependency fosters the establishment of new businesses, startups, and international firm branches. Concurrently, the frequent hosting of business events, conferences, and training workshops consistently generates demand for stationery and associated office products, underscoring the dynamic nature of the market.

The shift towards remote and hybrid work models, alongside re-export market dynamics and sustainability trends, is reshaping demand. The pandemic-accelerated adoption of home offices has created a distinct market for ergonomic and multifunctional furniture and supplies. Moreover, a growing preference for eco-friendly and technologically advanced office supplies, even amidst digitalization trends, ensures continued market evolution and sustained demand for diverse products.

Product Insights

Paper supplies dominated the market and accounted for 34.2% in 2024, owing to extensive use in expanding the education and office sectors, contributing significantly to stationery revenue. Growth in Dubai and Abu Dhabi office spaces and an expanding workforce further drive demand for writing and printing paper. The United Nations COMTRADE database reported that, in 2023, the UAE imported USD 1.91 billion worth of paper, paperboard, and related articles, reflecting significant demand for these products. The robust retail and e-commerce sectors increase the need for paper-based packaging, while paper products' easy availability and affordability make them preferred. Rising demand for sustainable, eco-friendly alternatives to plastics and heightened hygiene awareness continue to bolster the paper product market in the UAE.

Writing supplies are projected to grow significantly over the forecast period. The UAE’s demand for office supplies is rising, largely due to increased needs for writing instruments and stationery. This growth is propelled by expanding corporate and commercial sectors, especially in Dubai and Abu Dhabi, as new startups and multinational companies establish offices. Government economic diversification, infrastructure improvements, and growth in education and training further stimulate demand. Rising disposable incomes and a growing youth population contribute to increased consumption of office supplies, supporting productivity and employee well-being.

Distribution Channel Insights

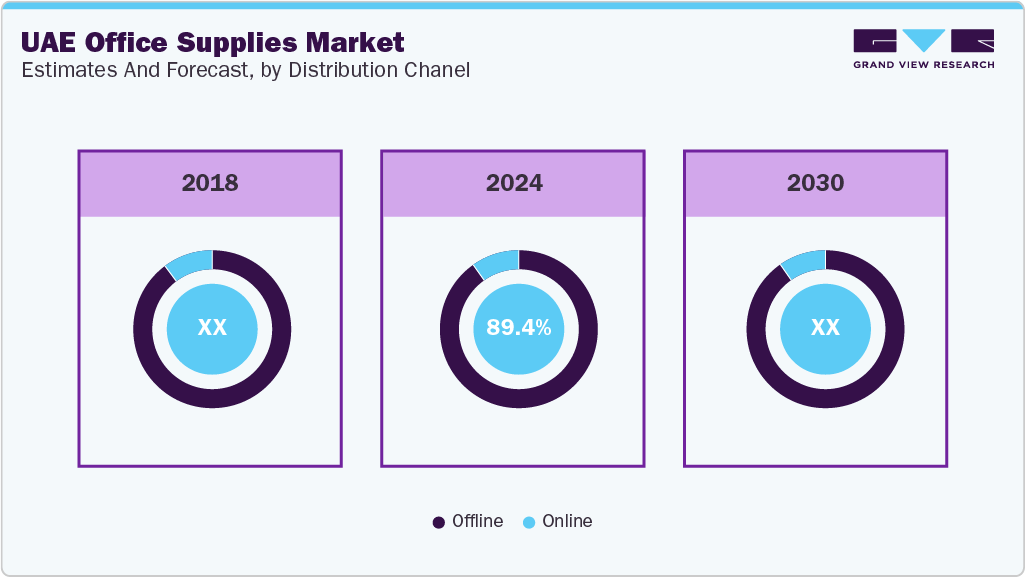

Offline distribution channels led the market with a revenue share of 89.4% in 2024, due to widespread physical presence and consumer preference for tangible product inspection. In-store promotions, competitive pricing, and strong ties with the education sector further contribute. Established supply chains ensure timely stocking and variety. Consumers in the UAE favor traditional shopping habits. A vast network of retail outlets, including multi-channel retailers prioritizing offline presence and their capability for bulk and corporate sales, integrates seamlessly with the local business ecosystem, solidifying offline distribution’s reach and supply dominance.

Online distribution channels are anticipated to witness lucrative growth over the forecast period, owing to rapid digitalization and the shift to remote work, boosting home office equipment needs. The booming e-commerce industry in the country facilitates this growth, as customers favor online price comparison and wider product variety. Online distribution offers nationwide accessibility, 24/7 ordering convenience, and diverse product selections. Efficient supply chains, competitive pricing, and data-driven personalization further enhance the online buying experience, catering to varied corporate, educational, and home office demands.

End Use Insights

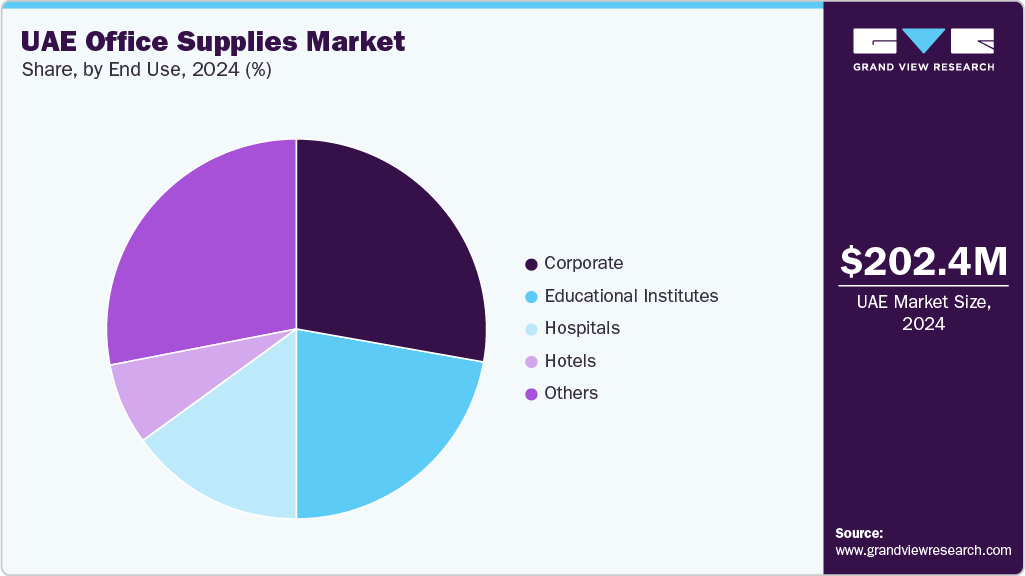

The corporate segment held the largest revenue share of 28.0% in 2024, driven by expanding office spaces in Dubai and Abu Dhabi. Inflows of businesses and foreign investment, attracted by the UAE’s business-friendly environment, are increasing demand for furniture, stationery, and equipment. According to an article by Property Gulf, projects such as the DWC (Al Maktoum International Airport) are expected to spur a 15%-25% rise in property prices by 2030, following a rapid growth in Dubai South and Expo City. For instance, in September 2024, Microsoft expanded its Global Engineering Development Center into Abu Dhabi, UAE, marking one of its first in the Arab world. This center focuses on creating cutting-edge AI innovations, cloud technologies, and advanced cybersecurity solutions to attract top talent and drive economic growth. Furthermore, the burgeoning start-up and co-working ecosystem, modernization, and digitalization efforts further boost the need for advanced office equipment. Emphasis on employee well-being and productivity drives investment in ergonomic and contemporary supplies.

Educational institutes are projected to grow at the fastest rate of 1.3% over the forecast period. According to an article in the digitalLEARNING Network in May 2025, the UAE’s education sector is rapidly evolving, with Dubai private school enrollment increasing 140% since 2007 to 387,441 students in 2024-25, driving the demand for office supplies in the UAE. The nation prioritizes innovation, aiming to define future global education standards through strategic frameworks and technological integration. Government backing and rising EdTech and private/international school growth necessitate more traditional and tech-enabled office and classroom supplies. This also supports the UAE’s goal of becoming a global education hub.

Key UAE Office Supplies Company Insights

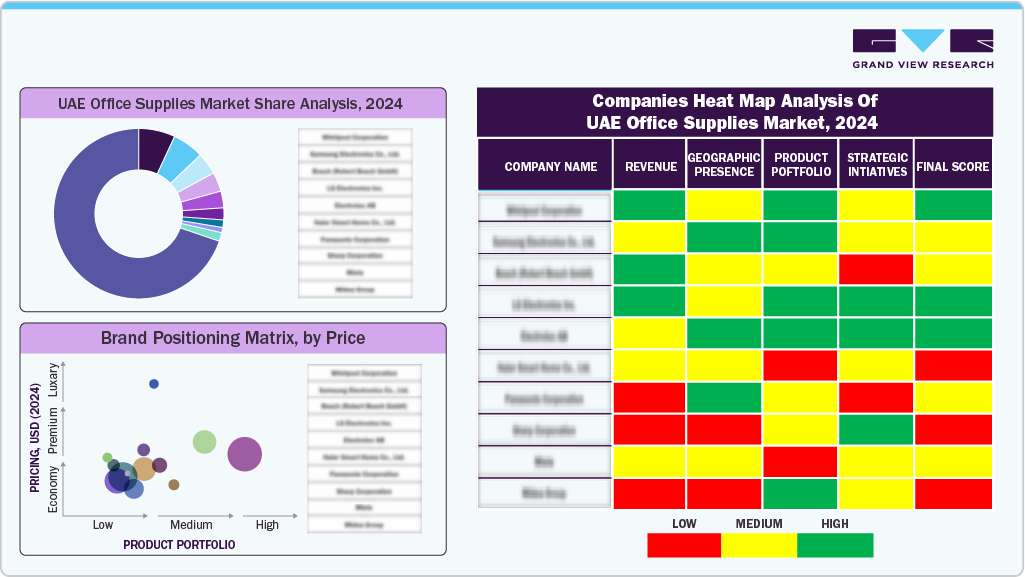

Some key companies operating in the market include KOKUYO Co., Ltd.; Pentel; 3M; and others. Strategic movement in the market is driven by both international and local suppliers. Key market players compete by offering modern, ergonomic solutions and rapid delivery to meet evolving business needs.

-

3M maintains a strong presence in the UAE through brands such as Post-it, Scotch, and Command. The company has leveraged innovation and a vast distribution and supply network to offer products aligning with UAE market trends, including remote work and sustainability, serving corporate, educational, and home office segments.

-

ACCO Brands is a global manufacturer of office supplies, offering diverse products under brands such as GBC and Esselte. As a key UAE supplier, ACCO leverages expanding office spaces, commercial projects, and demand for sustainable solutions. Its established distribution, across online and offline channels, caters to corporate, educational, and individual consumers in the evolving market space.

Key UAE Office Supplies Companies:

- KOKUYO Co.,Ltd.

- Pentel

- 3M

- Faber-Castell

- BIC

- ACCO Brands

Recent Developments

-

In December 2024, TTS partnered with Al Gurg Stationery in the UAE to enhance educational resource delivery in the country. This partnership provided schools with rapid material access and offered CPD workshops to support teachers and improve learning outcomes.

UAE Office Supplies Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 217.6 million

Growth rate

CAGR of 1.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, distribution channel, end use

Country scope

UAE

Key companies profiled

KOKUYO Co.,Ltd.; Pentel; 3M; Faber-Castell; BIC; ACCO Brands

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UAE Office Supplies Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UAE office supplies market report based on product, distribution channel, and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Paper Supplies

-

Notebooks and Notepads

-

Printing Paper

-

Others

-

-

Writing Supplies

-

Pens & Pencils

-

Highlighters & Markers

-

Others

-

-

Filling Supplies

-

File Folders

-

Envelopes

-

Others

-

-

Desk Supplies

-

Desk & Drawer Organizer

-

Paperweights & Stamp Pads

-

Others

-

-

Binding Supplies

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Corporate

-

Educational Institutes

-

Hospitals

-

Hotels

-

Others

-

Frequently Asked Questions About This Report

b. The UAE office supplies market size was estimated at USD 202.4 million in 2024.

b. The UAE office supplies market is projected to grow at a compound annual growth rate (CAGR) of 1.2% from 2025 to 2030 to reach USD 217.6 million by 2030.

b. Paper supplies dominated the market and accounted for 34.2% in 2024, owing to extensive use in expanding the education and office sectors, contributing significantly to stationery revenue. Growth in Dubai and Abu Dhabi office spaces and an expanding workforce further drive demand for writing and printing paper. The United Nations COMTRADE database reported that, in 2023, the UAE imported USD 1.91 billion worth of paper, paperboard, and related articles, reflecting significant demand for these products. The robust retail and e-commerce sectors increase the need for paper-based packaging, while paper products' easy availability and affordability make them preferred. Rising demand for sustainable, eco-friendly alternatives to plastics and heightened hygiene awareness continue to bolster the paper product market in the UAE.

b. Some prominent players in the UAE office supplies market include KOKUYO Co.,Ltd.; Pentel; 3M; Faber-Castell; BIC; ACCO Brands

b. The shift towards remote and hybrid work models, alongside re-export market dynamics and sustainability trends, is reshaping demand. The pandemic-accelerated adoption of home offices has created a distinct market for ergonomic and multifunctional furniture and supplies. Moreover, a growing preference for eco-friendly and technologically advanced office supplies, even amidst digitalization trends, ensures continued market evolution and sustained demand for diverse products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.